Monetary policy,accounting conservatism and trade credit☆

Bingbin Dai,Fan Yang

International School of Business,Beijing International Studies University,China

Monetary policy,accounting conservatism and trade credit☆

Bingbin Dai*,Fan Yang

International School of Business,Beijing International Studies University,China

A R T I C L E I N F O

Article history:

Received 19 September 2014

Accepted 28 September 2015

Available online 16 October 2015

JEL classifcation:

E52

G32

M41

Monetary policy

Using a sample of A-share listed frms in China during the 2003–2012 period, this paper investigates the efect of accounting conservatism on trade credit, taking changes in monetary policy into account.We fnd that corporations with higher accounting conservatism obtain more trade credit and that accounting conservatism has a greater infuence on trade credit under tight monetary policy.Furthermore,the backgrounds of the supplier and customer infuence the positive relationship between accounting conservatism and trade credit.This infuence is more evident when a company is privately owned and has greater market power,and less evident when the supplier or customer is the controlling shareholder.

©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

As a basic feature of accounting reporting,the main role of accounting conservatism is to promote the signing of debt contracts by preventing an enterprise from over-reporting its assets and thus damaging the interests of creditors(Watts,2003;Jiang and Zhang,2007).The creditors of an enterprise are mainly banks and trading partners(i.e.suppliers and customers),so two types of debt contracts exist:bank credit contracts and trade credit contracts.

Previous studies focus on the efect of accounting conservatism on bank credit(Zhang,2008;Rao and Jiang,2011;Zhu,2011;Cheng and Liu,2013),with less attention being paid to trade credit(Hui et al., 2012).However,trade credit is widely used in both developed and developing countries.In the UK,for example,trade credit accounts for 70%of short-term debt and 55%of credit loans(Kohler et al.,2000). Rajan and Zingales(1995)show that on average,trade credit accounted for 17.8%of the total assets of American companies in 1991,and for over 25%of those of their German,Italian and French counterparts. Although China’s fnancial system is not sound,trade credit plays a decisive role in its national economy.

Focusing on accounting conservatism and changes in monetary policy,we investigate how these two elements afect trade credit and discuss the diferent efects of accounting conservatism on trade credit for trading parties with diferent backgrounds.

Specifcally,we aim to answer the following questions.First,do accounting conservatism policies afect trade credit fnancing?The literature on trade credit is currently based mainly on the theories of alternative fnancing and market power.From the perspective of demand,the theory of alternative fnancing holds that credit rationing prevents some companies from obtaining sufcient bank lending.They therefore turn to trade credit fnancing,despite having to bear the higher costs of trade credit(Petersen and Rajan,1997;Biais and Gollier,1997).From the supply perspective,market power theory considers that due to market power,suppliers(customers)will take the initiative to provide a large amount of low-cost trade credit to a company to promote sales(supplies)(Summers and Wilson,1999;Fisman and Raturi,2004;Van Horen,2005).Regardless of what theory applies,a company seeking trade credit needs to sign a debt contract with a supplier or a customer.Hui et al.(2012)argue that as accounting conservatism can recognize losses in a timely fashion,it can protect the interests of customers and suppliers when signing contracts and reduce potential losses from such transactions.We therefore examine whether companies with higher accounting conservatism obtain more trade credit.

Second,how does accounting conservatism infuence trade credit when monetary policy changes?In a period of tight monetary policy,the problem of credit discrimination,or credit rationing,becomes worse and it becomes harder for companies to obtain bank loans.Meanwhile,suppliers or customers become more cautious about providing trade credit because of increasing uncertainty in the economic environment.We therefore investigate whether accounting conservatism has a greater efect on obtaining trade credit when the demand for trade credit increases and the supply reduces.Third,does accounting conservatism have diferent efects on trade credit for trading parties with diferent backgrounds?Previous studies fnd that enterprises with diferent levels of market power and diferent types of ownership obtain trade credit diferently(Lu and Yang,2011;Zhang et al.,2012),and that the contractual relationship in transactions between related parties can afect the choice of trade credit mode(Liu et al.,2009).We therefore investigate whether the diferent backgrounds of companies and their suppliers or customers afect the relationship between accounting conservatism and trade credit.

To test these research questions,we use data for Chinese listed companies during 2003–2012.First,we fnd that companies with higher accounting conservatism obtain more trade credit.Second,accounting conservatism has a greater efect on trade credit under tight monetary policy.Third,the positive relationship between accounting conservatism and trade credit is related to the backgrounds of the supplier and the customer.The infuence on this positive relationship is most marked when a company is privately owned and has greater market power,and less evident when a supplier or customer is the controlling shareholder.

The contributions of this paper are as follows.First,previous research on trade credit focuses on the motives for trade credit,but we explore the operational mechanism of accounting conservatism,a factor in obtaining trade credit,from the perspective of debt contracting.Second,with respect to monetary policy, we investigate the efect of accounting conservatism on trade credit under diferent monetary policies,which enriches the literature on macro-economic policy and micro-enterprise behavior.Finally,taking the diferent backgrounds of the parties into account,we discuss the joint efect of corporate characteristics,associated relationships and accounting conservatism in the contracting process,which expands the research on trade credit.

The rest of this paper is structured as follows.The second section briefy outlines the previous research with respect to trade credit and accounting conservatism,and outlines our research hypotheses;the third section explains the process of sample selection and the establishment of the model;the fourth section presents theresearch results and empirical analysis;the ffth section further discusses the results of sub-samples according to the diferent backgrounds of trading parties;and the sixth section provides the conclusions.

2.Literature review and research hypotheses

2.1.Accounting conservatism and trade credit

Accounting earnings information plays an important role in the process of signing contracts between enterprises and suppliers or customers.According to Williamson(1979),transactions can be divided into discrete transactions,long-term transactions and relational transactions.A discrete transaction involves a one-time contract,and the rights and obligations of the parties to the contract can be clearly defned.In a long-term transaction the contract is long-term and incomplete,and cannot cover all future uncertainties.In a relational transaction the contract is also long-term and involves special investment.From the perspective of reducing transaction costs,transactions between enterprises and suppliers or customers are usually long-term or relational transactions.Due to the incompleteness of long-term contracts,frms are more likely to adopt opportunistic behavior.In particular,in relational transactions in which the suppliers and customers often require special asset investment,if the company cancels the transaction because of fnancial difculties or other reasons,the suppliers and customers will incur high switching costs(Hui et al.,2012).Suppliers and customers are able to observe very recent changes in the operating conditions of a company through their business dealings, so have information advantages over banks and other credit institutions(Lu and Yang,2011).However,with respect to opportunity costs and sunk costs in long-term transactions,suppliers and customers still consider a company’s overall proftability when judging the prospects for long-term cooperation with that enterprise and when deciding whether or not to trade with a particular company or what type of transaction to provide to that company.

As suppliers and customers,unlike shareholders,are the main creditors in trade credit transactions,their proft function is asymmetric.That is,they bear the risk of enterprise bankruptcy but do not gain any appreciation in the value of assets,which leads them to pay greater attention to bad news regarding a company’s performance than to good news.Meanwhile,company managers have an information advantage over other stakeholders and tend to hide any bad news for reasons of self-interest.The interests of suppliers and customers will thus be damaged through information asymmetry when managers report relatively little relating to bad news for a company.

How,then,can the interests of suppliers and customers be protected in a transaction?Hui et al.(2012)confrm that accounting conservatism is one feasible mechanism for providing such protection.The conservatism principle stipulates that an enterprise cannot recognize a potential beneft,but should recognize a potential loss in a timely fashion(Basu,1997).Accordingly,the interests of suppliers and customers can be protected through the following two mechanisms.

First,by inhibiting excessive investment and insufcient investment,accounting conservatism can improve the future proftability of a company,ensuring long-term cooperation with its suppliers and customers. Accounting conservatism results in investment losses being refected in management reporting as soon as possible,so that shareholders receive timely signals that the net present value of an investment project is negative, which inhibits excessive investment(Ball and Shivakumar,2005).At the same time,accounting conservatism can help to alleviate underinvestment by reducing the fnancing costs of the enterprise(Garcia Lara et al., 2011).As a result,the higher the accounting conservatism of a company,the higher the company’s future profitability,and the lower the possibility of future special project expenditure(Ahmed and Duellman,2011).A higher proftability for a company can ensure sustainable cooperation relationships with suppliers and customers,who are then willing to provide more trade credit to that company based on the expectation of future long-term cooperation.

Second,accounting conservatism can help suppliers and customers to promptly identify poor performance by a company.Taking loan contracts as the object of study,Zhang(2008)concludes that higher accounting conservatism makes it easier for companies to violate restrictive clauses in debt contracts,and helps creditors to promptly enforce or re-sign contracts.Therefore,the higher the accounting conservatism,the lower the loan interest rate paid by the company.Similarly,accounting conservatism can also reduce information asymmetry,protect the interests of suppliers and customers to a greater extent,and help both parties to a contract to establish cooperative relations with mutual trust,such that suppliers and customers are willing to accept a certain degree of risk and provide more trade credit.Conversely,if a company’s accounting reports are less conservative and the interests of suppliers and customers cannot be protected,the payment terms required by the suppliers and customers will be more stringent because they wish to protect their own interests and safely control risk.Accordingly,they will not provide a large amount of trade credit.

Based on the above analysis,we propose the following hypothesis:

H1.Corporations with higher accounting conservatism obtain more trade credit.

