Relative performance evaluation and executive compensation: Evidence from Chinese listed companies

Donghua Chen,Shangkun Liang,Pin Zhu

Institute of Accounting and Finance,School of Business,Nanjing University,China

Relative performance evaluation and executive compensation: Evidence from Chinese listed companies

Donghua Chen,Shangkun Liang*,Pin Zhu

Institute of Accounting and Finance,School of Business,Nanjing University,China

A R T I C L EI N F O

Article history:

Accepted 7 February 2012

Available online 9 June 2012

JEL classification:

G30

J33

M52

Relative performance evaluation (RPE)

Top managers’compensation

Non-SOEs

SOEs

This paper focuses on the effect of relative performance evaluation(RPE)on top managers’compensation in Chinese public firms.Overall,we find no evidence of an RPE effect or any asymmetry in firms’use of RPE.The results obtained using Albuquerque’s(2009)method are similar to those obtained using traditional methods.In addition,we find that RPE is used more in non-SOEs than in SOEs.This may be due to the regulation of compensation, various forms of incentives and the multiple tasks of managers in SOEs.

Ⓒ2012 China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong.Production and hosting by Elsevier B.V.All rights reserved.

1.Introduction

The accurate evaluation of agents’work and the provision of appropriate compensation contracts is an important issue(Jensen and Meckling,1976).The cost of directly supervising executives is quite high,thus valuing their work indirectly,for example through relative performance evaluation(RPE),is more feasible(Jensen and Murphy,1990;Murphy,1999).As performance information reflects a company’s output level and return level,it is likely to be the most important economic characteristic.This information is considered to be reliable under modern accounting and auditing systems,and thus is widely applied.However,information on the company itself is not sufficiently accurate for evaluating managers’efforts because a company is in an open system,affected by many external factors that are not directly related to the effort of managers.Therefore, using only the performance of the company to value managers’efforts will create a bias.However,the method of evaluation would be improved if we could exclude systemic factors.

RPE theory is based on this logic.The theory assumes that companies inevitably face industry-level or macro-level external risk(common risk),and an optimal compensation contract that eliminates these common risks will be more efficient(Holmstrom,1982;Antle and Smith,1986;Gibbons and Murphy,1990).Nevertheless,RPE theory does not produce consistent empirical results.For example,Antle and Smith(1986)and Aggarwal and Samwick(1999b)find no support for the theory,and Gibbons and Murphy(1990),Janakiraman et al.(1992)and Crawford(1999)find only weak support.

Recent years have seen new developments in the research on RPE.One area of research involves identifying more appropriate peer groups from theoretical inference(Albuquerque,2009).Another area extracts information on peer groups directly from companies’annual reports(Carter et al.,2009;Faulkender and Yang,2010; Gong et al.,2011).Although empirical research has provided strong support for these two methods,there is little empirical evidence from China.Nevertheless,this issue is of concern in the context of China.For example,the foreign literature cannot provide any conclusions on whether there are differences in the use of RPE between SOEs(State Owned Enterprises)and non-SOEs(non-State Owned Enterprises).The executive compensation models of SOEs and non-SOEs are quite different.For example,SOEs have cash compensation regulations(Chenet al.,2005a).In addition,non-SOEs are more market-oriented and face more intense competition.Thus,on the one hand,we need to consider the difference in the nature of SOEs and non-SOEs when selecting peer groups,but on the other hand,non-SOEs may be more likely to use RPE.

Using data from 1999 to 2009,we conduct an empirical test of RPE theory in China.Overall,we find no significant RPE in China and also no asymmetry in the use of RPE.Considering the nature of companies,we find that non-SOEs are more likely to use RPE.We select peer groups using both the traditional method of Janakiraman et al.(1992),and the method described by Albuquerque(2009).We also conduct a strong-form RPE check,following Antle and Smith(1986).The results are consistent under all methods.

The paper proceeds as follows.In Section 2,we present the literature review,theoretical analysis and hypothesis development.In Section 3,we describe the sample selection,variable de finitions and descriptive statistics.We present the empirical tests in Section 4 and conclusions and limitations in Section 5.

2.Literature review,theoretical analysis and hypothesis development

RPE theory is logical and widely applicable.In the case of common risk,using the RPE method to choose a peer group can effectively extract the individual effort of managers and mitigate agency problems.The theory and models of RPE suggest that it is necessary to exclude the combined effect of peer groups(Baiman and Demski,1980;Diamond andVerrecchia,1982;Holmstrom,1979,1982).Antle and Smith(1986)and Gibbons and Murphy(1990)show that the benefit of adding relative performance considerations to executive compensation contracts is greater than the cost.

However,theoretical expectations have not received consistent support from empirical studies.Antle and Smith(1986)examine the relationship between CEO compensation and industry returns from 1947 to 1977. Using different definitions of compensation,they only find weak support for RPE.Gibbons and Murphy (1990)examine the relationship between change in compensation and firm stock returns for 1668 CEOs from 1974 to 1986.Their results show that changes in compensation are negatively related to industry and market performance.They also find evidence that RPE is related to CEO turnover.Jensen and Murphy(1990)find that changes in CEO compensation are positively related to changes in shareholder wealth.However,they find no significant relationships between change in compensation and change in net-of-industry wealth or net-ofmarket wealth.Janakiraman et al.(1992)examine 609 companies from 1970 to 1988.They find weak evidence in support of weak-form RPE,but no evidence in support of strong-form RPE.Aggarwal and Samwick (1999b)examine stock returns from 1993 to 1996 and use several methods,including median regressionsand OLS regressions,but find no systematic support for RPE.Aggarwal and Samwick(1999a)find some support for RPE using short-term compensation,but long-term compensation increases with industry performance.Garvey and Milbourn(2003)examine the relationship between CEO compensation and stock returns and find no support for RPE,except in companies where managers are younger and have less financial wealth.

To resolve such conflicts,researchers have offered possible explanations for the lack of RPE.On the one hand,constraint conditions will limit the use of RPE.For example,Aggarwal and Samwick(1999a)point out that the degree of competition might be an important factor in using RPE.On the other hand,the efficiency of compensation contracts is also in doubt.For example,Bebchuk and Fried(2003)find that in the case of poor corporate governance,CEOs can influence their own pay through their control over the design of CEO compensation.This will reduce the sensitivity of compensation and also lead to a lack of RPE.

There have been few empirical studies of RPE in China.Xiao(2005)tests the strong-and weak-form RPE in a sample of listed companies in 2002.Using the average ROE of peer groups in the same region and the average ROE by 2-digit industry code,they find evidence of weak-form,but not strong-form RPE.Gao (2006)uses a sample of all A-share listed companies from 2001 to 2004 to test the theory.He finds that RPE exists when the peer group is comprised of similar industry-size firms or the same industry-ownership firms.However,the article neither explains the theoretical base for the composition of peer groups,nor compares companies with different ownership types.Zhou and Zhang(2010)examine the effect of RPE in listed companies in China from 1999 to 2006 using their comprehensive index of performance.They find that RPE exists when peer groups are based on area,but find opposite effects when peer groups are based on industry or size.However,the comprehensive index of performance designed by the authors is a subjective measure.

In recent years,there has been substantial progress in the study of RPE.Albuquerque(2009)proposes a new theory and method for selecting peer groups.He regards size as the most important factor affecting outside risks at the company level.For example,large companies often face lower financing constraints because they are more likely to survive in the event of negative shocks.Additionally,size is often related to diversity and the degree of diversity can affect companies’risk tolerance.His empirical results support RPE theory. Carter et al.(2009)hand-collect information on peer groups in FTSE-listed companies in the UK.They find that the probability of using RPE does not increase when systemic risk increases,whereas external monitoring is an important factor for using RPE.Faulkender and Yang(2010)hand-collect information on peer groups in compensation plans in the US.Their results support RPE theory and their direct method has advantages over traditional methods,such as the industry-size peer group method.In addition,they find that companies prefer to put companies with high pay into their peer groups.Gong et al.(2011)also use manually collected information on peer groups in compensation plans in the US to test RPE theory.They find that 25%of listed companies explicitly use peer groups and the choice of peer groups supports a mixture of effective contract theory and rent-seeking theory.

In our opinion,it is essential to study RPE theory in China.First,studies on RPE in China are still rare and those that exist are mainly normative studies.Second,the existing empirical studies have produced mixed results(Xiao,2005;Gao,2006;Zhou and Zhang,2010),thus improving RPE methodology is important. Third,we believe that the nature of ownership is an important factor to be considered in studying RPE,which is not generally considered either in China or elsewhere1The influence of the nature of ownership in studying RPE is important.We need to compare the difference between the incentives of SOEs and non-SOEs to use RPE in a theoretical analysis,and we should also consider it in the methodology for constructing peer groups..

There are various differences in the way executive compensation is designed and evaluated for SOEs and non-SOEs.First,there are regulations on cash compensation in Chinese SOEs.In 2002 and 2009,for example, the SAC set multiple limits for executive cash compensation in SOEs.2The Guidelines about Further Standardizing the Executive Compensation in SOEs,issued in 2009,rules that the basic salary of executives in SOEs must not exceed five times the average salary of the workers and the upper limit for performance-related salary is three times their basic salary.However,there is no limit in non-SOEs, so executive compensation in non-SOEs is more market-oriented.Chen et al.(2005a)provide evidence that executives’relative pay in SOEs is far less than in non-SOEs.3Relative pay means the ratio of executives’average salary to non-executives’average salary.Second,there are various forms of incentivesin SOEs.For example,Chenet al.(2005a)find that perks were widely used as an incentive.Cao et al.(2010), Chen et al.(2011a)and Wang and Xiao(2011)argue that the opportunity for promotion of executives in SOEs is also an important incentive.However,such incentives are rare in non-SOEs and cash compensation is dominant.4Stock options have only recently become popular,and were not dominant in these sample years.Third,SOEs are affected by multiple tasks.Bai and Xu(2005)and Bai et al.(2006)find that executives in SOEs undertake diverse tasks.Executives in SOEs not only need to improve performance,but also need to consider other issues,such as the employment of workers.However,non-SOEs are often subject to less government intervention(Chen et al.,2011b),so performance is likely to be more closely related to executive evaluation.

