Active and Passive Factors of Oil Prices

HAI Bao(海 豹),SHEN Liyong(申立勇)*

1School of Mathematical Sciences,University of Chinese Academy of Sciences,Beijing 100049,China

2Key Laboratory of Big Data Mining and Knowledge Nanagement,Chinese Academy of Sciences,Beijing 100190,China

Introduction

Volatility of oil price directly affects the price level of daily production and living materials,and leads to the consumer price index(CPI)and producer price index(PPI).Moreover,it influences many fields related to economics,politics,and social development.The volatility increases the instability of international financial markets and gives the adverse effects to the global economic growth,for instance,increasing the difficulty of formulating macroeconomic policies,increasing energy security pressure,increasing the difficulty of production costs,and hindering the continuity of the investment[1-4].

There are papers focusing on finding the factors of oil price and their contributions to the price.Wang et al.discussed the relationship between oil prices and inflation[5].The impact of unexpected events on the oil prices was studied in Ref.[6].Dées et al.[7]investigated the factors that might have contribution to the oil price increase in addition to demand and supply for crude oil.Breitenfellner et al.[8]found that the macroeconomic impact of the most recent oil price upsurge was generally moderate until mid-2007.The demand and supply model was the natural model[9-11].However,some factors are difficult to explain their contributions using the demand and supply model.Actually,the oil and related products involve in many areas of economy and society,and the contribution factors often influence each other with nonlinear relationships.In this paper,we try to divide the factors by their active and passive contributions to the price.Active factors give active influences on the oil price.Passive factors interactively and passively impact on the oil price.In this situation,we give more reasonable explanation according the investigation.The price data in this paper are the WTI price.The data of the prices and the influence factors are collected from U.S.Energy Information Administration (EIA),National Bureau of Statistics of China,and some other authority organizations[12].

The paper is organized as follows.In the next section,we give some abnormal factors from the historic data under the traditional view.In section 2,we give more analyses of active and passive factors.Section 3presents the contributions for the price model.Finally,we conclude our paper in section 4.

