Audit mode change,corporate governance and audit efort☆

Limei Cao,Wanfu Li,Limin Zhang

aSchool of Accountancy,Guangdong University of Finance and Economics,China

bSchool of Accounting,Nanjing University of Finance and Economics,China

cSun Yat-sen Business School,Sun Yat-sen University,China,School of Economics and Management,Beijing Jiaotong University,China

Audit mode change,corporate governance and audit efort☆

Limei Caoa,*,Wanfu Lib,*,Limin Zhangc

aSchool of Accountancy,Guangdong University of Finance and Economics,China

bSchool of Accounting,Nanjing University of Finance and Economics,China

cSun Yat-sen Business School,Sun Yat-sen University,China,School of Economics and Management,Beijing Jiaotong University,China

A R T I C L E I N F O

Article history:

Received 25 December 2012

Accepted 29 May 2015

Available online 19 June 2015

JEL classifcation:

M42

G38

L22

Audit efort

This study investigates changes in audit strategy in China following the introduction of risk-based auditing standards rather than an internal control-based audit mode.Specifcally,we examine whether auditors are implementing the risk-based audit mode to evaluate corporate governance before distributing audit resources.The results show that under the internal control-based audit mode,the relationship between audit efort and corporate governance was weak.However,implementation of the risk-based mode required by the new auditing standards has signifcantly enhanced the relationship between audit efort and corporate governance.Since the change in audit mode,the Big Ten have demonstrated a signifcantly better grasp of governance risk and allocated their audit efort accordingly,relative to smaller frms.The empirical evidence indicates that auditors have adjusted their audit strategy to meet the regulations,risk-based auditing is being achieved to a degree,reasonable and efective corporate governance helps to optimize audit resource allocation, and smaller auditing frms in particular should urgently strengthen their risk-based auditing capability.Overall,our fndings imply that the mandatory switch to risk-based auditing has optimized audit efort in China.

©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

The information asymmetry between a principal(shareholder)and agent(management)may lead to adverse selection and moral hazard.When an enterprise constitutes a series of linked contracts(Jensen and Meckling,1976),managers are motivated to manipulate accounting policies and accounting choices to meet contract demands(Dechow et al.,2010).The question is how to efectively alleviate and control such managerial behavior.Theoretically,efective and reasonable internal controls can suppress management’s manipulation of fnancial information to some extent because one of the functions of internal controls is to provide reasonable assurance of the reliability of fnancial reporting.Of course,auditing is also an external mechanism designed to mitigate agency problems,and,when applied using the internal control-based audit mode,the auditor must thoroughly understand the internal controls related to the fnancial statements in question to be able to identify material misstatements by the company.

Unfortunately,the frequent cases of fnancial and management fraud and false accounting information seen in recent years have raised awareness that internal controls are not efective in preventing these practices (Cao and Qian,2011).Internal controls fail to reduce audit risk to an acceptable level because corporate governance is the main factor in audit risk,with efective controls depending on the rationality of corporate governance mechanisms.Refective and reasonable corporate governance mechanisms are efective in mitigating and controlling the manipulation of fnancial information and adverse selection by management.Regular and efective mechanisms can also monitor,motivate and evaluate management,thereby reducing the probability of managers failing to meet their contractual obligations(and thus manipulating fnancial information)and increasing the reliability of that information.

As a key principle,the fnancial reporting and behavior of auditors is directly related to the reliability of accounting information(Watts and Zimmerman,1983).External auditing,as an important part of external monitoring,provides reasonable assurance that fnancial reporting is fair and lawful in all material respects (Choi and Wong,2007).Efective corporate governance can provide reasonable assurance of the quality of fnancial information and reduce audit risk,thus infuencing auditor resources and efort.The revised auditing standards introduced by the U.S.Sarbanes–Oxley Act require the implementation of risk-based auditing, necessitating that auditors become thoroughly familiar with corporate governance mechanisms.The new audit guidelines implemented in China from 1 January 2007 also require such familiarity of auditors to enable them to assess the risk of material misstatements and confgure their auditing eforts accordingly.

Because the audit mode in China did not change as a spontaneous response of auditors to fraud risk,but rather was mandated by the government,this study investigates whether auditors have actually changed to the risk-based mode and now evaluate corporate governance before they confgure their audit efort.The results show that under the old regulations,when auditors applied the internal control-based audit mode,the relationship between audit efort and corporate governance was weak.Since implementation of the new risk-based mode required by the new auditing standards,that relationship has become signifcantly stronger.Further analysis reveals that the Big Ten auditing frms have demonstrated a signifcantly better grasp of governance risk, and allocate their auditing resources accordingly,in the wake of the changes relative to their smaller counterparts.The empirical evidence suggests that the higher the degree of corporate governance in a frm,the greater the assurance of its fnancial statements,which can save audit efort.Our fndings also indicate that auditors have adjusted their audit strategies to meet the new regulations,that risk-based auditing is being achieved to a certain degree,that reasonable and efective corporate governance helps to optimize audit resource allocation and that smaller auditing frms,in particular,need to strengthen their risk-based auditing capability as a matter of urgency.In sum,the risk-based audit mode has helped considerably to optimize auditing efort in China.

The main contributions of this study are as follows.First,audit quality refers to the joint probability of an auditor fnding and reporting a client’s material misstatements.Appropriate audit efort is not only important to the auditor fulflling the audit contract,but also to the allocation of infrastructure to identify material misstatements.Despite the requirement for auditors to report such misstatements,research in this area is rare in China,and this study thus provides important empirical evidence.

Second,regarding the regulatory change in audit mode,this study is the frst to examine the relationship between corporate governance and audit efort.It confrms the positive role of the risk-oriented audit mode in linking audit efort to corporate governance mechanisms,thus enriching the literature on auditing standards,auditing theory and corporate governance,and serving as a reference for policymakers in setting accounting policy.

Third,this study provides an empirical evidence to show that China’s auditors have adjusted their audit strategies in accordance with the 2007 regulations.Despite much discussion of the risk-based audit mode, empirical knowledge of its use is scarce.Hence,this study’s examination of its application in practice is of great signifcance in helping practitioners to understand the mode’s importance.

The remainder of this paper is organized as follows.Section 2 presents the literature review.Section 3 provides the study’s institutional background,theoretical analysis and hypotheses.The study design is set out in Section 4 and the results of the empirical analysis in Section 5.Conclusions are drawn in Section 6.

2.Literature review

There is an important practical and academic value in identifying and confguring the main risks afecting audit efort to reduce audit risk and improve audit efciency and efectiveness.Simunic(1980)views audit risk as a loss in present value to third parties due to audited fnancial reports,and argues that investment in auditing resources reduces that risk.Houston et al.(1999)expand Simunic’s(1980)defnition of audit risk,viewing it as comprising of two parts:undiscovered material misstatements and immaterial(irrelevant)misstatements. They suggest that an auditor should frst assess the business risk and then determine his or her audit efort in accordance with it.Although Houston et al.(1999)propose that audit efort be based on business risk,they ofer no clear defnition of what constitutes business risk.Empirical research carried out by O’Keefe et al. (1994)to characterize business risk shows that audit efort is signifcantly afected by frm size,complexity, debt risk,internal control risk and frm listing status.With advances in practical and academic research,subsequent studies have expanded the defnition of business risk to include corporate governance.Bedard and Johnstone(2004)studies corporate governance risk,earnings management and audit efort pricing,and fnds that a company’s earnings management risk and governance risk increase with the rate of increase in an auditor’s hourly wage.The evidence from the aforementioned overseas studies suggests that understanding of the business risk arising from audit risk has shifted from a vague understanding of specifc risks to an understanding of internal control risk,and then expanded to encompass corporate governance risk.

Although researchers have investigated the corporate governance and auditing practices of China’s main listed frms in the areas of audit quality,audit opinions,audit fees,information disclosure and internal governance,none to date has examined audit modes or audit efort in relation to corporate governance.This study difers from overseas research in the following ways.First,it uses data from companies listed in China. Relatively few studies have examined audit efort in developing countries,primarily because of limited data availability.Those that have been carried out are generally based on small samples and use questionnaire data from a single auditing frm or from clients audited by one of the Big Four.In contrast,the data used in this study cover the entire A-share market,and are thus widely applicable.Second,the corporate governance index used in this study is more comprehensive and objective than that used in Bedard and Johnstone(2004).As China’s corporate governance mechanisms difer from those of other countries,this study not only enriches the global literature on audit efort and risk-based auditing,but also provides evidence to support the regulation of the auditing market.Third,its focus on China’s change to risk-based auditing and the link between corporate governance and audit efort,an area of interest since the work of Bedard and Johnstone(2004), enriches audit theory and the theory of auditing standards.

3.System background,theoretical analysis and hypotheses

3.1.Institutional audit mode change

Traditional audit theory views independent auditing as necessary because of the separation between ownership and management rights.Its ultimate goal is to reduce the agency problem,capital market informationasymmetry and transaction costs while increasing the efciency of resource allocation(Wallace,1987).To achieve these objectives,auditors have to adopt a particular audit mode,or methodology,during the audit. However,with economic development and changes in the auditing environment,the prevailing audit mode has required a change.

Until the late 1930s,audit procedures were central to the formulation of U.S.auditing standards,the main goal being troubleshooting using a variety of measures.This early auditing mode was characterized by detailed accounts auditing without risk sampling,and audit efort was applied according to the volume of business accounts and business complexity.From the 1930s to the late-1970s,along with economic development,growing business sizes,the expansion of transactions and the increased complexity of internal management,company accounting became more complex,and the use of a variety of troubleshooting measures became uneconomical.Because management was responsible for fnancial reports,there was a close relationship between internal control and the quality of fnancial information.Changes also occurred in the audit mode in this period,with the application of sampling techniques adopted and a greater need for practitioners to understand business risk.The earlier detailed audit mode thus shifted to an internal control-based mode that required the auditor to understand the internal controls relevant to a frm’s fnancial statements,and then estimate the risk of material misstatements in accordance with the design of the frm’s internal controls,for example,whether they were operational,and fnally allocate resources and determine the nature and scope of the audit based on that risk.

Despite the infuence of laws and regulations on audit demand and supply,subsequent prominent cases of management fraud litigation and audit failures led auditors to realize that assessing the relevance of fnancial statements and internal controls was insufcient to efectively prevent and reduce audit risk,as management has an incentive to manipulate accounting policies and choose self-seeking options.However,the degree of such manipulation depends on the corporate governance mechanisms in place.Reasonable and efective corporate governance arrangements serve to constrain and incentivize management efectively,thereby reducing the likelihood of the company’s fnancial information being manipulated.It was in this context that the risk-based audit mode emerged.Risk-based auditing requires the auditor to assess a company’s internal controls and accounting books,estimate the likelihood of a material misstatement based on the company’s corporate governance mechanisms,and then determine the audit scope,priorities and efort required accordingly.

