Investigation on the Current Situation of China’s DTP Pharmacy and Suggestions for Its Development

Wen Dong,Dou Lele,Sun Yuyuan,Wang Shuling

(School of Business Administration,Shenyang Pharmaceutical University,Shenyang 110016,China)

Abstract Objective To summarize the main characteristics and development approaches of direct-to-patient (DTP)pharmacies,and to explore its future development trend.Methods Firstly,relevant policies of DTP pharmacies were sorted out based on some documents on the government website,and related articles were studied.Secondly,499 DTP pharmacies were investigated.Finally,the current status of the industry was summarized and analyzed.Results and Conclusion Policies on China’s DTP pharmacy have been constantly improved.According to industry standards,the current compliance rate of DTP pharmacies is about 46.09%.In terms of varieties,the market share concentration rate of biological products is higher than that of chemical drugs.The regional distribution of these drugs is mainly concentrated in the central and eastern provinces.However,63.45% of DTP pharmacies have less than 50 product specifications.DTP pharmacies have an average of 7.3 pharmacy technicians and 2.3 licensed pharmacists,which is higher than that of ordinary pharmacies.Due to the policy promotion,DTP pharmacies will be paid more attention by the public and the government,and the market share will become larger than before.Patients shifting from hospitals to drug-to-pharmacies can make them better layout.Besides,pharmaceutical services will become more specialized,and disease division will be more detailed.With the deepening of medical reform and the continuous improvement of national medical security as well as drug procurement and medical insurance payment methods,DTP pharmacies can play an important role in the national basic medical security system.

Keywords: DTP pharmacy;policy;industry standard;market share;pharmacy service

1 Introduction

Direct-to-patient (DTP) pharmacy model originated in the United States,where it is mature and widely used.In 1960s and 1970s,the prototype of DTP pharmacy appeared in China.However,due to the medical system and planned economic system in the early days of the founding of the People’s Republic of China,this pharmacy model did not fully develop.In 1999,Beijing Jewim Pharma cooperated with Novartis to carry out membership-based direct delivery of highend medicines in China,which tried to operate the DTP form as an independent business format.This marked the origin of the development of China’s DTP pharmacies,and it was only in the 21st century that DTP pharmacies really began to develop in China[1],especially the issue of medical separation policy in 2006.Besides,the policy that hospitals cannot restrict outpatients from going to out-of-hospital pharmacies to buy medicines with prescriptions was published in 2007[2].Then,a series of policies were successively introduced in China in 2009 to reduce the burden of medical treatment for patients.Problems such as“difficult and expensive medical treatment” greatly promoted the rise and development of DTP pharmacies in China.On May 10,2021,the “Guiding Opinions of the National Healthcare Security Administration and National Health Commission on Establishing and Improving the ‘Dual-Channel’ Management Mechanism for Drugs in National Medical Insurance Negotiation” issued by the National Healthcare Security Administration further promoted the “dualchannel” management of DTP[3],contributing to the further development of DTP.According to data from the China Pharmaceutical Business Association,there were 1 883 DTP pharmacies at the end of 2020,including chain DTP pharmacies and retail DTP pharmacies.499 DTP pharmacies were investigated in this study and relevant data were collected.This paper further explores the development status,standards and service characteristics of China’s DTP pharmacies by means of comparison and literature research.Then,the development trend of China’s DTP pharmacies is prospected.Lastly,some corresponding suggestions are out given to provide reference for further promoting the development of DTP pharmacy.

2 Materials and methods

2.1 Study sample

The on-site inspections of 499 DTP pharmacies and related data were studied in accordance with the “Specifications for Retail Pharmacies Operating Drugs for Special Diseases” (hereinafter referred to as the “Specifications”) formulated by the China Pharmaceutical Business Association[4].The deadline for the collection of data is the end of December,2020 (the data below are the survey data of 499 surveyed pharmacies unless otherwise noted),and 20 pharmacy managers were interviewed during the survey.

2.2 Study methods

2.2.1 DTP pharmacy data survey

The data in this paper are the inspection information of 499 DTP pharmacies nationwide made by relevant experts of the China Pharmaceutical Business Association,and various indicators of 499 DTP pharmacies were graded according to the scoring standards in the “Specification”.

2.2.2 Data collection

Firstly,some websites of relevant national departments and provincial government were investigated to sort out policies of DTP pharmacies.Secondly,the websites of drug distribution enterprises and drug retail chain enterprises were studied to get some related literature on DTP pharmacy.

2.3 Data statistical method

Excel software is used for data entry,statistics,and sorting.

3 Analysis results

3.1 Market scale of DTP

In the report “Global Oncology Drug Trends 2018”,IQVIA (a leader in the global healthcare industry) predicted that by 2022,the annual growth rate will be 12% -15%.The US cancer drug sales will reach 100 billion US dollars,and the global cancer drug market sales will also reach 200 billion US dollars within three years.