2.2.Monetary policy,accounting conservatism and trade credit

Monetary policy is important to governments as a means of intervening in and adjusting the macroeconomy.When monetary policy changes from loose to tight,enterprises face a diferent macroeconomic environment.The behavior of enterprises,creditors and shareholders may therefore also change(Gertler and Gilchrist,1994).The efect of monetary policy on a micro-enterprise is frst refected in changes in the information environment.During a period of monetary tightening,the degree of future information uncertainty that companies will face increases.Using panel data for listed companies in the UK for 1970–1990, Beaudry et al.(2001)fnd that in the 1980s,frequent changes in monetary policy led to the total variance of investment in listed corporations being signifcantly smaller than that in the 1970s.This refects the characteristic that enterprise investment behavior tends to be uniform when facing uncertainty due to monetary policy.

Due to imperfections in the capital market,the problem of information asymmetry and related contract cost is common within actual economic operations.Banks play an irreplaceable role in alleviating information asymmetry,dispersing risk and reducing transaction costs in the credit market.Monetary policy can infuence the availability of bank credit,and accordingly afect the behavior of enterprises,creditors and shareholders. Much empirical literature provides evidence that a tight monetary policy afects corporate fnancing.The literature indicates that a tight monetary policy reduces the funds available to banks to loan out,increases the difculty of obtaining loans and as a result afects the investments made by enterprises(Kashyap et al., 1993;Ye and Zhu,2009).In addition,increasing loan interest rates raises the capital cost to the enterprise (Mojon et al.,2002).In China,fnancing channels for enterprises are relatively less common than in other countries,and bank loans represent the main fnancing channel.At the same time,banking in China is very vulnerable to the actions and regulations of the government.As the People’s Bank of China tightens monetary policy by raising the deposit reserve rate,the benchmark interest rate and the discount rate,the real economy is afected through the credit channel,refected specifcally in a signifcant reduction in the amount of corporate credit fnancing(Ye and Zhu,2009).Accordingly,under a tight monetary policy,an enterprise’s external fnancing costs increase,the scale of external fnancing is limited and the problem of credit rationing worsens.

The worsening of credit rationing makes it difcult for an enterprise to obtain bank credit fnancing,and it becomes more dependent on trade credit fnancing.As the demand for trade credit increases while the funds available decrease due to the tight monetary policy,trade credit becomes a scarce resource.In such a period of monetary tightening,suppliers and customers,as providers of trade credit,will be more concerned about whether the assets of the enterprise can pay ofdebt.They will thus require a more conservative corporate accounting policy to enable them to adjust credit policies sooner.Under this premise,relative to a period of monetary easing,suppliers and customers in a period of monetary tightening will be more willing to provide trade credit for enterprises with higher accounting conservatism,and trade credit will then fow more intensively into these enterprises.

Based on the above analysis,we propose the following hypothesis:

H2.During a period of monetary tightening,corporations with higher accounting conservatism obtain more trade credit.

3.Research design

3.1.Sample and data

Using A-share listed companies in China during 2003–2012 as the basis and after removing companies in the fnancial industry and companies with missing data,the sample comprises 12,121 frm-year observations of 1880 companies.Data on corporate governance are from the CCER database and other data are from the CSMAR database.All observations in the top 1%and bottom 1%for continuous variables are winsorized to control for outliers,andt-values are clustered at the frm level.

3.2.Research design

3.2.1.Trade credit(TC)

With reference to Lu and Yang(2011)and Zhang et al.(2012),the following formula is used to calculate TC:TC=(accounts payable+notes payable+advances from customers)/total assets.

3.2.2.Accounting conservatism(C-Score)

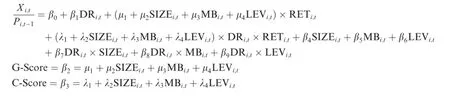

C-Score measures the timeliness of bad news(i.e.the level of conservatism).The higher the value of C-Score,the higher the degree of accounting conservatism.

3.2.3.Tight monetary policy(MP)

Based on the work of the Macro Group,CCER,PKU(2008),monetary liquidity can be measured on three bases:excess money,money stock and the interest rate in the short-term lending market.The measures based on excess money include the situation in which the money growth rate exceeds the nominal GDP growth rate(Baks and Kramer,1999),and that in which the money growth rate exceeds the actual GDP growth rate and the price increase rate(Yi,1991).The measures based on money stock include the growth rate ofM2,the diference in the growth rates ofM1 andM2 and the ratio ofM1/M2.The measures based on the interest rate in the short-term lending market include the one-year lending rate(Li and Wang,2011),the bond spread and so on.

Of these measurement bases,only the frst takes money demand into account.According to a general economic analysis,there will be excess monetary liquidity if the supply of money is greater than the demand, and a shortage of money liquidity when the supply of money is less than the demand.Accordingly,the frst measurement basis is adopted here.

We use the nominal GDP growth rate to measure the currency required for economic development,and theM2 growth rate to measure the supply of money.Thus,the diference between the nominal GDP growth rate and theM2 growth rate refects the degree of monetary liquidity shortage.If the diference is positive,this indicates that the current money supply is insufcient and a period of monetary tightening applies,and MP=1;if the diference is negative,this indicates that the current money supply is adequate and a period of monetary easing applies,and MP=0(Li and Wang,2011).The diferences between the nominal GDP growth rate and theM2 growth rate are-0.079,0.033,-0.023,0.013,0.061,0.004,-0.199,-0.012,0.005 and-0.045 from 2003 to 2012.Therefore,2004,2006,2007,2008 and 2011 are defned as monetary tightening periods,while the other years are defned as monetary easing periods.

3.2.4.Control variables

人们在日常生活中因为各种意外经常容易发生骨折,骨折患者严重者就需要进行手术治疗,患者对于手术本身就比较恐惧,骨折后患者的生活也有了许多不便,手术后还需要配合相应的康复训练,才能加快患者的康复。为了更好的服务患者,降低患者术后的并发症,提高康复速度,我院特对骨科患者进行了临床护理路径,经临床研究发现,相较于常规护理,在骨科护理中应用临床护理路径效果极佳。具体的研究分析报告如下。

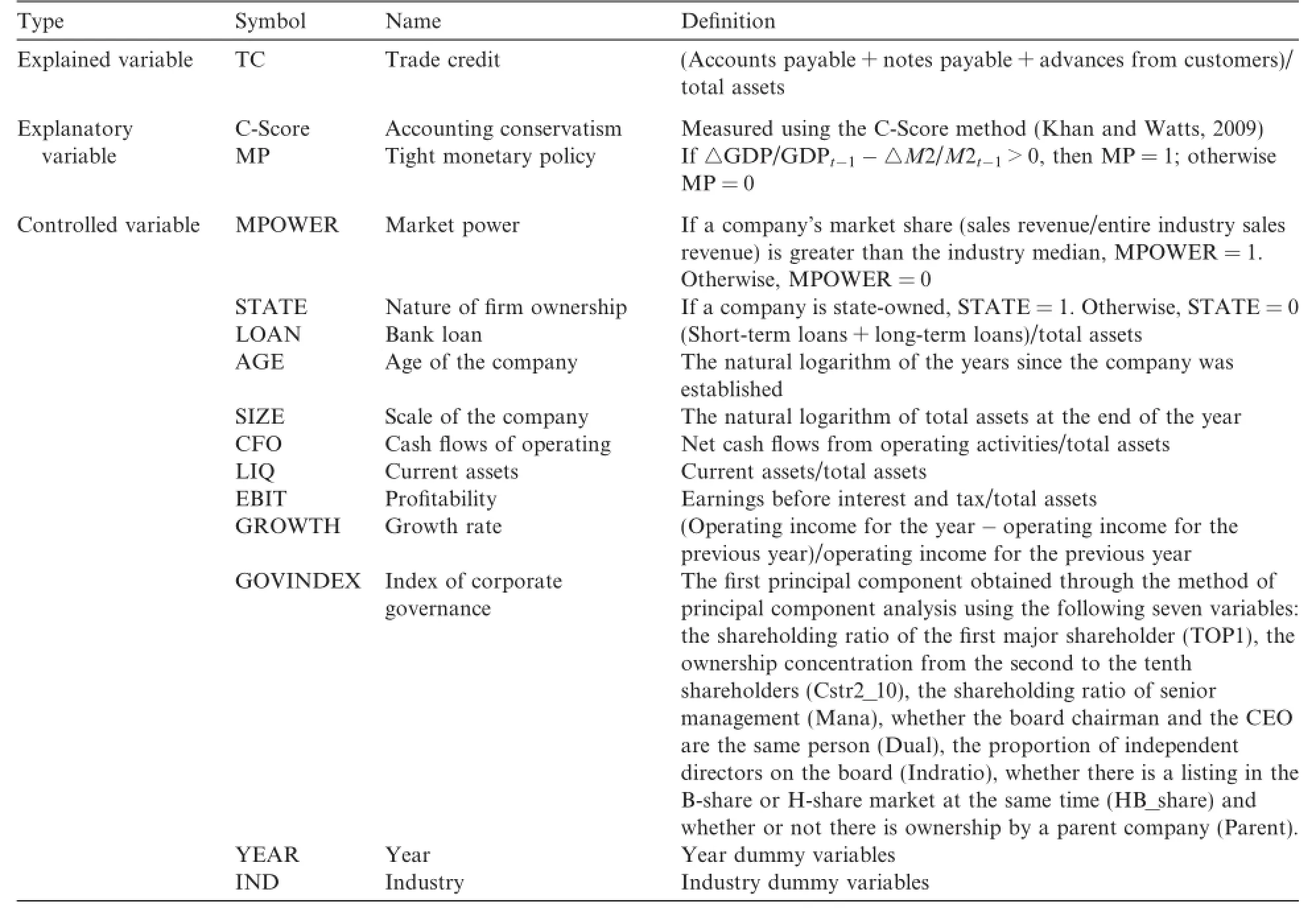

The control variables are CFO,LIQ,LOAN,AGE,SIZE,EBIT,GROWTH,MPOWER,STATE and GOVINDEX.