The risk-based audit mode,which is an improved version of the traditional internal control-based mode, was an inevitable development(Wang and Wu,2005)in helping to analyze and discover material misstatements.The risk-based audit system in the United States developed gradually from the late-1970s to the 1990s.In 1983,the U.S.General Accounting Standards Board(GASB)issued its Statement on Auditing Standards No.47,covering audit risk and importance,followed by further audit guidelines.As the U.S. risk-based mode matured,the International Auditing and Assurance Standards Board(IAASB)began to study and learn from the United States.In 2000,the IAASB and GASB established a joint risk analysis group, which concluded that the new method could improve audit efectiveness.The serious economic consequences of the Enron scandal led the IAASB to accelerate the introduction of risk-based auditing.In October 2003,it issued International Standard on Auditing ISA 315 entitled“Identifying and assessing the risks of material misstatement through understanding the entity and its environment”and ISA 330,“The auditor’s responses to assessed risks,”which emphasized the importance of auditor familiarity with the corporate governance of clients.

3.2.Audit mode change in China

To align with international practice,in February 2006 China’s Ministry of Finance issued new audit practice guidelines that came into efect on 1 January 2007.The new standards require auditors to implement the risk-based audit mode and familiarize themselves with clients’corporate governance mechanisms to be able to identify and assess the risk of material misstatements in fnancial statements before determining the appropriate audit nature,timeframe and efort.

Before 2007,China’s auditing standards were internal control-based and auditors assessed audit risk by evaluating the internal controls on fnancial reporting.Provided that auditors acted in accordance with the standards of practice,were familiar with the internal controls related to fnancial statements and collectedappropriate evidence to prove that they had followed the auditing standards,they could avoid any corresponding legal and regulatory responsibility even if audit failure or management fraud was subsequently uncovered.However,in 2007,regulators implemented revised auditing standards to meet the requirements of China’s economic development and secure convergence with international auditing practices.

The old and new auditing standards difer signifcantly.First,the new standards require reasonable assurance from auditors that fnancial statements are free of material misstatements on the whole,regardless of whether such misstatements are the result of fraud or error(Auditing Standards No.1141,16).This requirement increases the auditor’s liability and risk.Second,because of the risk that corporate governance is the source of audit risk,the new auditing standards require auditors to understand and evaluate a client’s corporate governance practices and environment,and thereby identifying and assessing the risk of material misstatements as a basis for determining audit efort,procedures and scope.Third,because the new auditing standards increase auditor responsibility in cases of fraud,and because the degree and efectiveness of corporate governance is a fundamental cause of concentrated business risk,auditors are required to use the risk-based audit mode when auditing listed companies.

As China’s revised auditing standards were introduced as a mandatory change,not in response to audit failure and fraud risk,and to adapt to the country’s market economy and allow convergence with international auditing practices,the increased legal liability and risk for auditors have forced them to pay attention to and evaluate corporate governance to reduce audit risk.

3.3.Theoretical analysis and hypotheses

A major objective of internal control is to ensure that fnancial information is reliable and efective.A range of business control activities such as authorization requirements,separation of incompatible duties,systematic accounting,property protection and budget controls helps to detect unintentional errors within a company contract(Ashbaugh-Skaife et al.,2008;Doyle et al.,2007),internal control defciencies and poor-quality fnancial information(Doyle et al.,2007).Efective internal controls can also improve the quality of earnings. Auditing is a signifcant external governance mechanism that helps to explicate the internal control of fnancial statements and establish the risk of material misstatements by enterprises.

However,as internal control mechanisms are afected by corporate governance,the supervision and encouragement of corporate governance are important to ensure the efective operation of those mechanisms. According to agency theory,one of the purposes of corporate governance is to guarantee the efective operation of fnancial controls in the following ways.First,management directly supervises daily fnancial controls through its internal control activities and takes responsibility for the veracity and reliability of fnancial information.Second,corporate governance supervises management’s fnancial control activities,as the board and audit committee are required to monitor the reliability of its fnancial reporting(Beasley et al.,1997; Johnstone et al.,2001).The lack of an audit committee(Dechow et al.,1996;McMullen,1996)and a small proportion of independent directors and audit committee members on the board both increase the likelihood of false fnancial reports(Beasley,1996;Abbott et al.,2000;Beasley et al.,2000).Studies have shown internal controls to be weak and inefective in monitoring management when the above corporate governance measures are absent or defective.Because efcient corporate governance is able to control and reduce a company’s agency problem,it has the ability to evaluate,inspire and motivate management,which can efectively prevent the manipulation of fnancial information and fraud(Cai,2007).

Compared with the internal control-based audit mode,the risk-based mode,if implemented efectively,can identify risks more scientifcally,assess the risk of material misstatements more rationally,and thus determine the key risk areas and appropriate audit efort more accurately.To reduce the level of audit risk,auditors need to increase their efort in key areas and reduce their efort in non-priority areas,rendering the overall audit efort allocation more rational,saving overall efort and improving the efciency of resource allocation.

However,the change in audit method in China occurred for reasons of socioeconomic development and international convergence.The risk-based audit method did not arise as a spontaneous response to audit risk, but rather through government decree.Due to the consequent change in liability and the requirement for auditors to have a thorough understanding and assessment of corporate governance,auditors who fail to examine a material misstatement that is related to governance bear legal responsibility for that misstatement.

To meet the new regulatory requirements and reduce their legal and regulatory risks,auditors must apply the new audit mode to evaluate corporate governance,leading to a change in audit efort.The literature shows that in 1994,after detailed standards were issued for non-standard audit opinions in response to a regulatory requirement to reduce audit risk,auditors exhibited a signifcant increase in non-standard audit opinions(e.g., DeFond et al.,2000).

Based on the above analysis and discussion,we hypothesize that before implementation of the new audit practice guidelines in China,auditors complied with the old internal control-based auditing standards and tended to lack motivation,or the necessary guidance,to evaluate corporate governance.Thus,the correlation between corporate governance and audit resources was weak in that period.

After implementation of the new audit practice guidelines,auditors had to adjust their audit strategy to meet regulatory requirements,and thus became concerned with the assessment of governance-related factors, leading to a change in audit efort.The change also led to more efective corporate governance,which reduced the risk of material misstatements and was more conducive to saving audit efort.Accordingly,we propose the following hypothesis.

Hypothesis 1.Since the change to the risk-based audit mode in China,the negative correlation between corporate governance and audit efort has been signifcantly enhanced.

Independent auditing is an important aspect of external oversight,and is carried out by allocating audit efort.According to DeAngelo(1981),audit quality refers to the joint probability of a material misstatement in a client’s fnancial statements being found and reported by the auditor and the auditor’s ability to detect such a misstatement due to professional competence,including audit experience,audit mode(method)and audit efort.

Although the risk-based audit mode requires auditors to gain competence in identifying the risk of material misstatements,and then to decide the audit scope,procedure and efort accordingly,auditing frms of diferent size have difering levels of ability to implement that mode and evaluate corporate governance risk.First,large audit frms have more extensive experience and more talented staf,and can thus more quickly grasp and apply the risk-based audit mode and assess corporate governance risk,and their allocation of audit efort is thus more competitive than that of smaller audit frms.Second,unlike smaller frms,the international Big Four and the larger domestic auditing frms were actively involved in drafting the new auditing standards(Pan, 2008).Hence,the Big Ten–the 10 largest audit frms in the American Institute of CPAs’(AICPA’s)top 100 frms–were exposed to the risk-based audit mode and the theory behind it earlier than their smaller counterparts,and they may thus have greater mastery of the new system and be more sensitive to corporate governance risk and better able to adjust their audit efort accordingly.Based on the above analysis,we propose the following hypothesis.

Hypothesis 2.Since China’s change to the risk-based audit mode,the Big Ten have demonstrated a signifcantly better grasp of governance risk and audit efort than smaller frms.

4.Study design

4.1.Sample data

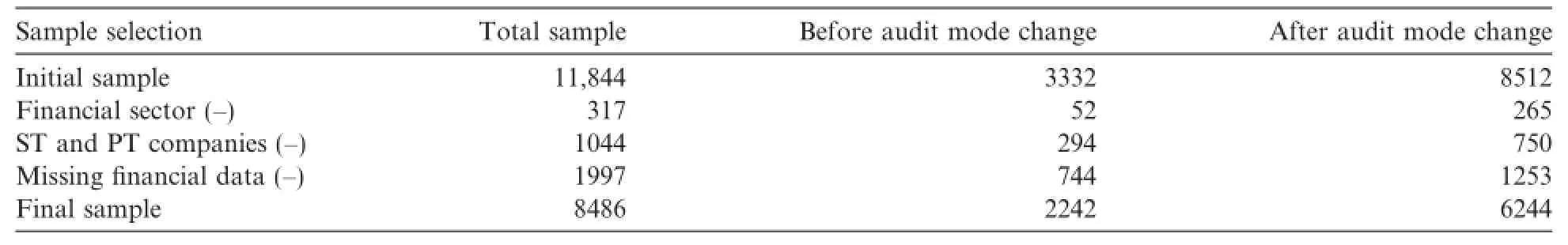

The implementation of the new practice guidelines marked the standardization of the risk-based audit mode in China.Taking 2007 as the starting point of institutional change,we select a sample of the listed companies from 2004 to 2011.Audit efort data come from the China Association of Certifed Public Accountants, and include auditor tenure,auditor conversion from manual risk-based collation and other data from the GTA database.The sample is fltered by the following criteria:(1)excluding fnancial companies;(2)excluding ST and PT companies;(3)excluding observations with missing fnancial and corporate governance information;and(4)winsorizing the main continuous variables at the 1%level to eliminate the efect of outlying values.The sample selection process is illustrated in Table 1.

Table 1 Sample selection.