The above differences may cause RPE to be applied differently in SOEs and non-SOEs.First,the regulation of executive cash compensation is expected to reduce the effect of RPE.For example,when cash compensation is close to the limit,even if relative performance is high,executives may not work harder,thus RPE is not effective.Second,the various forms of incentives in SOEs will reduce the benefit of RPE,because cash compensation is just one type of incentive in SOEs.Third,multiple tasks will obscure the relationship between firm performance and executive effort,which will increase the implementation cost of RPE.For example,the performance in company A’s financial statements is lower than in company B’s,but company A undertakes a lot of redundancies.Is the performance of company A better or worse than that of company B?However,in non-SOEs,there is no regulation of executive cash compensation,there is only one form of incentive and there is less intervention from multiple governmental goals,thus implementation of RPE will be easier and the net effects of RPE will be more obvious.

In summary,we believe that RPE is more likely to be applied in non-SOEs than in SOEs.

3.Sample selection,definition of variables and descriptive statistics

3.1.Sample selection

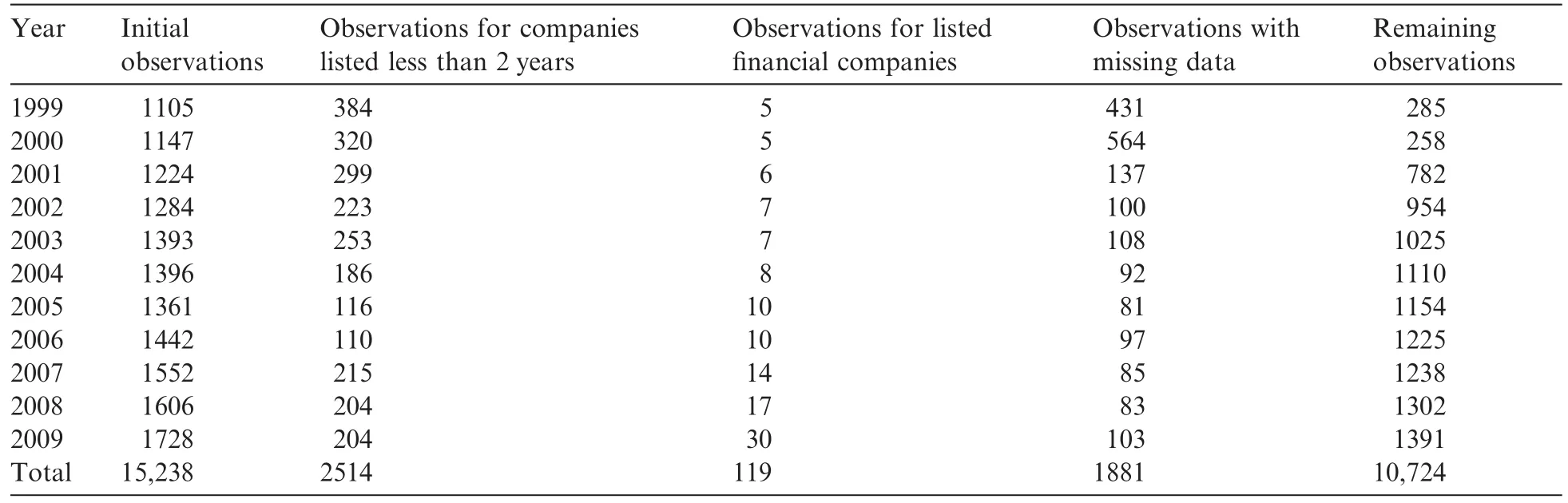

The initial sample used in this study comprises 15,238 observations for A-share firms listed on the Shanghai and Shenzhen stock markets.We screened the sample as follows:(1)we remove 2541 observations for firms that had been listed for less than 2 years;(2)we remove 119 financial companies;and(3)we remove 1881 observations with missing values.A total of 10,724 observations remain.To reduce the influence of extreme values,we exclude the top and bottom 1%of Roe and Ret values,which leaves 10,321 observations.The data used is from the CSMAR and CCER databases.We use SAS and STATA software to process the data.The procedure for sample selection is listed in Table 1.

3.2.Construction of peer groups

We use two methods to construct peer groups.The first group,denoted as M1,includes companies in the same year,with the same ownership type and the same industry(excluding the company itself).The second group,denoted as M2,includes companies in the same year,with the same ownership type,the same industry and of a similar size(excluding the company itself).The construction of M2 follows Albuquerque(2009).Similar size was defined as companies in the same quartile.Albuquerque(2009)believes that systematic discrepancies exist between different sized companies.For M2,each peer group was required to have at least three observations.Therefore,722 observations were removed.The remaining 9590 observations were included in the final analysis.

3.3.Definition of variables

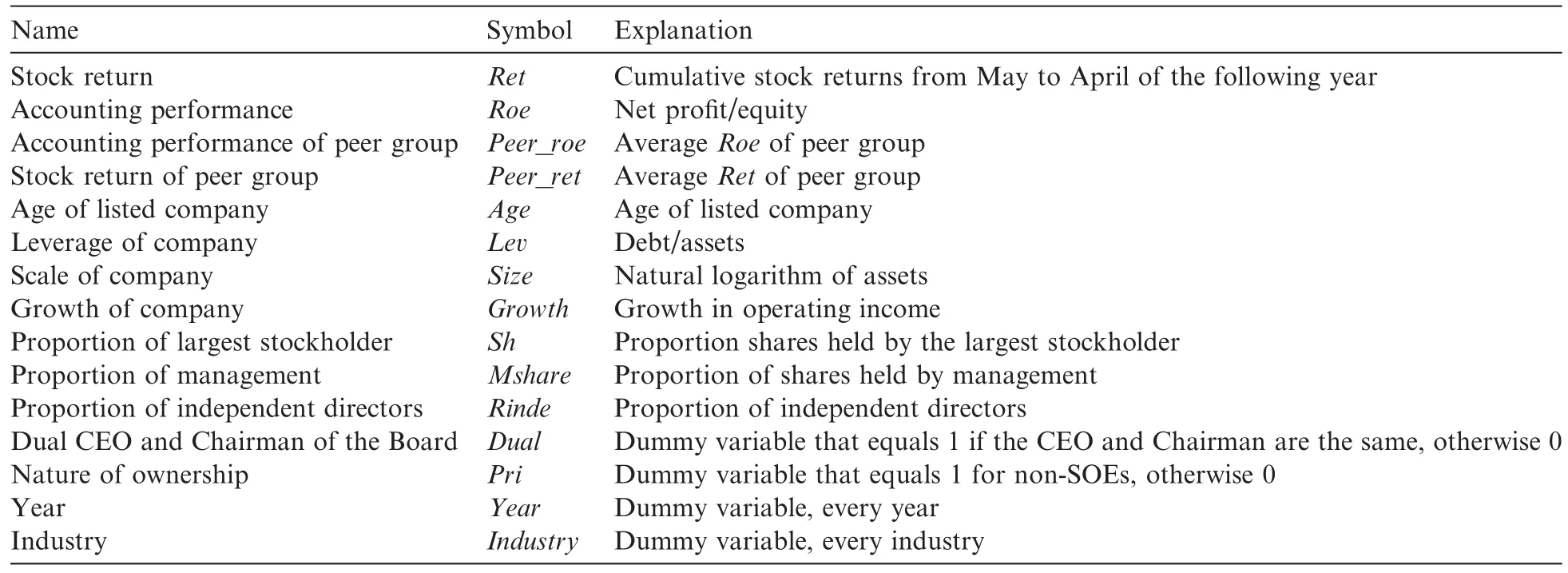

Table 2 shows the definitions of variables.

We select Ret and Roe as measurements of company performance.Ret is the cumulative stock returns from May to April in the following year(using the BHR method).Peer group performance is recorded as Peer_retand Peer_roe,which are the average values of the peer groups(M1 refers to Peer_ret1 and Peer_roe1;M2 refers to Reer_ret2 and Peer_roe2).Lncp is the natural logarithm of the total cash compensation of the top three managers.Age is the number of years the company has been listed.Lev is the company’s leverage.Size is the size of the company,the natural logarithm of total assets at the end of the year.Growth is the income growth rate.Sh is the shareholding ratio of the largest shareholder.Mshare is the shareholding ratio of managers.Rinde is the ratio of independent directors to the total number of directors.Dual is a dummy variable that equals 1 if the same person holds the positions of CEO and Chairman of the Board,and 0 otherwise.Pri is a dummy variable for the proprietary nature of the enterprise;it equals 1 if the company is a non-SOE,and 0 otherwise.Year are dummy variables for every year.Industry are industry dummy variables set by the CSRC.

