Board independence,internal information environment and voluntary disclosure of auditors’reports on internal controls

Ye Sun,Yng Yi,Bin Lin,c

aSchool of Business,Sun Yat-sen University,China

bDepartment of Accountancy,City University of Hong Kong,China

cCenter for Accounting,Finance and Institutions,Sun Yat-sen University,China

Board independence,internal information environment and voluntary disclosure of auditors’reports on internal controls

Ye Suna,b,*,Yang Yia,Bin Lina,c

aSchool of Business,Sun Yat-sen University,China

bDepartment of Accountancy,City University of Hong Kong,China

cCenter for Accounting,Finance and Institutions,Sun Yat-sen University,China

A R T I C L EI N F O

Article history:

Revised 20 May 2012

Accepted 29 May 2012

Available online 30 June 2012

JEL classification:

G30

K22

M41

D23

Voluntary disclosure

Auditors’reports on internal controls

Board independence

Internal information

environment

When there is high information asymmetry between directors and managers, independent directors do not have enough information to perform their functions.Only when faced with a good internal information environment can such directors acquire enough information to provide advice and monitor managers, and only under these conditions can increasing their proportion on the board effectively reduce agency problems,such as driving managers to disclose information to investors.Using a sample of Chinese listed firms that voluntarily disclose their auditors’reports on internal controls from 2007 to 2009,this study explores how the information acquisition costs of independent directors affect their monitoring effectiveness by investigating the disclosure decisions of their internal control audits.We find that when the information asymmetry between insidersandoutsidedirectorsislowandtheproportionofindependentdirectors onaboardishigh,afirmismorelikelytovoluntarilydiscloseitsinternalcontrol audit report.

Ⓒ2012 China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong.Production and hosting by Elsevier B.V.All rights reserved.

1.Introduction

Spurred by the seemingly ever-growing list of corporate scandals at the time,the United States passed the Sarbanes-Oxley Act(SOX)in 2002,which requires managers to evaluate the design and effectiveness of their internal control systems and report their overall conclusions,at which point they must employ an external auditor to audit their internal control systems and attest to the accuracy of the company management assertion that internal accounting controls are in place,operational and effective(SOX 302,404).In China,investors and policymakers have also paid increasing attention to firms’internal controls.Since 2006,the China Securities Regulatory Commission(CSRC)and the Shanghai and Shenzhen Stock Exchanges have released a series of internal control-related regulations.In 2008,the Ministry of Finance released the Enterprise Internal Control Basic Standard,which is considered the Chinese SOX(C-SOX)and is aimed at standardizing the construction of internal controls in Chinese firms and strengthening the supervision and assessment of internal controls.Regarding internal control audits,unlike in the United States,there were no mandatory requirements for most Chinese listed firms before 2010.Since 2007,the Shanghai and Shenzhen Stock Exchanges have explicitly encouraged listed firms to report their internal control self-assessments and voluntarily hire CPA firms to conduct audits of internal controls.Hiring auditors to provide extra audit reports on internal controls produces additional costs.However,according to our statistics,from 2007 to 2009,there were 133,161 and 210 listed firms that voluntarily disclosed their auditors’reports on internal controls(ARICs). What were the motives and incentives for those firms to voluntarily audit their internal control systems?What factors caused such differential disclosure decisions?These are still open questions.Lin and Rao(2009)show that firms with high internal control quality and those that want to refinance are more likely to audit their internal controls to send a positive signal to the market.This study investigates the motives behind the voluntary auditing of internal controls from a corporate governance perspective.In particular,we discuss the relationships among board independence,voluntary audit and disclosure decisions under different internal information environments.

As Jensen and Meckling(1976)note,the separation of property and management rights creates agency problems between principals and agents.The latter tend to hide information in the hope of maintaining their private control benefits(Chen and Jaggi,2000;Eng and Mak,2003;Gul and Leung,2004).As a mechanism for solving agency problems,effective corporate governance is capable of increasing both the quantity and quality of disclosures in addition to enhancing voluntary disclosure.Fama(1980)believes that the board of directors is the core of an internal governance mechanism that monitors agents.Among all of the board characteristics,the proportion of independent directors is one of the most important factors because it reflects board independence and is considered an objective and professional monitoring mechanism.Cheng et al. (2009)show that the independent director system provides a more secure control mechanism for managing employment contracts,such that the independent directors’professional knowledge makes board decisions more scientific and capable of effectively preventing financial report distortion.We predict that a higher proportion of effective independent directors on a board will drive the firm to voluntarily audit its internal control system and disclose the related audit report.

Independent directors affect auditing and disclosure decisions regarding internal controls in the following ways.First,consistent with the literature,the monitoring role of independent directors will push the firm to disclose more information,including internal control information,to investors,which increases the likelihood that the internal control system will be audited to reduce information asymmetry and agency problems(direct effect).Second,under the requirements of C-SOX,the board of directors has the primary responsibility for establishing internal controls.The audit committee,under the control of the board,plays a core role in the detailed design and daily review of the internal control system.If the board is more independent,its monitoring function will be more pronounced,to the extent that the firm will pay more attention to the establishment of its internal control system.These firms are also more likely to send a signal of the effectiveness of their internal controls by disclosing their third-party verification reports(indirect effect).

We choose the voluntary disclosure of ARIC to test the monitoring effectiveness of independent directors for the following reasons.First,given the increased attention that internal control systems have been receiving in China and around the world,internal control information has become more important to investors’decision making.An internal control system plays an important role in ensuring the efficiency of daily operationsand the reliability and relevance of financial information.Its effectiveness not only reflects the quality of a firm’s financial reports but also showcases the firm’s ability to avoid risk and fraud.Investors can then use it to evaluate the firm’s future value.Second,previous studies attempt to verify the monitoring role of independent directors by investigating whether it improves the firm’s earnings quality and value,but the results have been mixed. For example,from an earnings quality perspective,Park and Shin(2004)and Peasnell et al.(2005)show that an independent board can improve a firm’s earnings quality,whereas Klein(2002)does not find such a relationship.Results are also not consistent on the relationship between board independence and firm performance or value.1These studies often use measures such as firm financial ratios(e.g.ROA,EPS),Tobin’s Q and the market reaction to proxy for firm performance and value.Some studies show that there is a positive relationship(Rhoades et al.,2000;Rosenstein and Wyatt, 1990)while others find that the composition of the board does not influence firm value(Yermack,1996;Dalton etal.,1998;Hsu,2010).We believe that internal control quality is different from earnings quality and firm performance,although the former can influence the latter.The latter also varies between firms as the result offixed business models and economic environments,such that strengthening constraints and supervision mechanisms may not have a significant influence.However,the quality of a firm’s internal controls is a direct consequence of its monitoring mechanisms,and our investigation of the relationship between board independence and voluntary ARIC disclosure provides more direct evidence of the monitoring role of independent directors.Third,this voluntarily disclosed information is evaluated by third-party auditors who face litigation risks when providing their audit reports.Thus,compared to other voluntarily disclosed information,such as earnings forecasts and CSR reports,this information is more reliable and objective.

We also highlight how the information asymmetry between insiders and independent directors affects the monitoring effectiveness of the latter.As per the definition of an independent director in the code of corporate governance,an independent director should not have any pecuniary relations or transactions with the company or its promoters;his decisions should be independent of those who have a controlling stake in the company and be in the overall interests of the company and its stakeholders.However,board independence is a double-edged sword in that it reduces the likelihood of collusion between the board and management,but also weakens the board’s ability to obtain useful private information(Bushman et al.,2004).Given this,whether independent directors can adopt monitoring and advising roles depends on whether they can gather enough information.Jensen(1993)notes that management makes the decisions regarding when and how much information is disclosed to the board.If a significant amount of information is hidden,even talented directors are unable to review and evaluate management’s decisions and the firm’s strategies.When information asymmetry exists between management and the board and information acquisition costs are relatively high,corporate governance mechanisms such as independent directors and audit committees are hindered.The right to make decisions is also in the hands of management or controlling shareholders,such that the rights of minority shareholders are not protected.Only when internal information asymmetry is low and independent directors have enough information to help them make good decisions can they take appropriate actions to reduce agency problems and improve disclosure quality and the voluntary disclosure level.

