Determinants of human resource investment in internal controls

Jong-Hag Choi,Joonil Lee,Catherine Heyjung Sonu

College of Business Administration,Seoul National University,Republic of Korea

Determinants of human resource investment in internal controls

Jong-Hag Choi*,Joonil Lee,Catherine Heyjung Sonu

College of Business Administration,Seoul National University,Republic of Korea

A R T I C L EI N F O

Article history:

Using the unique reporting environment in Korea,this study investigates the determinants of human resource investment in internal controls for 1352 listed firms disclosing the number of personnel who are in charge of internal controlrelated tasks(IC personnel)from 2005 to 2008.We find that the number of IC personnel within a firm and several key departments increase with firm size, number of employees,complexity and for Chaebols,and decrease in rapidly growing firms.Additional analysis reveals that the factors influencing internal control systems have an accentuated effect on firms with relatively larger firm size.

Ⓒ2013 Production and hosting by Elsevier B.V.on behalf of China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong.

1.Introduction

In this study,we examine the determinants of human resource investment in internal controls.Internal control systems,which are vital to the continual existence of a firm,consist of measures implemented by a firm aimed at achieving purposes that include,but not limited to,safeguarding of assets and resources,deterring and detecting errors and fraud,ensuring accuracy and completeness of accounting data,and producing reliable and relevant financial information.Among the procedures and policies for internal control systems, internal controls over financial reporting are defined as a process designed to“provide reasonable assuranceregarding the reliability offinancial reporting and the preparation offinancial statements for external purposes”(Public Company Accounting Oversight Board(PCAOB),2004).1Specifically,the objective of the policies and procedures related to internal controls of a company are threefold:it aims“(1)to maintain records that accurately and fairly reflect the transactions and dispositions of the assets of the company,(2)to provide reasonable assurance that transactions are recorded in accordance with generally accepted accounting principles,and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company;and(3)to provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition,use or disposition of the company’s assets that could have a material effect on the financial statements”(PCAOB,2004).A good control environment has the potential to enhance the quality offinancial reports,and thus,is considered an important feature of a firm (Ashbaugh-Skaife et al.,2008).

In an effort to improve the reliability offinancial reporting,the US Congress enacted the Sarbanes-Oxley Act(SOX)in 2002 to improve firms’financial reporting practice.Section 302 of SOX requires management to indicate any significant changes in internal controls,while Section 404 of SOX enforces firms to assess the design and operating effectiveness,and auditors to certify the effectiveness of internal controls over financial reporting(Securities and Exchange Commission,2002,2003).In response to the wave offinancial reporting reforms,Korea also adopted several new regulations.First,the“Act on External Audit of Stock Companies”(the“External Audit Act”),which includes the regulation on the mandatory audit for the firms over a certain size,was significantly amended to improve the financial reporting environment in Korea.Specifically,the Act requires CEOs and CFOs of a firm to oversee and report on the operation and effectiveness of the internal control system to the board of directors.It also requires external auditors to evaluate the assessment by management on the internal control system and express their review opinion on the system.Importantly,the Financial Supervisory Service(the equivalent of the Securities and Exchange Commission in the US)issued a guideline in 2002 which requires every listed firm to disclose its total number of personnel who are in charge of internal control-related tasks(hereafter IC personnel)and the number of IC personnel by department.The requirement is the first in the world with no other countries having adopted a similar disclosure requirement. We use a hand-collected sample of Korean companies that disclosed the number of IC personnel from 2005 to 2008 to investigate factors which affect the human resource investment in internal controls.We define the number of IC personnel as a proxy for the investment in the internal control system.

Our results indicate that firms with a relatively high number of IC personnel are positively associated with(1) firm size,measured by the natural logarithm of total assets;(2)the number of employees,measured by the natural logarithm of the number of employees;(3) financial reporting complexity,as measured by a2Business conglomerates(group offirms)owned by founding families are called Chaebols in Korea.Chaebol firms dominate the Korean economy(Kim and Yi,2006;Kwon et al.,2012;Lee et al.,2012).ssets denominatedinforeigncurrenciesdeflatedbytotalassets;and(4)whethera firmisaChaebol firmornot.However,the numberofICpersonnelisnegativelyassociatedwith firmgrowth,measuredbysalesgrowthfromyeart-1tot. Furthermore,such relations are found to be pronounced among larger firms.These firm characteristics incentivize management to build and maintain a strong internal control system by securing sufficient IC personnel, which reduce problems related to the segregation of duties,inadequate staffing and supervision problems.

SincetheimplementationofSections302and404,therearealargenumberofstudiesinvestigatingtheareaof internal controls.One line of studies oninternalcontrols documents thepositivereporting effects ofhigh quality internal control systems.Doyle et al.(2007b)and Ashbaugh-Skaife et al.(2008)suggest that effective internal controls,measured by the non-existence of internal control weaknesses,increase financial reporting quality, proxied by accruals quality and the size of abnormal accruals,respectively.Furthermore,Ashbaugh-Skaife et al.(2009)find that adequate internal controls reduce information risk,thus lowering the cost of equity.Similarresults arereportedusingthedataonICpersonnelinKorea.Choi etal.(2013)findthattheproportionofIC personnel within the firm is negatively associated with the likelihood that the firm has internal control weaknesses.Lee et al.(2010)investigate the relation between IC personnel and audit fees and suggest that the high quality audit demanded by companies with larger investments in internal controls leads to higher audit fees.

Related to this study,prior research has identified the determinants of internal control weaknesses,arguing that firms with material weaknesses tend to be less profitable,smaller,younger,more complex,growing rapidly or undergoing restructuring(e.g.,Ge and McVay,2005;Krishnan,2005;Ashbaugh-Skaife et al.,2007;Doyle et al.,2007a).Our general findings about firms which heavily invest in increasing IC personnel,discussed above,complement and corroborate the findings of prior studies.We differ from prior literature in that we investigate the drivers for relatively high investment in human resource in internal controls,rather than the determinants offirms with material weaknesses.In so doing,we provide insight on the type of corporate environment that induces firms to make investments in information systems and internal controls.The investment in IC personnel eventually influences the strength of internal controls(Choi et al.,2013).In this respect,we believe that the results based on a unique reporting requirement in Korea offer valuable implications to stand-setters,practitioners and academics around the world.

The remainder of this paper is structured as follows.In Section 2,we discuss the institutional background in Korea and review prior literature.We develop research hypotheses in Section 3.In Section 4,we discuss our research design and specify our empirical models.Section 5 describes our sample and presents descriptive statistics.In Section 6,we present our empirical results and perform an additional test.Finally,Section 7 sets forth our conclusions.

2.The regulatory environment in korea and relevant literature

2.1.Regulatory background in Korea

Before the adoption of International Financial Reporting Standards(IFRS)in 2011,Korea used a set of accounting standards known as K-GAAP(Korean Generally Accepted Accounting Principles),which is similar to U.S.GAAP(Generally Accepted Accounting Principles).The convergence efforts led Korea to adopt IFRS beginning in 2011 and allow early adoption of IFRS from 2009.While the regulations and standards in Korea closely resemble those in developed countries,the enforcement system is not as strong(Choi et al., 2013).A distinctive feature of the Korean economy is that the influence of Chaebols,which are Korean business conglomerates,is substantial(Kim and Yi,2006;Kwon et al.,2012;Lee et al.,2012).Total assets of the 200 largest companies,most of which are Chaebols,in Korea increased from 84.1%to 101.2%of Gross Domestic Product,and sales increased from 70.5%to 86.5%over the decade from 1991 to 2001(Solidarity for Economic Reform,2010).Given the important role of Chaebols in Korea,their survival is vital for the continued growth of the Korean economy.

Before the passage of SOX,the regulations on internal controls offirms were virtually non-existent in Korea(Kim et al.,2007;Kim,2009;Choi et al.,2013).In response to the series of worldwide corporate scandals in 2002,the Financial Supervisory Service announced action plans to improve transparency of the accounting standards and systems in Korea.A series of plans was mandated into law and is referred to as K-SOX(Choi et al.,2013).Similar to SOX,the reform requires certification by CEOs and CFOs of the reliability of the financial reports,a mandatory rotation of auditors every 6 years and prohibits provision of certain non-audit services by incumbent auditors.It also enacted a Securities Class Action Suit Law,which increases the legal liability offirms,management and auditors with respect to financial reporting.Additionally,the plan enhanced the transparency of internal control systems by strengthening the unclear set of regulations that existed on internal control systems(Shin,2007).

The first wave of changes in regulations was implemented through amendments in the“External Audit Act”.It governs the rules on external auditing and was amended in December 2003 to include regulations on internal control systems.Specifically,Article 2-2 of the External Audit Act requires that any company with total assets over 7 billion Korean Won(approximately US$6 million)maintain rules and procedures on internal controls and implement adequate internal control systems.It sets forth the responsibilities of CEOs and CFOs to create and oversee their firm’s internal control system and designates one of the directors to be in charge of the operation of the internal control system.This designated director is required to report on the operation of the internal control system to the board of directors and the statutory auditor or an audit committee on a semi-annual basis.3The role of a statutory auditor in Korea is to supervise the board of directors.It is required for large public companies of which total assets are over 2 trillion Korean Won($1.7 billion)to create an audit committee.The rule states that a public company can have either at least one full-time statutory auditor or an audit committee comprised of at least three board members.The statutory auditor or an audit committee should evaluate the effectivenessof the internal control system and report his evaluation to the board of directors annually(Kim et al.,2007; Shin,2007;Kim,2009;Choi et al.,2013).

Article 2-3 of the External Audit Act defines the responsibilities of external auditors related to internal controls.External auditors are required to evaluate management’s report on the assessment of internal controls and express their review opinions.The difference between SOX Section 404 and related K-SOX regulation in article 2-3 of the External Audit Act is that Section 404(b)requires auditors’attestation while the Korean counterpart requires auditors’review opinion,which provides a lower level of assurance than an audit (Kim et al.,2007;Shin,2007;Kim,2009;Choi et al.,2013).