The main consumer groups in the DTP market are patients who need tumor drugs.DTP pharmacies account for about 46% of the sales of tumor drugs,about 20% of immunosuppressive drugs,about 20%of other drugs,and 34% of other drugs.According to statistics,from 2012 to 2018,the sales of anti-cancer drugs in China doubled,from 4.6 billion yuan to 13.6 billion yuan[5],with an average annual growth rate of about 20%,which is higher than that of global anti-cancer drugs.

3.2 Number of DTP pharmacies

3.2.1 Overall number of DTP pharmacies in China

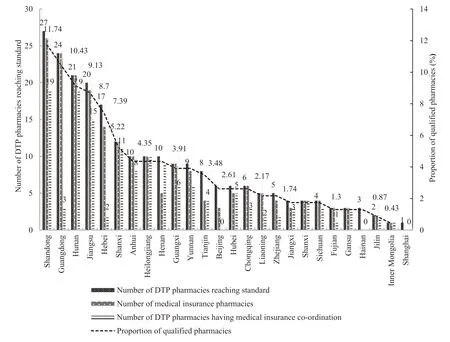

In the survey results of 499 DTP pharmacies,a total of 230 pharmacies in various provinces have reached the standard of DTP pharmacies.Among the DTP pharmacies that meet the standard,93 are retail pharmacies,accounting for about 40.43%,and the number of chain stores is 137,accounting for about 59.57%.Among these qualified DTP pharmacies,205 pharmacies are covered by medical insurance and 141 pharmacies coordinate with medical insurance.According to the survey data,the average annual sales of drug varieties in DTP pharmacies in China in 2019 was 4.003 4 million yuan.It was 3.308 3 million yuan in 2020,and the average gross profit margin dropped from 3.49% to 3.36%.