1 Abnormal Factors of the Data

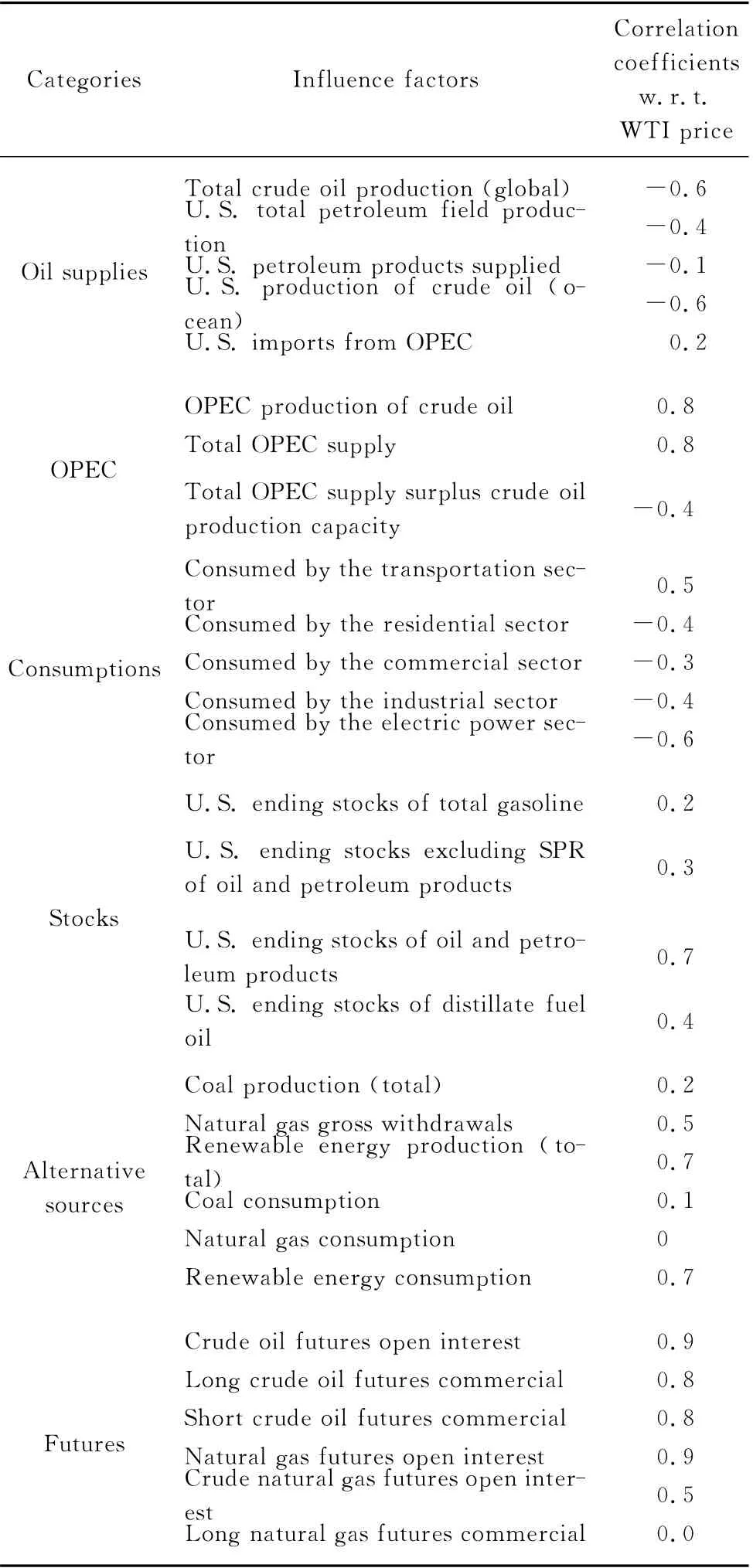

According to the qualitative analysis,crude oil supply and oil consumption as the basic factors affecting the price of oil,should be consistent with the basic law of market demand and supply model,i.e.,the more crude oil is supplied,oil prices should be lower;the bigger the consumption,the higher the price.However,through the correlation analysis of the factors of supply and demand of historical data and oil prices(see Tables 1and 2),we can see the influences of supply and demand factors,most of them agree with the basic laws of supply and demand effects of price fluctuations,but some of the factors and expected qualitative analysis results are inconsistent.

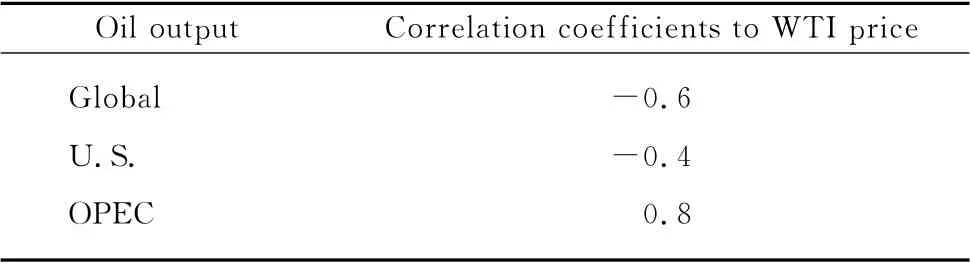

Table 1 Correlation between the oil outputs and WTI price

Table 2 Correlations between the consumptions and WTI price

1.1 Positive impact of OPEC production on the price

From Table 1,the total supply of oil and the oil price show a negative correlation which supports the fact that the oil supply can determine the trend of oil price to some extent.However,OPEC supply and oil price give strong positive correlation,it means that we cannot regard OPEC as a traditional oil supply.Therefore,we further discuss the OPEC oil supply factors.OPEC is an important organization but more than an oil supplier,and it also plays the policymaker and regulator in the global oil price system.OPEC output and the oil price show negative correlation;in fact,the OPEC output is set as a subsequent reaction for the price volatility.To show this more intuitively,we normalized the data in analysis.In Fig.1(the data is normalized),using the concepts of active and passive contributions,OPEC production can be regarded as an appropriate passive adjustment for the oil price.And this adjustment can also be used to secure a steady income to the member states and secure supply of oil to the consumers;these measures just meet the goal of OPEC.

Fig.1 Relationship between OPEC output and WTI price

During the period from 1999to 2009,OPEC gave the positive contribution to the price directly and obviously,but in the years following 2009,OPEC showed a negative correlation with the price in a short term.This shows that the regulatory effect of OPEC on oil price is a complex and evolutive process.

