Information asymmetry,mutual funds and earnings management:Evidence from China

Yunhao Dai,Dongmin Kong,Li Wang

School of Economics,Huazhong University of Science and Technology,China

Information asymmetry,mutual funds and earnings management:Evidence from China

Yunhao Dai,Dongmin Kong*,Li Wang

School of Economics,Huazhong University of Science and Technology,China

A R T I C L EI N F O

Article history:

Accepted 25 March 2013

Available online 30 April 2013

JEL classification:

G12

G14

G18

M41

This paper investigates how information asymmetry and mutual fund ownership affect listed companies’earnings management.We show that(1)reducing information asymmetry improves firms’earnings management behavior;(2) relative to short-term mutual funds,long-term mutual funds promote earnings quality by adopting a monitoring role;and(3)by dividing firms into high/low information asymmetry groups,we find that the information environment significantly increases the effect of long-term mutual funds on firms’earnings management.In this paper,we provide new evidence for the role that institutional investors play in a typical emerging capital market.Our results have clear policy implications:to increase earnings quality,it is essential to improve information transparency and develop long-term institutional investors.

Ⓒ2013 Production and hosting by Elsevier B.V.on behalf of China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong.

1.Introduction

Earnings information is an important basis for investors’decision making.In recent years,due to a series of significant accounting fraud and violation cases both at home and abroad,the issue of earnings management has attracted considerable attention from academics and practitioners.However,the focus of most studies islimited to how to measure earnings management behavior,the factors that influence earnings management and the economic consequences of earnings quality.

The majority of related studies overlook the effects of information asymmetry and institutional ownership and their influence on company earnings management issues.Information asymmetry usually refers to the inequality in the amount of information held by different market participants.It is well known that accounting information provides relatively accurate financial information to market participants.This information helps investors to understand the company’s operating activities and thus reduces the information asymmetry between investors and management(Armstrong et al.,2010;Bhattacharya et al.,forthcoming).The information environment is likely to impose certain externalities on accounting information:a company’s degree of information asymmetry can be decreased by an effective information disclosure system,which provides a transparent information environment for the company’s financial reports and accounting earnings quality. Managers under stronger supervision are more likely to provide high-quality accounting reports that further promote improvements in corporate earnings quality(Hunton et al.,2006;Xia and Lu,2005).

Institutional investors also play an increasingly important role in capital markets.Stock markets in the United States,for example,are largely dominated by institutional investors.Similarly,institutional investors have developed rapidly in China since the first securities investment funds were established in 1998.1There are various types of institutional investors.We choose securities investment funds(mutual funds)as a proxy variable for institutional investors in this study because mutual funds are the largest institutional investors in China and are the main securities investment funds affecting corporate governance,and because the data is relatively easy to access.Hence,unless otherwise stated,when referring to institutional investors,we mean mutual fund investors.Today, Chinese institutional investors are among the top 10 shareholders in more than half of the listed companies. Can the increasing number of institutional investors improve the governance structure of companies?Institutional investors are professionals who have advantages in terms offinancial support and information discovery-they are good at detecting companies’actual operating conditions and supervising management. However,there is considerable academic controversy over how institutional investors affect earnings management.On the one hand,they may use their professional advantage to oversee the management of listed companies and participate in the corporate governance process,thereby effectively inhibiting accruals-based earnings management behavior(Prowse,1990;Brous and Kini,1994;Warfield et al.,1995;Cheng,2006). On the other hand,there are concerns about their negative influence,as their herd-like and short-sighted behavior can exacerbate the extent of earnings management and thus reduce earnings quality(Graves, 1988;Porter,1992;Deng and Tang,2010).

Compared with capital markets in Western countries,Chinese listed companies have suffered from the‘dominance’of non-tradable shares,as a result of which institutional investors fail to play a full role.Zhao and Zheng(2002)argue that the relatively small proportion of Chinese institutional investors,together with the insufficiency of market information disclosure mechanisms and regulatory instruments,increases the information search and interpretation costs for Chinese institutional investors.Therefore,the extent of the information asymmetry between investors and listed companies is likely to further influence the relationship between institutional investors and earnings management.

In summary,can the level of transparency in the information environment influence company earnings management behavior in the Chinese capital market?As the enthusiasm for Chinese mutual funds continues to heat up,do the diverse types and characteristics of mutual funds have different effects on corporate governance?What is the combined effect of these two important factors on earnings management?Our aim in this paper is to explore these as yet unresolved issues.

This paper is innovative in the following two respects.First,although some scholars examine the relationships between the degree of information asymmetry,institutional ownership and earnings management,most studies are based on the mature markets of developed countries.As there is still a lack of comprehensive research into these three factors in China,in this paper we investigate their interaction in the emerging Chinese stock market.Second,previous studies generally analyze overall mutual fund behavior,but they either do not classify funds according to their different investment characteristics or use biased classifications(Brown and Goetzmann,1997;Sun et al.,2012).To distinguish between the corporate governance behavior of differenttypes of funds,we reclassify mutual funds as long-term and short-term funds using the method proposed by Yan and Zhang(2009).

The paper is organized as follows.Section 2 presents the literature review and research hypotheses.Section 3 describes the data sources,variable definitions and empirical models.Section 4 presents the econometric models and results of the empirical analysis.Section 5 presents the results of additional tests.Section 6 summarizes and concludes the paper.

2.Literature review and research hypotheses

Earnings quality is a measure of the profitability of listed companies.It indicates the degree of match between a company’s profitability and its cash flow.If they are not well matched,there are potential operating problems.Earnings management occurs when management tries to control or adjust reported accounting earnings information to maximize their own interests.It is clear that earnings management will cause the company’s earnings quality to deviate from its true level.Information asymmetry usually refers to inequalities between the information held by market participants,which can affect investors’decision-making.Studies conducted both in China and abroad show that a company’s earnings management is closely related to its information environment.Both Dye(1988)and Trueman and Titman(1988)find that information asymmetry between shareholders and management is a necessary condition for the existence of earnings management. Schipper(1989)defines earnings management as management’s manipulation of the disclosure offinancial reporting by purposefully using their information advantage to seek private interests,which often go against the interests of the business owners.When information asymmetry is high,stakeholders do not have sufficient resources,incentives or access to relevant information to monitor managers’actions,which gives rise to the practice of earnings management.Richardson(2000)provides empirical evidence that information asymmetry,as measured by the bid-ask spread and analysts’forecast dispersion,is positively related to the level of earnings management.Hunton et al.(2006)uses experimental methods to investigate whether greater transparency reduces earnings management attempts.In the experiment,62 financial executives and chief executive officers decide which available-for-sale security to sell from a portfolio under different levels of transparency of income reporting and projected earnings.The results suggest that more transparent reporting requirements can reduce earnings management attempts or change the focus of earnings management attempts to less visible methods.Jo and Kim(2007)examine the relationship between disclosure frequency and earnings management and the effect of this relationship on post-issue performance,using a sample of seasoned equity offerings (SEOs).They find that firms with extensive disclosure are less likely to face information problems,leading to less earnings management and better post-issue performance.The above discussion suggests that foreign scholars generally agree that earnings management increases as the degree of information asymmetry increases.

The Chinese literature concerning earnings management and the information environment is still relatively sparse.Yang(2005)investigates the relationship between information disclosure and earnings management using a client-agency model,which suggests that information forecasts can decrease the information asymmetry between managers and owners.Mangers should face an additional cost for their deliberate forecasting of inaccurate information,so that managers’information forecasts can reduce the possibility of earnings management.Xia and Lu(2005)use listed companies’condemned announcements as a proxy for information disclosure and their results show that the degree of earnings management and the quality of information disclosure are negatively related,implying that listed companies may lower information disclosure quality to conceal their earnings management.Fang and Hong(2007)conclude that the quality of corporate disclosure has an effect on analysts’behavior.Specifically,it improves the accuracy of predictions and reduces the dispersion between analysts,thus ensuring that earnings data are closer to reflecting a company’s actual profit.

From the results of studies conducted both in China and abroad,we conclude that the information asymmetry between investors and listed companies leads to management speculation.The accounting earnings information advantage of listed companies’management drives them to adjust their accounting records and information disclosure content to achieve their own personal interests or to benefit the minority.Therefore,improving the transparency of information disclosure to reduce the degree of information asymmetry can effectively regulate major shareholders’violation of interests and improve corporate governance.Furthermore,it can inhibit earnings management and promote companies’accounting reporting quality to reduce investment risk.Accordingly,we propose the following hypothesis:

Hypothesis 1.The information asymmetry of listed companies is positively related to the degree of earnings management

Institutional investors are often characterized as“sophisticated investors”who have advantages in acquiring and processing information compared to individual investors(Bushee,1998;Bartov et al.,2000;Jiambalvo et al.,2002).However,domestic and foreign scholars continue to disagree over their specific role in improving reporting quality.As developing capital markets are not perfect,with serious information asymmetry and a lack of funds and technical expertise,institutional investors have little motivation or ability to participate in company governance and thus act as“traders”rather than“owners”.Foreign studies consider institutional investors to be more concerned about current profits than corporate governance,as most institutional investors are still short-term speculators who pay little attention to long-term investment.When a listed company performs poorly,institutional investors tend to“vote with their feet”by selling stock.To prevent the loss of these important institutional investors,the company’s management may manipulate earnings to increase reported earnings.As a result,a growing number of significant shareholders who are short-sighted and speculative induce companies to provide low-quality accounting information in an attempt to maintain their attractiveness to institutional shareholders.For instance,Graves(1988)believes that fund managers look mainly for short-term gains from their equity investments.In response to a desire for advancement and job security,institutional investors encourage managers to forego an increase in risky and long-term investments in favor of increasing their short-term financial profitability.Due to the information asymmetry between managers and investors,Froot et al.(1992)show that it is more cost-effective for institutions to invest based on short-term performance,rather than valuing the long-term prospects of the firms in their diversified portfolios. In conclusion,institutional investors may lead to lower-quality accounting information because their frequent trading and short-term focus may encourage managers to exercise short-sighted discretion in reporting a firm’s financial performance.

