Bundling strategies for platforms with an installed base

Jie Wu,Chenwei Zhou,Xiang Ji,and Mingjun Li

School of Management,University of Science and Technology of China,Hefei 230026,China

Abstract: As an emerging platform,hardware/software platforms differ from traditional retail platforms because they require consumers to spend a certain amount of money accessing them.Therefore,an installation base is created.Considering the game console as an example,only consumers with an installation base can purchase a third-party game product on the platform.Otherwise,consumers will be unable to play games.It is generally believed that the existence of an installed base will benefit third-party content providers,and at the same time,it will not benefit platform manufacturers.Therefore,it can be observed that game platforms often bundle new consoles with third-party content,forcing consumers with installed bases to purchase a new console.Thus,building a model to study the impact of the installation based on the bundling strategy of the video game platform and to analyze the optimal pricing and profit under different bundling strategies is meaningful.Our study analyzed the impact of the installed base under different bundling strategies and found that the installed base dose not always have a positive impact on platform manufacturers.The study also analyzed the equilibrium of competing platform manufacturers and found that,under certain conditions,both the bundling-bundling strategy and the unbundling-unbundling strategy may exist as equilibrium.

Keywords: bundling;installed base;video game platform

1 Introduction

With the development of new digital technologies such as big data,Internet of Things,artificial intelligence,blockchains,and virtual reality[1],platforms are becoming increasingly common in the market,and software/hardware platforms,as emerging forms of platforms,are gradually being purchased by an increasing number of consumers.As a tool to enjoy game products,the platform attracts consumers not only through game products but also through its performance and basic applications.In contrast to the traditional retail platform,the software/hardware platform itself requires consumers to pay a certain fee to access it,that is,only consumers with an installation base can enjoy the content provided by third-party providers.As an emerging electronic product,the platform increases its appeal to consumers through access to third-party games and continuous updates.As content can be added to the platform,third-party games can expand the entertainment value of the platform and increase the platform’s appeal to consumers.Video game consoles (e.g.,Nintendo,Sony’s PS,Xbox) are examples of these platforms.The console platform relies on its own product performance and access to third-party games to attract consumers buy and acquire platform services.