4.2.Model set and variable defnitions

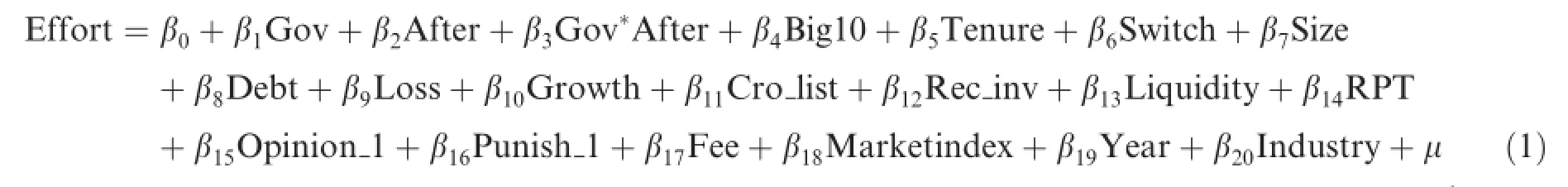

According to the above theoretical analysis,and with reference to Bedard and Johnstone(2004),we construct the following regression model to test our hypotheses.

In Model(1),the interaction term between corporate governance and a change in audit mode,Gov*After, is expected to have a negative coefcient.

To test Hypothesis 2,we construct Model(2)based on Model(1).In this model,the interaction term, Gov*Big101The test sample for Hypothesis 2 includes only data from the period after the audit mode change,and thus cross-multiplication is not included for the variable After.,examines whether the Big Ten are signifcantly diferent from smaller frms in their grasp of corporate governance risk and application of audit efort following the change in audit mode.We expect the coeffcient of Gov*Big10 to be negative.

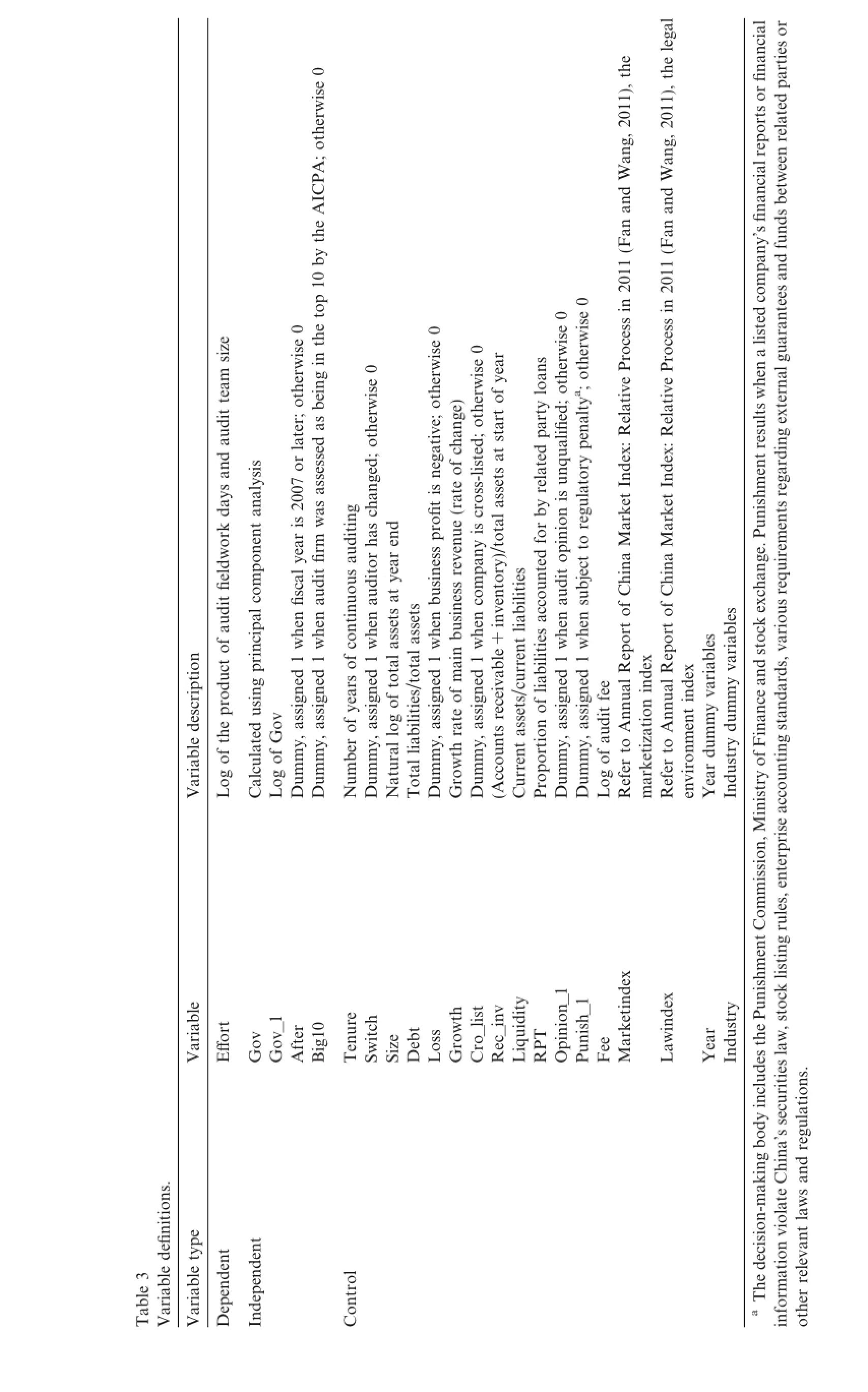

The main model variables and control variables are defned as follows.

4.2.1.Audit efort

The literature defnes audit efort as the number of days spent by the audit team(e.g.,Caramanis and Lennox,2008;Palmrose,1984;Davidson and Gist,1996).Audit days refer to the number of days taken to complete the entire audit process,including audit planning,feldwork and review.The research data in most overseas work in this area are obtained through questionnaires covering the entire audit process.Audit efort in this study is defned as the log of the product of the number of audit feldwork days and audit team size.We use feldwork days rather than the time taken to complete the entire audit process because feldwork is a core part of an independent audit,a key component of audit efort and a key step in constraining management,and is thus a representative of overall audit efort.

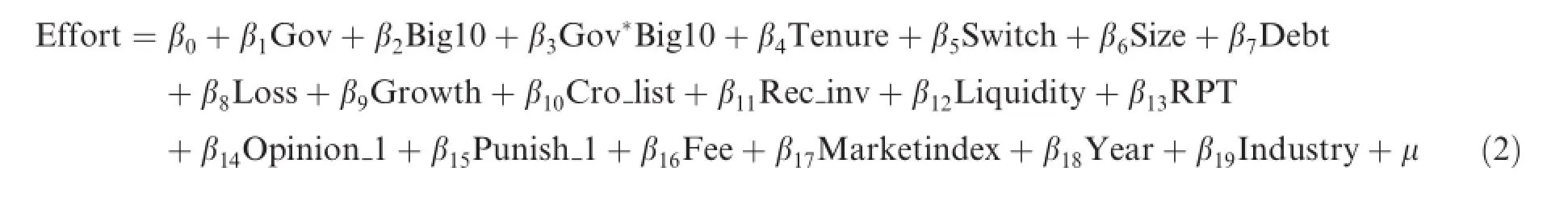

4.2.2.Corporate governance

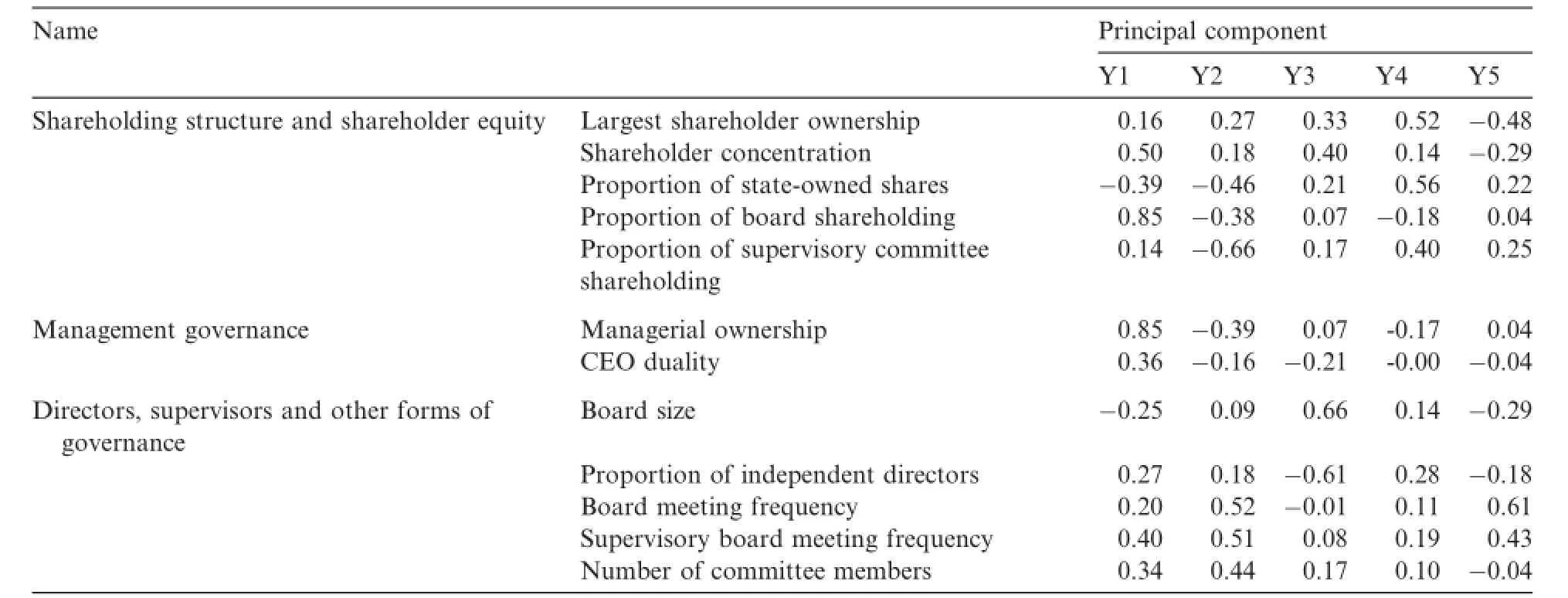

Corporate governance is an important mechanism for alleviating the agency problem,its core purpose being to encourage internal employees to act in accordance with the interests of shareholders,and constrain them from doing otherwise.Governance research covers the early stages of corporate governance through analysis of specifc corporate governance mechanisms,including ownership structures,boards of directors, management incentives and other features.In this study,we construct a corporate governance index as a measure of the overall quality of corporate governance(Gompers et al.,2003;Bai et al.,2005;Li and Zhang,2005; Liao et al.,2008;Zhang and Liao,2010).We follow Bai et al.(2005)and Zhang and Liao(2010)in usingprincipal component analysis(PCA)to fnd a linear combination of all indicators to defne the corporate governance index(Gov),combining a few of the top principal components from PCA.The construction of our corporate governance index is shown in Table 2,and the factor loading table and discussion of PCA are provided in the Appendix.