As the development of foreign capital markets involves not only further improvements in laws and regulations,but also the growing scale of institutional investors,the cost of institutional investors“voting with their feet”is increasing.Compared with exiting the market negatively through stock-selling,institutional investors increasingly take an active part in corporate governance by proposing shareholder bills or soliciting proxy voting rights,because they are more capable of achieving higher returns by monitoring managerial behavior than individual investors.Correspondingly,some foreign scholars support the monitoring effect argument,which assumes that institutional ownership will bring high-quality accounting information.Prowse (1990)finds that institutional investors that take part in corporate governance play a supervisory role in earnings management.Brous and Kini(1994)suggest that higher levels of institutional ownership are associated with more effective monitoring of the use of cash a firm obtains from equity issues,due to their higher ownership stake in the firm.Warfield et al.(1995)find that managerial ownership is positively associated with the explanatory power of earnings for predicting returns and inversely related to the magnitude of accounting accrual adjustments.Bushee(1998)holds that more sophisticated institutional investors remove incentives for managers’opportunistic behavior through closer monitoring of managerial behavior,either through explicit governance activities2For example,in the early 1990s,some institutional investors(i.e.,the California Public Employees Pension Fund and J.P.Morgan) lobbied for the removal of CEOs at several large,poor performing firms,including Kodak,IBM,Westinghouse,Borden,American Express and GM(Kahn and Winton,1998).or through the implicit collection and dissemination of information in the stock market.3Previous studies find that relatively more future earnings information is impounded in stock prices(Jiambalvo et al.,2002)and inefficient pricing of earnings is reduced(Bartov et al.,2000)when institutional ownership is high.According to this view,institutional investors play an active role in improving financial reporting quality because they are willing to monitor and discipline managers,thus ensuring that managers maximize the longterm value of the firm rather than their own interests.For example,there is evidence to suggest that firms with higher AIMR disclosure rankings have greater institutional ownership(Bushee and Noe,2000)and managers are less likely to cut R&D to reverse an earnings decline when institutional ownership is high.Chung et al.(2002)also find evidence that is consistent with institutional investors monitoring and constraining the selfserving behavior of corporate managers.

The recent foreign literature suggests a new method for studying this issue,by reclassifying institutional investors based on their historical investing characteristics.Following Bushee(1998),Liu and Peng(2006) group mutual funds into three categories4Bushee(1998)classifies institutional investors into three types.Due to data limitations,we choose the classification method used by Yan and Zhang(2009).and find that the accuracy of accruals is negatively related to the shareholdings of short-term institutional investors,but positively related to the shareholdings of long-term institutional investors.This suggests that short-term investors decrease earnings quality,whereas long-term investors play a role in monitoring management.Koh(2007)indicates that long-term institutional investors can mitigate aggressive earnings management,whereas transient institutional ownership is only associated with aggressive earnings management among firms that need to meet their earnings benchmarks.

With the rapid development of institutional investors in China,several domestic researchers examine the role of institutional investors with mixed results.Cheng(2006)finds that timeliness is positively associated with the shareholdings of institutional investors,whereas the extent of earnings management is negatively associated with the shareholdings of institutional investors.However,he does not consider the endogeneity problem between earnings quality and institutional shareholdings.Gao and Zhang(2008)use data from Chinese listed companies to show that institutional investors are involved,to an extent,in corporate governance and thus restrain earnings management.Huang(2009)finds an inverse-U relationship between the shareholdings of institutional investors and earnings management.Additionally,Deng and Tang(2010) query whether institutional investors can restrain earnings management.They find that the shareholdings of institutional investors are positively related to earnings management and furthermore,this relationship is more prominent in state-owned enterprises.Their results suggest that the majority of institutional investors in China are still myopic,and increase rather than reduce earnings management.

According to the above discussion,we find that the question of whether institutional investors are shortsighted is a contentious issue,especially in the emerging capital market of China.Supposing the aim of institutional investors is to seek profit maximization,then we have reason to conjecture that institutional investors are motivated to support management to manipulate earnings.Nevertheless,several studies consider how the characteristics of institutional investors affect the extent offirms’earnings management by classifying institutional investors into different types.To address these issues,we propose Hypothesis 2:

Hypothesis 2.Relative to short-term mutual funds,the monitoring effect of long-term mutual funds on listed companies’earnings management is stronger

To date,most studies consider how the information environment or institutional investors affect earnings management.However,they rarely study the issue by incorporating the relationship between information asymmetry and institutional investors.As Ramalingegowda and Yu(2012)suggest,the higher the shareholdings of institutional investors,the higher the earnings conservatism(an important component of earnings quality).When the extent of information asymmetry is higher,the relationship between the shareholdings of institutional investors and earnings conservatism is more prominent.Although the mutual fund industry has recently experienced fast development in China’s capital market,gaps still exist compared with the same industry in developed capital markets.The role of mutual funds in China is still limited to stabilizing market efficiency and monitoring the behavior of managers.With respect to the cost when mutual funds play a role in monitoring,the higher the information asymmetry,the higher the cost of supervision.Once the cost exceeds the potential profit,mutual funds will no longer supervise the firm and will vote with their feet(Coffee,1991). However,when the extent of information asymmetry is low,the cost of monitoring is also low and mutual funds can still gain high potential profits.5We thank the referees for this suggestion.Therefore,compared with developed capital markets,do mutual funds in China behave differently when they face firms with different levels of information asymmetry?For instance,do long-term mutual funds tend to have a greater monitoring role in comparison with short-term mutual funds when the extent of information asymmetry is low?Considering that the extent of informationasymmetry will affect the investment behavior of mutual funds,we group firms according to the extent of information asymmetry and then study the effect of mutual fund ownership on earnings management.We propose Hypothesis 3:

Hypothesis 3.When there is low information asymmetry,the monitoring effect of long-term mutual funds on listed companies’earnings management is stronger

3.Data and research design

3.1.Sample selection and data sources

As the number and size of institutional investors has increased since 2004,we choose all companies listed on the Chinese A-share market during the 2004-2010 period.Financial data and institutional investor shareholdings data are obtained from the WIND Database,and stock return and corporate governance data are drawn from the CCER Database.We initially group all listed companies into 13 industries following the CSRC industry classification standard.However,since most companies belong to manufacturing industries,we use subcategories for the manufacturing industry,which results in a total of 22 industry categories.

During the sample selection process,we exclude financial companies,companies listed on the GEM and“Special Treatment”or“Particular Transfer”companies.We also exclude companies with missing data.To minimize the influence of outliers,the top and bottom 1%of the variables are winsorized.In total,we have 7286 firm-year observations in our sample.

3.2.Variable definitions

We use empirical models to study the relationship between earnings management and information asymmetry and long-term or short-term mutual funds.The variables we use are defined as follows.

3.2.1.Earnings management(EM)

There is controversy in the existing literature regarding the definition and measurement of earnings management.Previous studies measure the extent of earnings management in different ways,such as timeliness, smoothness and persistence(Hunt et al.,1996;Lev and Thiagarajan,1993).However,these methods generally measure the earnings management of a particular group of companies,but not individual companies.The existing literature usually uses the relationships between earnings,operating cash flows and accruals to measure firm-level earnings management.We also follow this method by adopting the model of Dechow and Dichev(2002;hereafter referred to as the DD model)model and extending Ball and Shivakumar’s(2005) piecewise nonlinear regression model(hereafter referred to as the BS model).6We do not report the results of the BS model as they are consistent with those of the DD model.We provide a detailed description of the measurement method for the BS model in Appendix A.Furthermore,the Pearson correlation between|BS_eq|obtained from the BS model and|DD_eq|obtained from the DD model is 0.94,so using them as the same proxy measure is reliable.

The DD model considers the relationship between accruals and cash flows,and adopts the mapping relationships between current accruals at t and cash flows in periods t-1,t and t+1,to measure earnings management,as follows:

The principle of the DD model is to measure the degree of match between accruals and cash flows.When the part of accruals(εt)that cannot be explained by operating cash flows is relatively stable,the accruals quality is high and investors’uncertainty over predictions of future operating cash flows is low.This helps to ensure the high quality of information concerning future cash flows.Therefore,the extent of earnings management is low,and vice versa.

The DD model requires 7 continuous years of information from annual reports.In Eq.(1),ΔWCtis total accruals at t,measured as operating profit minus operating cash flow;and CFOt-1,CFOtand CFOt+1representthe operating cash flows in periods t-1,t and t+1,respectively.All of the above variables are scaled by average total assets to eliminate the size effect.Using Eq.(1),we regress by each industry and each year separately to obtain the residual εt,which represents abnormal accruals.In the DD model,there are generally two ways to calculate earnings management.The first uses the absolute value of the residual as the proxy for earnings management.The second uses the standard deviation of the residual from t-4 to t for each company to obtain the measure of earnings management.If the volatility of abnormal accruals over 5 years is weak,then the risk of earnings is low,and so is the extent of earnings management.

Koh(2007)points out that there is a difference between negative and positive earnings management. Negative earnings management occurs when management is concerned that firm performance will deteriorate in the future,so they use accounting conservatism to hide the firm’s current performance and thus artificially inflate future pro fits.Positive earnings management is due to company management attempting to hide the firm’s current poor performance by arti ficially inflating pro fits.Although both types of earnings management deceive investors and reduce earnings quality,their motivation and channels of implementation are different. In this paper,we attempt to distinguish the behavior of mutual funds by differentiating between positive and negative earnings management,so we choose the original value of εtas the proxy for earnings management, which is de fined as DD_eq.If DD_eq>0,then the accruals pro fit based on working capital exceeds the actual accruals profit calculated by 3 continuous years of operating cash flows,suggesting that accrual profit may be increased artificially,i.e.positive earnings management DD_eq(+).DD_eq(-)reflects negative earnings management.A higher value of|DD_eq|indicates higher earnings management.

