Does the transformation of accounting frms’organizational form improve audit quality? Evidence from China☆

Chunfei Wng,Hun Dou

aSchool of Accountancy,Central University of Finance and Economics,China

bGuanghua School of Management,Peking University,China

Does the transformation of accounting frms’organizational form improve audit quality? Evidence from China☆

Chunfei Wanga,Huan Doub,*

aSchool of Accountancy,Central University of Finance and Economics,China

bGuanghua School of Management,Peking University,China

A R T I C L E I N F O

Article history:

Received 31 December 2012

Accepted 26 August 2014

Available online 26 November 2014

Organizational forms of

accounting frms

Limited liability partnership

Audit quality

In this study,we examine the efects of the transformation of accounting frms’organizational form on audit quality.We fnd that the transformation from limited liability to limited liability partnerships has a signifcant negative efect on the absolute value of discretionary accruals of audited companies.In particular,the transformation has a signifcant negative efect on positive discretionary accruals and no efect on negative discretionary accruals.We also fnd that CPAs are more likely to issue modifed audit opinions in the year after the transformation,and that there is no evidence that accounting frm size and listed company ownership infuence the relationship between the transformation and audit quality.Our conclusions provide empirical evidence for policy makers and enrich the literature on accounting frms’organizational forms.

©2014 Production and hosting by Elsevier B.V.on behalf of China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong.

1.Introduction

Along with the reforms to China’s economy,Chinese accounting frms have undergone rapid development. At present,there are more than 7400 accounting frms,over 8.5 million CPAs and nearly 30 million employees in China.The scopes of the audit business and accounting frms have gradually increased,along with steady improvements in the special capabilities of CPAs and the CPA industry’s regulatory standards,making CPAs an indispensable force for healthy economic and social development.However,due to CPAs’weak foundations,poor audit quality has attracted attention within the rapid development of accounting frms.In recent years,CPAs’credibility has been increasingly questioned due to frequent cases of accounting fraud.

To accelerate the healthy development of China’s CPA industry,in 2010 the State Council and the Ministry of Finance issued“The Notice Regarding Several Opinions on Accelerating the Development of the Chinese CPA Industry”(Guo Ban Fa[2009]No.56)and the Ministry of Finance and the General Administration for Industry and Commerce jointly issued“The Regulation on Promoting Large and Medium Accounting Firms to Transform to Limited Liability Partnerships”(Cai Kuai[2010]No.12),hereafter referred to together as the“Regulations.”In response,large accounting frms were the frst to change their organizational form from limited liability to limited liability partnerships(LLPs).This change was expected to improve audit quality by increasing the legal liability of CPAs.In this study,we examine whether this unique transformation improves audit quality.

There have been no consistent conclusions made in extant theories on the correlation between such transformations and audit quality.From a risk perspective,the transformation from limited liability to LLPs increases partners’legal risks.According to the law,an accounting frm’s partners must not only compensate for audit failures through the frm’s total investment,they may also need to use their personal assets to compensate for audit failures.Therefore,partners may devote more time and efort to supervising the implementation of audit procedures to improve audit quality.From an organizational perspective,accounting frms can beneft from changes in organizational form that provide for sharing and insurance for audit risks and more opportunities for CPA promotion.However,because the entire transformation process is dominated by the government,accounting frms can receive other benefts from the transformation.For example,“The Notice of Accounting Firm Commitment of Central Governance Enterprises”requires that,under the same conditions,large accounting frms that have undergone the transformation are recommended to engage in H-share business and receive priority for audit work for central government business groups.In addition,to participate in H-share business,accounting frms must be organized as LLPs.Therefore,transformation is required to obtain these benefts,which may lead to increased internal confict of interests and reduced audit quality.1We appreciate the helpful suggestions of the chief editor,Professor Donghui Wu.Due to the complicated nature of the transformation’s efect on audit quality,this remains an open question to be addressed.

We use A-share listed companies from 2007 to 2012 to examine the efect of the transformation of accounting frms’organizational form on audit quality.We fnd that the transformation has a signifcant negative efect on the absolute value of discretionary accruals of audited companies.The results also show that the transformation signifcantly decreases the level of positive discretionary accruals,but has no signifcant efect on negative discretionary accruals.We also fnd that the transformation’s positive efect on audit opinions only lasts for one year.

We also examine the transformation’s efect on audit quality from the perspective of accounting and client frms’characteristics.Unfortunately,we fnd that accounting frm size and listed company ownership have no signifcant efect on the relationship between the transformation and audit quality.The transformation increases audit risk due to greater legal obligations,which makes the partners more cautious about undertaking audit work.Meanwhile,the partners are also more cautious in dealing with upward earnings management behavior,as it is more prone to audit failures.However,given the transformation regulations,the transformed accounting frms tend to be larger,but we do not fnd that our results difer by accounting frm size and listed company ownership.

This study contributes to the literature in several ways.First,it enriches the literature on the organizational forms of accounting frms.Firth et al.(2012)study the efects of partnerships and limited liability on audit quality and fnd that auditors in partnership frms are more cautious than those in limited liability frms. Lennox and Li(2012)studies the efect of transformations from partnerships to LLPs on audit quality and fnds that it does not reduce audit quality.In this study,we focus on the transformation from limited liability to a LLP,a transformative direction that difers signifcantly from those previously covered in the literature.

This study also contributes to the reform of the transformation of accounting frms in China.To meet frms’“bigger,stronger”strategy,the Ministry of Finance and Business Administration jointly issued the Regulations,requesting that larger accounting frms transform from limited liability to LLPs.Our study examines the efect that transformation has on audit quality and the results provide a theoretical reference for the improvement of the Regulations and the selection of organizational forms for accounting frms.In this study, we also make suggestions for the legal liability of CPAs that serve as a reference for situations such as the recent increase in discussions on the restricted legal liability of CPAs in Europe.In addition,the diference in diference(DID)model used here efectively estimates the Regulations’infuence to ensure the robustness and reliability of the results.

The remainder of this paper proceeds as follows.Section 2 reviews the literature and develops our hypotheses.Section 3 describes the sample and presents the research design.We report the results and robustness tests in Section 4.Finally,Section 5 concludes the paper.

2.Institutional background and hypothesis development

2.1.Institutional background

Accounting frms require unity and coordination within their ranks and their main functions are realized through the intellectual input of employees.CPAs are reliant on their professional knowledge,experience and professional judgment to provide high-quality audit services.Before 1998,almost all of the accounting frms in China were state-owned,in that they belonged to the local or central government,universities or government departments(DeFond et al.,2000;Yi,2003).In 1998,there was a reorganization in which accounting frms were required to become independent legal entities without any afliation with their original agencies. Once this reorganization was completed in 1999,the accounting frms each chose a form of organization based on their own conditions,such as limited liability or partnership.Some scholars have argued that in limited liability accounting frms,shareholders and auditors’maximum loss is their investment in the frm.As their risk is limited,they are more likely to spend less time and efort in the audit process,or to meet the inappropriate requests of customers to keep their clients,which can lead to lower audit quality(Dye,1993,1995;Chan and Pae,1998).Thus,some scholars have indicated that partnerships should be mandatory.However,this situation also has inherent defects,such as partners bearing unlimited and joint liability:any partner’s negligence or malpractice in the practice leads to the punishment of all of the partners,which can result in bankruptcy. The partnership can prompt extremely mismatched gains and risks,making it unpopular among accounting frms.LLPs,however,not only avoid the risk caused by other partners’improper behavior,but also protect investors by allowing them to recover their losses from audit failures.Thus,most scholars suggest that LLPs should be promoted.

There have been many fnancial frauds and audit failure cases in recent years,such as Yinguangxia and Shenzhen Zhongtianqin(2001),Enron and Andersen(2002),and Kelong and Deloitte(2004).These events have not only bankrupted frms,or left them on the verge of bankruptcy,but also strongly compromised overall audit quality.These events have seriously damaged the CPA industry’s reputation,prompting the Ministry of Finance and China Association of Certifed Public Accountants to try and strengthen supervision,improve audit quality and enhance the protection of investors’interests.To realize the above mentioned goals,the State Council[2009]No.56 and the Ministry of Finance[2010]No.12(the Regulations)explicitly require the transformation of large accounting frms from limited liability to LLPs.

