Experimental Evidence for Coverage Preferences in Flood Insurance

J.Connor Darlington•Niko Yiannakoulias

Abstract We used a hypothetical choice experiment to estimate the effect of dwelling value and coverage limits on the probability of purchasing flood insurance while holding the probability of flooding and insurance price constant.The results indicate that demand for flood insurance is negatively associated with the amount of insurance coverage.For people assigned higher-valued dwellings,however,the opposite effect is observed.Since more coverage is generally preferred to less,all else being equal,differences in purchase probability dependent on dwelling value indicate an inconsistent approach to home protection.The higher probability of purchasing flood insurance from people in higher-valued dwellings may indicate an investment into the home as a financial asset,a strategy that is not observed to the same extent among people in lower-valued dwellings.This suggests that use of coverage limits may be differentially preferred based on dwelling value,such that low coverage insurance may have lower uptake for those in high-valued dwellings.As Canada evaluates a national flood insurance program,this research suggests that variable coverage maximums could be a way to increase accessibility and uptake of insurance.This research shows an inconsistent demand for flood insurance,dependent on dwelling value and independent of income.

Keywords Canada∙Flood insurance∙Insurance choice experiment∙Willingness-to-buy

1 Introduction

Flooding is the most frequently occurring natural hazard in Canada,causing the most property damage and drawing the most funds from Canada’s federally funded disaster assistance program(Burn and Whitfield 2016;Public Safety Canada 2019).Flooding,like other climate-related risks,presents several challenges to effective insurance,which works best when risks are random,uncertain,and uncorrelated.In contrast,flooding occurs in predictable areas at recurrent intervals and often has a high temporal and spatial correlation of losses(IBC 2015).Since losses occur across multiple insurance portfolios at the same time and in the same areas,prices for flood insurance can be well beyond consumer willingness-to-pay(Charpentier 2008).A considerable portion of losses associated with flooding can be attributed to underinvestment in public infrastructure,outdated building codes,and ineffective land use planning.Structures located in floodplains and other floodprone regions reflect a predictable source of considerable loss,and homeowners outside of flood-prone regions often have little incentive to purchase flood insurance.This predictability leads to adverse selection,where demand for flood insurance is localized to high-risk areas,where insurers may choose to limit coverage(Sandink 2016).Without a broad consumer base of policies to share risk,prices for flood insurance can be extremely expensive and largely unaffordable for the property owners who want it.In Canada,overland flood insurance has only been available since 2015,as the insurance industry previously opposed involvement due to concerns about its economic viability(Thistlethwaite 2017).These concerns were in part due to a lack of adequate flood data for pricing the flooding risk,including high-quality flood mapping,civic information on flood defense infrastructure,and householdlevel data on flood risk factors(Sandink 2016).Before flood insurance was available in Canada,only some waterrelated damages were covered,often through an additional home insurance endorsement of sewer backup coverage(IBC 2015).Water damages from indoor plumbing problems,appliance malfunctioning,or water entering the home through an opening caused by extreme wind could be covered by home insurance(Oulahen 2015).In interviews with insurance industry representatives,it became evident that reputational risk and the risk of regulation were contributing factors to flood insurance coverage being eventually offered in Canada(Thistlethwaite 2017).

Despite its introduction in Canada,flood insurance still faces challenges.The optional nature of private flood insurance lends itself to adverse selection,as countries with optional coverage have historically observed demand occurring almost entirely in areas with a high flooding occurrence(Jongejan and Barrieu 2008;Sandink et al.2010;Sandink 2016).This results in low market penetration and leads to expensive rates for policyholders because diversification through risk pooling does not occur(IBC 2015).Communities with low flood risk and already low demand for insurance may be charged higher premiums to offset some of the costs for high-risk communities,known as cross-subsidization—however,this further reduces uptake in lower-risk communities(Jongejan and Barrieu 2008).This can be largely overcome by charging actuarially fair or‘‘risk-based’’premiums that represent individual homeowner risk and additionally act to disincentivize building in high-risk floodplains due to the associated higher costs of insurance(Clark 1998;Sandink et al.2010).

Though private flood insurance became available in Canada in 2015,insurers often avoid operating in high-risk areas due to the additional financial risk involved(Thistlethwaite 2017;IBC 2019).Partly in response,the federal government is developing options for managing the costs of flooding for residents in high-risk areas,including a national flood insurance program and a national property relocation action plan (Government of Canada 2019,2020).This would provide financial protection in high-risk areas,where insurance is unavailable or prohibitively expensive from private insurers,and internalize some costs formerly distributed as disaster financial assistance.Regardless,addressing the adverse selection and moral hazard problem are key components to supporting a solvent and viable insurance program.

One way to increase the affordability of an insurance policy is to limit the total coverage provided.However,such limits in coverage may be differently demanded among homeowners,particularly due to the high variability of flood hazard and value at risk across Canada.Limiting insurance payouts may make alternatives to insurance,such as self-insurance and self-protection,more appealing.Traditional economic theory suggests that an accounting of assets at risk may influence insurance purchase decisions(Smith 1968)—however,empirical evidence suggests that property value has been found to have both a significant positive(Brody et al.2017)and a significant negative(Botzen and van den Bergh 2012)association with willingness-to-pay for insurance.Since dwelling value is typically correlated with income,higher dwelling values may encourage self-insurance and self-mitigation if covering losses is easier for wealthy people,reducing the attractiveness of flood insurance(Botzen and van den Bergh 2012).

