Research Progress and Prospect of County-wide Finance in China between 1991 and 2013 Based on Bibliometric Method

, ,

1. College of Economics & Management, Huazhong Agricultural University, Wuhan 430070, China; 2. Hubei Rural Development Research Center, Wuhan 430070, China

ResearchProgressandProspectofCounty-wideFinanceinChinabetween1991and2013BasedonBibliometricMethod

QiHUANG1,2*,JianpingTAO1,2

1. College of Economics & Management, Huazhong Agricultural University, Wuhan 430070, China; 2. Hubei Rural Development Research Center, Wuhan 430070, China

In order to visually and comprehensively grasp scientific research progress of the county-wide finance in China, and explore new breakthrough point of county-wide finance studies, this paper took China National Knowledge Infrastructure (CNKI) database as research platform and made a bibliometrical study of literature indexed in CNKI between 1991 and 2013 by advanced search method. Results indicate that relevant researches take on the trend of firstly increasing then decreasing and finally steady; research hot spots mainly focus on county-wide finance and county-wide economy, county-wide inclusive finance, and county-wide finance exclusion. Based on literature review, it found subject research of county-wide finance and county-wide economic issue has become a relatively mature issue. The extension research of county-wide finance exclusion and inclusive finance is devoted to remove finance exclusion. This research is a blind spot in this field and may become a breakthrough point of stimulating re-growth of county-wide finance researches.

County-wide finance, Research progress, Prospect, Bibliometrical analysis

1 Introduction

From 2002 to 2014, No. 1 document of central government has stressed promoting development of county-wide economy for 13 consecutive years. The county-wide economy is a basic unit of Chinese economy. With the aid of mobility of capital, the development of county-wide finance can stimulate vitality of elements of the county-wide economy. According to statistics, domestic research about the county-wide economy started in 1991. Literature researches experienced three stages: exploration, development, and stable stages. On the whole, researches of county-wide finance are carried out mainly from definition, county-wide finance and county-wide economic issue, county-wide finance exclusion, and countermeasures for county-wide finance exclusion. In these, function of county-wide finance to county-wide economy and county-wide finance exclusion are major parts of relevant researches. In this study, through literature review, we hope to provide directive guidance for researches of development of county-wide finance in China.

According to search results of literature database, by the database update time, there is no study of China’s county-wide finance issue by combining literature and bibliometrical methods. With the aid of data mining technology, we arranged and analyzed literature related to county-wide finance researches indexed by China Academic Journals Full-text Database between 1991 and 2013, to realize more comprehensive and visual grasp of scientific research and frontier development of China's county-wide finance at current stage.

2 Data source and study method

2.1StudymethodIn this study, we mainly used literature study method, including bibliometric method and literature review.

The bibliometric method is a convenient and high efficient scientific study of breaking limitation of time and space from transverse and longitudinal perspectives through search, screening, sorting, quantitative literature analysis. This method can bring into play visual advantage of qualitative research, deeply and objectively understand current development situation, research hot spots of certain discipline using tables, graphics, and models, discipline distribution, and grasp general situations of relevant disciplines, to ensure value and frontier position of academic research.

Literature review is a comprehensive review of existing literature, which includes the current knowledge including substantive findings, as well as theoretical and methodological contributions to a particular topic. Literature reviews use secondary sources, and do not report new or original experimental work.

2.2DatasourceThe data in this study were collected from searching CNKI journal database. CNKI is highly recognized and wide applied in academic circle. Established in 1996, it is a high quality online integrated database covering digital resources for all disciplines with the largest scale in the world. Literature in CNKI is updated promptly, and the daily upload of new literature is up to 50000 papers. In this study, we mainly applied advanced search to obtain digital resources. Through comparison of several times of search test, we found that taking "county-wide" and "finance" as subject words in advanced search can combine comprehensiveness and accuracy of data resource search. We screened Economics and Management discipline, Social Science I, and Social Science II, made strict definition of categories of periodical source, and only selected SCI, EI, CSSCI, and core journals as source of periodicals. Considering significance of research, the time span for data selection is January 1st, 1991 to December 31, 2013.

3 Result analysis of literature samples

3.1AnalysisofliteratureoutputUsing advanced search, we rejected non-periodical literature and obtained 4204 papers studying "county-wide" and "finance". Limiting SCI, EI, CSSCI and core journals as source of periodicals, and deeply rejecting literature published in several journals at the same time, we found that the total valid papers published is 887 and high level papers account for 21% of total valid papers published.