The LLP,popular in the past 20 years,is a new form of business organization in the United States exclusively for professionals such as accountants,lawyers and doctors.A LLP and a partnership are approximately the same in that the auditor bears the results of audit failure by sufering losses of his own property(unlimitedliability).A LLP,however,can prevent the auditor from the joint liability caused by the faults of other auditors by overcoming the shortcomings of joint liability inherent in an unlimited liability partnership.The tentative“CPA LLP agreement”states that,“The debt of accounting frms caused by the mistake of a partner with intentional or gross negligence in the practice,should frst be paid with the property of accounting frms, and accounting frms obtain the right of recourse after bearing the liability,and the partner should bear full liability for the loss of accounting frms.The debt of accounting frms caused by the mistake of a partner without intentional or gross negligence in the practice should be paid by all partners with unlimited liability.”In this study,based on unique events,we examine whether the transformation afects audit quality.

2.2.Literature and research hypotheses

The transformation of an accounting frm’s organizational form increases the risk faced by its partners, which can result in behavioral changes.Audit risk2Chen(2006)suggested that audit risk has nine defnitions,and we use the fourth interpretation here to defne audit risk.means that an accounting frm must bear the economic and even criminal liability when mistakes in the conclusion of its audit report lead to investors or audit clients’losses.If audit failure occurs,investors are entitled to appeal to the courts to force the listed company to compensate them for their losses.They can also require the accounting frm to take joint responsibility for the audit failure.The transformation from limited liability to LLP increases the loss sufered by the partner who experiences audit failure.The partners must take responsible for the liability,which is not limited to their investment in the accounting frm,but also includes their personal property.

Some studies have found that audit quality increases with debt risk(Geiger and Raghunandan,2001; Geiger et al.,2006;Laux and Newman,2010;Liu and Wang,2006;Melumad and Thoman,1990; Venkataraman et al.,2008).Chan and Pae(1998)fnd that a reduction in debt risk could reduce auditors’efort,resulting in a lower level of audit quality.They argue that because the users of fnancial statements have no right to sue the auditor,the auditor fears nothing,resulting in a lack of demand for audit quality.Geiger and Raghunandan(2001)and Geiger et al.(2006)also fnd that a decline in auditors’debt risk allows them to be less cautious in issuing reports,and makes them less likely to issue a going concern audit report.The work of Firth et al.(2012),based on the special setting of China,examines whether the diference in debt risk between two forms of organization(limited liability and partnership)afects auditors’behavior.They fnd that the CPAs in partnerships were more cautious and more likely to issue modifed audit opinions,whereas due to fxed debt risk,limited liability led to more aggressive behavior and the CPAs did not tend to issue modifed audit opinions.Lennox and Li(2012)study the transformation from partnership to LLP in the United States and explore whether a reduction in debt risk changed auditors’behavior.Their results show no signifcant difference before and after the change in organizational form,possibly because the essence of partnership did not change and investors still had the right to recover their losses from the auditors.

Based on the transformation of accounting frms from limited liability to LLPs in China,we analyze whether an increase in auditors’debt risk improves audit quality.Debt liability generally comes from lawsuits against auditors.Legally,if the users of fnancial statements sufer losses due to improper audit opinions issued by auditors,they have the right to require compensation from the auditors.Thus,the debt risk is also closely associated with the national legal system.Studies have found that accounting frms in China actually assume a lower legal risk(Liu and Xu,2002)because the Chinese audit market is mainly formed by government regulation(Liu and Lin,2000).Meanwhile,the provisions on CPAs’legal liability are still relatively vague in China and the operability is also poor,such as the lack of clear audit quality requirements.In seeking economic interests,some accounting frms do not adequately investigate the audited entity when facing ferce competition. Although some accounting frms are warned about,ordered to address,or reprimanded for corporate fnancial reporting irregularities,the processes are limited to administrative penalties,which makes the CPAs’violation costs very low.As long as the accounting frms are not withdrawn,the frms can still earn money through IPO and annual audits.Lu and Chen(2005)analyze the relationship between legal risk and audit quality using a sequential game mode and fnd that legal risk has no signifcant efect on audit quality,possibly due to the defects in the Chinese judicial system.However,with the improvement of the environment of Chinese lawsand regulations,the legal risk faced by auditors is also increasing.To avoid the risk of litigation and fnancial losses occurred by audit failure,auditors attempt to advance their own audit quality control,invest more resources and work more carefully in the auditing process to reduce the likelihood of audit failures and thereby reduce litigation risks.Especially when there are changes in an accounting frm’s organizational form, the partners face greater debt service obligations when audit failure occurs,which increases audit quality requirements.

In addition,from an organizational form perspective,the transformation from limited liability to LLP is more suited to accounting frms because the integration of human and money capital is better,which helps improve their internal governance structure and provides a better organizational guarantee for risk management and employee promotion.However,because the entire transformation process is basically dominated by the government and the transformed frms gain additional benefts,“The Notice of Accounting Firm Commitment of Central Governance Enterprises”requires that,under the same conditions,large accounting frms that have undergone transformation are recommended to engage in H-share business and are prioritized to undertake audit work for central government business groups.In addition,to engage in H-share business,accounting frms must become LLPs.Accounting frms must transform to obtain these benefts,which may lead to increased internal confict of interests and reduce audit quality.Thus,we obtain our frst hypothesis(H1).

H1.The transformation of accounting frms’organizational form is unrelated to audit quality.

Although the development of the CPA industry in China is rapid,problems remain,such as a large number of small-scale accounting frms,extremely low audit fees,and even“low balling.”The literature has shown that frm size correlates with independence and audit quality(DeAngelo,1981;Subramanian,1996;Zhang and Liu,2002;Qi et al.,2004),such that the larger the accounting frm,the more independent the auditors and the higher the audit quality.However,the transformation starts among medium and large accounting frms and it may afect audit quality due to the high audit quality of these transformed accounting frms. Therefore,we argue that the size of the audit frm may have a positive efect on the level of audit quality.

H2.If the transformed accounting frm is a Big Four international accounting frm,the level of audit quality is higher.

The audit clients’characteristics might also efect audit quality.Most of the listed companies in the Chinese capital market are state-owned,which is a crucial factor for us to consider.Wang et al.(2008)suggest that state-owned listed companies have an advantage when dealing with fnancial difculties due to governmental support.As listed companies that were once state-owned show signs of bankruptcy,the government makes an efort to support the listed companies so they can overcome their difculties.Similarly,auditors face lower audit risk with state-owned listed companies than with other listed companies,because the probability of audit failure for the former is low.The transformation changes the debt liability faced by the partners in audit failure.The characteristics of state-owned listed companies mean that the transformation of accounting frms has a limited efect on the audit services for state-owned listed companies.Therefore,we obtain H3.

H3.The efect that the transformation of accounting frms has on audit quality is more positive for non-stateowned listed companies than state-owned listed companies.