3.4.Descriptive statistics and correlations

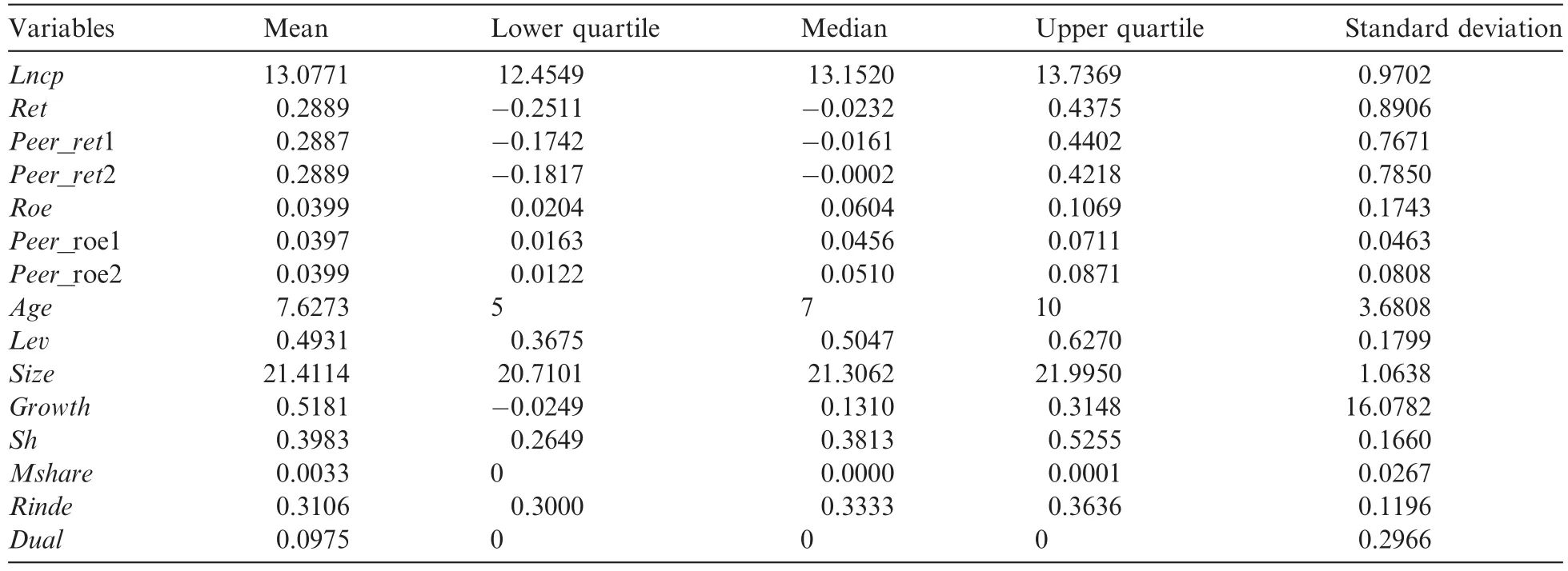

Table 3 reports the descriptive statistics for the main variables.The mean and median of Ret are 0.29 and 0.02 respectively,indicating a skewed distribution.The mean and median of accounting performance are 0.04 and 0.06 respectively.The average years listed(Age)is 7 years.Leverage(Lev)is around 50%.In about 10%of companies,the CEO and Chairman of the Board is the same person(Dual).

Table 1Sample selection.

Table 2Variable definitions.

Table 3Descriptive statistics.

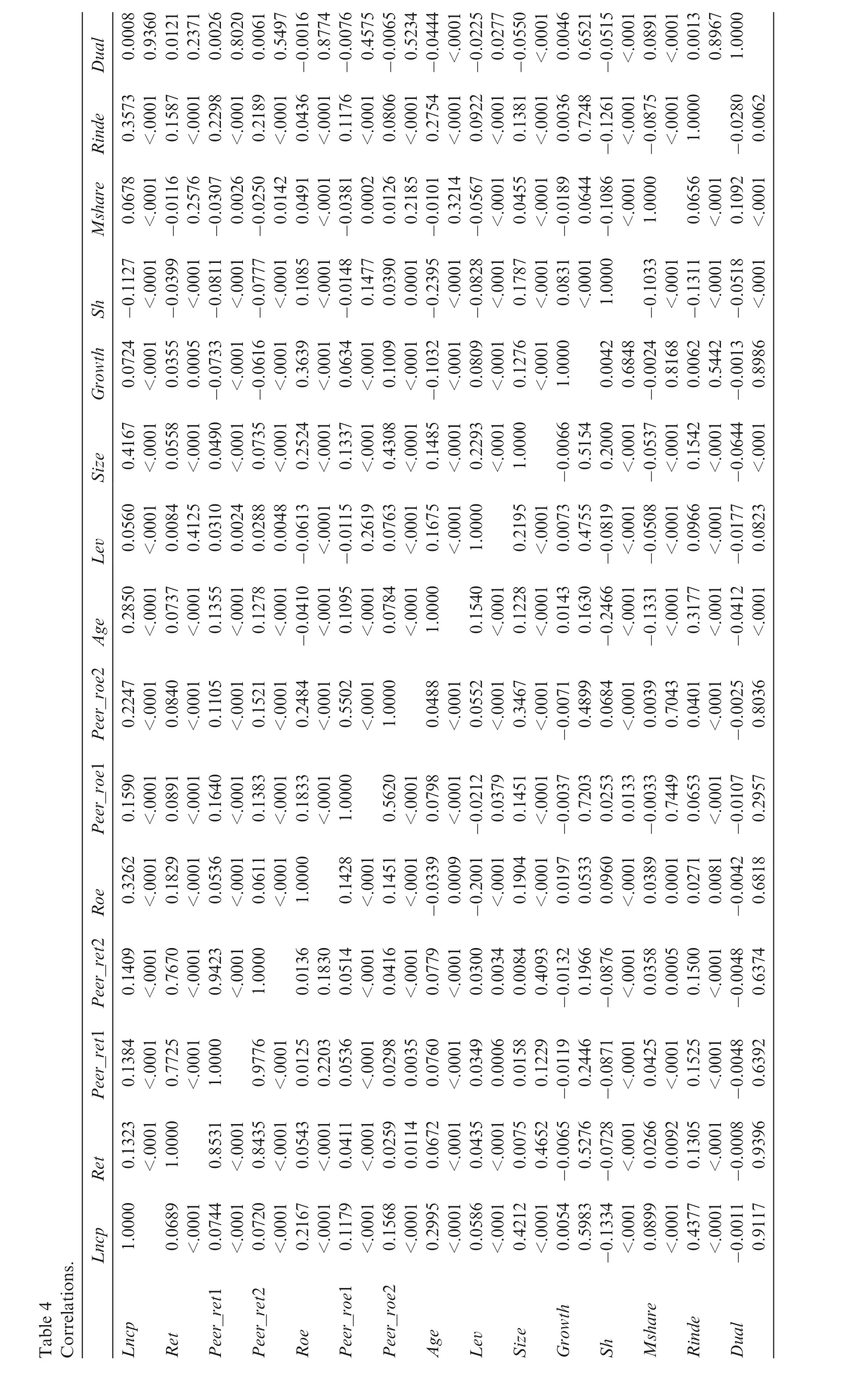

Table 4 shows the correlation analysis for the main variables;the Pearson correlation matrix is in the lower triangle and the Spearman correlation matrix is in the upper triangle.We find that managers’compensation (Lncp)is significantly and positively related to company performance(Ret,Roe),which shows the effectiveness of executive pay.Table 4 also shows that the main explanatory variables do not have any severe collinearity problems.

4.Empirical tests

4.1.Do Chinese companies use RPE?

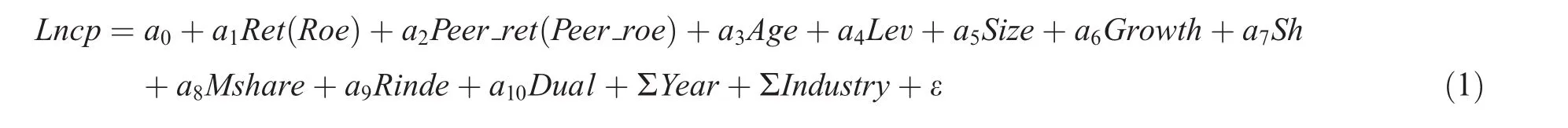

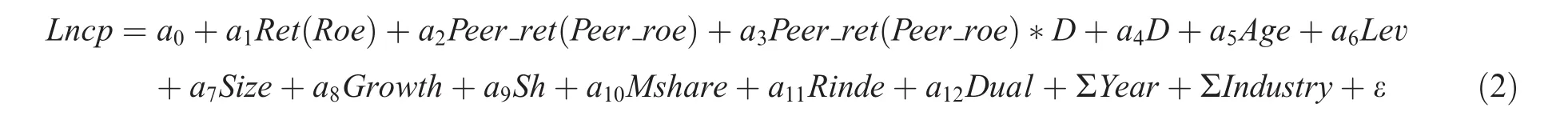

Following Albuquerque(2009),we establish model(1)to test whether listed companies in China adopt the RPE method to determine executive pay.