Table 2 Corporate governance index.

4.2.3.Big Ten

Big Ten(Big10)refer to the 10 largest audit frms in the AICPA’s top 100 frms.DeAngelo(1981)considers large audit frms that obtain long-term quasi-rents to be more independent than smaller frms,and they should thus be more active in exerting adequate audit efort to reduce earnings management and control audit risk (Caramanis and Lennox,2008).In China,however,much research has confrmed that the audit quality of neither the large domestic audit frms nor the international Big Four is high.Given the country’s lack of demand for high-quality auditing,large audit frms have little motivation to invest in the efort needed to provide such auditing,and the expected sign on Big10 is thus uncertain.

4.2.4.Control variables

With reference to Bedard and Johnstone(2004)and other studies,and in consideration of China’s special institutional background,we select the following control variables to control for other factors that may afect audit efort.

When auditor tenure(Tenure)is longer,auditors are more familiar with the client’s corporate governance and fnancial situation,and the degree of information asymmetry is lower than with new clients,which should help to conserve audit efort.Nevertheless,despite the theoretical expectations of this study,Caramanis and Lennox(2008)fnd auditor tenure to be positively correlated with audit efort.Hence,we do not predict the sign between Tenure and audit efort.

A change in auditor(Switch)increases the information asymmetry between auditors and clients.The successive auditor needs more time to understand and become familiar with the client and to carefully assess the risk of a material misstatement to correlate it with audit efort.However,according to DeAngelo’s(1981)theory of quasi-rents,auditors usually attract clients with low prices initially.In China,an auditor’s ability to obtain future quasi-rents is uncertain,as the audit division is likely to reduce the necessary audit efort afterthe frst audit.Because of the difering circumstances of individual audit frms,the expected sign on Switch is uncertain.

The larger the company(Size),the more audit efort needed(O’Keefe et al.,1994;Palmrose,1989).A positive association is thus expected between company size and audit efort.

The asset-liability ratio(Debt)refects the ability of companies to repay their loans.The higher the ratio, the greater both the debt risk and audit risk(O’Keefe et al.,1994).A positive association between Debt and audit efort is thus expected.

O’Keefe et al.(1994)claim that when an audited client is operating at a loss,auditors need to pay special attention to the business risk and be aware of the potential for business failure or shareholder litigation arising from the discontinuation of operations.In addition,the management of such a company may have a strong incentive to engage in a“whitewash,”meaning that auditors would be wise to increase their audit efort to control audit risk.We thus expect operating loss(Loss)to be positively associated with audit efort.

As company growth(Growth)is directly related to a company’s future proftability and ability to expand production,we expect it to be negatively correlated with audit efort(O’Keefe et al.,1994).

When domestic listed companies are also listed overseas(Cro_list),the various fnancial reporting requirements in the overseas jurisdictions can afect the quality of their data(Ball et al.,2000),a possibility that needs to be taken into account with regard to investment in audit efort if a cross-listed company’s fnancial reporting and audit reports are intended for both domestic and overseas use.Hence,we expect a positive association between Cro_list and audit efort.

The inventory-accounts receivable ratio(Rec_inv)is used to measure the complexity of a client’s business, with greater complexity requiring more audit efort.We thus expect it to have a positive association with audit efort.

The current ratio(Liquidity)refects a company’s ability to use corporate cash to repay short-term borrowings.The higher the current ratio,the lower both the debt and audit risk.Hence,we expect Liquidity to have a negative relationship with audit efort.

Related party loans(RPT)represent the proportion of company debt comprising direct or indirect debt. Loans from related parties reduce transaction costs,optimize capital structure and improve capital utilization. However,they are also associated with the way in which related parties or major shareholders take up company funds.As the circumstances difer for diferent companies,the expected sign is uncertain.

Prior year audit opinion(Opinion_1)represents a non-standard audit opinion,indicating that the previous annual fnancial statements contained a material misstatement or did not refect fair value in some signifcant respect.To reduce audit risk,auditors need to invest greater audit efort.Hence,we expect that efort to have a positive association with Opinion_1.

If a client was punished(Punish_1)by the regulatory authorities for the quality of its fnancial information in the previous year,we predict that both audit risk and regulatory risk are high,and auditors need to be more prudent.Thus,we expect a positive association between audit efort and Punish_1.

Palmrose(1989)considers the audit contract fee(Fee)to have two models:fxed cost and cost plus.Fixed costs are often ascertained before the initial audit,and remain unchanged over a given period(often several years),whereas the cost-plus model is generally based on audit efort,and is usually determined at the end of the audit.We speculate that a fxed-cost contract is likely to be an important variable in investment in audit efort,whereas a cost-plus contract is unlikely to exert any infuence.Because of the two types of fee contracts,“low-balling”has some efect on audit efort.DeAngelo(1981)claims that low-balling does not harm auditor independence because auditor switching has transaction costs,and auditors can thus recover their initial pricing discount through future audits.However,in 1998,the China Securities Regulatory Commission stated that low-balling and the payment of kickbacks or commissions greatly reduce an audit frm’s proft margin,leading some frms to reduce their audit efort considerably(China Securities Regulatory Commission,1998).In summary,the expected sign of the relationship between audit fee and audit efort is uncertain.

Market process(Marketindex)refers to the level of economic development in a region or area.The more economically developed the region/area,the better the legal environment it enjoys and the greater the regulatory and litigation risks for auditors.A positive association between Marketindex and audit efort is thus expected.

Finally,we also control for industry and year efects.All of the variables used in the models are defned in Table 3.

5.Empirical testing

5.1.Descriptive statistics

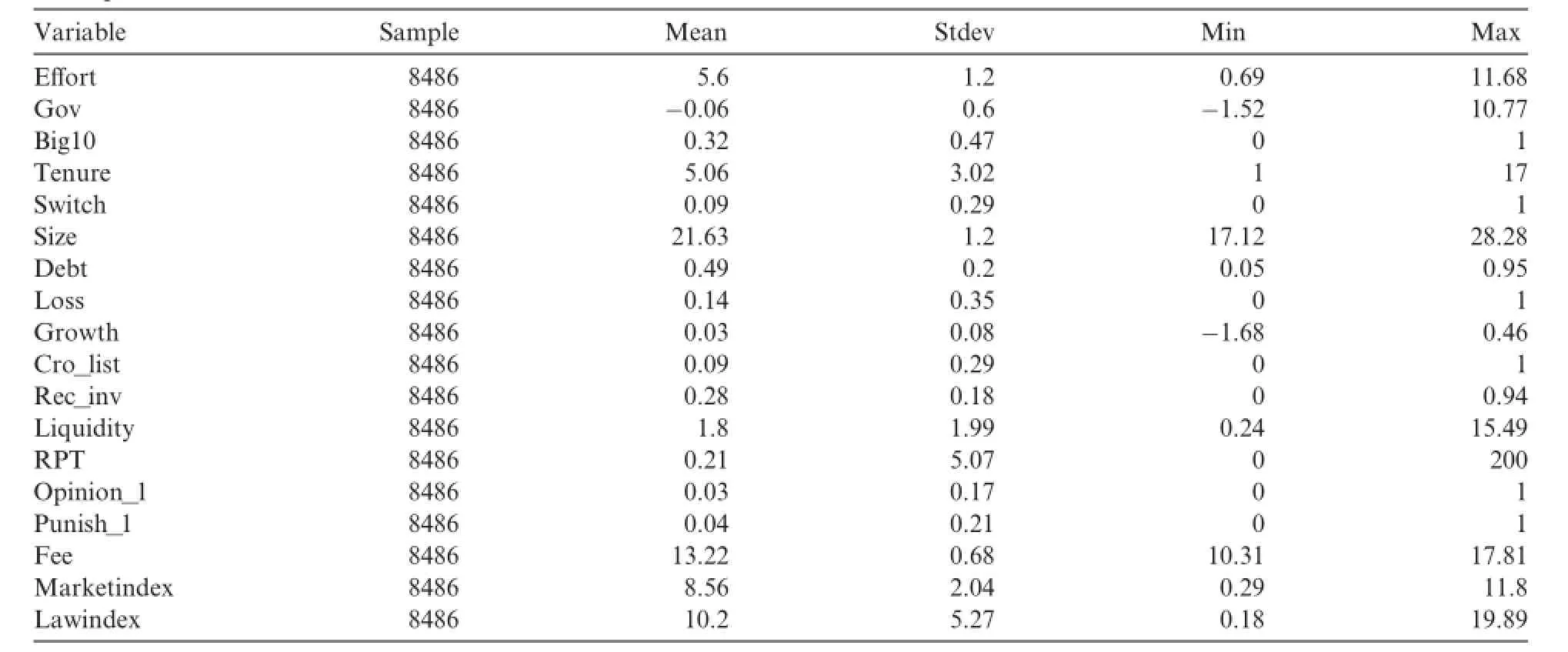

Table 4 presents the descriptive statistics for all of the variables.The average audit efort is 5.6,indicating that auditors devote some efort to searching for material misstatements to fulfll their contractual obligations. The maximum corporate governance index value is 10.77,the minimum is-1.52 and the mean is-0.06,with the standard deviation of 0.6 indicating signifcant diferences across companies.