Theoretical models of optimal insurance coverage and insurance demand are often rooted in expected utility theory(EUT)(Smith 1968;Ehrlich and Becker 1972).The demand for insurance has typically been justified under EUT as a preference for certainty,specifically the preference for certain losses instead of actuarially equivalent uncertain losses(Nyman 2001).This is justified through risk aversion,a well-established behavior people tend to exhibit away from uncertainty.Risk aversion is justified in EUT through the diminishing marginal utility of wealth(assuming a concave utility function),suggesting wealth,when nearer to poverty,is more valuable than when one is rich(Rabin 2013).

However,the core assumption within EUT of preference towards certainty in losses is challenged in prospect theory,which posits that people exhibit risk aversion in choices involving gains but risk seeking in choices involving losses(Kahneman and Tversky 1979;Tversky and Kahneman 1981).This challenges the main assumption of insurance purchase as a preference towards a certain loss to reduce uncertainty.One explanation behind insurance preference in prospect theory is due to the human bias of overweighting low probability events(Kahneman and Tversky 1979).This increases the desirability of protecting oneself due to high perceived risk and a desire to avoid loss.

While traditional economic models have assumed people are utility maximizing,this has been challenged in many empirical studies.For example,there is evidence that flooding,which in many areas is a low-probability and high-consequence event,is approached differently from high-probability,low-consequence events in terms of consumer insurance behavior,with a preference for insuring the latter(Browne et al.2015).Slovic et al.(1977)proposed that below a certain(low probability)threshold,an individual considers the probability of such an event to be zero.For flooding,this may be close to true.In areas of very low flood hazard,the probability of a flood occurring may be less than a fraction of a percent each year.

Although there is empirical evidence of higher-thanexpected risk aversion over modest stakes in the home insurance market(Sydnor 2010),for flood insurance it is possible that we could observe either the low probability event being subjectively discounted,as discussed in Slovic et al.(1977),or the probability being overweighted,as in Kahneman and Tversky(1979).This may be partly explained by risk misperception,where even with standard risk preferences,inaccurate subjective beliefs about flood probability,claim rates,or losses can lead to considerably high risk aversion,leading to overpaying for modest risks(Sydnor 2010).In the context of flooding in Canada,it seems that the risk of flooding is realized by the homeowners who are being flooded regularly,and the risk is discounted elsewhere,in line with the adverse selection problem.

As insurers and the federal government seek to address the potential coverage gaps in high-risk areas,coverage limits may be a variable that impacts consumer uptake and willingness-to-pay,as well as overall program viability.Due to the high costs associated with flooding,a cap in payouts may be a reasonable way to make some coverage affordable and accessible to homeowners more broadly,including in high-risk areas.However,it is not clear how such differences in coverage limits for flooding may influence insurance demand,particularly if low amounts of coverage are deemed insufficient or unappealing to a prospective buyer.Accordingly,there is a need for research that tests the flood insurance coverage parameter to better understand how its limitation may affect demand.

When it comes to gauging consumer preferences and estimating the value a person places on a good or service,a common approach used is contingent valuation(CV).Contingent valuation is useful when real market data are not accessible or when it is difficult to observe market transactions under specified or controlled conditions.Contingent valuation has been used for estimating willingness-to-pay(WTP)and willingness-to-buy(WTB)in many contexts,including flood insurance,where participants indicate their WTP or WTB a policy given a price or set of conditions.Often this research focuses on population-specific factors related to WTP,including socioeconomic characteristics,or characteristics related to risk perception.

When flood insurance is optional(as in Canada),the success of flood insurance in protecting homeowners depends in part on uptake and the price they are willing to pay for it in relation to program cost.A sample of past research into flood insurance CV can be broken down by outcome measured,such as willingness-to-pay(Botzen and van den Bergh 2012;Raschky et al.2013;Oulahen 2015),willingness-to-buy(Hung 2009;Petrolia et al.2013;Ren and Wang 2016;Va¨isa¨nen et al.2016),or observational studies of flood insurance policies-in-force(Brown and Hoyt 2000;Kriesel and Landry 2004;Kousky 2011;Lo 2013a,2013b;Atreya et al.2015;Brody et al.2017;Shao et al.2017).The purpose behind such research is to provide an estimation of value for insurance or factors associated with the purchase of insurance.

The aim of this research is to understand the effect of insurance coverage caps on consumer demand and illuminate potential consumer preferences.Kousky(2011)found that in areas of voluntary flood insurance in the state of Missouri,in the Midwestern United States,homeowners generally preferred lower deductibles,higher amounts of coverage,and that coverage increased with home value and income.Brody et al.(2017)found that respondents with higher-valued homes were more likely to purchase voluntary flood insurance than people in lower-valued homes.The intended contributions of this study are to examine experimentally how altering insurance caps may influence demand,while keeping the probability and price of insurance constant.In scenarios where caps in coverage are imposed to reduce financial liability to insurers or government cost-sharing programs,there is a need to better understand how optional insurance demand may be influenced.