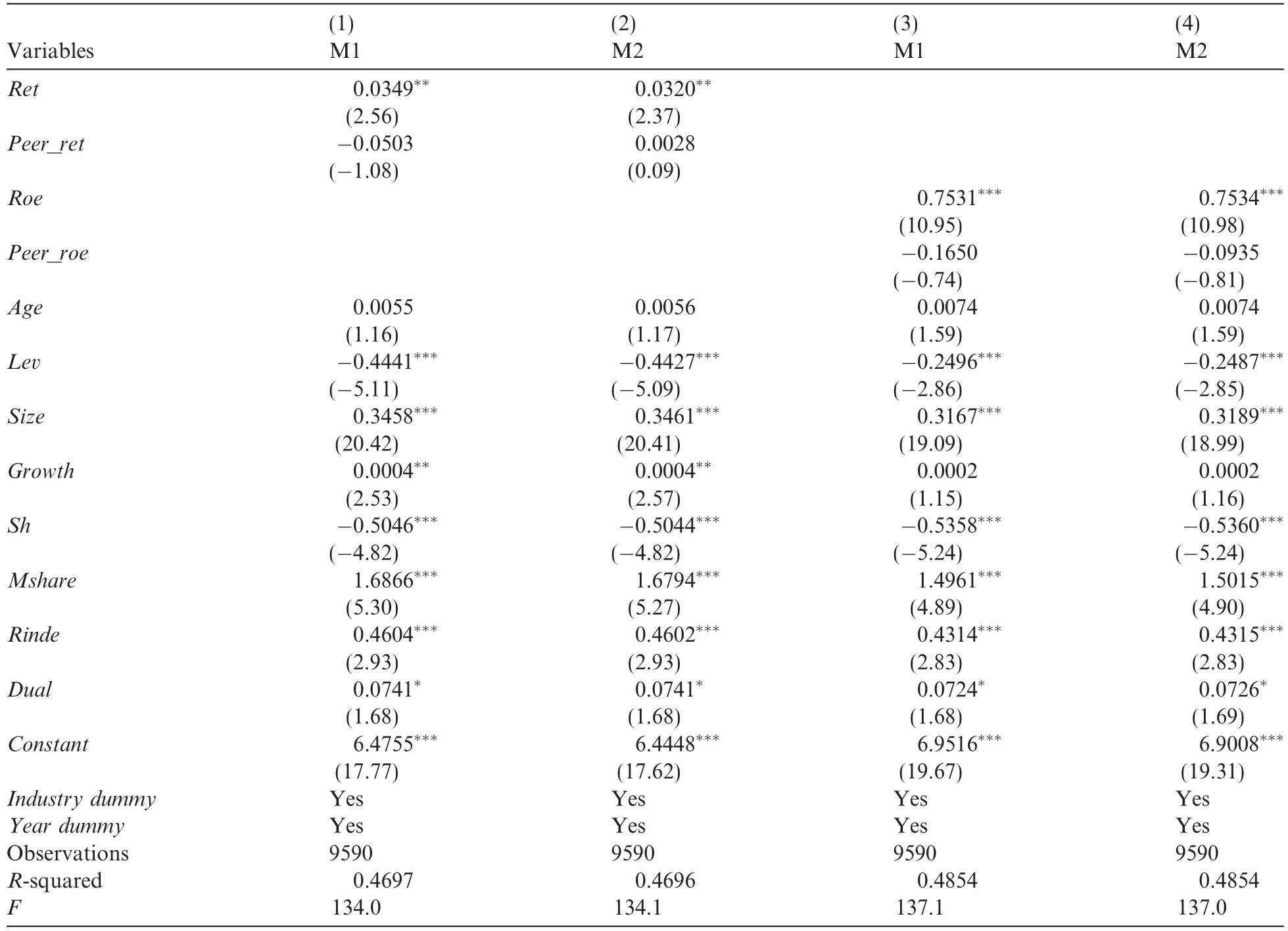

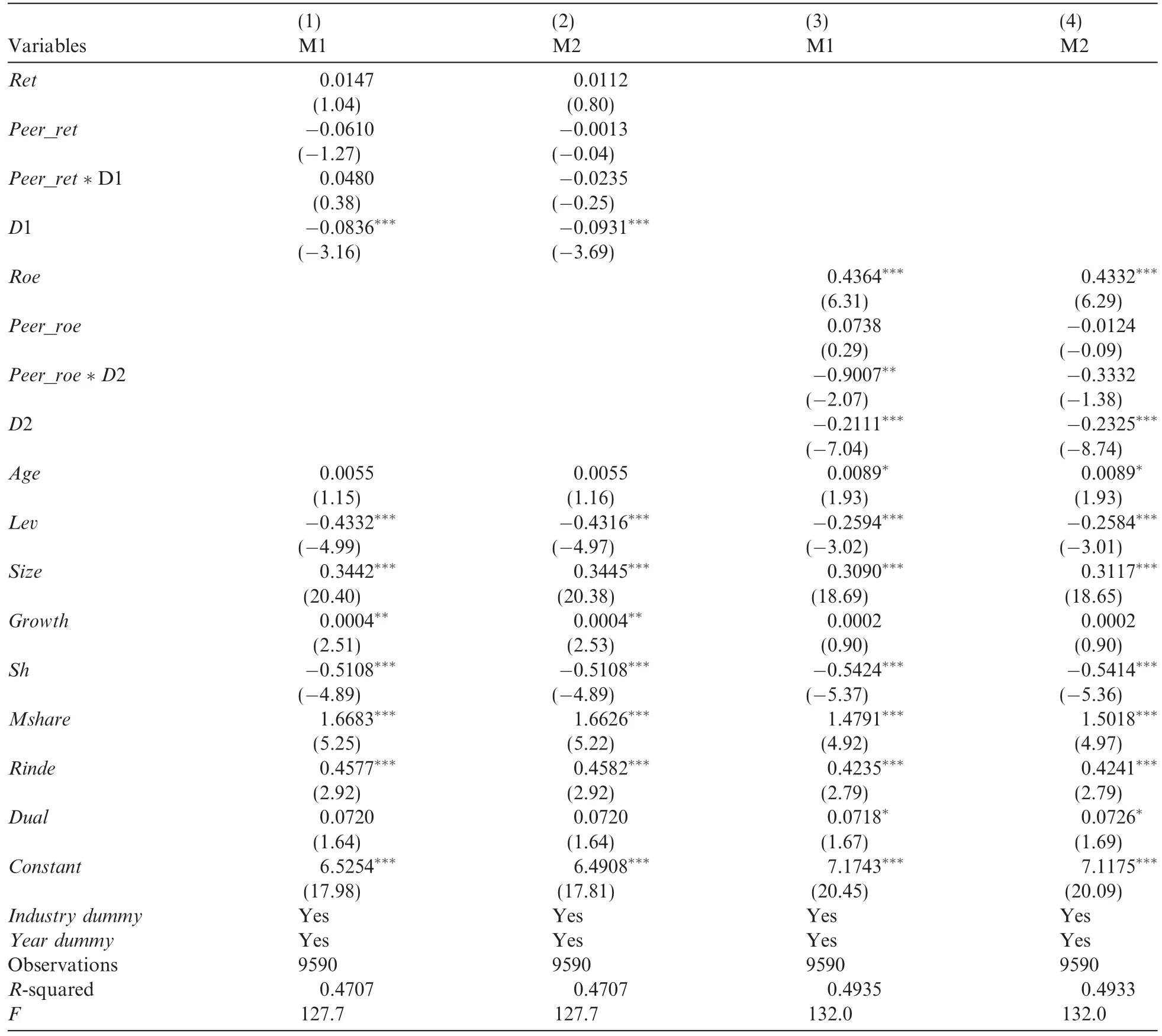

Table 5 displays the regression results using the method of clustering by companies and we report robust t-values.The explanatory variables in columns(1)and(3)of Table 5 are Peer_ret and Peer_roe,composed according to M1(the same year,the same ownership and the same industry).The explanatory variables in columns(2)and(4)of Table 5 are Peer_ret and Peer_roe,composed according to M2(the same year,the same ownership,the same industry and similar size).We find that company performance(Ret,Roe)is positive and significant,but peer group performance is not significant.This suggests that companies in China do not generally use RPE.

Albuquerque(2009)argues that there is asymmetry in the use of RPE:companies with poor performance are more likely to use RPE to avoid litigation risks.We follow Albuquerque(2009)and use model(2)to test this deduction.

In this model,D is a dummy variable,equal to 1 if the company’s performance is below the lower quartile and 0 otherwise.D1 and D2 refer to Ret and Roe respectively.

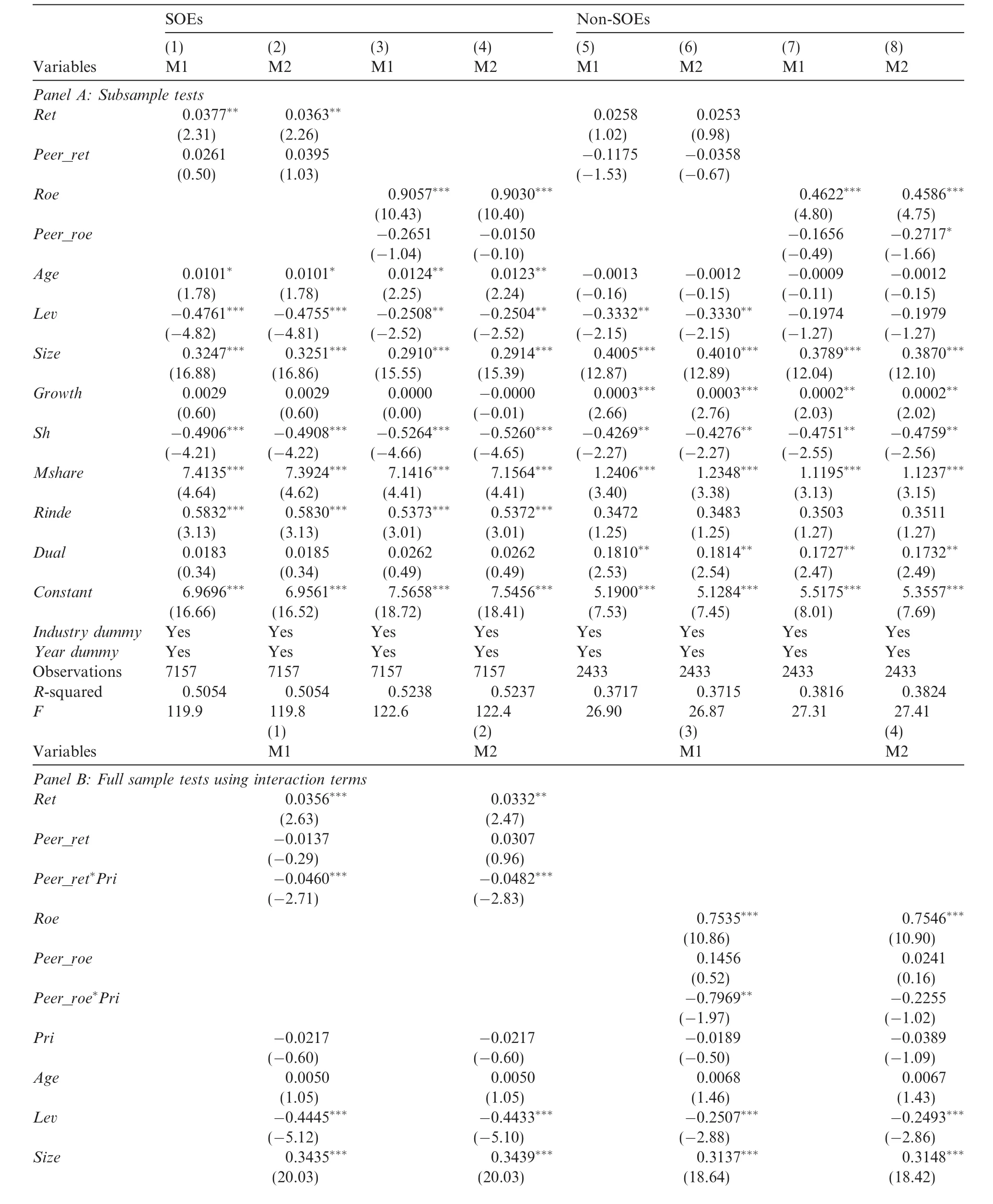

The regression results are shown in Table 6.We find a significant negative interaction only in column(3). The remaining interaction terms are insignificant.These results suggest that there is no asymmetry in the use ofRPE.The results also show that there is little difference between Albuquerque‘s(2009)method and the traditional method of constructing peer groups.