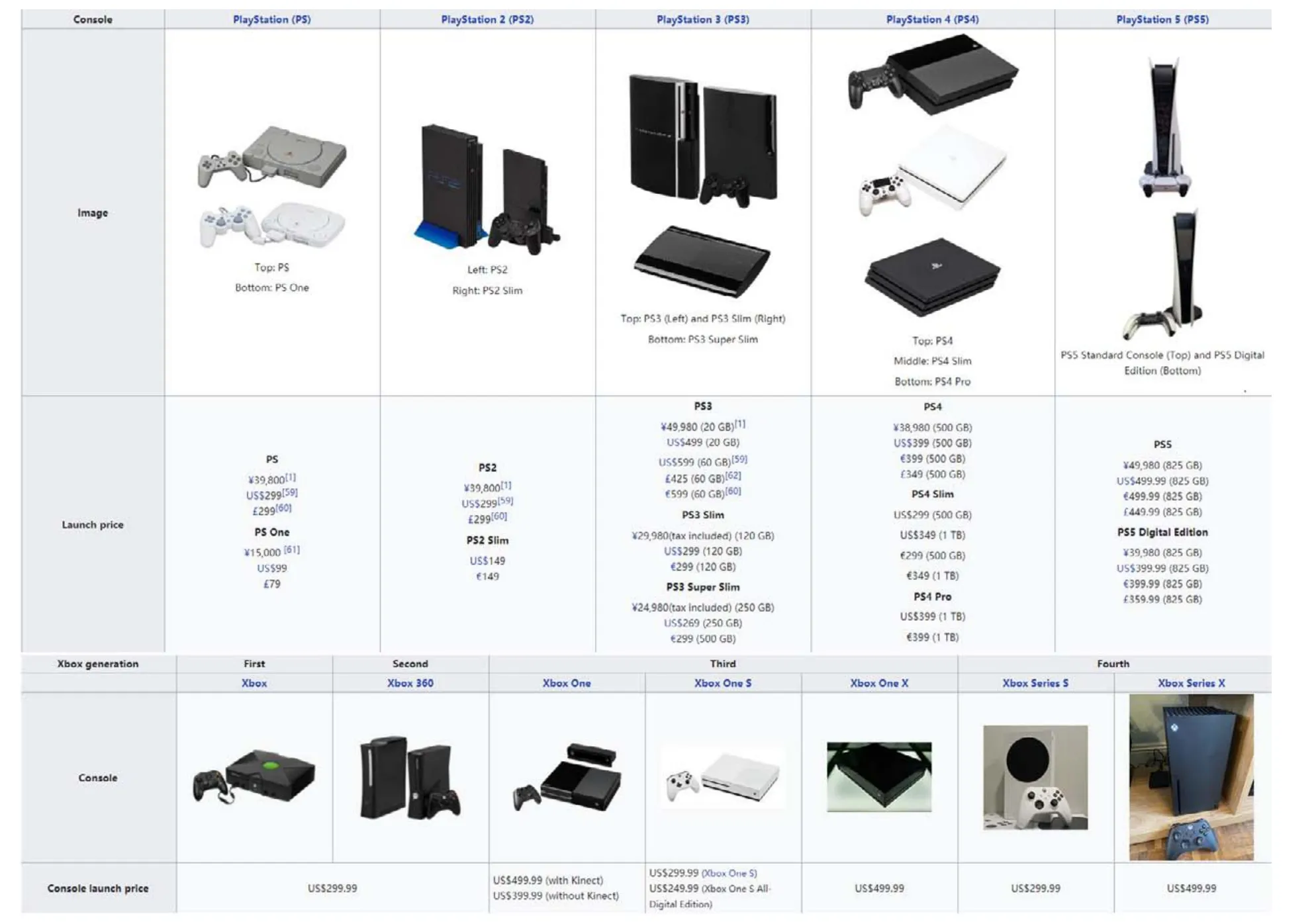

The console platform market comprises a series of products that are constantly updated.As shown in Fig.1,the Play Station series developed by Sony is a mainstream game console product.Ten generations of products have been launched since the release of the first generation in 1994.Microsoft’s Xbox series underwent constant updates.Frequent product updates can adapt to market demands,improve competitiveness,and promote a new round of consumption.With the continuous upgrading of game consoles,some consumers already have a certain version of the console,that is,the installed base of the brand.Consumer groups with an installed base affect the sales of new products from platform manufacturers and games attached to the platform.In this study,we examined the installed base.Intuitively,an increase in the installed base is conducive to market expansion for third-party games.Simultaneously,platform manufacturers will make less profit from selling game consoles because no consumers are willing to buy two consoles with the same function.Inducing more consumers buy new products has become an important issue for platform manufacturers.From real examples,it can be found that many manufacturers have chosen to cooperate with third-party game providers to further drive consumption through the tough measures of bundling new platforms with third-party content.

When platform manufacturers release new consoles and consider the sale of new game content,they choose different strategies.The new Spider-Man series “Marvel’s Spider-Man:Miles Morales” was sold exclusively on the PS platform in 2020.Owners of the PS4 and PS5 consoles belonging to the PS series can purchase and play the game.As a third-party game,the Octopath Traveler has been monopolized by Nintendo’s new console NS for a period of time since its release.This can only be played when consumers have an NS console.There are different bundling strategies for the cooperation between platform manufacturers and third-party content providers.According to the sales relationship between game content and new console products,cooperation between manufacturers and providers can be divided into bundled (game content is only added to the new console) and unbundled (game content can also be played on the old console).

Fig.1.Game consoles and price map (source from Wikipedia).

Game console manufacturers as platform manufacturers form a two-sided market with third-party game providers.As mentioned above,in such a two-sided market,to maximize benefits,platform manufacturers can make many different strategic choices,such as whether to let the game content be bundled with the new console or not bundling to allow consumers with the installed base to obtain the right to enjoy the game on their old console.Obviously,the decision to bundle or no bundle will make consumers with or without an installed base make different purchasing decisions.The decision also affects the market size of console manufacturers,content providers,and further changes the optimal profit of both sides.Therefore,the manufacturers must choose the right bundling decision to obtain the best profit for different installed base sizes.Content providers must also make appropriate pricing decisions based on different installation base sizes to maximize profits.Based on the above motivations,we develop the following questions.Considering the installation base,when the new generation of consoles is on sale,how does the installed base affect the pricing structure of game products under different bundling strategies? How does the installed base affect profit on both sides of the market under different conditions?

Based on the above issues,this study examines the pricing and decision-making issues of platform manufacturers and game providers in a competitive environment with an installed base.Considering the strategic choice of competing platforms,the bundling strategies presented in this study can be divided into three categories: BB: both companies choose bundling;CC: neither company chooses bundling;and BC:Only one of the two companies chooses to bundle.The equilibrium results in these three decision-making situations may be affected by different degrees of percentage of consumers with an installed base.The results show that the installation base has a significant influence on the profitability of the platform.Under certain conditions,an increase in the installation base augments the profitability of the platform manufacturer.This study also analyzes the pricing and profitability of content providers under the influence of the installation base,and finds that the pricing structure changes significantly with different strategies.Under certain conditions,the existence of the installed base will have adverse effects,and such adverse effects are caused by the bundling decisions made by competing companies.