However,internal information asymmetry levels are hard to measure.We use traditional measures that reflect the quality of the external information environment with expert information medium characteristics (including analysts and institutional investors)as proxy variables.If the external information environment is better,independent directors can obtain information through lower information acquisition costs,which helps them make better decisions based on the quality and quantity of the existing information disclosed by managers.Then,when making decisions or voting they can question managers.In addition,when the external information environment is better the firm will attract more attention from the public.In cases where a firm’s risky behavior or fraud is confronted,independent directors take on increased reputation costs and are thus more likely to ask managers to provide more private information.Thus,the external information environment indirectly helps reduce information asymmetry between insiders and independent directors.

Our main finding supports our expectation that when information asymmetry between insiders and outside directors is low,there is a positive relationship between the proportion of independent directors on the board and the likelihood of a firm voluntarily disclosing its ARIC.

Our study makes two contributions to the literature.First,regarding information disclosure,many studies discuss how board independence influences voluntary disclosure around the world.For example,Shen et al. (2010)find that in China the proportion of independent directors has a positive effect on the voluntary disclosure of corporate social responsibility.Zhang and Huang(2010)note that board independence drives firms to voluntarily conduct interim audits.Fang et al.(2009)show that there is a positive relationship between the proportion of independent directors and voluntary internal control information disclosure.Our study differs from these by showing how internal information asymmetry influences the monitoring role of independent directors in driving managers to improve voluntary disclosure levels.Our results partially explain the mixed results in the literature on the function of independent directors.Second,regarding internal controls,unlike US firms subject to SOX 404,which mandatorily requires that they audit their internal control systems,Chinese firms were able to choose whether to audit their internal controls during our sample period.This provides us with a unique setting and our findings will enrich the internal control literature.

The remainder of this paper is organized as follows.Section 2 reviews the related literature and develops our hypothesis.Section 3 introduces the sample and specifies our research design.Section 4 provides descriptive statistics and presents the results of our univariate and multivariate tests.Section 5 discusses several robustness tests and provides additional analysis.Section 6 concludes the paper.

2.Literature review and research hypothesis

Previous studies test whether board independence,as one of the monitoring mechanisms of corporate governance,increases disclosure quality,but the results are mixed.Using a sample of Hong Kong listed firms, Chen and Jaggi(2000)find a positive relationship between the proportion of independent directors and comprehensive financial disclosures.This positive effect is more pronounced in non-family controlled firms than family controlled firms.Using a sample of 385 Hong Kong listed firms,Gul and Leung(2004)show that the duality of a board’s CEO and Chairman negatively influences disclosure levels and that the proportion of experienced independent directors weakens this negative effect.Eng and Mak(2003)investigate Singapore listed firms to test the relationship between the proportion of independent directors and voluntary disclosure, specifically the comprehensive disclosure rating for non-mandatory strategies and non-financial and financial information.In contrast to Chen and Jaggi’s(2000)findings,Eng and Mak(2003)show that a higher proportion of independent directors is associated with lower voluntary disclosure levels.

However,these studies pay little attention to how independent directors should effectively fulfill their duties. Private control benefits andthepsychologicalvalueofbeing incontrol makeagentslesswillingtodiscloseinformation to outsiders or even other board members,such as independent directors(Dyck and Zingales,2004).A decision regarding whether a board is effective must consider more than whether it is independent because internal information asymmetry impedes outside directors from performing their monitoring and advising roles. Regarding the differentiation in the attainment offirm information,studies suggest that managers and inside directors grasp the most while independent directors attain less and outside investors are provided with the least (Armstrong et al.,2010).If the information asymmetry between independent directors and insiders is high,the former can hardly monitor and advise the agents.The literature(e.g.,Raheja,2005;Adams and Ferreira,2007; Harris and Raviv,2008;Duchin et al.,2010)suggests that it is important to consider the information environment that surrounds a board when evaluating the role of independent directors.Raheja(2005)claims that optimal board structure is determined by the trade-of fbetween maximizing the incentives for insiders to reveal their private information,minimizing coordination costs among outsiders and maximizing outsiders’ability to reject inferior projects.Adams and Ferreira(2007)analyze the dual roles of boards as monitors and advisors. They find that directors’monitoring costs significantly increase if the CEO is reluctant to share internal information,which suggests that management-friendly boards can be optimal.Harris and Raviv(2008)also use an analyticalmodeltoconcludethatgiventheinformationasymmetrybetweendirectorsandmanagers,shareholders are sometimes better of fwith an insider-controlled board.

Independent directors can thus only play their role and help reduce agency problems when internal information asymmetry is low.Therefore,our analysis investigates how the proportion of independent directors influences a firm’s voluntary disclosure decisions under varied internal information asymmetry.Specifically, we believe that when a firm’s inside information asymmetry is high,independent directors do not have enoughinformation to perform their monitoring and advisory roles,such that increasing the proportion of independent directors merely increases“free-riding”behavior rather than effectively inhibiting agency problems.Only when information asymmetry is low do independent directors have the necessary information to make judgments,and in such conditions,increasing their proportion effectively enhances their right to speak,which strengthens their monitoring and advising roles.

We predict that under lower internal information asymmetry,effective independent directors will influence firms’internal control audit decisions based on the following reasons.First,following the literature on the relationship between agency problems and voluntary disclosure,the conflicting interests of management and shareholders(or controlling and minority shareholders)will prompt management or controlling shareholders to hide relevant information in an attempt to maximize their personal interests(Luo and Zhu, 2010).In such a case, firms with serious agency problems will reduce their information disclosure,including the disclosure of internal control information,and will be less likely to hire third-party auditors.In contrast,a high-quality board with a high proportion of effective independent directors will help reduce agency problems and increase the likelihood that an external auditor will be hired to audit a firm’s internal control system and disclose the resultant report to the public.This is the direct effect of the independent directors’monitoring mechanism on internal control audit decisions.

Second,independent directors influence firms’disclosure decisions regarding internal control audits indirectly by improving the quality of their internal control systems.Under C-2See C-SOX 12 and 13.SOX,it is the board’s responsibility to establish a sound internal control system and ensure its effectiveness.In particular,an audit committeeunder the board,which is generally comprised of independent directors with financial backgrounds,is responsible for internal control review,monitoring and self-assessment.Independent directors can choose to be directly involved in the control system inspection process and review the detailed control procedures with financial and accounting sta ff.Furthermore,in the annual audit of financial statements,external auditors first conduct regular and/or special tests on the internal control system and if they are worried about its quality,an effective board would follow up on the auditors’concerns to ensure that management makes the required improvements.Thus,we expect that internal control quality will be positively related to board independence. Lin and Rao(2009)note that firms with high-quality internal control systems are more likely to have voluntarily audits because doing so sends a strong signal to the market,which increases the firm’s value as perceived by investors.Thus, firms with a high proportion of effective independent directors are more likely to disclose ARIC.