3.2.2.Information asymmetry(InfoAsy)—based on the standard deviation of idiosyncratic risk(SD)

Following Dierkens(1991)and Kong and Fu(2005)7We thank the referee for this suggestion.Although previous studies propose different measures of information asymmetry,we choose to follow Dierkens(1991),who suggests that the standard deviation based on idiosyncratic risk actually reflects the uncertainty offirm value,and this uncertainty stems from the information asymmetry between the company management and investors.When the extent of information asymmetry is higher,the disagreement between investors and management regarding firm value is higher,and the management have more chance to hide idiosyncratic information.As the extent of information asymmetry reduces,investors and management have consistent opinions about firm value and uncertainty is reduced.Although the bid-ask spread can also proxy for information asymmetry,it tends to reflect the information asymmetry in trading,which is more likely to be due to the different private information owned by investors.As this paper is interested in the information asymmetry between the company management and investors,we believe it is feasible to measure information asymmetry following Dierkens(1991)and Kong and Fu(2005).,for each company in each year,we regress the market model.Then,we calculate the standard deviation of the difference between the actual return and the normal return estimated by the market model and use it as the proxy for information asymmetry.The formula is as follows:

where ritis the actual daily return of companies in period t,and^ritis the normal daily return estimated by the following market model:

3.2.3.The classification of institutional investors(Insti)as long-and short-term mutual funds(long/short_ratio)

Previous studies rarely group institutional investors according to their characteristics,but some studies show that there is a bias error in the investment style of mutual funds(Brown and Goetzmann,1997;Sun et al.,2012).Therefore,we do not adopt the classification directly from the database,but follow Yan and Zhang(2009)in classifying mutual funds into long-and short-term investors based on their portfolio turnover over the past year.

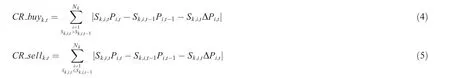

First,we calculate aggregate purchases and sales for each mutual fund k:

where CR_buyk,tand CR_sellk,tare mutual fund k’s aggregate purchases and sales for period t,respectively; Pi,tand Pi,t-1are the share prices for stock i at the end of period t and t-1;Sk,i,tand Sk,i,t-1are the number of shares of stock i held by investor k at the end of periods t and t-1,respectively;and ΔPi,tis the price change from t-1 to t.If the number of shares of stock i held by mutual fund k is less in period t than it is in period t-1,then mutual fund k sold stock i,and the capital change in stock i will be accounted for in aggregate sales,otherwise the capital change will be accounted for in aggregate purchases.

Then,we calculate mutual fund k’s churn rate(CR)for period t:

and obtain mutual fund k’s average churn rate based on the turnover over the past year:

Given the average churn rate measure,for each period t,we sort all mutual funds into three tertile portfolios based on AVG_CR.Those ranked in the bottom tertile are classified as long-term mutual funds and those ranked in the top tertile are classified as short-term mutual funds.Finally,for each stock,we define the longterm(short-term)institutional ownership(hereafter long_ratio and short_ratio)as the ratio of the number of shares held by long-term(short-term)mutual fund investors and the total number of shares outstanding.

3.2.4.Other control variables

There is extensive evidence in the literature that effective corporate governance contributes to the improvement of listed companies’accounting information.There are two views on this issue.The first is agency theory, which examines the relationship between management ownership,corporate governance and information content.Klassen(1997)and Warfield et al.(1995)both find that the pressure from capital markets induces companies with low management ownership to choose accounting measures to increase earnings,which consequently reduces the information content of earnings.The second concerns outside blockholders and focuses on the role of corporate governance and its effect on earnings quality.Kaplan and Minton(1994) and Kang and Shivdasani(1995)find that because outside blockholders have strong incentives to obtain information about companies and monitor management,they play a positive role in corporate governance. Therefore,to control for the influence of corporate governance on earnings management,we choose five corporate governance variables as follows:

Duality:A dummy variable that equals 1 if the chairman and the CEO are the same person,and 0 otherwise;

Out_ratio:The proportion of independent directors on the board;

Top1:The proportion of shareholdings of the largest shareholder;

Top2_10:The aggregate proportion of shareholdings by the second to the 10th largest shareholders;and

CR_5:The aggregate proportion of shareholdings of the top five shareholders.

In addition,financing needs,ultimate controllers,auditors and other firm factors may affect earnings management and information asymmetry.Thus,we also use the following control variables:

Offering:Following Ljungqvist et al.(2009),we use a corporate financing needs dummy variable,which equals 1 if the company has an SEO,rights offering or debt issue in period t,and 0 otherwise;

SOE:A dummy variable that equals 1 if the company is a state-owned enterprise,and 0 otherwise;

Audit:A dummy variable that equals 1 if the audit opinion is unqualified,and 0 otherwise;

TopAudit:A dummy variable that equals 1 if the company’s audit firm is a Big 4 firm,and 0 otherwise.8We thank the referees for this suggestion.

LnSize:Natural logarithm of total assets at the end of the year;

LnMB:Natural logarithm of the market-to-book ratio;and

To:The turnover of listed companies in each year,because Hakim et al.(2008)find that high earnings quality is positively associated with high liquidity.

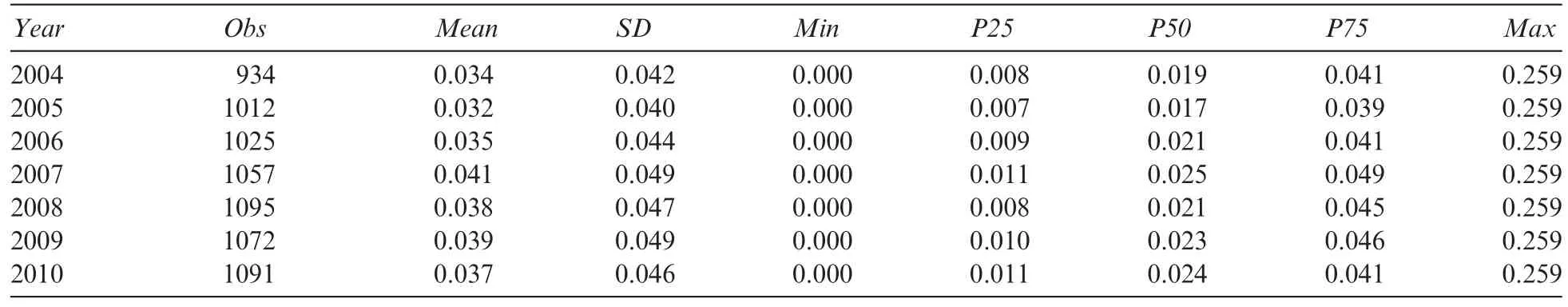

Table 1Descriptive statistics for|DD_eq|.

4.Empirical analysis

4.1.Descriptive statistics

We calculate abnormal accruals for each firm following the DD model,namely DD_eq.Table 1 presents the summary statistics for each year.It shows that since 2004,the earnings quality of listed companies in China first declines and then increases,and peaks in 2007.