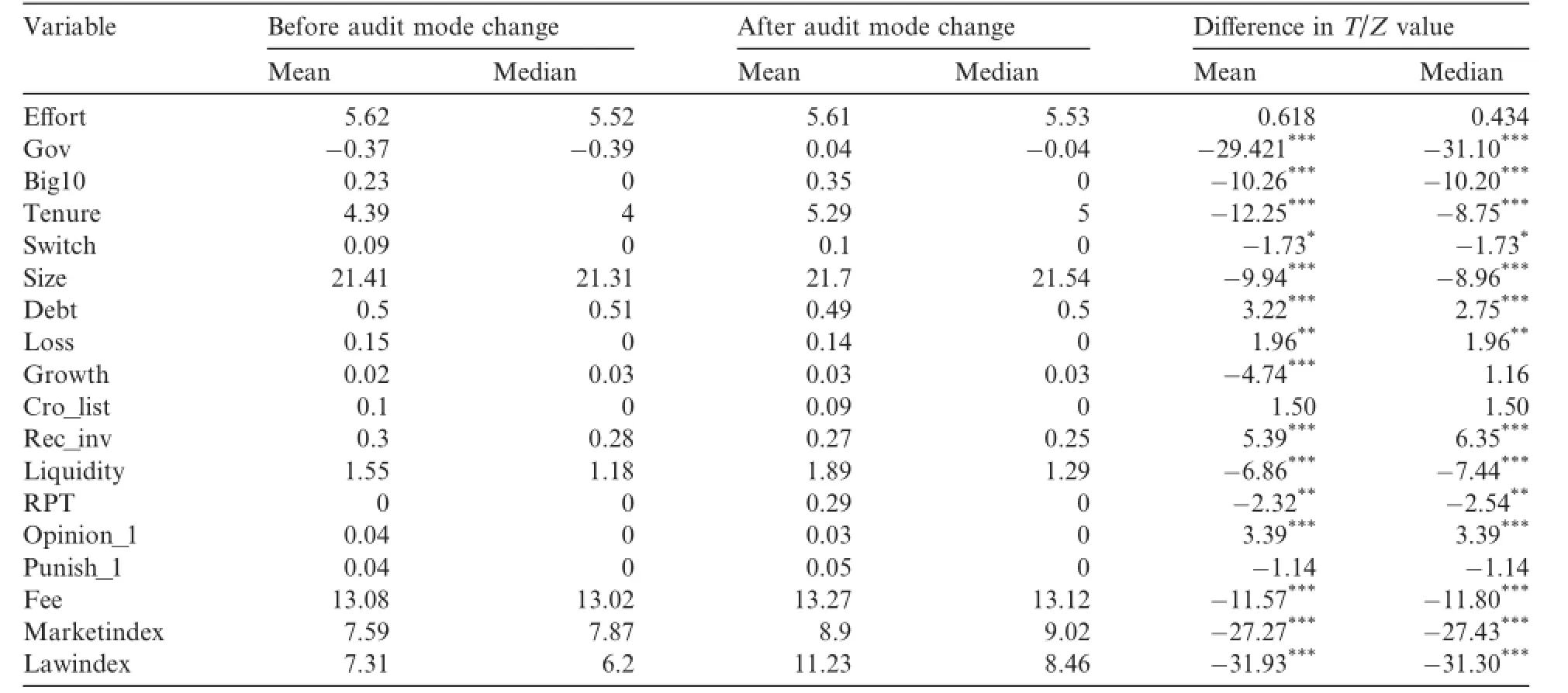

Table 5 reports the mean and median diferences in the main and control variables before and after the audit mode change.The majority of the variables exhibit signifcant diferences after the change.For example, the mean and median for corporate governance(Gov)shift from negative to positive,signifcant at the 1% level,indicating improvement in the extent of sound and efective corporate governance in the post-change period.In addition,the results in Table 5 also indicate the need to control for these factors in relation to audit efort.