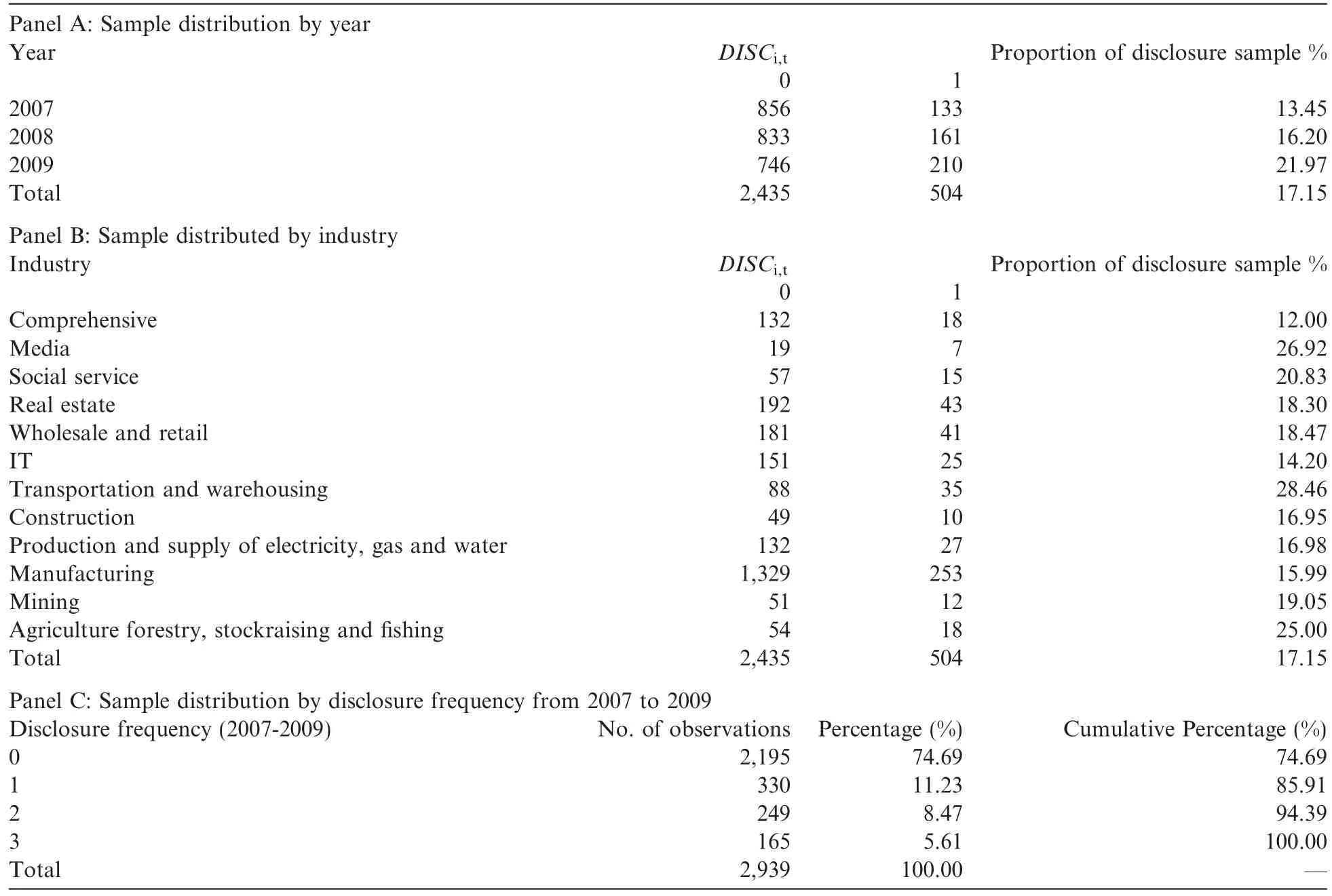

Table 1Distribution of voluntary disclosure sample

Based on the abovementioned discussion,we propose the following hypothesis:

Hypothesis 1.When a firm’s inside information asymmetry is low,there is a positive relationship between the proportion of independent directors on the board and the likelihood that a firm will voluntarily disclose its auditor’s report on internal controls.

3.Research design

3.1.Sample selection

Our sample selection criteria are as follows.The initial sample comprises all non-financial firms listed on the main boards of the Shanghai and Shenzhen Stock Exchanges.We exclude firms listed on the SME boards (small and medium firms)and those listed on the growth enterprise market(GEM)boards because the Shenzhen Stock Exchange has required firms listed on the SME and GEM boards to obtain a CPA firm’s audit report on the effectiveness of their internal controls over financial reporting at least once every 2 years since 2010.Although our sample period does not include 2010,it still reveals that the supervisory intensity of these two boards regarding internal controls differ from that of the main board.We exclude financial industry firms because they have stricter disclosure and audit requirements regarding internal controls.In addition,the CSRC has special regulations on the internal control audits of IPO and SEO firms,so we exclude these firms. We also exclude firms that have issued both A shares and H or B shares because they are under more stringent supervision.Finally,we exclude firms with missing financial data.As Table 1 outlines,we obtain a total of 2939 firm-year observations over the period from 2007 to 2009 after applying the abovementioned selection criteria.

Our sample period starts in 2007 because that is the year the Shanghai and Shenzhen Stock Exchanges released explicit provisions for disclosure requirements regarding the self-assessment of internal controls and encouraged firms to hire third-party auditors.In addition,Chinese firms began to follow the new corporate accounting standards in 2007,so financial data is more consistent after this year.We manually collect data from annual reports or special announcements about ARIC and ultimately indentify 504 firm-year observations(17.15%of the sample size)that disclose ARIC along with 2435 that did not.Additional financial and corporate governance data are from the CSMAR database.

Table 1 presents the distribution of voluntary disclosure observations by year and industry along with statistics on the number of times firms disclosed ARIC during the 2007-2009 period.Panel A reveals an annual increase in voluntary disclosures,from 13.45%of the sample in 2007 to 21.97%in 2009.Panel B shows that the proportion offirms making ARIC disclosures across various industries ranges from 12.00%to 27.46%,which is relatively uniform.Panel C indicates that 14.08%of the firms disclosed ARIC more than twice,which reflects a gradual acceptance of the effectiveness of ARIC.

3.2.Empirical model and variable definitions

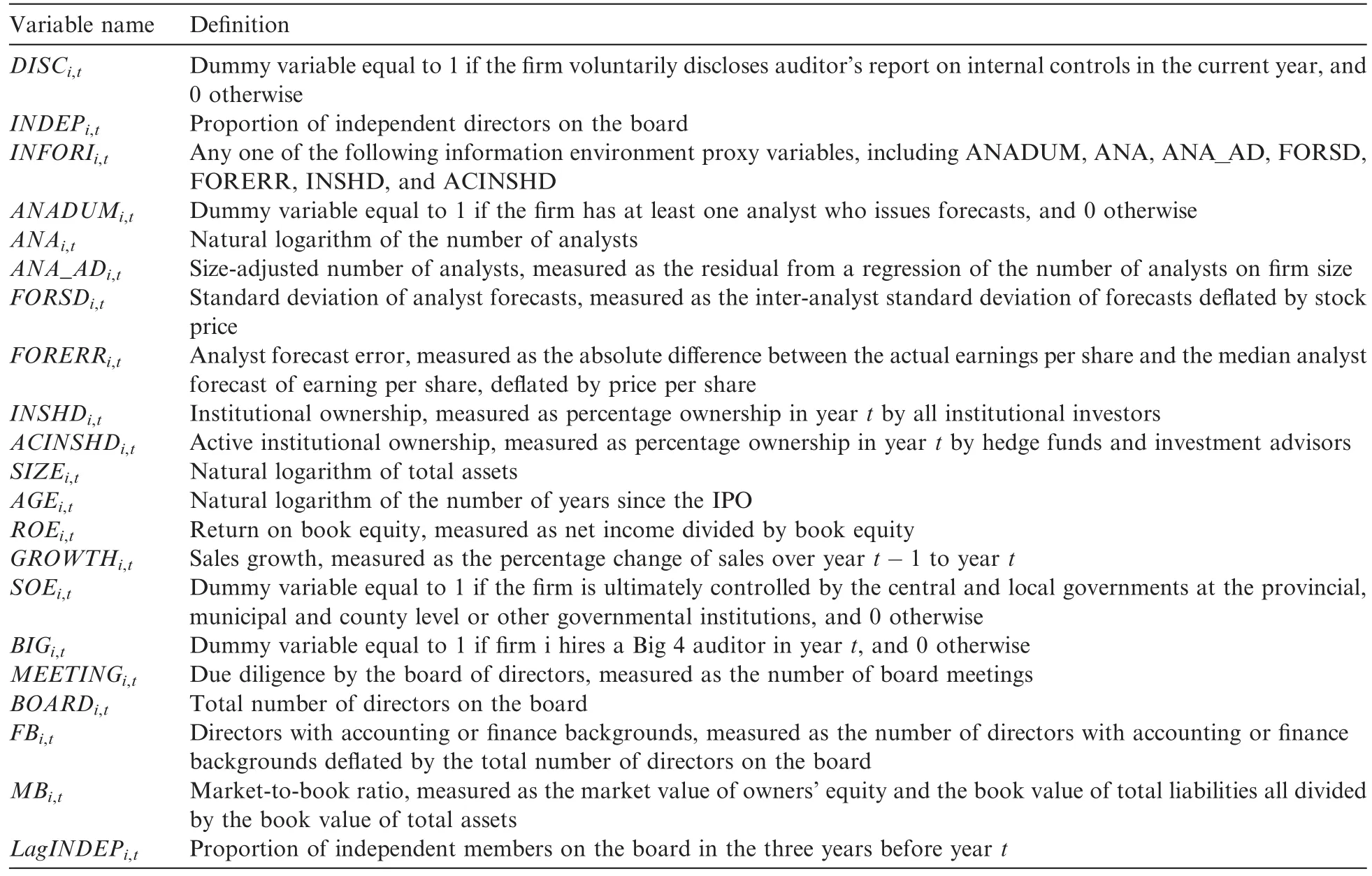

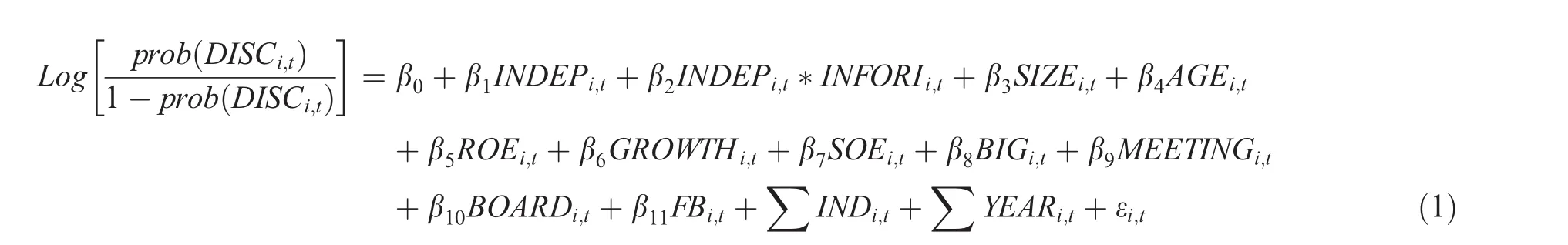

To examine the effect of board independence on firms’voluntary disclosure of ARIC decisions under varied inside information asymmetry,we estimate the following regression model:

Table 2Variable definitions.

where DISCi,tis a dummy variable equal to 1 when firm i voluntarily discloses ARIC in year t.Our main test variable is the interaction between the proportion of independent directors INDEPi,tand the information asymmetry proxy INFORIi,t.3Similar to Duchin et al.(2010),we do not put an information asymmetry proxy in the model.When we put an information environment index in the regression,the model has serious multicollinearity problems when submitted to VIF testing.For robustness,we also run subsample regressions based on information asymmetry high/low groups.Following previous studies(Lang and Lundholm,1996;Krishnaswami and Subramaniam,1999;Duchin et al.,2010),we choose an analyst following dummy variable,number of analysts,size-adjusted number of analysts,standard deviation of analyst forecasts,analyst forecast error,institutional ownership and active institutional ownership(including hedge funds and investment advisors)as the proxy variables.Detailed variable definitions are presented in Table 2.The rationale behind using external information environment variables to proxy for information asymmetry between insiders and outside directors is as follows.Independent directors can obtain information from two sources:outside public information and internal information privately disclosed by managers.For a given amount of inside information,when the external information environment is better,independent directors enjoy a wider range of information sources and can enjoy lower information acquisition costs,which verifies the reliability and relevance of the internal information and reduces the information asymmetry between independent directors and managers.In addition,by relaxing the assumption that the amount of inside information is constant and given the improvementof the external information environment,independent directors can obtain more private information.This is because the improvement of the external information environment makes firms more vulnerable to public concerns,such that their violations and poor decisions are more likely to be discovered.Accordingly,independent directors must then shoulder more responsibility and endure higher reputation costs.Therefore,independent directors will either ask for more private information,as the private information obtained by independent directors net of information disclosed to public is reduced,or they will choose to leave the firm.Ultimately,the improvement of the external environment will reduce the internal information asymmetry between insiders and independent directors.

As control variables,we use other firm-level variables that are deemed to influence voluntary ARIC disclosure decisions.These include firm size(SIZE),the number of years since IPO(AGE),firm performance(ROE), sales growth(GROWTH),auditor size(BIG)and whether or not the firm is a SOE(SOE).We also control for other board characteristics,including board size(Board),board meetings(MEETING)and board financial background(FB).All variables are defined in Table 2.