This study compares the profitability of the console platform under different decision-making situations and finds that the profit of the BB case is always more profitable than that of the CC case,but equilibrium does not always exist in the bundling case.In the case of bundling,under the influence of factors such as installed bases and royalties,the two competing companies may fall into a prisoner’s dilemma,then both choose not to bundle.At this time,the company can avoid entering into the prisoner’s dilemma by reaching an agreement to achieve greater profits.

The rest of this paper is organized as follows: Section 2 reviews the relevant literature.In Section 3,a mathematical model is established to simulate the pricing and decisionmaking problems of competitive platform manufacturers and content providers in the bilateral market.Section 4 analyzes the pricing and profit issues under different bundling strategies.Specifically,Section 4.1 analyzes the price decision when bundling does not occur,Section 4.2 analyzes the price decision when both companies choose bundling strategies,Section 4.3 analyzes the price decision when only one company chooses the bundling strategy,and Section 4.4 analyzes the equilibrium and under what conditions the equilibrium occurs.Finally,Section 5 summarizes the results of this study and proposes its limitations and prospects.

2 Literature review

Our work is closely related to the literature on strategic decision-making under bundling.Bundling has been studied extensively[2−6].Basu et al.[7]studied the strategic choices of monopolistic companies when consumer valuations are differentiated and concluded that when a product has a low marginal cost and when the difference between high and low valuations is not too large,pure bundling is optimal.Prasad et al.[8]studied the strategic choices of monopolistic companies when products have network externalities and showed that pure bundling is more profitable when both products have low cost or high network externalities.Cao et al.[9]combined limited supply with bundling and showed that limited supply can promote bundling.Zhang et al.[10]consider the strategic choices of competing companies when core products have quality differences and conclude that when the company’s core quality is good enough,sales bundling is more advantageous.To conclude,these articles studied the issue of bundling strategy from a single market and find the specific situation in which bundling might make a company profitable.Some studies[11−17]analyzed the issue of bundling starting from a two-sided market.Sun et al.[11]studied the bundling strategies of two competing companies that sell differentiated platforms and complementary products,and found that bundling is profitable when the degree of platform differentiation is small or the complementary products are highly differentiated.Chen et al.[18]simulated a two-sided market with an upstream and downstream structure in which two upstream companies compete with each other.The conclusion is that bundling is good downstream but bad upstream.Choi[19]studied the two-sided market of platform competition,considering that users can have multiple platforms,and showed that bundling allows users to join more platforms,which is beneficial to content providers.Bundling has been widely used as a sales method in several fields.Starting from the two-sided market formed by platforms and content providers,we studied the choice of bundling strategies in the presence of an installation base and the influence of different strategies on pricing and profits.

In addition,following studies have considered installed bases when studying the bundling problem.Yong et al.[20]studied monopoly platforms with integrated content,decided whether to bundle their own platform and inherited content,and concluded that the existence of an installed base encourages platform bundling.At times,price discrimination can be performed to obtain higher profits.Lin et al.[21]introduced competitive platforms and concluded that mixed bundling can always bring greater benefits when the installation base is very high.Similar to these studies,we also analyze several bundling strategies of the video game platform under the influence of the installation base,using a different strategy from the previous two studies[20,21]that let third-party content decide whether to join the platform based on the development cost,and their bundling strategy concerned the bundling of the platform’s integrated content and the platform itself.The bundling studied in our study is the bundling of the platform and third-party content,and the profitability of the content provider is also considered.In addition,Lin et al.[21]verified the optimality of mixed bundling in some situations,and proved that equilibrium may exist in both BB strategy and CC strategy.

Another stream of research related to our work studied video game platforms[22−26],especially the issue of console upgrades.The models in these articles are based on the characteristics of the platform and have drawn some interesting conclusions.Zhu et al.[27]studied the entrance of a platform-based market,and considered competition and installed bases.This study examines the relative importance of platform quality,indirect network effects,and consumer expectations regarding the success of entrants in platform-based markets.Anderson et al.[28]studied the issue of renewed investment during monopoly and competition and concluded that under monopoly,an increase in the degree of interest in third-party content and an increase in royalties will lead to an increase or decrease in performance investment.Competition leads to a decline.Tan et al.[29]studied the impact of integrated investment on platforms and third parties.Anderson et al.demonstrated that lower-performance platforms can dominate the market in some cases.Our work starts with a consideration of the game console’s updates.We use the concept of the installed base to simulate updates and consider the description of additional content by add-on[30−31].And we discuss bundling strategies in a competitive environment.

