Insight into the Trends in Chinese Enterprises Affected by the Pandemic

By Audrey Guo

2020 was an unusual year for the Chinese economy, as the macroeconomic environment was severely affected by theCOVID-19 pandemic and the unprecedented challenges it brought about for people from all walks of life. However, after a relatively short trough period, thanks to precise and impactful governmental measures (particularly in terms of the steadily developing system of internal circulation which focuses on expanding domestic demand and stimulating industrial upgrading, as well as the continuously emerging new economic models and new consump- tion scenarios), China managed to accelerate its transformation between the old and the new momentums, helping China become the only major economy in the world to achieve positive growth.

Recently, Qichachas Big Data Institution and the Center for City and Competitiveness of the Chinese Academy of Social Sciences (CASS) jointly issued the 2020 Statistics for Chinese Enterprise Development, which showed that, as of February 2021, there were 144 million active/sustained market entities in China, including 44.572 million enterprises and 96.046 million privately or individually-owned businesses. As a large developing country with a population of 1.4 billion, a working-age population of 900 million, and 144 million market players, China has always been an important driving force behind the global economic recovery.

In 2020, there were 27.354 million newly registered market entities in China, marking a year-on-year increase of 12.8%. Among these, there were 3,677,000 registered in the first quarter, down by 23.3% from a year ago, and 7,727,000 registered in the second quarter, which was up by 18.7%. Due to the second outbreak of the pandemic in Beijing Xinfadi, the growth rate slowed down in the third quarter to 14.9% from a year ago, with 7,347,000 new registrations. In the fourth quarter, as the Chinese economy fully recovered, the number of newly registered businesses rebounded to 8,601,000, up by 31.3% from a year ago.

According to Qichachas Data Institute, due to factors such as the quarantine and blockade measures adopted during the pandemic, the procedures for business cancellation or revocation was delayed throughout the first four months of 2020. Therefore, the actual number of companies in difficulty was much higher than that reported. Moreover, past experience suggests that June often witnesses a peak in the number of businesses stopping operation, and as such, this remarkable year-on-year growth of 56.3% in the second half of 2020 may better reflect the difficulties of existing enterprises in 2020.

Regions: Hainan had a noticeable performance, while the number of newly registered businesses in Wuhan returned to pre-pandemic level

In terms of the regional distribution of new businesses (excluding Hong Kong, Macao and Taiwan), there were 3,763,600 newly registered businesses in 2020 in Jiangsu Province, marking a year-on-year increase of 104.4%, making it the only region with a level of growth exceeding 100%, which was much higher than in other regions. It was followed by Guangxi Autonomous Region and Fujian Province with a yearon-year growth of 47.4% and 44.3% respectively.

Hainan Province ranked fourth, with 31.7% more new businesses being registered in 2020 from a year ago, partly because of the implementation of the Hainan Free Trade Port scheme, which attracted a large number of investors and entrepreneurs, resulting in a noticeable growth in the number of newly registered businesses there.

31 provinces and municipalities have recently announced their GDP growth rates for 2020. Hubei Province was the only one with a negative GDP growth rate, and also recorded a cut in the number of newly registered companies. In 2020, there was a total of 772,500 newly registered companies in Hubei Province, down by 11.0% from a year ago. Besides Hubei Province, Shaanxi Province, the Tibet Autonomous Region, Liaoning Province and Henan Province also recorded a decline of more than 10% in new registrations.

In terms of the decline in the numbers of newly registered businesses in the top 12 provinces and autonomous regions, other than Xinjiang and Tibet which have specific geographic limitations, as many as eight of these regions were in the north, which may suggest that northern provinces and autonomous regions in China were more heavily affected by the pandemic.

Surprisingly, Tibet, which was the least affected by the epidemic, realized a GDP growth of 7.8% year-on-year in 2020, ranking first in China. However, at the same time, the number of new business registrations in Tibet dropped by 14.7% year-on-year, ranking one before lastin a rather unusual set of statistics.

Among the cities in China, according tostatistics, in 2020, Suzhou had the most newly registered businesses, numbering 687,000(including individual businesses). In 2020, Suzhou realized a GDP topping RMB 2 trillion and become the sixth largest city by GDP after Shanghai, Beijing, Shenzhen, Guangzhou and Chongqing, thanks to the contributions of various market players.

In addition, the top five cities of Suzhou, Chengdu, Guangzhou, Shenzhen and Chongqing had newly registered businesses numbering more than 500,000 in 2020. Of the top 20 cities with the most newly established businesses, most were located in the Yangtze River Delta or along the southeast coastal line of China. Only four of these top 20 cities were in central and western China, namely Chengdu, Chongqing, Xian and Zhengzhou.

In 2020, the number of newly registered businesses in the five cities of Sanming, Taizhou, Yancheng, Wuxi, and Xuzhou more than doubled, honoring them with the top five position in terms of the highest growth among the top 20.

Since Wuhan was affected the most by the pandemic in the first half of 2020, the changes in the number of registered businesses in Wuhan and the entirety of Hubei Province are particularly worthy of attention.