In the following,we summarize the methods and findings from a hypothetical choice experiment that was administered to persons residing in Canada in 2018-2019.In this experiment,participants were provided a scenario in which the probability of flooding and the per-dollar cost of insurance is held constant,while dwelling value and flood insurance coverage are varied and assigned at random.We sought to answer two questions:

(1)Controlling for price,how does the amount of insurance coverage influence the probability of purchase?

(2)Controlling for income,how might this differ by dwelling value?

2 Methods

This section presents the methodology used in this study,including the design of a hypothetical choice experiment,participant recruitment,and the analytical modeling used to estimate the effect of experiment treatment information on the probability of purchasing a given flood insurance policy.

2.1 Data

We administered a hypothetical choice experiment from September 2018 to April 2019,targeting persons residing in Canada who were 20 years of age or older during the recruitment period.The purpose of this experiment was to examine the effect of coverage on the decision to purchase flood insurance in a controlled scenario.A pre-experiment survey collected demographic information including age,gender,ethnicity,income,education,employment,marital status,homeowner or renter designation,household size and number of dependents,and the post-experiment questions related to flood experience,coping appraisals,and threat appraisals.

Recruitment for this experiment took place in-person and online.In-person recruitment took place at various public spaces around Hamilton,Ontario,Canada.One of the researchers set up a table with a poster indicating that an experiment was being conducted and both passively and actively recruited people and asked if they would like to participate in a survey that would take approximately 10 minutes of their time.The response rate was about 10%during active recruitment.Participants were provided with their choice of means to complete the experiment,either a tablet computer or a paper version.The researcher was present for the completion of the survey and provided clarification if asked questions but did not guide any response.

Online participants were recruited through handing out business cards,poster recruitment,and social media sharing of the experiment weblink,including a brief description of the experiment.The experiment was shared on social media approximately 15 times across Twitter and Facebook.All online participants visited a webpage that directed them to a pre-experiment information page outlining the experiment detail.People were incentivized to participate by being entered into a drawing for a CAD 250 Amazon Gift Card.

2.2 Experiment Design and Hypothesis

The hypothetical choice experiment was structured as follows:

Imagine that you live in a$DV(dwelling value)house.The areas around the city you live in are classified by their flood risk,and your home is located in the 1-in-100 year flood zone,meaning there is a 1%chance that your house will be flooded each year.Your home insurance provider offers a flood insurance add-on to your policy that is$PR(premium)per year and provides$CL(coverage level)in protection in the event that a flood occurs.Would you buy the flood insurance policy?[Options:Yes or No]

where DV was a specific dwelling value that was randomly assigned from the options in Canadian dollars(CAD)250,000;500,000;750,000;and 1,000,000;PR reflects a specific insurance premium randomly assigned from the options 100,325,550,775,or 1000 CAD;and CL reflects a coverage level equal to the PR(premium)value times one hundred.For example,a CAD 325 per-year premium provides CAD 32,500 in coverage in the event of a flood.

The choice scenarios were specifically designed to hold the per-dollar value of insurance constant.The scenarios also provided actuarially fair premiums,such that expected costs are equal to policy value over time.No deductible was included for any policy to simplify the analysis of cost.Participants were asked to make decisions based on their real-world income(rather than an income assigned in the experiment),and were assigned one of five different insurance options and one of four different dwelling values,at random.Participants were not made aware of any alternative pricing or dwelling value options,so each scenario had no additional framing.By implementing experimental choice,this enables the controlling of factors related to the flood insurance purchase decisions that would otherwise be difficult to measure in the real flood insurance market in Canada.

With all scenarios having an equal probability of flooding(1%),the only things that differed across experimental treatments were(1)the random assignment of dwelling value(DV);(2)the random insurance coverage level(CL)since the cost of insurance premiums is proportional to coverage value;and(3)the participants’realworld income.It is important to note that conventional demand models quantify the demand for the same product at different prices,whereas in this case,the experiment examined the same product at different quantities—more cost means more coverage.Traditional economic theory would suggest that the same item would be demanded less at increasing prices,but since these insurance packages offer the same product at different quantities(of coverage)and proportional pricing,differences in demand reflect preferences in coverage.

This study generally assumes rational choice among participants under expected utility theory(EUT),whereby participants evaluate the information provided and choose the outcome that best satisfies their risk preferences.Smith(1968)noted that the factors important to insurance demand include wealth,loss probability,insurance price,the value at risk,and an individual’s utility function,similarly noted in Kousky (2011).The study includes assumptions that insurance demand is influenced by wealth—capturing both income and dwelling value—as well as loss probability and price.Though each participant may derive different utility among purchasing decisions,it is assumed that prior to deciding whether to buy the provided insurance policy each participant considers the scenario provided and evaluates their risk of loss in wealth.With price held constant and no alternative policy presented,it is assumed that individuals will purchase the insurance if they deem their premium to be equal to or less than a given flood event loss.This is in line with Kousky(2011),who noted that if the premium equals the expected loss,a risk-averse consumer faced with actuarially fair insurance pricing will fully insure.Participants may forego the insurance if they deem the risk to be low—probabilistically and financially—such that the premium would be a greater loss than a given prospective event.