3.2.2 Number and distribution of DTP pharmacies

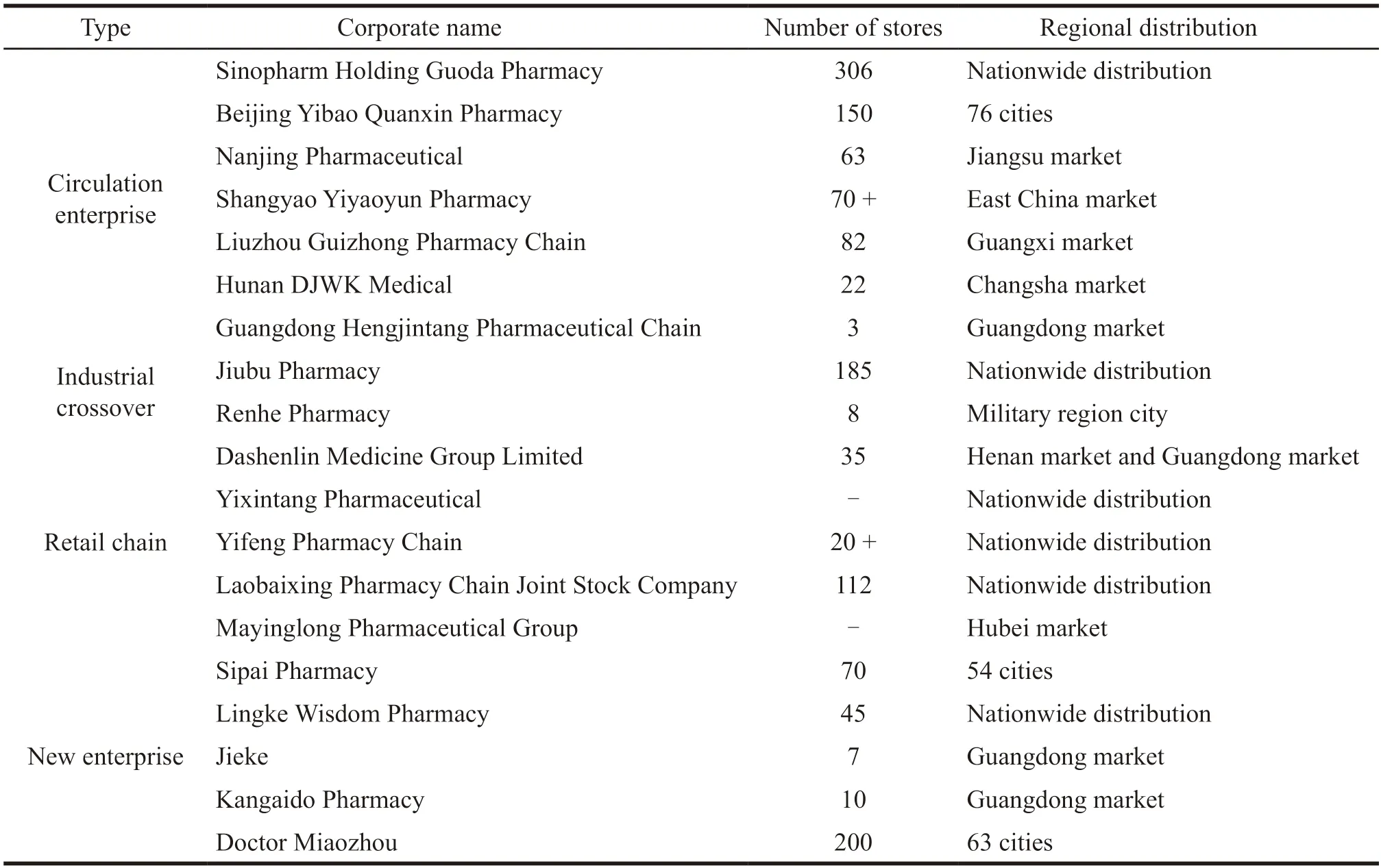

According to the research report of “Souyao” in 2021,the number and distribution of DTP pharmacies,circulation enterprises own a large number of DTP pharmacies.They normally occupy the central and eastern markets.The number of DTP pharmacies belonging to cross-industrial industries is small,and most of them are distributed in the cities where the military region hospitals are located.Retail DTP pharmacies and chain DTP pharmacies,such as Dashenlin,Laobaixing,etc.all belong to common enterprises.Except for some DTP pharmacies of enterprises distributing in certain regions,the other DTP pharmacies are distributed evenly throughout the country.Finally,some new enterprises have certain number of DTP pharmacies.Their distribution of DTP pharmacies is not as good as other types of enterprise,but because they are good at using big data,they can systematically grasp patient medication information to achieve better development.The specific numbers and regional distribution are shown in Table 1.