?

Table 5Relative performance evaluation and executive compensation.

4.2.The difference between SOEs and non-SOEs

Earlier,we discussed a series of differences in executive compensation between SOEs and non-SOEs.These differences will also affect the use of RPE,especially in non-SOEs.To test this inference,we regress model(1) on different subsamples according to the type of ownership.

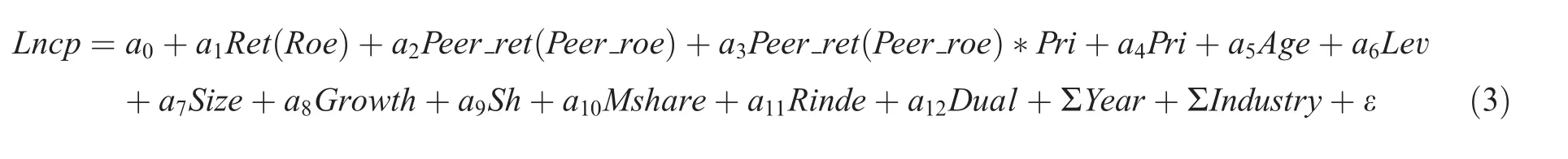

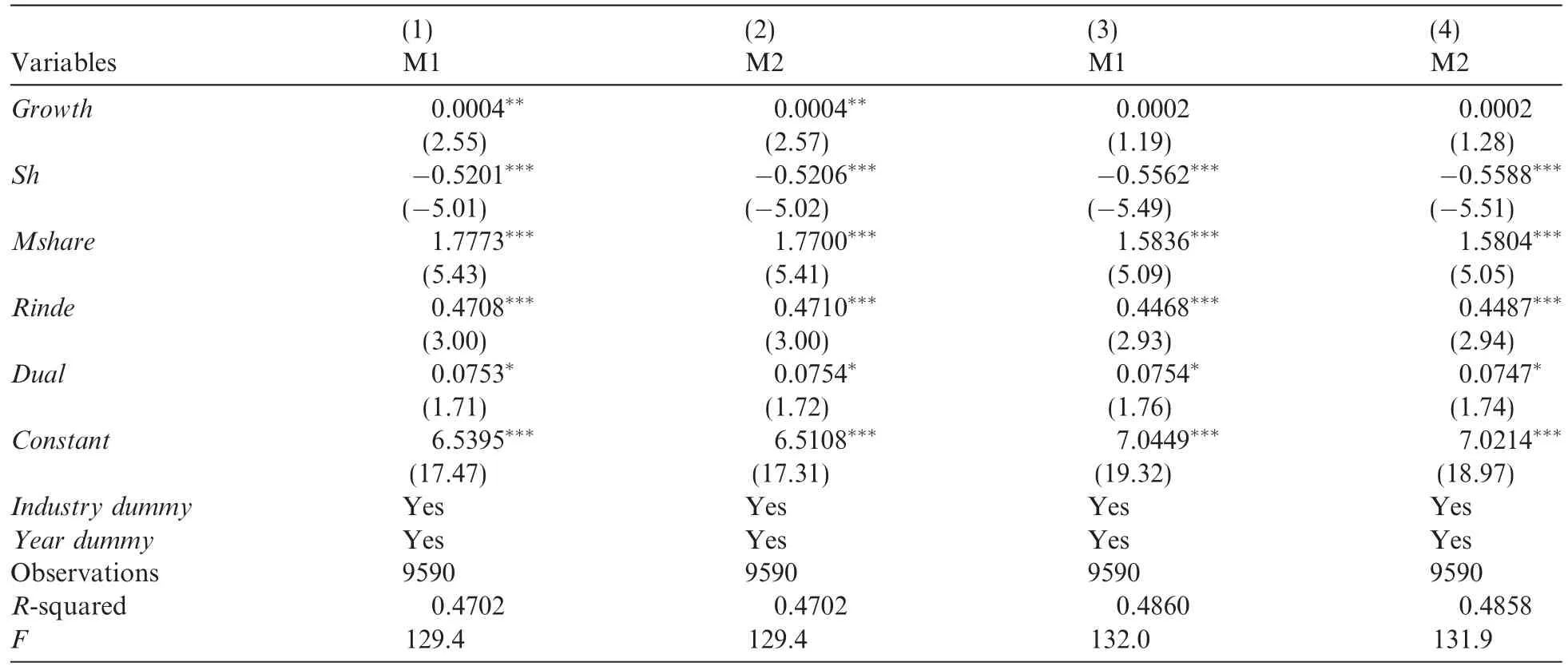

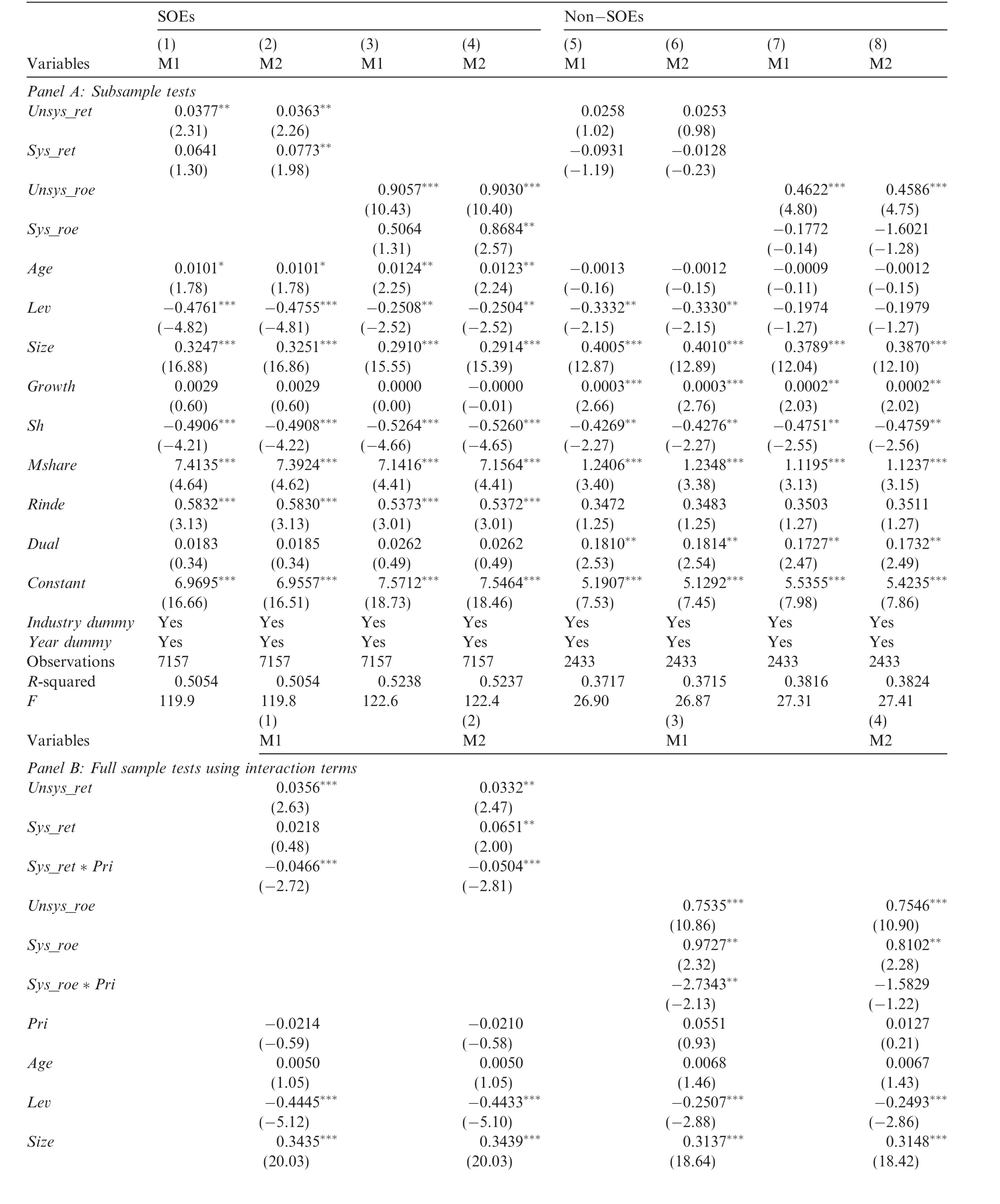

Table 7 Panel A presents the regression results.Peer group performance for SOEs is positive or insignif icant.Peer group performance for non-SOEs is negative,but only significant in column(8).To compare the two groups,we construct model(3).Pri is a dummy variable that equals 1 for non-SOEs,and 0 otherwise. If non-SOEs use RPE more than SEOs,then the interaction should be significantly negative.