The demographic indicators were collected to help us understand our sample but are not critical and are beyond the scope of this article to assess our two experimental research questions—the effect of coverage limits on flood insurance demand and how this may differ by dwelling value.The treatment information for each scenario was assigned randomly (independent of sociodemographic characteristics)and allowed us to experimentally assess the effect of coverage limits and dwelling value on insurance demand.We proceeded without further inclusion of the demographic information (which serves a different research purpose,mainly the construction of an overall predictive demand model using a wide range of population inputs)and focused on the experimental variables for our targeted research questions.It is expected that the inclusion of other demographic indicators would serve as effect modifiers on the same general phenomena we observed from the experiment and may be a focus of future work.

2.3 Analysis

The hypothetical-choice question yields a binary purchase decision(yes or no)at each scenario’s random price and random dwelling value.To examine factors influencing the purchase decision,a binary logistic regression was used to derive the log-odds of purchase based on the predictor variables related to each experiment.The empirical logistic model is:

whereπiis the probability of buying the flood insurance for the i-th person,β0reflects the intercept,βnreflects the model coefficients,and xinare the explanatory variables for the i-th person.The independent variables used in the model are premium(PR),which reflects the coverage and cost,dwelling value(DV),and income(INC).The main effects of the experiment can be modeled by:

In order to understand the effect of coverage at different housing values,an interaction term between premium and dwelling value is included,which is given by the following model:

where a non-zero β4coefficient denotes that the relationship between coverage value and probability of flood insurance purchase varies by dwelling value.Similarly to Eq.3,an interaction term between premium and income is added in order to model the effect of coverage on flood insurance purchase by variations in income,and is given as:

where a non-zeroβ5coefficient denotes that the relationship between coverage value and the probability of flood insurance depends on income.

3 Results

This section presents the results of the study,including descriptive statistics of the study participants’demographic characteristics,the estimated coefficients of the logistic regression models defined in the Methods section,and the average marginal effects and standard errors of house value,coverage,and income on the probability of flood insurance purchase.