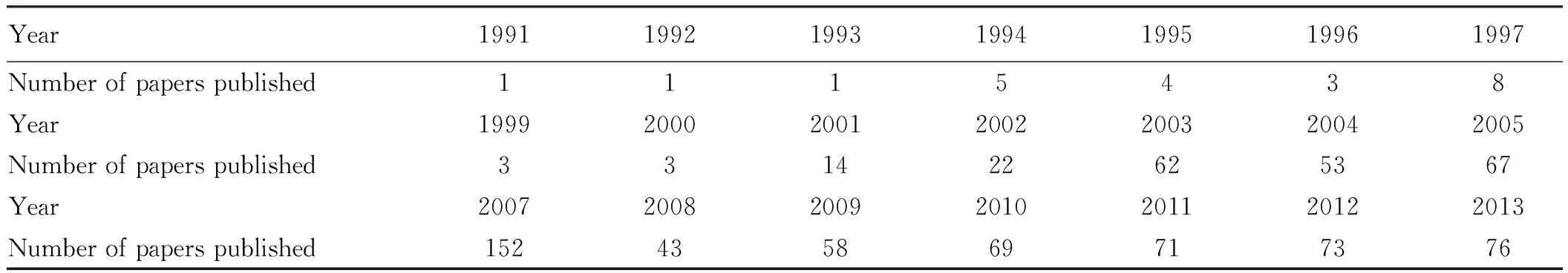

Table 1 lists general situations of literature research with "county-wide finance" as subject between 1991 and 2013. Researches of "county-wide finance" generally take on firstly increasing, then decreasing, and finally steady trend. Between 1991 and 2000, scholars published 8 papers about "county-wide finance" in 1997, which is the largest number; in other years, the number was less than 5. Between 2001 and 2007, the number of papers annually published gradually increased, and rose to the peak value in 2007, the number was up to 152. However, the number was sharply dropped in 2008, less than 1/3 of the year 2007. After 2008, it steadily rose. Between 2011 and 2013, the number of papers annually published got steady at more than 70.

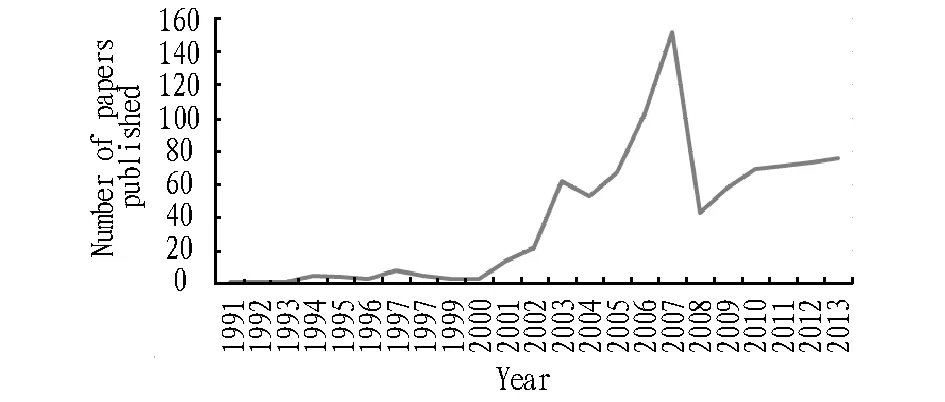

In Fig. 1, from analysis of the overall trend of number of papers about "county-wide finance", the researches of this field can be divided into 3 stages. The first stage is between 1991 and 2000. At this stage, academic circle started to make preliminary exploration of "county-wide finance". In these 10 years, 34 papers were published, accounting for 3.83% of the total papers published between 1991 and 2013, the annual number was 3.4. The second stage is between 2001 and 2007. This stage is the development stage of researches of "county-wide finance". At this stage, the total papers published reached 473, accounting for 53.33% of the total papers published between 1991 and 2013, annual number was 67.57. In 2004, central government firstly proposed that China should reform and innovate upon county-wide financial system, guide flow of credit funds through county-wide financial institutions, adjust financial service methods, and promote county-wide economic development. Later, No. 1 document of central government included requirement of promoting county-wide economic development through county-wide finance for 3 consecutive years. Between 2004 and 2007, papers about county-wide finance realized breakthrough growth and 152 such papers were published in 2007. Due to influence of global financial crisis in 2008, academic circle focused on financial crisis, the proportion of papers about "financial crisis" rose from 5.57% in 2007 to 17.47% in 2008, and papers about "county-wide finance" were sharply decreasing. From Fig. 1, we can see that researches about "county-wide finance" in 2008 took on linear dropping. The third stage is between 2008 and 2013. At this stage, the researches of "county-wide finance" were steady. Total number reached 390 in 6 years, accounting for 43.97% of the total papers published between 1991 and 2013, the annual number was 65. The number of papers about "county-wide finance" rose steadily and became gradually stable. At this state, high concern of central government and policy support were power source of researches about "county-wide finance".