Table 6Asymmetry of relative performance evaluation.

Table 7 Panel B presents the regression results.The interactions are negative and significant at the 1%level in columns(1)and(2),and significant at the 5%level in column(3).These results support our inference that non-SOEs use RPE more than SOEs.

4.3.Tests of strong-form RPE

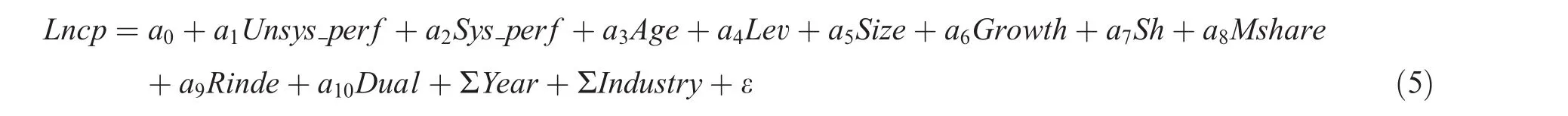

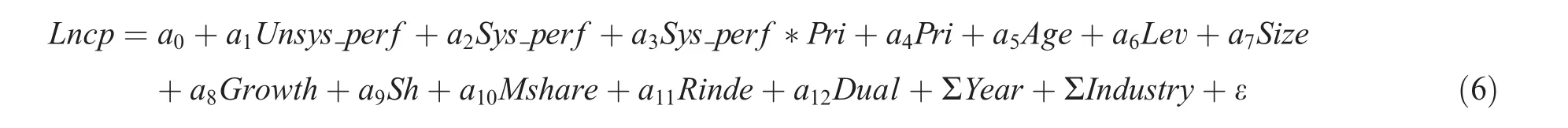

According to Holmstrom and Milgrom(1987),executive compensation should be adjusted for systematic risks associated with performance,and should only relate to the company’s own performance.Antle and Smith(1986),Janakiraman et al.(1992)and Albuquerque(2009)perform an empirical test of this strong-form RPE.Following the above literature,we divide company performance(Perf)into performance with systemic risk(Sys_perf)and with its own risk(Unsys_perf).

Table 7Relative performance evaluation,ownership and executive compensation.

Table 7(continued)

Table 8Full sample tests of strong-form RPE.

Table 9Ownership and strong-form RPE tests.

Table 9(continued)

The performance of the company includes stock returns(Ret)and accounting performance(Roe).The residuals of model(4)are Unsys_perf,and Sys_perf is the difference between Perf and Unsys_perf.Performance measured as stock returns refers to Sys_ret and Unsys_ret respectively.Performance measured as accounting performance refers to Sys_roe and Unsys_roe respectively.We use model(5)to test whether the full sample uses strong-form RPE.If strong-form RPE exists,then the coefficient,a2,will be insignificant.

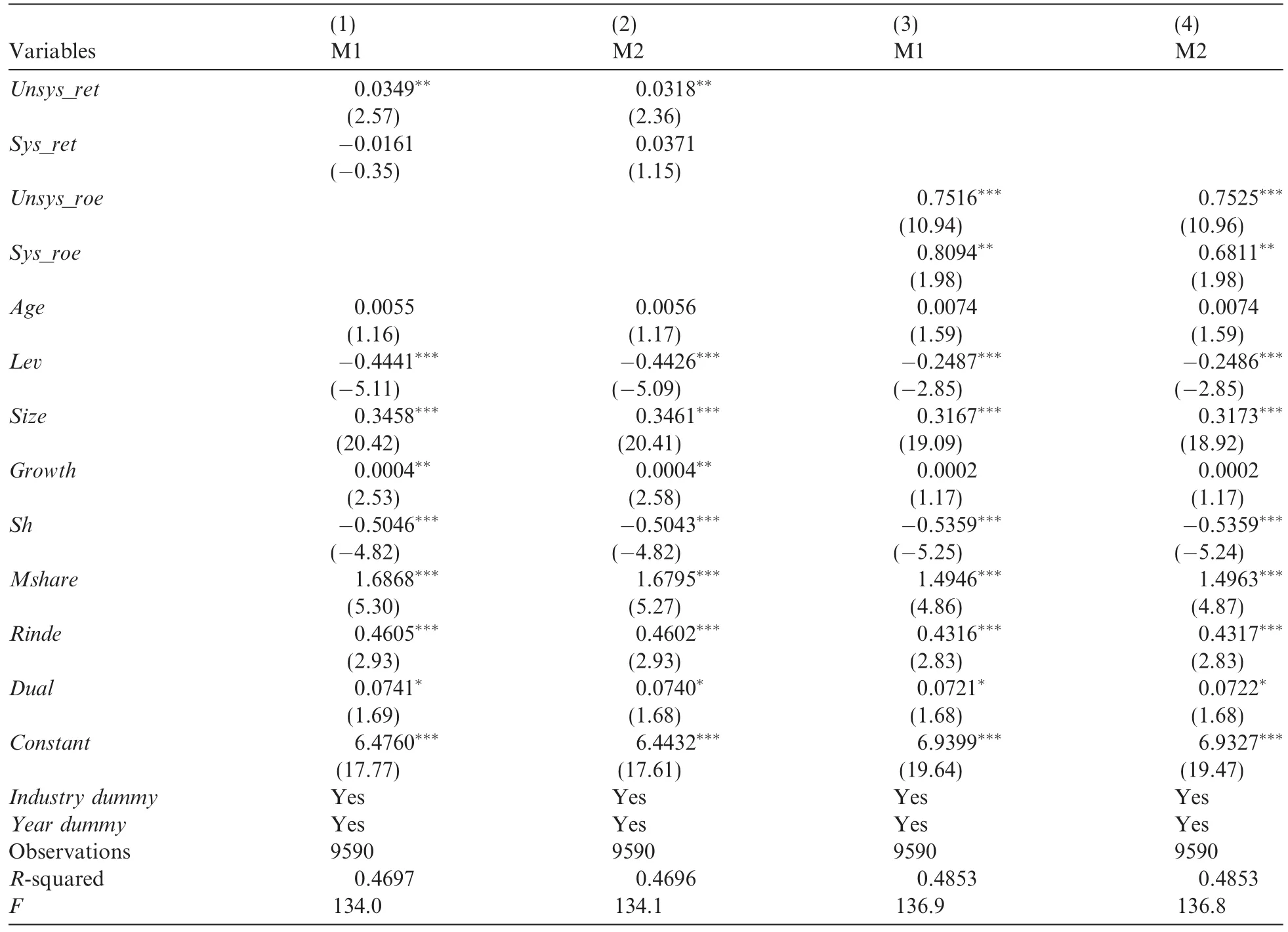

Table 8 shows the regression results for model(5).We find that Unsys_ret and Unsys_roe are significantly positive.Sys_ret is not significant,whereas Sys_roe is positive and significant at the 5%level.This indicates that accounting performance does not support strong-form RPE.

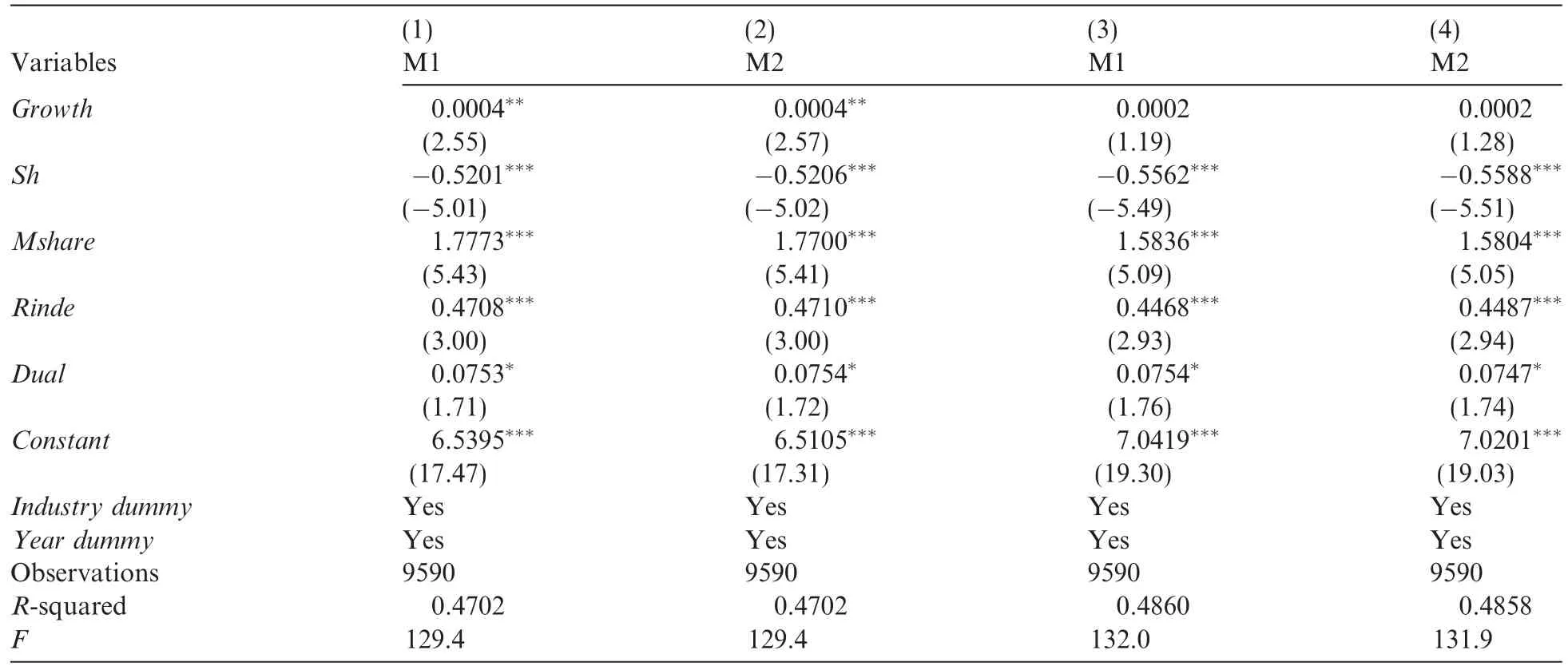

Next,we consider the type of ownership.Table 9 Panel A presents the regression results for the subsamples by type of ownership.Table 9 Panel A shows that Sys_perf for non-SOEs is insignificant,whereas Sys_perf for SOEs is positive and significant at the 5%level in columns(2)and(4).This indicates that the SOE subsample does not support strong-form RPE.Systematic performance will increase executive pay.The results of model (6),shown in Panel B of Table 9,further reveal the difference between SOEs and non-SOEs,and we find that the interactions are negative and significant.