Secondly,the Operating Committee of Internal Control over Financial Reporting in Korea,which is a committee of the Korea Listed Companies Association,issued the Best Practice Guideline for Internal Control over Financial Reporting(the“Guideline”)in June 2005 to reform the accounting system in Korea.The guideline,which is similar to the U.S.Committee of Sponsoring Organization’s(COSO,1992)framework,provides an integrated framework for Korean companies to design and operate an effective internal control system and to evaluate the effectiveness of the system(Choi et al.,2013).Accordingly,in 2005,the Korean Institute of Certified Public Accountants issued the“Standard of Review of Internal Control Systems”,which is similar to PCAOB’s(2004)Auditing Standard No.2 in the US,although the level of assurance is slightly lower in Korea(Choi et al.,2013).

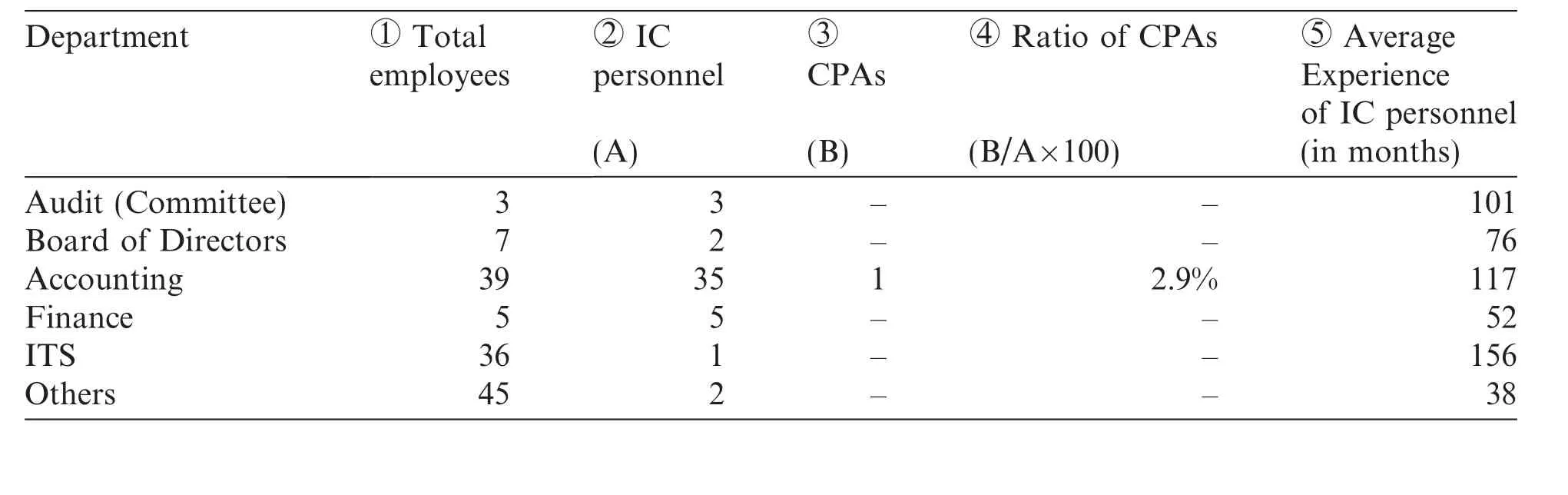

The Financial Supervisory Service issued guidelines in 2002 on disclosures related to internal control systems which require every listed firm to report its total number of IC personnel and the number of IC personnel by department(accounting department,audit committee,board of directors,finance department,information technology and system(ITS)and“other”4“Other”pertains to the different departments that are related to internal control tasks,not all other departments existing in the firm.departments).Additionally,the guidelines mandate the disclosure of the number of certified public accountants(CPAs)in each department and the average length of experience of the IC personnel.These data are disclosed in the“Report on the operation of internal control systems”as a part of a firm’s annual report and an example of the disclosure on IC personnel is presented in the Appendix for reference.Overall,regulations on internal controls in Korea are similar to those in the US although the level of enforcement may be slightly weaker.

2.2.Prior literature

After the data on internal controls became available upon the enactment of Sections 302 and 404 of SOX, voluminous studies on internal controls have emerged.One strand of research investigates the effect of internal control weaknesses on the capital market.Beneish et al.(2008)and Ogneva et al.(2007)document the adverse stock price reaction to the disclosure of internal control weaknesses.Additionally,Hammersley et al.(2008) report that the adverse consequences of disclosure of material weaknesses depend on the severity of internal control weaknesses.

Another strand of research investigates whether the quality of internal controls affects financial reporting quality.Doyle et al.(2007b)document a negative relationship between accruals quality and ICWs filed under Section 302.Ashbaugh-Skaife et al.(2008)suggest that earnings quality improves following the remediation of internal control weaknesses reported under both Sections 302 and 404.Korean studies by Shin(2007)and Lee et al.(2007)report similar findings.Furthermore,Feng et al.(2009)examine the relation between internal controls and the accuracy of management guidance and conclude that internal control quality leads to fewer errors in internal management reports.Other studies argue that internal control systems can be influenced by the monitoring mechanisms in place,such as an independent board of directors or audit effort(Krishnan, 2005;Hogan and Wilkins,2008),with weak monitoring mechanisms resulting in internal control weaknesses.

There are two studies which use the data on IC personnel in Korea.Choi et al.(2013)investigate the effect of the quality of internal control systems on internal control weaknesses and show that the proportion of IC personnel is inversely related to the existence of internal control weaknesses,both at the firm and department levels.This finding is in line with Ge and McVay(2005),who conclude that poor internal controls can be attributed to the lack of qualified accounting personnel.The second study that uses the IC personnel datais Lee et al.(2010)who focus on the effect of internal control quality on audit fees.They document a positive relationship between IC personnel and audit fees.The findings suggest that firms with a higher number of IC personnel require a more thorough audit.As a result,auditors increase their effort level(i.e.,increase audit hours),which is reflected in higher audit fees.

The strand of literature for which our work is relevant is the literature that identifies the determinants of internal control weaknesses.Using data from the pre-SOX period,Krishnan(2005)examines internal control deficiencies,which consist of both significant deficiencies and those not classified as material weaknesses,for the period 1994-2000.She investigates the characteristics of material weakness firms,focusing on the effect of the quality of monitoring systems(e.g.,board of directors,audit committees)on internal control weaknesses. Ge and McVay(2005)document that firms with material weaknesses are relatively more complex,smaller and less profitable,compared to firms without material weaknesses.Doyle et al.(2007a)find results similar to those in Ge and McVay(2005)but include additional variables such as firm age,extreme sales growth and restructuring charge.Doyle et al.(2007a)add to the literature by suggesting that firms disclosing material weaknesses tend to be younger,growth firms and undergoing restructuring.Ashbaugh-Skaife et al.(2007)partially confirm the findings in Doyle et al.(2007a)by documenting that firms with internal control weaknesses are more complex and add that such firms have recent changes in organizational structure,more accounting risk exposure,and fewer resources to invest in internal controls.

This paper corroborates prior findings in this line of literature by analyzing the types of firms that hire sufficient personnel in internal control-related departments.Firms with a relatively high number of IC personnel are likely to have fewer de ficiencies in the financial reporting process,segregation of duties problems and inappropriate account reconciliation caused by the lack of quali fied accounting personnel(Choi et al.,2013).Compared with most prior studies,we present a much more balanced analysis on the characteristics of firms with varying levels of internal control strength because the data used in this study allows us to make comparisons across all companies regardless of whether or not they report an internal control weakness.In contrast,most prior studies focus on the difference between firms with internal control weaknesses and other firms without weaknesses,thereby treating all firms not reporting internal control weaknesses(more than 95%in most analyses)as being equal.5By focusing on the number of IC personnel,we can look into the firms without internal control weaknesses and infer how strong the internal control system of these firms is.In this respect,we believe that our analyses provide valuable insights over the findings in prior studies.Thus,the results of our study offer a more general picture of the types offirms that strive for high quality internal control systems.

3.Hypotheses development

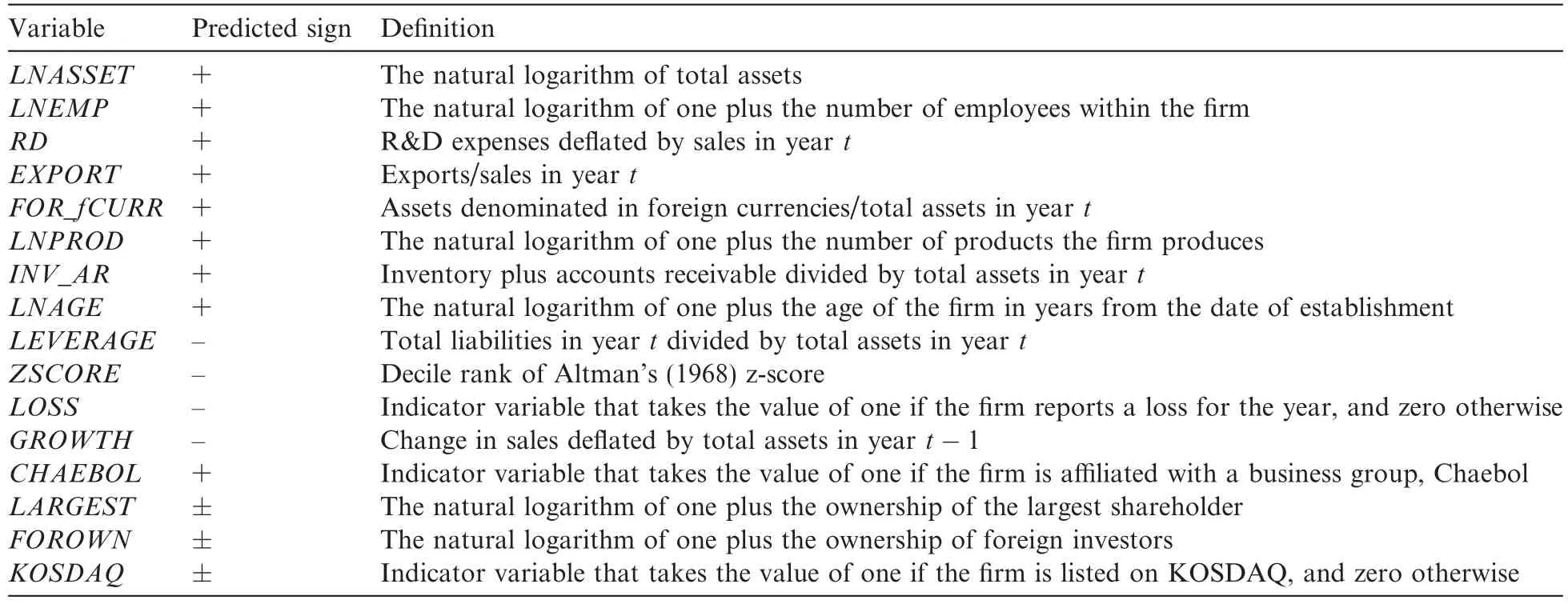

In this section,we investigate the specific characteristics that are associated with firms that have a relatively high number of IC personnel.Based on the guidance and results from prior research,we explore eight aspects:size,business complexity,age,financial distress,growth,business group,corporate governance and the type of exchange market.We present predictions on the directional relationships between IC personnel and factors that determine IC personnel in Table 1.