Table 1 Number and distribution of DTP pharmacies in 2020

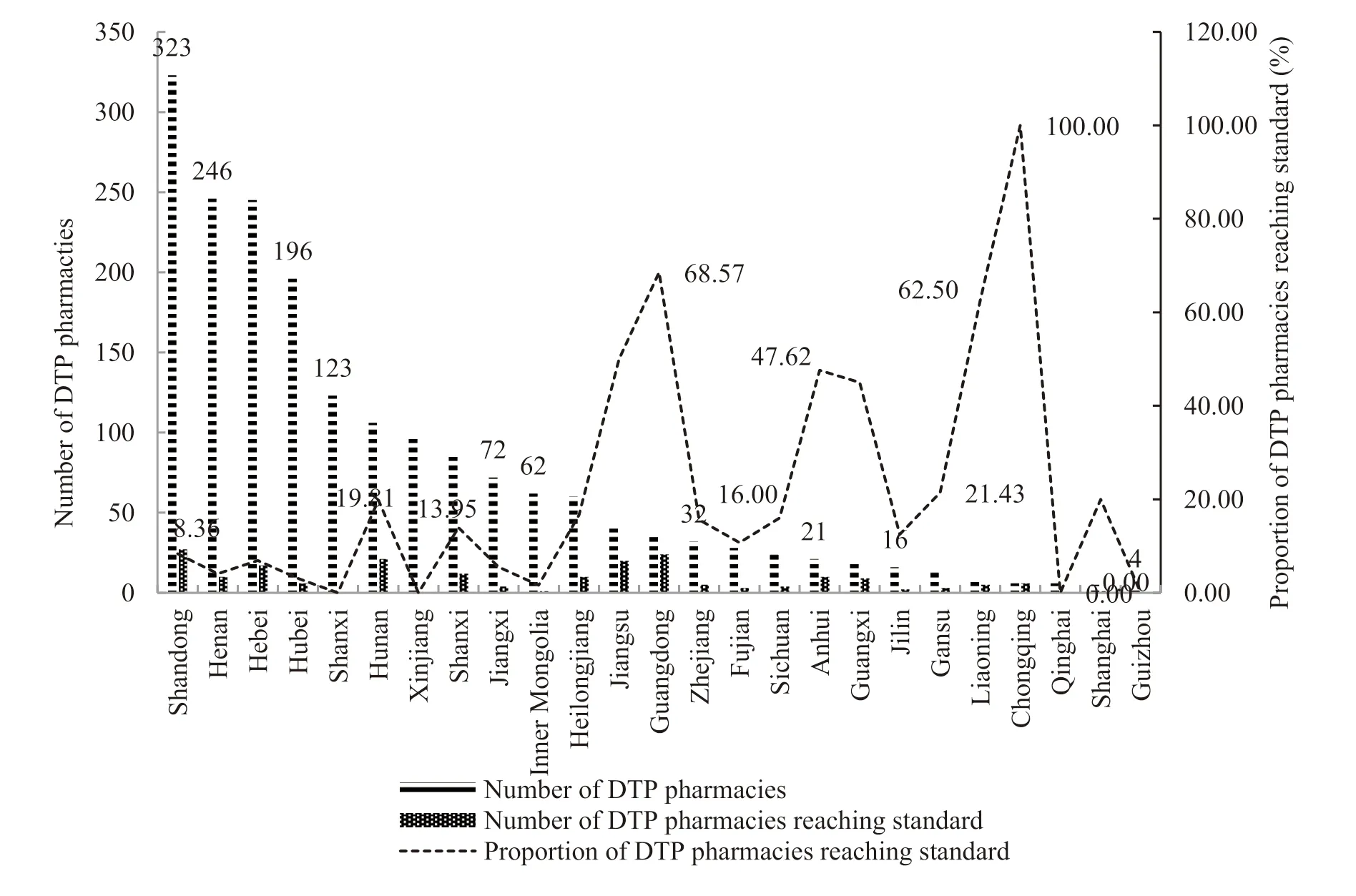

3.3 Geographical distribution of DTP pharmacies

Provinces with the largest number of DTP pharmacies in China in 2020 are Shandong,Henan,Hebei,and Hubei,which are in the central plains of China geographically.Meanwhile the number of DTP pharmacies in southwestern regions such as Yunnan,Chongqing,and Guizhou is relatively small.China is divided into eastern,central and western regions(Eastern region: Beijing,Tianjin,Hebei,Liaoning,Jilin,Heilongjiang,Shanghai,Jiangsu,Zhejiang,Fujian,Shandong,Guangdong;Central region:Shanxi,Shaanxi,Anhui,Jiangxi,Henan,Hubei,Hunan;Western region: Inner Mongolia,Guangxi,Sichuan,Chongqing,Guizhou,Yunnan,Gansu,Qinghai,Ningxia,Tibet,and Xinjiang).There are 792 DTP pharmacies in eastern China,850 in central,and 241 in western China (Fig.1).

Fig.1 The number of DTP pharmacies in each province in 2020

Based on the latest ranking of the GDP of each province in 2020,31 provinces in China are divided into developed provinces,less developed provinces and developing provinces (Developed provinces:Guangdong,Jiangsu,Shandong,Zhejiang,Henan,Sichuan,Fujian,Hunan,Hubei,and Anhui;Less developed provinces: Shanghai,Beijing,Hebei,Jiangxi,Shaanxi,Chongqing,Yunnan,Liaoning,Guangxi,and Shanxi;Developing provinces: Guizhou,Inner Mongolia,Tianjin,Xinjiang,Jilin,Heilongjiang,Gansu,Hainan,Ningxia,Qinghai,and Tibet).There are 1 052 DTP pharmacies in China’s developed provinces,573 in less developed provinces,and 258 in the developing provinces.

3.4 Concrete conditions of DTP pharmacies reaching standard

The number of DTP pharmacies reaching standard is basically proportional to the number of DTP pharmacies in various provinces.The proportion of DTP pharmacies that meet the standard shows the same trend as the number of DTP pharmacies.The proportion of DTP pharmacies having medical insurance co-ordination is lower than the proportion that meets the standard (Fig.2)

Fig.2 DTP pharmacies reaching standard

3.5 Sales of DTP pharmacy category

3.5.1 Sales category ranking

According to the survey data,the drugs sold in DTP pharmacies are mainly chemical drugs and biological products.The number of drugs has risen from 527 to 622.In the ranking of chemical drugs,the sales of osimertinib mesylate tablets increased signif icantly in 2020,while the f iuctuation of other drugs was relatively stable.In the ranking of biological products,the sales of camrelizumab for injection increased significantly in 2020,while the sales of trastuzumab for injection dropped significantly in 2020,and the fluctuation of other drugs was stable.In the survey of drug types in 499 pharmacies,the top ten generic names of chemical drugs and biological products in 2019-2020 are shown in Table 2 and Table 3.

Table 2 Sales of the top ten products with generic names of chemical drugs from 2019 to 2020

Table 3 Sales of the top ten products with generic names of biological products from 2019 to 2020