3.1 Survey Results

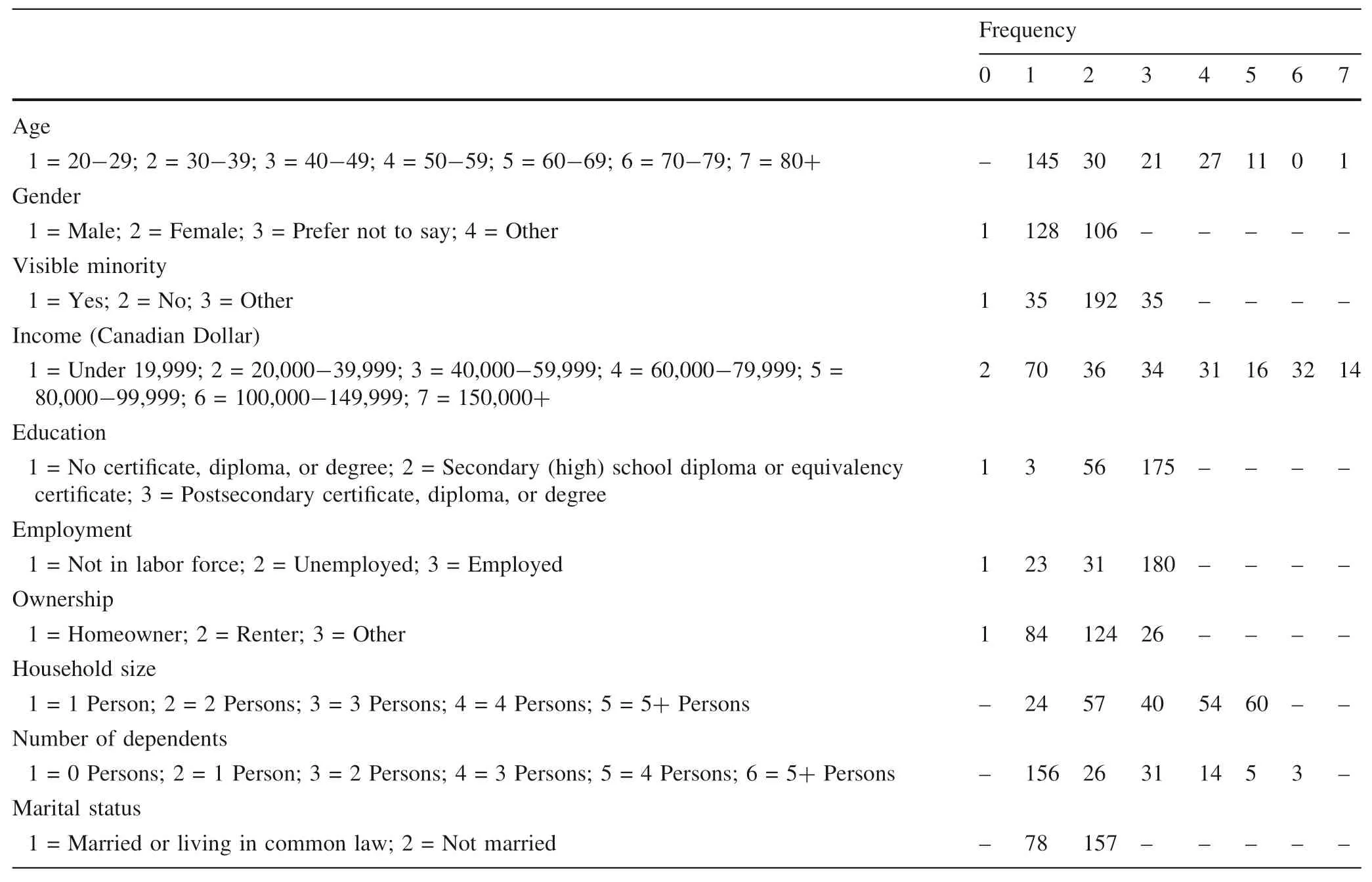

A total of 235 participants completed the survey,103 of whom were recruited in-person(43.8%),96 through social media(40.9%),34 notified by a friend,family member,or colleague other than the researcher about the survey(14.5%),and 2 responses appeared to find the experiment through other online searching.The socioeconomic characteristics of the participants are summarized in Table 1.A considerable proportion of the participants were under 40 years of age(74.4%),and slightly more males did the survey than females(54.5%).Roughly 15% of the respondents self-identified as visible minorities,while another 15%classified themselves as‘‘Other.’’Visible minority self-identification used the Canadian Employment Equity Act definition,referring to persons other than Indigenous peoples who are non-Caucasian in race or nonwhite in color(Government of Canada 2022).Most participants had completed postsecondary education(74.5%);the remainder had completed secondary education(23.8%)or no secondary education(1.3%).Most of the respondents were employed(76.6%),13.2%stated they were unemployed,and 9.8%stated they were not in the labor force(not employed and not looking for employment).A large proportion of renters completed the survey(52.8%),while 35.8% were homeowners and 11.1% listed ‘Other.’’Household size varied across options between one person and five or more people,with the lowest proportion of people living alone(10.2%),and the remainder split somewhat evenly across categories.The number of dependents was overwhelmingly 0 persons at 66.4%of the respondents,while 24.3%of the respondents had 1 or 2 dependents,and the remainder had 3 or more.Roughly one-third of the respondents were married or living in common law(living with a partner as a couple while not married to that person),while the remainder were not married.

3.2 Experiment Results

Of the 235 participants,117(50%)chose to buy the randomly assigned insurance policy and 118 did not,though this varied by dwelling value and insurance coverage.The results of the experiment are described in the model description below and summarized in Tables 2 and 3.Table 2 provides the logistic model coefficients for Models 1,2,and 3,while Table 3 provides the average marginal effects(AME)and standard error on the probability of buying flood insurance for Model 1 and Model 2.Model 3 was omitted from Table 3 due to the non-significance of the second interaction term between premium and income and resemblance to Model 2.

In the main effects model(Model 1),the dwelling value has a positive and statistically significant association with purchase decision(Table 2).Income is positively associated with the probability of purchase,though the coefficient is near 0.For example,in Model 1,a CAD 10,000 increase in income is associated with a 0.0021(or 0.21%)increase in the probability of purchase(Table 3).Similarly,a CAD 100,000 increase in income would be associated with a 2.1%increase in the probability of purchase.Coverage has a small negative effect on the probability of purchase—a CAD 10,000 increase in coverage is associated with a 0.31%reduction in the probability of purchase.A CAD 10,000 increase in house value is associated with a 0.26%increase in the probability of purchase(P<0.05)—a CAD 100,000 increase results in a 2.6%increase in purchase probability.Overall,Model 1 suggests that individuals consider the value of the house at risk prior to determiningwhether to buy flood insurance,with a preference to protect higher-valued dwellings.On average,the negative effect of coverage may suggest that though the price per dollar of insurance is equal,higher coverage(and subsequently yearly premium)decreases the probability of purchase.Income has a weak positive relationship to the probability of purchase.

Table 1 Sociodemographic characteristics of the 235 participants in the study on coverage preferences in flood insurance

Table 2 Summary of hypothetical choice experiment models.Dwelling value,coverage,and income are in 10,000 of Canadian dollars

Table 3 Average marginal effects(standard error)on the probability of buying flood insurance for Model 1 and Model 2.

The modeled relationship between coverage and purchase probability is represented visually in Fig.1,with the income held constant at the sample mean(CAD 58,112).The figure shows a simple pattern of predicted probability of purchase,with increasing house value associated with increasing probability of flood insurance purchase.Across coverage levels,there is a roughly 20%higher probability of flood insurance purchase for the CAD 1,000,000 dwellings compared to the CAD 250,000 dwellings,with the former more likely to buy than the latter.The effect of coverage is comparatively subtle and negative—across the CAD 90,000 range of coverage options,we observed roughly a 2%decline in probability with increasing coverage from the lowest to highest coverage.

