Empirical Study on Customer Equity of the Pesticide Industry

, ,

College of Economics and Management, Huazhong Agricultural University, Wuhan 430070, China

1 Introduction

TheReporttotheSixteenthNationalCongressoftheCPCstressed that we should foster new types of agricultural business entities, develop large-scale agricultural operations in diverse forms, and establish a new type of system for intensive agricultural operations that are specialized, well organized and commercialized, which points out direction for innovation of agricultural system and development of modern agriculture. Since the reform and opening-up, there have been great changes in agricultural business entities, from family operation households leading pattern to many types of business entities coexisting pattern, mainly large specialized households, family farms, specialized farmer cooperatives, and agricultural enterprises.

At the end of the Twelfth Five-Year Plan period, China established the objective of realizing zero growth of pesticide use by 2020. Pesticide industry should focus effort in pursuing new development, expanding existing pesticide market, developing and applying technologies. However, domestic pesticide market is relatively separate and small. In 2014, the sales amount of top ten pesticide enterprises accounted for only 11% of the whole country. Zhejiang Wynca Chemical Industry Group Co., Ltd with the largest market share also still accounts for 2% of domestic market. The entire pesticide industry of China only takes up 5% of international market, showing weak competition in the world. The Twelfth Five-Year Plan defined quantitative objective for development of the pesticide industry. But by the end of 2014, there was still a large gap with the objective.

In the context of external motive of world pesticide industry transfer and serious export situation, internal pressure of low end products occupying market and relatively decentralized market, in addition to regulations and requirements of national policies, the pesticide industry will welcome a great policy reform and most medium and small sized pesticide enterprises will be eliminated mercilessly in the reform. To ensure competitive edge and stand out in the consolidation tide, pesticide enterprises should grasp change trend of agriculture, farmers and rural areas. Besides, the national food safety supervision system is increasingly strict and efforts of investigation and prosecution of environmental pollution are reinforced, stringent punishment for excess pesticide residue lead to shift of focus of pesticide buyers. They demand that pesticide should ensure bumper harvest and more important ensure safety. As a type of organization buyer, new agricultural business entities are different in buying decision process compared with single buyer of family farmers. Therefore, it is urgent to study driving factors of customer equity. Empirical analysis of customer equity can assist pesticide enterprises in satisfying new demands, chose more valuable marketing activities, make reasonable marketing resource allocation, realize reasonable use of limited resources, and seize larger market shares, to lift profitability, form competitive edge, and finally stand out in the consolidation tide.

2 Literature review

2.1ReviewofstudiesoncustomerequityThe focus of modern marketing has shifted from products and enterprise level of traditional marketing to customer level, and customer equity is receiving closer attention.

2.1.1Basic definition of customer equity. Robert and Professor John Deighton firstly defined customer equity in an article inHarvardBusinessReview(1996). According to them, customer equity is the sum of discounted value of lifetime value of all customers, and all customers only refer to actual customers. Rust, Lemon, and Zeithaml included the expected value of potential customers into the customer equity inHowtoManageCustomerEquity? (2001)

2.1.2Studies on driving factors and sub-driving factors of customer equity. In studies on driving factors of customer equity, a typical one is value - brand - driving factor model. In this model, driving factors include value equity, brand equity, and relation equity; value equity includes quality, price and convenience; brand equity includes brand awareness, brand familiarity, brand attitude, brand association, and company morality; relation equity includes loyalty, intimate plan, community building, and knowledge building programs. Huo H, Xu W, and Chen K (2013) held that advertisement, convenience and price have high driving effect on buying frequency, while preferential policy, convenience and price have significant driving effect on buying amount.

Domestic studies on driving factors and sub-driving factors of customer equity are mainly empirical analysis and most studies are carried out in service industry. Besides, most of them follow the value - brand - driving factor model and take some changes or expansions on this basis. Li Pei (2008) added hidden equity such as customer information and cross purchase. Zhang Zhiping (2003) studied driving factors and sub-driving factors of customer equity in telecommunication industry. Zou Fuxia (2009) added perception equity and mainly studied cross purchase and reputation propaganda. Taking real estate as research object, Hao Liguang (2012) analyzed direct influence and indirect function of value equity, brand equity and relation equity on customer equity and customer loyalty. Zhang Yilei (2012) made an empirical analysis on express hotels and studied influence of value driving, relation driving, brand driving and relation driving on premium on purchase, recommended value, repeat purchase, and knowledge contribution. Liu Hanyu and Chen Xinkang (2012) added the motive ability and contended that market orientation, social network ability, and resource rebuilding ability can raise the ability of enterprise to obtain information, which can bring into play indirect effect through marketing information and customer response. Shao Jingbo (2012) introduced a relatively complete four dimensional driving model of drive equity, including perception driving factors.

