A Fierce Battle Between Active Stock Buyers and Active Stock Sellers Leads to a Surge in Trading Volume -Guangzhou Futures Exchange Imposes Trading Limits on Lithium Carbonate Futures

The prices of lithium carbonate futures domestically have gone downward rapidly since mid-November this year,and the fierce battle between active stock buyers and active stock sellers has driven the main contract turnover of lithium futures to a record high since its listing in July,leading to trading limitation measures taken by the exchange on them to reduce daily trading frequencies.

On the evening of November 24,Guangzhou Futures Exchange (hereinafter referred to as “GFE”) announced that the single-day opening-transaction volume for members or customers of non-futures companies on each contract of lithium carbonate futures shall not exceed 10,000 lots.The single-day opening-transaction volume refers to the sum of the buying opening-transaction volume and selling opening-transaction volume by the two types of participants on a single contract on the same day;when it comes to hedging transactions and quote-driven-market,the single-day opening-transaction volume is not subject to the above criteria.Different accounts with one actual owner are regarded as one account.GFE will adjust the trading limit depending on market trends.According to an analyst,such a move is to reduce single-day transaction frequency,which helps stabilize the futures market.At the close of trading on November 24,the main lithium carbonate contract 2401 (i.e.,for delivery in January 2024) was reported at RMB 124,000 per ton,a slight increase of 0.94% from the previous day.On that day,the contract’s open interest was 121,700 lots (one lot equals one ton),with the turnover reaching 699,500 lots,marking the highest level since its listing.High turnover means a high exchange rate of futures contracts,indicating good liquidity and potential volatility.Since its listing on the GFE in July this year,the price of lithium contract has been falling,from a list price of RMB 246,000/ton all the way down to RMB 150,000/ton at the end of September,reflecting the market’s expectations of an oversupply of lithium carbonate next year.Entering October,spot traders supported prices in the market,leading to a brief stabilization and recovery of lithium futures prices for half a month.However,by the end of October,prices had once again entered a downward trend.

China Securities pointed out that in October,there was also concern in the market about whether the deliverable shares of lithium main contracts were sufficient.Some investors held the view that there was a shortage of deliverable shares,and a risk of tramping close position for short position,which may push up the prices in December.However,with the widespread training provided by exchanges and futures companies,as well as simulated delivery in the past two days,the expectation of price increases based on delivery risk has basically fallen through.Starting from November 16th,the lithium main contract accelerated its decline again,with a range of a price drop of up to 14% in seven trading days.It also hit the limit down for the first time since its listing on November 22nd,further reflecting the market’s expectation of oversupply in 2024.During the same period,the contract’s volume was also on the rise,increasing from 342,900 lots on Nov.21 to 531,200 lots on Nov.12 and further to 581,900 lots on Nov.13,while the open interest remained below 120,000 lots.

A practitioner believes that the performance of the lithium spot market has been far from good recently,and the increase in lithium contract trading volume is a reflection of people’s expectation of the futures market to come.Such turnover rate has also occurred in other varieties,which is not exceptional.Lithium spot prices have fallen to the level of RMB 130000.On November 24th,domestic lithium carbonate spot prices were reported at RMB 137000/ton,marking the first time that they have fallen back to this level since September 2021,with a year-on-year decline of over 70%.This has also fallen below the cost line of some lithium mica projects,and many lithium mica mines located in Jiangxi have been shut down.Lithium resources are mainly divided into three categories,that is,liquid lithium brine,solid lithium pyroxene and lithium mica.Among them,the cost of lithium salt brine is the lowest,below RMB 50,000/ton;the cost of lithium pyroxene is not more than 80,000 RMB/ton,and the cost of lithium mica is the highest,generally around 110,000 RMB/ton,even up to 200,000 RMB/ton.The implementation of trading limits is a way to reduce the fluctuation of the futures market.It mainly aims to combat speculation,and hedging transactions are not subject to this restriction.The exchanges can carry out their operation according to market conditions.For example,the Zhengzhou Commodity Exchange announced on November 23 that it will implement varied opening trading quantity restrictions on eight futures varieties,including methanol,rapeseed meal,and sugar.

Price War Intensifies -Prices of Domestic Energy Storage Products Close to the Cost Line

Against the background of overcapacity,the price war in the domestic energy storage industry has intensified.Equipment vendors continue to lower the quotation in order to win the energy storage project.Currently,there are companies having their lowest quotation approaching the industry’s cost line.

Chen Haisheng,Director of the Energy Storage Special Committee,China Energy Research Society (CERS),said at the 2023 Energy Storage Forum of CERS held on November 23,that current bidding price for energy storage shows a clear downward trend,with the average bidding price for energy storage systems dropping by 34% from the beginning of the year to the present;the lowest bid price fell below RMB 0.9/watt hour.From the perspective of enterprise quotations,some energy storage cells are priced below RMB 0.5/watt hour,while some 2-hour-charging-discharging energy storage systems are priced below RMB 0.7/watt hour.Someone in charge of the energy storage division of a leading domestic power battery company stated that both of these quotations are approaching the cost line,and the above-mentioned RMB 0.7/watt hour quotation for energy storage systems should be below the cost line.

For the rapid decline in the offer,he believes that the main reason lies in the price war caused by severe overcapacity of domestic batteries,followed by a decline in the price of lithium carbonate,a raw material for batteries.Since the beginning of this year,the significant slowdown in sales growth of new energy vehicles has led to a decrease in battery demand.In order to consume excess production capacity,a large number of power battery companies have turned to the energy storage field in search of new opportunities,ultimately leading to a fierce price war.According to the China Power Battery Industry Innovation Alliance,in the first 10 months of this year,the cumulative output of power and energy storage batteries in China reached 611 GWh.Although the production of enterprises slowed down,the overall production still increased by 40% YoY.As domestic competition intensified,many companies turned to expanding overseas markets,and the volume of domestic batteries sold overseas rose to 115.7 GWh,accounting for 20% of total production over the same period.

Due to the policy of mandatory configuration of new energy power stations,domestic energy storage projects are being launched rapidly.Data from China Energy Storage Alliance (CNESA) shows that in the first three quarters of this year,the scale of energy storage projects newly installed and put into operation reached 12.3 GWh.Chen Haisheng predicts that the annual installed capacity of new energy storage is expected to reach 15-20 GWh in 2023,exceeding the sum of the past decade.However,most energy storage projects in China are actually operating at a loss due to the lack of a clear profit model.Therefore,operators often hope to lower project costs,and for many procurement projects,low prices are the determining factor to win.The above-mentioned person stated that a number of companies are in the stage of taking orders and expanding shipment volume to prepare for listing,so they are willing to take orders despite losing money,which ultimately leads to price competition among device manufacturers,making the current price war even worse.