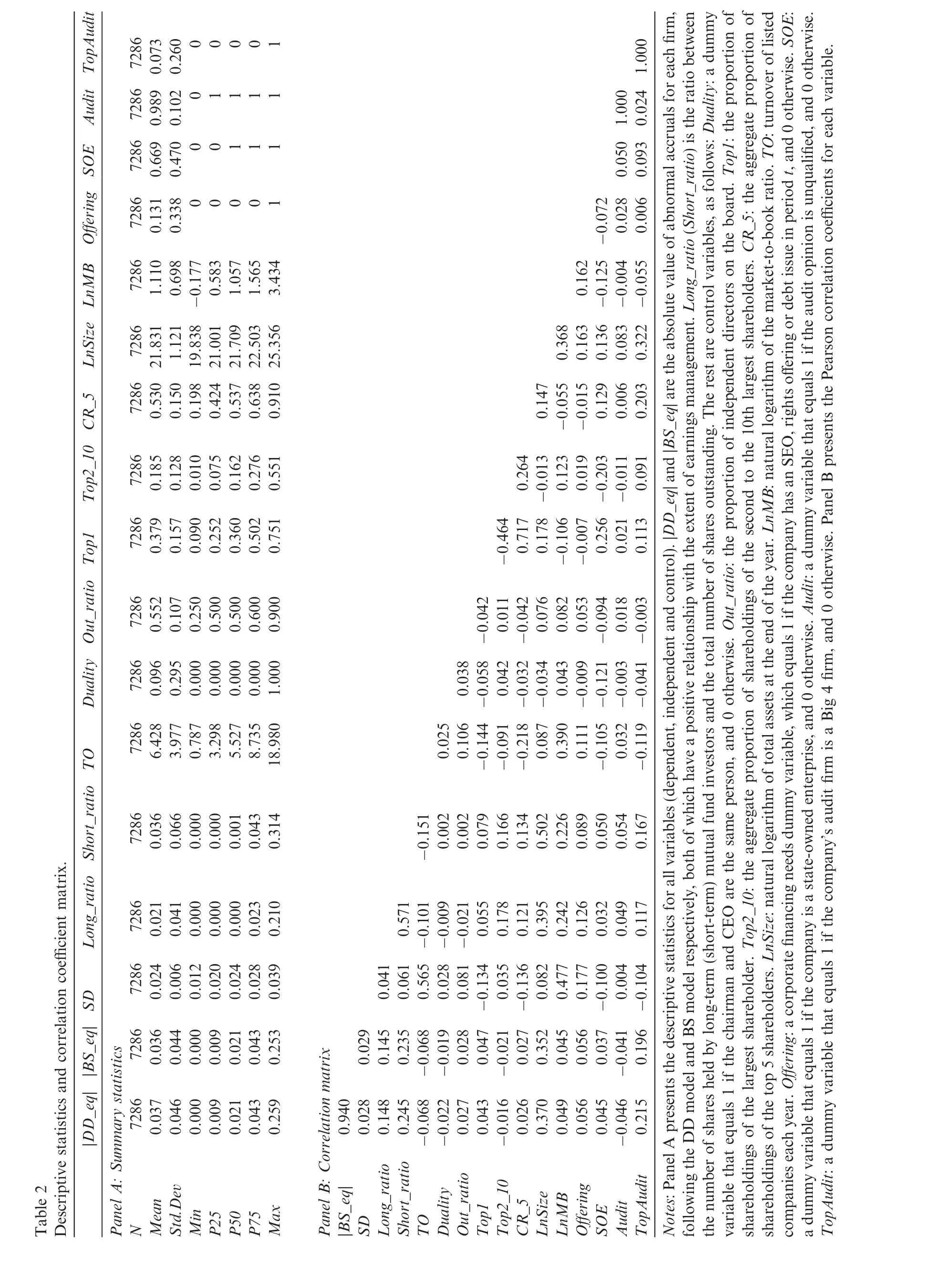

Table 2 presents the summary statistics for the key variables.The table shows that the average|DD_eq|is 0.037,and the range is between 0 and 0.259.The average|BS_eq|is 0.036,and the correlation coefficient of |DD_eq|and|BS_eq|is 0.94,thus it is reliable to use them as the same proxy measure.The mean of SD,which is a proxy for information asymmetry,is 0.024,and the standard deviation is 0.006,suggesting that differences in information asymmetry exist among companies.Furthermore,the average proportion of shareholdings of long-term mutual funds is 0.021 and for short-term mutual funds is 0.036.The summary statistics for the corporate governance variables show that ownership concentration in Chinese listed companies is relatively high. The mean of Top1 is 37.9%and the maximum value is 75.1%,while the average TOP2_10 is 18.5%.Considering the corporate governance structure,on average,the proportion of independent directors is relatively high,with a mean of 55.2%,which can play a positive role in monitoring controlling shareholders and management and protecting minority investors.Meanwhile,the average Duality is 9.6%,which may reduce earnings quality.

Panel B of Table 2 shows that the extent of earnings management is significantly positively related to information asymmetry and the proportion of shareholdings of long-and short-term mutual funds.This suggests that the extent of earnings management increases as the extent of information asymmetry increases,and both long-term and short-term mutual funds are likely to increase earnings management behavior.Both company size and market-to-book ratios are positively related to abnormal accruals,which shows the dominant role of speculation.The negative correlation coefficient between turnover and abnormal accruals is consistent with the conclusion in Hakim et al.(2008).Consideringthe corporate governance variables,Top1 andCR_5 are both positively related to abnormal accruals,which suggests that large shareholders have an incentive to implementtunneling and propping behavior that benefits themselves but damages other shareholders’interests(Liu and He,2004).The direct consequence of tunneling and propping is the reduction of earnings quality,so tunneling behavior will reduce transparency and distort earnings.This finding is consistent with Bertrand et al.(2002).

?

In general,the relationships between the variables are consistent with our predictions.Next,we introduce the control variables and use the regression models to investigate the specific effects of information asymmetry and long-and short-term mutual fund ownership on earnings management.

4.2.Empirical results and analysis

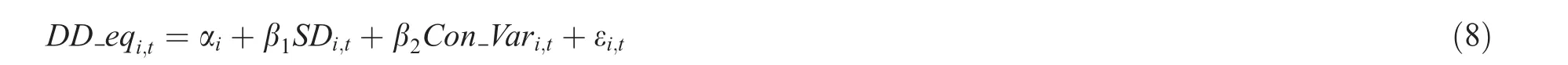

We investigate how the extent of information asymmetry and long/short-term mutual fund ownership,and a combination of the two,affect listed companies’earnings management.To test Hypothesis 1,we examine the relationship between information asymmetry and earnings management,and propose the following regression model:

There is an endogeneity problem between information asymmetry and earnings management,because a reduction in transparency may exacerbate earnings management behavior.High quality earnings information may,in turn,reduce the extent of information asymmetry between shareholders and company management. To mitigate this problem,we adopt a difference-in-difference regression method to control for endogeneity, and propose the following regression model:

In Eqs.(8)and(9),DD_eqi,tis the abnormal accruals offirm i in period t,ΔDD_eqi,tis the change in abnormal accruals from t-1 to t.To distinguish between positive and negative earnings management,we not only use |DD_eqi,t|,but also divide DD_eqi,tinto two groups based on whether the value of DD_eqi,tis larger than 0, then obtain DD_eqi,t(+)and DD_eqi,t(-).SDi,tis a proxy for the extent of information asymmetry for firm i in period t,and ΔSDi,tis the change in information asymmetry from t-1 to t.Con_Vari,tindicates the other control variables for firm i in period t,including LnSize,LnMB,TO,the corporate governance variables (Top1,Duality,Out_ratio,CR_5,Top2_10)and the dummy variables(Offering,SOE,Audit,TopAudit)that may affect the firm’s earnings management.The regression results are presented in Tables 3 and 4.

From the tables,we find that the absolute value of abnormal accruals|DD_eq|(|D_DD_eq|)is significantly positively related to the information asymmetry measure SD(D_SD)in both Eqs.(8)and(9).These results indicate that as the extent of information asymmetry increases,earnings management behavior becomes more serious,thus confirming Hypothesis 1.

We examine positive and negative abnormal accruals separately and find that positive abnormal accruals, DD_eq(+),are signi ficantly positively related to the extent of information asymmetry,and this is also confirmed in the difference-in-difference regression.Negative abnormal accruals,DD_eq(-),are only signi ficantly negatively related to the extent of information asymmetry in Eq.(8),suggesting that when a company’s information transparency is low,both positive and negative earnings management increase,resulting in worse earnings quality.To explain why the coefficient of D_DD_eq(-)is not signi ficant,we consider a more common situation in reality:if a firm’s management have an information advantage and have more private information,they will usually seek to maximize pro fits to attract more investors.Therefore,they have an incentive to cover up any potential operational problems and are more likely to manipulate profits,leading to positive earnings management.Consequently,their earnings quality is worse,as in the well-known Enron scandal or“Yin Guang Xia”incident.Such companies can successfully report deceptive earnings information due to the serious information asymmetry between shareholders and management.In particular,because of the high cost of supervision for minority shareholders,investors lack information and cannot determine the company’s actual earnings,thus directly providing insiders with the opportunity to manipulate earnings and capture short-term gains.In reality,even if a company has the ability to cover up good performance when they face serious information asymmetry,they do not have the incentive to do so because the negative management will have an adverse effect on the company’s short-term performance.Moreover,taking into consideration thecompany’s corporate reputation,long-term development and investor confidence,the company will use less negative earnings management.

According to the above,the higher the extent of information asymmetry,the more serious the extent of earnings management,whether positive or negative.Therefore,to reduce earnings management,regulators should strengthen the supervision of listed companies,improve the quality of information disclosure and reduce the information asymmetry between investors and listed companies.

Table 3Regression results for information asymmetry and earnings management.

Table 4Difference-in-difference regression results for information asymmetry and earnings management.