Firstly,literature shows conflicting evidence on the effect of size on internal control quality.Krishnan (2005)finds a negative relationship between firm size and quality of controls.In contrast,studies investigating the factors that are important in determining the likelihood that a firm will disclose an internal control def iciency generally find a positive association between firm size and the quality of internal controls(Ge and McVay,2005;Ashbaugh-Skaife et al.,2007;Doyle et al.,2007a).Though the evidence is mixed,intuition suggests that large firms have the resources to invest in hiring more qualified internal control personnel which will ensure adequate policies and procedures to be in place.Beasley,(1996),who focus on the cases offinancial statement fraud,document a negative relationship between firm size and incidence of fraud.Thus,we expect to find higher quality internal controls for larger firms.We measure size by the natural logarithm of total assets(LNASSET)and the natural logarithm of the number of employees within a firm(LNEMP).

Another factor that likely determines IC personnel is complexity of the firm.Firms with complex operations and transactions are more likely to experience internal control problems(Ashbaugh-Skaife et al.,2007).We posit that firms with greater complexity and diverse operations have a higher demand for effective internal control systems to prevent deficiencies in internal controls.For example,a multinational firm which has branches in various locations is affected by the different legal and institutional environments in each country,making it more difficult to structure adequate internal control systems.Also,firms with many distinct product lines,relative to firms with a single product line,need to implement policies and procedures separately for each product line,thus affecting effective internal controls.In summary,we conjecture that firms with high levels of complexity will heavily invest in their internal control systems.We measure complexity using five proxies including RD,defined as research and development expenses deflated by sales in year t;EXPORT, defined as the ratio of exports to total sales in year t;FOR_CURR,defined as assets denominated in foreign currencies divided by total assets in year t;LNPROD,defined as the natural logarithm of one plus the number of products the firm produces;and INV_AR,defined as the sum of inventory and accounts receivables divided by total assets in year t.6These variables are frequently used in prior studies to represent firm complexity(e.g.,Ashbaugh-Skaife et al.,2007;Choi et al.,2008, 2013).

Thirdly,the experience of a firm may be associated with the effectiveness of its internal control system. Older firms are likely to have more established processes and procedures in place due to longer experience. Prior studies suggest that firms reporting material weaknesses tend to be younger(Ge and McVay,2005; Doyle et al.,2007a).In connection to the number of IC personnel,it is likely that older firms have established adequate controls in place and are staffed with experienced accounting personnel who are capable of achieving effective internal control systems,thus reducing the need for a higher number of IC personnel.Age is measured by the natural logarithm of one plus the age of the firm in years from the date of establishment(LNAGE).We predict a positive sign for LNAGE.

Table 1Variable definitions and expected relationships with IC personnel.

The fourth determinant of IC personnel is a firms’ financial health.The ability to establish proper internal control systems may be affected by the performance of firms.Krishnan(2005)argues that poorly performing firms may not be able to invest in adequate internal control systems and reports results consistent with this argument.Relatedly,Ge and McVay(2005) find firm pro fitability to be inversely related to firm disclosure of maternal weaknesses.Doyle et al.(2007a)con firm the findings in Ge and McVay(2005)and report that two financial resources measures,the existence of a loss and bankruptcy risk,are positively related to reporting an internal control problem.Based on prior findings,we argue that financial distress prevents firms from investing in effective internal control systems.Consequently,the lack of sufficient time and money in buildingproper controls decreases the number of IC personnel.We measure financial distress using three measures, LEVERAGE(total liabilities in year t divided by total assets in year t),ZSCORE(Decile rank of Altman’s (1968)z-score)and LOSS(whether or not a firm reports a loss for the year).We expect these proxies for financial distress to be negatively related to the number of IC personnel.

Fifth,Krishnan(2005)and Doyle et al.(2007a)suggest that firms growing too rapidly may outgrow their existing internal control systems,and thus require additional time and investment to reorganize and revamp the internal control systems in place.Improvement in internal control systems requires implementation of new processes,new technology,and most importantly,new personnel.It is likely that rapidly developing firms lack such resources,and thus have a small internal control department.In this study,growth of a firm is measured by changes in sales deflated by total assets in year t-1(GROWTH).

Sixth,in Korea,a large number of public and private firms are affiliated with business conglomerates, known as Chaebols,in which founding families have full control over affiliated companies(Kim and Yi, 2006;Kwon et al.,2012;Lee et al.,2012).Chaebols are a major determinant of the Korean economy and their influence on Korean society is significant(Chang and Hong,2000;Joh,2003).One stream of literature focuses on corporate governance and intra-group transactions within Chaebol-affiliated firms.For example,Kim and Yi(2006)raise the possibility that business group affiliation engenders severe agency problems.The complex structure of business groups makes it difficult for outsiders to monitor self-dealing transactions,and thus Chaebol-affiliation firms have greater opportunities and incentives to divert firm resources through tunneling at the expense of minority shareholders.Another strand of literature analyzes the characteristics of Chaebol firms.Kim and Berger(2009)report that Chaebol firms are larger in size,have higher sales growth rates,lower pro fitability and lower business risk.Challenging the research methodology adopted by Kim and Berger (2009)and Kim(2012)presents different results for analyses of Chaebol-affiliated firms,using a more re fined research design by employing the matching estimator technique.Kim(2012)examines the value implication of business groups in Korea and finds Chaebol-affiliated firms,over time,tend to be larger,more pro fitable,grow faster with more investments,and enjoy bene fits from tax shields and monitoring effects.In summary,prior studies on the characteristics of Chaebols provide general evidence that Chaebol-affiliated firms tend to be larger in size,more pro fitable and have the capacity to make larger investments,enabling them to prosper for a long period of time.While we acknowledge that the negative effects(e.g.,tunneling activities,agency problems)of Chaebols may lead to deteriorating internal control systems,we argue that the greater resources and capacity of Chaebols will have a positive effect on investments in human resources in internal controls. We include an indicator variable,CHAEBOL,to identify Chaebol-affiliated firms.

Finally,corporate governance mechanisms may play an important role in the internal control systems of firms.There is mixed evidence on the association between the quality of corporate governance and internal control systems.Krishnan(2005)examines the relation between audit committee quality and the quality of internal controls.She finds that firms with more independent audit committees and audit committees with financial expertise are inversely associated with the existence of internal control problems.Doyle et al. (2007a)posit that firms with good corporate governance mechanisms exhibit fewer material weaknesses.However,they do not find the quality of governance to be significantly related to disclosing a material weakness. The inconsistent results may be explained by the substitutive role of internal control systems.For example, high quality audits by external auditors may alleviate the adverse consequences of material weaknesses (Hogan and Wilkins,2008).We measure the level of corporate governance by two measures,LARGEST (the natural logarithm of one plus the ownership of the largest shareholder)and FOROWN(the natural logarithm of one plus the ownership of foreign investors).Concentrated ownership gives owners better incentives to monitor firms and make necessary changes in management(La Porta et al.,1999).By contrast,in firms with diffuse ownership,no single owner has an incentive to“mind the store,”so management is not disciplined for bad performance or rewarded for good performance,leading to poor oversight of management.Therefore, firms with high ownership of the largest shareholder will be better governed.Similarly, firms with high levels of foreign investor ownership will be under enhanced monitoring(Guedhami et al.,2009).Thus,high levels of LARGEST and FOROWN are consistent with high quality corporate governance structures.As the substitutive role of internal control systems suggests,the low level of corporate governance may be alleviated by high quality internal control systems(e.g.,Choi and Wong,2007),resulting in an inverse relationship between corporate governance and IC personnel.We do not predict a sign for LARGEST and FOROWN.Finally,weinclude an indicator variable,KOSDAQ,which is comparable to NASDAQ in the US,to control for differences in firms listed on different stock exchanges.7The variable has a value of 1 if a firm is listed on the KOSDAQ market,and 0 otherwise.Firms listed on the KOSDAQ are less subject to government regulations than firms listed on the Korean Stock Exchange(KSE),which is the major exchange in Korea.