4.Results

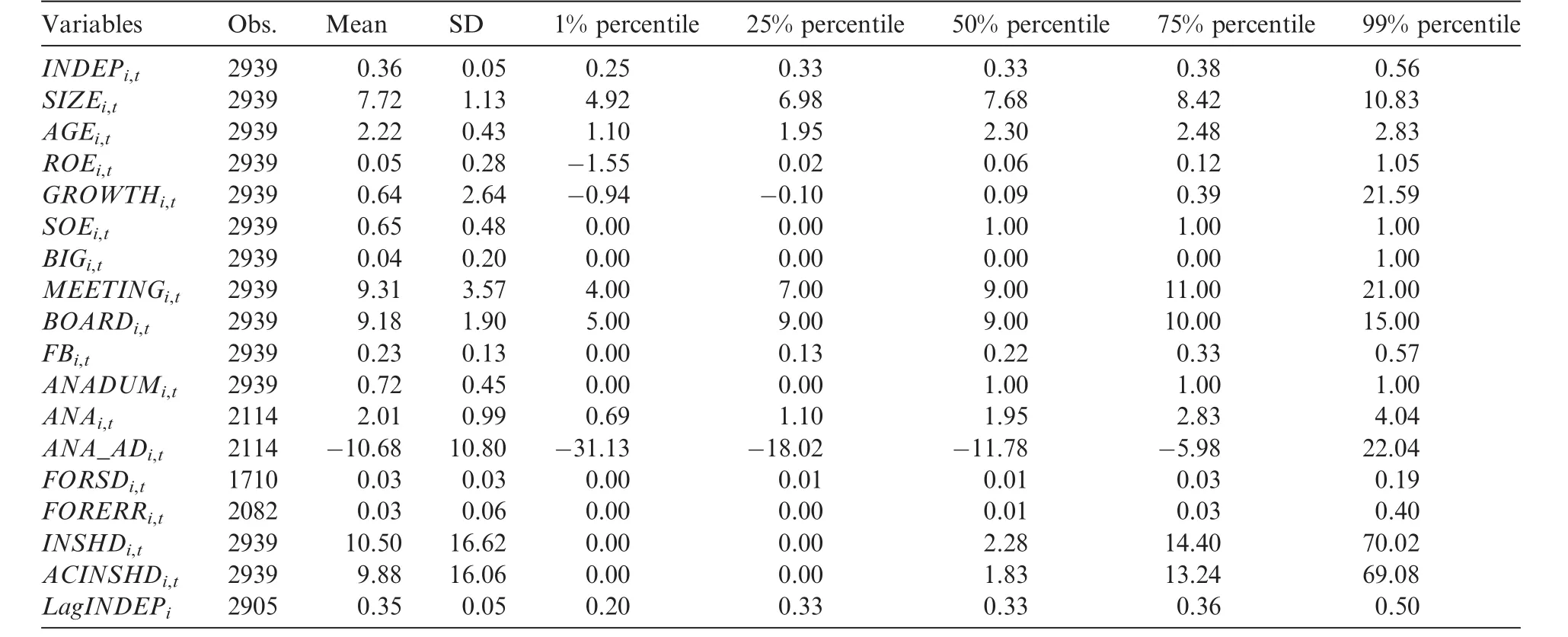

4.1.Descriptive statistics and univariate tests

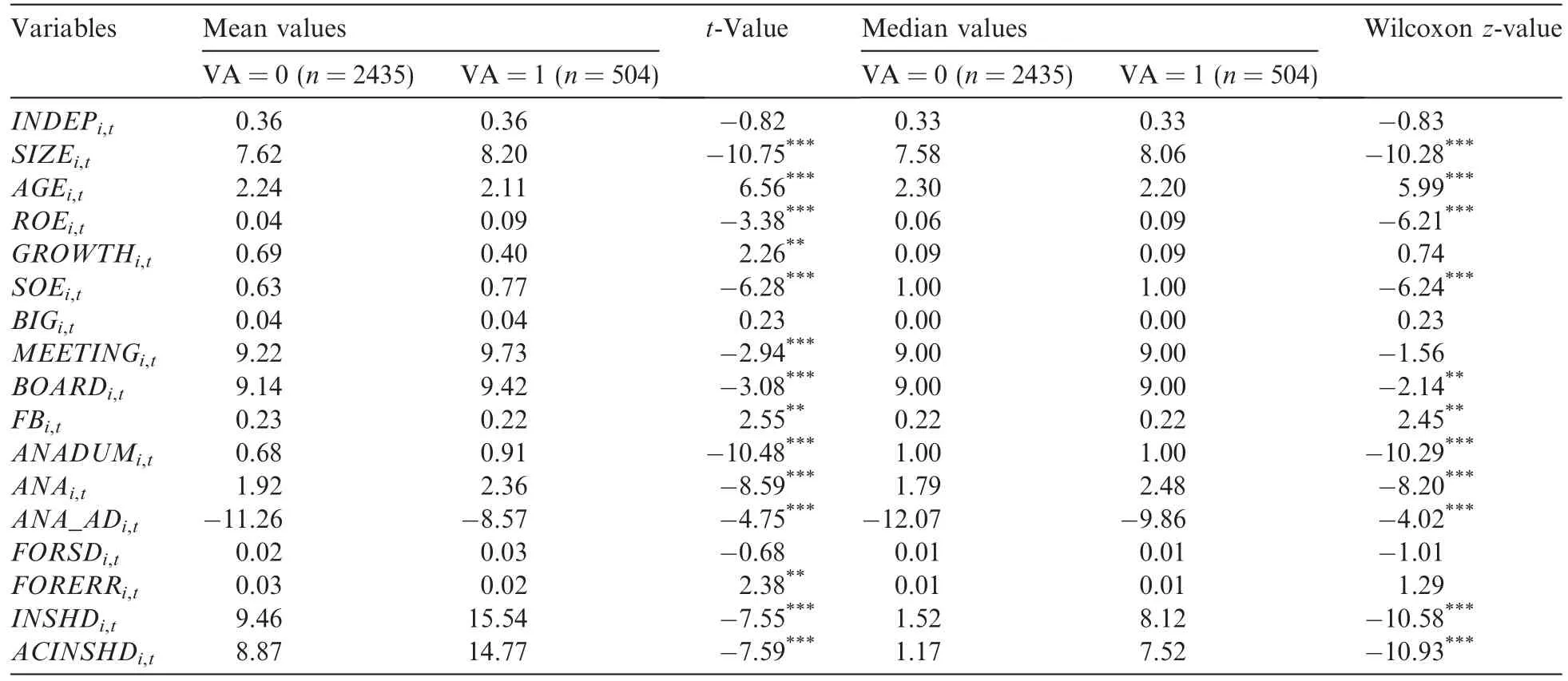

Table 3 presents descriptive statistics for all of the variables.The small standard deviations of all of the variables relative to their means show that there is not wide variation among sample observations.The mean (median)of the proportion of independent directors in the sample is 36%(33%)and the minimum and maximum are 25%and 56%.Table 4 reports the results of both parametric and non-parametric tests for the mean and median differences among all of the main variables,respectively,between the two groups that do or do not disclose ARIC.The univariate tests show that the mean and median of the proportion of independent directors in the voluntary disclosure group are not significantly greater than those in the other group,which indicates that a failure to consider internal information asymmetry creates a situation in which the monitoring effectiveness of independent directors is unclear.Regarding the other control variables,larger firms with higher ROE are more likely to disclose ARIC,which is consistent with signaling incentives.That is,bigger and better firms grasp more benefits in avoiding adverse selection when they send good news to the market. Firms with shorter listing periods are also more likely to disclose ARIC because young firms have more infor-mation asymmetry with outsiders,which increases their motive to disclose more information to reduce financing costs.In contrast,older firms tend to have stable relationships with creditors and shareholders,which makes them less likely to voluntarily disclose information.Regarding the nature of property rights,SOEs are more likely to disclose ARIC compared to non-SOEs because regulators such as the CSRC encourage SOEs,particularly central SOEs,to take the lead in following internal control-related regulations.The abovementioned results are consistent with the findings of previous studies,such as those of Lin and Rao(2009). Regarding board characteristics,our results show that when board size is larger,the corporate governance level is higher and the firm is more likely to disclose ARIC.However,the t-test shows that the companies with more directors that have financial backgrounds are less likely to disclose ARIC,which is not consistent with our expectation.We also find that most of the proxy variables for information environment show that when firms have better information environments,they are more likely to disclose ARIC.

Table 3Descriptive statistics.

Table 4Univariate tests.

4.2.Regression results

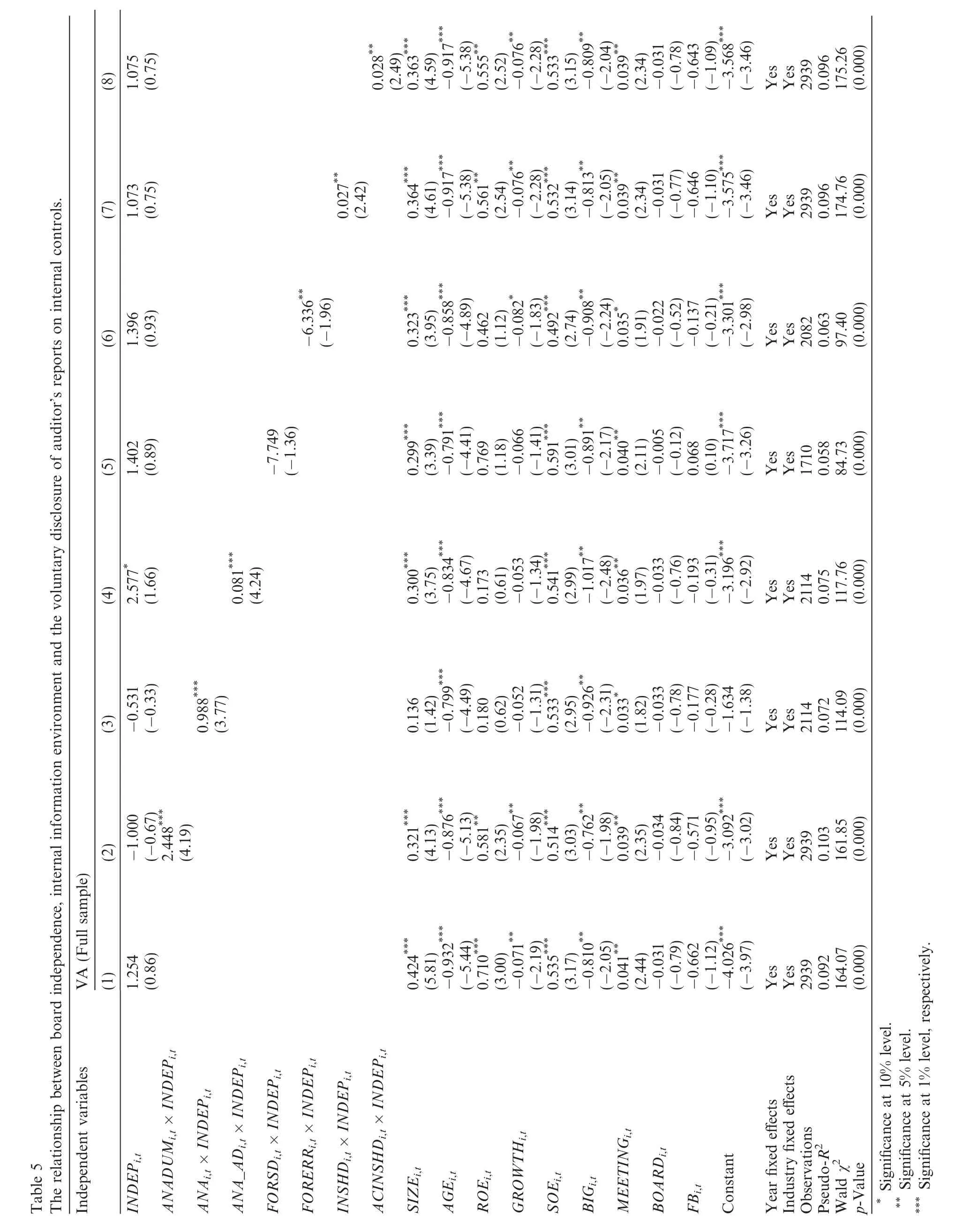

Table 5 presents the results of our main regression of Eq.(1).All of our reported p-values for the estimated coefficients are on an adjusted basis using standard errors correlated for clustering at the firm level to alleviate concerns about residual serial correlation and adjusted for heteroskedasticity.Column 1 of Table 5 presents the model that does not consider information asymmetry,which reveals that the coefficient of INDEP is not significant.Columns 2-8 present analyst following,number of analysts,size-adjusted number of analysts, standard deviation of analyst forecasts,analyst forecast error,institutional ownership and active institutional ownership,respectively,as proxy variables for inside information asymmetry to examine the relationship between the proportion of independent directors and voluntary disclosure decisions under varied information asymmetry between insiders and independent directors.Our results show that all of the signs of the interactions between the information asymmetry proxy variables and INDEP are consistent with our expectations and,except for FORSD*INDEP,all of them are significant.Specifically,when a firm has at least one analyst who posts forecasts(ANADUM=1),or when the number of analysts(or size-adjusted number of analysts)is larger,or when the standard deviation of analyst forecasts is smaller,or when analyst forecast error is smaller, or when institutional ownership(or active institutional ownership)is higher,then a higher proportion of independent directors creates a higher likelihood that the firm will disclose ARIC,such that the interactions ofcolumns 2,3,4,7 and 8 are positive and the remaining two are negative.These results are consistent with Hypothesis 1.