Table1Comparisonofnumberofpaperspublishedaboutcounty-widefinancebetween1991and2013

Year19911992199319941995199619971998Numberofpaperspublished11154385Year19992000200120022003200420052006Numberofpaperspublished331422625367103Year2007200820092010201120122013-Numberofpaperspublished152435869717376-

Fig.1 Comparison of number of papers published about county-wide finance between 1991 and 2013

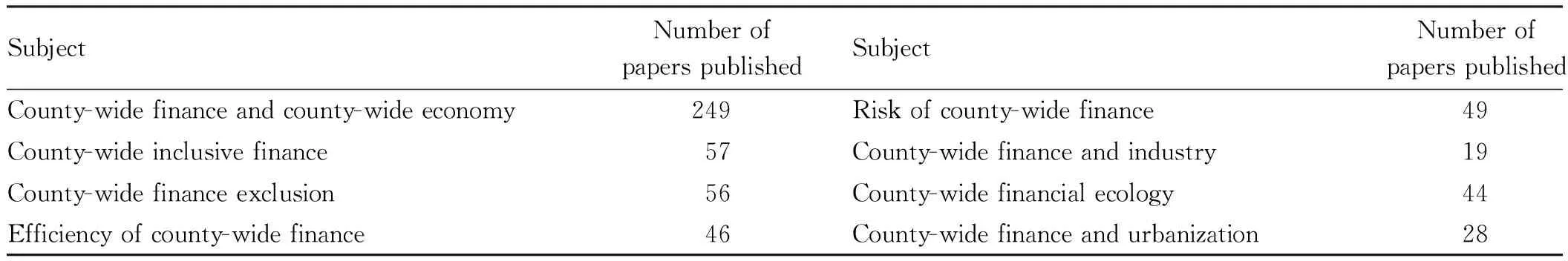

3.2AnalysisofresearchhotspotsThrough summarizing and arranging research subjects of county-wide finance, relevant hot spots are clear, as listed in Table 2. For the top 8 hot spots of county-wide finance researches, the number of papers published was 548, accounting 61.78% of total papers published. Top 3 subjects are county-wide finance and county-wide economy, county-wide inclusive finance, and county-wide finance exclusion, the number of these three hot spots was 249, accounting for 45.44% of total papers published. Other hot spots also include assessment of county-wide financial efficiency, evaluation of county-wide financial risk, risk influence factors, and risk preventive measures; support of county-wide finance for industries; agglomeration of county-wide financial industry; ecological evaluation and optimization of county-wide finance. In sum, county-wide finance and county-wide economy, county-wide inclusive finance, and county-wide finance exclusion were given more attention.

Table2Distributionoftop8researchhotspotsofcounty-widefinance

SubjectNumberofpaperspublishedSubjectNumberofpaperspublishedCounty-widefinanceandcounty-wideeconomy249Riskofcounty-widefinance49County-wideinclusivefinance57County-widefinanceandindustry19County-widefinanceexclusion56County-widefinancialecology44Efficiencyofcounty-widefinance46County-widefinanceandurbanization28

4 Research progress of county-wide finance

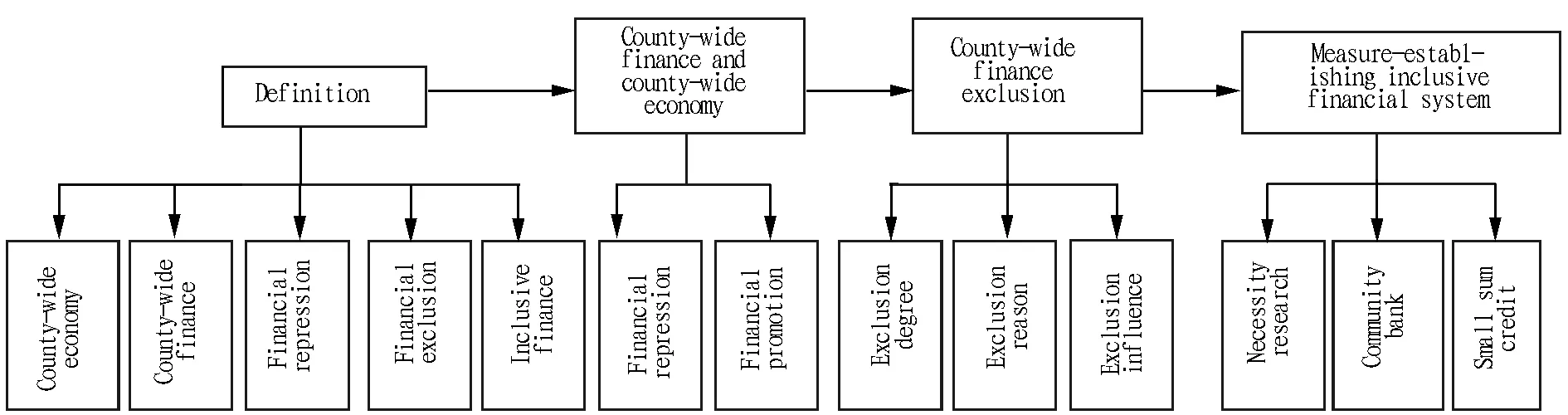

From 2002 to 2014, No. 1 document of central government has stressed promoting development of county-wide economy for 13 consecutive years. The county-wide economy is a basic unit of Chinese economy. With the aid of mobility of capital, the development of county-wide finance can stimulate vitality of elements of the county-wide economy. According to statistics, domestic research about the county-wide economy started in 1991. Literature researches experienced three stages: exploration, development, and stable stages. On the whole, researches of county-wide finance are carried out mainly from definition, county-wide finance and county-wide economic issue, county-wide finance exclusion, and countermeasures for county-wide finance exclusion. In these, function of county-wide finance to county-wide economy and county-wide finance exclusion are major parts of relevant researches.