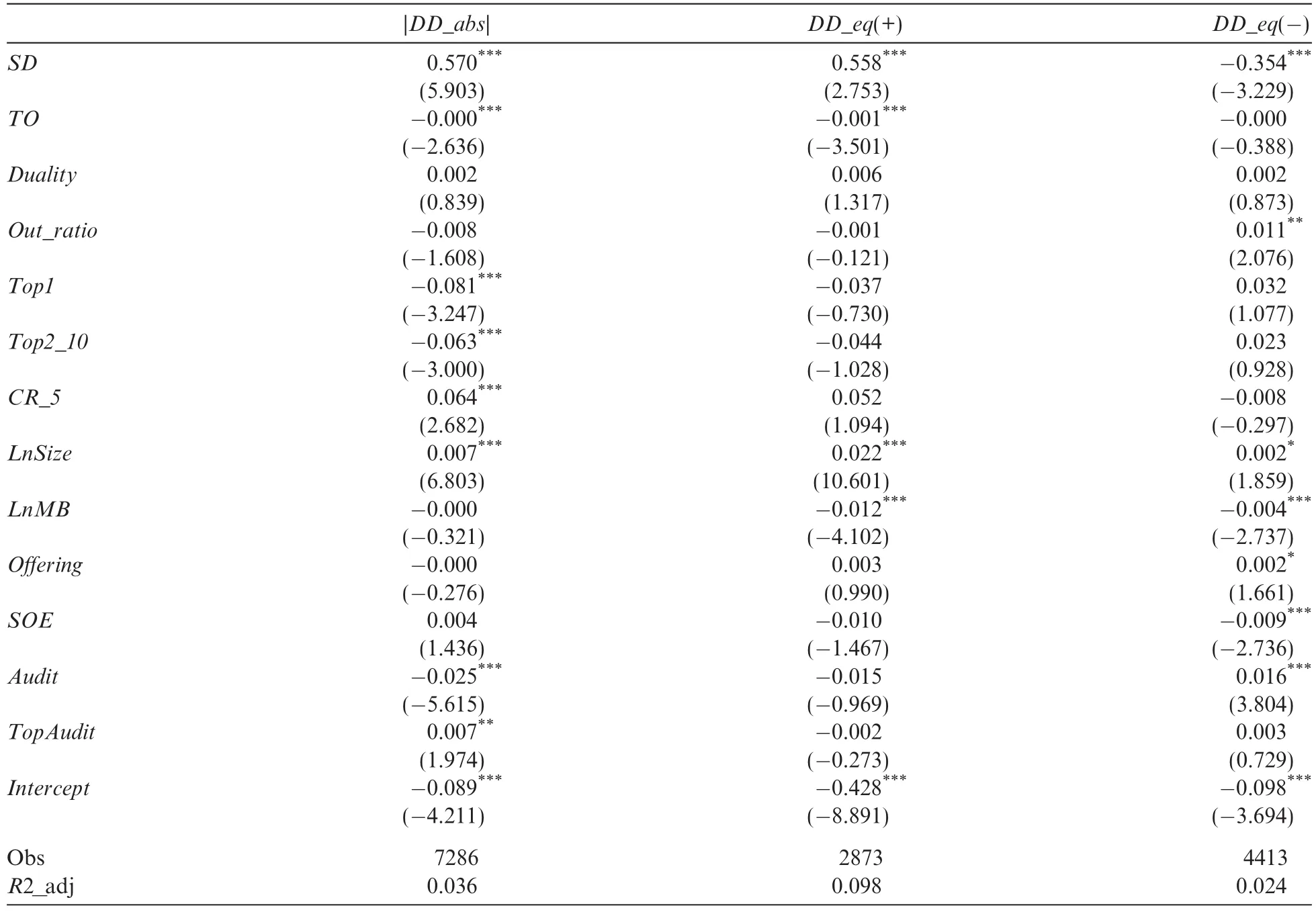

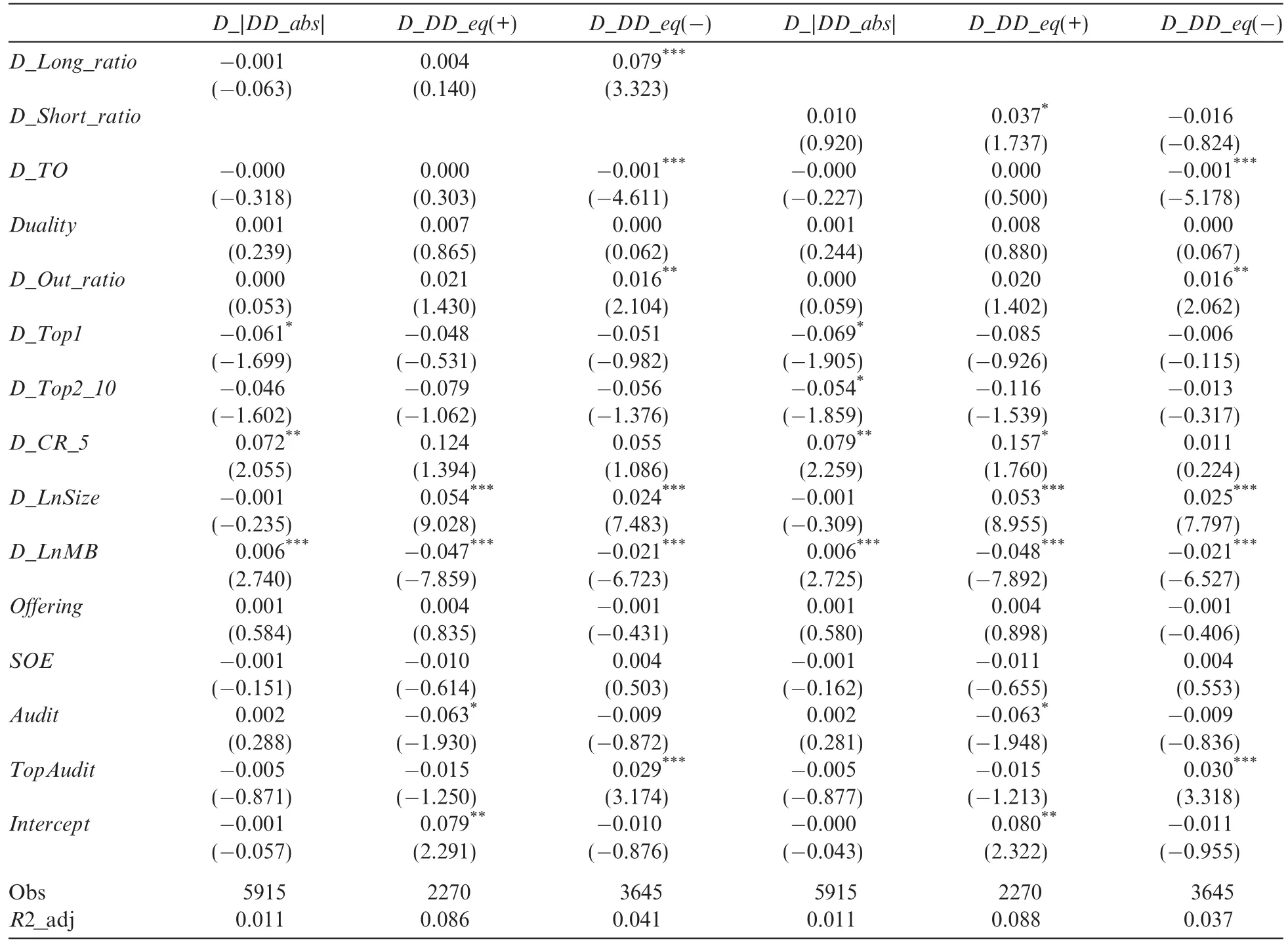

We also use a fixed-effect model to test Hypothesis 2.Because institutional investors may reduce their investment in companies with low earnings quality,we also use a difference-in-difference regression to control for this endogeneity problem,and propose the following equations:

Table 5Regression results for long/short-term mutual funds and earnings management.

where Instii,tis the proportion of shareholdings held by long-or short-term mutual funds i in period t(Long/ Short_ratio).ΔInstii,tis the change in the proportion of shareholdings held by long-or short-term mutual funds from period t-1 to t(D_Long/Short_ratio).Other variables are the same as those used above,and the results are presented in Tables 5 and 6.

Table 6Difference-in-difference regression results for long/short-term mutual funds and earnings management.

The results in Tables 5 and 6 indicate a prominent difference between long-and short-term mutual funds. When the dependent variable is negative earnings management,the coefficient of the proportion of shareholdings held by long-term investors is significantly positive.This implies that long-term mutual funds can reducecompanies’negative earnings management behavior and play a supervisory role of management,because they have an information advantage and can communicate with listed companies effectively.Furthermore,their large investments and long-sighted view of performance means they are more likely to actively participate in corporate governance and monitor management,thereby reducing the company’s profit manipulation behavior.This“supervision effect”increases the company’s earnings quality and increases mutual fund investors’returns to compensate them for their monitoring costs and uncertainty risk.

Table 7Regression results for long/short-term mutual funds and earnings management after grouping based on the extent of information asymmetry.

?

However,we find a difference in short-term mutual funds’investment behavior.Table 5 shows a significant positive relationship between the proportion of shareholdings held by short-term investors and positive abnormal accruals.The sign is consistent with our prediction in the difference-in-difference regression when the dependent variable is D_|DD_abs|,although it is only marginally significant.This result suggests that an increase in the proportion of shares held by short-term mutual funds reduces listed companies’earnings quality and,in particular,increases positive earnings management.We also find that the coefficient for the proportion of shareholdings held by short-term investors is not significant when the dependent variable is negative abnormal accruals.As negative management will not increase short-term returns,there is less incentive to implement negative earnings management to reduce financial reporting quality.

From the investment behavior of long-and short-term mutual funds,we conclude that compared with short-term mutual funds,the monitoring effect of long-term mutual funds on listed companies’earnings management is stronger,consistent with Hypothesis 2.