3.Research design

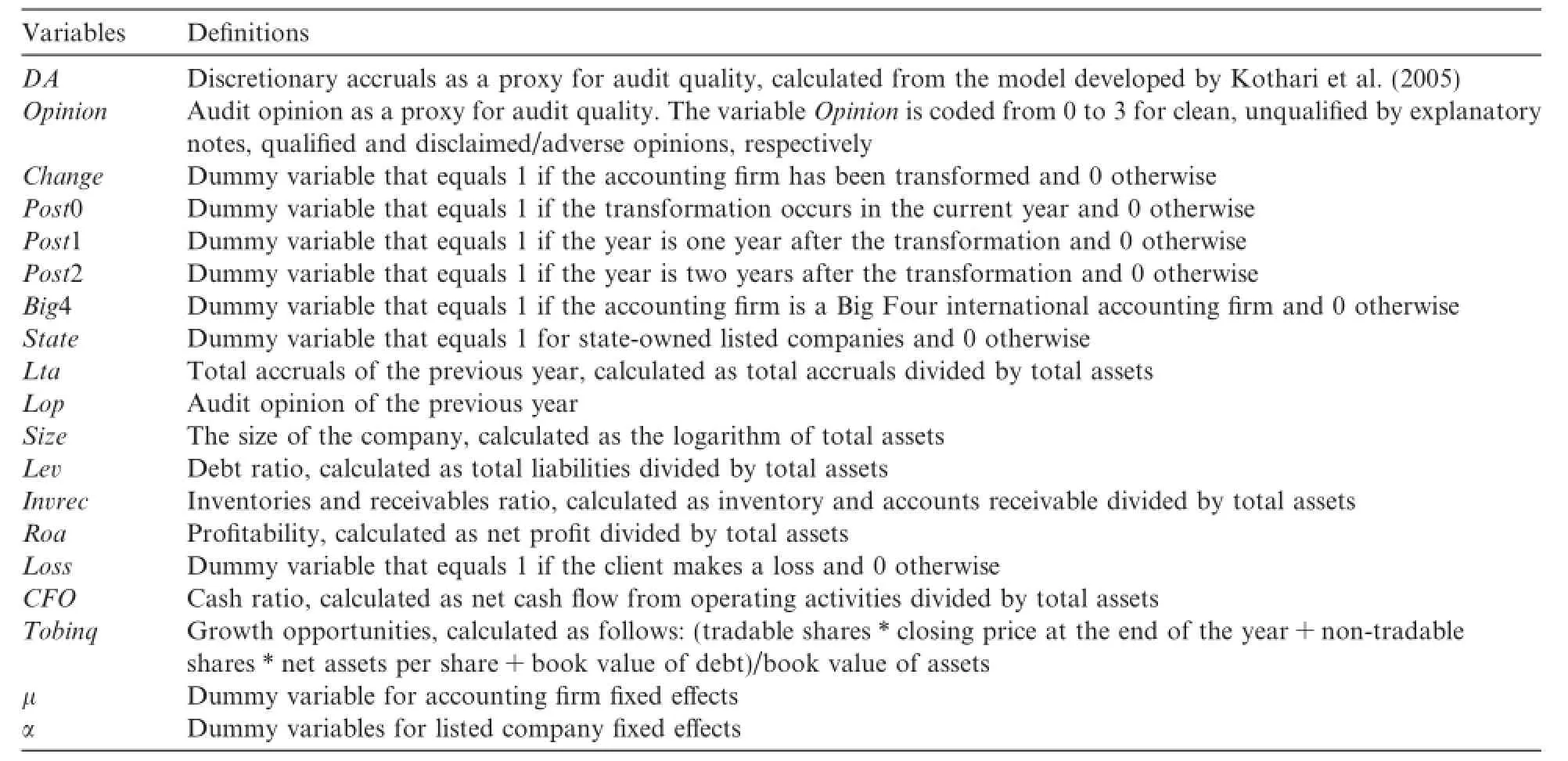

3.1.Variable defnitions and models

3.1.1.Accounting frm transformations

We defne an accounting frm that has changed its organizational form from limited liability to LLP as a transformed frm(Change,equal to 1).An accounting frm whose organizational form has not been transformed is a non-transformed frm(Change,equal to 0).We also defne variables to examine the subsequent efects of accounting frm transformations,such as the transformed year(Post0),one year after transformation (Post1),and two years after transformation(Post2).Given that the current observations only go to 2012,thespan from 2010 to 2012 is just two years,we fnd that Post0,Post1 and Post2 are sufcient to cover the efect of accounting frm transformations on audit quality.

3.1.2.Audit quality

We use the performance-matched Jones model advanced by Kothari et al.(2005)to fnd the paired company with the most similar performance for each sample company,with discretionary accruals(DA)gained through the following regression cross-sectionally within each year and industry.We consider DA as the proxy for audit quality.The model specifcation is as follows:

where total accruals(TAi,t)equal net proft minus net cash fow from operations,the change in sales(ΔSalesi,t) equals the sales for the current year minus those for the previous year,the change in accounts receivable (ΔARi,t)equals the accounts receivable for the current year minus those for the previous year,(PPEi,t)is the net amount of property,plant and equipment(PPE)for the current year,with each variable standardized by total assets for the previous year,and(Roai,t)is the return on assets for the current year.In addition,based on previous research on audit quality,we use the audit opinion as another proxy for audit quality.

3.1.3.Models

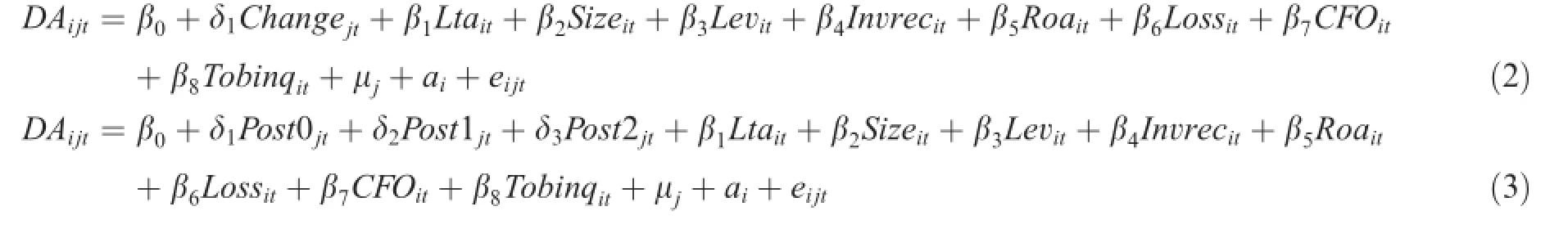

According to Lennox and Li(2012),we use the DID model to examine whether the transformation of accounting frms afects audit quality.We focus on the relationship between the transformation(Change) and DA and further examine the subsequent efects of the transformation event on DA in the current and post-transformation years.The model specifcations are as follows:

Following Lennox and Li(2012),we control for accounting frm fxed efects(μj)and listed companies fxed efects(αi),and examine the diference in pre-and post-transformation audit quality to ensure that the result is more robust and reliable.

Following Ashbaugh et al.(2003)and Wang et al.(2010),our study includes several control variables,such as the total accruals for the previous year(Lta),frm size(Size),debt ratio(Lev),inventories and receivables ratio(Invrec),proftability(Roa),loss(Loss),cash ratio(CFO)and growth opportunities(Tobinq).

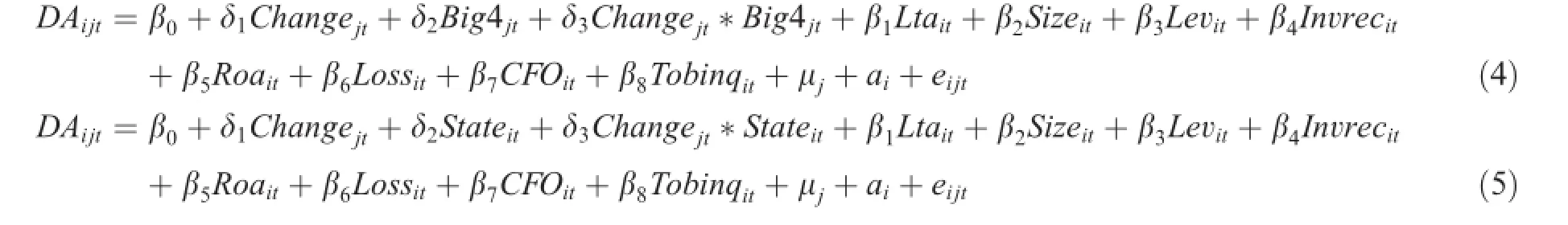

Model(2)is our basic model and is used to examine H1.We also add some relevant variables to model(2) to create models(4)and(5),which we use to examine H2 and H3.Model(4)tests whether an accounting frm’s status as a Big Four accounting frm infuences the relationship between the transformation and audit quality. Model(5)tests whether the clients’status as a state-owned listed company infuenced the relationship between the transformation and audit quality.The model specifcations are as follows:

The variables’specifc defnitions and calculations are detailed in Table 1.