Fig.2 Block diagram for research progress of county-wide finance

4.1Researchofdefinitionofcounty-widefinanceBoth the researches of project team of editor department ofJinanFinance[1]and Qian Shuitu (2006)[2]provide us with clear definition of county-wide economy. In their opinion, county-wide economy is an economic form with the county (basic unit of China's administrative division) as carrier, towns as center, and rural areas as foundation, to realize effective connection between urban economy and rural economy. Jin Lei (2007)[3]defined the county-wide finance as finance different from urban finance with county as basic unit of financial research, including county-wide financial institutions, financial business, financial market, as well as county-wide financial environment. Huang Qietal(2013)[4]made a definition of county-wide financial institutions. In their opinion, with reference to classification standard of China Banking Regulatory Commission for rural finance, county-wide financial institutions include five largest commercial banks (Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, and Bank of Communications), policy banks, joint-equity commercial banks, urban commercial banks, rural cooperative banks, rural commercial banks, and postal saving; county-wide credit cooperatives include all levels of rural credit cooperatives and new rural institutions. American economist Ronald I. Mckinnon (1973)[5]and Edward S. Shaw (1973)[6]defined financial repression and financial deepening. Financial repression refers to the problems of incomplete financial marketization, lack of diversity in financial institutions, excessive financial regulation, and low financial efficiency in developing countries; financial deepening refers to overcoming financial repression through loosening financial regulation, promoting financial marketization, and improving financial system. In opinion of Du Gang (2007)[7], county-wide financial repression is the situation of non-marketization, excessive financial regulation, and lack of diversity in financial institutions leading to vicious circle of mutual restriction of county-wide economy and county-wide finance. According to researches of Leyshon and Thrift (1995), Carboetal(2005)[8], financial exclusion is the inability of certain groups to access necessary financial services in an appropriate form. It can stem from problems with access, prices, marketing or financial literacy, or from self-exclusion in response to negative experiences or perceptions. A person is considered financially excluded when they have no access to some or all of the services offered by mainstream financial institutions in their country of residence or do not make use of these services. Dong Xiaoling and Xu Hong (2012)[9]stated that there was no clear definition of financial exclusion, but it may refer to obstruction of weak groups in obtaining financial services. As for the definition of inclusive finance, there are still no unified opinions both at home and abroad. Helms (2006)[10]stated that it is required to improve financial service system, provide widespread financial services, and ensure excluded groups can obtain effective financial services; Du Xiaoshan (2006)[11]held that inclusive financial system should reflect its fairness and satisfy groups needing financial services, not subject to limitation of income level and spatial distance. Tian Jie (2012) stated that financial development should consider financial depth and width, financial depth can be deemed as inclusive finance, while financial width takes availability and convenience of financial service as objectives[44].

4.2Researchofcounty-widefinanceandcounty-wideeconomyIn the researches of county-wide finance, the number of papers about the relationship between county-wide finance and county-wide economy is as large as 249, accounting for 28.07% of the total papers published. The editor department of Jinan Finance[1]is the organization that carried out the research of county-wide finance and county-wide economic development in the earliest time. According to its researches, there is significant linear positive correlation between financial institutions and loan issue of county-wide economy and changes in total supply and demand of county-wide macro economy. With deepening of researches, scholars start to concern about financial promotion and financial repression.