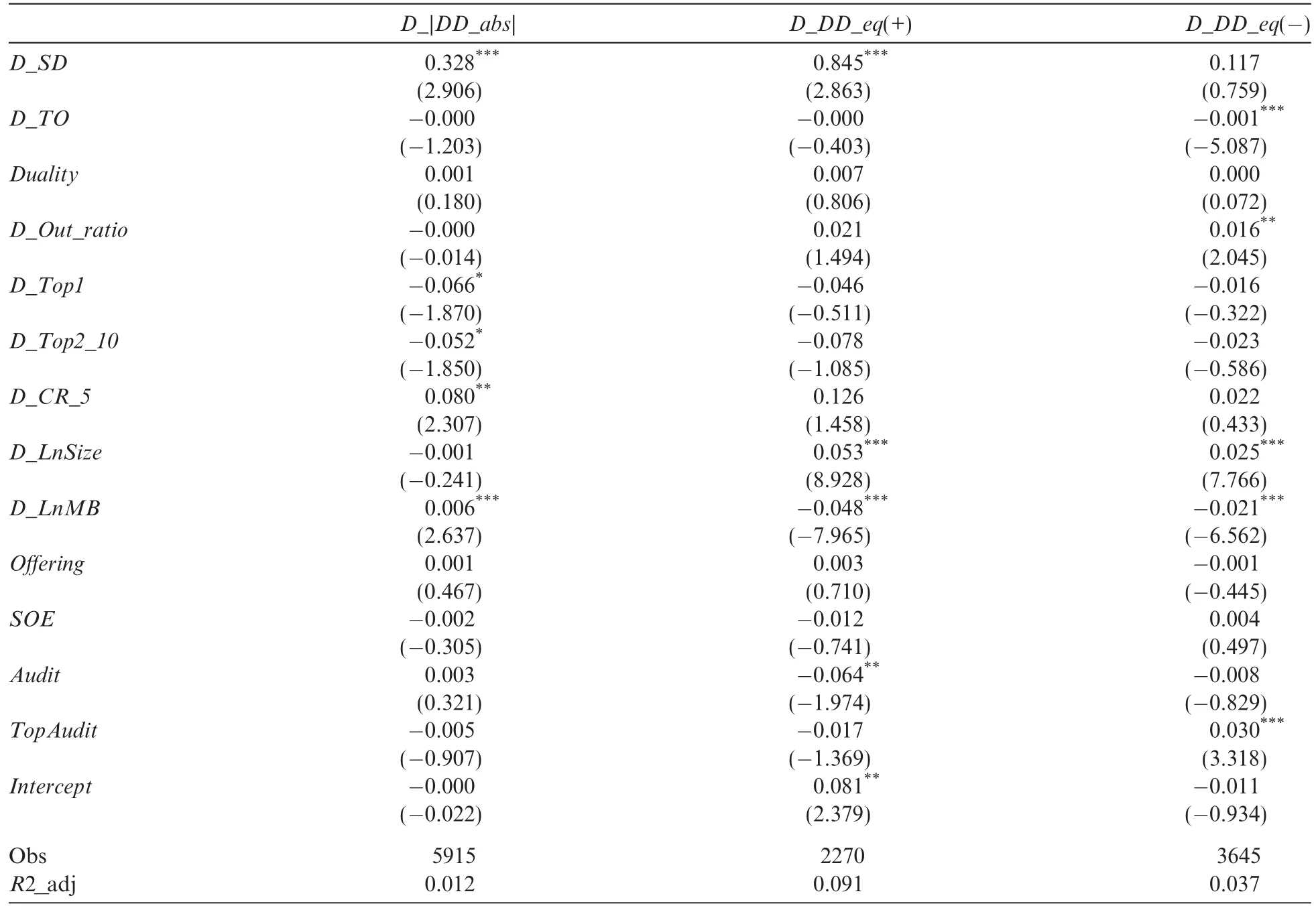

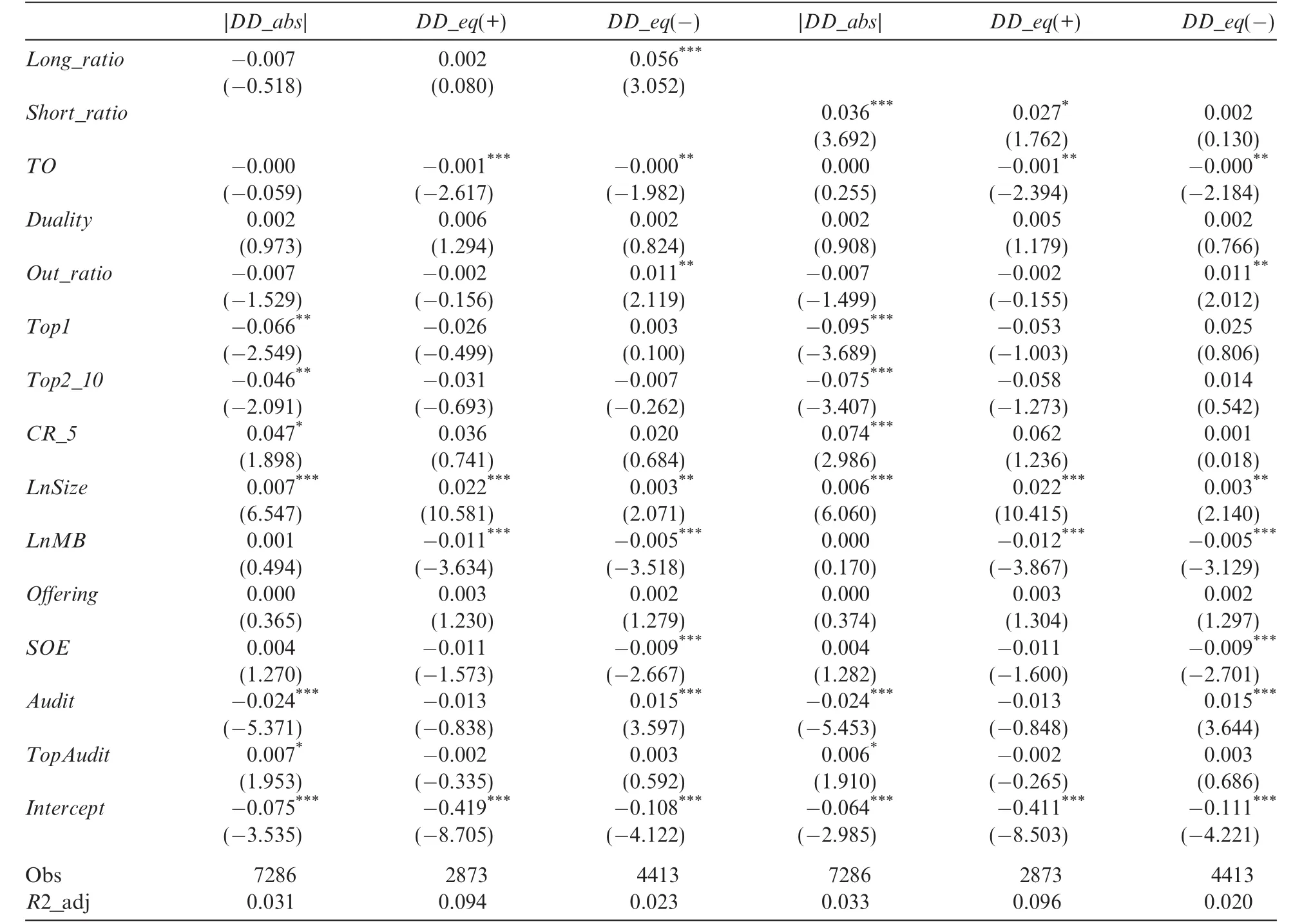

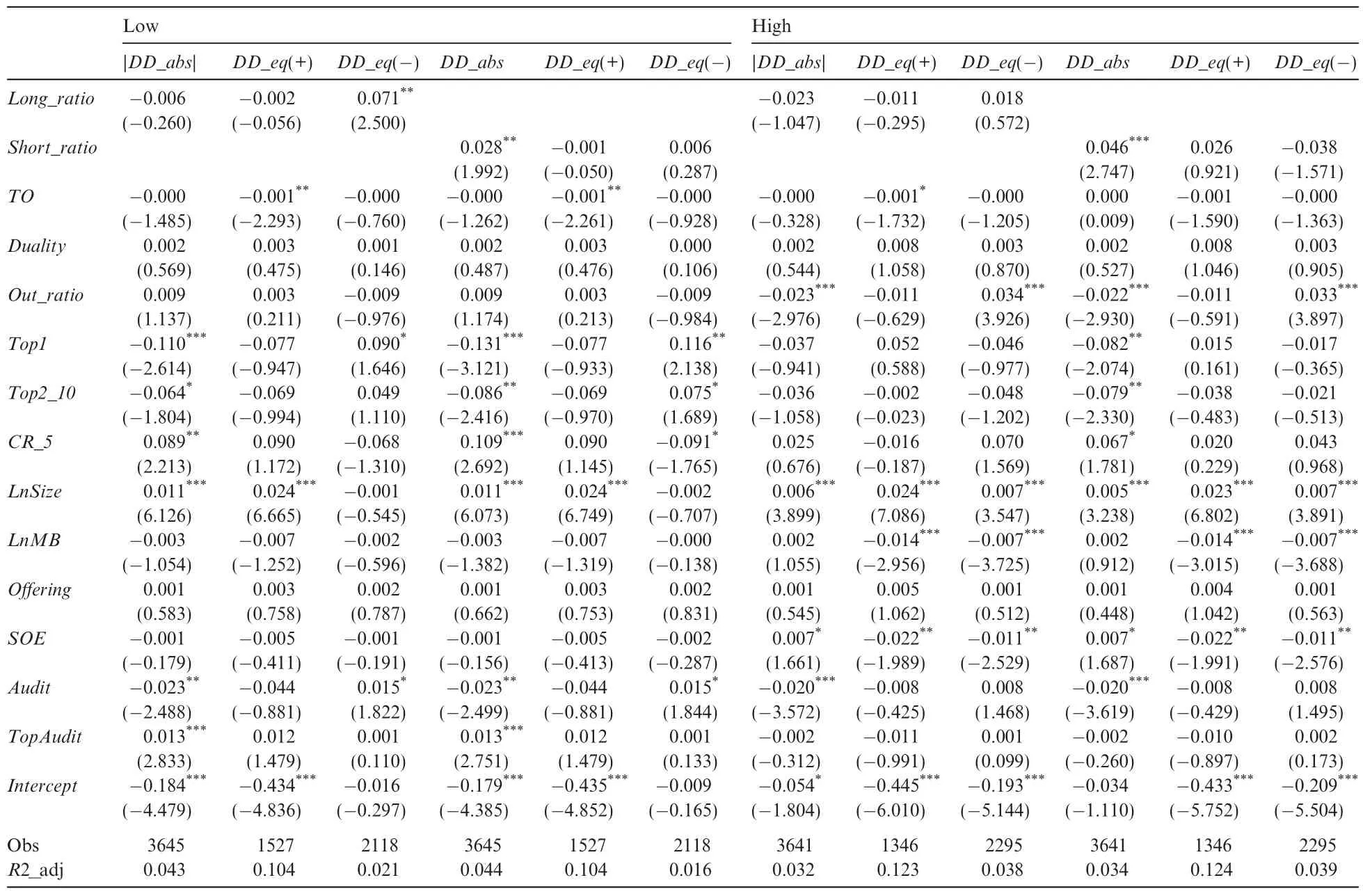

For Hypothesis 3,we divide the sample into Low and High groups based on the extent of listed companies’information asymmetry,and investigate the effect of the proportion of shareholding held by long-and shortterm mutual funds on earnings management in different information environments.The results are presented in Tables 7 and 8.

The results indicate that the speculation of short-term mutual funds is observable,regardless of the extent of information asymmetry.In the low information asymmetry group,for each unit increase in the proportion of short-term mutual funds,the company’s earnings management increases by 2.8%.In the high information asymmetry group,the increase is 4.6%.This suggests that when short-term mutual funds invest in high information asymmetry companies,they are more likely to focus on short-term returns.For long-term mutual funds,when the extent of information asymmetry is low,the proportion of shareholdings is significantly positively related to negative abnormal accruals.This suggests that in a relatively transparent information environment,long-term investors can mitigate negative earnings management and increase earnings quality. However,when the extent of information asymmetry is high,all of the coefficients for long-term mutual funds are non-significant.Therefore,when the information environment is relatively transparent,the monitoring effect of long-term mutual funds on listed companies’earnings management is stronger,consistent with Hypothesis 3.Based on these results,we suggest that it is important to promote the development of long-term institutional investors by expanding information channels and increasing the information transparency between listed companies and investors.

In summary,we find that although short-term mutual funds may exploit their information advantage to trade frequently,when the information environment is more transparent,long-term investors can mitigate earnings management and the earnings information published by listed companies will be more credible.These results reveal the importance of improving transparency for institutional investors.We propose that regulators could prevent institutional investors from manipulating profits and reducing companies’earnings quality by strengthening information disclosure and transparency.