3.5.2 Distribution of DTP pharmacy product specif ications

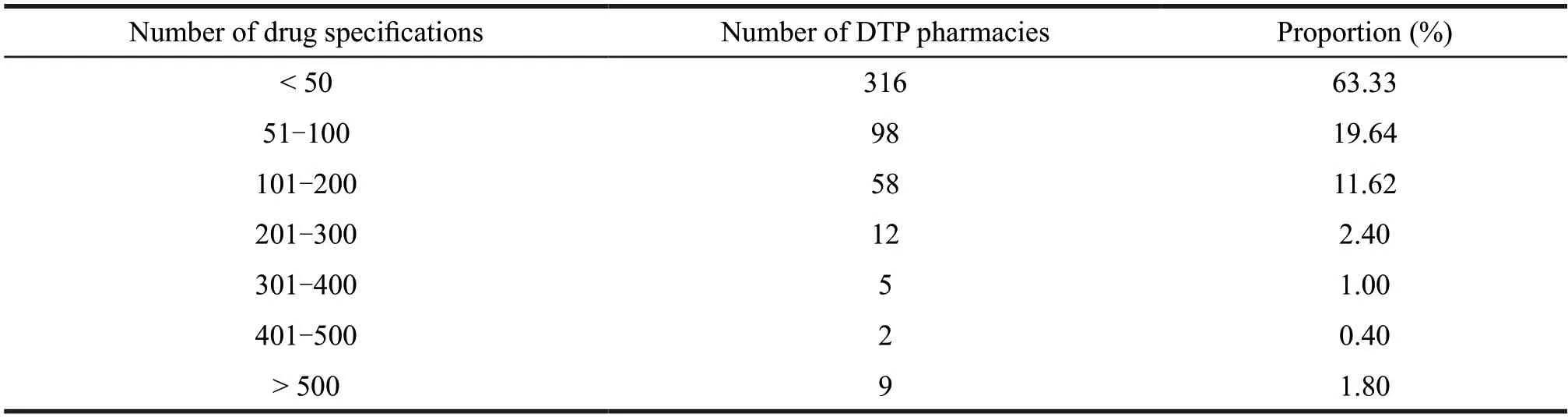

The number of product specifications of 499 DTP pharmacies was investigated to rank the number of product specifications in each DTP pharmacy.5.61% have more than 200 drug specifications,and only 3.20% have more than 300 drug specifications(Table 4).

Table 4 Number and proportion of product specifications in DTP pharmacy

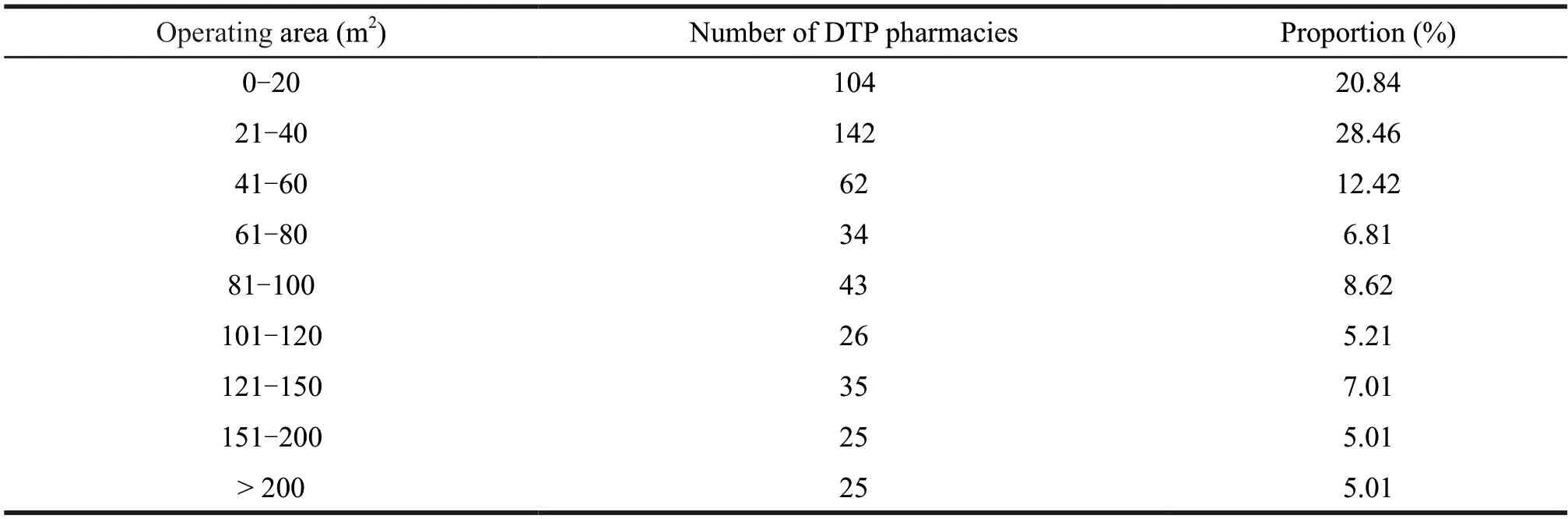

3.6 Allocation of pharmacists in DTP pharmacies

The survey data of 499 DTP pharmacies shows that 429 DTP pharmacies have more than 6 pharmacists,accounting for 85.97%,and 307 DTP pharmacies have no less than 2 licensed pharmacists,accounting for 61.52%.269 DTP pharmacies meet the requirements of the specification with the number of pharmacists,accounting for 53.91% of the DTP pharmacies surveyed.Among the 499 pharmacies,165 DTP pharmacies just meet the personnel requirements,314 DTP pharmacies have pharmacy technicians and 189 pharmacies have the licensed pharmacists to meet the requirements.Nearly half of the DTP pharmacies are not qualified in the number of pharmacists.Among the 499 DTP pharmacies,each pharmacy has an average of 7.3 pharmacy technicians and 2.3 licensed pharmacists.A survey was conducted on the education status of 3 375 clerks and the proportion of pharmacists in 483 pharmacies.It was found that there were 2 058 licensed pharmacists,accounting for 60.98% of the total number of surveyed.Among the registered licensed pharmacists,1 is a chief pharmacist who possessed a doctoral degree,15 have a master’s degree,820 have a bachelor’s degree,942 have a college degree,and 276 have a high school(secondary) education.Therefore,the education level of these pharmacists is mostly undergraduate and junior college,and there are fewer people with higher education (doctor,master) or lower education (high school,technical secondary school).See Table 5 and Table 6 for details.