There are extensive studies about customer equity. With increasingly mature studies and improvement of theoretical system, those that can reach common understanding have become a mainstream. (i) In customer equity, customer include actual customers and potential customers, thus it is necessary to take scientific method to calculate lifetime value of customer equity (Wang Tao, 2004). (ii) For studies on driving factors and sub-driving factors of customer equity, there are great differences between different industries. It is necessary to consider characteristics of the industry and work out sub-driving factors easy for understanding and measurement. (iii) When considering purchase behavior of customers, it is necessary to attach importance to non-purchase behavior, and shift the marketing input to reputation propaganda, knowledge, experience, and emotion.

The customer-centered marketing strategy is being widely accepted by academic circles and enterprises, but customer equity are dynamic and emotion dependent (Shao Jingbo, 2012; Liu Hanyu and Chen Xinkang, 2012). As new development direction of agriculture, compared with traditional separate farmers, new agricultural business entities are greatly different in purchase decision process, their focus has been shifted, so their customer asset driving factors are also changed.

2.2ReviewofstudiesonorganizationpurchasebehaviorOrganization market is marketing activity between organizations. Compared with individual consumers, organization market has few customers, but its purchase scale is large, purchase behavior is professional, and purchase process is formal, thus each time of purchase behavior plays a great strategic influence on survival and development of an organization. Organization market purchase has its own distinct characteristics: one-time purchase quantity is large, purchasers are few, geographical position is centralized, professional purchase, collective decision making, rational, demand lacks elasticity, influence from price fluctuation in short term is little, and business connection is close, and it is able to establish long term relation.

New agricultural business entities are innovation of modern agricultural operation method and also the products of conflict between decentralized operating farmers’ small production and integrated domestic and foreign big market. They conform to organization market. Only through finding driving factors of their customer equity, may it be able to make pertinent marketing, develop towards platinum level and gold level in the customer Pyramid model, and realize optimal allocation of limited resources, so as to cultivate competitive edge and core competitive power fighting with transnational gigantic pesticide enterprises, and expand domestic market share to the maximum extent.

3 Design of the study

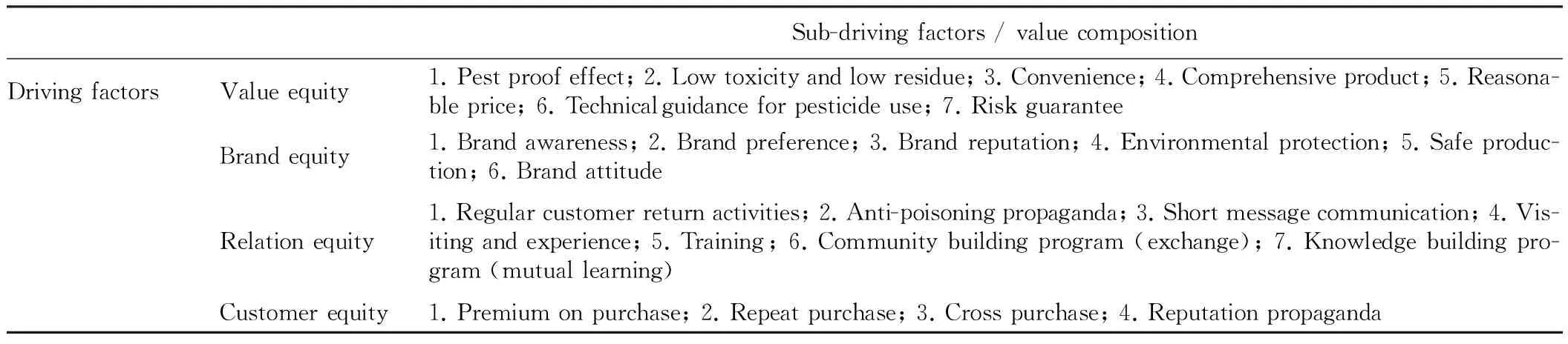

3.1EstablishingcustomerassetdrivingfactormodelIn this study, we took customer asset VBR driving factor model as the basis. The background is pesticide market. Therefore, we made some changes when designing sub-driving factors, to make them more suitable for characteristics of pesticide market, as listed in Table 1.