For those demanding trade credit,the adequacy of internal cash fows and the availability of bank loans are important factors afecting trade credit fnancing,according to pecking order theory and alternative fnancing theory.Therefore,we use CFO(net cash fow from operating activities/total assets)to measure an enterprise’s ability to generate cash,LIQ(current assets/total assets)to measure the liquidity ratio and LOAN(bank loans/total assets)to measure the proportion of bank loans to total assets.

Those supplying trade credit will take a frm’s establishment age(AGE),size(SIZE),proftability(EBIT) and growth ability(GROWTH)into account when providing trade credit.

In addition,the amount of trade credit that an enterprise obtains refects its bargaining power in the industry.The stronger the market position,the more trade credit may be obtained(Fisman and Raturi,2004;Zhang et al.,2012).MPOWER is used to measure the market position of an enterprise.If the market share of the enterprise,that is,the ratio of the frm’s sales revenue to the industry’s sales revenue,is greater than the industry median,then MPOWER equals 1,and 0 otherwise.

The existing literature shows that the amount of trade credit obtained by state-owned enterprises is significantly higher than for non-state-owned enterprises,because state-owned enterprises have good credit ratings and no constraints on fnancing(Liu et al.,2009;Lu and Yang,2011).Thus,STATE is used to control for the efect of the nature of frm ownership,which equals 1 if a frm is state-owned,and 0 otherwise.

Finally,the efect of corporate governance is also controlled for in our analysis.With reference to the approach of Bai et al.(2005)and Zhang and Lu(2012),we use the shareholding ratio of the frst major shareholder(TOP1),the ownership concentration from the second to the tenth shareholders(Cstr2_10), the shareholding ratio of senior management(Mana),whether the board chairman and the CEO are the same person(Dual),the proportion of independent directors on the board(Indratio),whether there is a listing in the B-share or H-share market at the same time(HB_share,which equals 1 if listed at the same time,and 0 otherwise)and whether there is ownership by a parent company(Parent,which equals 1 if owned,and 0 otherwise)to construct a corporate governance index through the method of principal component analysis.1Bai et al.(2005)also consider the nature of frm ownership when constructing a corporate governance index.Previous studies fnd that the amount of trade credit obtained by state-owned enterprises is signifcantly higher than for non-state-owned enterprises,and the direction of this infuence is not consistent with the directions of the other corporate governance factors for trade credit;thus,we examine the nature of frm ownership alone.The frst principal component obtained from the analysis is defned as an indicator of corporate governance level,GOVINDEX.Specifc defnitions of the variables are given in Table 1.

3.3.The empirical model

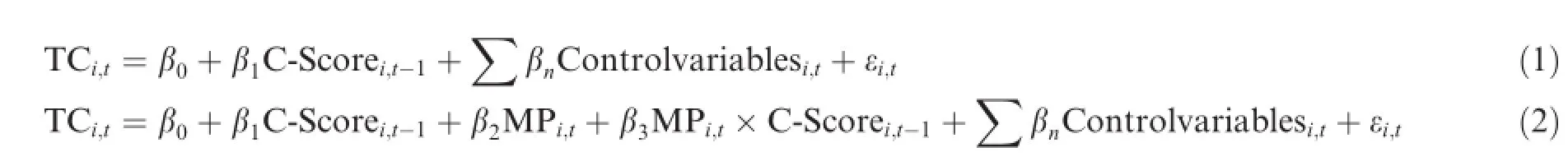

To analyze whether accounting conservatism afects an enterprise’s trade credit fnancing behavior,and to test the efect of accounting conservatism on trade credit under diferent monetary policies,we use the following models2To avoid the problem of endogeneity,we use lagged C-Score values in the model to measure accounting conservatism.The results are not afected if current C-Score values are used.:

Table 1 Variable defnitions.

If H1 is supported,the coefcient for C-Score,β1,should be signifcantly positive.In addition,β3should also be signifcantly positive if H2 is supported.

4.Empirical analysis

4.1.Descriptive statistics

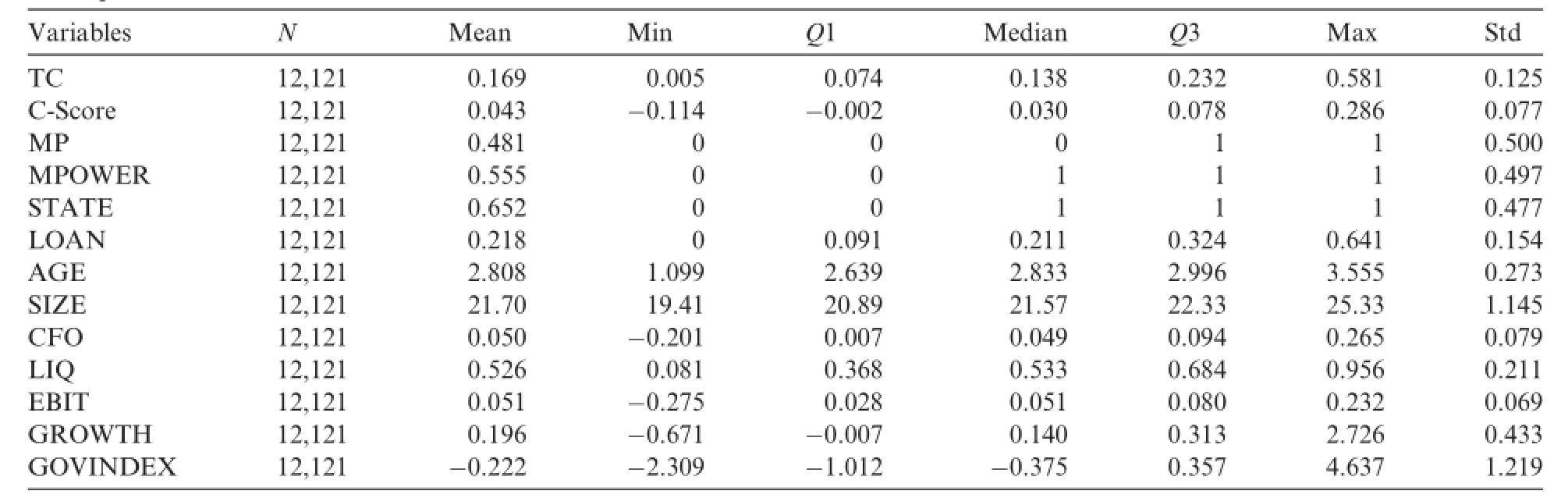

Table 2 lists the descriptive statistics for all of the variables.The mean of trade credit is 16.9%and the median is 13.8%.The mean and median of C-Score are 0.043 and 0.030 respectively,implying that the sample companies implemented conservative accounting policies during 2003–2012.The mean of monetary policy (MP)is 48.1%and the standard deviation is 50%,showing that the observations are relatively uniform under tight monetary policy and loose monetary policy.The maximum and minimum of SIZE are 25.33 and 19.41 respectively,and the maximum and minimum of EBIT are 0.232 and-0.275 respectively,which are reasonable.

