MARKET WATCH

OPINION

Three Issues Confronting China Railway Corp.

During the First Session of the 12th National People’s Congress held in March,the MOR, which was established in 1949, was dismantled into commercial and administrative arms. China Railway Corp. takes over its commercial functions, while the administrative functions were transferred to the Ministry of Transport. The reform was in response to public criticism over the fact that the MOR was both a policymaker and service provider.

Whether the newly born China Railway Corp. can become a top-notch state-owned enterprise depends on its ability to solve the following three issues.

First, establishing a reasonable ticket pricing mechanism.

Chinese people are used to paying a relatively low price for their train tickets. There have been lots of concerns over the surge of ticket prices after the establishment of the company. Adjusting prices according to supply and demand is inevitable to a company.But questions remain as to how to adjust prices to a level that is fair to everyone.

It’s feasible to offer discounts to attract more passengers during off-peak periods.China Railway Corp. should never follow in the steps of the country’s three major petroleum companies, who raised oil prices much more frequently than cutting them, thus raising the ire of the public.

Second, solving the debt issue.

由图6可以看出,随着砂粒含量的增大,砂质黄土的黏聚力减小,砂粒含量从30%增长至45%,黏聚力从6.08减至3.28,降幅为46%。曲线形态表现为先缓后陡,即当砂粒含量小于35%时黏聚力随砂粒含量的增加缓慢降低,当砂粒含量大于35%时黏聚力随砂粒含量的增加其降低趋势增大。

By the end of September 2012, the MOR had amassed a debt of 2.66 trillion yuan($428 billion), which will be transferred to the new company. Dealing with the hefty debt on the one hand depends on market-based corporate operations and on the other hand requires a flexible debt-restructuring plan.

There have been discussions about China Railway Corp.’s listing in the capital markets to tackle its debt, but the general public has voiced disapproval.

The ultimate solution to the debt issue is to improve the company’s performance. This requires the company to establish a modern corporate governance system; run itself more openly, transparently and efficiently;and offer higher-quality railway products and services. This will lead to increased profits,and it is the only way to dissolve its vast debt.

Finally, introducing competition and treating private capital with due respect.

Before the reform, the MOR did poorly in attracting investment due to its lack of transparency. After the establishment of China Railway Corp., private capital should be given more access to railway construction.

In the past, private capital was only allowed for projects with a long construction period and lower investment return. China Railway Corp. should work to attract more private capital to be invested in areas that could yield higher returns. The prejudice that only heavily indebted state-owned enterprises resort to private capital should be changed. ■

NUMBERS

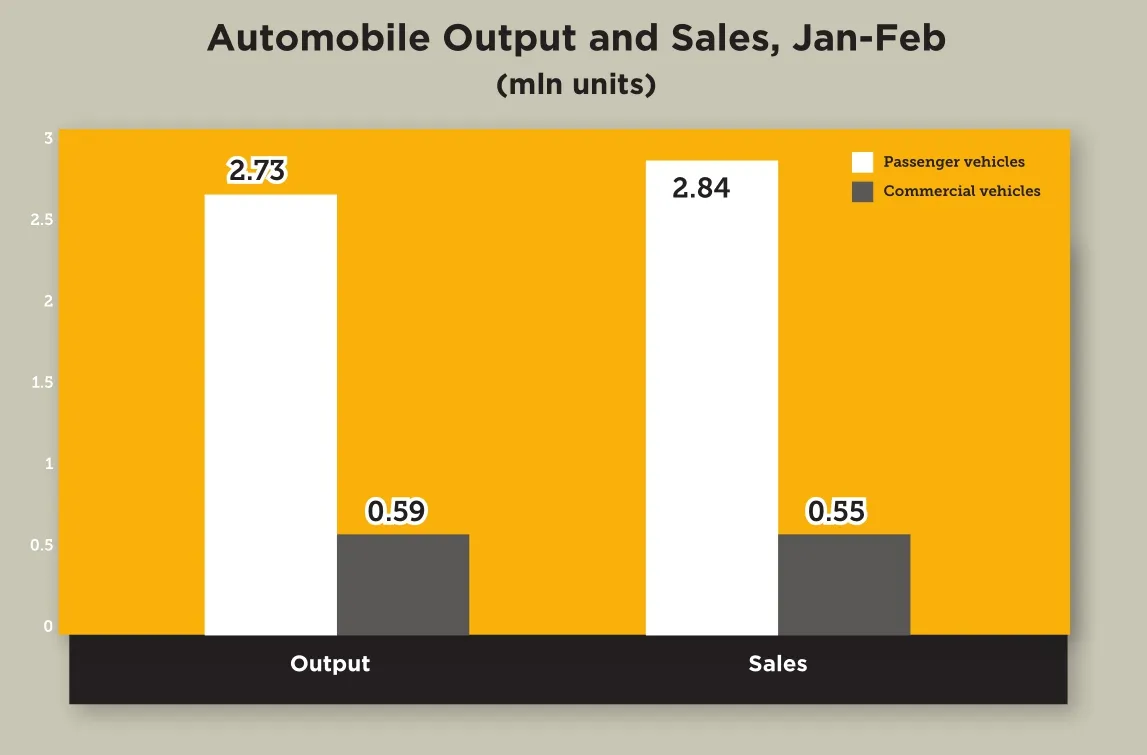

3.39mln

January and February automobile sales in China

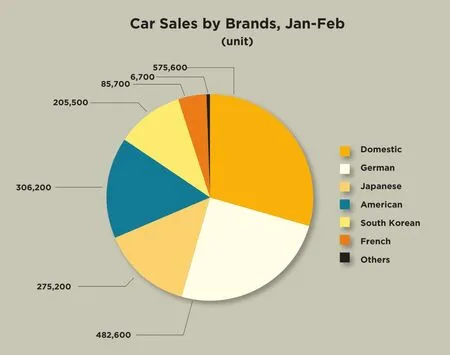

29.71%

Market share of domestic brand cars in January and February

66.97%

Proportion of sales by the top 10 carmakers in January and February

(Source: China Association of Automobile Manufacturers)

THE MARKETS

Mild Expansion

Ping An Insurance (Group) Co., one of China’s major insurance companies, saw mild growth in its net pro fits in 2012.

The company’s net profits increased 3 percent year on year to 20.05 billion yuan ($3.2 billion) in 2012, according to its annual business report filed with the Shanghai Stock Exchange.

By the end of 2012, its total assets jumped 24.5 percent to 2.84 trillion yuan ($457.2 billion)from the same period last year.

Ping An Bank contributed the most to its parent company. Its net profits surged 65.9 percent year on year to 13.23 billion yuan ($2.13 billion) in 2012, with 6.87 billion yuan ($1.1 billion) turned over to the group.

Raising Stakes

AkzoNobel intends to invest an extra 65 million euros ($84.1 million) in its Chinese factories, the Dutch paints, coatings and chemicals company said on March 19.

The new investment will be used to boost the capacity and performance of its surface chemistry manufacturing sites.

According to AkzoNobel, half of the money will be spent on the company’s facility in Shandong Province, which was taken over as part of the acquisition of Boxing Oleochemicals in January 2012.

In Ningbo, Zhejiang Province, a new alkoxylation unit will be built, bringing the total investment at the site to 400 million euros($517.87 million).

AkzoNobel currently employs more than 7,000 people in China, generating sales revenue of 1.7 billion euros ($2.2 billion) in 2012, mostly from local demand. ■

- Beijing Review的其它文章

- Narrowing the Wealth Divide

- ECONOMY

- SOCIETY