The scale determined three driving factors of customer equity, including 20 measurement items, using Likert Scale five point scale method to evaluate and quantify scores.

3.2Hypotheses

H1: Basic characteristics (such as sex, age, educational level, annual income level, and proportion of vegetable income) of pesticide purchasers have significant influence on driving factors of customer equity.

H2: New agricultural business entities Relation equity driving effect > Brand equity driving effect > Value equity driving effect.

H3: In value equity driving factors of new agricultural business entities, low toxicity and risk guarantee have the greatest effect.

H4: In brand equity driving factors of new agricultural business entities, safe production and environmental protection have the greatest effect.

H5: In relation equity driving factors of new agricultural business entities, knowledge building, visiting and experience have the greatest effect.

H6: In customer equity value composition of new agricultural business entities, premium on purchase and reputation on purchase have the largest proportion.

Table1Drivingfactors,sub-drivingfactorsandvaluecompositionofcustomerequityofpesticidemarket

Sub-drivingfactors/valuecompositionDrivingfactorsValueequity1.Pestproofeffect;2.Lowtoxicityandlowresidue;3.Convenience;4.Comprehensiveproduct;5.Reasona-bleprice;6.Technicalguidanceforpesticideuse;7.RiskguaranteeBrandequity1.Brandawareness;2.Brandpreference;3.Brandreputation;4.Environmentalprotection;5.Safeproduc-tion;6.BrandattitudeRelationequity1.Regularcustomerreturnactivities;2.Anti-poisoningpropaganda;3.Shortmessagecommunication;4.Vis-itingandexperience;5.Training;6.Communitybuildingprogram(exchange);7.Knowledgebuildingpro-gram(mutuallearning)Customerequity1.Premiumonpurchase;2.Repeatpurchase;3.Crosspurchase;4.Reputationpropaganda

3.3DatacollectionIn our survey, we mainly took vegetable industry of Hubei Province as object and samples were relatively representative. Hubei is a large vegetable production province. Its annual vegetable planting area is up to 19 million mu, with annual yield of 38 million tons and annual output value more than 75 billion yuan. During December 2013 and November 2014, we made field survey in Dangyang, Changyang, Enshi, Anlu, Shayang, Tianmen, Guanghua, Huangpi, Jiangxia, and Gongan of Hubei Province, collected 227 copies of questionnaire from small farmers and 113 copies of questionnaire from new agricultural business entities. Samples were relatively few. Later, through coordination with rural credit cooperatives in Yichang and Xiaogan, we finally collected 175 copies from new agricultural business entities. In order to ensure real and valid samples, through careful inspection, review and screening, 161 copies from new agricultural business entities were valid, the response rate reached 93.4% and the rate of validity reached 92%, conforming to demands of this study.

4 Empirical results and discussions

4.1ReliabilityandvaliditytestWe tested the reliability of the scale with the aid of Cronbach’sα. From test results, we can see thatαvalue of the scale for new agricultural business entities were 0.794, 0.774, 0.993 respectively, and that of the scale was 0.847, indicating that this scale had excellent internal consistency and reliability. Reliability test adopts KMO test and Bartlett sphericity test. KMO value of the new agricultural business entities was 0.749, fully meeting requirements of analysis. Through Bartlett test, results indicate that the significance level of irrelevance between variables (measurement items) sig.(<=1) was 0.000, indicating that there was high correlation between variables, suitable for factor analysis.

4.2VarianceanalysisonsinglefactorofpopulationstatisticalvariablesWith the aid of SPSS17.0, we made variance analysis on driving factors of sex of pesticide purchasers and customer equity. Data analysis and test indicate that in population statistical variables, the significance levelPvalue of sex on brand equity and relation equity was 0.707 and 0.650, and the sex exerts no significant influence on driving factors of customer equity; the significance of age of new agricultural business entities on brand equity was 0.532, showing no significant influence;Pvalue of educational level on relation equity was smaller than 0.05, showing significant influence; P value of monthly income on brand and relation equity was 0.041 and 0.1, showing no significant influence; P value of proportion of vegetable income on value, brand and relation equity was 0.231, 0.755, and 0.173 separately, showing no significant influence.