4.Model specification and test procedures

4.1.Determinants of human resource investment in internal controls

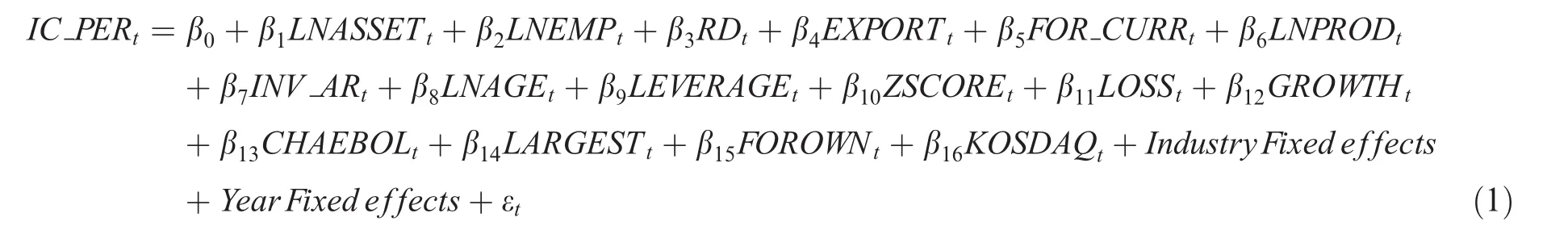

To investigate the determinants of human resources in internal controls,we model IC personnel as a function of the above-mentioned firm characteristics.Specifically,we estimate the following multivariate regression:

where t indexes the year and IC_PER is either IC_TOTAL1,IC_TOTAL2,IC_ACC,IC_FIN,IC_ACCFIN or IC_IT.IC_TOTAL1 is the natural logarithm of the sum of the number of personnel in the internal control department(namely,IC personnel)for accounting,finance,ITS and other departments in the firm.8We use the logged value instead of the raw value to remove the undue influence of a few outliers.IC_TOTAL2 is the natural logarithm of the sum of the number of personnel in the internal control department for accounting,finance and ITS departments in the firm.IC_ACC,IC_FIN,IC_ACCFIN and IC_IT are the natural logarithm of the IC personnel for accounting,finance,accounting and finance combined,and ITS departments in the firm,respectively.9As reported in the Appendix,Korean firms are required to disclose IC personnel on the audit committee,board of directors, accounting,finance,ITS and other departments separately.Following Choi et al.(2013),we do not include the number of IC personnel working on the audit committee and the board in our analyses because there is almost no variation in the number of IC personnel in these two departments.Most of the sample firms employ 1 or 2 IC personnel in these two departments.In addition,we decide to combine accounting and finance departments to generate IC_ACCFIN because some firms do not separate these two departments.All other variables are as defined in Table 1.We include industry and year indicator variables to control for industry fixed effects and year fixed effects.We adjust standard errors for heteroscedasticity and firm-level clustering.All variables are winsorized at 1%and 99%values.

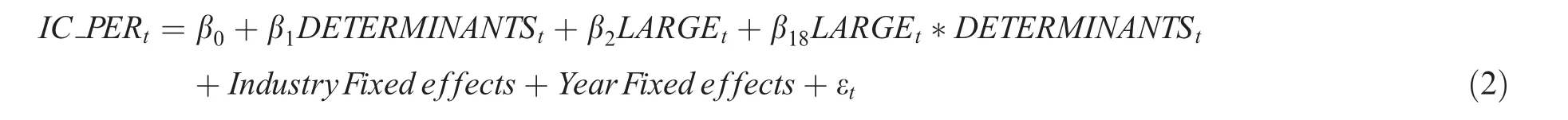

4.2.The Effect of Firm Size on the Determinants of Human Resource Investment in Internal Controls

As a further test to understand firms’characteristics that influence the quality of internal controls,we examine under which situations the importance of determinants has an accentuated effect on IC personnel.Prior studies on the area of internal control systems generally suggest that smaller firms have weaker internal controls due to the lack of resources and infrastructure.Size,as one of the most critical factors which influence the internal control system of a firm,represents firms’ability and capacity to invest in information systems and internal controls.We divide the sample into two sub-samples by the median value of LNASSET,the natural logarithm of total assets.10The results using LNEMP,another proxy for the firm size,is qualitatively identical and thus not separately reported.We investigate whether the determinants have a larger effect on IC personnel for firms with relatively larger size.To examine the effect of relatively large firm size on the relation observed in Eq.(1),we use the following multivariate regression model:

where t indexes the year and IC_PER is ether IC_TOTAL1,IC_TOTAL2,IC_ACC,IC_FIN,IC_ACCFIN or IC_IT.In the regression model,we include a variable named DETERMINANTS to convey the sixteen variablesused in our study,LNASSET,LNEMP,RD,EXPORT,FOR_CURR,LNPROD,INV_AR,LNAGE, LEVERAGE,ZSCORE,LOSS,GROWTH,CHAEBOL,LARGEST,FOROWN,KOSDAQ.To capture differences in firm size,we include the variable LARGE,an indicator variable which equals one if the size of the firm is greater than the median firm size and zero otherwise.Interactions with LARGE and the sixteen factors that are known to influence the number of IC personnel(DETERMINANTS)are included.Specific de finitions of the variables are provided in Tables 1 and 2.For all regressions,we report t-statistics that are adjusted using standard errors corrected for heteroskedasticity and firm-level clustering.All variables are winsorized at 1%and 99%values to remove the potential influence of outliers.In all regression specifications,we include industry and year indicator variables to control for industry fixed effects and year fixed effects.

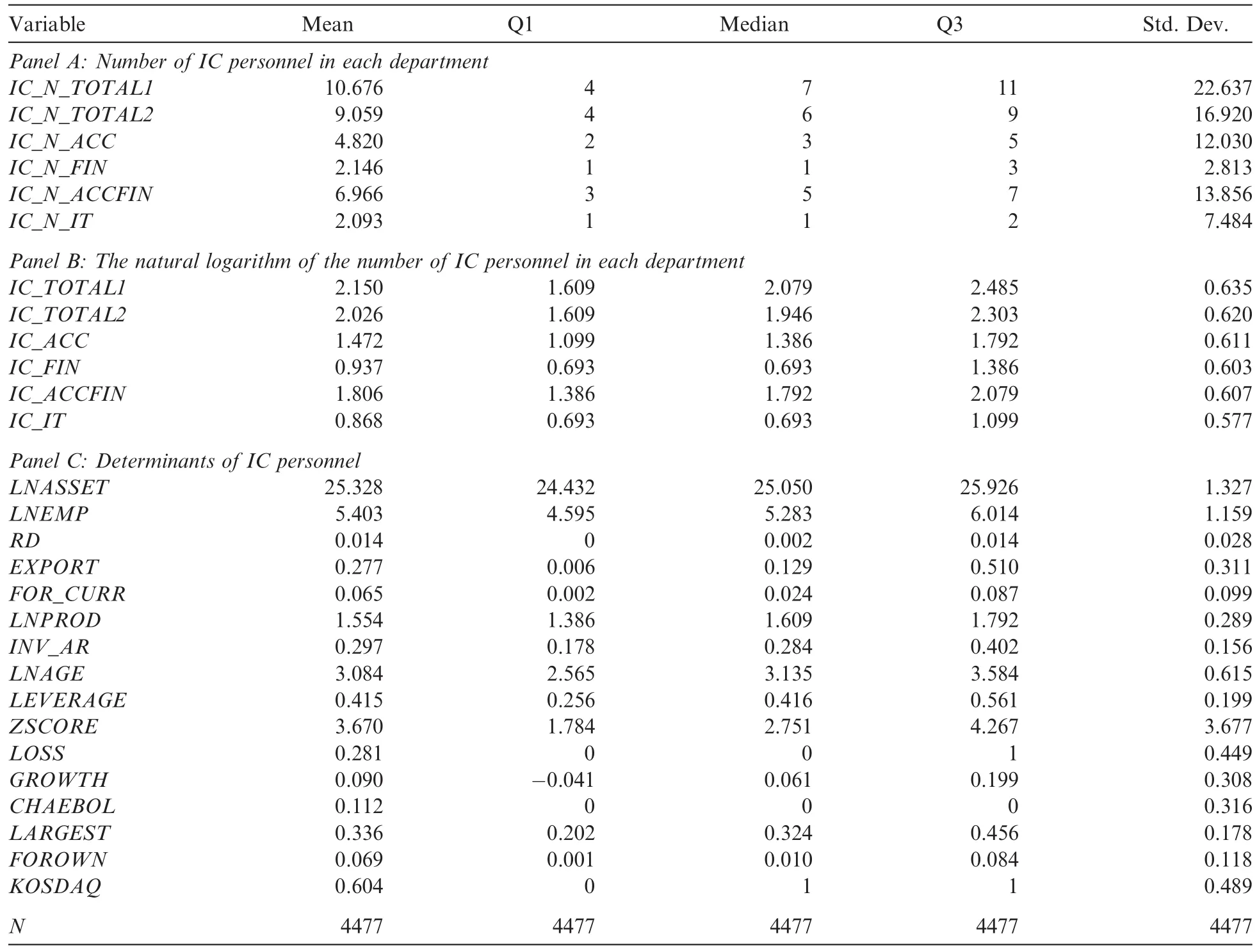

Table 2Descriptive statistics.

5.Sample and data

5.1.Data collection

The data on the number of employees in the internal control function for accounting,finance,ITS and other departments are hand-collected for the period 2005-2008.An example of the excerpt from the financial statement of Samsung SDI Co.is presented in the Appendix.We take the information presented in the financial statement of each firm and construct our variables of interest from this information.

While the information on IC personnel first became available in 2002,the enforcement of the release of such information became effective beginning in 2005.Due to reliability issues,we use the sample period from 2005 to 2008.We collect data on the financial variables from the KIS-VALUE database.11KIS-VALUE is equivalent to the COMPUSTAT database used for US data and contains financial statement information.KISVALUE receives its data from the Korean Information Service(KIS),which is the largest credit rating agency in Korea.Corporate governance variables are hand-collected from annual reports for the period 2005-2008.We include all firms listed on the KSE and KOSDAQ market for which firm-specific financial,corporate governance and internal controlrelated data are available.Firms in financial,real-estate and utilities industries are excluded.We exclude holding companies from our sample to control for differences in the corporate structure.This yields a sample of 1352 listed firms and 4477 firm-year observations.