5.Additional tests

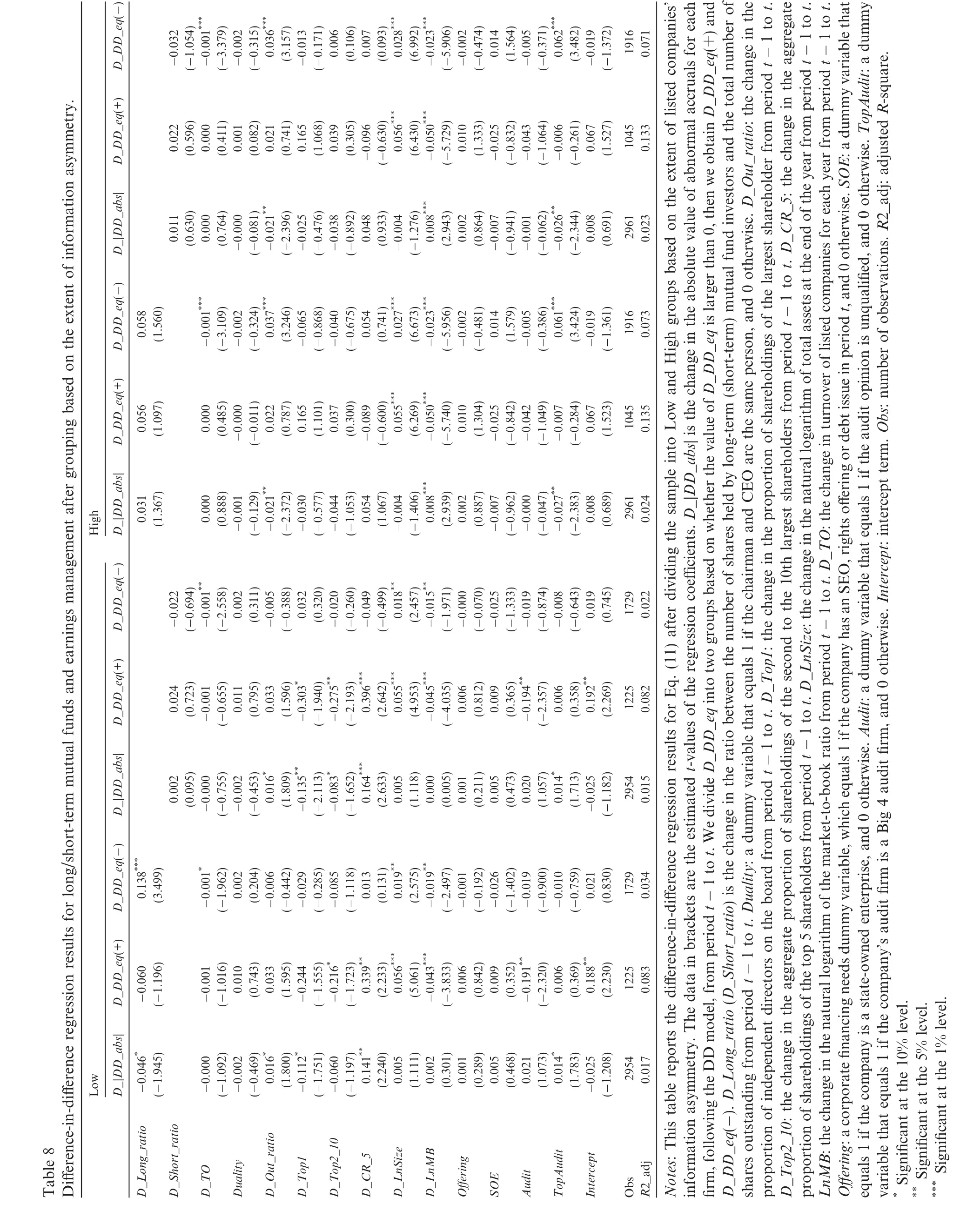

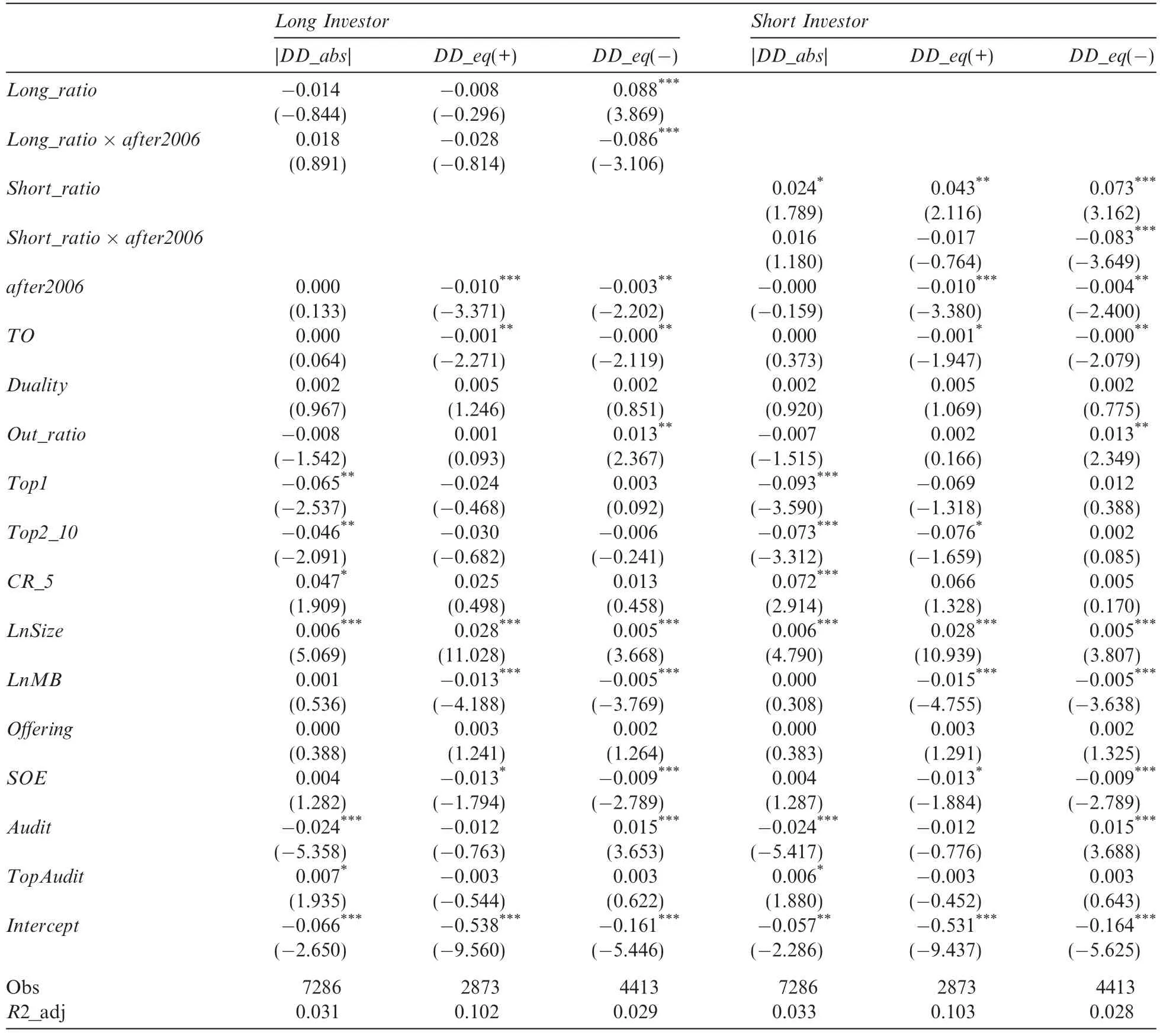

Because Chinese accounting standards changed significantly in 2006,we create a dummy variable to examine the effect of this change.The dummy variable is defined as follows:all years before and including 2006 take the value of 0,and all subsequent years take the value of 1.The interaction terms of this year dummy variable and the other main variables reflect the differences before and after the change in accounting standards.We run the regression using Eqs.(12)and(13),and the results are shown in Tables 9 and 10.

From Table 9,we find that the interaction term coefficients for information asymmetry and the year dummy variable are both significantly positively related to positive and negative earnings quality.This indicates that after 2006,the association between information asymmetry and positive earnings management ismore significantly positive,while the association with negative earnings management is more significantly negative.Overall,however,companies are more likely to artificially increase their earnings by using information asymmetry after 2006.

Table 10Regression results for long/short-term mutual funds and earnings management using year dummy variables.

In Table 10,the coefficients for the interactions between long-and short-term investors and negative earnings management are significantly negative,which suggests that both types of investors have a reduced monitoring effect after 2006.Combining these results with those in Table 9,we conjecture,on the one hand,that more companies might exploit information asymmetry to manipulate earnings after 2006,resulting in a reduction in institutional investors’monitoring behavior.On the other hand,the rapid development of institutional investors in China has created increasingly strong industry competition.Consequently,more and more institutional investors may shun long-term investments and monitoring of corporate governance in favor of shortterm returns.This would also explain the reduced monitoring effect of institutional investors in recent years.

6.Conclusion

In this paper,our sample includes all listed companies in the Chinese A-share market for the 2004-2010 period.We calculate earnings management based on the DD model proposed by Dechow and Dichev(2002), define the standard deviation of idiosyncratic risk as the information asymmetry measure,divide mutual funds in China into long-and short-term mutual funds following Yan and Zhang(2009),and use the proportion of long-and short-term mutual funds as our proxy for institutional investors’shareholdings.In addition,we control for companies’fundamental characteristics,corporate governance,accounting standards,financing needs, auditors and ultimate controllers and so forth,to investigate how the extent of information asymmetry and the behavior of long-and short-term mutual funds affect listed companies’earning management.We also divide our sample into two groups based on the extent of information asymmetry and examine the effect of the interaction between information asymmetry and mutual funds on earnings management.

We find that low information asymmetry can increase companies’earnings quality.This promotes effective monitoring and encourages company management to publish reliable earnings information by expanding information channels and increasing information transparency.Furthermore,the Chinese capital market is speculative,and the good and the bad are intermingled in the mutual fund industry.The empirical results indicate that compared with short-term mutual funds,long-term mutual funds play a supervisory role of company management and effectively reduce negative management behavior,resulting in increased earnings quality.