According to the data from Qichacha, in February, there were only 351 new businesses registered in Hubei Province, marking a decrease of 99.0% from the previous month. However, this number rebounded to 14,600 in March, an increase of 4067.2% from the previous month, and 78,700 in April, up by 438.3% month-on-month. Later on, the number alternately increased and decreased between May and December.

Specifically, in Wuhan, only 71 new businesses were registered in February, which was a decrease of 99.4% from the previous month, with the number rising to 543 in March, up by 664.8% month-on-month. A real leap took place in April, with the number rising to 11,200, showing a month-on-month increase of 1954.1%. In the following months, other than in October, the number kept growing on a month-on-month basis. It can be seen that, compared with the rest of Hubei Province, Wuhan had a much slower but more steady recovery in terms of the economy, with an orderly resumption of work and production. Various indexes regarding the economy were fully restored to pre-pandemic levels in the fourth quarter.

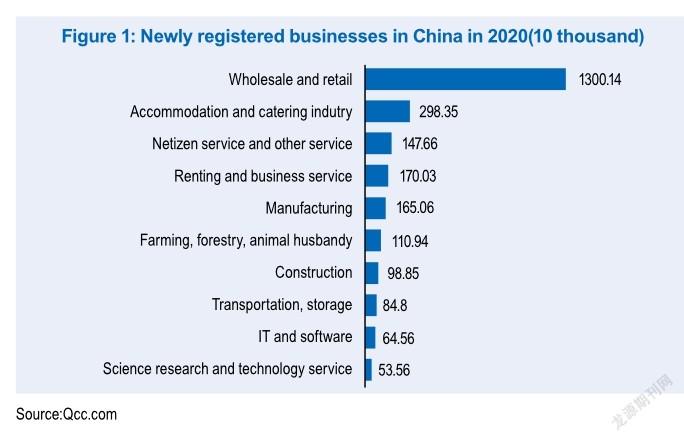

Finance, culture & sports, and technical industries maintained high growth, while real estate, manufacturing, accommodation and catering suffered a decline

From the perspective of international standards for industry classification, of the total of 18 industries (excluding public administration, social security, and social organizations and international organizations), 12 recorded more newly registered businesses in 2020, while 6 industries suffered a year-onyear decline. The financial industry recorded a 98% jump in the number of new registered businesses from a year ago, followed by culture, sports and recreational services (83.4%).

Primary industry and industries concerned with basic livelihoods maintained a relatively high growth, for example,the production and supply of electricity, heat, gas and water recorded a year-on-year increase of 82.1% in newly registered businesses, with this percentage reaching 66.1% for farming, forestry, animal husbandry, and fisheries, and 57.1% for the management of water conservancy,the environment and public facilities. All of the above industries had growth rates of above 50%.

The science and technology industry (scientific research and technical services) has maintained a high growth rate for years, with a total of 535,600 new businesses being registered in 2020, which was a year-on-year increase of 72.8%. At the same time, due to the pandemic, health and social work also had a high growth rate of 43.1%.

It is worth noting that the real estate and manufacturing industries were includedamong the industries recording a decline in the number of newly registered businesses from a year ago, which was directly related to the lower prosperity of the domestic real estate industry and the weakened physical manufacturing industry in 2020. At the same time, due to a decline in the global tourism industry, the number of newly registered businesses in the accommodation and catering industry dropped by 27.0% year-onyear, marking the second largest decline from a year ago, just after the mining industry.

Of these secondary sub-industries, Qichacha picked out ten with the most newly registered businesses. The statistics showed that the news and publishing industry ranked first with an ultra-high growth of 6257.8% from a year ago, followed by the postal industry, land administration, and pipeline transport, all of which recorded a year-on-year growth rate of higher than 1,000%. In addition, sub-industries including railway transportation, comprehensive utilization of waste resources, the chemical fiber manufacturing industry, and water conservancy also achieved a growth rate of more than 500%.

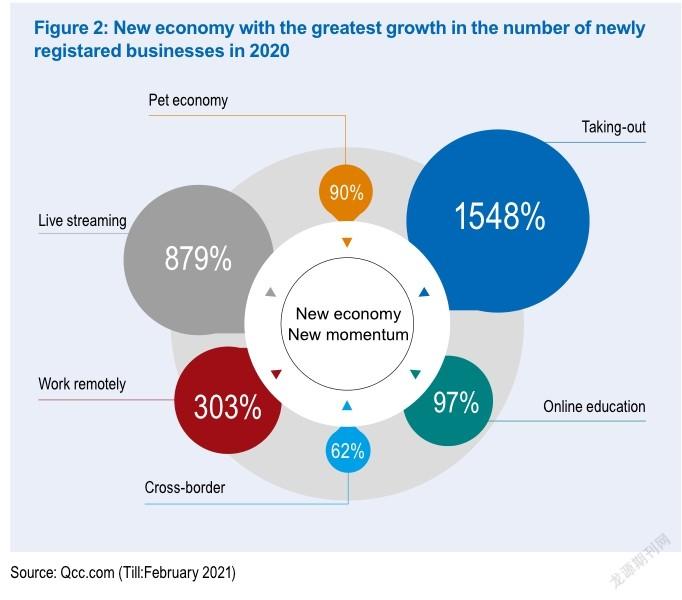

The new economy brings new momentum: take-out and live streaming grew tenfold; golden period for cloud living and pet economy ushered in

Take-out, live streaming, online education, the pet economy and so on all become success stories.In such an unusual year, 2020 witnessed the development of new engines based on new economic scenarios, as well as measurable achievements, despite facing great domestic and global challenges.