3 Model

In this section,we simulate a competitive,two-sided market model.The market comprises two video game platform manufacturers and one content provider.In particular,this study examines a market composed of two symmetrical console platforms and one third-party content provider.This model has three types of roles: consumers,content providers (or game providers),and platform manufacturers.Table 1 summarizes the symbols used in the model.Next,we introduce this model from three aspects: platform manufacturer,consumer,and content provider.

Table 1.Parameters and decision variables.

3.1 Platform manufacturer

This study assumes a competitive market with two symmetrical video game console manufacturers.We call these twosymmetrical platform manufacturers firms 1 and 2.As mentioned earlier,products manufactured by platform manufacturers are constantly updated.We assume that when a company launches new products,the company’s old console of the same series already exists in the market,and a certain percentage of consumers have purchased the old products.These consumers constitute an installed base.In this study,we define αias the proportion of consumers with an installed base.

The game console product has certain basic functions and brings value to consumers.We assume that the valuation that users can obtain by purchasing a console platform isV,and the platform charges a pricep.The utility that consumers obtain from purchasing a console can be written asU=V−p.When utility is positive,consumers will buy a new console.

This study makes the following assumptions:

(A1) Assuming for the two competing companies that produce game console platforms,the price of the previous console and the next generation remains unchanged.This assumption is consistent with the facts.As shown in Fig.1,the prices of different generation consoles with the same configuration produced by platform manufacturers remain unchanged.In this work,for easy calculation,we set the constant console price to 1.

(A2) We assume that for all consumers,the platform’s valuationVis a uniform distribution between 0 and 1.We setV<1because the main purpose of consumers buying consoles is to play console games and the value of consoles that do not have games is not enough to encourage consumers to make purchases.

3.2 Content provider

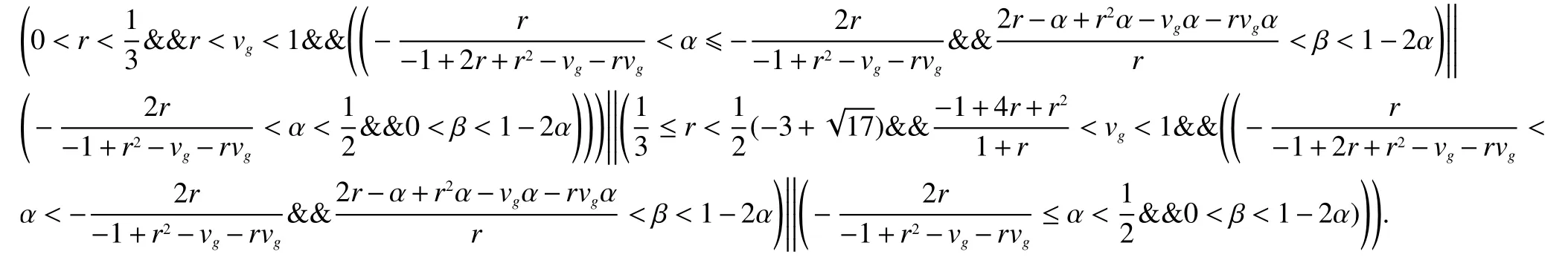

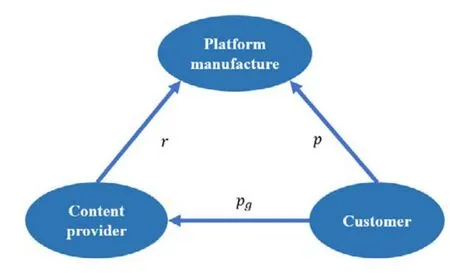

New games are often sold with a new game console.The content provider sells the game as additional content on the console platform as a third party.The third-party game sells directly to consumers and is charged a certain royalty by the platform.We defineras the royalty per unit of content collected by the platform from the content provider,and definepgas the price of the game charged by the content provider to consumers for each piece of content sold.The content provider decidespgindependently.The specific transaction flow between consumers,the platform,and the content provider is shown in Fig.2.