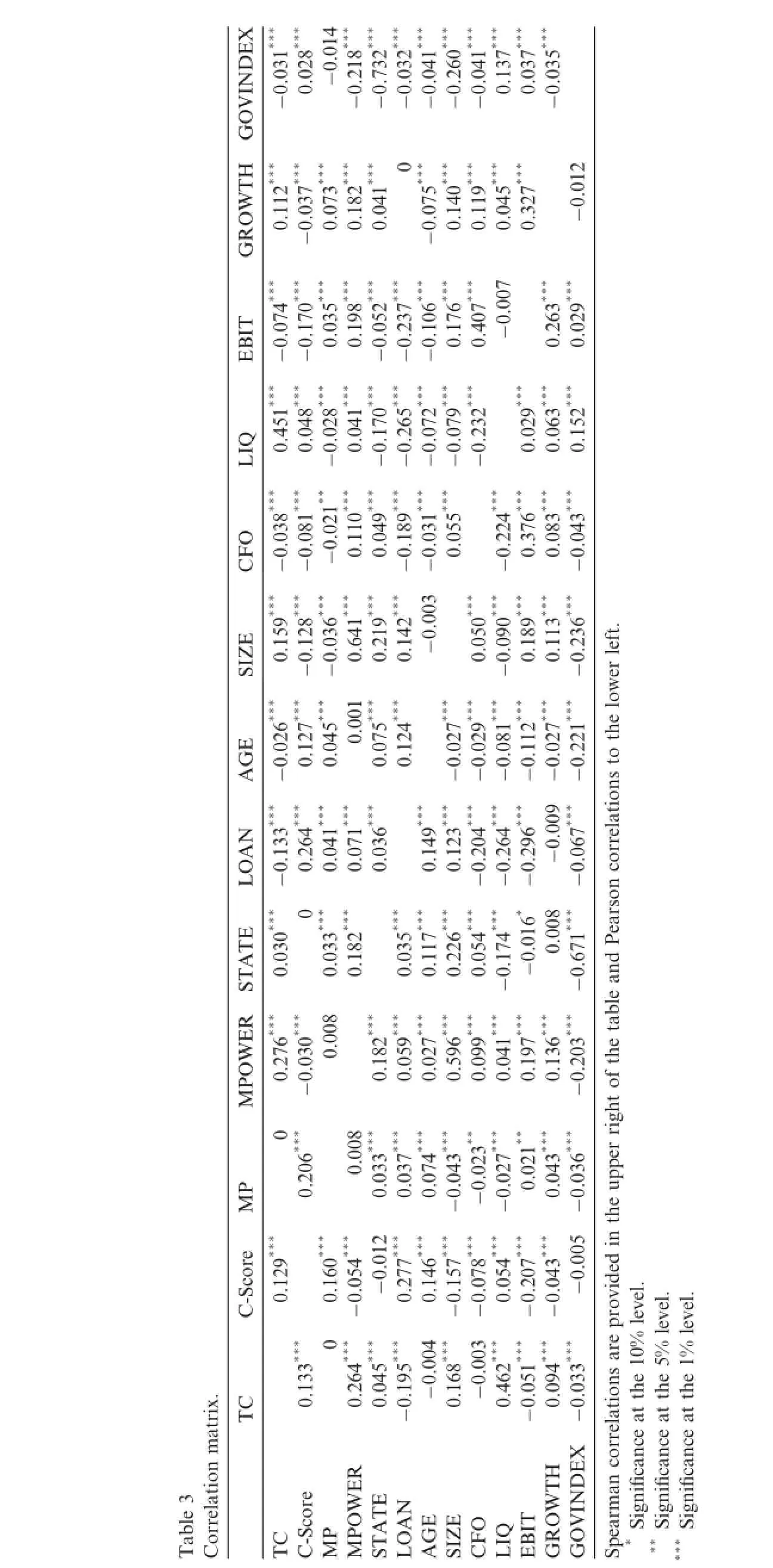

Table 3 gives the correlations between the variables.There is a signifcant positive correlation between TC and C-Score,showing that the higher an enterprise’s accounting conservatism,the more trade credit it obtains. The relationship between TC and C-Score is consistent with our expectations.The correlations of TC withMPOWER and STATE are also signifcantly positive,indicating that companies with a strong market position or state ownership obtain more trade credit.The relationship between LOAN and TC is signifcantly negative,implying that if an enterprise can obtain more loans from banks,it will reduce its demand for trade credit,thus confrming fnancing substitution theory.

Table 2 Descriptive statistics.

4.2.Regression analysis

4.2.1.Accounting conservatism and trade credit

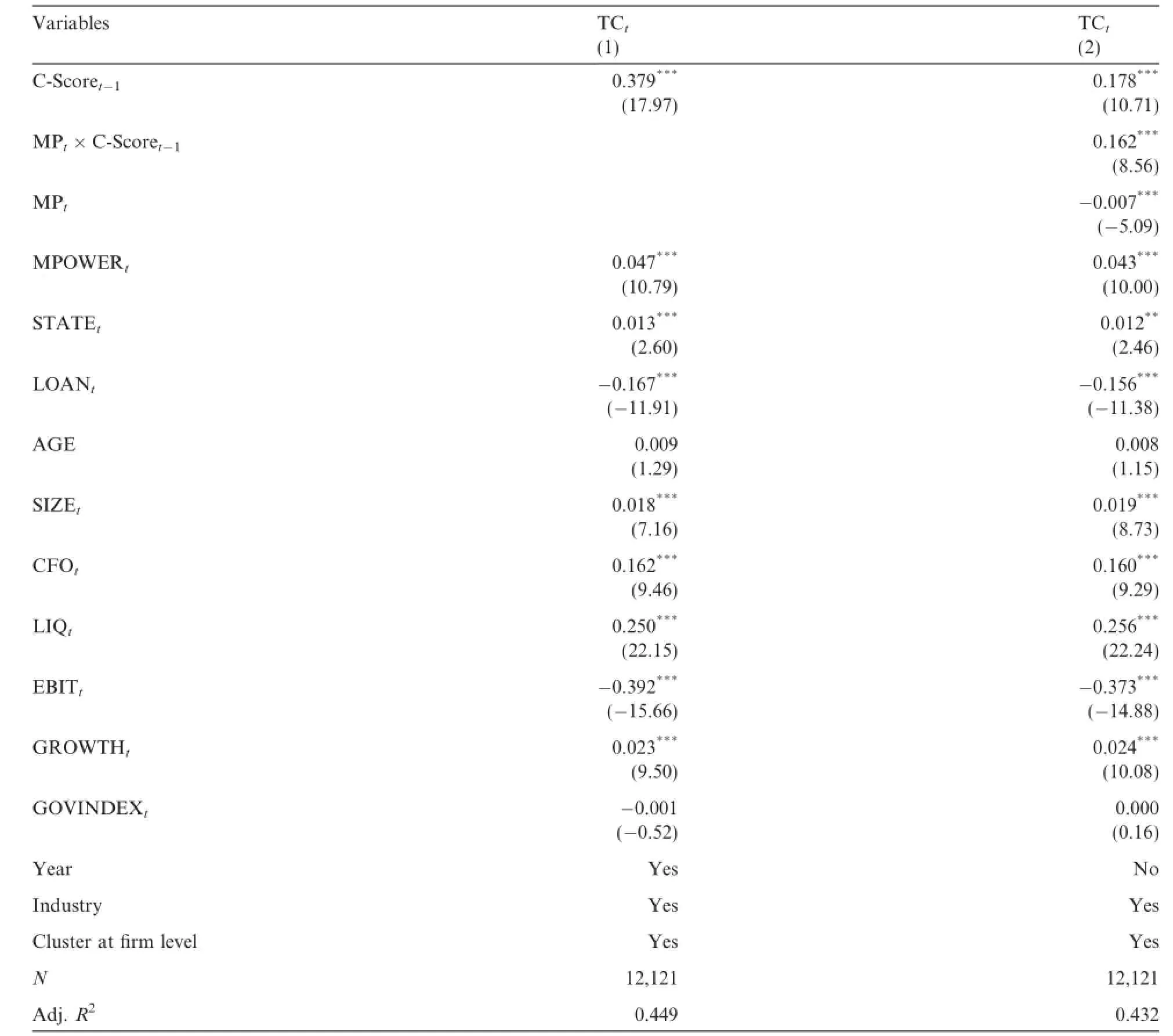

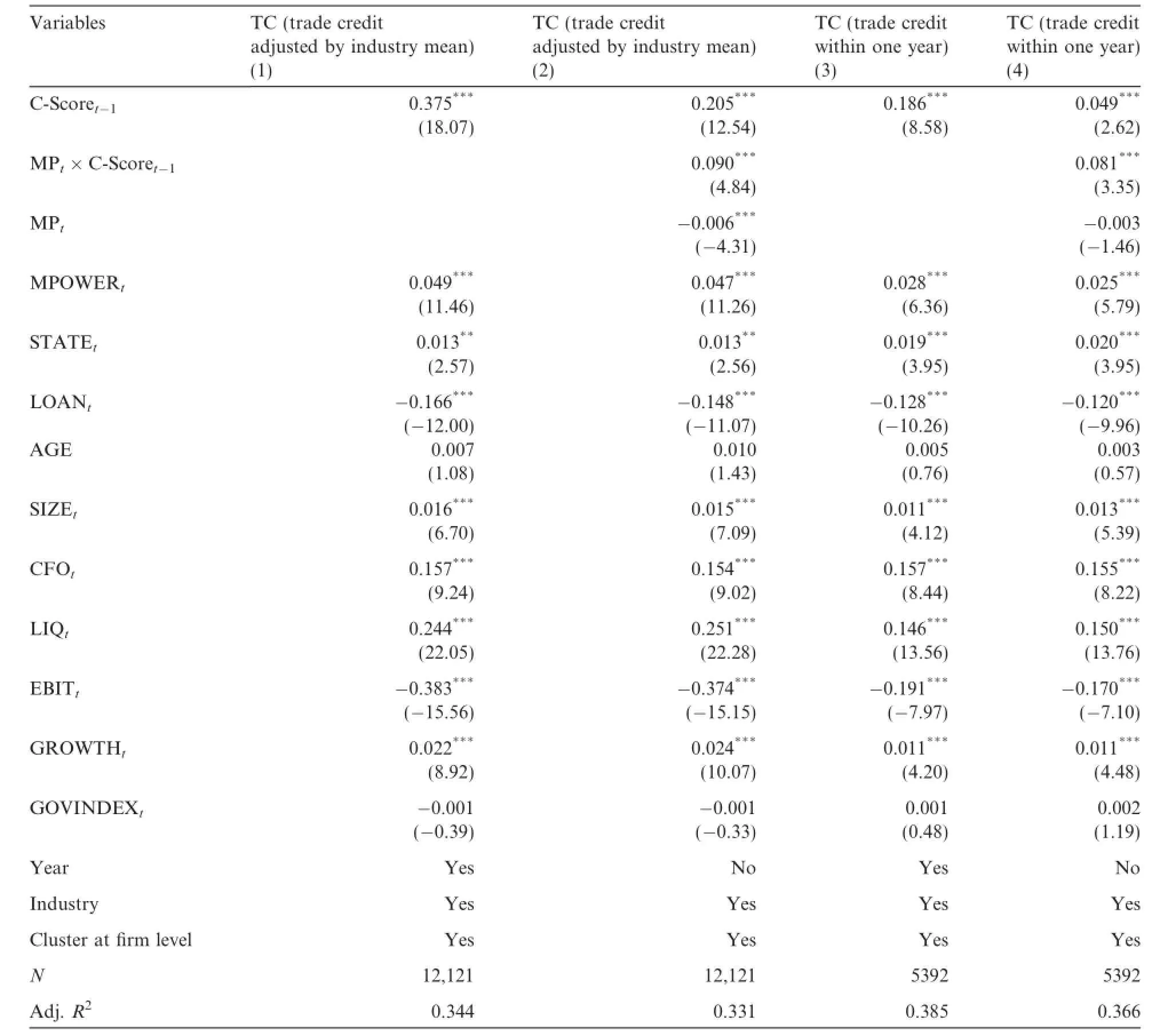

First,we investigate the efect of accounting conservatism on trade credit,with the results of the regression analysis provided in Table 4.