4.2.1Repression of county-wide finance to county-wide economy. A lot of scholars have studied county-wide financial repression, such as Dong Jisheng and Yang Xuefeng (2003)[12], Qian Shuitu and Cheng Jianwei (2005)[13], Qian Shuitu and Yu Jianrong (2005)[14], Qian Shuitu (2006)[15], Yang Lin and Yan Linlin (2012)[16], Du Gang (2007)[7], Qin Wanshun (2010)[17], You Jiang and Fan Liang (2010)[18], and Du Lixia[19]. According to Dong Jisheng and Yang Xuefeng (2003)[20], vacancy of county-wide financial service restricts development of county-wide economy, and capital is indispensible in the development of county-wide economy. Qian Shuitu and Cheng Jianwei (2005)[13], Qian Shuitu and Yu Jianrong (2005)[14], Qian Shuitu (2006)[15], Yang Lin and Yan Linlin (2012)[16]studied county-wide financial repression from the perspective of supply-demand conflict. Chaired by Qian Shuitu, their studies concluded that actual conflict between county-wide finance and county-wide economy stems from the conflict between endogenous action of county-wide economic development to demand of county-wide finance and leading of government over county-wide financial supply. Yang Lin and Yan Linlin divided the supply and demand conflict of financial repression and put forward the concept of "supply type financial repression" and "demand type financial repression". The supply type financial repression is manifested in insufficiency of financial supply subjects and disorderly operation, while the demand type financial suppression is manifested in financial demand subjects failing to reach high threshold of financial supply subjects. Du Gang (2007)[7]studied current situations of China’s dual economic structure and stated that there is still dual structure in China's finance. Researches have shown that the county-wide financial repression is significant and there are problems of diversified county-wide finance, low innovation degree, and outflow of county-wide funds, and uncoordinated urban and rural financial development. Qin Wanshun (2010)[17]made regression of county-wide economic growth and county-wide financial development through establishing panel data model, and found that smaller county-wide finance has higher promotion to county-wide finance and the development efficiency of county-wide finance leaves no significant influence on county-wide economy. You Jiang and Fan Liang concluded that county-wide financial repression is resulted from low competition of county-wide financial market. Du Lixia (2012)[19]compared county-wide financial development in developed areas and underdeveloped areas and stated that there is worse financial repression in underdeveloped areas.

4.2.2Promotion of county-wide finance to county-wide economy. A lot of scholars have made relevant researches about finance, such as Shi Quanhu (2009)[21], Qian Liangxin (2010)[22], Shi Shenglin (2011)[23], Gao Xiaoyan (2013)[24], Guo Yanling (2013)[25], and Tian Jie (2013)[26]. Shi Quanhu (2009)[21]made theoretical analysis and proposed promotion mechanism of county-wide finance, namely, it brings about flow of other county-wide production elements through fund demand of county-wide economic development and raising funds through financial approach, to realize growth of county-wide economy. Qian Liangxin (2010)[22]combined theoretical analysis and empirical analysis, made theoretical analysis on promotion mechanism of county-wide finance, and verified financial promotion mechanism through analyzing data of Zhejiang Province between 2001 and 2008. According to opinions of Shi Shenglin (2011)[23]and Guo Yanling (2013)[25], the financial promotion mechanism is not unique, there is difference in county-wide financial promotion mechanism due to difference in regional economic development level. For economically developed areas, the relationship between finance and economy is demand chasing; for medium-developed areas and underdeveloped areas, the relationship between finance and economy is supply leading. With the aid of panel data, Gao Xiaoyan (2013)[24]and Tian Jie (2013)[26]made an in-depth study on the relationship between county-wide finance and county-wide economical development. Gao Xiaoyan made a panel analysis on data of 47 counties in eastern, central and western areas of China between 2005 and 2011, and found that as for the efficiency of county-wide financial development, there is positive correlation between county-wide financial development and county-wide economy in these areas, and the positive correlation is more significant in eastern areas; as for development scale of county-wide finance, there is positive correlation between county-wide financial development and county-wide economic growth in central areas, while there is negative correlation between county-wide economic growth and county-wide financial development in eastern and western areas. Tian Jie (2013)[26]enriched research data and studied the applicability of panel data of 1769 counties (cities) between 2006 and 2010 for testing the "optimum financial structure" theory, and found that the decline of concentration of county-wide banks promotes county-wide economic growth.