Table 5 Number of licensed pharmacists in DTP pharmacies and the proportion of qualified pharmaceutical technicians

Table 6 Number of years of licensed pharmacists in DTP pharmacies

3.7 DTP pharmacy service

According to the survey,477 of the 499 DTP pharmacies have a patient service system,accounting for 95.78% of the total,and 471 pharmacies have a supporting information service system,accounting for 94.58%.

As to the number of patients served,according to the survey data,each DTP pharmacy can serve 213 patients on average every day.95.78% of the DTP pharmacies have a patient service system,and the pharmacist’s follow-up of patients has almost reached 95%.

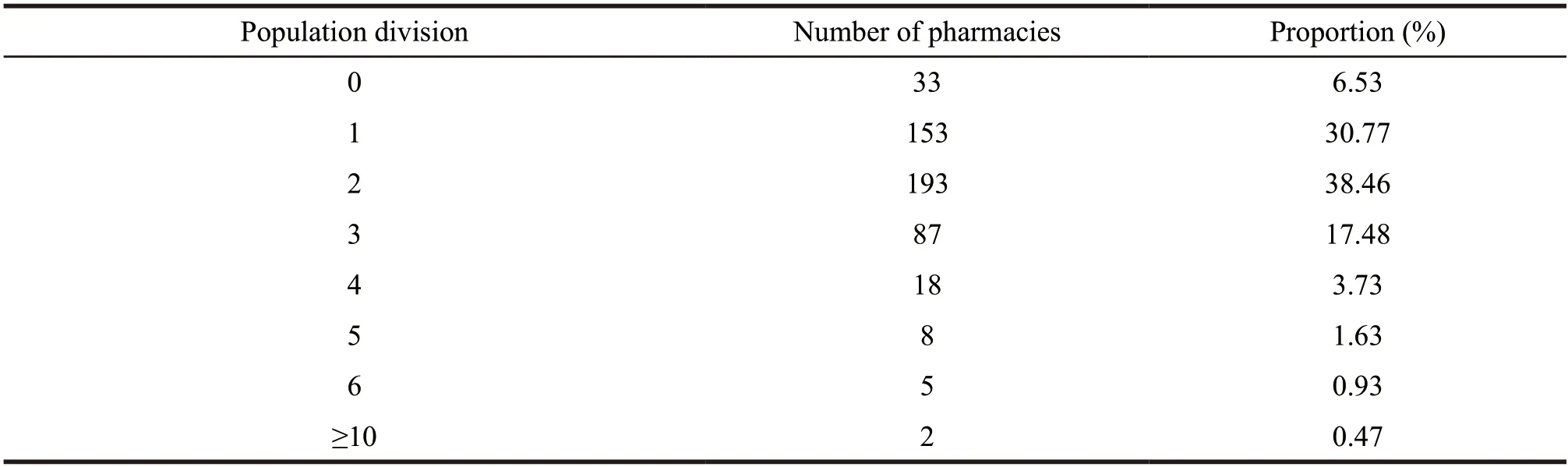

As to pharmacy service business area,according to the survey,most of the 499 DTP pharmacies have a business area of 20-40 square meters,and a few pharmacies have an operating area of more than 150 square meters or even more than 200 square meters(Table 7).

Table 7 Operating area and proportion of DTP pharmacies in 2020

4 Discussion

4.1 National policies are conducive to the development of DTP pharmacies

Among the series of policies promulgated by the state,the key points are the separation of medicines,the management of medicines by classification,the cancellation of drug additions,the outflow of prescriptions from hospitals,the initiative of medical institutions to provide prescriptions to patients,the encouragement of retail pharmacies to undertake outpatient pharmacy services,and the online review of pharmacists.Besides,prescriptions should be connected with medical insurance settlement information and drug retail consumption information,and the qualified Internet medical services should be included in the scope of medical insurance reimbursement.These policies can greatly promote the development of DTP pharmacies in China.In 2006,the government issued a policy that pointed out the separation of medicines[6],DTP pharmacies began to appear in China.In the process of development,DTP pharmacies focus on serving the public and create more convenience for consumers by reducing their profit rate.

4.2 Market environment is conducive to the development of DTP pharmacies

The macroeconomic policy environment has provided the impetus for the rapid development of DTP pharmacies.Due to changes in the disease spectrum,the increase in aging,and the increase in the proportion of chronic diseases,DTP pharmacies face great opportunities.One of the main consumer groups in the DTP market is patients who need oncology drugs[7],followed by immunosuppressive drugs,and finally other drugs,including neuro-drugs and rare disease drugs.The increase in the number of people who need special drugs,especially the demand for tumor drugs,has also prompted drug manufacturers to increase the research and development of tumor drugs[8].The sales market for cancer drugs is huge in recent years.

With the further development of drug centralized procurement,more special drugs will enter the National Reimbursement Drug List.Therefore,DTP pharmacies have become more widely accepted by the public[9].