3.2.Sample selection

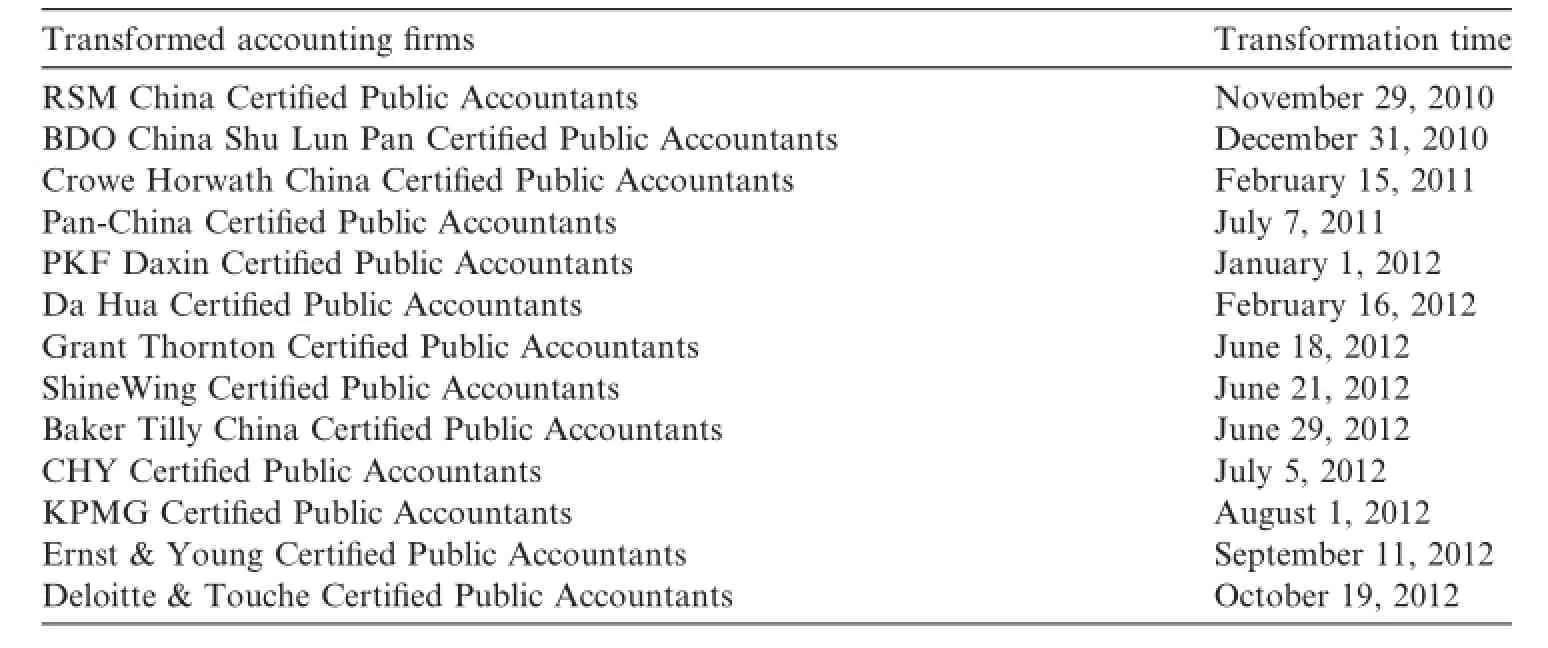

Our study uses all of the A-share listed companies from 2007 to 2012 as our sample.The main variable (Change)is based on accounting frm transformations taken from the American Institute of CPAs’website, where accounting frms whose names have changed to LLPs are defned as transformed accounting frms,withall others defned as non-transformed accounting frms.The fnancial data of listed companies are sourced from the China Stock Market and Accounting Research and WIND(Wind Information Co.,Ltd)databases.

Table 1 Variable defnitions.

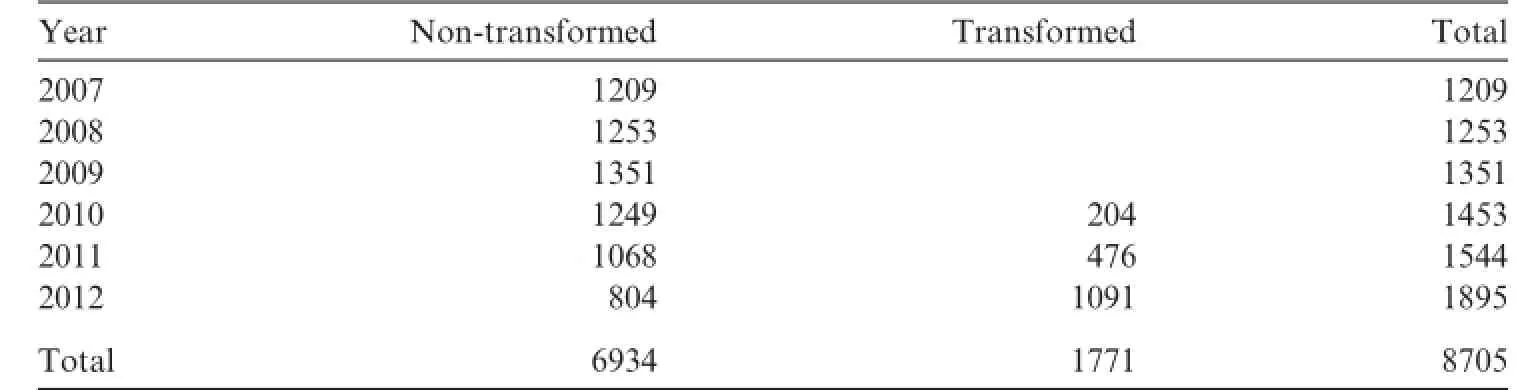

We remove fnancial companies from our sample,along with newly listed companies,specially treated frms and frms with missing variables.We obtain 8705 observations.As many of the variables are the estimated values of the model that are infuenced by outliers,all of the continuous variables are winsorized at the 1% and 99%levels to ensure the robustness of the results.Table 2 displays details of the accounting frm transformations by the end of 2012.

The distribution of the fnal sample is shown in Table 3.

4.Empirical results and analysis

4.1.Descriptive statistics

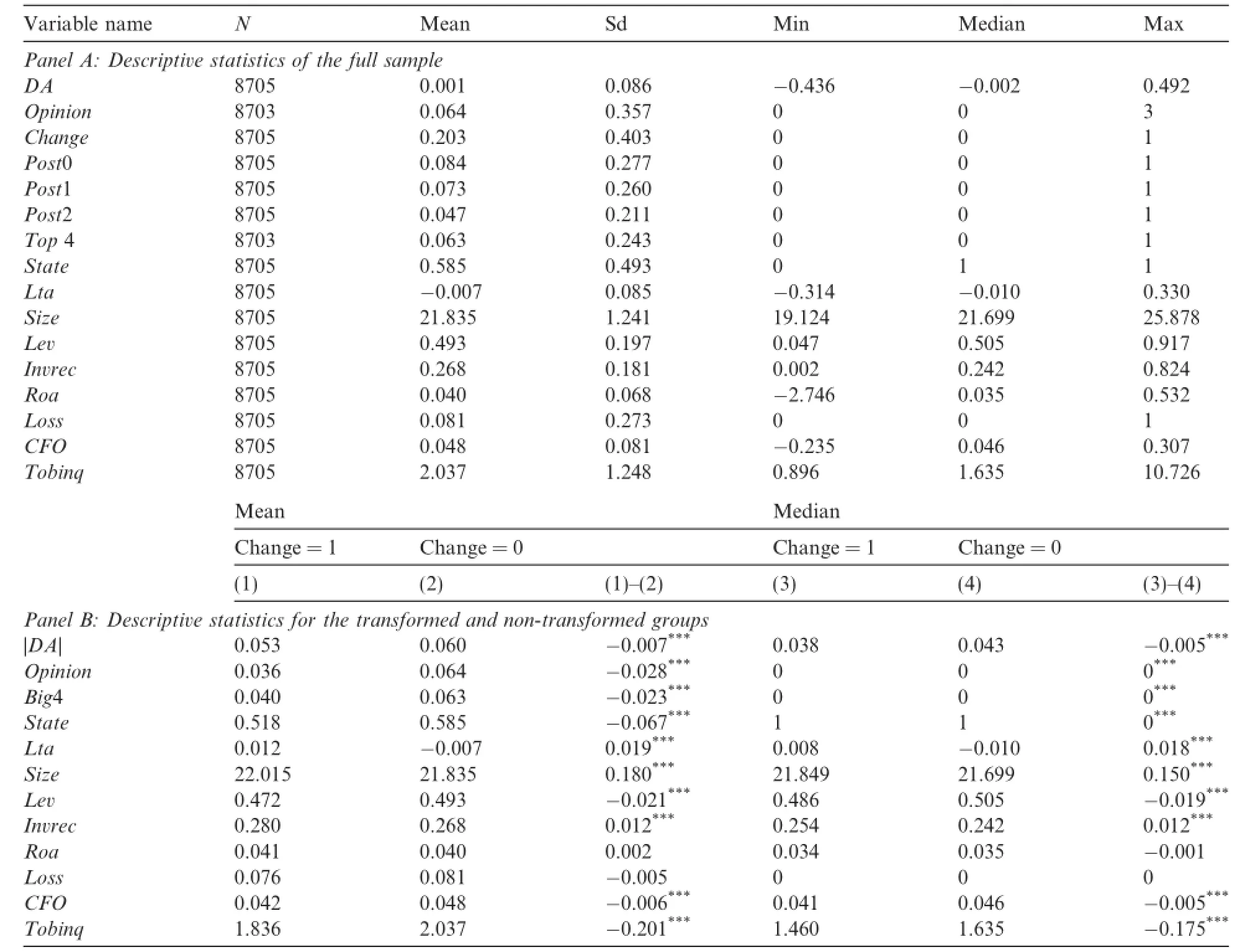

Panel A of Table 4 reports the descriptive statistics for the full sample.The mean and median of DA are 0.001 and-0.002,respectively,indicating that there is no systematic bias in the observations.The mean andmedian of audit opinion(Opinion)are 0.064 and 0,respectively.The mean and median of the explanatory variable(Change)are 0.203 and 0,which is consistent with our sample because a minority of accounting frms transformed during the sample period.