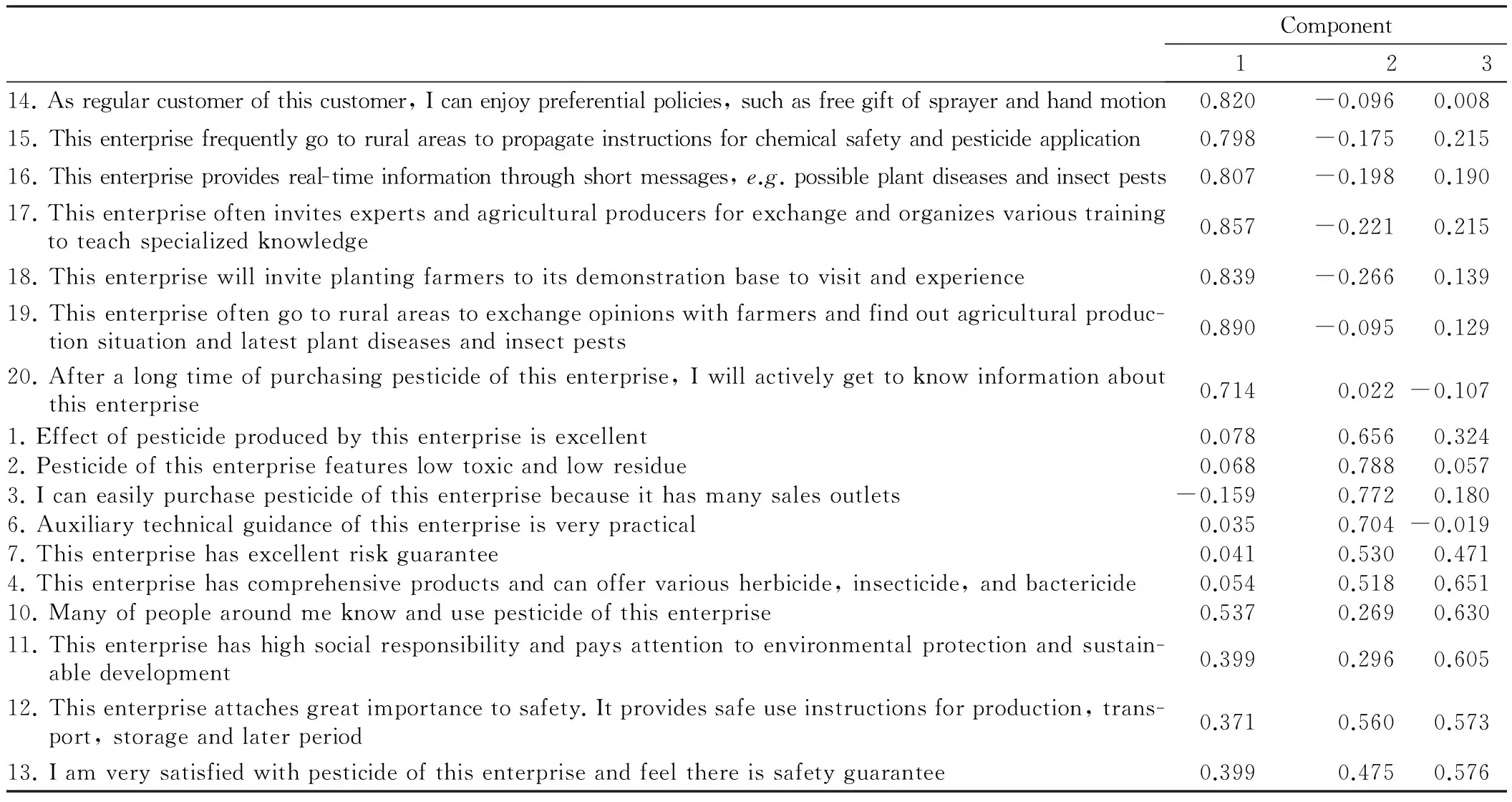

4.3FactorrotationWe applied the principal component analysis and Kaiser standardized orthogonal rotation method and obtained results as listed in Table 2.

In the above exploratory factor analysis, load of factor 5, 8 and 9 is smaller than 0.5, and that of other factors is higher than 0.5; after excluding these three factors, we made factor rotation again. From the above, the original 20 variables can be classified into 3 types. From variance explanatory table, we can know that the variance contribution rate of these three factors is up to 74.286%. There is certain deviation between sub-items included in 3 new factors and our initial assumptions, thus we assigned new names to these three factors.