3.3 Model 2 Results

In the second model,the interaction term between house value and coverage(premium and dwelling value)is positive,though interpretation of the interaction from the table alone is difficult(Table 2).To aid in the interpretation of the interaction term,we have parsed the AME by dwelling value grouping to observe the effect of coverage dependent on house value(Table 3).The effects of income and house value are roughly the same as in Model 1,but the effect of coverage varies based on dwelling value.Specifically,the effect of increasing coverage is negative with the CAD 250,000 and CAD 500,000 dwelling values,while the effect is positive for the CAD 750,000 and CAD 1,000,000 dwelling values.A CAD 10,000 increase in coverage has a 0.032(3.2%)decrease in the probability of purchase for those with a CAD 250,000 house value,while the same increase in coverage has a 0.029(2.9%)increase in the probability of purchase for those with a CAD 1,000,000 house value.When displayed graphically using the sample income average(Fig.2),we observed that increasing amounts of coverage increase the probability of purchase for higher-valued dwellings,despite the negative effect of the coverage term.

Fig.1 Main effects model of flood insurance purchase probability by coverage

As with Model 1,income appears to have little effect on the probability of flood insurance purchase.The house value-dependent effect of coverage on preference for flood insurance may seem intuitive as it suggests that,controlling for income and holding price of coverage constant,people in lower-valued dwellings demand less coverage.However,high-value homeowners appear less likely to buy lowcoverage insurance,despite the same per-dollar cost of insurance.Assuming high dwelling value homeowners desire protecting their home through insurance,the low demand at lower coverage suggests an inconsistency towards risk.We observed risk aversion when the coverage is high(resulting in higher probability of purchase),but risk seeking when coverage is low.This suggests a preference in higher quantities of insurance coverage,with lower amounts of coverage less in demand among high dwelling value homeowners.

The description of Model 3 is limited as the inclusion of the income and coverage interaction term had a very small effect size,and the result closely resembles Model 2(Table 2).

Fig.2 Model of flood insurance purchase probability by coverage including an interaction term between premium and dwelling value

4 Discussion

This section provides a discussion of the results of the hypothetical choice experiment and the models used to estimate the effect of dwelling value and coverage limits on the probability of flood insurance purchase.Interpretations for the observed model effects and possible explanations for these observed effects are provided.

4.1 Research Findings

This study made use of a hypothetical choice experiment to examine the effect of dwelling value and coverage amount on the probability of flood insurance purchase.The results of the experiment reveal that flood insurance demand may be influenced by both coverage amount and dwelling value.In general,increasing coverage is negatively associated with flood insurance purchase decisions,though the analysis provided suggests that this relationship may vary by dwelling value such that the probability of purchase increases with coverage for people with higher-valued dwellings.This is not to suggest that people prefer less coverage,but rather,that a trade-off exists—the home is an asset,and spending more money for proportionally more coverage is an investment into protecting that asset.This is in line with Brody et al.(2017)who found that respondents with higher-valued homes were more likely to purchase voluntary flood insurance than people in lower-valued homes.Similarly,Kousky(2011)found that the amount of coverage purchased increases with the value of a home.The explanation for this finding was that people who have the financial capacity to afford more expensive homes are more likely to take actions to protect their investment(Brody et al.2017).

Conversely,higher coverage is less likely to be purchased by participants with lower-valued dwellings.This negative relationship between coverage and purchase may be a preference for monetary wealth over investing into the property if the property is not viewed in the same manner as a wealth investment.The trade-off for consumers may seem worthwhile when protecting a high-value asset,but much less for lower-valued homes.Kousky(2011)found a negative relationship between poorer households and coverage levels,noting that poorer households are more likely to have lower-valued homes and choose lower coverage levels to keep premiums lower.Owners of lower-valued homes may choose lower amounts of coverage for practical reasons of cost saving,or may not see the need for high amounts of coverage relative to the home value.Reduced purchase of higher-coverage policies could be explained if individuals were liquidity constrained and could only afford a small premium or none at all,but the models controlled for income and saw little influence of income on probability of insurance purchase.

Rational choice assumptions for protecting wealth are challenged by the inconsistent demand for insurance among individuals in high valued dwellings.Namely,if a homeowner is willing to spend CAD 1000 for CAD 100,000 in coverage,it is expected that the same person would spend CAD 100 for CAD 10,000 in coverage,if no other option is provided.If motivated by risk aversion,the policies reflect an equivalent ratio trade-off of wealth to the potentially flooded state at no additional cost per unit of insurance.In isolation,the observed behavior of high dwelling value homeowners against low coverage aligns more with prospect theory(Kahneman and Tversky 1979),in that risk seeking is often observed when choosing between a sure loss—the premium—and the risk of a larger loss.If the premium is viewed as a sure loss,then consistent with prospect theory,homeowners may take a chance at losing nothing—no premium and no flood loss.This effect does change at high coverage levels.As the coverage levels increase,homeowners express an increased demand for insurance.These results suggest an asymmetry in approaching risk aversion.When the absolute value of the coverage increases,homeowners appear to become more risk averse.At lower expected losses or coverage availability,this may reflect a preference for self-insurance if coverage is deemed insufficient.