5.2.Empirical results and analysis

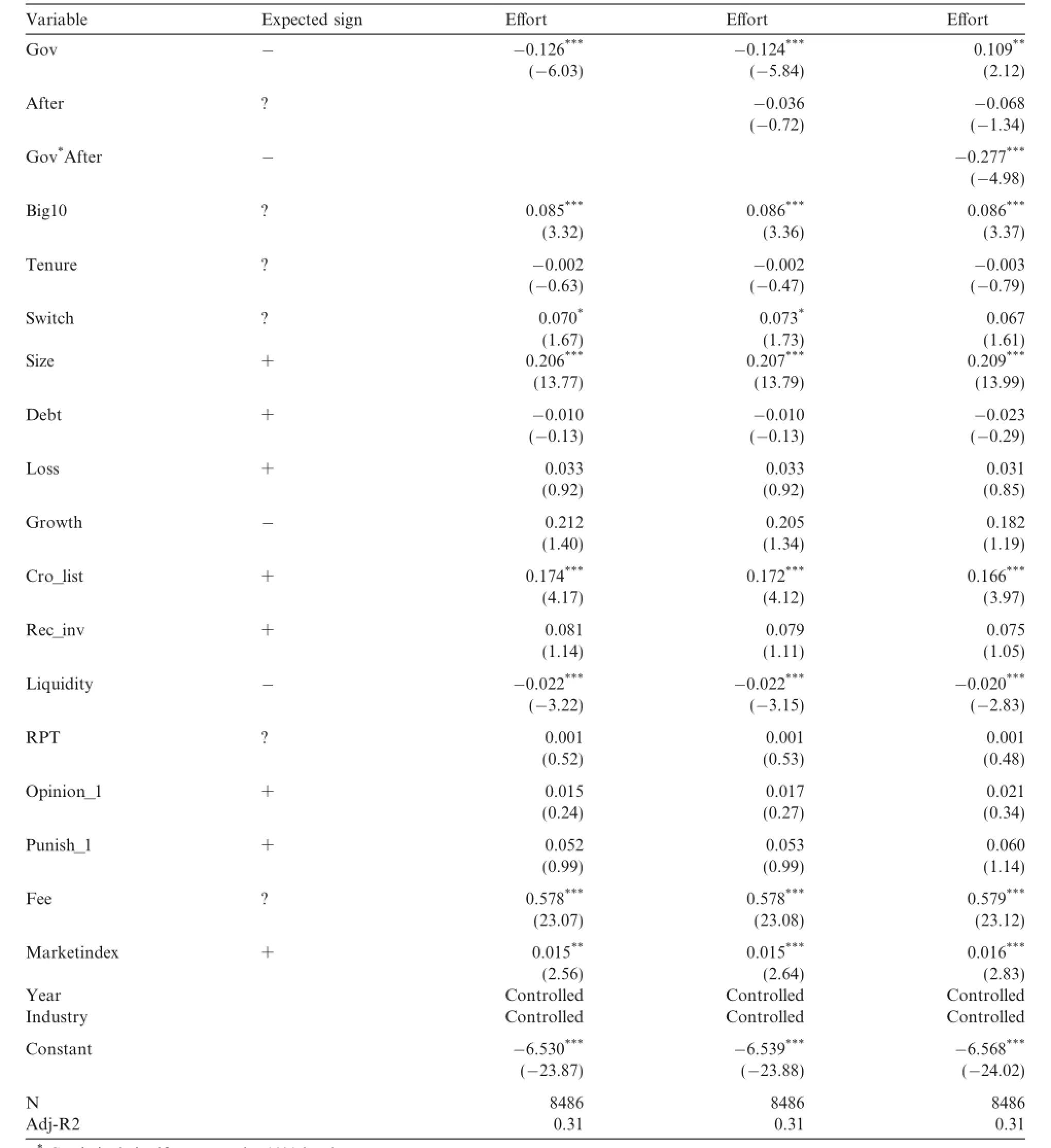

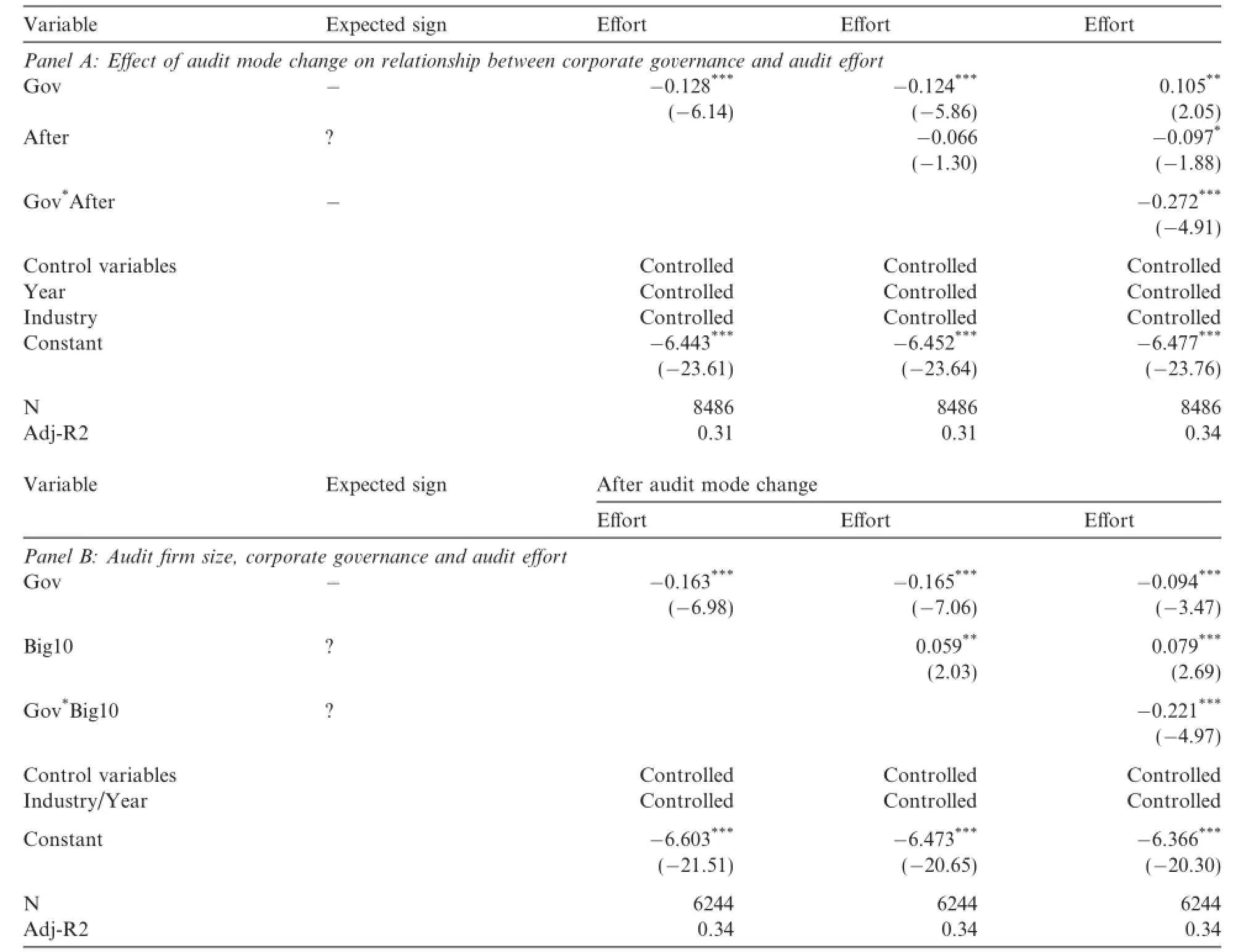

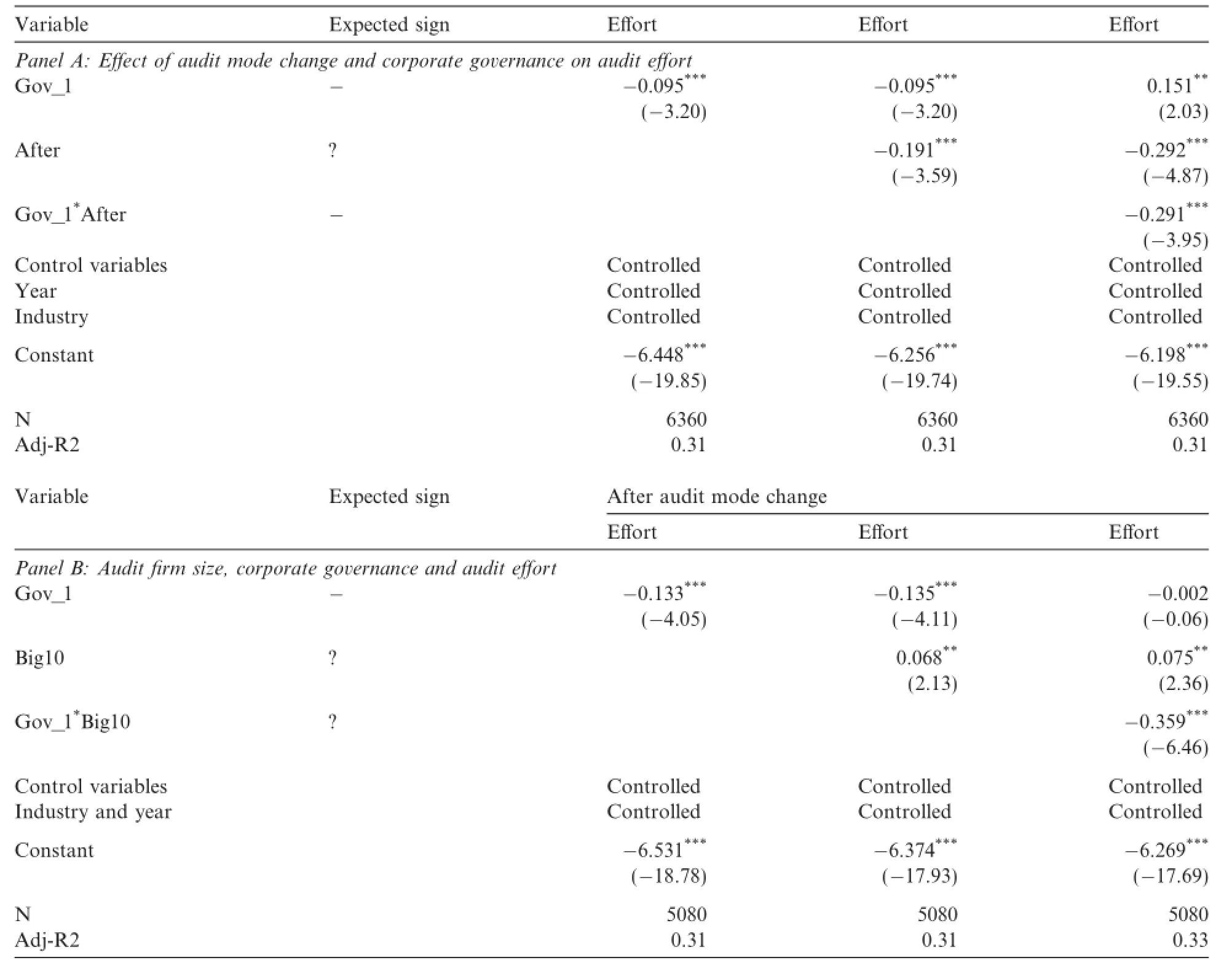

Table 6 reports the testing of Hypothesis 1.The coefcient for the main efect of Gov is 0.109,and the coeffcient for the interaction term,Gov*After,is-0.277(Tvalue=-4.98),signifcant at the 1%level,suggesting that better corporate governance did not save audit efort before the mode change,but reduced it signifcantly after it.Keeping other factors constant,a one unit increase in the corporate governance index is associated with a reduction in the number of feld days by 18.3%.Regarding economic signifcance,marginal efect analysis shows that after the audit mode change(i.e.,After=1),a corporate governance index increase from the 25th to the 50th percentile(-0.43 to-0.13)is equal to a reduction of 26 days(equivalent to a 10.4%median change)in audit efort.Thus,these fndings are both statistically and economically signifcant.Overall,when auditor decision-making considers internal controls alone to be relevant to fnancial statements,investment in audit efort does not refect corporate governance risk,whereas risk-based auditing encourages auditors to consider corporate governance factors more fully.The regression results in Table 6 support Hypothesis 1, and show that the objectives of the risk-based audit mode have been fulflled to a certain extent.

Table 7 reports the test results for Hypothesis 2.The coefcients for Gov*Big10 are signifcant at the 1% level(T=-4.93),supporting the hypothesis that the Big Ten are better able than their smaller counterparts to recognize improved corporate governance and adjust their audit efort accordingly.This result also indicates that the risk-based audit mode improves practice and risk control to some extent.It also implies that smaller frms need to strengthen their grasp of risk-based auditing and that the Chinese Institute of CPAs needs to improve its supervision and inspection regime and apply more efective controls to ensure that small frms implement the risk-based mode.