?

?

Examining the control variables,firms with larger size,better performance and shorter listing periods are more likely to disclose ARIC.SOEs are more likely to disclose ARIC because of high regulation pressure. These results are consistent with the univariate tests.For auditor size,hiring a Big 4 audit firm can be considered as a signal to reduce agency problems.Therefore,as a substitution effect,the Big 4 dummy variable is negatively related to the voluntary disclosure of ARIC.For internal governance,when directors are more diligent,the company is more likely to disclose ARIC.

In summary,the regressions in Table 5 show that board independence influences voluntary ARIC disclosure behavior and this effect is conditional on lower inside information asymmetry.Only when independent directors’information acquisition costs are low can their governance roles successfully drive their firms to voluntarily disclose ARIC.

5.Robustness tests and additional analysis

5.1.Sub-sample regressions based on information environment

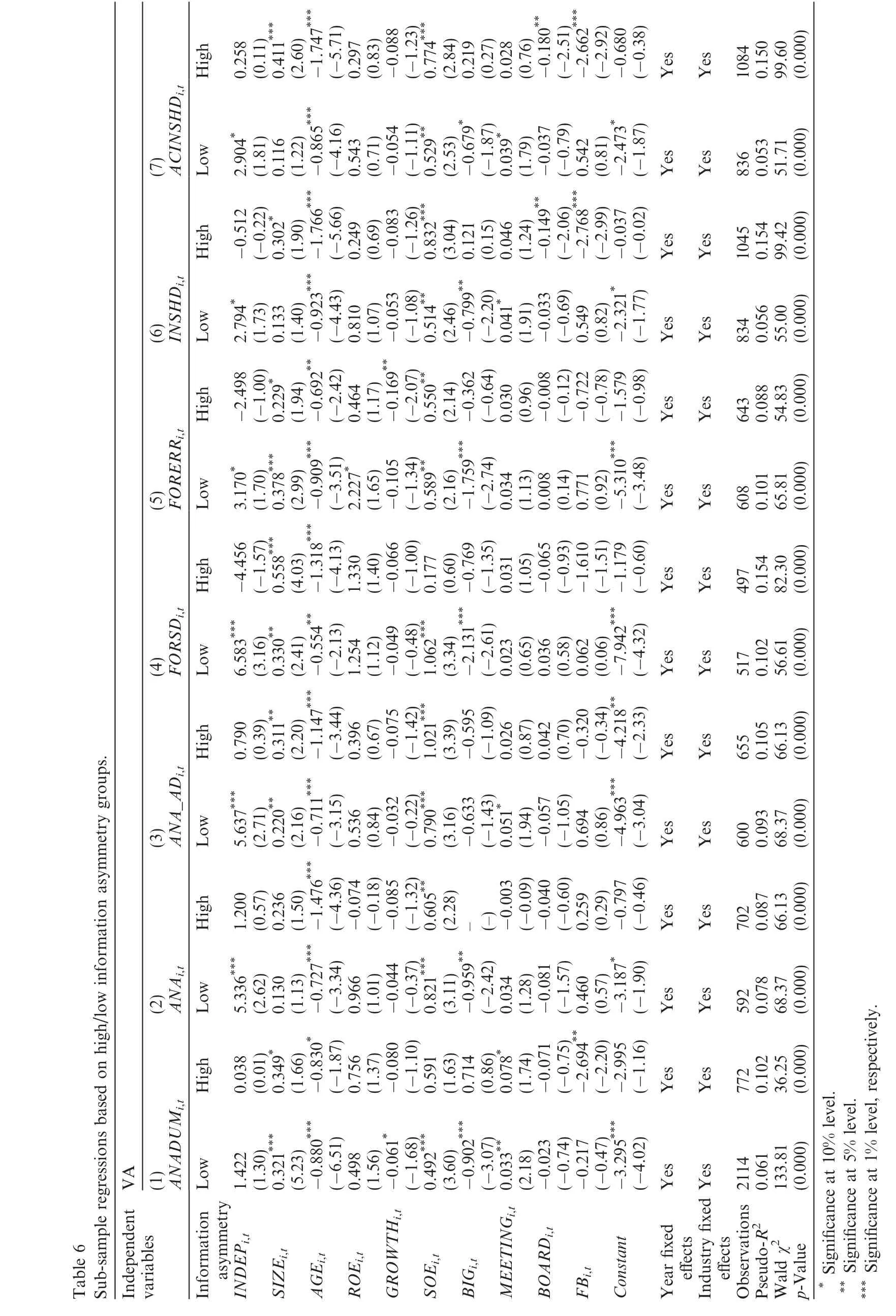

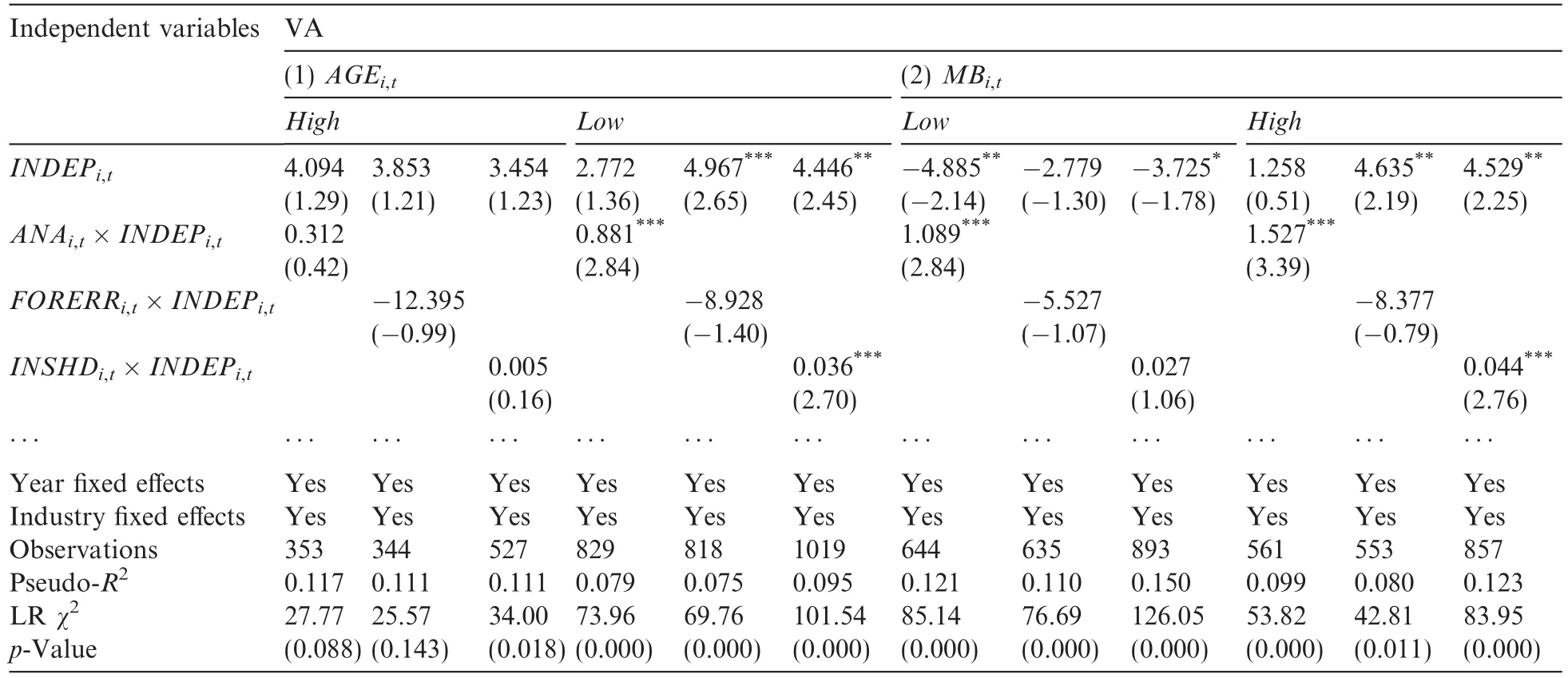

The proxy variables for information environment listed in Table 4 reveal significant differences between the disclosure and no disclosure groups.The information environment is better in the disclosure group,which is consistent with the literature on the information environment’s effect on information disclosure(Lang and Lundholm,1996;Healy and Palepu,2001).This means that our results offer an alternative explanation,specifically that the external information environment has a direct effect on disclosure decisions,as opposed to an indirect effect through independent directors.In the main tests,we use interaction terms to prove our arguments.However,it is unclear whether firms with different external information environments exhibit systematic differences in firm characteristics.To rule out this possibility,we partition the sample according to the degree of information asymmetry.For the dummy variable of analyst following,we just partition the data into 1/0 groups.For other continuous information asymmetry proxies,we divide the sample into high/low groups, respectively based on the top 30%and bottom 30%of observations.4Alternatively,we take the top(bottom)40%or 20%of observations and the results are consistent.For each pair of high/low groups,we rerun the regression of Eq.(1)without the interaction term and test the effect of the proportion of independent directors on ARIC,respectively,and then compare the coefficients.The results are shown in Table 6.