Factor 1 include all relation equity driving factors in hypothesis model and is consistent with hypothesis. Thus, we assigned relation equity to this factor as its new name.

Factor 2 includes sub-items 1, 2, 3, 6, and 7 in value equity driving factors in hypothesis model, thus we assigned value equity to this factor as its new name.

Factor 3 includes sub-items 10, 11, 12, and 13 in brand equity driving factors in hypothesis model and sub-item 4 (product comprehensiveness) in value driving factors, the product comprehensiveness is also an indicator of brand, so we named this factor brand equity.

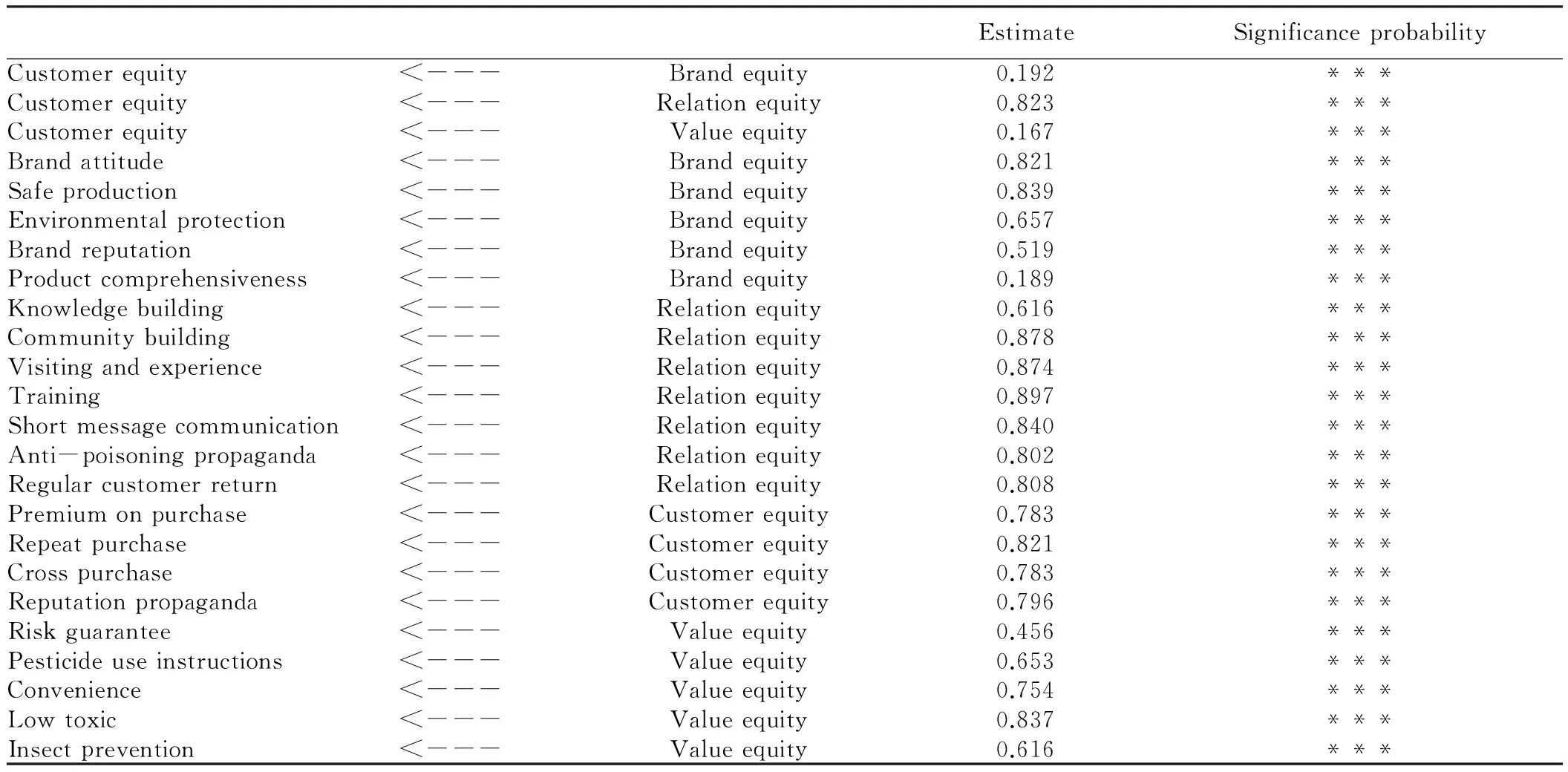

4.4StructuralequationanalysisBefore structural equation analysis, we firstly made fitting analysis, to ensure accuracy of the model. For new agricultural business entities, M.I. value ofe5 ande6 was the largest. We modified the model, there was collinear relation between error variablese5 ande6. After the modification, the Chi-Square was 282.828, the significance probabilityp=0.432>0.05. From the second-order confirmatory factor analysis, the fitting indicator of each dimension variable: Chi-Square degree of freedom 1.554<2.0, AGFI=0.965>0.900 GFI=0.936>0.900, RMSEA=0.026<0.08, CFI=0.902>0.900. From the above data, we can see that the fitting is good no matter for the absolute fit index, incremental fit index, or parsimonious fit index, and there is excellent structural reliability. Path analysis was illustrated in Fig. 1.

Table2Matrixofrotationcomponent(Newagriculturalbusinessentities)

Component12314.Asregularcustomerofthiscustomer,Icanenjoypreferentialpolicies,suchasfreegiftofsprayerandhandmotion0.820-0.0960.00815.Thisenterprisefrequentlygotoruralareastopropagateinstructionsforchemicalsafetyandpesticideapplication0.798-0.1750.21516.Thisenterpriseprovidesreal-timeinformationthroughshortmessages,e.g.possibleplantdiseasesandinsectpests0.807-0.1980.19017.Thisenterpriseofteninvitesexpertsandagriculturalproducersforexchangeandorganizesvarioustrainingtoteachspecializedknowledge0.857-0.2210.21518.Thisenterprisewillinviteplantingfarmerstoitsdemonstrationbasetovisitandexperience0.839-0.2660.13919.Thisenterpriseoftengotoruralareastoexchangeopinionswithfarmersandfindoutagriculturalproduc-tionsituationandlatestplantdiseasesandinsectpests0.890-0.0950.12920