5.2.Descriptive statistics

Table 2 provides the descriptive statistics of the variables employed in our analyses for testing H1.Panel A of Table 2 reports the mean,Q1,median,Q3 and standard deviation of the number of IC personnel for the entire firm and for individual departments.The mean number of employees working for accounting departments(IC_N_ACC),finance departments(IC_N_FIN)and ITS departments(IC_N_IT)are 4.82,2.14 and 2.09,respectively.The mean number of employees engaged in all internal control-related departments(IC_N_-TOTAL1)is 10.68,which indicates that the average IC personnel in each firm is approximately 11.Panel B of Table 2 lists the natural logarithm of the number of IC personnel in each department.In our tests,we use the log-transformed figure of IC personnel to measure proportionate effects of the determinants on IC personnel. The mean of the natural logarithm of the number of employees working for accounting departments (IC_ACC),finance departments(IC_FIN)and ITS departments(IC_IT)are 1.47,0.94 and 0.87,respectively. The mean of the log-transformed total number of employees in all internal control-related departments is 2.15.

Panel C of Table 2 reports the descriptive statistics of the sixteen determinants of IC personnel,which are included in our regressions.The interpretation on the statistics of the factors that influence IC personnel is as follows.First,the average size of the sample firms(LNASSET)is 25.33,which is translated to approximately US$84 million.The natural logarithm of the number of employees of our sample firm is 5.40,which is equivalent to 662 employees.The proxies which capture complexity are research and development expenses(RD), amount of exports(EXPORT),assets denominated in foreign currencies(FOR_CURR)which represents the significance of foreign operations,the natural logarithm of the number of products of a firm(LNPROD)and the sum of inventory and accounts receivable(INV_AR).The mean of the variables which capture complexity of business activities and operations are 0.01,0.28,0.07,1.55 and 0.30 for RD,EXPORT,FOR_CURR, LNPROD and INV_AR,respectively.The average number of products that a firm produces is around 3.91.The natural logarithm of age of a firm is 3.08,which is equivalent to 25.04 years since its founding. The variables that are intended to capture financial distress are LEVERAGE,ZSCORE and LOSS,which have mean values of 0.42,3.67 and 0.28,respectively.The average growth rate of our sample firms is 0.09. The mean of the indicator variable CHAEBOL suggests that 11.2%of our sample is composed of Chaebolaffiliated firms.Two variables which represent the level of corporate governance are LARGEST andFOROWN.The mean of the natural logarithm of the two variables are 0.11 and 0.34,respectively.Lastly,the mean of the indicator variable KOSDAQ indicates that 60.4%of our sample is composed offirms listed on KOSDAQ.

6.Empirical results

6.1.Univariate analyses

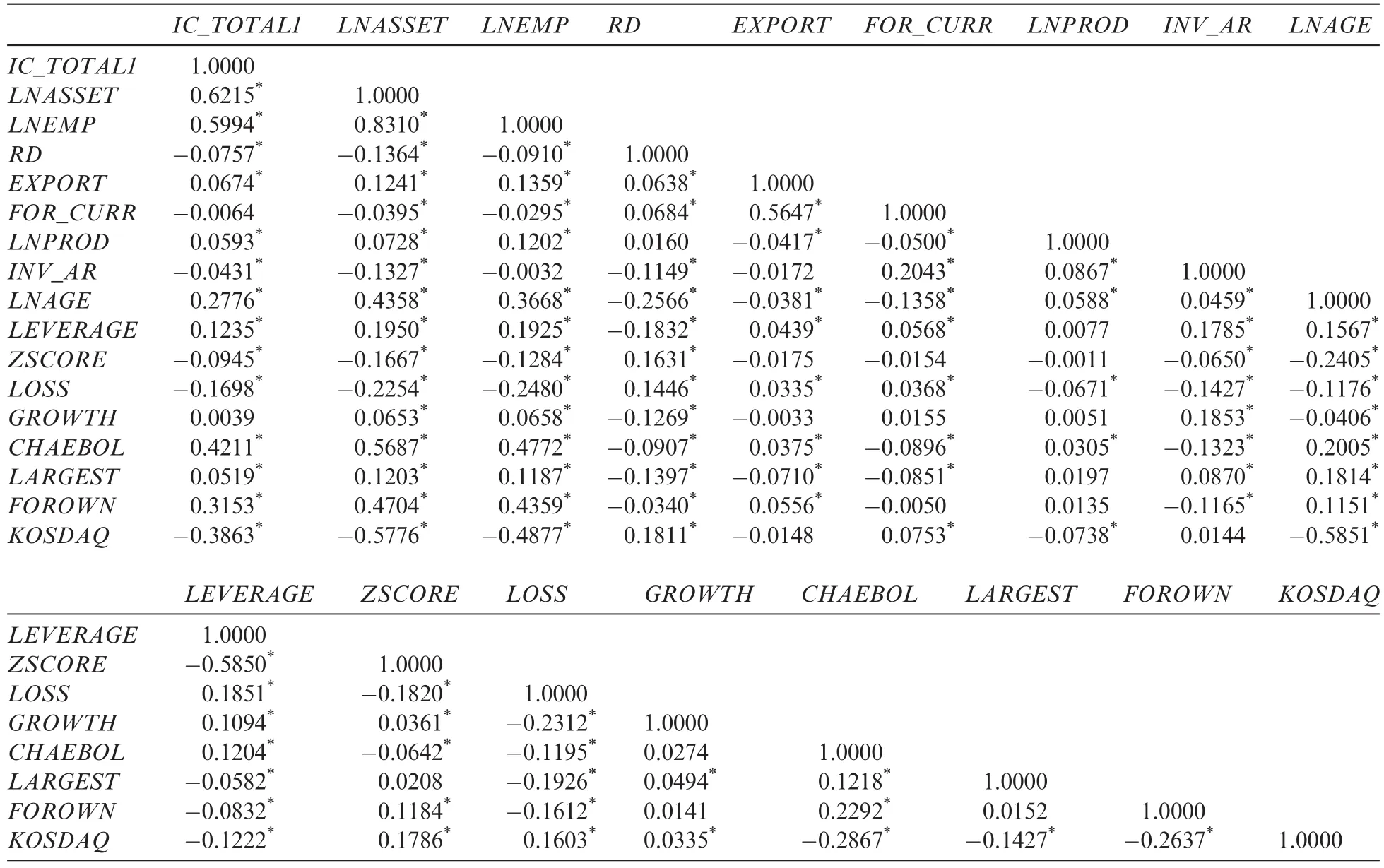

Table3presentsthepairwisePearson correlationsbetweenthetotalnumberofemployeesintheinternal control-related departments and the determinants of IC personnel.12We do not report the correlations with IC_TOTAL2,IC_ACC,IC_FIN,IC_ACCFIN and IC_IT in Table 3 for simplicity purposes. They are generally similar to the correlations for IC_TOTAL1.The results indicate that size,measured by total assets and the number of employees of a firm,are positively associated with IC personnel,consistent with ourexpectation.Therearemixedresultsforthevariables whichcapture thecomplexityofafirm.Astheneedfor an effective internal control system increases for complex firms,we find EXPORT and LNPROD to have a positive correlation with IC personnel.However,other proxies of complexity such as RD,FOR_CURR and INV_AR,appear to have an inverse relationship with IC personnel.We further examine this issue in the multivariate analyses below.Furthermore,experience of a firm(LNAGE)has a positive effect on IC personnel.As for proxies that capture financial distress,two of the three variables,ZSCORE and LOSS,are negatively associated with IC personnel,consistent with our prediction that financial distress prevents a firm from investing in its internal control system.The variable GROWTH is not signi ficantly related to the internal control systems of firms.There is also preliminary evidence that Chaebol-affiliated firms are more likely to have a larger number of IC personnel.Also,high levels of ownership of the largest shareholder and foreign investors are generally associatedwithhighlevelsofICpersonnel.Finally,KOSDAQfirmsarelikelytohavefewernumberofICpersonnel.

In general,our univariate results are consistent with our hypotheses and predictions outlined in Section 3. However,it is likely that there are multicollinearity issues as evidenced by the significant correlation between variables LNASSET and LNEMP of 0.831.13To remove the potential effect of the high correlation between LNASSET and LNEMP,we perform analyses with Eq.(1)but without LNEMP(LNASSET).The empirical results are qualitatively the same and,thus,not separately displayed.Also,the proxies for complexity are significantly correlated with each other.For example,the correlations between RD and EXPORT and between RD and FOR_CURR are 0.064 and 0.068,respectively,which are significant at the 5%level.The effect of each of the factors can be validated after controlling for other factors that may affect IC personnel individually or jointly.As a next stage, we re-examine the important determinants of internal control systems using multivariate regression models.