4.3 DTP pharmacies are unevenly distributed,but the proportion of provinces meeting the standard is high

There is a big disparity between southwest China and the central plains,and the distribution of DTP pharmacies is uneven.According to the eastern,central and western divisions,there are more DTP pharmacies in the eastern and central regions,while the western region has a big gap compared with eastern regions.Based on the degree of development of the provinces,the number of DTP pharmacies in these provinces is large.The provinces with a large GDPs have more DTP pharmacies than the provinces with a smaller GDPs.Judging from the proportion of DTP pharmacies that meet the standards and the number of DTP pharmacies,the overall level of DTP pharmacies in China is low.However,the proportion of DTP pharmacies that meet the standards in provinces with small GDPs is high.The reason is that the small number of DTP pharmacies can meet the standard easily.It can be seen from the number of DTP pharmacies with medical insurance and the number of pharmacies that have opened medical insurance coordinating payment that the more pharmacies that meet the standards,the larger number of them with medical insurance and medical insurance coordinating payment,except for some specific places,such as Guangdong,Hebei,Beijing and other regions.

4.4 DTP pharmacies have stable sales varieties and centralized product specifications

According to the data of the changes of generic names of drugs sold by DTP pharmacies in 2019-2020,among the chemical drugs,the sales of osimertinib mesylate tablets increased greatly in 2020,and the fluctuation of other drugs was relatively stable.In the changing trend,the sales of camrelizumab for injection increased significantly in 2020,while the sales of trastuzumab for injection decreased significantly in 2020,and the fluctuation of other drugs was relatively stable.According to the statistics of China’s DTP pharmacy product specifications,most of China’s DTP pharmacies have relatively few product specifications,which proves China’s DTP pharmacies tend to develop more professionally.

4.5 The size of DTP pharmacy is smaller than that of general pharmacy

The overall scale of China’s DTP pharmacies is expanding,but their yields are declining.Although DTP pharmacies under the support of the policy are growing quickly,the policy also restricts their growth.The development of DTP pharmacy should adhere to people-oriented principle,and it will have a bright future.

According to the survey data,the average operating area of general retail pharmacies is about 314.52 square meters,while the average operating area of DTP pharmacies is 87.27 square meters.In terms of sales per store,the average sales of pharmacies in 2020 are about 18.134 million yuan.However,the average sales of DTP pharmacies in 2020 are 33.983 million yuan.As to the number of drug specifications,the average number of drug specifications in general retail pharmacies is about 2 074.46,and the average number of drug specifications in DTP pharmacies is 72.48.In terms of pharmacy employees,the average number of employees in general retail pharmacies is 13.14,while the average number of pharmacy technicians in DTP pharmacies is 7.33.Therefore,the average value of general retail pharmacies is far greater than that of DTP pharmacies.

4.6 Competency of pharmaceutical technicians in DTP pharmacies is higher than that in general retail pharmacies

The significance of the DTP pharmacy model is that it can serve patients directly.The core task of DTP pharmacy is to provide patients with whole-process health management and medication guidance,and to conduct after-sales follow-up.Therefore,technical personnel of a DTP pharmacy are licensed pharmacists with pharmacy knowledge.A team of licensed pharmacists should be formed for DTP pharmacy[10].For DTP pharmacies,pharmacy services are a very important part.In today’s economic and social development where the service industry accounts for an increasing proportion,people pay more attention to the quality of services.For patients,they not only required the best service in the pharmacy,but the after-sales service is necessary too.Therefore,it is vital for DTP pharmacies to possess high-quality pharmaceutical technicians.

4.7 DTP pharmacies make patients easy to buy drugs

Hospitals,patients,and pharmaceutical enterprises are the most important stakeholders of DTP pharmacy.DTP pharmacy skips the distribution links such as agents,drug bidding and hospitals,to establish contact with pharmaceutical companies,which not only provides sales channels for pharmaceutical companies,but also obtain higher profits.DTP pharmacies have a positive impact on physicians,patients and pharmaceutical companies to a certain degree.For patients,a shorter supply chain also brings low drug prices.For doctors,after the implementation of drug centralized procurement,they are more inclined to recommend patients to purchase drugs from DTP pharmacies.Besides,the winning bid companies are actively promoting the outfiow of prescriptions.The channel of DTP pharmacies in the provinces where centralized procurement is carried out has become significant.As the gap between enterprises and patients for a longer time becomes narrow,more patients will go to DTP pharmacy to buy drugs,which brings more profits for DTP pharmacies.This has great advantages for pharmaceutical companies,patients,and pharmacies.

5 Suggestions on the development of DTP pharmacies

5.1 Attaching importance to the role of policy promotion and standardizing the development of DTP pharmacies

Since 2006,with the goal of controlling medical expenses and improving the quality of medical services,the government has issued a series of policies to intensify medical reform,including separation of medicines,zero mark-up on medicines,two-invoice system,and volume-based procurement.These polices can guarantee patients’ right to purchase drugs outside the hospital with prescriptions.These important factors promote the rapid development of DTP pharmacies.Since 2016,the introduction of various policies has linked medical insurance with DTP pharmacies,which speeds up the development of DTP pharmacies.