4.3County-widefinancialexclusionZhu Yinglietal(2010)[27]and Tian Jie and Tao Jianping (2011)[28]studied county-wide financial exclusion from the perspective of administrative division. Researches of Zhu Yinglietal(2010)[27]indicate that there usually exists financial exclusion in counties where natural conditions are poor, economic development is backward, rural population is large, and the proportion of primary industry to tertiary industry is high. Tian Jie and Tao Jianping (2011)[28], using σ convergence, β convergence and club convergence methods, on the basis of panel data of 1728 counties between 2006 and 2009, analyzed convergence of county-wide financial exclusion with index of financial exclusion (IFE) as indicator. According to their researches, there exists σ convergence in overall situation of financial exclusion and significant β convergence; after controlling geographical position, per capita GDP, urbanization ratio, educational level, urban and rural income gap, information technology, employment rate, and commercial environment, financial exclusion in rural areas shows conditional β convergence; there is no club convergence in eastern, central and western areas; western and eastern areas show divergence, while central areas show convergence. Dong Xiaolin and Xu Hong (2012)[9]analyzed factors influencing the county-wide financial exclusion from the perspective of financial supplier. On the whole, counties with small population size, small total retail sales of social consumer goods, and poor financial infrastructure are vulnerable to financial exclusion; when designing network distribution, commercial banks mainly consider urban population size and urban resident income, but rural credit cooperatives mainly consider population size when designing network distribution. On the basis of previous researches and with the aid of panel data, Tian Jie and Tao Jianping (2012)[29]evaluated county-wide financial exclusion by IFE and studied influence of regional factors and other social and economic factors on county-wide financial exclusion. Their researches indicate that there is serious financial exclusion in western counties, followed by central counties, and the situation of financial exclusion is not significant in eastern counties. These reflect that there is positive negative correlation between social economic characteristics and economic support and county-wide financial exclusion. Tian Jie and Tao Jianping (2011)[30]made empirical analysis on the relationship between county-wide financial exclusion and urban and rural income gap from national level and eastern, central and western level. They found that there is significant positive correlation between county-wide financial exclusion and urban and rural income gap at national level, and there is significant negative correlation between county-wide financial exclusion and urban and rural income gap in counties with higher proportion of non-agricultural industries; at regional level, there is significant positive correlation between county-wide financial exclusion and urban and rural income gap in eastern and western counties, and the correlation is not significant in central areas. Previously, some scholars have mentioned factors influencing county-wide financial exclusion, but not mentioned the degree of influence. Combining theoretical and empirical analysis, Tan Yanzhietal(2014)[31]discussed factors leading to county-wide financial exclusion. They found that there is significant positive correlation between county-wide economic development level and number of county-wide financial institutions, and county-wide economic level gap can roughly account for 33% of rural financial exclusion gap. This conclusion is also adaptable to arrangement of county-wide commercial financial institutions and rural financial institutions.

4.4Countermeasuresforcounty-widefinancialexclusion:buildinginclusivefinancialsystem

4.4.1Necessity of building inclusive financial system. Huang Wensheng and Tao Jianping (2009)[32]found that innovation of county-wide financial institutions can effectively solve the problem of county-wide financial exclusion. Meng Fei (2009)[33]held that inclusive finance can effectively solve the problem of county-wide financial exclusion. Tan Wenpei (2013)[34]stated that it is necessary to build a framework integrating market, government, and communities, forming a county-wide inclusive financial system with three parts mutually promoting and complementing.

4.4.2Building inclusive finance: small sum credit and community banks. Financial innovation of Huang Wensheng and Tao Jianping (2009)[32]and Zhang Ping (2011)[35]refers to building inclusive financial system, namely, developing small sum credit and building micro finance through absorbing capitals to county-wide financial system, to solve the problem of county-wide financial exclusion.

(i) Building small sum credit mechanism. On the basis of referring to Grameen Model, Zhou Mengliang and Li Mingxian (2010)[36]built team combined insurance mode and small sum credit mechanism through technological innovation of loan, to stimulate enthusiasm of customers for repaying the loan. Zhou Mengliang and Li Mingxian (2011)[37]stated that it is feasible to build "large commercial banks + small sum credit institutions + farmers" integrated small credit operation mode using advantages of large commercial banks absorbing deposits and sensitivity of credit demand of small sum credit institutions. Wu Xiaoling (2013)[38]found that small sum credit can effectively solve the problem of county-wide financial exclusion, and believed that proper positioning, moderate innovation and excellent external environment can eliminate obstacles to development of small sum credit.

(ii) Innovation of financial institutions: community banks. Meng Defengetal(2012)[39]and Leng Tianming (2014)[40]stated that developing community banks can effectively solve the problem of county-wide financial exclusion. According to researches of Meng Defengetal(2012)[39], economic, social, policy, and financial facilities are core factors influencing county-wide financial exclusion; there is positive correlation between village and township bank development and economic opening, enterprise economic benefits, and employment situation, it is negatively correlated with tax policies; village and township banks are not limited to county-wide economic factors and financial facilities, and can break the difficulty in county-wide financial exclusion. According to researches of Leng Tianming (2014)[40], establishing community banks can effectively solve the problem of county-wide financial exclusion and community banks can be established through transformation of small sum credit companies, launching by existing commercial banks, or setting up by private capital investment. Researches of Meng Fei (2009)[41], You Chun and Zuo Chengxue (2013)[42], and Leng Tianming (2014)[40]indicate that building of county-wide financial innovation and inclusive financial system is inseparable from perfect supervision system and support of rating system. Meng Fei (2009)[41]stated that it is necessary to implement different supervision methods according to characteristics of county-wide financial institutions. You Chun and Zuo Chengxue (2013)[42]held that establishing rating system pertinent to micro financial institutions is a foundation for building community banks.