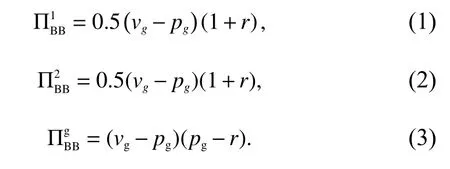

Assume that the consumers’ valuation of third-party games isvg.To ensure that the valuation of third-party games is not excessively large,we assume thatvg<1.Then,the consumers’utility of the third-party game can be written asUg=vg−pg.WhenUg>0,consumers will tend to buy games.For encouraging consumers to buy games and resulting in provider profit,the game provider setspg Assuming that the total number of consumers is one,consumers can be divided into four types according to whether they purchase the previous generation console platform: consumers have only installed the base of firm 1;consumers have only installed the base of firm 2;consumers with installed bases of firm 1 and firm 2;and consumers without any installed base.We assume that consumers can multihome in the two companies,so there are consumers who have the installation base of the two companies.We use some parameters to represent the respective proportions of these consumers.Let αibe the consumer who only has firmi’s installed base and let β be the group without any installed base.Then,the group of consumers with two firms’ installed bases can be expressed as 1−α1−α2−β.When consumers make purchasing decisions in two competing companies,we assume that when they have the same utility for the two companies,the probability of consumers buying from one of the companies is 1/2.For consumers who do not have an installed base,although their valuations of the console platform are not sufficient to make purchases,the pulling effect of the game product’s utility may prompt consumers to buy the game and its console.The consumer’s utility formula can be written asU=V+[vg−pg]+−p,whereV−pis the net utility of consumers who buy a new console.As mentioned,for profit purposes,the game provider always sets the game pricepg Fig.2.Transaction flow between three sides of the market. There are three roles in this model: two competing manufacturers,a content provider,and customers who have access to purchasing products from either manufacturer.The sequence of the events is shown in Fig.3. We allow competing firms to decide whether to bundle first,and then the content provider decides its optimal price.Consumers then choose whether to buy,what to buy,and to buy from which company. In this section,we calculate and analyze the decision-making and profitability of competing platforms and third parties under different strategies (BB,CC,and BC strategies). Under the BB strategy,both companies choose a bundling strategy.Under this condition,the game content and new console products are sold in a bundle.Any consumer who has an installed base needs to repurchase the console if he wants to play games.Here,the consumer utility isV+[vg−pg]+−p.When consumers have the same valuation of the two companies,the probability of consumers choosing firms 1 and 2 is equal.Therefore,each platform manufacturer allocates 1/2 consumers whose utility is greater than 0.The profits of the platform manufacturers and the content provider can be written asrespectively: Under BB strategy,the profits of platform manufacturers come from the purchase of consoles and games together.At this time,consumers’ purchases are only related to their net utility of both the game and console platforms.The optimal game price and profit can be obtained to maximize the profits of platform manufacturers and content providers,as shown in Lemma 4.1. Fig.3.Sequence of events. Lemma 4.1.When the BB situation occurs,the pricing and profit in the market are: From Lemma 4.1 we can see that the optimal price of the content provider does not setpg=vgto obtain all surplus consumers.This is because,under the influence of the dual-bundling strategy of game console platforms,the pricing of content providers is completely tied to console pricing,and content providers need to appropriately lower prices to stimulate demand. Proposition 4.1.When the two competing console platforms are bundled,the installed base does not affect the profits of either side of the market. At this time,the presence or absence of the installed base will not change the consumer’s purchase decision;therefore,the final company profit will not be affected by the installed base.This result also corresponds to a practical phenomenon:when companies choose to bundle a new console product with a game product,the size of the group of consumers with an installed base no longer has an impact on the sales of the new console and game. Under the CC strategy,both companies choose to sell the new console and game products separately so that consumers can play games on old consoles.At this time,buying games is meaningful to consumers with an installed base.Therefore,consumers with an installed base can buy third-party games only,whereas consumers without an installed base may choose to buy games as well as consoles under the influence of games. The profit of each company under the CC condition can be written below: The profit formula of the platform manufacturer can be understood in two parts: one part is the royalty income of consumers with a corresponding installed base,and the income of the console platform and royalty income of consumers who do not have an installed base.Compared to the BB situation,the content provider’s market share is larger because the content provider can sell the game to all consumers with an installed base.The optimal game price and profit can be obtained to maximize the profits of platform manufacturers and content providers,as shown in Lemma 4.2. Lemma 4.2.When the CC situation occurs,the pricing and profit in the market are: When CC occurs,the content provider can securely obtain the profits of consumers with an installed base.Therefore,the pricing of the game only needs to be responsible for consumers without an installed base.At this point,content providers can appropriately raise prices and obtain higher profits.For platform manufacturers,the unbundling situation will bring more royalty income,but it will inhibit the platform purchase behavior of consumers with an installed base.Therefore,CC does not necessarily generate better profits for platform manufacturers.In Proposition 4.2,we will analyze the impact of the installed base on the pricing structure and profit under the CC strategy. Proposition 4.2.When the CC situation occurs: As mentioned above,the price of the game only needs to consider the needs of consumers,without an installed base.A higher price can result in greater consumer surplus when there are more consumers without an installed base.Therefore,pgdecreased as β increased.The more consumers have an installed base,the more profitable is the content provider.Thus,the content provider’s profit decreases as β increases.For platform manufacturers,in the consumer structure of the market,consumers who have a rival company’s installed base represent consumers who cannot be obtained.Thus,the profit of firm 1 decreases inα2.