Table 2 Transformed accounting frms.

Table 3 Annual distribution of transformed and non-transformed observations.

Panel B of Table 4 reports the descriptive statistics for the transformed(Change=1)and non-transformed (Change=0)accounting frms.The mean and median of the absolute value of DA(|DA|)for the transformedgroup are signifcantly lower than the non-transformed group,which supports our hypothesis that accounting frm transformation improves audit quality.In the analysis of the dummy variable(Big4),the transformed group is signifcantly lower than the non-transformed group,which is due to the late transformation of the Big Four accounting frms in 2011,and thus there are fewer observations.Similarly,the dummy variable (State)of the transformed group is also signifcantly lower than the non-transformed group.

Table 4 Descriptive statistics.

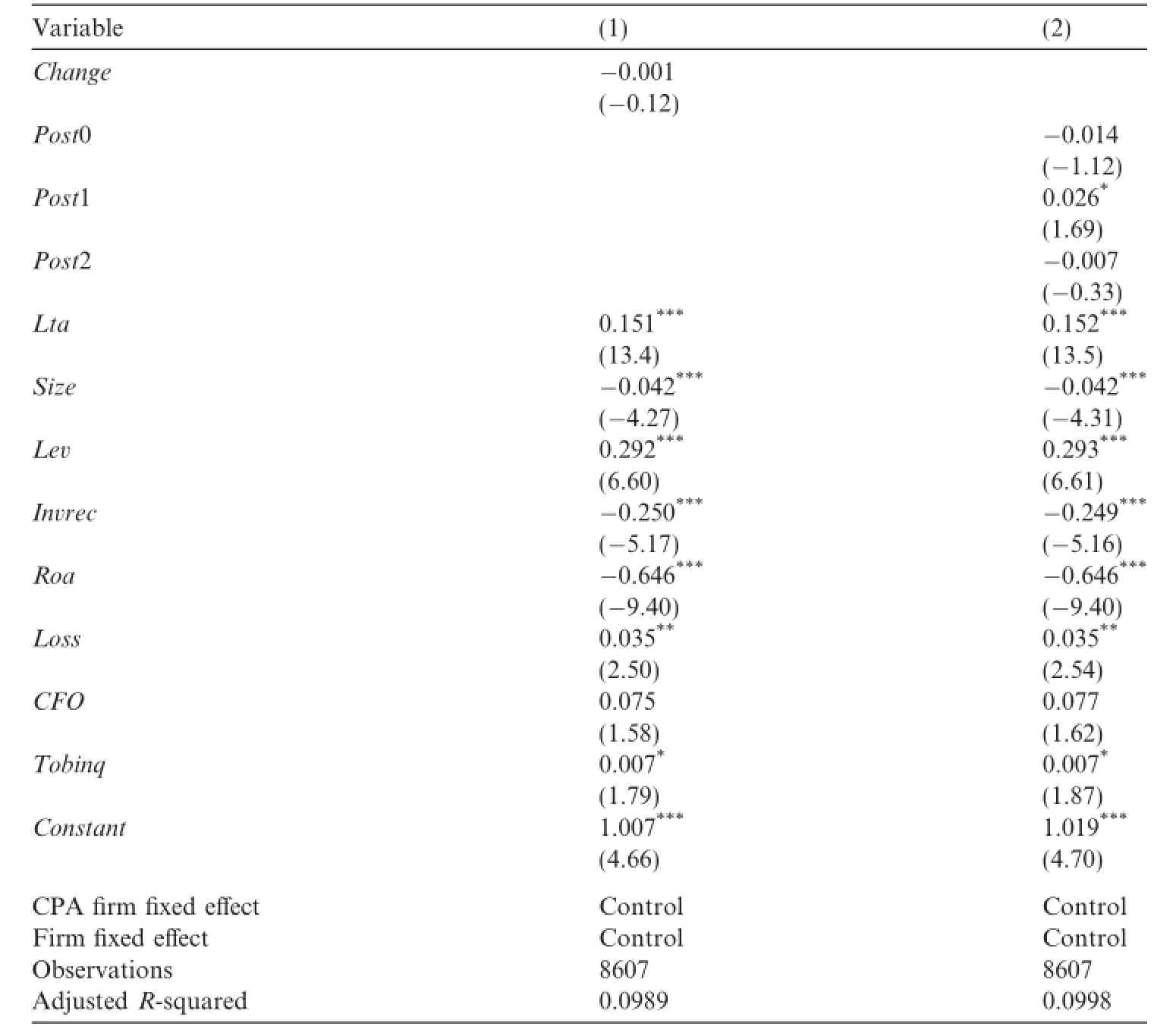

Table 5 The efect of accounting frm transformations on audit quality.

Table 5(continued)

Table 6 The efect of accounting frm transformations on audit opinions.

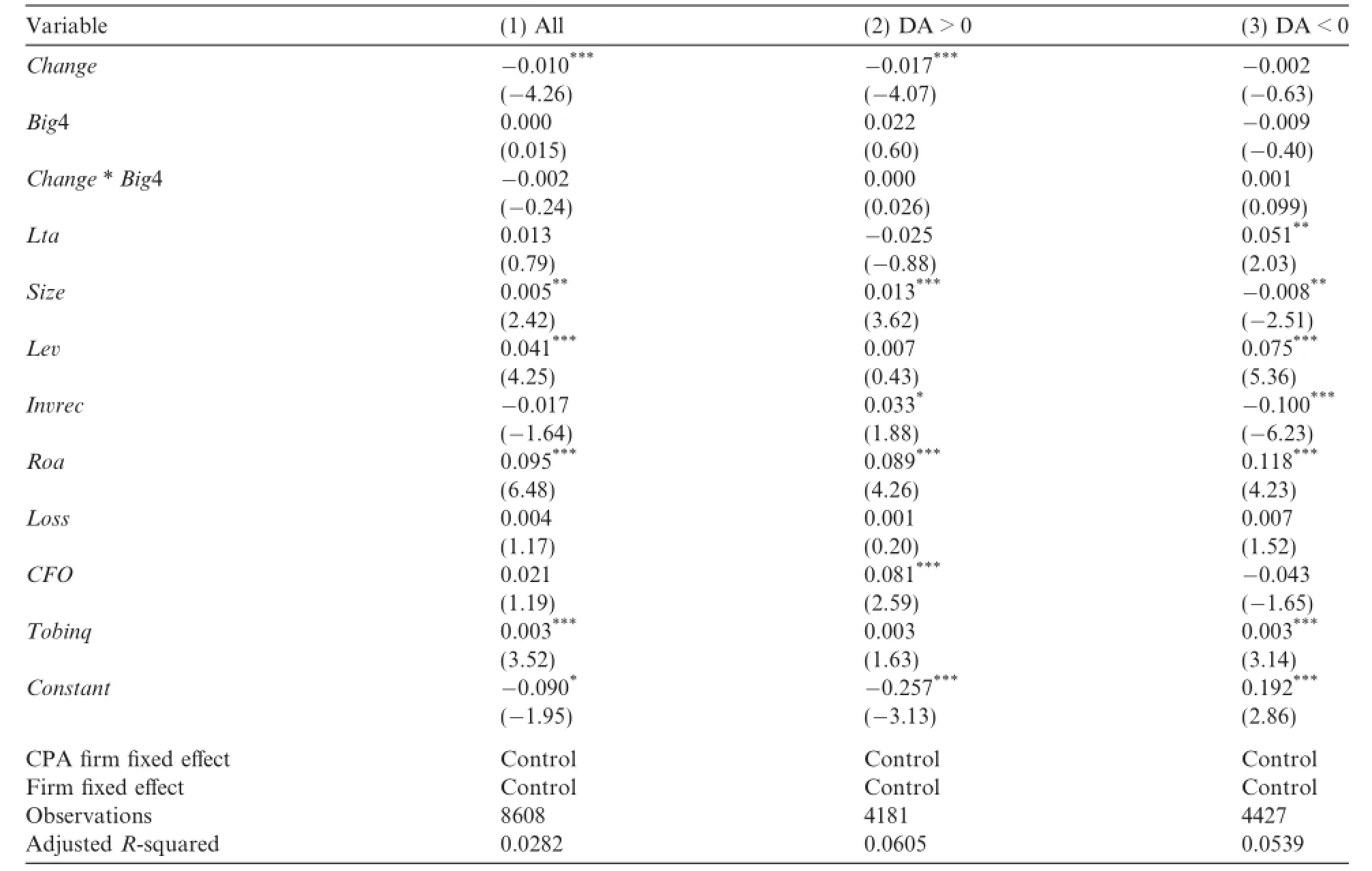

Table 7 The efect of the accounting frm size.