.Afteralongtimeofpurchasingpesticideofthisenterprise,Iwillactivelygettoknowinformationaboutthisenterprise0.7140.022-0.1071.Effectofpesticideproducedbythisenterpriseisexcellent0.0780.6560.3242.Pesticideofthisenterprisefeatureslowtoxicandlowresidue0.0680.7880.0573.Icaneasilypurchasepesticideofthisenterprisebecauseithasmanysalesoutlets-0.1590.7720.1806.Auxiliarytechnicalguidanceofthisenterpriseisverypractical0.0350.704-0.0197.Thisenterprisehasexcellentriskguarantee0.0410.5300.4714.Thisenterprisehascomprehensiveproductsandcanoffervariousherbicide,insecticide,andbactericide0.0540.5180.65110.Manyofpeoplearoundmeknowandusepesticideofthisenterprise0.5370.2690.63011.Thisenterprisehashighsocialresponsibilityandpaysattentiontoenvironmentalprotectionandsustain-abledevelopment0.3990.2960.60512.Thisenterpriseattachesgreatimportancetosafety.Itprovidessafeuseinstructionsforproduction,trans-port,storageandlaterperiod0.3710.5600.57313.Iamverysatisfiedwithpesticideofthisenterpriseandfeelthereissafetyguarantee0.3990.4750.576

Fig.1 Path analysis of customer equity driving factors of new agricultural business entities

Table3Testresultsofnewagriculturalbusinessentitymodelafterstandardization

EstimateSignificanceprobabilityCustomerequity<---Brandequity0.192***Customerequity<---Relationequity0.823***Customerequity<---Valueequity0.167***Brandattitude<---Brandequity0.821***Safeproduction<---Brandequity0.839***Environmentalprotection<---Brandequity0.657***Brandreputation<---Brandequity0.519***Productcomprehensiveness<---Brandequity0.189***Knowledgebuilding<---Relationequity0.616***Communitybuilding<---Relationequity0.878***Visitingandexperience<---Relationequity0.874***Training<---Relationequity0.897***Shortmessagecommunication<---Relationequity0.840***Anti-poisoningpropaganda<---Relationequity0.802***Regularcustomerreturn<---Relationequity0.808***Premiumonpurchase<---Customerequity0.783***Repeatpurchase<---Customerequity0.821***Crosspurchase<---Customerequity0.783***Reputationpropaganda<---Customerequity0.796***Riskguarantee<---Valueequity0.456***Pesticideuseinstructions<---Valueequity0.653***Convenience<---Valueequity0.754***Lowtoxic<---Valueequity0.837***Insectprevention<---Valueequity0.616***

Note: * denotes significance at 0.1; ** denotes significance at 0.05; *** denotes significance at 0.01.