As Table 6 illustrates,except for the analyst following proxy,the coefficients on INDEP are significantly positive for all of the other proxy variables of information asymmetry in the low groups,which indicates that the higher the proportion of independent directors,the higher the likelihood that a firm will voluntarily disclose ARIC.However,in the high groups,the results are not significant and the signs are not consistent with our predictions.In addition,we find that both the significance level and the absolute value of the coefficients are larger in the low groups compared to the high groups.The results in Table 6 further prove our hypothesis.

5.2.The endogeneity problem

Many studies find that the proportion of independent directors is determined by the corporate governance structure and the nature or characteristics of the firm(Hermalin and Weisbach,1988;Ye et al.,2007;Duchin et al.,2010).Since these factors might also affect firms’voluntary disclosure behavior,our conclusion may have an endogeneity problem.

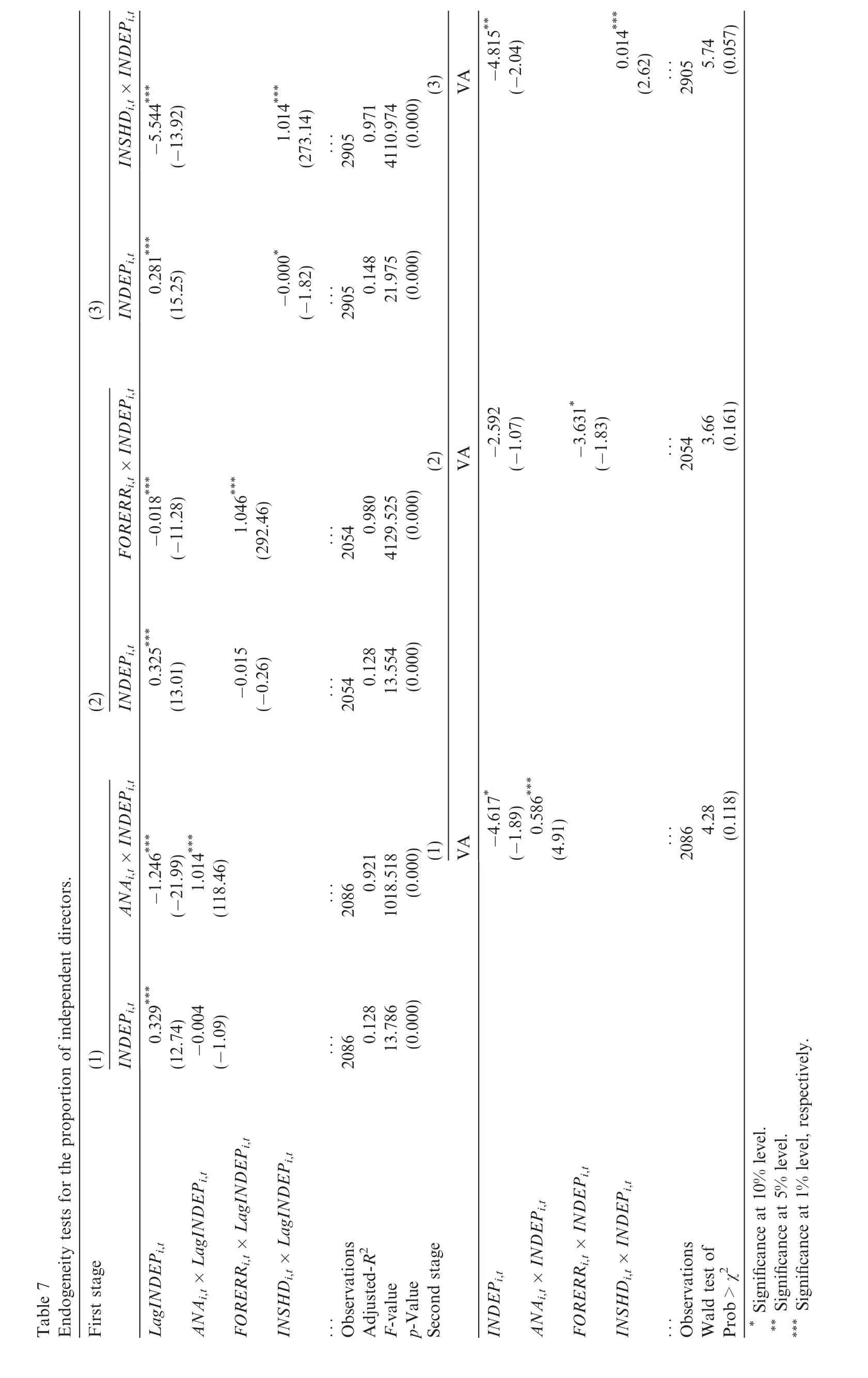

We run a two-stage regression to alleviate this concern.We choose the proportion of independent directors 3 years ago,LagINDEP,as the instrumental variable because independent directors are usually appointed for a term of 3 years and while the previous term’s directors cannot impact recent firm decisions,the previous term’s board structure can affect that of the present term,which makes LagINDEP an effective instrument variable.Specifically,in the first step we use LagINDEP,the interaction terms of LagINDEP and theinformation environment proxies as the instrumental variables for INDEP,the interaction terms of INDEP and the information environment proxies,respectively.The results are shown in Table 7.

For brevity,we choose ANA,FORERR and INSHD as the proxies of information asymmetry and only report the results of the main test variables.Table 7 reveals that in the first stage the coefficients of the instrumental variables are significant,which indicates their effectiveness.In the second regression,we find results that are consistent with Table 5.Thus,our results are robust after adjusting for the endogeneity problem.

5.3.Other robustness tests

For listed firms in China,since 2001 the proportion of independent directors on the board is expected to be at least 1/3.Unlike in countries such as the United States,the proportion of independent directors on the boards of Chinese listed firms is subject to a threshold.If we want to use an independent director proportion index to proxy for board independence,as US studies have done,we must consider an increment beyond 1/3. Thus,we replicate our regression using only those observations with more than 1/3 of independent directors on the board.5We use the real“more than 1/3 proportion”sample,which refers to when the number of independent directors,minus 1,is still larger than 1/3 of the board members.The results(untabulated)do not change significantly.

Our sample period includes important events such as the financial crisis and the Chinese government’s fourtrillion-dollar economic stimulus.Given the overall deterioration of the external economic situation and opportunities for national investment and credit support,listed firms might also have taken the initiative to increase the voluntary disclosure of ARIC.To rule out any influence that these events may have,we re-run the regression of Eq.(1)for the 2007-2008 period and obtain consistent results(untabulated).

5.4.Additional analysis

We further anticipate that the effect of board independence on voluntary disclosure behavior varies among firms with different features and we should find more pronounced interaction effects when the benefits of auditing internal control systems is larger or in firms that are more likely to have an inefficient internal control system.We partition the sample based on listing age and market-to-book ratios.On the one hand,young firms are more likely to face financing constraints and increasing information disclosure helps reduce financing costs.The market-to-book ratio measures growth rates,with a higher market-to-book ratio indicating a higher demand for financing.On the other hand,both young and high-growth firms are exposed to more potential internal control weaknesses(Doyle et al.,2007)and auditing internal controls not only sends a signal to the market that reduces information asymmetry,but also reflects the effectiveness of a firm’s monitoring mechanisms.Thus,we predict that the monitoring role of independent directors will be more pronounced in such firms.The results of our sub-sample regressions are displayed in Table 8.For listing age and market-to-book ratios,we divide the sample observations into two groups,respectively based on the top 30%and bottom 30%of observations.6We also try the top(bottom)40%or 20%of observations and the results are similar.We re-run the regressions of Eq.(1)for each group.For brevity,we only use ANA,FORERR and INSHD as the information asymmetry proxy variables and only report the main test variables.Most of the results in Table 8 reveal that,relative to low growth or high listing age,in the high-growth or low listing age groups the coefficients of the interactions between the information asymmetry proxies and the proportion of independent directors are larger and more significant, which is consistent with our predictions.However,the regressions with the FORERR index do not produce significant results.