1.2 Nonuniform impact of oil consumptions on the price

From Table 2,the transportation consumption of oil and the historical price show the positive correlation,which supports the basic market rule of price and demand.However,the other petroleum consumptions,including residential,industrial,commercial,electric power,etc.,have the negative correlation to price.In fact,one can find that transportation consumption is a rigid demand.And the other consumptions can be elasticity of demand in different levels.When the price of oil is high,the consumption of these types will have a corresponding reduction;conversely,the consumption of these will have a corresponding increase with low oil price.Of course,increase or decrease of these consumptions leads changes to oil price in the next stage.These consumptions have become passive influence factors of the oil price.

2 More Analyses about Active and Passive Factors

Based on the above correlation analysis,we find that if the factors of oil price are distinguished with active and passive factors then the detailed analysis is conducive to the convenient and accurate qualitative analysis of the relevant factors,and can also provide the better theoretical quantitative model.

Active factors give active influences on the oil price.These factors for the volatility play key roles and directly determine the basic trend of oil price,and therefore,these factors are essential parameters in the mathematical model.

Passive factors interactively and passively impact on the oil price.Their changes associate with the last stage of oil price fluctuations,which in turn affect the price of oil to the next stage.The passive factors follow not only their own properties but also the constraint of oil price.Hence,the changes of these factors are more complex,with more uncertainty.

From the analysis of active and passive factors,we can find some unusual but very meaningful results.

2.1 Active and passive factors of oil output

Oil output is a main factor determining the oil price,and the quantity of oil output directly determines the basic price level.According to the data analysis,the oil outputs exactly belong to the active factors.One can find that the global oil output and the crude oil output of U.S.correlate with the oil price negatively.The output influences the price actively and the fact is consistent with market expectation.However,the OPEC output is shown as a passive factor.And another discovery,the crude oil output of China is also acted as a passive factor.

2.2 Active and passive factors of oil consumption

Oil consumption plays a demand role in the market.It is another important active factor of oil price.Similar to the discussion above,transportation oil consumption is a rigid demand;it plays a decisive role in the formation of the oil price and then belongs to the active factors.However,the consumptions of business,industrial and electric power are due to the oil price in a controlled state.Thus,they form a group of passive influence factors.

2.3 Passive factor of Chinese oil output

The oil output,the amount of import and export of oil and CPI of China all show strong positive correlations to the oil price.

Chinese crude oil output has a positive correlation with the oil price,and the correlation coefficient reaches 0.8.As a reasonable explanation,Chinese crude oil output is a stress response of the oil price,in other words,a kind of passive factor.When oil price is high,China has to increase the national oil output and reduce the demand of foreign imports;when oil price is low,China's oil output decreases and foreign imports increases.It is also a natural market balance for keeping continuing supply of resources in a low price level.Besides,the passive correlation shows the fact that China has little voice in international crude oil pricing and has to be apassive factor in the past years.

2.4 Active influence of incident

Incident is an event beyond people's expectations.In a relatively short period of time after the incident,the oil price often has volatilities.These features make the incident a typical of the active type factor.We summarize the historic events to support the fact(see Fig.2),and we can find that there are important events near the big price disturbances.Incidents will generally affect oil prices from two aspects,one is to change the short-term supply and demand amount of oil and the other is the impact on people's psychological expectations of future prices.With the strengthening of responsibility of the oil market in emergency,the impact of unexpected incident will be gradually weakened.

Fig.2 The historic events with the WTI price

2.5 Stocks changing their roles as needed

The safe stocks are used to avoid large price fluctuations and ensure national economic security.When oil price rises,the stocks increased by short-term market supply will reduce prices;when oil price falls,stocks are replenished and turned to be the consumers.Therefore,the stocks converse between active and passive factors as needed,and influence the oil price adjustment directly.The positive correlation of stocks and price is an active performance.When the oil price rises but is still in the acceptable range,stocks are not released,but gradually increased and accumulated to a certain number to ensure the inventory volume can adjust price in a high level.Further,when the oil price is rising to a peak,the stocks are then released and the price declines.The phenomenon is shown as the release of stock leading low prices.