Chen Haisheng pointed out that the overall capital market is active,and a number of industry chain enterprises have entered the listing process in the first half of the year.For example,the IPO of the energy storage system integrator HyperStrong was accepted by the Shenzhen Stock Exchange in June this year,with a planned fundraising of RMB 783 million.However,the IPO process in the industry slowed down in the second half of the year.Previously,there were rumors in the market that energy storage companies may undergo stricter reviews when listing in the future.Under the intensifying price war,there is a growing concern among many people in the industry that the industry reshuffle is about to come.Chen Yongchong,Deputy Secretary General of the Energy Storage Application Branch of the China Industrial Association of Power Sources (CIAPS) said at the World Energy Storage Conference in early November that there are prominent issues such as the intensification of industry competition,overcapacity in the industrial chain,and serious product homogenization;In the capital market,energy storage enterprises are no longer as favored as before,with some listed companies experiencing a decline in profits in the environment of intense competition.Such involution has revealed that the reshuffle of the energy storage industry is just around the corner.“Energy storage serves the purpose of use,and it should not be regarded as vanity projects or for seeking privileges”.Wu Kai,chief scientist of CATL,reminded at the above meeting that it is good to let a hundred flowers bloom,but we should also keep in mind the risk of rushing headlong into action.

The energy storage industry has been flooded with a large number of new players.According to data from KPMG and China Electricity Council,the number of newly established enterprises related to the energy storage chain in China in 2022 reached 38,000,covering fields of energy storage systems,project operations and upstream components and materials,and others,which is 5.8 times more than that in 2021.A sharesA large number of cross-border energy storage companies also emerged in the market,including Wuliangye,Black Sesame,Midea Group,Hengda Hi-Tech,to name just a few.“The energy storage market is thriving this year,however,80% of companies [energy storage system integrators] may shut down in 2024.” Zheng Hanbo,General Manager of Energy Storage Division,Envision Energy,expressed his concern publicly in May this year.There are a large number of struggling system integrators in the industry,winning projects relying on extremely low quotations to maintain their business.The fact that some enterprises without core technology survive through price reduction has also brought hidden troubles to the industry,just as the course of wind power and photovoltaic industry more than a decade ago.

How to Judge the M&A “Window Period” For Mining Enterprises? -By Li Chaochun from CMOC

The mining industry is a typical cyclical industry,and it is very important for enterprises to judge the timing of M&A.CMOC,the world’s second-largest cobalt and niobium producer,leverage the capital market to reserve cash before M&A opportunities arose,and then made efforts to seize the opportunity of the M&A“window period” when the industry was in a slump.The above comments were made by Li Chaochun,Vice Chairman and Chief Investment Officer of CMOC,at the 2023 World Copper Conference (Asia) on November 15.

When making an investment,one should be patient and wait for the acquisition opportunity to arise.He noted that CMOC was listed on the Hong Kong stock market in 2007,however,the company didn’t conduct its acquisition business until 2013.“Giving up is difficult,since giving up means abandoning something.”In 2013,CMOC acquired an 80% interest in NPM,a copper concentrate mine in North Parkes,Australia,for a consideration of US$820 million.After the financial crisis in 2008,the international copper prices started to recover from 2009,hitting the recorded high price of USD10,000 per ton in 2011.Then they slowly declined.Against the backdrop of oversupply,copper prices fell below US$5,000 per ton in late 2015 and further down to around US$4,300 per ton in early 2016,marking the lowest point of the current industry cycle.“We seized the opportunity during the industry downturn in 2015 and 2016,which was a very tough time for the entire mining industry.” Li Chaochun recalled that CMOC had done a lot of work on its balance sheet in the early stages,handled a large number of inefficient assets and entered the capital market through convertible bonds.

“We had piles of cash in reserve then,that is,tens of billions of dollars in our bank account,which helped us conduct investment activities in the following three years.”

In May 2016,CMOC invested US$2.65 billion to buy a 56% stake in the TFM copper and cobalt mine in the Democratic Republic of Congo from the U.S.-based Freeport-McMoRan,and then invested US$1.5 billion in October of that year to acquire the Brazilian niobium and phosphorus mine from British and American businesses,reorganizing and setting up CMOC Brazil.In April 2017,CMOC increased its stake in TFM to 80%for a consideration of $1.1 billion.“Large overseas mining companies have been taking advantage of leveraged actively over the past 5 to 10 years.As loan policies tighten when the industry hits a down cycle,these companies are willing to trade their stakes in cash,which is a window period for Chinese companies.”“CMOC was fortunate to have seized such opportunities in two major deals in Brazil and Africa,” said Li Chaochun frankly.Relying on the above key acquisitions,CMOC has become a major global producer of tungsten,cobalt,niobium,molybdenum,and copper,as well as a major producer of phosphate fertilizer in Brazil.Covering over 1,500 square kilometers,the TFM copper and cobalt mine is among the top mines of its kind in the world when it comes to both quantity and quality.In the cobalt sector,CMOC is currently the world’s second-largest cobalt producer,following international mining giant Glencore (LSE: GLEN).

In addition to their routine activities such as processing,exploration and mining,large international mining companies have also grown through M&A,which has given the mining industry a pan-financial nature.According to Li Chaochun,when a company is engaged in a multi-billion dollar deal,the balance sheets may face pressure,and the changes in industry cycles can exert an impact on profitability,so financing is very important.For example,the type of financing structure matters a lot.“For a very large deal,we may spend 60 to 70 percent of our time and effort on the financing structure,and companies often turn to the market to raise capital in response to the problem of fund balancing after completing a large acquisition.After completing three huge deals in a row,CMOC returned the funds of RMB 18 billion in July 2017 through targeted additional issuing,following the company’s issuance of RMB 4.9 billion of convertible bonds in 2014.Prior to that,the company raised HKD 8.1 billion in an IPO in Hong Kong in 2007,and RMB 3.646 billion in a secondary IOP to the Shanghai Stock Exchange in 2012.

The expansion plan for TFM in 2021 caused a dispute over the issue of additional premiums involved with the local government of the Democratic Republic of the Congo (DRC).As a result,exports of TFM products have been suspended since July 2022.It was not until April 2023 that the two sides reached a settlement agreement on additional premium and the export resumed from May 2023 onwards.Under export restrictions,the performance of CMOC in 2023 was significantly affected.The net income attributed to shareholders in the first three quarters halved year-on-year to RMB 2.443 billion,while the revenue remained basically unchanged year-on-year,reaching RMB 131.7 billion.However,CMOC’s copper,cobalt and molybdenum output maintained growth during the period despite the export restrictions.Among them,the TFM and KFM copper and cobalt mines in the Democratic Republic of Congo(DRC) produced 156,300 tons of copper in total,up 25% year-on-year,and 19,400 tons of cobalt,up 86%year-on-year.As a result,the third key measurement for investment,Li adds,is risk assessment,which involves not only technical issues such as the grade (quality) of the mine,but also the infrastructure,project location and the attitude of the local community towards mining activities.Such questions,not purely technical,are more about the overall operating environment and community infrastructure,and are equally important for evaluating projects.

An Average Production Resctrition of 20% Implemented Since November -Production Restriction Becomes Consistent for Yunnan Electrolytic Aluminum Enterprises

The hydropower province of Yunnan entered the dry season,and production restrictions for its electrolytic aluminum enterprises became consistent.Yunnan Province issued a document on October 30th,requiring electrolytic aluminum enterprises in the province to achieve an average production restriction ratio of about 20%.The start date is November 1st,and the implementation shall be completed within a week.However,some delay is expected for enterprises during implementation since it takes some time to shut down the electrolyzer.It is reported that production restrictions may not be removed until the flood season at the end of May 2024.