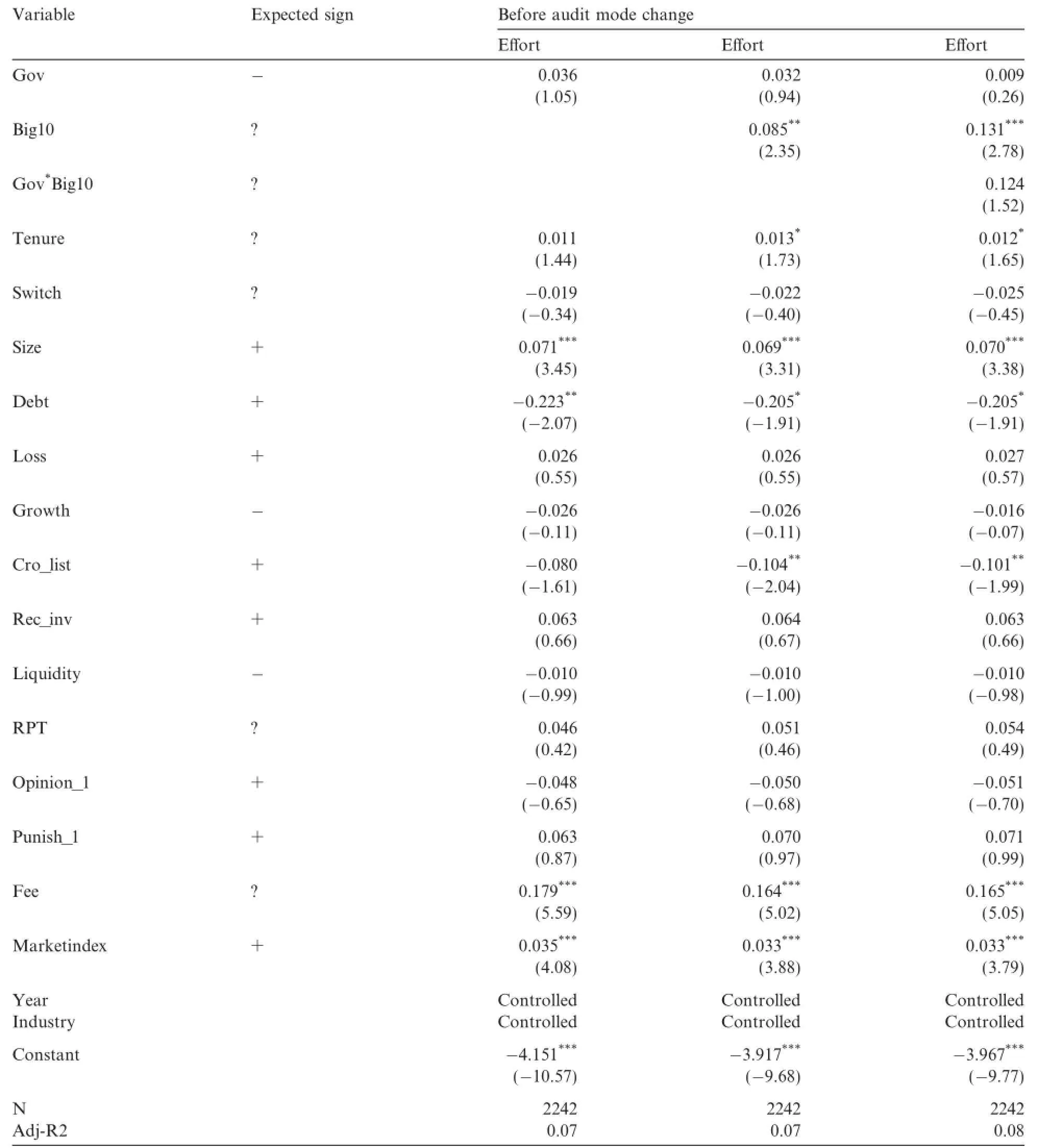

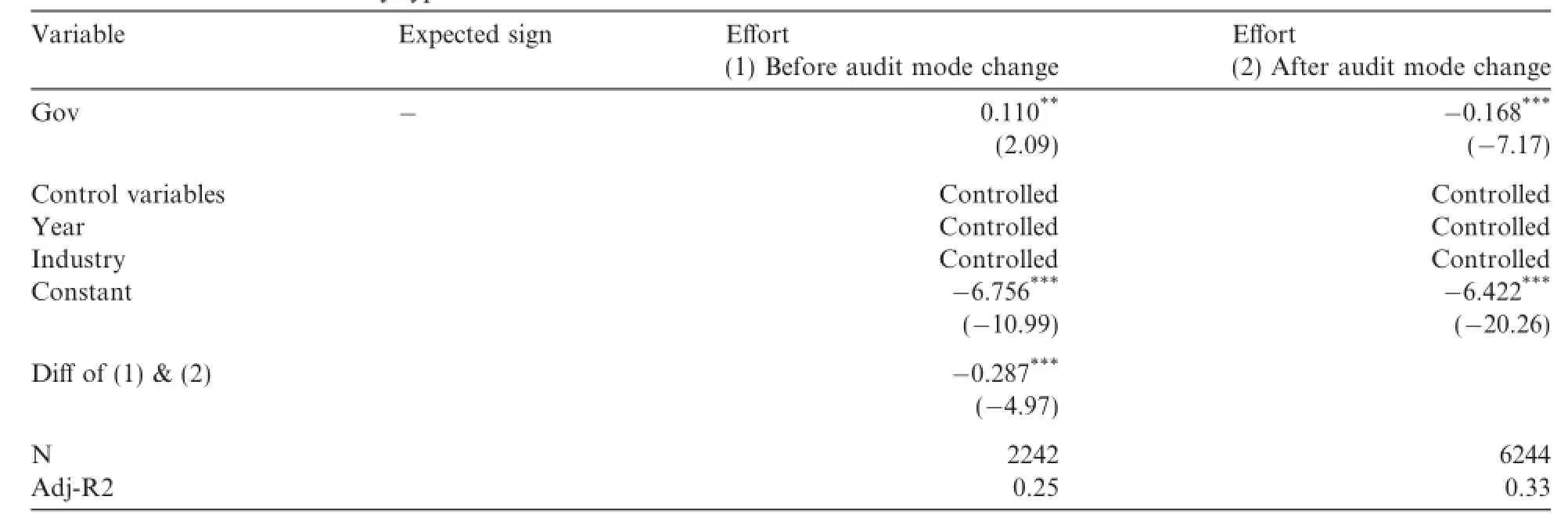

To seek further evidence for Hypothesis 2,we also test the sample in the period before implementation of the new auditing standards.As shown in Table 8,a positive but not signifcant relationship is found between corporate governance and audit efort,but the regression results are inconsistent with those after the audit mode change.The coefcient of Gov*Big10 is positive but not signifcant,and does not match the assumption, providing further evidence for Hypothesis 2.

5.3.Robustness tests

5.3.1.Addition and deletion of transition sample

The foregoing tests used 2007 as the start of the research window,but it is possible that auditors may already have been afected by the new auditing standards in 2006.We thus also test fscal year 2006 as the date of the change in auditing practice,but our conclusions remain unchanged.The results also remain unchanged when we remove 2006 from the sample.(The results of these tests are not reported due to space limitations.)

sizedit teamd auandaysrkwodit feldaundescriptiouct oflee prodVariabthg ofLoleVariabortEfns.itiot Table 3ledefntypeVariableVariabenDependise 0otherwA;e AICPthbyise 0e top 10thotherwg inbeinasalysisorlater;t an2007enisonmpcipal cofscal yeardit frm was assessedenenaug prin1 wheded1 whusinCalculatedvGoassigny,y,assigng ofLommDummDuGovv_1 GoAfter Big10 t endependInciald Wang,2011),thelegal anfnrts orcialrepoeen related parties orand Wang,2011),theananans betw(Fan(Fy’s fnand fundmpanProcess in020112011co0 0 0 erwisea listedteesaranise 0erwiseerwiseyearserwiseanguthProcess inenalthge) related party lootherw;othnegative;oan;othedRelativeRelativelts whg externged;chcross-listedstart ofalifatt resupenaltya;oinryundex:Index:enofInett isditinganr has chishmregarde(ratetsrevenud ioregueny isettal assetsquunry)/toprofr byn islatoenauussinessmpditoted foinsinessa Markanina Markinge.Piremuotoyearunanbject toauatcotal assetsbuCh+invenilities dit opofChofs requcontinyears of1 whenenenliabtal assetsilities/toedmain1 wh1 whbuenenrtrtles leles variouededliabt assets/current1 whilities accoausuededs,1 whdex toRepoy variabd stock exchdardassignnun inaldex ofg ofassignofrateRefer tonmmmduassignmmoftal liabassigny,y,auRepoery,mmthy,Any,ortionetizationudit feealAnt inenyvariabistry oftingral lostrymbassignmmFinance anGrowmmstanNunts receivabDuNatuToDuDuccou(ACurrenPropmmDuDummLog ofRefer tomarkenYearviroduduIninaccoun,MissionriseterpmmComentg rules,en_1nishetinreTenuitchssdex thGrowity Opnishe PuRec_inidexn_1 DebtSwSizeCro_listv LiquTinioLoRPPuFee MarkLawindYearstryduInthlaw,stock listincludess.inritiesdylationg boa’s secuinind reguakan-mn violate ChlawslntroatiodecisionhermCoaTfoinother relevant

Table 4 Descriptive statistics.

Table 5 Univariate tests.

5.3.2.Controlling for the legal environment

During the period in which the audit mode changed,the legal environment also changed,which may have afected the relationship between audit efort and corporate governance.Hence,we re-examine the legal environment after the change(because the market process and legal environment are highly correlated,we no longer control for the marketization index when we control for the legal environment).The regression results, shown in Table 9,leave our conclusions unchanged,further supporting our hypotheses.

Table 6 Audit mode change,corporate governance and audit efort.

Table 8 Audit frm size,corporate governance and audit efort before audit mode change.

Table 9 Robustness test:controlling for legal environment.

5.3.3.Controlling for the self-selection problem

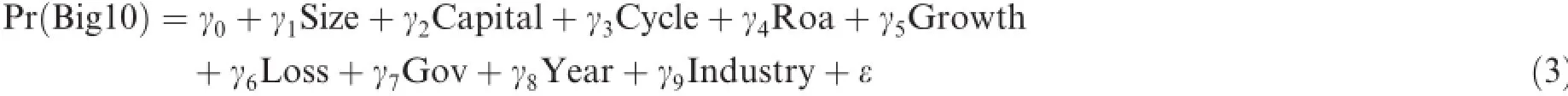

Because a client’s choice of auditor is a business decision that is seldom random,there may be a self-selection problem.For example,a client may choose a large audit frm,which is more likely to provide a high-quality audit,to signal excellence to the market(Francis,1984;Francis and Simon,1987).We thus speculate that companies that difer in corporate governance quality may also difer in their choice of auditor and that auditors may accept clients in accordance with their level of corporate governance,thus creating a self-selection problem that may bias least squares estimation.To control for this possibility,we use Heckman’s(1978)two-stage selection,as follows.

First,we estimate the probability model of an audit frm being chosen to calculate the inverse Mills coeffcient(i.e.,Mills).The frst step in Model(3)is shown below,with the dependent variable being the probability of a listed company selecting a Big Ten audit frm.

The independent variables in Model(3)come primarily from Francis and Krishnan(1999),with some additional variables.Francis and Krishnan(1999)argue that companies with a high level of accruals are more likely to employ large audit frms,with capital intensity and the business cycle being the key variables afecting the level of accruals.Capital intensity(total fxed assets divided by net sales)mainly measures long-term accruals,with greater capital intensity indicating fewer accruals.The longer the operating cycle(inventory turnover days+accounts receivable turnover days)and the more inventory and accounts receivable,the higher the level of accruals.To these two variables,we add company size,growth,proftability and fnancial distress. As the new auditing standards require auditors to evaluate a client’s corporate governance,we also include the corporate governance index(Gov)in this model(variable defnitions not reported due to space constraints).

Second,we incorporate the estimated inverse Mills coefcient(i.e.,Mills)into Model(2),and then regress according to the previous method.

The results of the self-selection regression model show that the greater a company’s size,sales cycle,profitability and corporate governance index,and the lower its capital intensity,the greater the probability of it hiring one of the Big Ten.The coefcients for each variable are consistent with expectations.The regression results are essentially consistent with Table 7,and as they are based on the estimated Mills coefcient used in Model(3)and entered into the Model(2)regression,they support our earlier conclusion(results unreported due to space constraints).

5.3.4.Endogenous decision-making problems between audit efort and corporate governance

Jensen and Meckling(1976)consider external auditing to be an important guarantee mechanism for reducing both conficts of interest between a company’s contractual parties and agency costs.The visibility of external auditors afects a company’s corporate governance,and there may thus be an endogeneity problem between decisions made by external auditors(including their allocation of audit efort)and corporate governance risk,which could in turn afect the reliability of the estimated coefcients in the regression model. Caramanis and Lennox(2008)encounter a similar problem in the relationship between audit efort and earnings quality,and use lagged estimated audit efort as the instrumental variable to solve the corresponding endogeneity problem.

Drawing on Caramanis and Lennox(2008),to represent corporate governance we select an instrumental variable that does not directly afect audit efort.The lag variable of corporate governance is deemed appropriate for this purpose,as it meets the demands of both the Sargan and Hausman tests as an instrument.

Furthermore,although the internal and external governance environment is constantly changing in theory, it is not reasonable to expect auditors to consider the lag in corporate governance when making decisions. Hence,although lagged corporate governance variables can explain the current period of corporate governance,they are unlikely to afect current audit efort directly.Empirical tests confrm that the lag in corporate governance can explain current corporate governance but has no direct correlation with current audit efort (results unreported owing to space constraints).We thus use the estimated lag in corporate governance as an instrumental variable in the corresponding regression analysis.As shown in Table 10,the results still support the original conclusion.

5.3.5.Structural change test

Because all listed companies in China have been afected by the new auditing standards,no control sample is possible,rendering it difcult to exclude other factors over the study period.We thus conduct sub-period analysis to examine the relationship between corporate governance and audit efort before and after 2007. Using the Chow test with dummy variables,we assess whether there has been structural change.The results in Table 11 show that in the period before 2007 there is a positive correlation between audit efort and corporate governance,which is inconsistent with our theoretical expectation.In the period after that year,however,there is a negative correlation between the two,and a coefcient diference test shows the diference to be signifcant(Tvalue=-4.97).Hence,the relationship between audit efort and governance before and after 2007 is the result of structural change.

Table 10 Robustness test:controlling for endogenous decision-making problem.

Based on the empirical tests above,we consider our main conclusions to be relatively robust.

5.4.Supplementary analysis

If,following the adoption of the risk-based audit mode,auditors exerted greater efort in the face of poor corporate governance,and thus improved audit quality and corporate governance while simultaneously reducing audit efort without any decline in audit quality,that would constitute further proof of the optimization of audit efort in the post-change period.

We thus conduct supplementary analysis using earnings quality as a proxy for audit quality,and fnd that for companies with poor corporate governance,increased audit efort reduces earnings management and improves audit quality.We also fnd no evidence of a decline in audit quality when audit efort is reduced due to better corporate governance.These fndings suggest that the implementation of the risk-based audit mode has indeed optimized audit efort in China(results unreported due to space constraints).

Table 11 Results of chow test for dummy type.