5 Conclusions and prospect

The relationship between county-wide finance and county-wide economic development is a research hot spot of domestic scholars and also a key issue in No. 1 document of central government for many years. Scholars mainly focus on restriction of county-wide finance to county-wide economy and promotion of county-wide finance to county-wide economy. For county-wide financial repression and promotion, scholars have made extensive studies from all aspects and perspectives, and studied current situations, reasons, degree, and countermeasures of financial repression. The research in this field is relatively mature and has formed a comparatively complete and mature research system. Therefore, it is difficult for research of this field to stimulate breakthrough point of growth of county-wide financial researches. Researches about countermeasures for county-wide financial exclusion are mainly concentrated on building county-wide inclusive financial system with building community banks and implementing small sum credit as starting point. Researches of this field mainly remain qualitative and theoretical researches, nearly no case studies and practical researches. Besides, there are few researches about countermeasures for county-wide financial exclusion, only Tan Yanzhi (2014)[43]made certain innovation on research of county-wide financial exclusion and found that urbanization plays an irreplaceable role in solving the problem of rural financial exclusion. With other variables not changing, if urbanization level of counties is equal, the gap of county-wide financial exclusion will shrink about 20%. Research of extension of county-wide financial exclusion and inclusive finance is devoted to eliminating blind points of practical researches of financial exclusion, and also is future direction of county-wide financial researches. The research of this field is likely to become breakthrough point of stimulating re-growth of county-wide financial researches.

[1] The Editorial Department of Ji’nan Economy. An empirical analysis on financial resource allocation and county economic development[J]. Journal of Financial Research, 2002(6): 79-86. (in Chinese).

[2] QIAN ST. County economic development and financial system restructuring: The case of Zhejiang Province[J]. Journal of Financial Research, 2006(9): 148-157. (in Chinese).

[3] JIN L. How to realize the harmonious development of county economy and county finance[J]. Contemporary Finance, 2007(6): 31-32. (in Chinese).

[4] HUANG Q, TAO JP, TIAN J. The factors to impact the credit risks of county financial institutions—An analysis based on the samples of China’s 2069 counties (cities)[J]. Finance Forum, 2013,18(10): 9-15, 57.[] (in Chinese).

[5] McKinnon Ronald I. The order of the liberalization of the economy[M]. Beijing: China Financial Publishing House, 1993. (in Chinese).

[6] EDWARD SS. Financial deepening in economics development[M]. Shanghai: Shanghai Sanlian Bookstore Press, 1988.(in Chinese).

[7] DU G. Study on financial repression of the county[J]. Journal of Shanxi Finance and Economics University, 2007(S2): 113-115. (in Chinese).

[8] TIAN J. Study on rural finance exclusion in China[D]. Wuhan: Huazhong Agricultural University, 2012.(in Chinese).

[9] DONG XL, XU H. An empirical analysis on the influencing factors of rural finance exclusion in China[J]. Journal of Financial Research, 2012(9): 115-126. (in Chinese).

[10] HELMS B. Aeeess for all: building inclusive financial systems[M]. World Bank Publications, 2006.

[11] DU XS. On the idea of inclusive financial system and rural financial reform[J]. Rural Credit Cooperative of China, 2006(10): 23-24. (in Chinese).

[12] DONG JS, YANG XF. Financial scarcity and vicious cycle of poverty[J]. Contemporary Finance & Economics, 2003(10):51-53.(in Chinese).

[13] QIAN ST, CHENG JW. Study on the development of county economy and the reconstruction of county finance system[J]. Zhejiang Social Sciences, 2005(6): 218-222. (in Chinese).

[14] QIAN ST, YU JR. Study on the reconstruction of China’s county financial system based on the requirement of county economy[J]. Business Economics and Administration, 2005(7): 59-63. (in Chinese).

[15] YANG , YAN LL. On the dilemma and path choice of economic development supported by county finance[J]. Productivity Research,2013(8):71-73.(in Chinese).

[16] QIN WS, ZHONG HN. An empirical analysis on the relationship between the growth of county economy and financial development in China[J].Comprehensive Competitiveness,2010(4):64-70.(in Chinese).

[17] YOU J, FAN L. Rural financial competition level and development of rural financial institutes: Samples from provincial finance[J]. Finance & Economics 2010,04:17-24.(in Chinese).

[18] DU LX. On the rural financial repression in the underdeveloped area and its solution[J]. Commercial Time,2012(4):61-63.(in Chinese).

[19] DONG JS, YANG XF. Financial scarcity and vicious cycle of poverty[J].Contemporary Finance & Economics,2003(10):51-53.(in Chinese).

[20] SHI QH. On the theoretical thinking of economic development supported by county finance [J]. Comparative Economic and Social Systems, 2009(2): 60-64. (in Chinese).

[21] QIAN LX. The empirical study on the mechanism of intra-county finance and intra- county economic development[J]. China Development, 2010(4): 63-67. (in Chinese).

[22] SHI SL. An empirical study of financial density and economic growth in county areas: Explanations by the monopolistic competition model[J]. Journal of Central University of Finance & Economics, 2011(4): 39-44. (in Chinese).