4.2.Empirical results and analysis

4.2.1.The efect of accounting frm transformations on audit quality

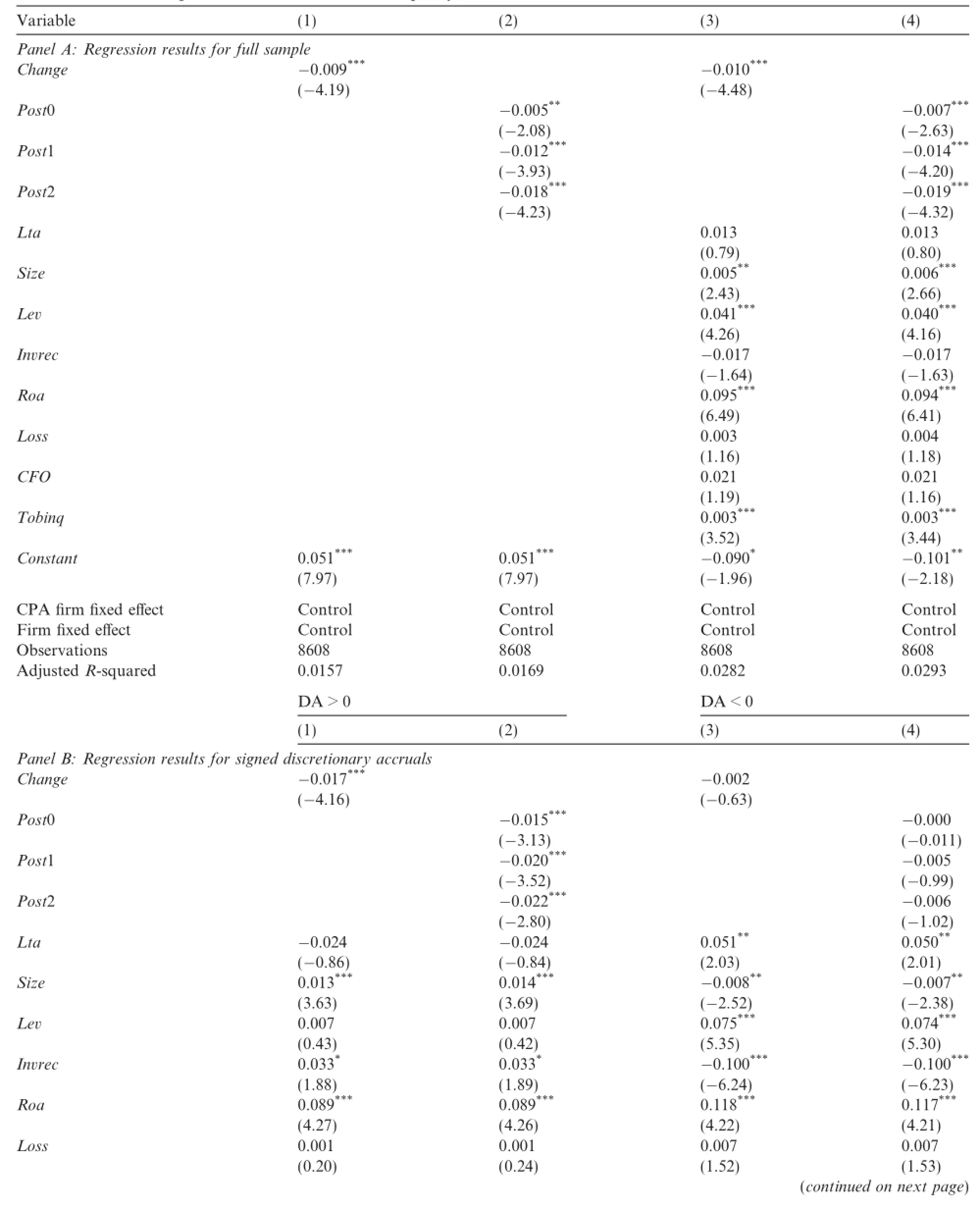

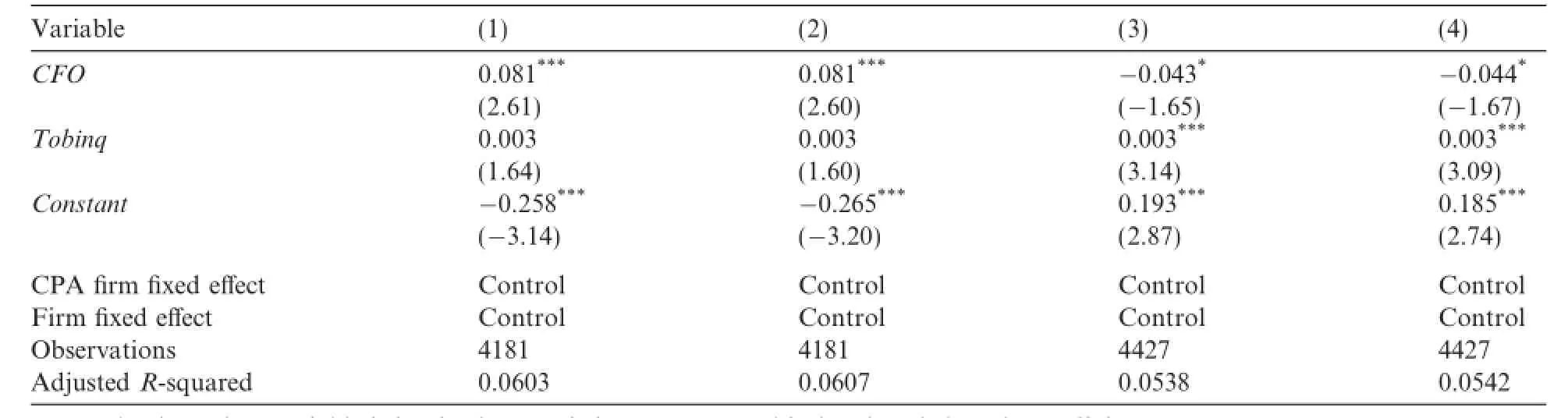

Panel A of Table 5 presents the results of the efect of accounting frm transformations on absolute DA. Columns(1)and(2)of Panel A are the regression results without the control variables.The variable(Change) is negative and signifcant(the coefcients are-0.009 and-0.010,and thet-statistics are-4.19 and-4.48, respectively)in columns(1)and(3)of Panel A.Accounting frm transformations are thus signifcantly negatively related to the absolute value of DA,supporting H1.We suggest that the transformation of accounting frms increases the audit and debt risks faced by partners of accounting frms,which urges the partners to be more cautious and prudent in the auditing process,improving audit quality.We further analyze the posttransformation efects among accounting frms.The variable(Post0)is negative and signifcant(the coefcients are-0.005 and-0.007,and thet-statistics equal-2.18 and-2.63)in columns(2)and(4),which indicates that the transformation of accounting frms has a positive efect on audit quality in the transformation year.Like-