6.Conclusion

?

Using a sample of listed firms that voluntarily disclose ARIC from 2007 to 2009,this study investigates whether and how board independence as an important governance mechanism drives firms to voluntarily audit their internal control systems and disclose ARIC under the theoretical analysis structure of informationasymmetry and agency problems.Unlike previous studies,we highlight that only when firms have better information environments and the information asymmetry between insiders and independent directors is relatively low can independent directors effectively fill their governance roles,which increases the likelihood that firms will voluntarily audit their internal control systems.Our results are consistent after adjusting for the influence of the endogeneity problem,Chinese independent directors’regulation factors and the financial crisis.Further, we also find some evidence in sub-samples with shorter listing periods and higher growth rates that the monitoring roles played by independent directors to encourage voluntary disclosure decisions are more pronounced.

Our results highlight how the information acquisition costs of independent directors affects their monitoring effectiveness by giving them the opportunity to investigate the disclosure decisions of internal control audits,which partially explains the prior mixed results on the monitoring role of independent directors.Furthermore,our results have policy implications that improve the effectiveness of independent directors.However,we focus exclusively on ARIC-related disclosure decisions to test the monitoring role of independent directors.Whether or not our results can be generalized to include all voluntary disclosure decisions will require further testing.Moreover,we use external information environment variables to proxy for the information asymmetry between insiders and outside directors.While we have provided explanations for the use of these variables,further studies are needed to find more appropriate proxies for testing and verifying our conclusions.

Table 8Additional analysis.

Acknowledgements

We appreciate useful comments from Professor Jinsong Tan,Shunlin Song from Sun Yat-sen University, Dr.Weiqiang Tan from Hong Kong Baptist University,Professor Wei Luo from Beijing University and participants of the Fourth China Youth accounting scholars Symposium.Special thanks go to the editor and anonymous referee for their useful comments and suggestions on an earlier version of the manuscript.Any errors are our own.We acknowledge financial support for this project from the China National Natural Science Foundation“Internal Control of Listed Companies and Investors Protection”(Project No.70972076); Humanities Social Science Foundation of the Ministry of Education“Internal Control,Overinvestmentand Financial Crisis”(Project No.09YJA790199);The Key Research Institutions of Humanities and Social Science Foundation of Guangdong Province“Internal Control and Value Creation-An Empirical Study Based on China’s Capital Market”(Project No.11JDXM79004);National Social Science Foundation Youth Project(Project No.10CGL041)and Academic New Distinguished Scholar Prize 2011 for PhD candidates offered by the Ministry of Education(14000-3191033).

Adams,R.B.,Ferreira,D.,2007.A theory of friendly boards.The Journal of Finance 62(1),217-250.

Armstrong,C.S.,Guay,W.R.,Weber,J.P.,2010.The role of information and financial reporting in corporate governance and debt contracting.Journal of Accounting and Economics 50(2-3),179-234.

Bushman,R.M.,Piotroski,J.D.,Smith,A.J.,2004.What determines corporate transparency?Journal of Accounting Research 42(2),207-252.

Chen,C.J.P.,Jaggi,B.,2000.Association between independent non-executive directors,family control and financial disclosures in Hong Kong.Journal of Accounting and Public Policy 19(4-5),285-310.

Cheng,X.,Li,H.,Luo,Y.,Du,P.,2009.Can financial information distortion events prompt the companies revise the system of independent directors?China Accounting Review 7(1),87-96(in Chinese).

Dalton,D.R.,Daily,C.M.,Ellstrand,A.E.,Johnson,J.L.,1998.Meta-analytic reviews of board composition,leadership structure,and financial performance.Strategic Management Journal 19(3),269-290.

Doyle,J.,Ge,W.,McVay,S.,2007.Determinants of weaknesses in internal control over financial reporting.Journal of Accounting and Economics 44(1-2),193-223.

Duchin,R.,Matsusaka,J.G.,Ozbas,O.,2010.When are outside directors effective?Journal of Financial Economics 96(2), 195-214.

Dyck,A.,Zingales,L.,2004.Private benefits of control:an international comparison.The Journal of Finance 59(2),537-600.

Eng,L.L.,Mak,Y.T.,2003.Corporate governance and voluntary disclosure.Journal of Accounting and Public Policy 22(4), 325-345.

Fama,E.F.,1980.Agency problems and the theory of the firm.The Journal of Political Economy 88(2),288-307.

Fang,H.,Sun,H.,Jin,Y.,2009.Corporate characteristics,external audit,and voluntary disclosure of internal control information:an empirical study based on annual reports of listed companies of Shanghai stock exchanges from 2003 to 2005.Accounting Research 10, 44-95(in Chinese).

Gul,F.A.,Leung,S.,2004.Board leadership,outside directors’expertise and voluntary corporate disclosures.Journal of Accounting and Public Policy 23(5),351-379.

Harris,M.,Raviv,A.,2008.A theory of board control and size.Review of Financial Studies 21(4),1797-1832.

Healy,P.M.,Palepu,K.G.,2001.Information asymmetry,corporate disclosure,and the capital markets:a review of the empirical disclosure literature.Journal of Accounting and Economics 31(1-3),405-440.

Hermalin,B.E.,Weisbach,M.S.,1988.The determinants of board composition.The RAND Journal of Economics 19(4),589-606.

Hsu,H.,2010.The relationship between board characteristics and financial performance.an empirical study of United States IPO. International Journal of Management 27(2),332-341.

Jensen,M.C.,1993.The modern industrial revolution,exit,and the failure of internal control systems.The Journal of Finance 48(3),831-880.

Jensen,M.C.,Meckling,W.H.,1976.Theory of the firm:managerial behavior,agency costs and ownership structure.Journal of Financial Economics 3(4),305-360.

Klein,A.,2002.Audit committee,board of director characteristics,and earnings management.Journal of Accounting and Economics 33 (3),375-400.

Krishnaswami,S.,Subramaniam,V.,1999.Information asymmetry,valuation,and the corporate spin-of fdecision.Journal of Financial Economics 53(1),73-112.

Lang,M.H.,Lundholm,R.J.,1996.Corporate disclosure policy and analyst behavior.The Accounting Review 71(4),467-492.

Lin,B.,Rao,J.,2009.Why do listed companies disclose the auditor’s internal control reports voluntarily?An empirical study based on signaling theory in China.Accounting Research 2,45-52(in Chinese).

Luo,W.,Zhu,C.,2010.Agency costs and corporate voluntary disclosure.Economic Research Journal 10,143-155(in Chinese).

Park,Y.W.,Shin,H.,2004.Board composition and earnings management in Canada.Journal of Corporate Finance 10(3),431-457.

Peasnell,K.V.,Pope,P.F.,Young,S.,2005.Board monitoring and earnings management:do outside directors influence abnormal accruals?Journal of Business Finance&Accounting 32(7-8),1311-1346.

Raheja,C.G.,2005.Determinants of board size and composition:a theory of corporate boards.Journal of Financial and Quantitative Analysis 40(2),283-306.

Rhoades,D.L.,Rechner,P.L.,Sundaramurthy,C.,2000.Board composition and financial performance.a meta-analysis of the influence of outside directors.Journal of Managerial Issues 12,76-91.

Rosenstein,S.,Wyatt,J.G.,1990.Outside directors,board independence,and shareholder wealth.Journal of Financial Economics 26(2), 175-191.

Shen,H.,Yi,Y.,Wu,Y.,2010.Legitimacy,corporate governance and social disclosure.China Accounting Review 8(3),363-376(in Chinese).

Ye,K.,Lu,Z.,Zhang,Z.,2007.Can independent directors deter the tunneling of large shareholders?Economic Research Journal 4,103-111(in Chinese).

Yermack,D.,1996.Higher market valuation of companies with a small board of directors.Journal of Financial Economics 40(2),185-211.

Zhang,T.,Huang,J.,2010.An empirical investigation of voluntary auditing:cause and consequence.China Accounting Review 8(2), 147-160(in Chinese).

8 December 2011

*Corresponding author at:Department of Accountancy,City University of Hong Kong,China.

E-mail address:sunye_74@163.com(Y.Sun).

China Journal of Accounting Research2012年2期

China Journal of Accounting Research2012年2期

- China Journal of Accounting Research的其它文章

- The reform of accounting standards and audit pricing

- State control,access to capital and firm performance

- Relative performance evaluation and executive compensation: Evidence from Chinese listed companies

- Government auditing and corruption control:Evidence from China’s provincial panel data