There are at least two possible explanations for this observation.First,the risk-seeking behavior that high-value homeowners exhibit towards low-coverage insurance may be a matter of framing—a lower payout may be subjectively interpreted by the homeowner as flooding having a comparatively lower expected damage.In contrast,the risk aversion towards flooding when provided with high-coverage insurance may reflect a subjective interpretation that the potential flooding could cause damage worthy of a CAD 100,000 maximum.This suggests that for consumers in high-value dwellings,high coverage insurance options may make the magnitude of financial consequences from flooding more salient,providing a risk signal that increases demand despite equivalent value-per-dollar of coverage.

Second,the negative association between coverage level and willingness-to-buy insurance suggests that participants are more negatively influenced by the premium cost than positively influenced by the proportional increase in coverage.However,it is important to interpret this finding with the risk assessment—homeowners are making a subjective assessment of the flood probability,and if expected damage is very low the policy would not seem like a good use of money.Risk aversion assumes a risk,and if subjectively this risk is small or nonexistent,we would observe more risk-seeking behavior.Since we assume that premiums are actuarially fair and the participants are not provided more than one option,the main economically rational reason for a risk-averse person to forgo insurance would be if the subjective assessment of the flooding risk was that the prospective damage would be less than the coverage provides,such that bearing the risk of inundation without insurance is the better choice.

It is also possible that the results suggest that there may be an optimal proportion of coverage in relation to dwelling value.In the experiment,the probability of flooding is explained as being 1%each year,but no flood damage estimate is provided.For the CAD 1,000,000 dwellings,the modeled probability of purchase increases from 46.9%at CAD 10,000 in coverage to 73.3%at CAD 100,000 in coverage.For CAD 200,000 dwellings,this changes from a 54.6%probability at CAD 10,000 in coverage to 17.3%at CAD 100,000 in coverage.For high-valued dwellings,this effect could be due to the desire to protect the more valuable asset compared to the lower-valued dwelling,or rather the estimation that a high proportion of coverage for the lower-value dwelling is unnecessary.Without a damage estimate,people choose whether to buy flood insurance based on the treatment information and a subjective interpretation of the flooding damage possibilities.

4.2 Limitations

Generalizability is almost always a concern for hypothetical choice experiments.Although the participants agreed to answer as they would behave in the real world based on participation,the translation of intention into real-world action especially when costs are involved is not clear.This may explain why no significant income effect was observed on the purchase decision,as costs are not nearly as salient when choosing between policies in the abstract.Regardless,the objective of the research to gain an understanding of flood insurance coverage limitations on insurance demand is one that would be difficult to pursue in a non-experimental setting,as the artificial limiting of coverage to different amounts raises ethical questions,let alone controlling for the probability of flooding and other characteristics.

Due to the random assignment of scenarios within surveys,it was possible that low-income individuals were asked to make a flood insurance purchase decision on highvalue dwellings.Though we acknowledge the unlikelihood of such a scenario being realized in actuality,the focus of this research is on the effect of coverage on flood insurance demand,which may be viewed or interpreted differently depending on a person’s income framing.Income had a negligible effect on flood insurance purchase,suggesting this framing does not matter,at least within this study.Income,as it is included in this study,serves more as an effect modifier and control for the other observed effects of coverage and dwelling value.Though this does not negate the critique of scenario realism(which can be farfetched in other contingent valuation work),it is worth noting that some of the participants would lack the income framing associated with the dwelling value at risk.

As with most survey-based data collections,the voluntariness of participation in the survey,along with the group of individuals sampled,may limit the interpretation of findings.Almost 75%of the respondents were under 40 years of age and roughly 75%had completed postsecondary education,suggesting a relatively young and educated sample.Roughly 34% of the respondents had dependents—this group may have other expenses and priorities that deprioritize optional insurance coverage for the home and subsequently reduce demand.The interpretations and generalizability of such findings therefore should factor in the generally young and educated nature of the study participants.

The voluntariness of participation may inherently lead to differences in who chooses to engage in the experiment compared to who chooses not to,a problem consistent with other non-mandatory surveys.Though economic experiments frequently rely on students or other convenience samples in laboratory experiments,this can inherently limit the generalizability of findings.Renters usually have the option of purchasing flood insurance to protect contents,but this is often a considerable subset of the full costs of flooding to the structural elements of the building.Though we may be able to discern intent from renters in the given scenario provided,this decision is more hypothetical than for existing homeowners.Flood insurance specifically is a new product in Canada,and even experienced homeowners may be unaware of such a product,and the general provision of resources to protect one’s home would be more readily apparent for a current homeowner than otherwise.