The ratio of production restriction varies from enterprise to enterprise.The production restriction ratio of the supporting deep processing aluminum plants under Aluminum Corporation of China and Weiqiao Group is relatively low,while the enterprises without deep processing business,such as Sunho Group and Qiya Group,are subject to higher production restriction ratios.Li Lin,head of the aluminum industry chain at Aize Consulting,stated that the operating capacity of electrolytic aluminum in Yunnan Province is about 5.7 million tons.If the policy is strictly implemented,it is expected that about 1.18 million tons of electrolytic aluminum production capacity will be affected,but it is not yet certain whether the policy will be strictly implemented,and the resumption time will also depend on the water supply in 2024.

Previously in September 2022,Yunnan also imposed a production restriction ratio of approximately 20%on the local electrolytic aluminum industry.Entering February 2023,Yunnan Province has implemented further restrictions on electrolytic aluminum production,accounting for about one-third of Yunnan’s built production capacity.After this production restriction,Li Jintao,a non-ferrous analyst from First Futures said that production restrictions in Yunnan Province may become consistent,and the weekly aluminum production in the province has not seen a decline yet,not exerting much impact on the market for the time being.“Previously,there was an expectation of production restrictions in the market.Currently,the expectation has been fulfilled,and the market response will not be particularly large,but it is positive for aluminum prices,” added Li Lin.After the issuance of the document by Yunnan Province,the price of the main contract of Shanghai aluminum has returned to above RMB 19,000/ton,and the price on November 8th was reported to be about RMB 19,235/ton.Antaike (brand)“(Production restrictions) have supported the price as a whole,but production is not limited as strictly as in previous years,and so is the impact.However,we will keep an eye on the trend as production reduction is subject to changes at any time.

Yunnan’s power structure is dependent on the climate,and installed hydropower capacity accounts for more than 70%.It relies on the supplementation of other power sources such as coal-fired power during the dry period from November to May each year.“It’s the same problem which has existed for long.During the dry season,the hydropower output is insufficient,the thermal power cannot fully fill this gap,and wind and solar power are intermittent.In addition,Yunnan has introduced power-consuming enterprises such as aluminum plants to build factories in the province at in large scale.The high electricity consumption,plus insufficient power generation capacity,leads to a shortage of electricity in the province,” said local people.According to a recent report by Yunnan Daily,an insider and head of the Yunnan Provincial Energy Bureau frankly stated,“Considering the recent water supply situation,the fact that the flood season is about to end,and the need to ensure power supply,there is still a significant electricity shortage in the province in the fourth quarter of the year,and power supply this winter and next spring is facing challenges.”

The 10-billion-yuan Energy Storage Battery Project Signed

On November 16th,Jiangsu Heng An Energy Storage Technology Co.,Ltd.(referred to as “Jiangsu Heng An”) held a groundbreaking ceremony for a project with an annual production of 10GWh of zinc bromide liquid flow energy storage battery in Suqian High tech Zone,Jiangsu.The project has a total investment of RMB 10 billion,with a land area of 920 Mu(~613,333.33 m2),and 20 specialized automated production lines for energy storage batteries are planned to be built.After being put into production to a full capacity,it can achieve a production value of RMB 20 billion and an annual sales revenue of RMB 18 billion.Data show that Jiangsu Heng An was established in 2021,as an indirect wholly-owned subsidiary of China Anchu Energy Storage Group Limited (02399.HK).

From the information disclosed by China Anchu Energy Storage Group Limited,the 10GWh zinc-bromine flow energy storage battery project is progressing rapidly.China Anchu Energy Storage Group Limited announced on November 14 that Jiangsu Heng An has recently entered into a non-legally binding framework cooperation agreement with Suqian High-tech Zone Management Committee,planning to build production facilities for the project of the 10GWh of zinc-bromine flow battery.Jiangsu Heng An had not signed a formal agreement yet at that time.However,just two days after the announcement,the 10GWh zinc-bromine flow energy storage battery project has been formally started,indicating the sincerity and power of execution of both parties.Of course,one of the main reasons why Jiangsu Hengan is able to quickly implement project cooperation is that its parent company,China Energy Storage,has already established a zinc bromide flow battery production base in the Jiangning Economic Development Zone in Nanjing,and has a cooperative foundation with Jiangsu Province.

Before introducing the project of China Anchu Energy Storage Group,let’s see just one word about the company.Formerly known as China Fordoo Holdings Limited,China Anchu Energy Storage Group Limited is mainly engaged in the sale of branded men’s apparel,as well as the sale of automobiles,motorcycles and other types of industrial products in the Middle East through its indirect subsidiary in Hong Kong.As for the energy storage business,in January 2022,through Jiangsu Hengan,it acquired intellectual property rights and production R&D equipment related to zinc bromide flow batteries from Zbest Power for RMB 53.6 million,marking the beginning of its entry into the energy storage field.In March of the same year,the zinc-bromine flow battery project was landed in Jiangning Economic Development Zone,with a planned capacity of 4.5GWh and a total investment of $500 million.In the future,it will conduct comprehensive cooperation with enterprises such as China Huaneng,China Huadian,CHN Energy,SPIC,and CECEP to supply the national and even global markets.The project is expected to have an annual output value of 5 billion RMB and tax revenue of over 300 million RMB after reaching full production capacity.The first phase of the project has a planned capacity of 1.5GWh,with an estimated annual output value of RMB 1.5 billion,and has been put into trial production on October 15,2022.For the second phase of the project,a letter of intent was signed in February this year,and the project is expected to be completed by the end of 2023.It is worth mentioning that one month prior to the trial production of the first phase of the project in Jiangning,i.e.,in September 2022,China Fordoo Holdings Limited.changed its name to China Anchu Energy Storage Group Limited,which implies its firm determination to transform into the track of energy storage.

While accelerating the expansion of production capacity,Jiangsu Heng An also obtained the first big order.On September 5,China Anchu Energy Storage announced that Jiangsu Heng An has recently signed a procurement contract on 200MW/800MWh zinc-bromine flow energy storage battery with a customer.Jiangsu Heng An is expected to start the production of energy storage batteries in early 2024,and the products be delivered to the customer in installments according to the procurement contract within 2024.The procurement contract is scheduled to be completed by the end of 2024.

Fluid flow battery is a new type of storage battery,which is regarded as a substitute for lithium-ion batteries in the future.It can meet a wide range of technical requirements,with a fast cost reduction rate,and enjoys a promising prospect in applications of energy storage.It mainly includes all-iron,all-vanadium,zinc-bromine,zinc-nickel,zinc-iron and zinc-air flow batteries.Among them,zinc-bromine flow battery,in addition to an all-vanadium flow battery,is currently a commercially successful flow battery technology.It was first invented by ExxonMobil in the United States.The positive electrode uses bromine ions and bromine elemental pairs,and the negative electrode uses zinc ions and new elemental pairs.It has the advantages of a simple structure,high energy density,and low cost.At present,the domestic representative enterprises engaged in this technology route mainly include the aforementioned merged Zbest Powe,Anhui Meineng Energy Storage,Shaanxi Huayin,TBEA and so on.Overseas representative enterprises mainly include the ZBB,Primus Power Company from the United States,Sumitomo Electric from Japan and Redflow from Australia.Relevant literature points out that the cycle life of zinc-bromine flow batteries can reach more than 6,000 times,and the energy efficiency can reach 70%.However,for zinc-bromine flow batteries,there are currently issues including battery self-discharge caused by leakage of electrode active substances,as well as pollution caused by the corrosiveness,chemical oxidation,and volatility of bromine itself.