6.2.Multivariate analyses

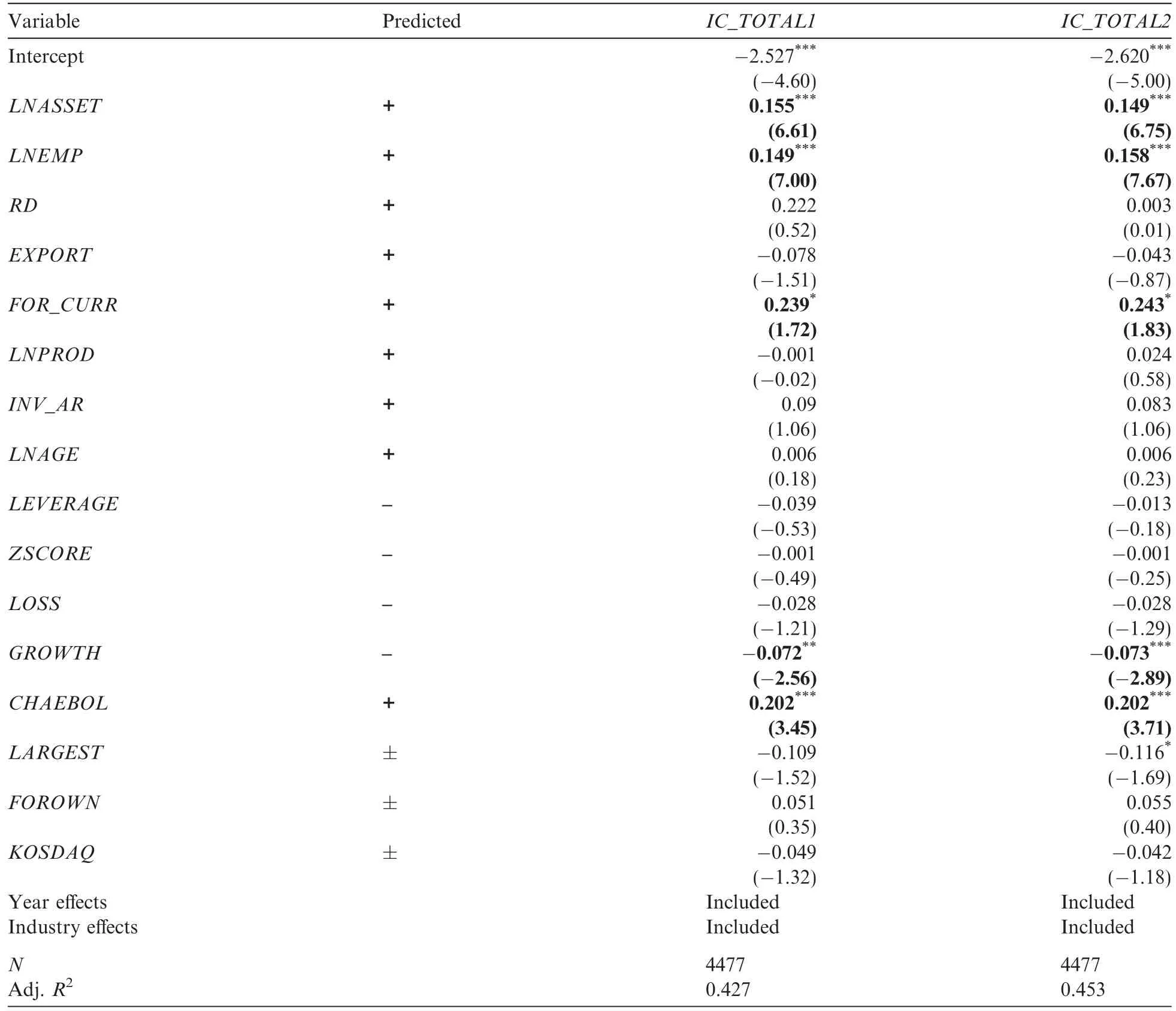

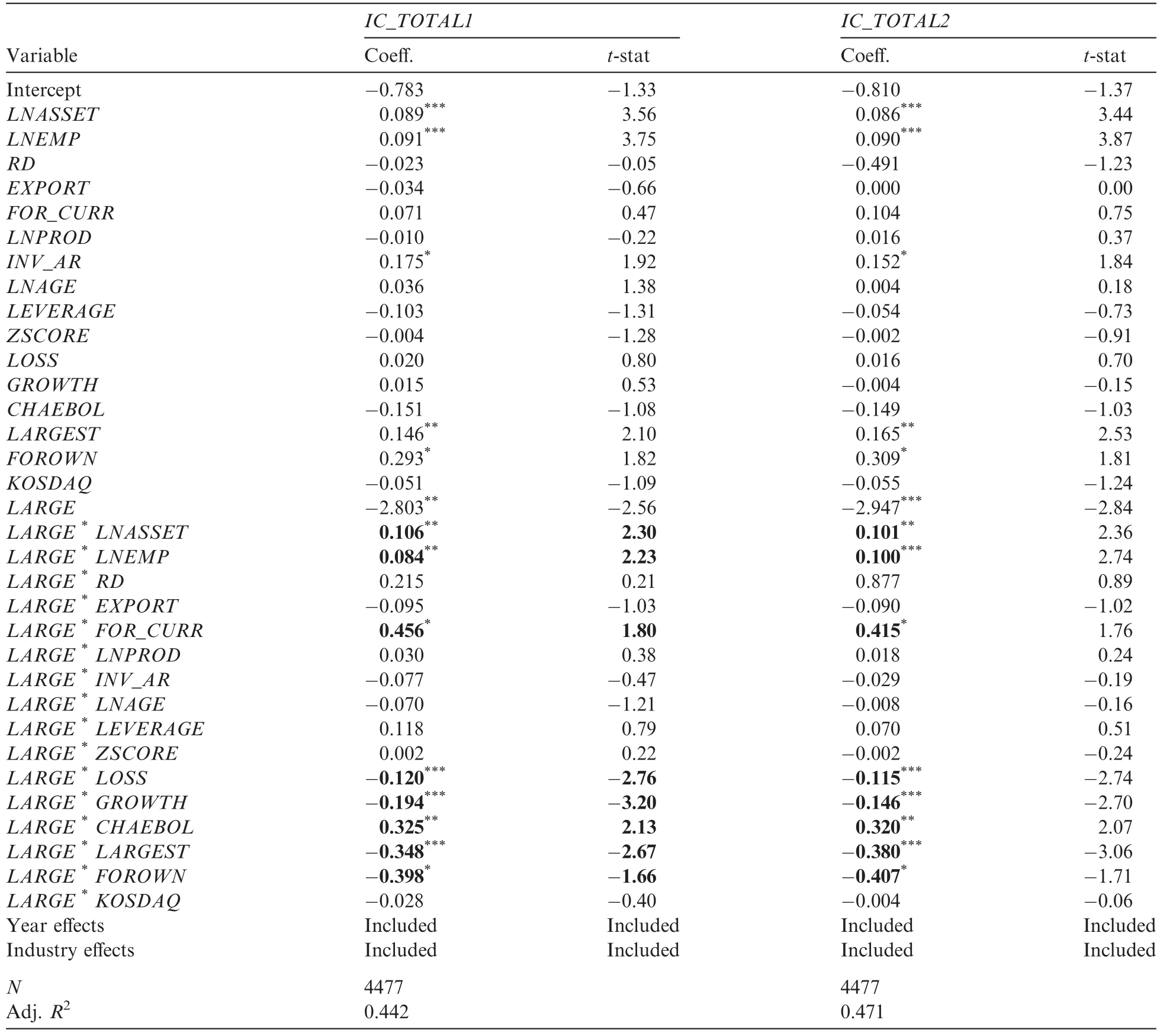

Table 4 presents the regression results of Eq.(1),which examines the determinants of IC personnel with IC_TOTAL1 and IC_TOTAL2.In the first column of Table 4,we employ IC_TOTAL1 as the dependent variable,while,in the second column,we use IC_TOTAL2 as the dependent variable.The two variables are similar in that they capture the natural logarithm of the number of employees from all departments engaged in internal control functions,except that IC_TOTAL2 omits“other”departments.14See footnote 4 for the definition of other departments.The adjusted R2in Table 4 is 42.7%and 45.3%for the regression models using IC_TOTAL1 and IC_TOTAL2,respectively.The explanatory power is signi ficantly high in both models.