In regression(1),we use TCt,i.e.(accounts payable+notes payable+advances from customers)/total assets,as the dependent variable.The coefcient for C-Scoret-1is 0.379,which is signifcantly positive at the 1%level,suggesting that the higher the accounting conservatism,the more trade credit is obtained from the supplier and the customer.High accounting conservatism can reduce the degree of information asymmetry to more efectively protect the interests of suppliers and customers,and help trading parties to establish cooperative relations with mutual trust,such that the supplier and the customer are willing to accept a certain degree of risk and provide more trade credit.Thus,hypothesis 1 is confrmed.

The coefcient for MPOWERtis signifcantly positive,indicating that enterprises with stronger market positions can obtain more trade credit.The coefcient for STATEtis signifcantly positive,indicating that state-owned enterprises can obtain signifcantly more trade credit than private enterprises.The relationship between LOAN and TC is signifcantly negative,showing that the more bank credit obtained,the less trade credit obtained.There is a specifc substitution relationship between bank credit and trade credit,in line with the theory of fnancing substitution.

4.2.2.Monetary policy,accounting conservatism and trade credit

We further investigate the efect of accounting conservatism on trade credit in the context of monetary policy changes.The results of this regression analysis after adding MPt×C-Scoret-1to the model are provided in Table 4.

The results of regression(2)show that C-Scoret-1is still signifcantly positive and MPt×C-Scoret-1is too, indicating that accounting conservatism is more important under tight monetary policy.In a period of monetary tightening,trade credit becomes a type of scarce resource.Thus,suppliers or customers become more cautious about providing trade credit due to increasing uncertainty in the economic environment.In this situation,an enterprise with a higher level of accounting conservatism has more advantages in terms of obtaining trade credit provided by suppliers or customers.That is,relative to a period of monetary easing, suppliers and customers are more willing to provide trade credit to enterprises with higher accounting conservatism in a period of monetary tightening.Thus,hypothesis 2 is confrmed.

EXVIND0.028*** -0.0140.137*** 0.037*** GO-0.031*** -0.218*** -0.732*** -0.032*** -0.041*** -0.260*** -0.041*** -0.035*** TH* * * * * 0 * * * * * OWGR0.112**-0.037**0.073**0.182**0.041**-0.075**0.140**0.119**0.045**0.327**-0.012* -0.074*** -0.170*** * * * * -0.106**0.035**0.198**-0.052**-0.237*** * * * ITEB0.176**0.407**-0.0070.263**0.029*** * * -0.021**-0.028**0.451**0.048*** * -0.170**0.041*** * * -0.079**-0.265**-0.072*** * * * LIQ -0.232**0.029**0.063**0.152**O CF-0.038*** -0.081*** 0.110*** 0.049*** -0.189*** -0.031*** 0.055*** -0.224*** 0.376*** 0.083*** -0.043*** SIZE0.159*** -0.128*** -0.036*** 0.641*** 0.219*** 0.142*** -0.0030.050*** -0.090*** 0.189*** 0.113*** -0.236*** wer left. e loE 0.001 thAG-0.026*** 0.127*** 0.045*** 0.075*** 0.124*** -0.027*** -0.029*** -0.081*** -0.112*** -0.027*** -0.221*** tonsANrrelatioLO-0.133*** 0.264*** 0.041*** 0.071*** 0.036*** 0.149*** 0.123*** -0.204*** -0.264*** -0.296*** -0.009-0.067*** n coE AT-0.016* 0.030*** 0 0.033*** 0.182*** 0.035*** 0.117*** 0.226*** 0.054*** -0.174*** 0.008 ST-0.671*** d PearsoEROW-0.030*** 0.276*** 0.008 e table anthMP0.182*** 0.059*** 0.027*** 0.596*** 0.041*** 0.136*** -0.203*** t of0 * 0.008 * * * * * * * per righMP0.206**0.033**0.037**0.074**-0.043**-0.023**0.099*** -0.027**0.021**0.197*** 0.043**-0.036**e upthC-Score * 0.129*** 0.160*** -0.054**-0.012* 0.277*** 0.146*** -0.157*** -0.078*** 0.054*** -0.207*** -0.043**-0.005ined* 0 * * * * * * level.* level.are providns0.133**n matrix. rrelatioththth0.264**0.045**e 5%-0.195**-0.0040.168**-0.0030.462*** e 1%0.094**-0.033**TCcorrelatioanifififERe 10%level. cance atTHEXcance atVINDTable 3 CoTCC-Score MPMPOWE ATE cance atOWSTANLOAGSIZEO CFLIQ IT-0.051**EBGRGOearmSpSignSign* **Sign* **

Table 4 Monetary policy,accounting conservatism and trade credit.

5.Further discussion

5.1.Diferent company types:according to ownership and market position

Based on the alternative fnancing theory,companies that cannot obtain bank loans have to turn to trade credit,which mainly occurs for private enterprises in China.The existing research shows that China’s banks exhibit clear‘credit discrimination”against enterprises on the basis of ownership,with state-ownedenterprises enjoying more preferential credit policies(Lu et al.,2009;Jiang and Li,2006).Even setting‘ownership discrimination”aside,fnancial institutions demand higher interest rates or impose stifer conditions for small and medium enterprises,and may even refuse to provide loans to avoid adverse selection and moral hazard,because the fnancial institutions are unable to fully appreciate the true situation of these enterprises.A survey suggests that guarantees,mortgages,fnancial transparency,corporate operating performance and other practical problems continue to restrict the fnancing of small businesses(Research Group of Center for Chinese Banking Studies in Central University of Finance and Economics,2007).This prompts private enterprises to turn to suppliers or customers.Suppliers are willing to provide trade credit because they can detect changes in a company’s operation and credit situation in a timely fashion,and are able to encourage the company to abide by a contract through taking control of raw materials.However,in this case the cost of trade credit is generally high,most likely because the supplier requires the company to pay an insurance premium and a default premium to alleviate risk(Cunat,2007).Thus,relative to state-owned enterprises, improving accounting conservatism may help a private enterprise to obtain trade credit.

Based on the market power theory,a company with a stronger market position will encourage suppliers or customers to take the initiative to provide trade credit,to promote sales or obtain supplies.However,suppliers or customers have no control over the company’s products or channels due to the company’s buyer market power over suppliers and seller market power over customers.In addition,individual suppliers or customers are unable to detect changes in the company’s operating conditions because the individual business volumes are too small.Therefore,suppliers and customers take advantage of accounting conservatism to provide protection for a trade credit contract.For a company with a strong market position,therefore,higher accounting conservatism provides greater benefts for suppliers and customers and makes more trade credit available to the company.

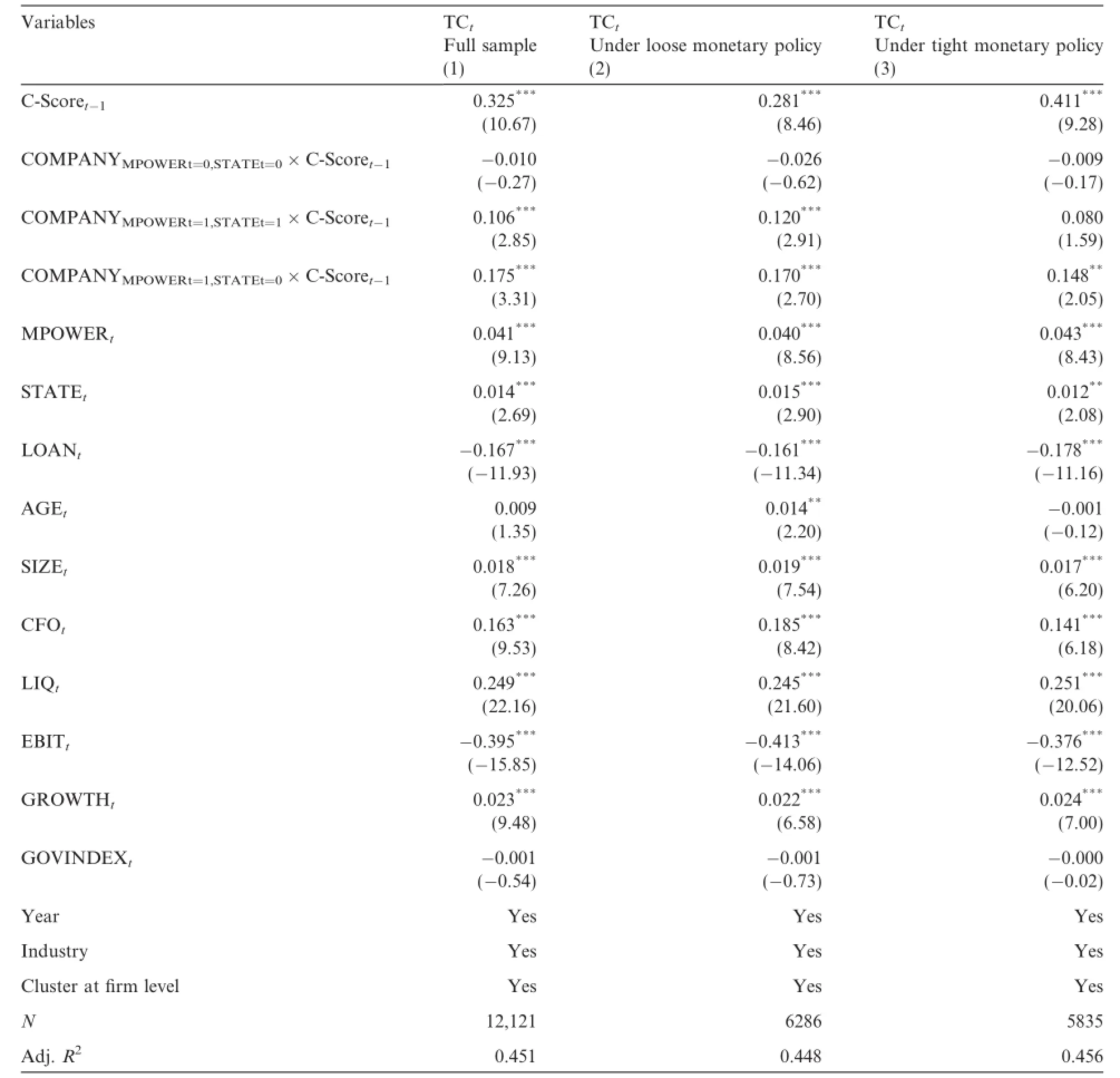

The overall sample is divided into four according to ownership and market position:state-owned enterprises with a weak market position,private enterprises with a weak market position,state-owned enterprises with a strong market position,and private enterprises with a strong market position.Using state-owned enterprises with a weak market position as the benchmark,the importance of accounting conservatism for diferent ownership and market position is examined.