To further examine the findings,we divide the sample into different groups based on the extent of information asymmetry.Considering the difference in the investment style and objectives of long-and short-term mutual funds,when information asymmetry is low,long-term mutual funds can monitor earnings management more effectively and thus increase earnings quality.However,as the extent of information asymmetry increases,the supervision effect of long-term mutual funds is seriously weakened,while short-term mutual funds are associated with higher earnings management and thus reduce earnings quality.Therefore,it is important for corporate governance to improve information disclosure systems in China and to regulate the behavior of Chinese institutional investors.

Acknowledgements

We thank anonymous referees,Donghua Chen,Yuan Ding,Rui Ge,Feng Liu,Xijia Su,Jinsong Tan and other participants at the CJAR Summer Research Workshop 2012 for their valuable suggestions.All errors are our own.We also acknowledge financial support from the Nature Science Foundation of China(NSFC:71173078;70803013).

Appendix A

A.1.Ball and Shivakumar(2005)piecewise nonlinear regression model

Based on the DD model,Ball and Shivakumar(2005)propose a piecewise nonlinear regression model to improve traditional models.They argue that traditional linear models cannot reflect the nonlinear properties of accruals,so they introduce DCF and the interaction of DCF and CF to adjust the DD model.Wang(2006) and Yang et al.(2007)both use the BS model to measure earnings management.The BS model increases the explanatory power of traditional models,and it only requires financial information for 1 year before and after:

where ACCtis total accruals in period t,CFt,CFt-1and CFt+1are the operational cash flows in periods t, t-1 and t+1,respectively.All variables are scaled by average total assets to eliminate the size effect.DCFtequals 1 if CFt-CFt-1<0,and 0 otherwise.Following the CSRC industry classification standard,we regress by each industry and each year,and the residual εtis the proxy for earnings management,BS_eq.Similar to the DD model,we distinguish between positive earnings management BS_eq(+)and negative earnings management BS_eq(-).The higher the absolute value of|BS_eq|,the higher the extent of earnings management.

Armstrong,C.S.,Guay,W.R.,Weber,J.P.,2010.The role of information and financial reporting in corporate governance and debt contracting.Journal of Accounting and Economics 50(2-3),179-234.

Ball,R.,Shivakumar,L.,2005.Earnings quality in UK private firms:comparative loss recognition timeliness.Journal of Accounting and Economics 39,83-128.

Bartov,E.,Radhakrishnan,S.,Krinsky,I.,2000.Investor sophistication and patterns in stock returns after earnings announcements.The Accounting Review 75(1),43-63.

Bertrand,M.,Mehta,P.,Mullainathan,S.,2002.Ferreting out tunneling:an application to Indian business groups.Quarterly Journal of Economics 117,121-148.

Bhattacharya,N.,Desai,H.,Venkataraman,K.,forthcoming.Does earnings quality affect information asymmetry?Evidence from trading costs.Contemporary Accounting Research.

Brous,P.A.,Kini,O.,1994.The valuation effects of equity issues and the level of institutional ownership.Financial Management 23,33-46.

Brown,S.J.,Goetzmann,W.N.,1997.Mutual fund styles.Journal of Financial Economics 43,373-399.

Bushee,B.J.,1998.The influence of institutional investors on myopic R&D investment behavior.The Accounting Review 73(3),305-333.

Bushee,B.J.,Noe,C.,2000.Corporate disclosure practices,institutional investors,and stock return volatility.Journal of Accounting Research 38,171-202.

Cheng,S.Q.,2006.An empirical study on the relationship between institutional ownership and the listed firms’accounting earnings information.Management World 9,129-136(in Chinese).

Chung,R.,Firth,M.,Kim,J.B.,2002.Institutional monitoring and opportunistic earnings management.Journal of Corporate Finance 8, 29-48.

Coffee,J.C.,1991.Liquidity versus control:the international investor as corporate monitor.Columbia Law Review 91(6),1277-1368.

Dechow,P.M.,Dichev,I.D.,2002.The quality of accruals and earnings:the role of accrual estimation errors.Accounting Review 77,35-59.

Deng,K.B.,Tang,X.Y.,2010.Can institutional investors really decrease earnings management?Evidence from China’s listed firms. Industrial Economics Research 5,71-86(in Chinese).

Dierkens,N.,1991.Information asymmetry and equity issues.Journal of Finance and Quantitative Analysis 26,181-199.

Dye,R.A.,1988.Earnings management in an overlapping generations model.Journal of Accounting Research 26,195-235.

Fang,J.X.,Hong,J.Q.,2007.Listed firms’information disclosure quality and securities analysts’earnings forecasts.Securities Market Herald 3,25-30(in Chinese).

Froot,K.A.,Scharfstein,D.S.,Stein,J.C.,1992.Herd on the street:information inefficiencies in a market with short-term speculation. Journal of Finance 47,1461-1484.

Gao,L.,Zhang,J.,2008.Corporate governance,institutional investors and earnings management.Accounting Research 9,64-72(in Chinese).

Graves,S.B.,1988.Institutional ownership and corporate R&D in the computer industry.Academy of Management Journal 31(2),417-428.

Hakim,F.,Triki,F.,Omri,A.,2008.Earnings quality and equity liquidity:evidence from Tunisia.International Journal of Managerial and Financial Accounting 2,147-165.

Huang,Q.,2009.An empirical study on the relationship between institutional investors and earnings management of China listed companies.Modern Economic Science 4,108-115(in Chinese).

Hunt,A.,Moyer,S.,Shevlin,T.,1996.Managing interacting accounting measures to meet multiple objectives:a study of LIFO firms. Journal of Accounting and Economics 21(3),339-374.

Hunton,J.E.,Libby,R.,Mazza,C.L.,2006.Financial reporting transparency and earnings management.The Accounting Review 81(1), 135-157.

Jiambalvo,J.,Rajgopal,S.,Venkatachalam,M.,2002.Institutional ownership and the extent to which stock prices reflect future earnings. Contemporary Accounting Research 19(1),117-145.

Jo,H.,Kim,Y.,2007.Disclosure frequency and earnings management.Journal of Financial Economics 84(5),561-590.

Kahn,C.,Winton,A.,1998.Ownership structure,speculation,and shareholder intervention.Journal of Finance 53(1),99-129.

Kang,J.K.,Shivdasani,A.,1995.Firm performance,corporate governance and top executive turnover in Japan.Journal of Financial Economics 38,29-58.

Kaplan,S.N.,Minton,B.A.,1994.Appointments of outsiders to Japanese boards:determinants and implications for managers.Journal of Financial Economics 36,225-257.

Klassen,K.J.,1997.The impact of inside ownership concentration on the trade-of fbetween financial and tax reporting.The Accounting Review 72(3),455-474.

Koh,P.S.,2007.Institutional investor type,earnings management and benchmark beaters.Journal of Accounting and Public Policy 26, 267-299.

Kong,D.M.,Fu,K.H.,2005.A study on market reaction and impact factors of the Chinese stock market’s seasoned equity offerings. World Economy 10,51-59(in Chinese).

Lev,B.,Thiagarajan,S.R.,1993.Fundamental information analysis.Journal of Accounting Research 31(2),190-215.

Liu,F.,He,J.G.,2004.Ownership structure and substantial shareholders’choice in interest realizing methods:tentative study on tunneling in Chinese capital market.China Accounting Review 2,141-158(in Chinese).

Liu,L.Y.,Peng,E.Y.,2006.Institutional Ownership Composition and Accruals Quality.Working Paper.

Ljungqvist,A.,Mally,C.J.,Marston,F.C.,2009.Rewriting history.Journal of Finance 64,1935-1960.

Porter,G.,1992.Accounting earnings announcements,institutional investor concentration and common stock returns.Journal of Accounting Research 30(1),46-155.

Prowse,S.D.,1990.Institutional investment patterns and corporate financial behavior in the United States and Japan.Journal of Financial Economics 27,43-66.

Ramalingegowda,S.,Yu,Y.,2012.Institutional ownership and conservatism.Journal of Accounting and Economics 53,98-114.

Richardson,V.J.,2000.Information asymmetry and earnings management:some evidence.Review of Quantitative Finance and Accounting 15(4),325-347.

Schipper,K.,1989.Commentary on earnings management.Accounting Horizons 3(4),91-102.

Sun,Z.,Wang,A.,Zheng,L.,2012.The road less traveled:strategy distinctiveness and hedge fund performance.Review of Financial Studies 25(1),96-120.

Trueman,B.,Titman,S.,1988.An explanation for accounting income smoothing.Journal of Accounting Research 26,127-139.

Wang,D.C.,2006.Founding family ownership and earnings quality.Journal of Accounting Research 44,619-656.

Warfield,T.D.,Wild,J.J.,Wild,K.L.,1995.Managerial ownership,accounting choices,and informativeness of earnings.Journal of Accounting and Economics 20,61-91.

Xia,L.J.,Lu,X.N.,2005.On the relationship between earnings management and information disclosure quality of listed firms. Contemporary Economy&Management 10,145-150(in Chinese).

Yang,D.M.,2005.The disclosure of information forecasts and earnings management.Chinese Journal of Management Science 7,108-112 (in Chinese).

Yang,D.M.,Lin,B.,Xin,Q.Q.,2007.Earnings quality,investors’reasonless behavior and earnings momentum.Journal of Financial Research 2,122-132(in Chinese).

Yan,X.M.,Zhang,Z.,2009.Institutional investors and equity returns:are short-term institutions better informed?Review of Financial Studies 22,893-924.

Zhao,T.,Zheng,Z.X.,2002.Asymmetric information and manipulate stock in institutions behavior.Economic Research Journal 7,41-48 (in Chinese).

19 August 2012

*Corresponding author.Tel.:+86 15927068886.

E-mail addresses:daiyunhao@hust.edu.cn(Y.Dai),kongdm@hust.edu.cn(D.Kong),wang_li@hust.edu.cn(L.Wang).

Information asymmetry

Mutual funds

Earnings management