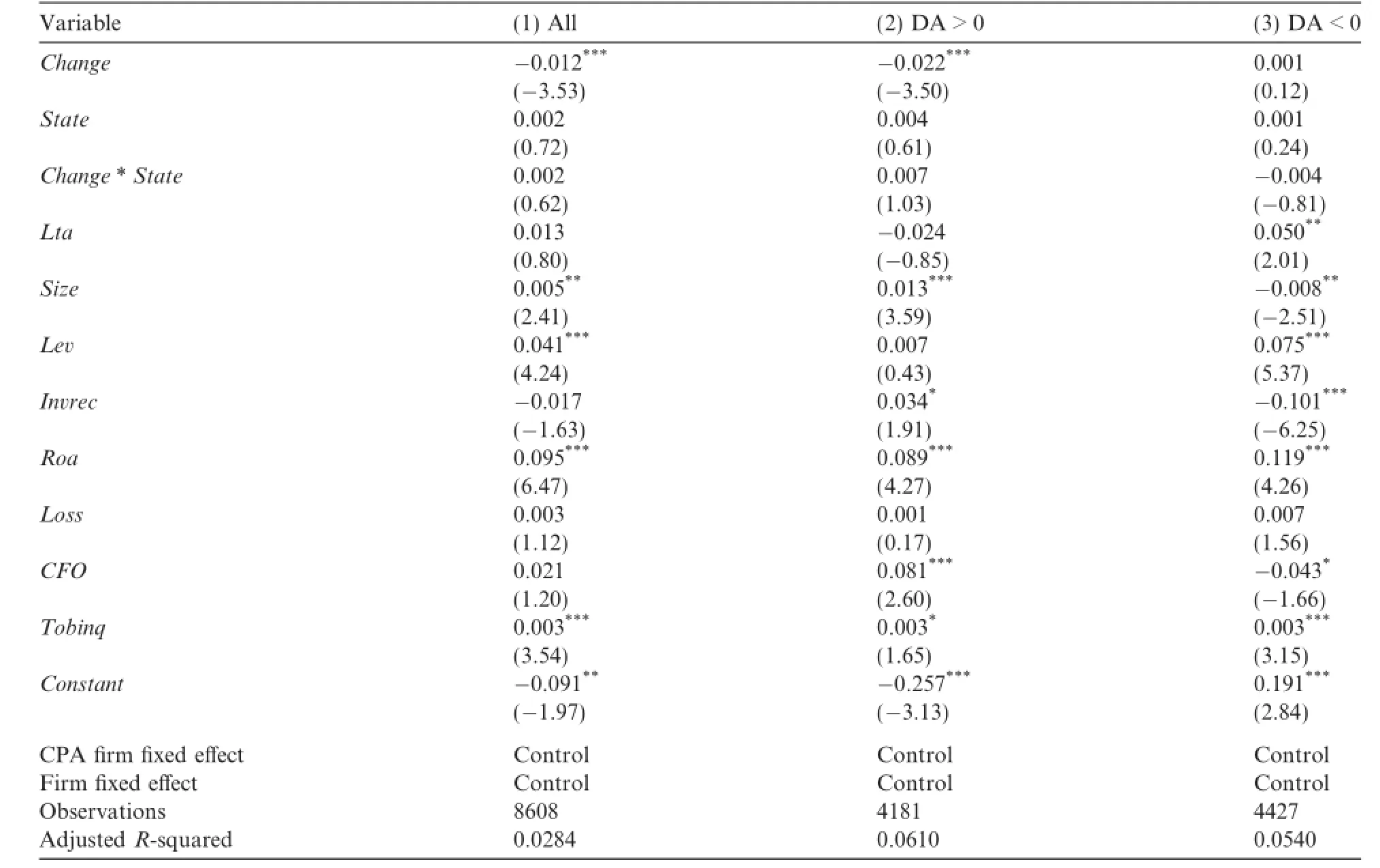

Table 8 The efect of listed company ownership.

Note:The dependent variable is|DA|.Thet-statistics are presented in brackets below the coefcients.

*Signifcance at the 10%level,using two-tailed tests.

**Signifcance at the 5%level,using two-tailed tests.

***Signifcance at the 1%level,using two-tailed tests. wise,the variables(Post1)and(Post2)are also signifcantly negatively related to|DA|,suggesting that the transformation of accounting frms still has positive efects on audit quality one and two years after the transformation.Further,the above results show that the coefcients of the variables are Post2<Post1<Post0, which indicates that the transformation year’s efect is weaker than that of one and two years after the transformation.We argue that the partners of transformed accounting frms fully realize the possible increase in audit risk,and thus they are more cautious in the audit process,resulting in improved audit quality.

Panel B of Table 5 presents the results for signed DA.The coefcient of the variable(Change)is-0.017 and signifcant at the 1%level in column(1).However,the coefcient of the variable(Change)is-0.002 and insignifcant in column(3).The above results show that improvements in audit quality are mainly due to a reduction in upward earnings management,with no efect on downward earnings management.Further,the variables(Post1)and(Post2)are consistent with the above results.

To test the direct efect of accounting frm transformations on audit quality,we also use audit opinions as a proxy for audit quality.Column(1)of Table 6 shows that the coefcient of the variable(Change)is-0.001, but is not signifcant.3DeFond and Zhang(2014)indicate that,because the proxies in each category refect diferent dimensions of audit quality,they cannot entirely refect audit quality.Our research question is whether the transformation of accounting frms improves audit quality given their increased audit risk.The auditors usually issue modifed audit opinions when listed companies have major uncertainty in their operations, or when the companies obey the accounting principles and occur signifcant accounting errors.Therefore,the use of audit opinions to proxy for audit quality might ignore the tiny diferences in the audit process.The coefcient of the variable(Post1)is 0.026 and signifcant at the 10%level in column(2).These results mean that accounting frm transformations still afect audit opinions one year after the transformation,possibly because accounting frms must take time to address post-transformation quality control, thereby enhancing the audit quality of the audit services provided for listed companies.

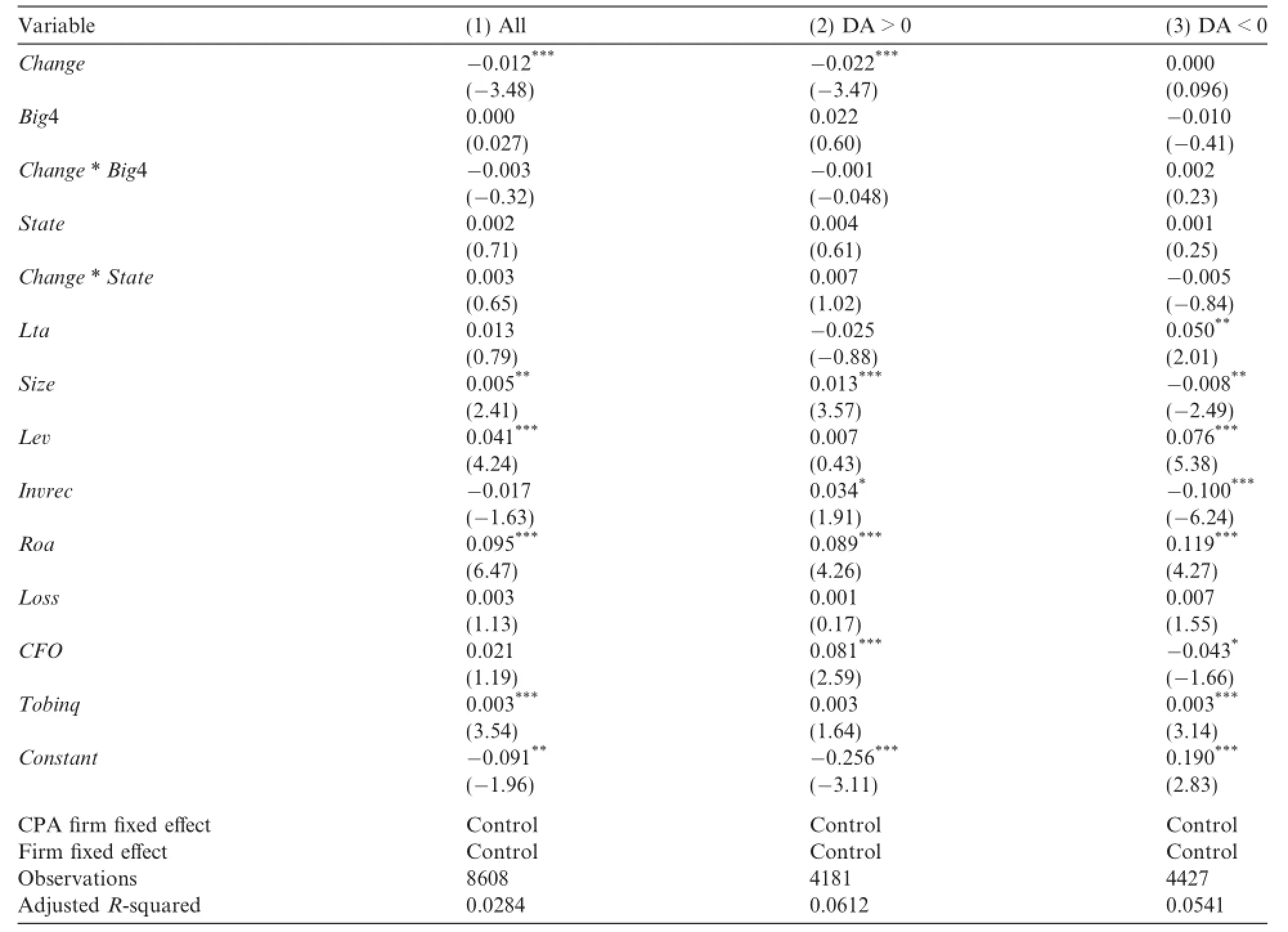

Table 9 The efect of accounting frm size and listed company ownership on the relationship between transformation and audit quality.