6.Conclusions

Given that contract management creates an incentive to manipulate fnancial information,auditors who adopt the internal control-based mode fnd it difcult to identify fnancial manipulation by management, which afects both the efciency and results of their audits.The risk-based system,in contrast,requires auditors to perform a deeper assessment of clients’corporate governance,as reasonable and efective corporate governance directly constrains management from falsifying fnancial statements.

Based on a literature review and an analysis of China’s institutional background,this study examines whether auditors have been evaluating corporate governance to guide their allocation of audit efort since the government-mandated change to the risk-based audit mode.It also explores the optimal allocation of audit efort needed to improve audit efectiveness and the way in which corporate governance has infuenced the allocation of audit efort since the change in audit mode.Our fndings show that under the earlier internal control-based mode,the relationship between audit efort and corporate governance was weak,but became signifcantly stronger following the implementation of the risk-based mode.Further analysis shows that since the change in audit mode,Big Ten auditors have gained a signifcantly better grasp of governance risk and allocated their audit eforts accordingly.

The results indicate that the mandatory switch to the risk-based audit mode has improved the ability of auditors in China to practice risk control and audit efciency.However,the Chinese Institute of CPAs needs to strengthen its supervision and inspection,particularly for smaller auditing frms,to ensure a better understanding and more skilled use of the risk-based mode.Our study ofers a useful perspective on the issues concerned and provides empirical evidence for the development of policy relating to investor protection and market regulation.

It should be noted that there are some inherent limitations in our sample.Most importantly,because the regulations require all listed companies and auditors to apply the risk-based audit mode,it is not possible to fnd a control sample of companies unafected by the new auditing standards for use in our regression models.

Appendix A

Based on PCA,we use software to normalize the 12 indicators and select 5 main components.The corporate governance index is based on the weightings of principal components Y1 to Y5 (Gov=W1*Y1+W2*Y2+W3*Y3+W4*Y4+W5*Y5,where W is the calculated variance contribution rate).The factor loadings of the principal components are shown in Table 12.In PCA,a factor with aloading greater than 0.3 is generally considered signifcant in explaining the original variable.For the frst principal component,the loading factors of shareholder concentration,proportion of board shareholding and management ownership account for more than 50%of the variance,and are thus used to represent and refect shareholding structure,shareholder equity and managerial ownership.The second principal component is a less important factor in the composition,and the loading factors of the meeting frequency of the board of directors and supervisory board are slightly more signifcant than the other indicators,and better refect directors,supervisors and other forms of governance.For the third main component,the highest loading factors are board size followed by shareholder concentration,and these two indicators thus refect shareholding structure and shareholder equity,and directors,supervisors and other forms of governance.For the fourth principal component,the largest loading factors are the largest shareholder and state-owned shares, which account for more than 50%,and thus better refect shareholding structure and shareholder equity. For the ffth main component,the loading factors of board and supervisory board meeting frequency are the most signifcant indicators to refect directors,supervisors and other forms of governance.Thus,the keys to improving corporate governance are to increase the shareholdings of the largest shareholders,to reduce the proportion of state-owned shares,and to increase managerial ownership and the meeting frequency of both the board of directors and supervisory board.

Table 12 Principal component factor loadings.

Abbott,L.J.,Park,Y.,Parker,S.,2000.The efects of audit committee activity and independence on corporate fraud.Manage.Finance 26 (11),55–67.

Ashbaugh-Skaife,H.,Collins,D.W.,Kinney,W.,LaFond,R.,2008.The efect of SOX internal control defciencies and their remediation on accrual quality.Account.Rev.83(1),217–250.

Bai,C.E.,Liu,Q.,Lu,Z.,Song,M.,Zhang,J.X.,2005.Empirical study of Chinese corporate governance structure.Econ.Res.2,81–91.

Ball,R.,Kothari,S.P.,Robin,A.,2000.The efect of international institutional factors on properties of accounting earnings.J.Account. Econ.29(1),1–51.

Beasley,M.S.,1996.An empirical analysis of the relation between the board of director composition and fnancial statement fraud. Account.Rev.71(4),443–465.

Beasley,M.S.,Carcello,J.V.,Hermanson,D.R.,1997.Fraudulent Financial Reporting:1987–1997.COSO,New York,NY.

Beasley,M.,Carcello,J.V.,Hermanson,D.R.,Lapides,P.,2000.Fraudulent fnancial reporting:consideration of industry traits and corporate governance mechanisms.Account.Horizons 14(December),441–454.

Bedard,J.C.,Johnstone,K.M.,2004.Earnings manipulation risk,corporate governance risk,and auditors’planning and pricing decisions.Account.Rev.79(2),277–304.

Cai,J.P.,2007.Relationship of corporate governance,audit risk and audit fees.Auditing Res.3,65–71.

Cao,Y.Q.,Qian,X.H.,2011.Corporate governance and risk management:based on the analysis of governance risk perspective.Account Res.7,3–77.

Caramanis,C.,Lennox,C.,2008.Audit efort and earnings management.J.Account.Econ.45,116–138.

China Securities Regulatory Commission,1998.The notifcation of issuing speech of Fan Fuchun on the Symposium about the proper practice of accounting frms with securities-related qualifcation.CRSC fle:CSRC[1998]No.3.

Choi,J.H.,Wong,T.J.,2007.Auditors’governance functions and legal environments:an international investigation.Contemp.Account. Res.24(1),13–46.

Davidson,R.A.,Gist,W.E.,1996.Empirical evidence on the functional relation between audit planning and total audit efort.J.Account. Res.34(1),111–124.

DeAngelo,L.E.,1981.Auditor size and audit quality.J.Account.Econ.3(3),183–199.

Dechow,P.,Sloan,R.,Sweeney,A.,1996.Causes and consequences of earnings manipulation:an analysis of frms subject to enforcement actions by the SEC.Contemp.Account.Res.13(1),1–26.

Dechow,P.M.,Ge,W.,Schrand,C.,2010.Understanding earnings quality.J.Account.Econ.50(2–3),344–401.

DeFond,M.,Wong,T.J.,Li,S.,2000.The impact of improved audit independence on audit market concentration in China.J.Account. Econ.28,269–305.

Fan,G.,Wang,X.L.,2011.NERI Index of Marketization of China’s Provinces 2011 Report.The Economic Science Press,Beijing(in Chinese).

Doyle,J.,Ge,W.,McVay,S.,2007.Accruals quality and internal control over fnancial reporting.Account.Rev.82(5),1141–1170.

Francis,J.R.,Krishnan,J.,1999.Accounting accruals and auditor reporting conservatism.Contemp.Account.Res.16(1),135–165.

Francis,J.R.,Simon,D.T.,1987.A test of audit pricing in the small client-segment of the U.S.audit market.Account.Rev.1,145–157.

Gompers,P.A.,Ishii,J.L.,Metrik,A.,2003.Corporate governance and equity prices.Quart.J.Econ.118(1),107–115.

Heckman,J.,1978.Dummy endogenous variables in a simultaneous equations system.Econometrica 46(4),931–959.

Houston,R.W.,Peters,M.,Pratt,J.H.,1999.The audit risk model,business risk and audit-planning decisions.Account.Rev.74(3),281–298.

Jensen,M.C.,Meckling,W.H.,1976.Theory of the frm:managerial behavior,agency costs and ownership structure.J.Financ.Econ.3 (4),305–360.

Johnstone,K.M.,Sutton,M.H.,Warfeld,T.D.,2001.Antecedents and consequences of independence risk:framework for analysis. Account.Horizons 15(1),1–18.

Li,W.A.,Zhang,G.P.,2005.Empirical research between governance evaluation index of managers and related performance.Econ.Res. 11,87–98.

Liao,L.,Shen,H.B.,Li,J.L.,2008.Empirical study of equity division reform and governance of listed companies.China Ind.Econ.5,99–108.

McMullen,D.A.,1996.Audit committee performance:an investigation of the consequences associated with audit committees.Audit.:A J. Pract.Theory 15(Spring),87–103.

O’Keefe,T.B.,Simunic,D.A.,Stein,M.T.,1994.The production of audit services:evidence from a major public accounting frm.J. Account.Res.32(2),241–261.

Palmrose,Z.,1984.The demand for quality-diferentiate audit services in an agency-cost setting:An empirical investigation.In:Auditing Research,Symposium,pp.229–252.

Palmrose,Z.-V.,1989.The relation of audit contract type to audit fees and hours.Account.Rev.64(3),488–499.

Pan,K.Q.,2008.Corporate governance,audit risk and audit pricing:Empirical evidence based on CCGINK.Nankai Bus.Rev.1,106–112.

Simunic,D.A.,1980.The pricing of audit services:theory and evidence.J.Account.Res.18(1),161–190.

Wallace,W.A.,1987.The economic role of the audit in free and regulated markets:A review.Res.Account.Regul.1,7–34.

Wang,Y.M.,Wu,J.Y.,2005.The study about development and application of modern risk-oriented audit.Audit Res.6,51–55.

Watts,R.L.,Zimmerman,J.L.,1983.Agency problems,auditing and the theory of the frm:some evidence.J.Law Econ.26,613–634.

Zhang,X.Y.,Liao,L.,2010.Equity division reform,voluntary disclosure and corporate governance.Econ.Res.10,28–39.

*Corresponding authors.

E-mail addresses:caolimei925@163.com(L.Cao),lwf2007@126.com(W.Li).

☆We appreciate the valuable comments of Prof.Xijia Su and the other participants at the 2013 Special Issue Symposium for the China Journal of Accounting Research,especially the detailed and constructive suggestions of Donghui Wu(editor)and the anonymous referees. The work described in this paper was supported by grants from the National Natural Science Foundation of China(Project No. 71472047),Humanities and Social Science Foundation of the Ministry of Education of China(Project No.13YJC630080),Young and Middle-aged Teacher Education and Science Research Foundation of Fujian Province of China(Project No.JA13047S)and Social Science Research Planning Foundation of Fujian Province of China(Project No.2014B022).

http://dx.doi.org/10.1016/j.cjar.2015.05.002

1755-3091/©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

Risk-based audit mode

Corporate governance

China Journal of Accounting Research2015年4期

China Journal of Accounting Research2015年4期

- China Journal of Accounting Research的其它文章

- Guidelines for Manuscripts Submitted to The China Journal of Accounting Research

- Monetary policy,accounting conservatism and trade credit☆

- Does the transformation of accounting frms’organizational form improve audit quality? Evidence from China☆

- Financial development and the cost of equity capital: Evidence from China