α1will directly bring royalty income,and β will introduce royalties and platform income.Both will bring increased profits to the platform. When the BC strategy occurs,one company bundles new console products with game products,while the other sells its new console products and game products separately.Since the competing companies are symmetrical,the final result is the same,regardless of which company makes the bundling decision.Therefore,we assume that firm 1 chooses the bundling strategy,and firm 2 chooses not to bundle.The firm 1’s bundling strategy made consumers with only firm 1’s installed base be seen as without an installed base,and consumers with two installed bases will only choose to purchase games on firm 2’s platform.The profit formula at this time can be written as Under the BC condition,the content provider can gain all consumers with firm 2’s installed base and some with firm 1’s installed base.In the case of BC,the content provider’s market share is greater than BB’s and less than CC’s.The optimal game price and profit can be obtained to maximize the profits of the platform manufacturers and content providers,as shown in Lemma 4.3. Lemma 4.3.When the BC situation occurs,the pricing and profit in the market are: It can be seen from Lemma 4.3 that,in the case of BC,the value ofpgis negatively correlated with α1and β and is between that in BB and CC.Combining the discussion of market share above,it can be concluded that profit will also be in between.In Proposition 4.3,we will analyze the impact of the installed base on the pricing structure and profit when one of the two competing platforms is bundled. (i) Console platform 1’s profitincreases in α1,β. (ii) Console platform 2’s profitdecreases or increases in α1,β,and the increase or decrease depends on the relationship betweenrandvg. (iii) The content provider’s profitdecreases in α,β.1 When firm 1 is bundling and firm 2 is not bundling,the game provider’s profit decreases as the number of consumers without an installed base increases.Therefore,the game provider’s profit decreases for α1,β.The profit of game console platform 1 depends on the number of consumers who have lost their installed base and consumers who do not have any installed base.Therefore,platform 1’s profit increases for α1,β.In the profit structure of firm 2,consumers with firm 2’s installed base and consumers with two installed bases both bring stable royalty income to firm 2 and transform the impact of α2into α1+β.The relationship between the increase and decrease in the profit of platform 2 with α1and β depends on the trade-off between the royalty income brought by the installed base and the royalty income and platform income brought by those without the installation base. The pricing and profit under the three strategies are analyzed above.Next,we discuss when a certain strategy should be used.To simplify the calculation,we assume that symmetrical firms 1 and 2 have the same installed bases.In other words,we assume α1=α2=α,in this section.Constraint condition 2α+β ≤1is satisfied to ensure that the sum of the proportions of all types of consumers is not greater than 1.By comparing the profits of the two companies under different equilibria,we obtain Proposition 4.4. Proposition 4.4. (i) When equilibrium exists between BB and CC,the company’s profit under BB is always higher than the profit under CC. That was not a loving speech, said Sophy, nor spoken like aChristian. In a future state, where there is neither marrying norgiving in marriage, but where, as you say, souls are attracted to eachother by sympathy; there everything beautiful develops itself, andis raised to a higher state of existence: her soul will acquire suchcompleteness that it may harmonize with yours, even more than mine,and you will then once more utter your first rapturous exclamationof your love, Beautiful, most beautiful! (ii) Whenris small,α and β satisfy certain conditions.Under such conditions,equilibrium will exist in the BB strategy. (iii) Whenris moderate,there is a threshold ofvg,.When>vg,there exist α and β satisfying certain conditions.Under such conditions,equilibrium exists in the BB strategy;whenvg<,equilibrium exists in the CC strategy. (iv) Whenris large,equilibrium exists in the CC strategy. As stated in Proposition 4.4 (i),we find that,for host manufacturers,choosing bundling will bring greater profit.However,from Propositions 4.4 (iii) and (iv),although the bundling decision will bring higher profits to the company,both bundling and no-bundling strategies are possible equilibrium situations.Whenris not too small andvgis not too large,the two companies will encounter a prisoner’s dilemma.At this time,the no bundling strategy is the optimal strategy.In other cases,the existence of equilibrium changes with changes in the installed bases.To analyze the relationship between the appearance of a specific equilibrium and the installed base,we set several sets ofrandvgvalues and plotted the equilibrium diagram of changes in the installed base. As shown above,α represents the number of consumers with a single installed base for each firm,and β represents the number of consumers without an installed base.We now use