Though the per-dollar value of insurance is held constant in the experiment,the absolute costs between options differ.For example,the CAD 325 per year premium is clearly more than the CAD 550 per year premium,despite each having a proportional increase in coverage.Absolute cost alone may reveal preferences among participants if costs are self-determined to be unaffordable,despite the perceived need of the insurance.Assuming insurance is demanded,this would lead to a‘‘some is better than nothing’’approach to coverage,where there is a higher demand for lower amounts of insurance since it is more affordable in absolute terms.But the effect of increasing coverage seemed to only reduce uptake when assigned to lower-valued dwellings.Additionally,though participants are provided with some risk information—specifically a probability of flooding—any contingent valuation research including this study that asks hypothetical purchase questions in a relatively short amount of time may not be fully realistic.The assumptions of rational choice posit that participants can grasp the information presented and make consumptive choices based on a potential risk as they would in the real world.This challenge is consistent with our contingent valuation research,but should no less be considered a limitation on the transferability of findings.

To improve on these limitations going forward,future research should seek to:(1)collect a larger sample of participants with a broader range of incomes and attributes;(2)test these findings with accurate and recent dwelling value estimates rather than experimental ones;(3)further establish whether this inconsistency in approach to coverage exists in other settings and with larger samples,both experimentally and,if possible,observationally;and(4)ask additional questions (when using experimental research)to assess post-decision rationale as to whether any observed asymmetric preferences towards coverage can be explained by participants.In particular,it would be interesting to see whether the apparent disinterest in lowcoverage insurance is,in fact,a stated preference towards self-insurance as the explanation for this apparent riskseeking behavior.

5 Conclusion

The observations from the experiment indicate that demand for flood insurance may be dependent on dwelling value,with demand being negatively related to the amount of coverage for people in low-value dwellings,and demand being positively related to coverage for high-value dwellings.This result has been observed in other research(Kousky 2011;Brody et al.2017),with the explanation that people with the financial capacity to afford more expensive homes are more likely to protect their investment.Though other research has found a positive relationship between household income and coverage(Landry and Jahan-Parvar 2011),the effect of income was minimal in this study.

The main finding of this research is that risk tolerance(as expressed by willingness-to-buy insurance)may be dependent on dwelling value.The results suggest that high dwelling value homeowners may be more risk seeking when provided low-coverage policies and more risk averse when provided high-coverage policies.Since no indication of expected damage was provided and flood insurance cost was constant,we would expect the same or more demand for low-coverage policies than we would for high-coverage policies.This asymmetry is interesting and suggests there may be a disinterest or reduced demand for low-coverage policies.The effect may be due to framing,that is,participants may be unintentionally primed when presented with higher levels of coverage such that they become more inclined to buy insurance through some risk signalling.It is also possible that people may adopt some sort of proportional approach to insurance,where some amount of coverage is ideal relative to the house value.

Most flood insurers limit total coverage available in high-flood areas to reduce financial risk,which may have impacts on homeowners of higher-value dwellings who wish to insure with greater amounts of coverage.For capped insurance policies going forward,this research suggests insurance uptake may be higher for lower-coverage policies among lower-valued dwellings,which may be a market opportunity for small coverage provisions in Canada.However,this research suggests that high dwelling value homeowners may,if insurance is demanded,prefer greater coverage to lower coverage.This may suggest general disinterest in flood insurance for high-valued dwellings if the insurance is capped at a low coverage.If this observation is replicated in other research—particularly with a larger sample—it could suggest some potential for cross-subsidization whereby lower dwelling value homeowners at risk of flooding are in part subsidized by any unused cap demanded by higher dwelling value homeowners.Such an insurance arrangement depends on the notion that more insurance is preferred to less among those in expensive properties,and sometimes this may exceed anticipated losses.

AcknowledgementsThis work was supported by the Natural Science and Engineering Research Council(NSERC)Canadian FloodNet(Grant Number:NETGP451456).

Open AccessThis article is licensed under a Creative Commons Attribution 4.0 International License,which permits use,sharing,adaptation,distribution and reproduction in any medium or format,as long as you give appropriate credit to the original author(s)and the source,provide a link to the Creative Commons licence,and indicate if changes were made.The images or other third party material in this article are included in the article’s Creative Commons licence,unless indicated otherwise in a credit line to the material.If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use,you will need to obtain permission directly from the copyright holder.To view a copy of this licence,visit http://creativecommons.org/licenses/by/4.0/.

International Journal of Disaster Risk Science2022年2期

International Journal of Disaster Risk Science2022年2期

- International Journal of Disaster Risk Science的其它文章

- A Building Classification System for Multi-hazard Risk Assessment

- A Regional Economy’s Resistance to the COVID-19 Shock:Sales Revenues of Micro-,Small-,and Medium-Sized Enterprises in South Korea

- Dealing with Multisource Information for Estuarine Flood Risk Appraisal in Two Western European Coastal Areas

- Resilience in Agriculture:Communication and Energy Infrastructure Dependencies of German Farmers

- How Participatory is Participatory Flood Risk Mapping?Voices from the Flood Prone Dharavi Slum in Mumbai

- Carbon Emission Risk and Governance