The results in Tables 8 and 9 suggest that strong-form RPE is more widely applied in non-SOEs than in SOEs.

4.4.Robustness tests

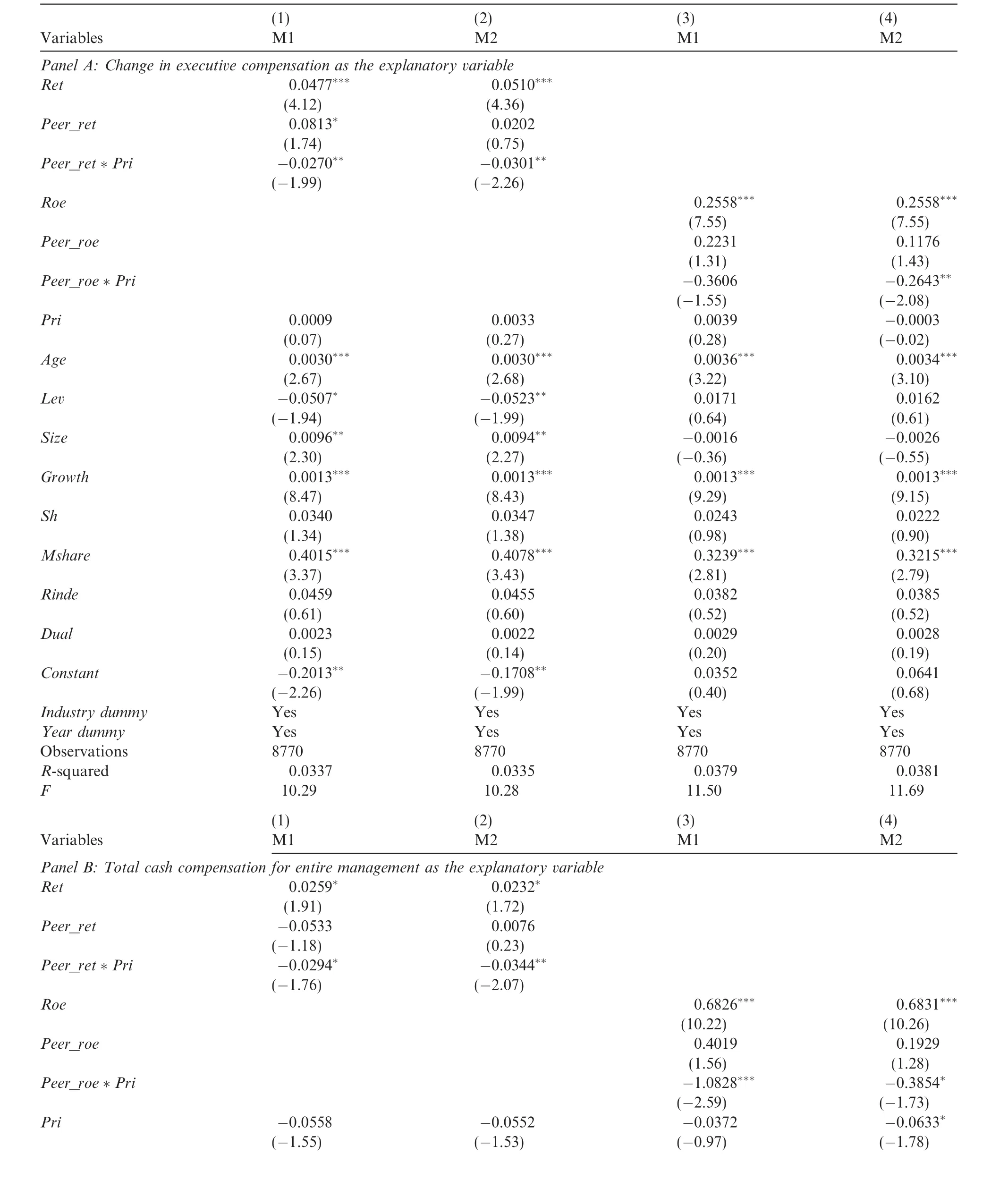

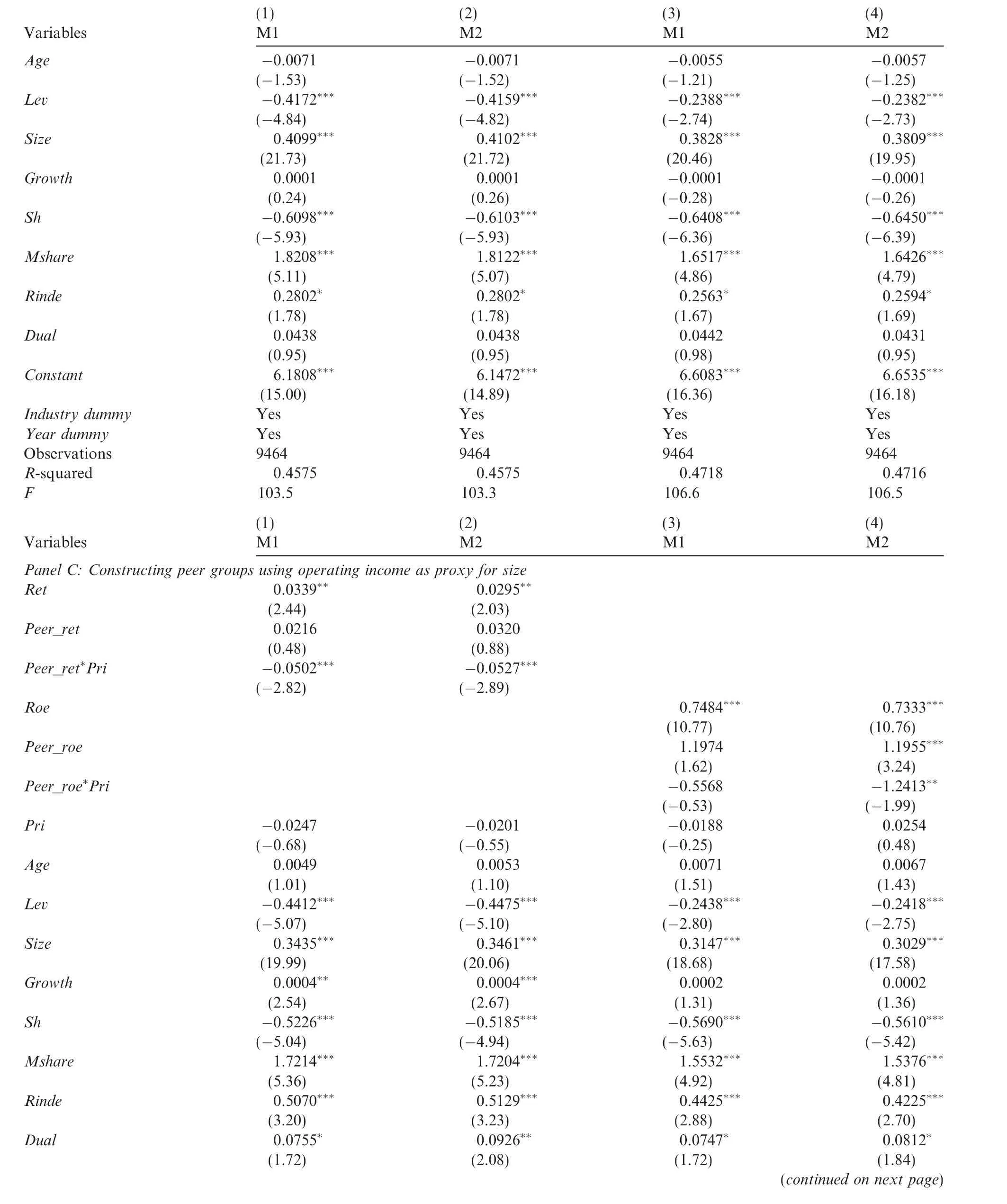

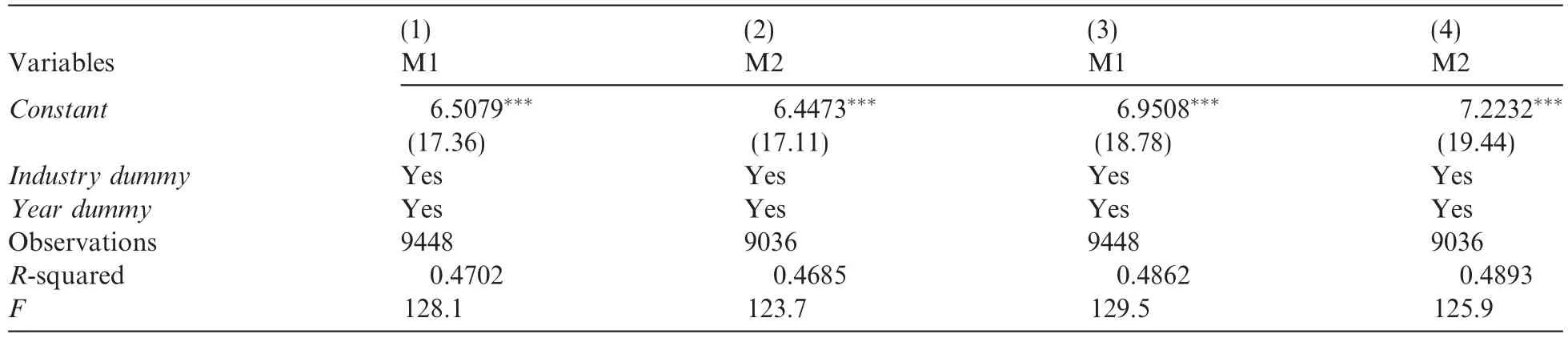

We conduct the following several robustness tests:(1)we use the change in executive compensation-the difference between the natural logarithm of the top three executives’total cash compensation and the value for the previous year-as the explanatory variable;(2)we use the total cash compensation for the entire management(directors,supervisors and managers)as the explanatory variable;and(3)we construct peer groups using operating income as a proxy for size.Due to space limitations,we only present the results for model(2).The

results of the three robustness tests are shown in Panels A-C of Table 10.Results are consistent with our previous analysis.