γto denote users who have the two firms’ installed bases,select Fig.4a as parameter substitution,and obtain Fig.4e.From Fig.4e,we can see that when the group of consumers with a single firm’s installed base is large enough,and the scale of consumers with two firms’ installed bases is also not very small,the equilibrium between the two companies stays at both bundled or neither bundled.When the group of consumers with two installed bases is small,equilibrium will only exist in the BB condition.This is because when CC occurs and one of the firms makes a bundling decision,it loses its installed base and is at a disadvantage in the market of consumers with two installed bases.Therefore,when the consumer market with two installed bases has a certain scale,the firm will not leave this equilibrium to avoid a decrease in profits.However,when the consumer market with two installed bases is not large,the loss of profit is reduced.In the end,the added value of the profit from selling the console is greater than the loss of profit caused by the loss of the consumer group,so both firms will leave the equilibrium for bundling in order to gain more profit from selling consoles and finally achieve the maximum profit under BB condition. In this study,we analyze the impact of the installed base on the pricing and profitability of competing platforms under different bundling decisions.The different strategy choices of platform manufacturers were as follows: both bundling,neither bundling,and one of them bundling.Based on these three strategies,we analyzed the optimal pricing strategy of content providers,the optimal profits of platform manufacturers and content providers,and studied the impact of the installed base on pricing and profits. The results shown that when there is no bundling,or one of which is bundling,the installed base has a positive impact on game pricing: the profit of the content provider benefits from the increase in consumers who have an installed base.We also show that the impact of the installed base on the console platform is uncertain,and that the impact of the installed base on the game console platform depends on the choice of different bundling strategies,as well as the specific relationship between game valuation and royalty parameters.When two console manufacturers choose to bundle,the installed base loses its impact on game pricing and manufacturer profit.Our results also show that console platform equilibrium,considering the installed base under competitive conditions,may exist in both bundling and no bundling.The existence of different equilibria is affected by the size of royalties and game valuation.We found that when royalties are not too large,bundling equilibrium exists,and the range of existence decreases as the proportion of consumers with dual installed bases increases. This study provides insights for management.First,thirdparty game providers can consider bundling conditions before deciding on pricing issues: game providers can increase their prices when no firm decides to bundle,and lower their prices when bundling occurs.Doing so will help game providers balance the relationship between pricing and demand,and maximize profits.Second,console manufacturers should consider the impact of installed bases and royalties when making bundling decisions.When the consumer group with both firms’ installed bases is small,it is unwise to decide on unbundling,and when the royalties charged are high,because of the game between the two companies,the platform manufacturer may have to choose not to bundle to obtain greater benefits.According to the conclusion,the unbundling-unbundling equilibrium is a sub-optimal balance,it brings less profits.Then,in actual competition,the two companies can consider reaching an agreement to balance in a bundlingbundling situation for maintaining optimal profits. Fig.4.Optimal bundling decisions under different r. (a) r=0.2,vg=0.6.(b) r=0.5,vg=0.9.(c) r=0.5,vg=0.6.(d) r=0.6,vg=0.8.(e)r=0.2,vg=0.6.γ=1−β−2α. The contributions of this study are as follows.First,we consider the role of the installed base in bundling strategy.Second,we analyze a competing bundling strategy,where bundling occurs between the platform and third-party content providers.Furthermore,our results suggest that the impact of the installed base on the host platform is nonlinear and depends on the strategy of the platform.Meanwhile,Our study has some limitations.First,we assumed that the consumer valuations of games are consistent.Perhaps,calculating different valuation distributions among consumers will yield some interesting conclusions.Second,we only considered the bundling strategy of symmetrical competing companies.In the future,we will consider the results for platform manufacturers with asymmetrical competitive relationships.Finally,we only made linear assumptions when considering consumers’ valuations of the console’s basic functions.Consumer valuations under different distributions can yield different results.We will consider these limitations in future research. Acknowledgements This work was supported by the National Natural Science Foundation of China (72171219,71921001,71801206,71971203),the Fundamental Research Funds for the Central Universities (WK2040000027,WK2040000041),USTC Research Funds of the Double First-Class Initiative(YD2040002004),Special Research Assistant Support Program of Chinese Academy of Sciences,and the Four Batch Talent Programs of China. Conflict of interest The authors declare that they have no conflict of interest. Biographies Jie Wureceived his Ph.D.degree in Management Science from the University of Science and Technology of China (USTC) in 2008.He is currently a professor at the School of Management,USTC.His research mainly focuses on operational research. Mingjun Lireceived her Ph.D.degree in Management Science from the University of Science and Technology of China (USTC) in 2021.She is currently a postdoctoral fellow at the School of Management,USTC.Her major research interests focus on operations management. Appendix3.3 Consumer