[23] GAO XY, DU JX, MA L. The empirical research on the interactive relationship between the county economy and county finance in our country: Based on the 47 counties data of China’s eastern, central and western areas[J]. Journal of Central University of Finance & Economics, 2013(12): 43-49. (in Chinese).

[24] GUO YL. Financial development, financial system efficiency and economic growth in county areas: An empirical study based on 91 counties of Shandong Province[J]. South China Finance,2013(1): 46-51.(in Chinese).

[25] TIAN J, LIU Y, TAO JP. The influence of rural banking structure on the rural economic growth-Based on the background of new type of rural financial institutions innovation[J].Economy and Management,2013, 27(9):36-42.(in Chinese).

[26] ZHU YL, LIU GH, LI XJ. Study on the measurement and causes of the financial exclusion in the center area[J]. Financial Theory and Practice, 2010(2): 70-74. (in Chinese).

[27] TIAN J, TAO JP. Empirical analysis on spatial differences and convergence of the rural financial exclusion:Based on the data from 1728 counties and cities[J]. Statistics & Information Tribune, 2011, 26(12):97-102.(in Chinese).

[28] TIAN J, TAO JP. Social economic characteristics, information technology and rural finance exclusion[J]. Modern Economic Science,2012(1):58-65, 126.(in Chinese).

[29] TIAN J, TAO JP. The impact of rural financial exclusion on the rural-urban income gap empirical analysis based on the panel data from our 1578 counties (cities)[J]. Economic Issues in China, 2011(5):56-64.(in Chinese).

[30]TAN YZ, CHEN B, TIAN LP,etal. The factors and extent that have resulted in the rural financial exclusion problem: An empirical research based on the data of 667 counties from six central provinces of China[J].Economic Review,2014(1):25-37. (in Chinese).

[31] HUANG WS, TAO JP. Innovating new type rural financing institution, breaking the “marginalization” of rural finance[J]. Productivity Research, 2009(4): 28-30.(in Chinese).

[32] MENG F. Accessibility of financial service: Regulatory issues and institutional innovation[J]. Finance and Economics, 2009(8):18-24.(in Chinese).

[33] TAN WP. On constructing the rural inclusively financial system from the perspective of "trinity"[J].Journal of Hunan University of Science & Technology (Social Science Edition), 2013,16(6):85-88.(in Chinese).

[34] ZHANG P. Vigorously developing micro-credit, promoting inclusive finance system construction in China[J]. Productivity Research, 2011(5): 51-52.(in Chinese).

[35] ZHOU ML, LI MX. Group lending model and microfinance mechanism innovation: Based on inclusive finance perspective in China[J].Business Economics and Administration,2010(9):51-58.(in Chinese).

[36] ZHOU ML, LI MX. The model and mechanism of big commercial bank’s involving in microfinance in the view of inclusive financial system[J].Reform, 2011(4):47-54.(in Chinese).

[37] WU XL. Develop micro-credit and promote inclusive finance[J]. China Business and Market, 2013, 27(5):4-11. (in Chinese).

[38] MENG DF, LU YJ, FANG JB. Analysis on the influencing factors of the development of village banks from the angle of financial exclusion[J]. Economics Information,2012(9):70-73.(in Chinese).

[39] LENG TM. Study on the development path and risk management of community banks[J]. Finance and Economy, 2014(2): 48-50, 38. (in Chinese).

[40] MENG F. Accessibility of financial service: Regulatory issues and institutional innovation[J].Finance and Economics,2009(8):18-24.(in Chinese).

[41] YOU C, ZUO CX. Study on the rating system of micro finance institution in China[J].New Finance, 2013(4):60-63.(in Chinese).

[42] TAN YZ, CHEN B, TIAN LP,etal. The factors and extent that have resulted in the rural financial exclusion problem: An empirical research based on the data of 667 counties from six central provinces of China[J]. Economic Review, 2014(1): 25-37. (in Chinese).

[43] TIAN J, JIA TY, TAO JP. Productivity effect of rural inclusive finance development in China——Empirical study on data from 1 867 counties(cities)[J].Journal of Huazhong Agricultural University(Social Sciences Edition), 2012(3): 28-32.(in Chinese).

November 19, 2015 Accepted: December 11, 2015

Supported by Social Science Foundation of Hubei Province (2011LJ023); Project of National Natural Science Foundation (71173086).

*Corresponding author. E-mail: 1091612955@qq.com

Asian Agricultural Research2016年1期

Asian Agricultural Research2016年1期

- Asian Agricultural Research的其它文章

- Application and Residue Pollution of Mulching Films in Xinjiang

- Resource Dependence Relationship between Grass-roots Government and Farmers’ Specialized Cooperatives

- Urban Residents’ Consumption Risk Perception about the Dairy Products

- Study on the Aromatic Components of Green Plum Wine by HS-SPME-GC-MS

- Effect of Vacuum Packaging on Storage Quality of Peanut

- Innovative Development of Fishery and Ecological Protection of Poyang Lake