In Table 5,COMPANYMPOWERt=0,STATEt=0represents private enterprises with a weak market position, COMPANYMPOWERt=1,STATEt=1represents state-owned enterprises with a strong market position and COMPANYMPOWERt=1,STATEt=0represents private enterprises with a strong market position.The coefcient for C-Scoret-1indicates the efect of accounting conservatism on trade credit for state-owned enterprises with a weak market position.The coefcients for the three interactions with C-Scoret-1indicate,relative to stateowned enterprises with a weak market position,the incremental efects of accounting conservatism on trade credit for the other three company types.

The results show that the coefcient for C-Scoret-1is signifcantly positive,as are the coefcients for COMPANYMPOWERt=1,STATEt=1×C-Scoret-1and COMPANYMPOWERt=1,STATEt=0×C-Scoret-1,in a period of monetary easing.Conversely,in a period of monetary tightening,only the coefcients for C-Scoret-1and COMPANYMPOWERt=1,STATEt=0×C-Scoret-1are signifcantly positive.This shows that even for state-owned enterprises with a weak market position,accounting conservatism is also signifcantly positive with respect to trade credit,and this positive correlation is particularly signifcant for private enterprises with a strong market position,especially under tight monetary policy.

5.2.Relationship between trading parties:related party vs.non-related party

In both alternative fnancing theory and market power theory,it is implicitly assumed that an independent relationship exists between a company and its suppliers or customers.Therefore,when suppliers or customers provide trade credit to the company,they will consider the company’s size,proftability,development prospects,ownership type,accounting information quality and so on,to ensure the protection of their interests. In practice,the company may have an associated relationship with the counterparty.A supplier may be the company’s parent company or subsidiary,or be controlled by the same parent company.Given the existence of such a relationship,the trading parties may have diferent motives when providing trade credit to the company.

Table 5 Monetary policy,accounting conservatism and trade credit:diferent company types.

Liu et al.(2009)contend that it is easy to develop trust between related enterprises through a contractual relationship,and that this type of relational trust may afect the choice of trade credit mode.Hong and Fang (2005)and Tong and Cheng(2007)also hold that the controlling shareholder of a listed corporation may exhibit supportive or tunneling behavior depending on the circumstances.By making supportive decisions,controlling shareholders can improve the stability of the company’s earnings and thus improve the value of thecompany.Therefore,based on a trust relationship,suppliers or customers may place less value on accounting conservatism and other operating features when providing trade credit.They may even ofer trade credit to the company for supportive purposes,such as to help the company get through a period of fnancial strain.

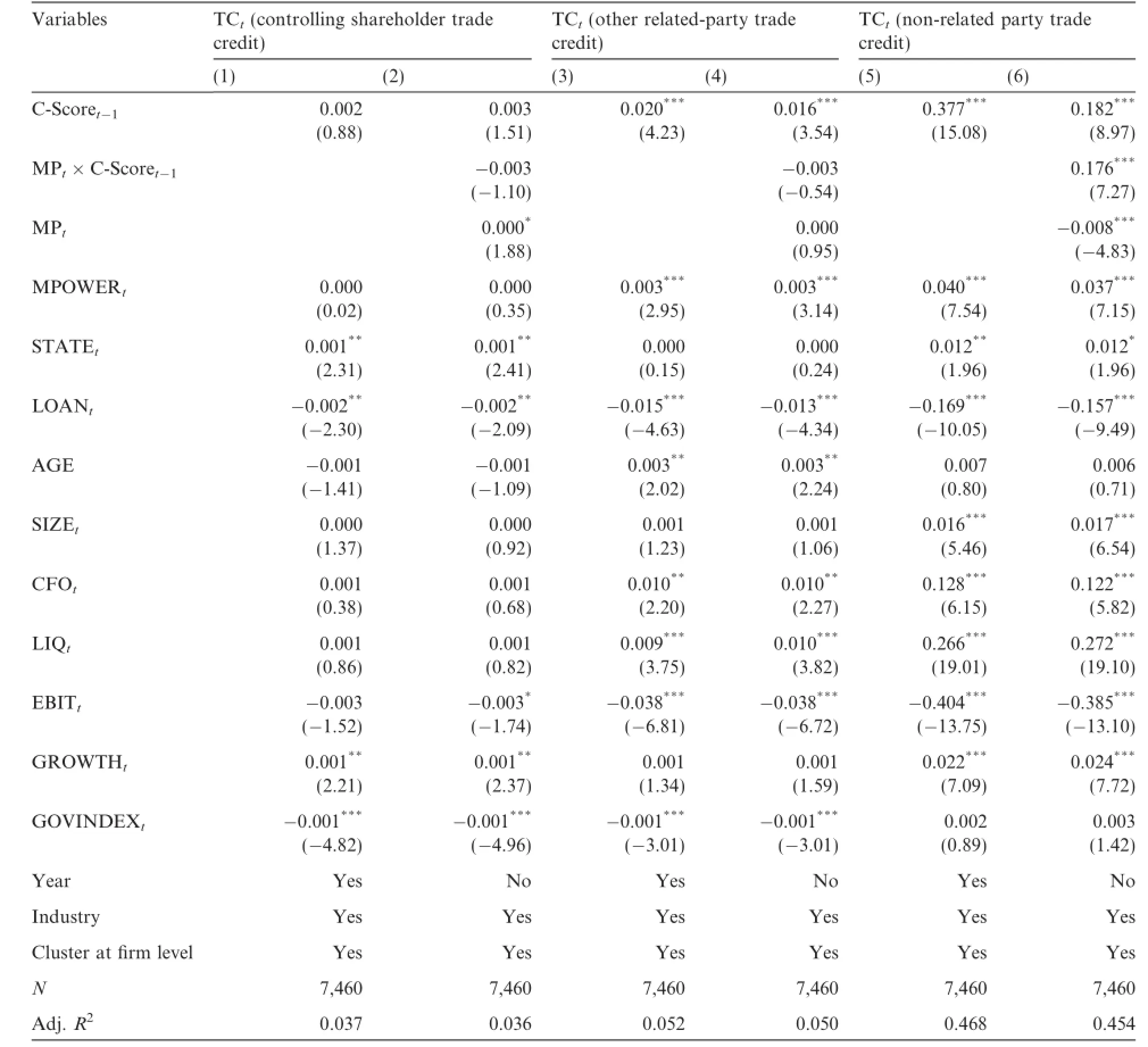

Hence,we examine the efect of related transactions on the acquisition of trade credit.From the full sample we identify 7460 frm-year observations involved in related transactions,and divide trade credit into controlling shareholder trade credit,other related party trade credit and non-related party trade credit.3According to the CSMAR related transaction database,other related parties that provide trade credit in the A-share market are mainly other enterprises controlled by the same parent company as the listed company(accounting for 62%of the total),associated enterprises of the listed company(4%),joint ventures of the listed company(2%)and investors who can exert a signifcant infuence on the listed company(2%).Descriptive statistics show that the mean of overall trade credit is 18.4%,and the means of non-related party trade credit and related party trade credit are 17.1%and 1.3%,respectively.For related party trade credit, trade credit obtained from controlling shareholders and from other related parties averages 0.2%and 0.9%, respectively.With respect to scale,the amount of related party trade credit is far less than that of nonrelated party trade credit,and the amount of controlling shareholder trade credit is also lower than that of other related party trade credit.

Through regression analysis,we fnd signifcantly diferent results for controlling shareholder trade credit, related party trade credit and non-related party trade credit.In Table 6,the results are similar to Table 4 when non-related party trade credit is used as the dependent variable.The coefcients for C-Scoret-1and MPt×C-Scoret-1are signifcantly positive,while that for MPtis negative.These results indicate that the higher the accounting conservatism,the more trade credit is available from non-related parties,and this is especially signifcant in a period of monetary tightening.When related party trade credit is used as the dependent variable,the coefcient for C-Scoret-1is still signifcantly positive while those for MPt×C-Scoret-1and MPtare not signifcant,indicating that although accounting conservatism has an efect on the trade credit available from other related parties,this efect is not pronounced in a period of monetary tightening.When controlling shareholder trade credit is used as the dependent variable,the coefcients for C-Scoret-1and MPt-×C-Scoret-1are not signifcant and that for MPtis signifcantly positive at the 10%level.These results show that controlling shareholders do not focus on accounting conservatism,and even enhance their support of the company by loosening their credit policy during periods of monetary tightening.

5.3.Sensitivity testing

5.3.1.Endogeneity problem

In Hui et al.(2012),the bargaining power of an enterprise with respect to a supplier decides the level of accounting conservatism,but our results show that accounting conservatism infuences trade credit provided by the supplier.This fnding may indicate that there is a bi-directional association between accounting conservatism and trade credit,namely that accounting conservatism may be related to the residual term.As a company’s accounting conservatism may remain stable over a period,merely lagging accounting conservatism may not solve the problem completely.To control for this endogeneity problem relating to accounting conservatism in H1,a company’s short-term debt-paying ability(CR)is used as an instrumental variable to carry out two-stage least-squares regression and the results continue to support H1.