From Table 3, we can see that the path coefficient of value equity, brand equity and relation equity on customer equity was 0.167, 0.192, and 0.823 separately, the corresponding significance probability P value is significant at 0.01 level, indicating that value equity, brand equity and relation equity exert positive influence on customer equity, and relation driving effect > brand driving effect > value driving effect, so hypothesisH2holds true.

In value equity, the convenience, low toxic, insect prevention, pesticide use instructions, and risk guarantee have significant influence on value equity, which is slightly inconsistent with original hypothesisH3. In brand equity, brand attitude, safe production, environmental protection, brand reputation, and product comprehensiveness have significant influence on brand equity, especially the safe production and brand attitude, which is slightly inconsistent with original hypothesisH4. In relation equity, regular customer return, visiting and experience, training, short message communication, anti-poisoning propaganda, community building, knowledge building and brand attitude have significant influence on relation equity, especially with training, community building and visiting and experience, which is slightly inconsistent with hypothesisH5.

For four parts of value composition of customer equity: premium on purchase, repeat purchase, cross purchase, and reputation propaganda, the path coefficient was 0.783, 0.821, 0.783, and 0.796 respectively. The repeat purchase and reputation propaganda were the highest and accounted for the largest proportion in value composition, which is slightly inconsistent with original hypothesis H6, mainly manifested in repeat purchase. For a long term, most purchasing entities have long term cooperation pesticide supplier, so the possibility of repeat purchase is high. Even if the same type of pesticide leads to antibody due to repeat use, pesticide enterprises have developed new products through technical innovation, such product update is undertaken within the same brand.

5 Conclusions and recommendations

5.1Majorconclusions

5.1.1Influence of basic characteristics of new agricultural business entities on customer equity driving factors. The sex exerts no significant influence on customer equity driving factors because of special feature of agricultural production. As main labor, men are direct purchasers of pesticide; educational level exerts significant influence on relation equity, higher educational level will consider problems from a long-term perspective and incline to establish mutual relation with suppliers; vegetable income proportion exerts no significant influence on brand equity and relation equity because large scale production belongs to specialized production, and more than 80% of vegetable income proportion is in 76%-100%, showing slight influence on customer equity driving factors.

5.1.2Influence of driving factors on customer equity. The path coefficient of value equity of new agricultural business entities is low and has slight influence; brand equity ranks the second place in customer equity driving effect coefficient. Safe production has higher influence on brand equity, reflecting that due to toxicity of pesticide, risk awareness of pesticide purchasers is gradually enhanced, pesticide enterprises need to disseminate their positive image of product safety and reliability. Path coefficient of relation equity is the highest and its influence is the greatest. Training, community building and visiting and experience have the greatest influence. As organization purchasers, new agricultural business entities are developing towards specialized and large-scale direction and they have strong ability of obtaining information from various channels, and pay attention to improving related knowledge and skills. When suppliers can provide free training and set up information exchange platform, these new agricultural business entities will actively participate in these activities from a long-term perspective and will be inclined to establish reciprocal win-win cooperation with suppliers.

5.2Recommendations

(i) Developing low toxic pesticides. In value equity driving factors, low toxicity has the most significant influence on value equity. And the trend and policy inclination are increasingly clear from ecological agriculture and biological pesticide demands from high toxic and efficient pesticide demands. Farmers demand that pesticide should ensure bumper harvest and more important guarantee safety. Therefore, pesticide enterprises should increase research and development input, produce pesticides with low toxicity and low residue, and effectively inhibiting plant diseases and insect pests, so as to obtain sustained competitive edge and sustainable development.

(ii) Establishing stable cooperative relation with new agricultural business entities. For new agricultural business entities, establishing stable cooperative relation is of utmost importance. Since order-oriented vegetable purchasing enterprises have certain requirements for vegetable production and vegetable quality, pesticide enterprises can consider cooperation with them as intermediaries, reach agreement with vegetable purchasing enterprises, while pesticide enterprises play vegetable production supervisors to guarantee vegetable quality.