3.4 Timing of the model

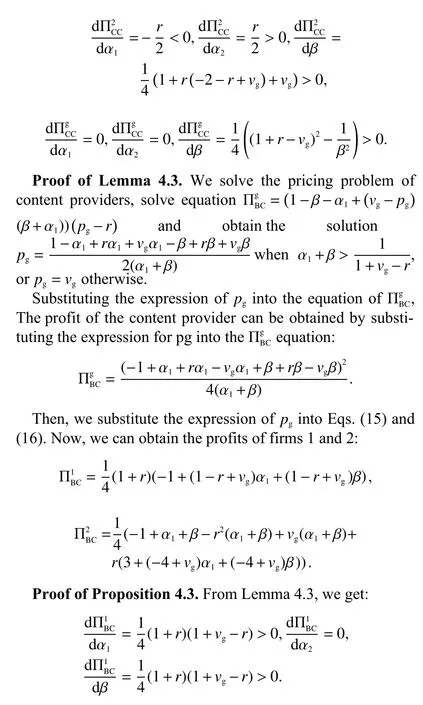

4 Equilibrium analysis

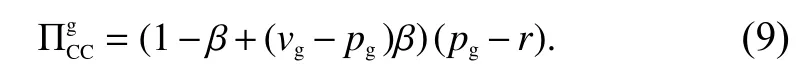

4.1 BB strategy

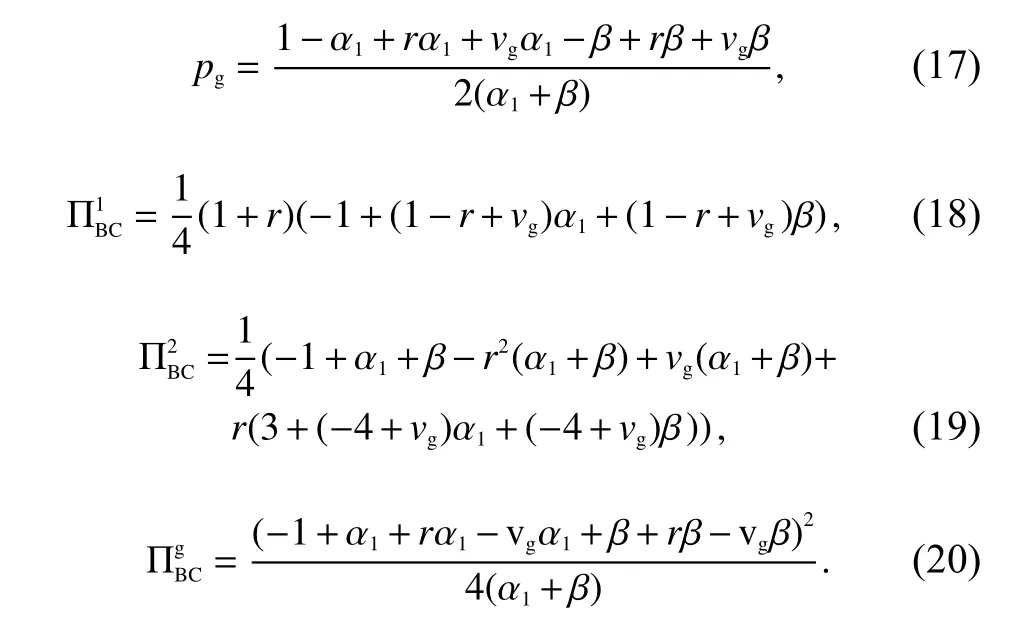

4.2 CC strategy

4.3 BC strategy

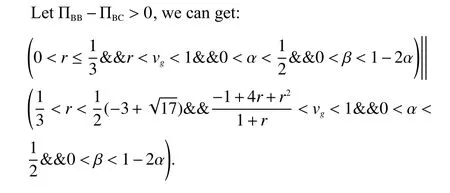

4.4 Strategic analysis

5 Conclusions