The instrumental variable is selected according to Petersen and Rajan(1997).They hold that when a supplier provides business credit,the main consideration is the actual operating conditions and the capacity for long-term development,and current solvency is not especially important.However,if company debt ratios greatly increase,banks will require companies to adopt more prudent accounting policies to protect the banks’own interests(Guay and Verrecchia,2007).Therefore,we use short-term solvency as an instrumental variable, and carry out the under-identifcation test(Anderson canon.corr.LM statistic)and the weak-identifcation test(Cragg–Donald WaldFstatistic).The results show that the instrumental variable is correlated with the endogenous variable.

Table 6 Monetary policy,accounting conservatism and trade credit:related party transactions.

5.3.2.Alternative variables for trade credit

To avoid industry factors afecting the results,the industry mean is subtracted from each company’s trade credit in a sensitivity test,with the results provided in Table 7.The coefcient for C-Scoret-1is still signifcantly positive and that for MPt×C-Scoret-1is also positive,which supports the hypotheses.

Although accounting conservatism is an annual variable,trade credit may include accounts payable and advances from customers from previous years.Therefore,in a sensitivity test,the sum of accounts payable, notes payable and advances from customers within a year is used to represent trade credit,standardized bytotal assets.The results are shown in Table 7.The coefcients for C-Scoret-1and MPt×C-Scoret-1are still signifcantly positive,which supports the hypotheses.

Table 7 Alternative variables for trade credit:adjusted by industry mean or within one year.

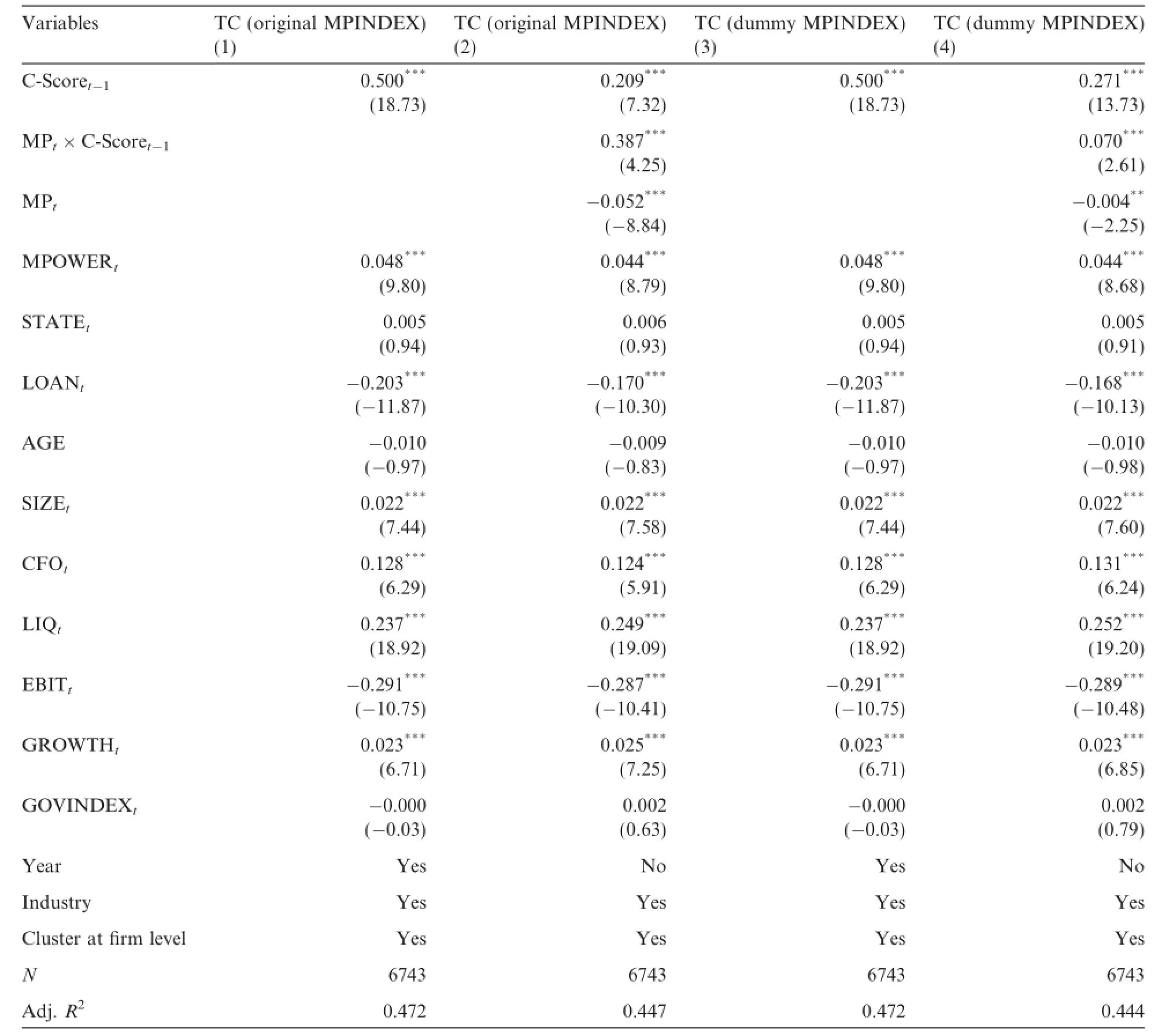

5.3.3.Alternative variables for tight monetary policy

Since the frst quarter of 2004,the website of the People’s Bank of China has published a quarterly‘national banker survey report”on systematic investigations carried out jointly by the People’s Bank of China and the National Bureau of Statistics.About 3000 banking institutions are investigated through acombination of overall investigation and sampling surveys.The overall investigation is used for all types of institutions at municipal level or above,while a stratifed PPS sampling survey(proportional to the scale of each credit cooperative)is used to investigate rural credit cooperatives.The respondents include directors of headquarters and presidents and vice presidents in charge of credit at provincial and secondary-level branch institutions in various banking institutions(including foreign commercial banks).The report gives the proportion of investigated bankers who believe that current monetary policy is‘‘loose,”‘moderate”or‘‘tight.”Here,a‘‘tightness”index(MPINDEX)is used to measure the tightness of monetary policy rather than indicators based on monetary liquidity.4Between the frst quarter of 2004 and the third quarter of 2006,the report categorizes beliefs about current monetary policy into‘‘too loose,”‘‘loose,”‘‘moderate,”‘tight”or‘too tight.”It drops the‘‘too tight”category from the fourth quarter of 2006,and reports beliefs only as‘‘moderate”since the frst quarter of 2010.Hence,a‘‘tightness”index is used to measure the degree of monetary tightening,and the sample window is narrowed to 2004–2009.

Table 8 Alternative variables for tight monetary policy:monetary policy tightness index..

Table 9 Alternative variable for accounting conservatism:average C-Score.

For each year between 2004 and 2009,the monetary policy tightness index is 37.53%,18.95%,18.98%, 39.63%,51.03%and 5.03%,respectively.Based on the original value of the monetary policy tightness index (MPINDEX),we defne 2004,2007 and 2008 as years with tightening monetary policy and 2005,2006 and 2009 as years with easing monetary policy,substituting a dummy variable into the regression equation.

The results are shown in Table 8.The coefcients for C-Scoret-1and MPINDEXt×C-Scoret-1are significantly positive,confrming the hypotheses.

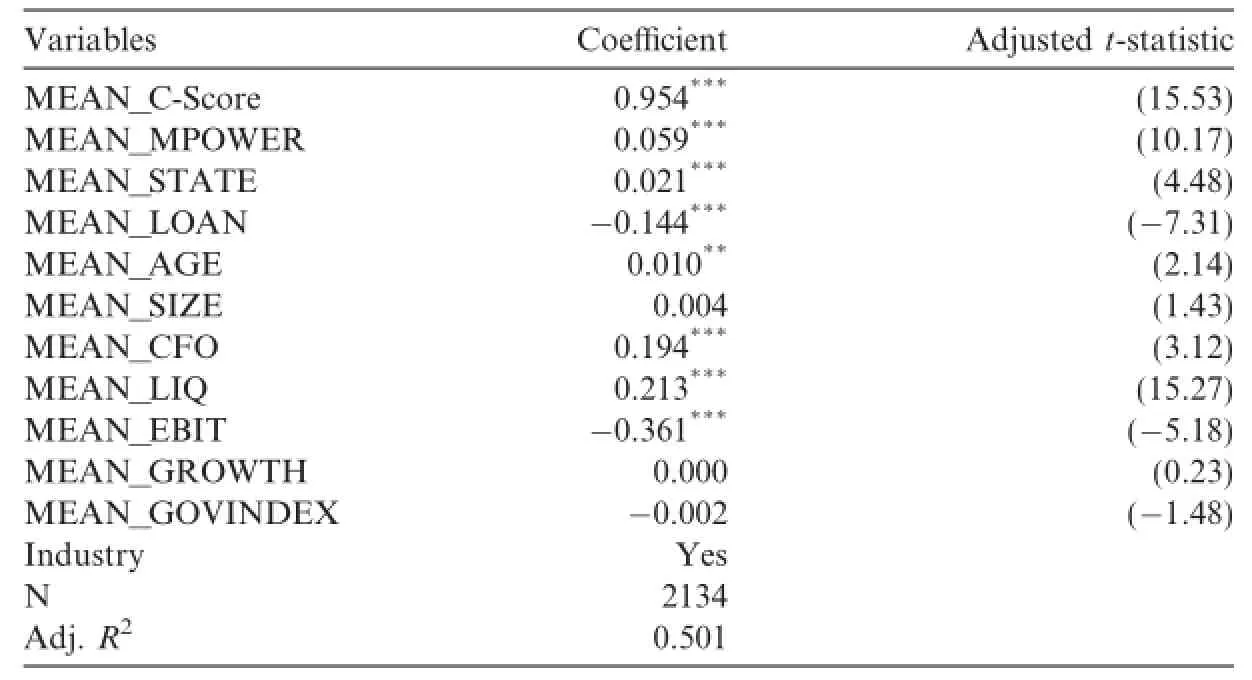

5.3.4.Alternative variable for accounting conservatism

To avoid error in measuring accounting conservatism,we average the values for C-Score in 2003–2012 to obtain an average conservatism index.To maintain unity,the average values of the other variables are also calculated,giving data for 2134 companies.The results of the regression analysis using these values are shown in Table 9.The coefcient for MEAN_C-Score is signifcantly positive,indicating that H1 is still supported.