There are other commodities,such as alternative sources of energy and gold,and their prices are associated with the oil price complicatedly.These complicated interactions,also from the view of the active and passive influence factors,can be explained reasonably.For instance,the alternative energy can substitute the oil in certain situations.Hence,when the oil price is higher than expected,consumption of alternative sources of energy will increase,so do their prices.Conversely,the lower oil price leads the increase of oil consumption;the demand of alternative sources of energy will decrease.Then,the oil price rises while the alternative energy prices reduce.These situations help to make all kinds of energy consumption and prices to be relatively reasonable in a state of equilibrium.

3 Contributions for Oil Price Analysis Model

By correlation analysis of the active and passive factors,we can have a clear and intuitive understanding of oil associated factors.The main correlation analysis can provide certain theoretical expectations and related guidance for the price analysis and predictions.For instance,we list three aspects as follows.

(1)Active factors give the decisive effects on the oil price,therefore,the active factors should be included in the price prediction model.

(2)Passive factors generally do not influence the prices directly,but they also play important roles.Actually passive factors analysis is more complex,because the passive factors are usually dependent each other and are affected by the previous stage of oil price.And a detailed analysis of the passive factors is necessary for the prices in predictions.

(3)For other complicated factors,such as stocks,alternative sources of energy and gold,these factors performance as different active or passive factors in different stages.Therefore,for the analyses of these factors,we should adjust the model timely according to the significant changes of oil prices.

4 Conclusions

Oil analysis and prediction are related to the economic development and national security issues.But there are few models can be adapted to different countries and periods.According to historic data,we study the active and passive factors related to the oil price,and our results are expected to help to construct and improve the price analysis models.

[1]Cologni A,Manera M.Oil Prices,Inflation and Interest Rates in a Structural Cointegrated VAR Model for the G-7Countries[J].Energy Economics,2008,30(3):856-888.

[2]Hamilton J.What Is an Oil Shock?[J].Journal of Econometrics,2003,113(2):363-398.

[3]Nandha M,Faff R.Does Oil Move Equity Prices?A Global View[J].Energy Economics,2008,30(3):986-997.

[4]Narayan P K,Narayan S.Modelling Oil Price Volatility[J].Energy Policy,2007,35(12):6549-6553.

[5]Wang B,Li C,Ma W T.Spillover Effect between International Oil Prices and Inflation and Their Dynamic Relationship[J].Journal of Finance and Economics,2010,36(4):25-35.(in Chinese)

[6]Wang S P,Chen Y,Jin Y J.Analysis about the Impact of Emergencies on International Oil Price[J].Mathematics in Practices and Theory,2009,39(9):88-92.

[7]Dées S,Gasteuil A,Kaufmann R K,et al.Assessing the Factors behind Oil Price Changes[R].European Central Bank Working Paper No.855,2008.

[8]Breitenfellner A,Cuaresma C J,Keppel C.Determinants of Crude Oil Prices:Supply,Demand,Cartel or Speculation?[J].Monetary Policy &the Economy,2009,4:111-136.

[9]Bond M E.Export Demand and Supply for Groups of Non-oil Developing Countries[J].Staff Papers—International Monetary Fund,1985,32(1):56-77.

[10]Backus D K,Crucini M J.Oil Prices and the Terms of Trade[J].Journal of International Economics,2000,50(1):185-213.

[11]Krichene N.World Crude Oil and Natural Gas:a Demand and Supply M o del[J].Energy Economics,2002,24(6):557-576.

Appendix:the correlation coefficients

Here,we give the correlation coefficients of other factors with respect to the WTI price as below.The correlation coefficients are computed from the data in a decade from 1999to 2009.The influence incidents are mainly listed in Fig.2.

?

continued

Journal of Donghua University(English Edition)2015年2期

Journal of Donghua University(English Edition)2015年2期

- Journal of Donghua University(English Edition)的其它文章

- Analysis of Co3O4/ Mildly Oxidized Graphite Oxide (mGO )Nanocomposites of Mild Oxidation Degree for the Removal of Acid Orange 7

- Ontology-Based Semantic Multi-agent Framework for Micro-grids with Cyber Physical Concept

- A Motivation Framework to Promote Knowledge Translation in Healthcare

- Aircraft TrajectoryPrediction Based on Modified Interacting Multiple Model Algorithm

- Two Types of Adaptive Generalized Synchronization of Chaotic Systems

- A Dependent-Chance ProgrammingModel for Proactive Scheduling