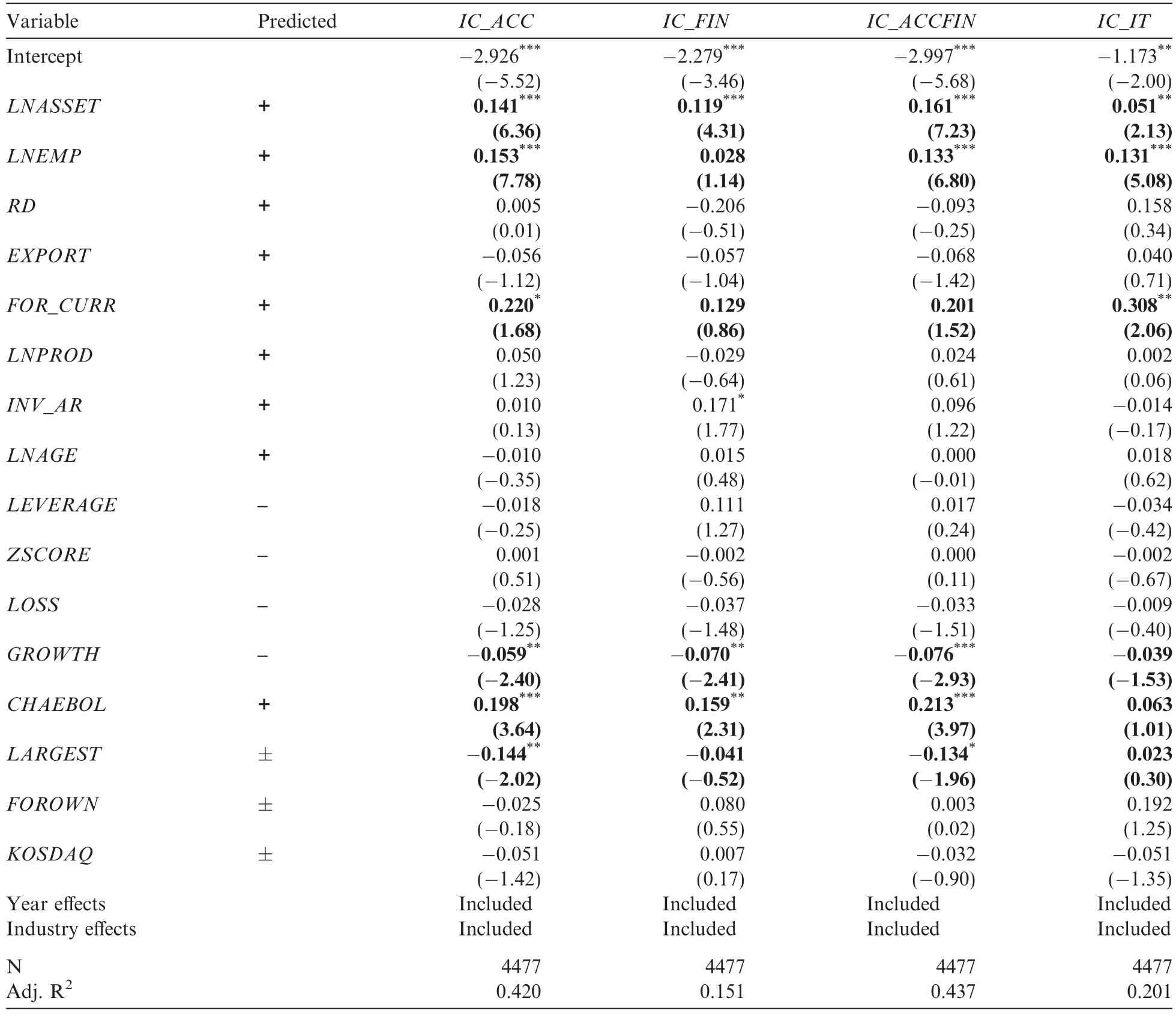

Table 5 reports the results of Eq.(1),using the number of IC personnel for each department(a2ccounting, finance,sum of accounting and finance,ITS department)as the dependent variable.The adjusted Rin Table 5 ranges from 15.1%to 43.7%for the four regression models.The explanatory power is high for regressions which employ IC_ACC and IC_ACCFIN as the dependent variable,but relatively low for regressions which employee IC_FIN and IC_IT as the dependent variable.The weak results are likely to be caused by low cross-sectional differences in the number of employees for the finance and ITS departments in internal control (see Panel A of Table 2).The overall results based on Tables 4 and 5 suggest that the coefficients on at least fiveof the sixteen variables,LNASSET,LNEMP,FOR_CURR,GROWTH and CHAEBOL,are in the predicated direction and are statistically significant.We provide interpretations of the results for each aspect of factors that influence IC personnel below.

Table 3Pairwise Pearson correlations.

6.2.1.Firm size and IC personnel

Results from both Tables 4 and 5 confirm the significant role played by firm size.The two variables which represent the size of a firm,LNASSET and LNEMP,are positively associated with IC personnel,for both the whole firm as well as the individual departments(IC_TOTAL1,IC_TOTAL2,IC_ACC,IC_ACCFIN)at less than 1%levels.For example,when IC_TOTAL1 is used as a dependent variable,the coefficients on LNASSET and LNEMP are 0.155(t-value=6.61)and 0.149(t-value=7.00),respectively,in Table 4.This finding is consistent with prior studies that report the overall positive association between firm size and internal control quality(Ge and McVay,2005;Ashbaugh-Skaife et al.,2007;Doyle et al.,2007a).This evidence confirms the argument that the resources and infrastructure within large firms allow them to invest in hiring more qualified internal control personnel which will ensure adequate policies and procedures to be in place.The statistical significance of size on IC personnel is weaker or disappears when IC_FIN or IC_IT are used as the dependent variable in Table 5.It is likely that the low variability across the numbers of IC personnel within finance(mean value of 2 employees)and ITS departments(mean value of 2 employees)is a cause for the weak results.

6.2.2.Complexity and IC personnel

Examining the five variables for complexity,only one variable,FOR_CURR,is statistically significant in explaining IC personnel.The coefficient on FOR_CURR is significant at the 10%level when IC_TOTAL1,IC_TOTAL2,IC_ACC,IC_IT are used as the dependent variables in Tables 4 and 5.For example,when IC_TOTAL1 is used as the dependent variable,the coefficient on FOR_CURR is 0.239(t-value=1.72). The positive association suggests that as the complexity offirms’activities and operations increases,proxied by the significance of foreign operations(FOR_CURR),it increases the need for effective internal controls, thus resulting in a high number of IC personnel.Significant foreign operations indicate the possibility that a firm is affected by different institutional and legal environments in which it operates in.The exposure to different environments makes it more difficult to implement adequate internal controls in place,which in turn, increases the demand for effective internal control systems.The positive coefficient on the variable FOR_-CURR confirms this relationship.While the statistical significance of the coefficient on FOR_CURR disappears when IC_FIN and IC_ACCFIN are used as the dependent variable,the sign is directionally consistent in all analyses.

Table 4Results of determinants of IC personnel using the natural logarithm of total number of IC personnel.

Table 5Results of determinants of IC personnel using the natural logarithm of number of IC personnel by department.

6.2.3.Age,financial distress and IC personnel

In Tables 4 and 5,neither the age of a firm nor the financial distress of a firm appears to have a significant effect on the number of IC personnel,although they are significantly correlated with IC_TOTAL1 in the univariate analyses as reported in Table 3.Other determinants of IC personnel may have subsumed the effect of experience and financial performance on the investment in the internal control systems of a firm.

6.2.4.Growth and IC personnel

Next,growth of a firm has a negative effect on the number of IC personnel at the 5%level.The coefficient on GROWTH is statistically significant at the whole firm(IC_TOTAL1 and IC_TOTAL2)as well as individual department levels,except for the ITS department.For example,when IC_TOTAL1 is used as the dependent variable,thecoefficientonGROWTHis-0.072(t-value=2.56).ThisisconsistentwiththeargumentmadebyKrishnan(2005)and Doyle et al.(2007a)who suggest that rapidly growingly firms outgrow their internal control systems.It is likely that the lack of(human)resources,processes and less advanced techniques hinder firms in maintaining adequate internal controls and making investments in human resources in internal control functions.

6.2.5.Business group affiliation and IC personnel

The coefficient on the variable CHAEBOL is statistically significant at the 1%level in Table 4.For example, when IC_TOTAL1 is used as the dependent variable,the coefficient on CHAEBOL is 0.202(t-value=3.45), indicating the strong influence of business group affiliation on IC personnel at the whole firm level.We find consistent evidence at the individual department level,except for the ITS department.Prior work investigating the characteristics of Chaebols indicates that Chaebols are generally larger in size,more profitable and more capable of making investments(Kim,2012).The positive coefficients on CHAEBOL across different specif ications reinforces this finding by suggesting that the larger capacity borne by Chaebol-affiliated firms enables them to make relatively bigger investments in information systems and internal control functions.

6.2.6.Corporate governance and IC personnel

Examining the corporate governance variables,there is a marginally significant effect of the ownership of the largest shareholder on IC personnel.The coefficient on LARGEST is significant at the 10%level when IC_TOTAL2,IC_ACC and IC_ACCFIN are used as the dependent variable.For example,when IC_TOTAL2 is used as the test variable,the coefficient on LARGEST is-0.116(t-value=-1.69)in Table 4.The other corporate governance variable,FOROWN is not statistically significant in any specification.The negative association documented between corporate governance and IC personnel is potentially due to the substitutive effect of internal control systems.Concentrated ownership by the owners facilitates the monitoring process and incentivizes them to closely oversee management and to enforce changes when necessary.Firms with good monitoring mechanisms have a reduced need for effective internal control systems,resulting in a lower number of IC personnel.The substitution effect is an explanation for the inverse relation between LARGEST and the number of IC personnel.15Alternatively,it may be possible that firms with concentrated ownership avoid the investment in IC personnel to pursue private benefits at the expense of minority shareholders.However,this alternative explanation is less likely to occur in the current strong legal environment after the implementation of K-SOX.

Finally,whether or not the firm is listed on KOSDAQ does not have a statistically significant effect on the number of IC personnel.

Overall,both our univariate and multivariate analyses support our hypotheses in Section 3.We find that the number of IC personnel is relatively higher for firms with bigger size in terms of total assets and the number of employees,firms with complexity and for Chaebol-affiliated firms,however,the number of IC personnel is relatively lower for growth firms.These findings suggest that firms with greater capacity and established infrastructure tend to invest more in human resources in internal control departments.In contrast,firms are hesitant to invest heavily in their internal control systems in the face of a lack of resources,and/or a rapidly changing business environment.The analyses based on the results from Tables 4 and 5 presents moderately significant implications that corporate governance and internal control systems are substitutes. Specifically,a strong corporate governance structure within a firm weakens the need for a high quality internal control system,thus leading to a lower number of IC personnel.

6.3.Additional test

Table 6 provides the results of regression Eq.(2)in which the indicator variable,LARGE,which partitions firms with relatively large size,and the interactive terms with the indicator variable are included.The objectiveof this test is to gain an understanding of the situation in which the relations observed in the section above are prevalent.The results of Table 6 suggest that the effect of the determinants of IC personnel is pronounced among firms with relatively larger size(LNASSET).The significant coefficients on the interaction terms between the LARGE indicator variable and the determinants indicate that the effect of the factors known to influence internal control systems increase with firm size.Specifically,in Table 6,we find that the interaction terms with LNASSET,LNEMP,FOR_CURR,LOSS,GROWTH,CHAEBOL,LARGEST and FOROWNare statistically significant.16Note that the coefficients on LOSS,LARGEST and FOROWN are mostly insignificant in Tables 4 and 5.The significant interaction terms on these variables in Table 6 suggest that these variables influence the number of IC personnel only in large firms.For example,when IC_TOTAL1 is used as the dependent variable,the coefficient on LNASSET is 0.089(t-value=3.56)and that on LARGE*LNASSET is 0.106(t-value=2.30)in Table 6. The results imply that small firm size influences the number of IC personnel(logged value)by 0.089(the coefficient on LNASSET),while large firm size influences the number of IC personnel(logged value)by 0.195(the sum of 0.089 and 0.106).Speci fically,characteristics including firm size,complexity and business group affiliation have a larger positive effect on IC personnel for firms with relatively bigger size(in terms of the natural logarithm of total assets).Large firms experiencing a loss make relatively lower levels of investments in human resources in internal controls.Additionally,the positive effect of business group affiliation on internal control systems is prevalent for large firms.Finally,the substitutive effect of internal control functions and corporate governance is accentuated in large firms.In summary,factors such as firm size,complexity of business environment and operations,financial distress,growth,business group affiliation and corporate governance structure have a larger effect on IC personnel for firms with relatively large total assets.17Note that we do not tabulate the results for individual departments in Table 6 for simplicity purposes.The untabulated results are generally similar to the tabulated results.

Table 6The effect offirm size on the determinants of IC personnel.