The 6-billion-yuan Lithium Materials Project Settled in Baoji

On the evening of November 19,Zhongyi Technology announced that the company intends to sign a project investment agreement and related subsidiary agreements with the People’s Government of Baoji City,Shaanxi Province,the People’s Government of Jintai District of Baoji City,and Baoji Industrial Development Group Co.Ltd.(“IDG”).The company and IDG will jointly invest to establish a controlling subsidiary,Zhongyi Shaanxi,and use it as the investment entity to build an 80,000-ton advanced electronic materials industry base project in Jintai District,Baoji City.The total planned investment of the project is about RMB 6 billion,and the project will be constructed in three phases,namely 30,000 tons/year,30,000 tons/year and 20,000 tons/year,and the period between the commencement and the official commissioning of each phase is about 18 months.IDG is a state-owned enterprise wholly owned by Baoji State-owned Assets Supervision and Administration Commission.The joint venture company Zhongyi Shaanxi established this time intends to engage in the research,development,production,and sales of advanced electronic materials such as high-performance electronic copper foil and battery current collectors,with a registered capital of RMB 500 million.Among them,Zhongyi Technology contributed RMB 325 million in monetary form,accounting for 65% of the registered capital;IDG contributed RMB 175 million in monetary form,accounting for 35% of the registered capital.

Zhongyi Technology said that the investment project is centered on the company’s main business,after the completion of the project,it will further enhance the company’s production capacity,market share,and overall competitiveness,thus boosting the company’s business development.Zhongyi Technology was founded in 2007,and it was successfully listed on the GEM in April 2022.The company is mainly engaged in the R&D,production and sales of various types of high-performance single-and double-sided optical electrolytic copper foil series products.The company has two major electrolytic copper foil production bases under its jurisdiction,namely Yunmeng Base and Anlu Base.Its main products are lithium battery copper foil and standard copper foil,which are widely used in new energy vehicle power batteries,energy storage equipment and electronic products,copper-clad panels,printed circuit boards,and other fields.As of June 30 this year,Zhongyi Technology has a total production capacity of 42,500 tons/year of electrolytic copper foil.In the field of lithium copper foil,at present,the main product specifications of Zhongyi Technology include 4.5μm,5μm,6μm,7μm,8μm single and double-sided optical lithium copper foil products.At present,the company’s main product is ultra-thin lithium battery copper foils with a thickness of 6μm and below.Also,the ultra-thin lithium battery copper foil with a thickness of 6μm and below is also an important “magic weapon” for Zhongyi Technology to win key clients.According to last year’s prospectus,this year’s announcement in April and the 2022 annual report,CATL,BYD,REPT are the three core customers of Zhongyi Technology.Among them,CATL is a major customer that Zhongyi Technology has spent a lot of effort to establish cooperation.It is said that Zhongyi Technology began to reach CATL in September 2017.After going through various processes such as supplier review,multiple rounds of sample testing,and factory inspection,it finally supplied products to CATL in small batches in June 2019 and successfully entered the supplier system of CATL.After nearly two years of “testing”,in the second month after offering small-batch supply,that is,in August 2019,Zhongyi Technology began to supply goods to CATL in batches.Since then,CATL has become the No.1 major customer,and at that time the product supplied was a 6μm copper foil for lithium-ion batteries.Zhongyi Technology didn’t begin to supply extremely thin lithium copper foil with a thickness of 4.5μm4 to CATL until 2020.Also since this year,lithium copper foil has begun to outperform standard copper foil in terms of revenue,becoming the No.1 business in Zhongyi Technology.

According to the prospectus,in 2019-2020,the sales revenue contributed by CATL was RMB 59 million,and RMB 415 million,accounting for 7.1% and 35.46%respectively.Alongside that,according to the announcement disclosed by Zhongyi Technology on April 3 this year,from May 2022 to March 2023,the sales orders realized by the company and its subsidiaries with CATL and its controlling subsidiaries amounted to a total of RMB 1.174 billion (excluding tax),which is more than 50% of the company’s audited operating income in 2021,and accounted for 53.43% of the company’s operating income in 2021.

Western Mining Plans to Acquire 36% Stake of the Yellow River Mining,Aiming to Expand Its Resource Reserves

On November 21,Western Mining announced that the company plans to participate in the bidding for the 36%stake of the Yellow River Mining held by Qinghai Huangdian Mining Management Co.,Ltd.The floor price for the asset transfer of this acquisition is RMB 3.66 billion,and the bidders are required to pay a deposit of RMB 300 million.

Yellow River Mining is a company with rich mineral resources,holding mining rights and peripheral prospecting rights of nickel-copper ore in the anomalous area No.26 of Xiari Hamu HS in Golmud City.The company has abundant experience and powerful strength in the field of mineral development and has its business of developing and operating the Xiari Hamu nickel-copper mine.The Xiari Hamu nickel-copper mine is a well-known super-large nickel deposit in China.For Western Mining,the acquisition of the equity interest of Yellow River Mining will bring important strategic value to the Company.

By acquiring the equity interest in Yellow River Mining,the Western Mining will further expand the Company’s business presence and enhance its strength in the field of mining and mineral resources development.This will help enhance the Company’s resource reserves,as well as its competitiveness in both domestic and international markets.For Western Mining,the acquisition of Yellow River Mining will be an important milestone,signifying that the Company is moving towards its long-term development strategy.Western Mining will actively participate in and fully cooperate with the relevant procedures in the process of acquiring the equity interest of Yellow River Mining.According to the Company,it will do its utmost to safeguard the interests of the Company and ensure that the equity transfer will bring new opportunities and growth points for the Company’s development.It should be noted that there are still uncertainties about the result of this acquisition.Although Western Mining intends to acquire the equity of Yellow River Mining,it is required to go through a rigorous evaluation and bidding process.Western Mining indicated that it is full of confidence and will continue to follow and drive forward the progress.