(iii) Vegetable enterprises should strengthen brand construction, because good brand reputation plays a great role in increasing value equity and improving relation equity. Market environment is constantly changing. Enterprises need to drive businesses through brands, establish brand awareness through appropriate way, and guarantee high quality and excellent technical service and after-sale guarantee to ensure benefits of vegetable planting farmers, and cultivate a good many domestic brands with high quality and reputation to compete with foreign famous brands and expand the influence power of national brands. Advertisement propaganda may be placed in professional magazines, such as China Vegetables, China Pesticide, and some agricultural sci-tech newspapers.

[1] FU XH, SONG WT. Purchase will and purchase behavior of biological pesticide and its influencing factors analysis——Case of Sichuan[J]. Journal of Agrotechnical Economics, 2010(6):120-128. (in Chinese).

[2] HAO LG. Study of influence factors of customers’ assets[J] . Modern Business,2012( 26) :140-141. (in Chinese).

[3] LIN N. An empirical study on the influence of specific purchase behavior affected by customer equity driving factors of retail business[D] . Harbin Institute of Technology, 2011. (in Chinese).

[4] JIA XL, DONG HR,QI LL,etal. Study on using pesticide behavior of the vegetable growers——In Hebei Province[J]. Problems of Forestry Economics,2011(3):266-270. (in Chinese).

[5] LIU YH, CHEN XK. Study on the strategies promoting customers’ asset value by business movement ability[J]. Modern Management Science,2012( 3) :30-34. (in Chinese).

[6] RUO ST. Customers’ assets management[M]. Beijing: Peking University Press, 2009. (in Chinese).

[7] SHAO JB, CHEN KK, WU XJ. Research on the model of customer equity drivers under social network effect[J]. China Soft Science, 2012(8): 84-97. (in Chinese).

[8] SHAO JB, LU HY. On the promotion of customers’ assets based on four-dimensional formation of drivers[J]. Academic Exchange, 2012(6): 106-109. (in Chinese).

[9] Stephen P. Robbins. Organizational behavior (the 14th edition)[M]. Beijing: China Renmin University Press,2012. (in Chinese).

[10] WANG JH, MA YT, LI Q. Behavior choice of agricultural producers'pesticide application and agricultural products safety[J]. Journal of Public Management,2015(1): 117-126. (in Chinese).

[11] WANG T, LI SZ. Analysis on the quality of customers’ assets[J]. Economic Management,2003,10:57—62. (in Chinese).

[12] WANG T, XU L. Customer equity and competitive advantage[J]. China Soft Science, 2002 (1): 52-56. (in Chinese).

[13] WANG YG. Customers’ resource management[M]. Beijing: Peking University Press,2005. (in Chinese).

[14] WEI KN. Organizational behavior[M]. Chengdu: Sichuan People’s Publishing House,2003. (in Chinese).

[15] ZHANG Y. A study on corporate competitive advantage based on customer equity[D]. Liaoning: Liaoning University,2011. (in Chinese).

[16] ZHANG YL. Study on the driving factors of asset value of customers of express hotel[D]. Tianjin University of Finance and Economics, 2012. (in Chinese).

[17] ANDERSON ET, SIMESTER D. A step-by-step guide to smart business experiments[J]. Harvard Business Review,2011, 89: 98-105.

[18] CHANG W,CHANG C,LI Q. Customer lifetime value: A review[J]. Social Behavior and Personality: an international journal,2012, 40(7): 1057-1064.

[19] HUO H,XU W,CHEN K. The influence of customer equity drivers on specific purchasing behavior in retail industry[J]. Information Technology Journal, 2013,12(11): 13-14.

[20] XIE Z, DAN B. Method to recognize the key factors impact the customer equity value[M]. Information Engineering and Applications. Springer London, 2012: 1217-1222.

Asian Agricultural Research2016年5期

Asian Agricultural Research2016年5期

- Asian Agricultural Research的其它文章

- Is It Worthwhile for Farmers to Grow Grain?—A Study of Farmers’ Behavior of Growing Grain

- Establishment of Chinese Agricultural Brand Value Scale and Study of Its Reliability and Validity Based on Customer Value

- How to Develop Chinese Rural Tourism in the Context of New Urbanization?

- Chinese Customers’ WTP for Legal Digital Music Downloading

- High Standard Capital Farmland Construction Based on Grain Security

- Research on the Brand Construction of Agritourism Enterprise in Chongqing