Of the six industries in the new economy with the greatest growth in terms of the number of newly registered businesses, according to Qichacha, the takeout industry attracted 776,000 new businesses in 2020, marking a year-on-year increase of 1548%. The catering industry was severely affected by the pandemic, boosting the digital transformation and upgrading throughout the industry. On the other hand, the diversification of takeaway products to include breakfast, afternoon tea, and supper, also encouraged consumer demand and stimulated the rapid growth of the takeaway industry.

Undoubtedly, live streaming e-commerce was the hottest new economic format in 2020. In 2020, the live streaming industry had 75,000 newly registered businesses in China, displaying an increase of 879% year-onyear, and exceeding the total number of businesses registered in previous years.

The number of pet owners is also constantly increasing. In 2020, there were 376,000 newly registered petrelated companies, up by 90% from a year ago. Especially when the pandemic first broke out in 2020, pets became the companions of many “empty-nest”young people, bringing the pet economy into a golden period.

Cloud living and the stay-at-home economy are also being associated with more and more life scenarios, especially education and working scenarios. In 2020, the number of newly registered online education and remote office related companies increased by 97% and 303% from a year ago respectively. In addition, the overseas warehouse network is being formed and perfected, helping more goods which were madeinChinago abroad, and encouraging cross-border e-commerce. In 2020, 62% more crossborder e-businesses were registered from a year ago.

Capital analysis: new energy vehicles gain momentum for development, and community group buying creates new opportunities

In the face of unprecedented uncertainty, the capital market became more rational in 2020, which was reflected in the decline in both the number and amount of financing events disclosed. However, on the other hand, hot spots continued to receive more and more attention. According to Qichacha, the number of financing events in 2020 was cut by 22.1% from a year ago, to 6,357. There were 1,183 financing events in the first quarter, a year-on-year decrease of 48%, and this number decreased by 24.8% and 13.5% respectively when carrying out the same comparison in the second and third quarters, meaning that the declines slowed down quarter by quarter. In the fourth quarter, there were 1910 financing events, marking a year-onyear increase of 2.4%.

1. [Acceleration] The annual financing for new energy vehicle enterprises exceeded RMB 100 billion for the first time

As the annual sales volume jumped from less than 10,000 to more than one million, the new energy vehicle industry in China is developing towards a midto-high end position, and is growing into a popular concept in the capital market. According to Qichacha, the number of disclosed financing events for new energy automobile brands dropped by 18.3% in 2020 from a year ago, but the total amount increased by 159.4% year-on-year, reaching RMB 129.21 billion, and topping RMB 100 billion for the first time in a decade.

2. [New opportunities] The disclosed amount of financing for community group buying surged by 121% year-on-year

In 2020, community group buying became a new hot spot that attracted Internet giants, while also causing concern in the second half of the year. According to Qichacha, in 2020, there were 37 public financing events for enterprises involved in community group buying, with the disclosed amount totaling as high as RMB 20,516 million, up by 121% from a year ago, both of which were new records.

3. [Great market] The new tea industry received investment through financing which was 378.6% higher than a year ago

In recent years, milk tea has gradually become a popular drink among young people. Many distinctive tea brands have emerged, and are favored by consumers and also by the capital market. According to Qichacha, there were 11 financing events for tea brands in 2020, which was basically the same as in 2019, but the disclosed amount reached RMB 1.04 billion, meaning a year-on-year increase of 378.6%.

4. [Strong demand] The disclosed amount of financing for the healthcare industry increased by 43% year-on-year

Due to the current COVID-19 pandemic, there is a strong demand for medical and health services, which interested the capital market greatly in 2020. According to Qichacha, in 2020, the medical and health service industry received a total of 1,120 sums of investment and financing, with a disclosed amount totaling RMB 245.9 billion, which is an increase of 43% year-on-year, including 60 projects exceeding RMB 1 billion. In terms of sub-fields, 26% of the money went into medical device-related projects, followed by biopharmaceuticals and related R&D, diagnostic testing and chemical pharmaceuticals.

Looking forward to 2021, as the domestic pandemic situation continues to remain stable and controllable, the pandemic will eventually become a thing of the past. In the post-pandemic era, we have reason to believe that offline businesses which rely on the flow of people will soon return to normal, as will the physical manufacturing industry. Meanwhile, these online new economic models will become more mature, and the cloud living will be further integrated into our daily lives, together revitalizing the consumption market.

- China’s foreign Trade的其它文章

- Chinese Elements Highlight the Charms of Fashion

- Post-epidemic Demand for Talent Illustrates New Trend

- The Number of Overseas Students Returning to China Has Doubled

- China and Thailand Discuss Innovative Investment Online

- Feet Firmly on the Gas Pedal in GBA

- American Companies Show More Confidence in Business Outlook in China