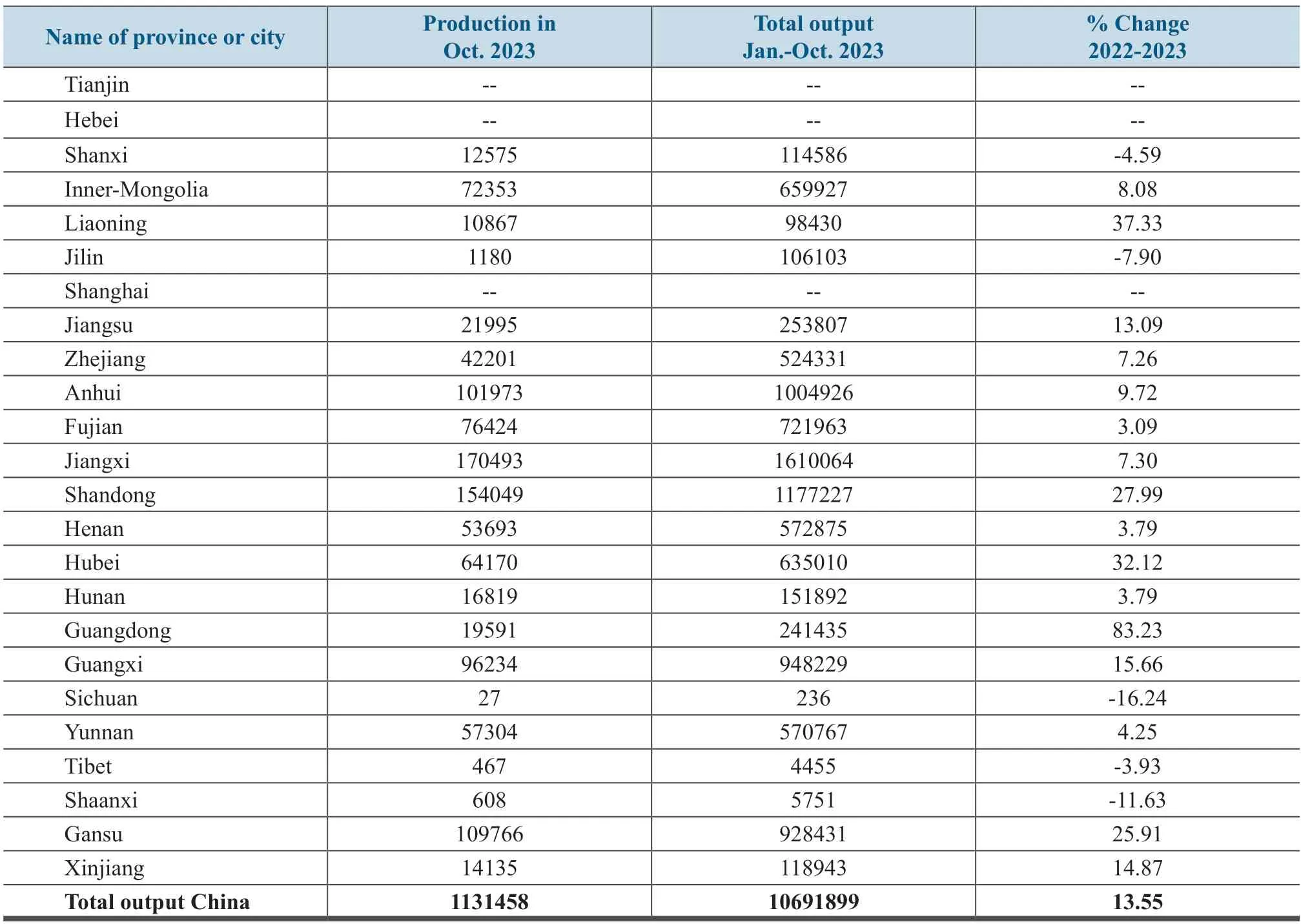

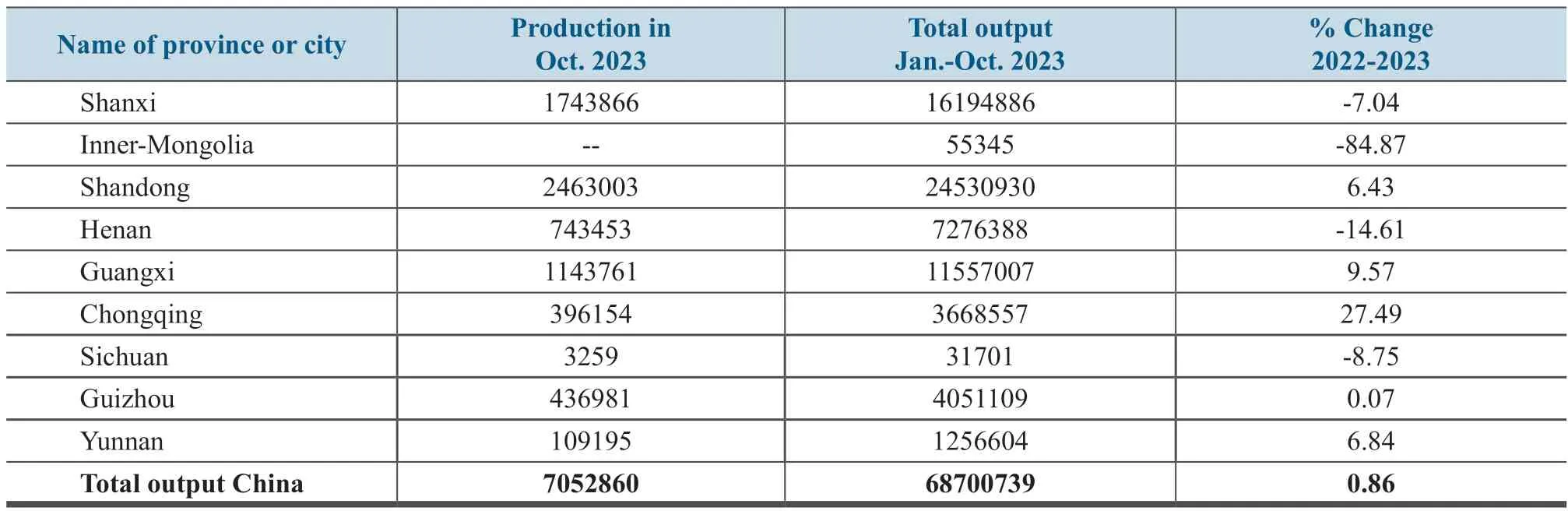

Refined Copper Production by Province or City in 2023 Unit: metric ton

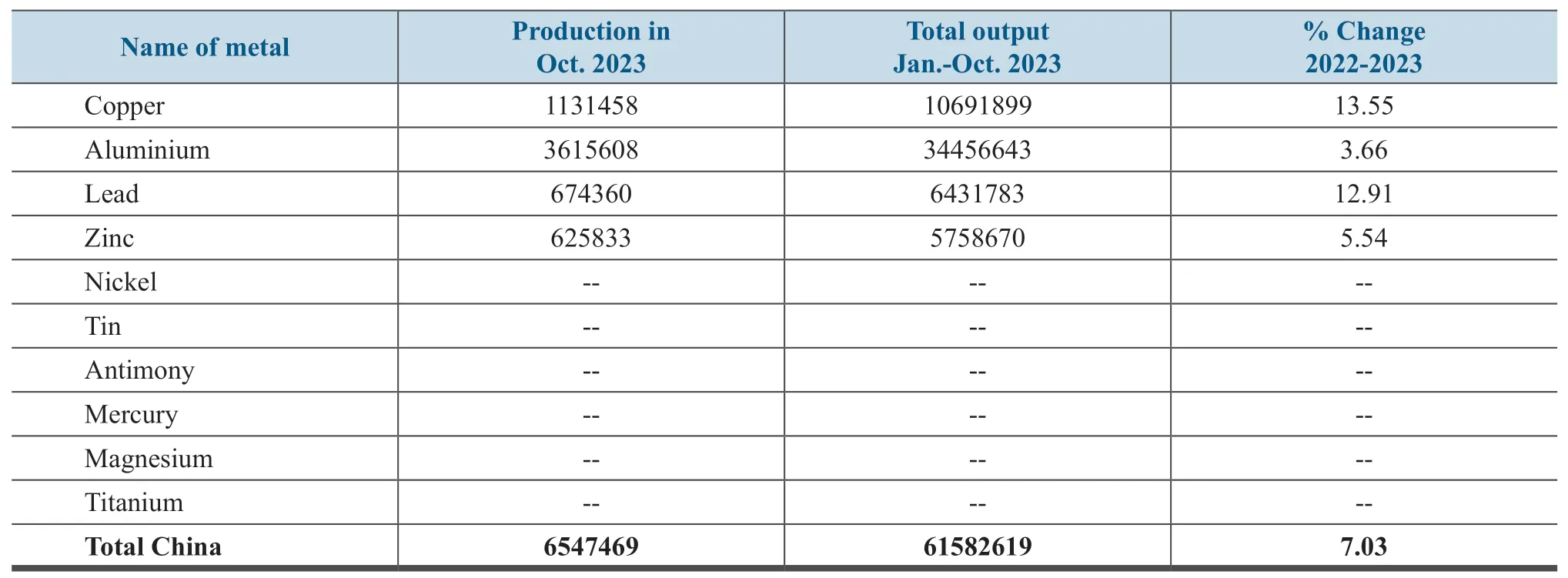

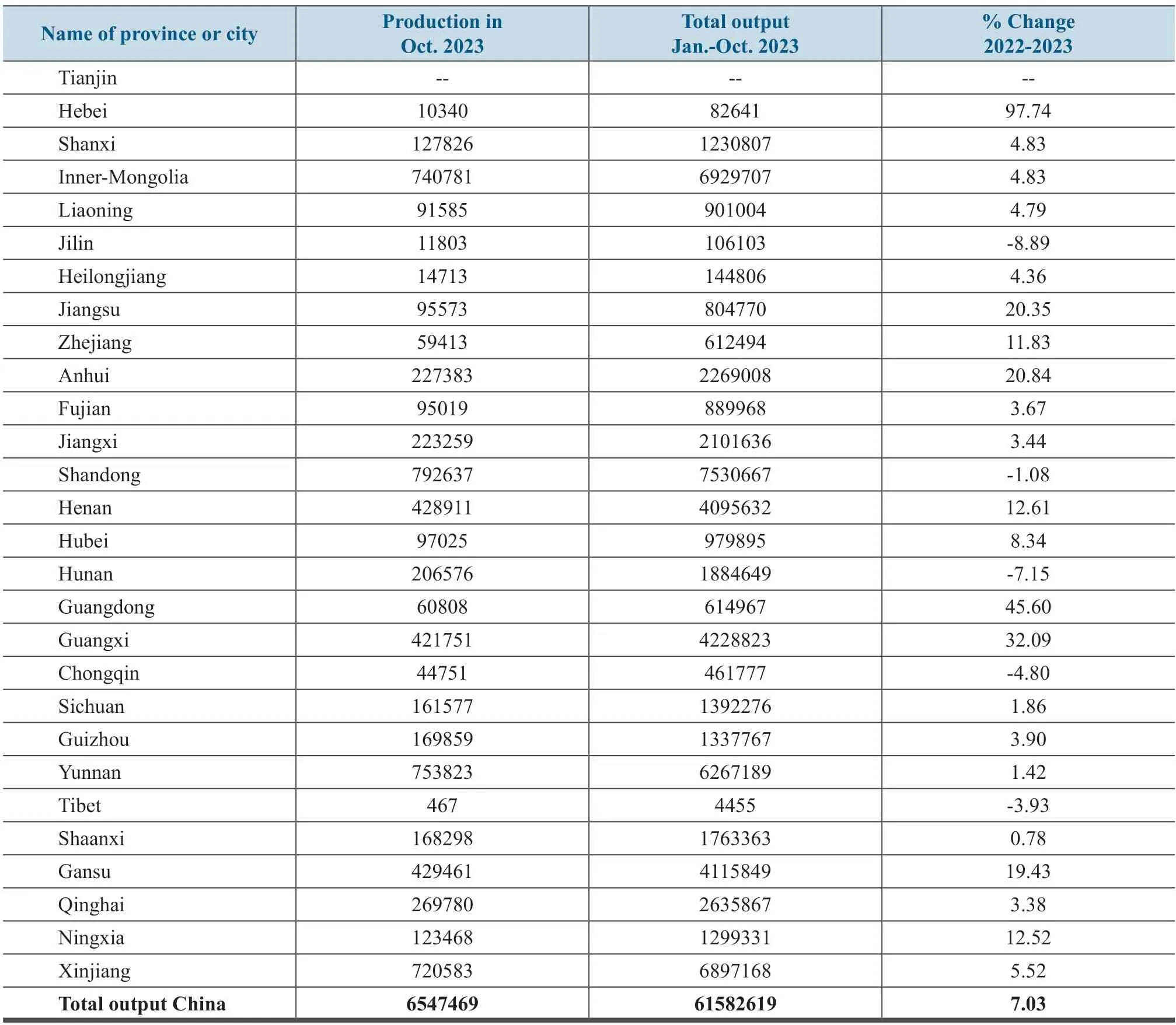