Table 10Robustness tests.

Table 10(continued)

In addition,we carry out other unreported tests:(1)we measure accounting performance by Roa instead of Roe;(2)we measure peer group performance as the median rather than the mean of performance;and(3)we denote D as 1 if a company’s performance is below 10%or the median when testing the asymmetry of RPE. The results are consistent with our previous findings.

Table 10(continued)

5.Conclusions and limitations

RPE is a long-discussed theoretical problem.Although a number of new research methods and research findings on RPE have recently emerged,there have been relatively few studies in China and their methods and conclusions differ.This paper follows the latest research,such as Albuquerque(2009),to examine the use of RPE in listed companies in China.

We use data on Shanghai and Shenzhen A-share listed companies from 1999 to 2009.The results show that overall,RPE does not exist in China’s listed companies,nor is there asymmetry in the use of RPE.In contrast to the extant literature,we argue that the type of ownership cannot be ignored when researching RPE in China.When we consider the type of ownership,we find that RPE is more likely to be used in non-SOEs than in SOEs.This result is likely due to the regulation of cash compensation,various forms of incentives and the multiple tasks of managers in SOEs.These results are stable across a variety of relative performance measures and robustness tests.In addition,our results show that there is little difference between the traditional method and Albuquerque‘s(2009)method of constructing peer groups.

Of course,this paper still has some limitations.First,Faulkender and Yang(2010)find that using peer groups disclosed by the company is superior to constructing them using Albuquerque‘s(2009)method.This means that our method can be improved upon.For example,maybe all companies select the same several companies with a high reputation in the industry as their peer group.Our method may miss this result. Second,there are various incentives in SOEs and RPE may be used in decisions on perks or promotion rather than cash compensation.Chen et al.(2005b)and Zhou et al.(2005)find evidence to suggest that RPE is used in the promotion of local government officials.Third,the multiple tasks in SOEs make it difficult to evaluate the true effort of managers.Excluding these factors may make our results more precise.These points not only represent the limitations of this study,but also future research directions.

Acknowledgments

This paper is the result of research supported by the National Social Science Foundation(08CJY2009)and the National Nature Science Foundation of China(70602011).We are grateful for support from the International Accounting PHD(IAPHD)scheme of Nanjing University,the Accounting and Finance Research Institute of the Shanghai University of Finance,the Center for Economic Transformation and Development,the Study of Economic Growth and Structural Transformation and the 985 plan topics of Nanjing University,the New Century Excellent Talents Project and the First Scholarship Award for Excellent Doctor Student of the Education Ministry.We also appreciate the suggestions made by scholars attending the 2011 China Journal ofAccounting Research Workshop.We are thankful for the helpful advice of scholars such as Qi Xiangqin,Shen Yongjian,Jiang Dequan and Xin Fu.We acknowledge the executive editor of this paper and the anonymous reviewer for their useful comments and suggestions,but stress that we are completely responsible for the content of this paper.

Aggarwal,R.K.,Samwick,A.A.,1999a.Executive compensation,strategic competition,and relative performance evaluation:theory and evidence.Journal of Political Economy 54(6),1999-2043.

Aggarwal,R.K.,Samwick,A.A.,1999b.The other side of the trade-of f:the impact of risk on executive compensation.Journal of Political Economy 107(1),65-105.

Albuquerque,A.,2009.Peer firms in relative performance evaluation.Journal of Accounting and Economics 48(1),69-89.

Antle,R.,Smith,A.,1986.An empirical investigation of the relative performance evaluation of corporate executives.Journal of Accounting Research 24(1),1-39.

Bai,C.-E.,Lu,J.,Tao,Z.,2006.The multitask theory of state enterprise reform:empirical evidence from China.The American Economic Review 96(2),353-357.

Bai,C.-E.,Xu,L.C.,2005.Incentives for CEOs with multitasks:evidence from Chinese state-owned enterprises.Journal of Comparative Economics 33(3),517-539.

Baiman,S.,Demski,J.S.,1980.Economically optimal performance evaluation and control systems.Journal of Accounting Research 18 (Suppl.),184-220.

Bebchuk,L.,Fried,J.M.,2003.Executive compensation as an agency problem.Journal of Economic Perspectives 17(3),71-92.

Cao,J.,Lemmon,M.,Pan,X.,Tian,G.,2010.Political promotion,CEO compensation,and their effect on firm performance.Working Paper.

Carter,M.E.,Ittner,C.D.,Zechman,S.L.C.,2009.Explicit relative performance evaluation in performance-vested equity grants.Review of Accounting Studies 14(2-3),269-306.

Chen,D.,Chen,S.,Li,Z.,Liang,S.,2011a.Administrative rank and firm performance.Working Paper.

Chen,D.,Chen,X.,Wan,H.,2005a.Regulation and non-pecuniary compensation in Chinese SOEs.Economic Research 2,92-101(in Chinese).

Chen,S.,Sun,Z.,Tang,S.,Wu,D.,2011b.Government intervention and investment efficiency:evidence from China.Journal of Corporate Finance 17(2),259-271.

Chen,Y.,Li,H.,Zhou,L.,2005b.Relative performance evaluation and the turnover of provincial leaders in China.Economics Letters 88 (3),421-425.

Crawford,A.J.,1999.Relative performance evaluation in CEO pay contracts:evidence from the commercial banking industry. Managerial Finance 25(9),34-54.

Diamond,D.W.,Verrecchia,R.E.,1982.Optimal managerial contracts and equilibrium security prices.Journal of Finance 37(2),275-287.

Faulkender,M.,Yang,J.,2010.Inside the black box:the role and composition of compensation peer groups.Journal of Financial Economics 96(2),257-270.

Gao,Y.,2006.Relative performance evaluation with different peer groups:Evidence from China’s listed enterprises.Journal of ShanXi Finance and Economics University 28(2),86-89(in Chinese).

Garvey,G.,Milbourn,T.,2003.Incentive compensation when executives can hedge the market:evidence of relative performance evaluation in the cross section.Journal of Finance 58(4),1557-1581.

Gibbons,R.,Murphy,K.,1990.Relative performance evaluation for chief executive officers.Industrial&Labor Relations Review 43(3), 30-51.

Gong,G.,Li,L.Y.,Shin,J.Y.,2011.Relative performance evaluation and related peer groups in executive compensation contracts.The Accounting Review 86(3),1007-1043.

Holmstrom,B.,1979.Moral hazard and observability.Bell Journal of Economics 10(1),74-91.

Holmstrom,B.,1982.Moral hazard in teams.Bell Journal of Economics 13(2),324-340.

Holmstrom,B.,Milgrom,P.,1987.Aggregation and linearity in the provision of intertemporal incentives.Econometrica 55(2),303-328. Janakiraman,S.,Lambert,R.,Larcker,D.,1992.An empirical investigation of the relative performance evaluation hypothesis.Journal of Accounting Research 30(1),53-69.

Jensen,M.C.,Meckling,W.H.,1976.Theory of the firm:managerial behavior,agency costs and ownership structure.Journal of Financial Economics 3(4),305-360.

Jensen,M.C.,Murphy,K.J.,1990.Performance pay and top-management incentives.Journal of Political Economy 98(2),225-264.

Murphy,K.J.,1999.Executive compensation.In:Ashenfelter,O.,Card,D.(Eds.),Handbook of Labor Economics,vol.3.Elsevier Science,Amsterdam,pp.2485-2563(Chapter 38).

Wang,K.,Xiao,X.,2011.Controlling shareholders’tunneling and executive compensation:evidence from China.Journal of Accounting and Public Policy 30(1),89-100.

Xiao,J.,2005.A synthesis of relative performance evaluation theory and empirical research.Economic Management 14,17-27(in Chinese).

Zhou,H.,Zhang,W.,2010.The comparative effects of managers’compensation in Chinese A-listed companies:an empirical study based on relative performance evaluation.Accounting Research 7,50-56(in Chinese).

Zhou,L.,Li,H.,Chen,Y.,2005.Relative performance evaluation:empirical research on the promotion mechanism of Chinese local officials.Economic Journal 1,83-96(in Chinese).

25 June 2011

*Corresponding author.Tel.:+852 54961492;fax:+852 34420349.

E-mail address:jevonacc@gmail.com(S.Liang).

China Journal of Accounting Research2012年2期

China Journal of Accounting Research2012年2期

- China Journal of Accounting Research的其它文章

- The reform of accounting standards and audit pricing

- State control,access to capital and firm performance

- Board independence,internal information environment and voluntary disclosure of auditors’reports on internal controls

- Government auditing and corruption control:Evidence from China’s provincial panel data