4.2.2.The efect of accounting frm size

Table 7 presents the results of the relationship between transformation and audit quality by dividing the sample into two groups:Big Four and non-Big Four.The coefcients of the interact terms(Change*Big4) are all insignifcant in columns(1)–(3),which indicate that there is no incremental efect of accounting frm transformations on audit quality when distinguishing by frm size.One possible reason is that the audit quality of Big Four accounting frms is always higher and therefore the potential for further improvement is limited. Therefore,even though the audit risk faced by the partners increases after the transformation,there is no signifcant incremental efect on audit quality.

4.2.3.The efect of listed company ownership

Table 8 presents the results of the relationship between the transformations and audit quality after dividing the sample into two groups,state-owned and non-state-owned.The coefcients of the interaction term (Change*State)are all insignifcant in columns(1)–(3),which indicate that there is no incremental efect of accounting frm transformations on audit quality when distinguishing by the nature of ownership of listed companies.

4.3.Robustness tests

4.3.1.Diferent estimations of discretionary accruals

To ensure that the conclusions of this study are not infuenced by the estimation of DA,we also use the performance-matched Jones model,the median-adjusted Jones model and the modifed Jones model to estimate DA.After repeating the above regression analysis,the results are still robust,indicating that the conclusions of this study are not infuenced by the estimation of DA.

4.3.2.Diferent defnitions of audit opinion

To ensure that our conclusions are not afected by the defnition of audit opinions,we also defne clean audit opinions as 0 and modifed audit opinions as 1.The results are still robust,indicating that our conclusions are not afected by the defnition of audit opinions.

4.3.3.Diferent model specifcations

We also simultaneously examine the efects of accounting frm size and listed company ownership nature on the relationship between transformations and audit quality.We fnd that the results are the same(see Table 9), indicating that the conclusions do not change.

5.Conclusions

We use Chinese A-share listed companies from 2007 to 2012 to examine the efects of accounting frm transformations on audit quality.We fnd that accounting frm transformations are negatively related to the absolute value of DA.The results of signed DA show that when DA is positive,accounting frm transformations signifcantly reduce the level of DA,whereas the efect is not signifcant when DA is negative.We also fnd that accounting frm transformations only have a positive efect on audit opinions one year after the transformation.

We examine the efects of accounting frm transformations on audit quality from the characteristics of each accounting frm and each client,to explore the research question more deeply.However,we do not fnd that accounting frm size and listed company ownership signifcantly afect the relationship between transformations and audit quality.The transformation from limited liability to LLP increases the audit risk faced by the partners of accounting frms,especially in lawsuits after audit failure,as the partners must compensate for the loss with all of their investments and their personal assets.Therefore,faced with an increasing debt risk,the partners tend to focus more on implementing audit procedures and using audit tools,which improve audit quality.Partners are more cautious in dealing with upward earnings management behavior because it is more prone to audit failures.Due to the policy,transformed accounting frms are generally larger in size and their clients are of a higher quality.Therefore,we did not fnd diferences based on accounting frm size and listed company ownership.

In this study,we fnd that accounting frm transformations improve audit quality,providing policymakers with important empirical evidence.Likewise,the continual implementation of the policy can have a positive efect,urging auditors to provide higher quality audit services that make the capital market more transparent. With the increase in transformed accounting frms,future studies will have more reliable data to work with. These transformations will afect the insurance functions of audits,audit fees and audit client choice,etc., which can also form future directions for research on the topic of accounting frm transformations.

Ashbaugh,H.,LaFond,R.,Mayhew,B.W.,2003.Do non-audit services compromise auditor independence?Further evidence.Acc.Rev. 78(3),611–639.

Chan,D.K.,Pae,S.,1998.An analysis of the economic consequences of the proportionate liability rule.Contemp.Acc.Res.15(4),457–480.

Chen,Z.,2006.Audit Risk,Auditor Risk and institutional Risk.Audit.Res.3,88–92(in Chinese).

DeAngelo,L.,1981.Auditor size and audit quality.J.Acc.Econ.3,181–199.

DeFond,M.,Zhang,J.,2014.A Review of Archival Auditing Research.Working Paper,University of Southern California.

DeFond,M.L.,Wong,T.J.,Li,S.,2000.The impact of improved auditor independence on audit market concentration in China.J.Acc. Econ.28(3),269–305.

Dye,R.A.,1993.Auditing standards,legal liability,and auditor wealth.J.Polit.Econ.101(5),887–914.

Dye,R.A.,1995.Incorporation and the audit market.J.Acc.Econ.19(1),75–114.

Firth,M.,Mo,P.L.L.,Wong,R.M.K.,2012.Auditors’organizational form,legal liability,and reporting conservatism:evidence from China.Contemp.Acc.Res.29(1),57–93.

Geiger,M.A.,Raghunandan,K.,2001.Bankruptcies,audit reports and the Reform Act.Audit.:J.Pract.Theory 20(1),187–195.

Geiger,M.A.,Raghunandan,K.,Rama,D.V.,2006.Auditor decision-making in diferent litigation environments:the Private Securities Litigation Reform Act,audit reports and audit frm Size.J.Acc.Publ.Policy 25,332–353.

Kothari,S.P.,Leone,A.J.,Wasley,C.E.,2005.Performance matched discretionary accrual measures.J.Acc.Econ.39(1),163–197.

Laux,V.,Newman,D.P.,2010.Auditor liability and client acceptance decisions.Acc.Rev.85(1),261–285.

Lennox,C.,Li,B.,2012.The consequence of protecting audit partners’personal assets from the threat of liability.J.Acc.Econ.54,154–173.

Liu,F.,Lin,B.,2000.CPA decoupling and government choice:an explanation.Acc.Res.2,9–15(in Chinese).

Liu,C.,Wang,T.,2006.Auditor liability and business investment.Contemp.Acc.Res.23(4),1051–1071.

Liu,F.,Xu,F.,2002.Risk based auditing,litigation risk and auditing quality.Acc.Res.2,22–27(in Chinese).

Lu,P.,Chen,X.,2005.Limited liability,unlimited liability and audit quality:a game perspective.Audit Res.2,41–43(in Chinese).

Melumad,N.D.,Thoman,L.,1990.On auditors and the courts in an adverse selection setting.J.Acc.Res.28(1),77–120.

Qi,J.,Chen,H.,Zhang,Y.,2004.CPA frm size,brand,price and audit quality–the research on the audit fee and audit quality of International“big four”in Chinese audit market.Audit Res.3,59–64(in Chinese).

Subramanian,K.R.,1996.The pricing of discretionary accruals.J.Acc.Econ.22,249–281.

Venkataraman,R.,Weber,J.P.,Willenborg,M.,2008.Litigation risk,audit quality,and audit fees:evidence from initial public oferings. Acc.Rev.83(5),1315–1345.

Wang,Q.,Wong,T.J.,Xia,L.,2008.State ownership,the institutional environment,and auditor choice:Evidence from China.J.Acc. Econ.46(1),112–134.

Wang,C.,Wu,L.,Lu,Z.,2010.Does hiring the same auditor in a corporation group impair auditor independence?Acc.Res.11,65–71 (in Chinese).

Yi,C.,2003.An empirical study on the privatization of CPA frms and their subsequent performance.Chin.Acc.Financ.Rev.5(1),162–188.

Zhang,Y.,Liu,F.,2002.Empirical research on the correlation between earnings management and audit opinions.Chin.Financ.Acc.Res. 1.

*Corresponding author.

E-mail address:helena8857@pku.edu.cn(H.Dou).

☆We appreciate the helpful comments and suggestions of the editor Professor Donghui Wu,an anonymous referee,and seminar participants at the 2013 CJAR Special Issue Symposium.Our study is supported by the National Natural Science Foundation of China under the following grants(No.71302131,No.71132004 and No.71172029),the MOE Project of Humanities and Social Sciences (13YJC630160),the Beijing Municipal Commission of Education“Joint Construction Project”and“Pilot Reform of Accounting Discipline Clustering,”the Youth Innovation Team Support Plan of Central University of Finance and Economics(research direction: Empirical Accounting and Auditing),and the“2011 Synergetic Innovation”Key Project on“Development of Public Accounting Profession”for the Central University of Finance and Economics,China.

http://dx.doi.org/10.1016/j.cjar.2014.08.005

1755-3091/©2014 Production and hosting by Elsevier B.V.on behalf of China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong.

China Journal of Accounting Research2015年4期

China Journal of Accounting Research2015年4期

- China Journal of Accounting Research的其它文章

- Guidelines for Manuscripts Submitted to The China Journal of Accounting Research

- Audit mode change,corporate governance and audit efort☆

- Monetary policy,accounting conservatism and trade credit☆

- Financial development and the cost of equity capital: Evidence from China