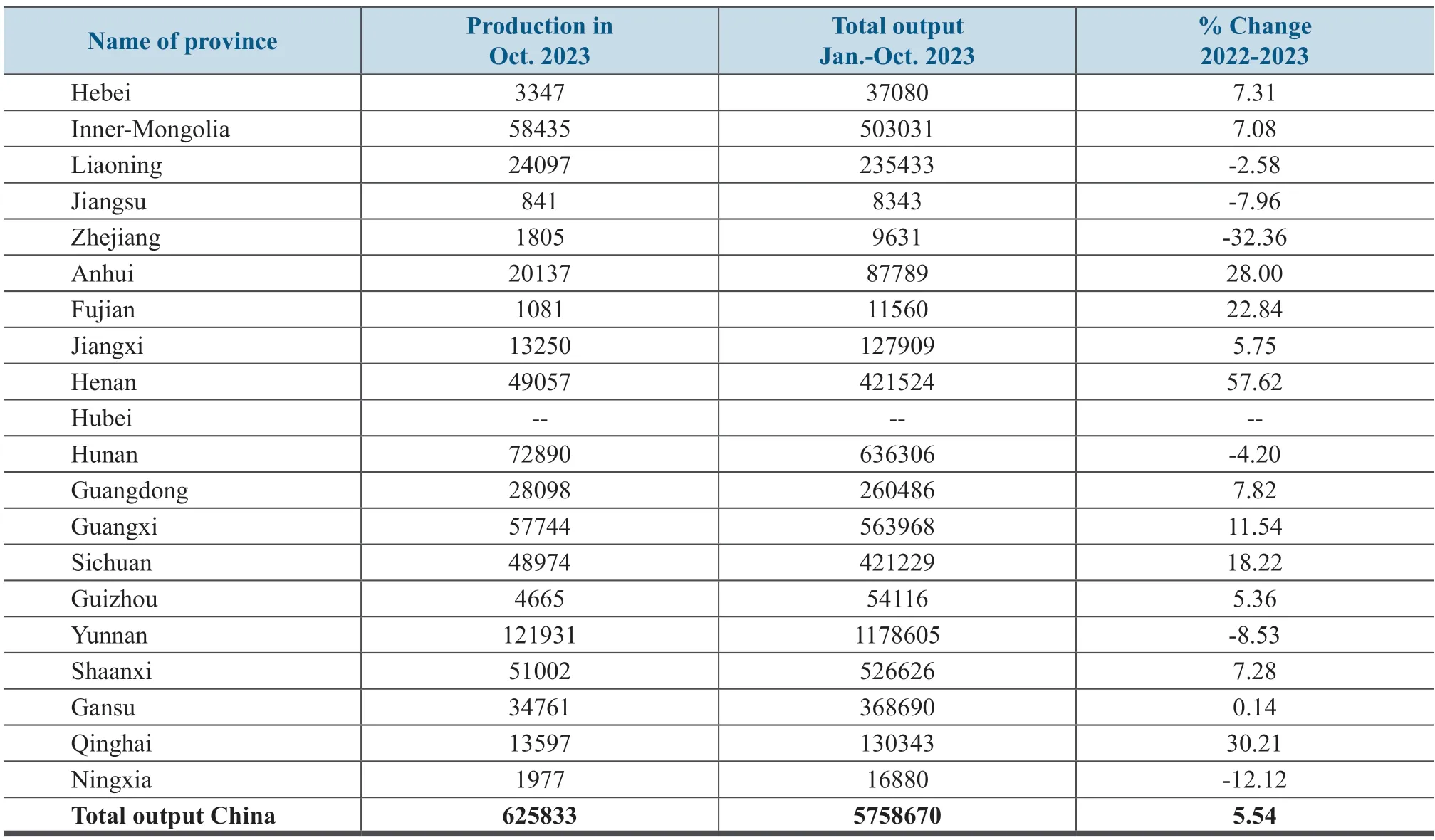

Production of the Ten Major Nonferrous Metals in 2023 Unit: metric ton

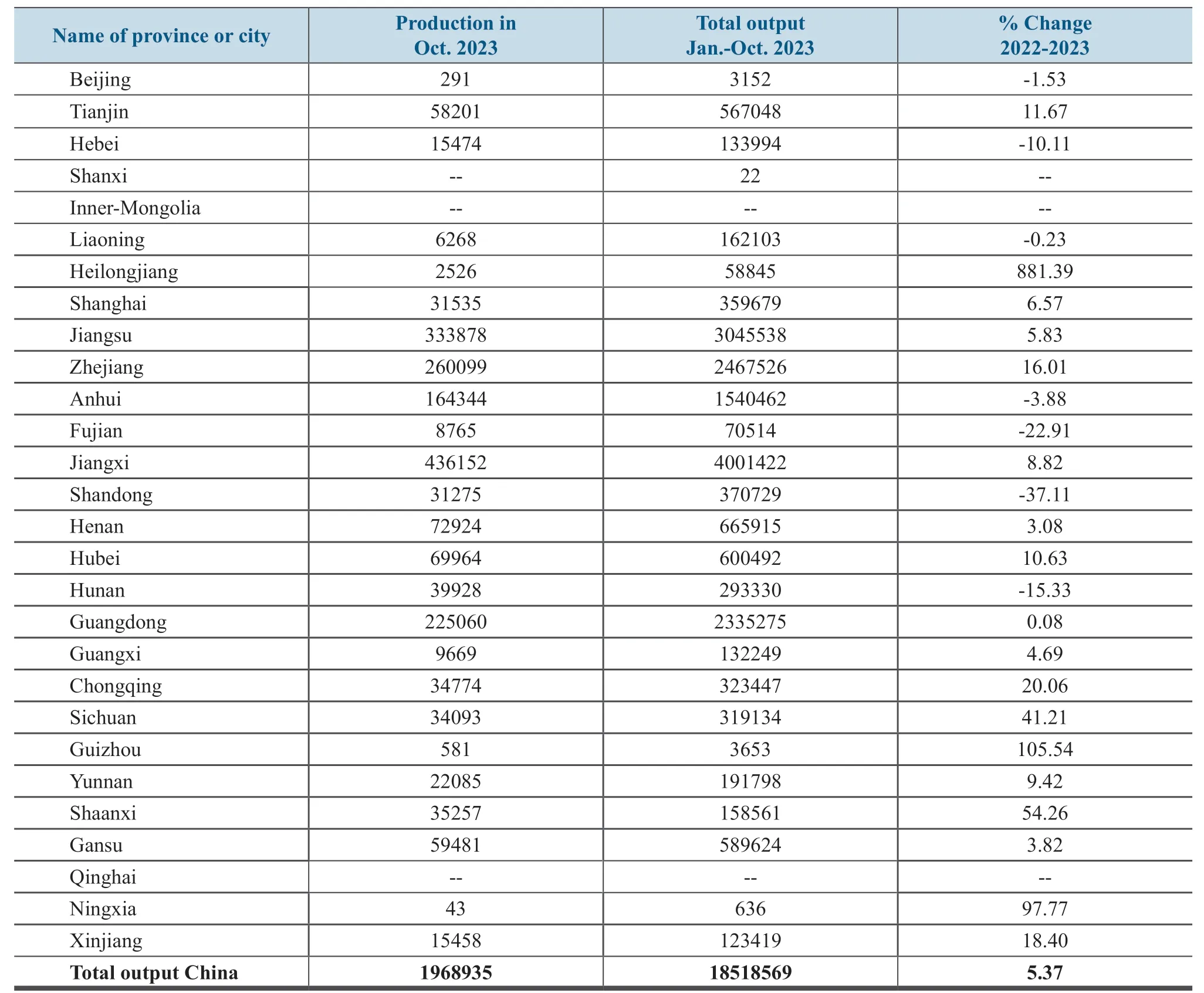

Fabricated Copper Production by Province or City in 2023 Unit: metric ton