6.Conclusions

Using a sample of A-share listed frms in China during 2003–2012,we investigate the efect of accounting conservatism on trade credit,taking the efect of monetary policy into account.The results show that corporations with higher accounting conservatism obtain more trade credit,and this relationship becomes more positive under tight monetary policy.

After grouping the enterprises by market position and ownership type,the positive correlation between accounting conservatism and trade credit is most signifcant for a private company with a strong market position.However,when the suppliers and customers are grouped according to transaction relationships,the positive correlation between accounting conservatism and trade credit is no longer signifcant if the trading party is a controlling shareholder.

The conclusions show that accounting conservatism can reduce the degree of information asymmetry,protect the interests of suppliers and customers more efectively,and help both parties to contract to establish cooperative relations with mutual trust,such that suppliers and customers are willing to accept a certain degree of risk and provide more trade credit.These efects are particularly signifcant in private enterprises with a strong market position.

Ahmed,A.S.,Duellman,S.,2011.Evidence on the role of accounting conservatism in monitoring managers’investment decisions.Acc. Finance 51,609–633.

Bai,C.E.,Liu,Q.,Lu,J.,Song,M.,Zhang,J.X.,2005.An empirical study on Chinese listed frms’corporate governance.Econ.Res.J.2, 81–91(in Chinese).

Baks,K.,Kramer,C.,1999.Global liquidity and asset prices:measurement,implications,and spillovers.IMF Working Papers.Available at SSRN:http://ssrn.com/abstract=880823.

Ball,R.,Shivakumar,L.,2005.Earnings quality in UK private frms:comparative loss recognition timeliness.J.Acc.Econ.39,83–128.

Basu,S.,1997.The conservatism principle and the asymmetric timeliness of earnings.J.Acc.Econ.24,3–37.

Beaudry,P.,Caglayan,M.,Schiantarelli,F.,2001.Monetary instability,the predictability of prices,and the allocation of investment:an empirical investigation using UK panel data.Am.Econ.Rev.91,648–662.

Beaver,W.H.,Ryan,S.G.,2000.Biases and lags in book value and their efects on the ability of the book-to-market ratio to predict book return on equity.J Accounting Res 38(1),127–148.

Biais,B.,Gollier,C.,1997.Trade credit and credit rationing.Rev.Financial Stud.10(4),903–937.

Cheng,L.B.,Liu,F.,2013.Bank supervision and discrimination:from the perspective of accounting conservatism.Acc.Res.1,28–34(in Chinese).

Cunat,V.,2007.Trade credit:suppliers and debt collectors as insurance providers.Rev.Financial Stud.20,491–527.

Fisman,R.,Raturi,M.,2004.Does competition encourage credit provision?Evidence from African trade credit relationships.Rev.Econ. Stat.86,345–352.

Garcia Lara,J.M.,Garcia Osma,B.,Penalva,F.,2011.Conditional conservatism and cost of capital.Rev.Acc.Stud.16(2),247–271.

Gertler,M.,Gilchrist,S.,1994.Monetary policy,business cycles,and the behavior of small manufacturing frms.Quart.J.Econ.109,309–340.

Givoly,D.,Hayn,C.,2000.The changing time-series properties of earnings,cash fows and accruals:has fnancial reporting become more conservative?J.Acc.Econ.29(3),287–320.

Guay,W.R.,Verrecchia,R.E.,2007.Conservative disclosure.Available at SSRN:http://ssrn.com/abstract=995562.

Hong,J.Q.,Fang,J.X.,2005.Related party sales and the informativeness of accounting earnings.China Acc.Rev.1,87–98(in Chinese).

Hui,K.W.,Klasa,S.,Yeung,P.E.,2012.Corporate suppliers and customers and accounting conservatism.J.Acc.Econ.53,115–135.

Jiang,G.H.,Zhang,R.,2007.Conservatism or fair value:an analysis based on stock price reactions.Acc.Res.6,20–25(in Chinese).

Jiang,W.,Li,B.,2006.Institutional environment,state-owned property and bank-lending discrimination.J.Financial Res.11,116–126 (in Chinese).

Kashyap,A.K.,Stein,J.C.,Wilcox,D.W.,1993.Monetary policy and credit conditions:evidence from the composition of external fnance.Am.Econ.Rev.86(1),310–314.

Khan,M.,Watts,R.,2009.Estimation and empirical properties of a frm-year measure of accounting conservatism.J.Acc.Econ.48,132–150.

Kohler,M.,Britton,E.,Yates,A.,2000.Trade credit and the monetary transmission mechanism.The Bank of England Working Paper No.115.Available at SSRN:http://ssrn.com/abstract=234693.

Li,Z.J.,Wang,S.P.,2011.Monetary policy,information disclosure quality and corporate debt fnancing.Acc.Res.10,56–62(in Chinese).

Liu,F.W.,Li,L.,Xue,Y.K.,2009.Trust,transaction cost and mode of trade credit.Econ.Res.J.8,130–133(in Chinese).

Lu,Z.F.,Yang,D.M.,2011.Commercial credit:alternative fnancing or buyers’markets?Manage.World 4,6–14(in Chinese).

Lu,Z.F.,Zhu,J.G.,Fan,Z.,2009.Monetary contraction,bank discrimination and investor losses in the non-state listed companies.J. Financial Res.8,124–136(in Chinese).

Macro Group,CCER,PKU,2008.The measurement of liquidity and the relationship between monetary liquidity and asset price.J. Financial Res.9,44–55(in Chinese).

Mojon,B.,Smets,F.,Vermeulen,P.,2002.Investment and monetary policy in the euro area.J.Bank.Finance 26(11),2111–2129.

Petersen,M.A.,Rajan,R.G.,1997.Trade credit:theory and evidence.Rev.Financial Stud.10,661–691.

Rajan,R.G.,Zingales,L.,1995.What do we know about capital structure?Some evidence from international data.J.Finance 50,1421–1460.

Rao,P.G.,Jiang,G.H.,2011.Monetary policy changes,bank credits and accounting conservatism.J.Financial Res.3,51–71(in Chinese).

Research Group of Center for Chinese Banking Studies in Central University of Finance and Economics,2007.Why it’s difcult for small enterprises to apply for loans—a survey on the service status of fnancial institutions.China Economic Times 6(in Chinese).

Summers,B.,Wilson,N.,1999.An empirical investigation of trade credit use:a note.A Report from the Credit Management Research Centre of Leeds University Business School.

Tong,Y.,Cheng,X.K.,2007.The interest fow direction of transactions between related parties and the earning quality of China’s listed companies.Manage.World 11,127–138(in Chinese).

Van Horen,N.,2005.Do frms use trade credit as a competitiveness tool?Evidence from developing countries.World Bank Working Paper.

Watts,R.L.,2003.Conservatism in accounting.Part I:explanations and implications.Acc.Horizon 17,207–221.

Williamson,O.E.,1979.Transaction cost economics:the governance of contractual relations.J.Law Econ.22,233–261.

Ye,K.T.,Zhu,J.G.,2009.Between short money supply and the allocation of credit resources.Manage.World 1,22–28(in Chinese).

Yi,G.,1991.The monetization process in China during the economic reform.China Econ.Rev.2(1),75–95.

Zhang,H.L.,Lu,Z.F.,2012.Cash distribution,corporate governance,and over-investment:an investigation based on the state of the cash holdings of China’s listed companies and their subsidiaries.Manage.World 3,141–150(in Chinese).

Zhang,J.,2008.The contracting benefts of accounting conservatism to lenders and borrowers.J.Acc.Econ.45,27–54.

Zhang,X.M.,Wang,Y.,Zhu,J.G.,2012.Market power,trade credit and business fnancing.Acc.Res.8,58–65(in Chinese).

Zhu,J.G.,2011.Accounting conservatism and protection of creditors’interests:a research based on lawsuits between banks and listed companies.Acc.Res.5,50–57(in Chinese).

☆The authors thank the executive editor and the anonymous referees for their helpful suggestions.This study was supported by the National Natural Science Foundation of China(Project No.71202170),and The Importation and Development of High-Caliber Talents Project of Beijing Municipal Institutions(Project No.CIT&TCD201504003).

*Corresponding author at:International School of Business,Beijing International Studies University,No.1,Nanli Community,Dingfu Town,Chaoyang District,Beijing 100024,China.

E-mail addresses:daibb@bisu.edu.cn(B.Dai),yf5236741@163.com(F.Yang).

http://dx.doi.org/10.1016/j.cjar.2015.09.002

1755-3091/©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

Accounting conservatism

Trade credit

China Journal of Accounting Research2015年4期

China Journal of Accounting Research2015年4期

- China Journal of Accounting Research的其它文章

- Guidelines for Manuscripts Submitted to The China Journal of Accounting Research

- Audit mode change,corporate governance and audit efort☆

- Does the transformation of accounting frms’organizational form improve audit quality? Evidence from China☆

- Financial development and the cost of equity capital: Evidence from China