7.Conclusion

This paper investigates the characteristics offirms that induce firms to make investments in human resources in internal controls.Using unique firm-level data on the number of employees engaged in the internal control functions both at the whole firm and individual department levels,we are able to identify the types of firms which implement adequate internal control systems.Prior studies investigating the factors that expose firms to internal control risks generally find that such firms are smaller,younger, financially troubled,more complex,growing rapidly or undergoing restructuring(Ge and McVay,2005;Ashbaugh-Skaife et al.,2007; Doyle et al.,2007a).Extending this line of research,this study aims to understand the major factors which determine human resource investment in internal controls within a firm.Importantly,the literature attributes material weaknesses in internal controls to the following:lack of training,de ficiencies in adequate processes and procedures,lack of segregation of duties and inappropriate account reconciliation(Ge and McVay,2005). The root problem can be signi ficantly alleviated by having“quali fied accounting sta ff”which is directly related to our main variable of interest,IC personnel.

Following guidance from prior literature,we examine the determinants of the internal control system of a firm in eight aspects:size,business complexity,age, financial distress,growth,business group,corporate governance and type of exchange market.Our results suggest that high quality internal control systems are more likely for firms that are larger both in terms of total assets and number of employees,more complex,less rapidly growing and for Chaebol-affiliated firms.However,other factors including age,financial distress or the type of exchange market do not seem to have a significant effect on the quality of internal control systems. The findings suggest that firms with sufficient resources and established infrastructure(e.g.,large firms,Chaebols)have the capability to invest in their internal control systems while growth firms struggle with their financial reporting controls in the face of a lack of resources and a changing business environment.Additional analysis reveals the accentuated effect offirm characteristics on IC personnel among larger firms.

While our findings provide valuable insights,the findings may be subject to certain caveats.First,it is largely a descriptive study which focuses on association,rather than causation.We cannot rule out the possibility that unobserved factors that are correlated with both firm characteristics and IC personnel may drive the results.Second,although the regulations in Korea on internal controls are similar to those in the US or other developed countries,the results may not be generalizable to other countries due to differences in regulatory environments.However,this paper offers valuable insights to policymakers,practitioners and academics as the results demonstrate the important characteristics offirms which adopt high quality internal control systems.

Appendix A.An example of the disclosure of IC personnel

The following table shows the disclosure of SDI Co.,Ltd.on IC personnel for the fiscal year ending December 31,2008.This information is contained in the“Report on the operation of internal control systems,”which is a part of the firm’s annual report.The first column shows the number of employees working in each department and the second column reports the number of employees who are in charge of the task for the implementation of internal controls in each department.The third column shows how many CPAs are working in each department.In the case of Samsung Engineering Co.,Ltd.,one of the board members is a CPA. The fourth column shows the ratio of CPA to the number of IC personnel.The last column presents the average work experience of IC personnel in months.

Department①Total employees④Ratio of CPAs⑤Average Experience of IC personnel (A)(B)(B/A×100)(in months) Audit(Committee)33--101 Board of Directors72--76 Accounting393512.9%117 Finance55--52 ITS361--156 Others452--38②IC personnel③CPAs

Altman,E.,1968.Financial ratios,discriminant analysis,and the prediction of corporate bankruptcy.Journal of Finance 23,589-609.

Ashbaugh-Skaife,H.,Collins,D.,Kinney,W.,2007.The discovery and reporting of internal control deficiencies prior to SOX-mandated audits.Journal of Accounting and Economics 44(1/2),166-192.

Ashbaugh-Skaife,H.,Collins,D.,Kinney,W.,LaFond,R.,2008.The effect of SOX internal control deficiencies and their remediation on accrual quality.The Accounting Review 83(1),217-250.

Ashbaugh-Skaife,H.,Collins,D.,Kinney,W.,LaFond,R.,2009.The effect of SOX internal control deficiencies on firm risk and cost of equity.Journal of Accounting Research 47(1),1-43.

Beasley,M.S.,1996.An empirical analysis of the relation between the board of director composition and financial statement fraud.The Accounting Review 71(4),443-466.

Beneish,M.D.,Billings,M.,Hodder,L.,2008.Internal control weaknesses and information uncertainty.The Accounting Review 83(3), 665-703.

Chang,S.J.,Hong,J.,2000.Economic performance of group-affiliated companies in Korea:intergroup-resource sharing and internal business transactions.Academy of Management Journal 43(3),429-448.

Choi,J.-H.,Choi,S.,Hogan,C.,Lee,J.,2013.The effect of human resource investment in internal control on the existence of internal control weaknesses.Auditing:A Journal of Practice and Theory 31(4),forthcoming.

Choi,J.-H.,Kim,J.-B.,Liu,X.,Simunic,D.A.,2008.Audit pricing,legal liability regimes,and Big 4 premiums:theory and cross-country evidence.Contemporary Accounting Research 25(1),1-49.

Choi,J.-H.,Wong,T.J.,2007.Auditors’governance functions and legal environments:an international investigation.Contemporary Accounting Research 24(1),13-46.

Committee of Sponsoring Organizations of the Treadway Commission(COSO),1992.Internal Control2.Internal Control ContU.S.

Doyle,J.,Ge,W.,McVay,S.,2007a.Determinants of weaknesses in internal control over financial reporting.Journal of Accounting and Economics 44(1/2),193-223.

Doyle,J.,Ge,W.,McVay,S.,2007b.Accruals quality and internal control over financial reporting.The Accounting Review 82(5),1141-1170.

Feng,M.,Li,C.,McVay,S.,2009.Internal control and management guidance.Journal of Accounting and Economics 48(2/3),190-209.

Ge,W.,McVay,S.,2005.The disclosure of material weaknesses in internal control after the Sarbanes-Oxley Act.Accounting Horizons 19, 137-158.

Guedhami,O.,Pittman,J.,Saffar,W.,2009.Auditor choice in privatized firms:empirical evidence on the role of state and foreign owners. Journal of Accounting and Economics 48(2/3),151-171.

Hammersley,J.S.,Myers,L.,Shakespeare,C.,2008.Market reactions to the disclosure of internal control weaknesses and to the characteristics of those weaknesses under Section 302 of the Sarbanes Oxley Act of 2002.Review of Accounting Studies 13(1),141-165.

Hogan,C.E.,Wilkins,M.S.,2008.Evidence on the audit risk model:do auditors increase audit fees in the presence of internal control deficiencies?Contemporary Accounting Research 25(1),219-242.

Joh,S.W.,2003.Corporate governance and firm profitability:evidence from Korea before the economic crisis.Journal of Financial Economics 68(2),287-322.

Kim,C.S.,2012.Is business group inefficient?A long-term perspective.Asia-Pacific Journal of Financial Studies 41,258-285.

Kim,J.-K.,2009.Internal control weakness over financial reporting and accruals quality.Korean Accounting Journal 18(4),33-64, Printed in Korean.

Kim,H.J.,Berger,P.,2009.The management characteristics of Korean chaebols vs.non-chaebols:Differences in leverage and its ramifications:myth or reality?Advances in Management 2,26-35.

Kim,Y.-S.,Hwang,K.-J.,Kim,Y.-C.,2007.The effect offirm characteristics and corporate governance on the quality of internal control over financial reporting.Korean Accounting and Auditing Research 46,249-275,Printed in Korean.

Kim,J.-B.,Yi,C.H.,2006.Ownership structure,business group affiliation,listing status,and earnings management:Evidence from Korea. Contemporary Accounting Research 23(2),427-464.

Krishnan,J.,2005.Audit committee quality and internal control:an empirical analysis.The Accounting Review 80,649-675.

Kwon,D.-H.,Choi,J.-H.,Shin,J.,Hyun,J.-H.,2012.The effect of agency problem between controlling shareholders and minority shareholders on board and audit committee characteristics.Korean Accounting Review 37(1),121-155,Printed in Korean.

La Porta,R.,Lopez-De-Silances,F.,Shleifer,A.,1999.Corporate ownership around the world.Journal of Finance 54(2),471-518.

Lee,J.-I.,Choi,S.,Choi,J.-H.,2010.The association between human resource investment in internal control and audit fees.Korean Accounting and Auditing Research 51,191-225,Printed in Korean.

Lee,M.-G.,Choi,S.-T.,Chang,S.-J.,2007.Weaknesses in internal accounting control system:its relation with earnings management and information risk.Korean Accounting and Auditing Research 46,61-91,Printed in Korean.

Lee,M.,Shim,H.-S.,Choi,J.-H.,2012.Board characteristics and the frequency of disclosure of the firms belonging to large business groups.Korean Accounting Review 37(2),279-320,Printed in Korean.

Ogneva,M.,Subramanyan,K.R.,Raghunandan,K.,2007.Internal control weakness and cost of equity:evidence from SOX Section 404 disclosures.The Accounting Review 82(5),1255-1297.

Public Company Accounting Oversight Board(PCAOB),2004.An Audit of Internal Control over Financial Reporting Performed in Conjunction with an Audit of Financial Statements.Auditing Standard No.2.Washington,D.C.:PCAOB.

Securities and Exchange Commission(SEC),2002.Final Rule:Certification of Disclosure in Companies’Quarterly and Annual Reports. Release Nos.33-8124;34-46427.Washington,D.C.:SEC.

Securities and Exchange Commission(SEC).2003.Final Rule:Management’s Reports on Internal Control over Financial Reporting and Certification of Disclosure in Exchange Act Periodic Reports.Release Nos.33-8238;34-47986.Washington D.C.:SEC August 14.

Shin,H.G.,2007.Analysis of review reports on internal control systems.Korean Accounting Journal 16(1),107-128,Printed in Korean.

Solidarity for Economic Reform,2010.The analysis on the Dynamic Changes of 200 Largest Companies Over 1986-2006 Period.Seoul, Korea,Printed in Korean.

28 March 2013

*Corresponding author.

E-mail addresses:acchoi@snu.ac.kr(J.-H.Choi),leejoonil@gmail.com(J.Lee),csonu@snu.ac.kr(C.H.Sonu).

Accepted 20 June 2013

Available online 29 July 2013

Internal control personnel

Internal control systems

Internal control weaknesses