Lead Production by Province or City in 2023 Unit: metric ton

Key Financial Indicators of Non-ferrous Companies Above Designated Size

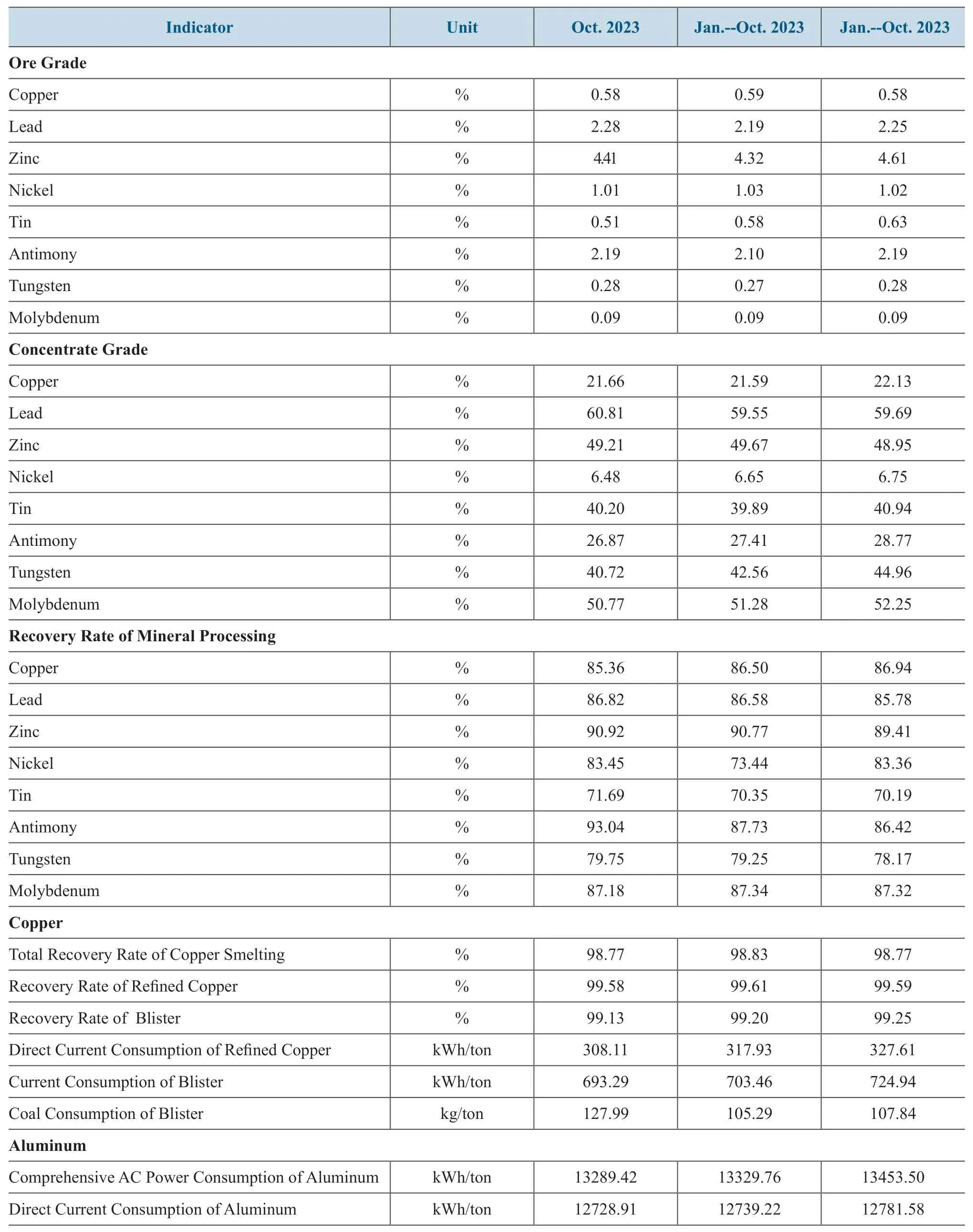

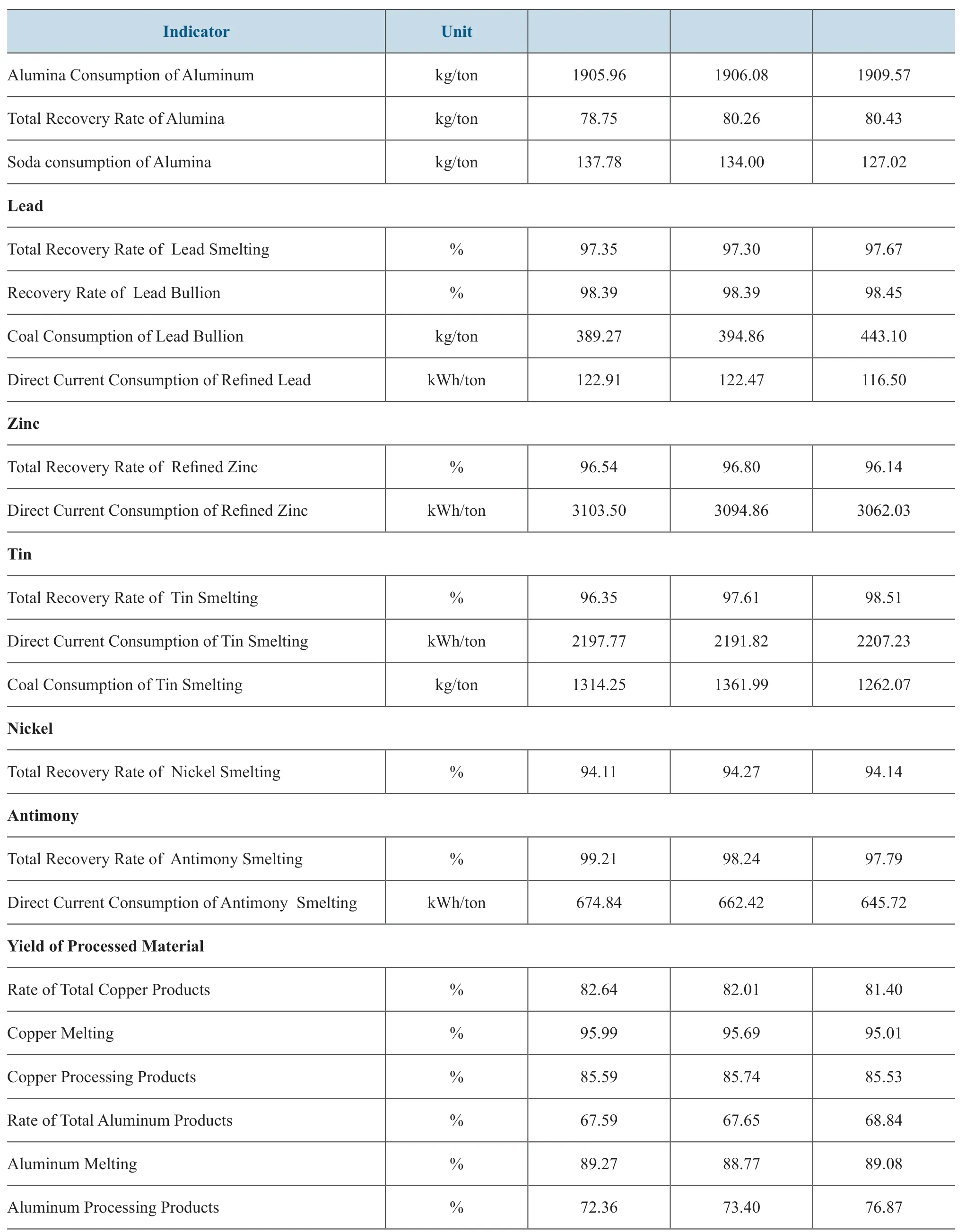

Technical and Economic Indicators of Major Enterprise

Source: China Nonferrous Metals Industry Association

Alumina Production by Province in 2023 Unit: metric ton

Yield of Ten Major Types of Nonferrous Metals By Region

Zinc Production by Province in 2023 Unit: metric ton