China has issued a series of policies to guide and clarify the relationship between medicine and the sale of drugs.These policies have made the DTP pharmacy market more standardized,and the distinction becomes clear,which has also promoted the number of DTP pharmacies to a certain extent.The increase in numbers has greatly promoted the development of DTP pharmacies in China.In the future,DTP pharmacies should closely follow the support and guidance of policies.With the introduction of policies to better standardize DTP pharmacies,they should also conduct self-supervision in accordance with national standards,which can promote the development of DTP pharmacies in a good direction.

5.2 Actively expanding the market share of DTP pharmacies

China’s drug centralized procurement policy is a major boost to the development of DTP pharmacies.There are two different stages before and after purchasing with quantity.One is that before special drugs enter the hospital,DTP pharmacies often cooperate with manufacturers and conduct joint management with doctors and patients.The other is that after special drugs enter the hospital,drug manufacturers will focus their resources on hospitals,while DTP pharmacies become a supplemental channel.Since 2018,with the continuous advancement of national volume-based procurement,DTP pharmacies have once again become an important channel for manufacturers to sell their product.In the long run,DTP pharmacies will sell more varieties.In addition,drug prices in current DTP pharmacies should be stable with small profits.Under the premise of national policy support,DTP pharmacies should actively expand their market share,which provides more convenience and benefit for the public.

5.3 Rationally designing the space allocation of DTP pharmacies

The policy of drug centralized procurement has an overall promotion effect on DTP pharmacies,while medical insurance access can also promote the development of some pharmacies with medical insurance access qualifications.For DTP pharmacies with medical insurance access qualifications,they not only increase their customer fiow,but also have a better price advantage for patients.It can prompt more patients to purchase drugs from pharmacies that are eligible for medical insurance access.

At present,DTP pharmacies are mostly located near hospitals.The reason is that there are many patients around hospitals[11].Since DTP pharmacies have a large amount of patient data,and their cold chain distribution system does not allow them to carry drugs for long-distance distribution,they should actively grasp the distribution area of consumers in the development process,and determine more suitable locations to provide convenient services for the people.

In terms of layout,China has more DTP pharmacies in the central and eastern regions.There are also more DTP pharmacies in provinces with better GDPs.However,DTP pharmacies should consider their layout in the developing provinces,which will benefit more people in China.

5.4 Detailing disease division and specializing pharmaceutical care

In terms of business categories and development directions,some pharmacies currently use the types of drugs with larger sales volume as the development direction of pharmaceutical services and pharmacist divisions.The number of drug varieties in DTP pharmacies is 12.17 in 2019,while it is 11.68 in 2020.It can be seen that the average number of varieties in DTP pharmacies is decreasing,which means the trend of specialization.DTP pharmacies should pay more attention to the detailed division of diseases in the follow-up development.More specialized pharmaceutical care will become the core task of DTP pharmacy to meet the market demand.Therefore,more value-added pharmaceutical services are provided to consumers.In addition,DTP pharmacy service staff are more professional technicians and pharmacists who can not only make professional suggestions when patients purchase drugs,but also conduct professional follow-up service.This is also the core competitiveness of DTP pharmacy.As an important reason for pharmaceutical services,DTP pharmacy should take professional services as a major focus of its development.More detailed disease divisions and professional pharmaceutical services brought by licensed pharmacists will greatly enhance the competitiveness of DTP pharmacies.

5.5 Actively cooperating between suppliers and retailers

There is a trend of diversification in the supplier-to-retailer cooperation model between DTP pharmacies and enterprises.The connection between DTP pharmacies and drug production enterprises has greatly shortened the supply chain of medicines to patients,which is a win-win model for both pharmaceutical companies and DTP pharmacies.DTP pharmacies can carry out diversified cooperation models with pharmaceutical companies.For example,as to new special drugs,the company provides professional guidance to the pharmacy,and the pharmacy should offer professional feedback to the company.Close cooperation will bring good development opportunities to both pharmaceutical enterprises and pharmacies.

- 亚洲社会药学杂志的其它文章

- Enlightenment and Suggestions on the Construction of Information Platform and Processing Mechanism of Drug Shortages in Developed Countries to China

- Study on the Management of Chronic Diseases in American and British Community Pharmacy

- lnfluence and Suggestions on Trial lmplementation Measures for Early Settlement Mechanism of Drug Patent Disputes

- Enlightenment of COVID-19 Treated by Botanical Drugs on the Development of Drugs for Rare Diseases in China

- Research on Liposomal Irinotecan in Combination with 5-FU/LV for Metastatic Pancreatic Ductal Adenocarcinoma

- Present Situation and Thinking of the Evaluation and Management of Biomedical Projects in Shenzhen Industrial Park of Shenzhen-Hong Kong Cooperation Zone