American Companies Show More Confidence in Business Outlook in China

By Audrey Guo

According to the 2021 White Paper on the Business Environment (hereinafter referred to as the survey) in China recently released by the American Chamber of Commerce in South China, 94% of participating companies remain optimistic towards the business outlook in China. No company showed willingness to completely shift away from China. China was the most popular investment destination among almost all the respondents, with more than 90% of the studied companies selecting China as one of their investment destinations.

This is the 17th annual study. 208 companies participated in the study in total, with questionnaires from 191 companies finally being adopted. While 31% of these are engaged in the primary and secondary sectors, 26% are in the field of consumption products and services, and 43% are in professional services. Most of them are medium and small sized companies.

Approximately 90% of companies reported that they have already turned a profit in China

The survey shows that more than 40% of the participating companies have operated in China for more than twenty years, representing a large group of mature businesses. The primary business objective of 81% of the participating companies is to provide goods or services to the Chinese market, rather than manufacturing to export, which is consistent with the results seen in previous years.

Influenced by the COVID-19 pandemic and a variety of other factors, compared with the 2019 data, there was a significant decrease in foreign employees in China in 2020. 30% of these companies now have a reduced headcount. However, 44% of them reported plans to significantly or slightly increase their headcounts in 2021.

The survey reflects the fact that, compared with the past three years, companies saw slight fluctuations in the percentage of their global annual revenues from China in 2020. More than half of the companies gained more than 30% of their revenue from China. As COVID-19 has taken hold of the global economy, nearly 50% of the companies2020 revenue in China was slightly/significantly decreased compared with that of 2019. This is the most significant reduction in the past few years.

Although the companies profitability in China has declined slightly compared to that seen in the past two years, the overall situation is still relatively optimistic. Approximately 90% of the companies report they have already turned a profit in China. Meanwhile, only 10% of the companies claim that they havent reached profitability in China. From the perspective of the origins of these companies, more than 90% of American companies and other companies have achieved profitability, while 83% of Chinese companies have achieved the same. However, roughly half of the companies that have been profitable reported that their profitability did not meet their budget expectations, with an increase of 12% year on year. Compared with previous years, fewer companies are expecting to reach profitability in a short period of time. While an overwhelming majority of the respondents expect their companies to be profitable within two years, more than 30% assume that it would take more than three years to become profitable.

Most of the companies reported that their overall returns on investment in China were positive. Compared with their global overall returns on investment, the majority of the respondents considered their overall returns on investment in China to be higher than other places. Compared to data from 2016 to 2019, there is a significant increase in those who are optimistic about Chinas business landscape, while American companies show more confidence in the business outlook in China.

China is the most popular investment destination among almost all the respondents

More than half of the respondents consider China as holding the top spot in their global investment plans, which is a 10% increase compared with 2019. China is the most popular investment destination among almost all the respondents, with more than 90% of the studied companies selecting China as one of their investment destinations and 44% of foreign companies choosing China as the number one investment destination. More than 60% of the consumption product and service companies chose China as their number one priority. China was also the priority for 59% of the professional servicecompanies.

The actual reinvestment in China in 2020 was basically the same as predicted by the result of the 2019 research. Compared with the previous year, 4% fewer companies claimed that they had reinvested in China in 2020.

The number of companies that reinvested less than USD 250 million in China in 2020 is similar to that of 2019. The number of high-volume re-investments (more than USD 250 million) has experienced a ten percent drop against what was budgeted for 2020.

The pandemic has triggered the deepest global recession in decades. Various pressing factors were found to have impacted the global economy in 2020. This survey shows that there was a significant change in reinvestment from profits in China year on year. More companies (17%) reported that their reinvestment quota in China in 2020 decreased in comparison with 2019. Compared with the last few years, there were fewer increases in reinvestment and more decreases in reinvestment in 2020.

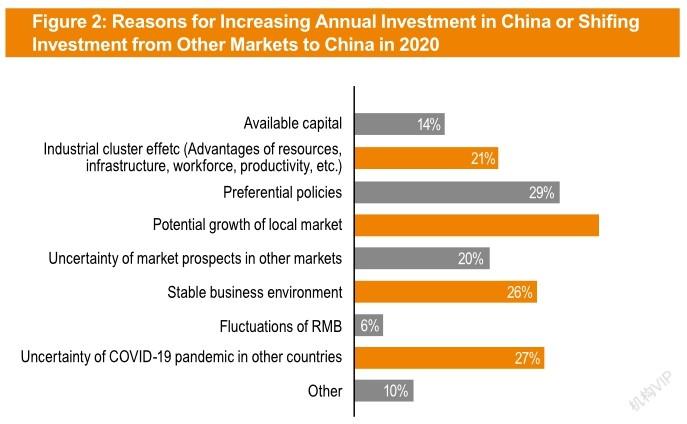

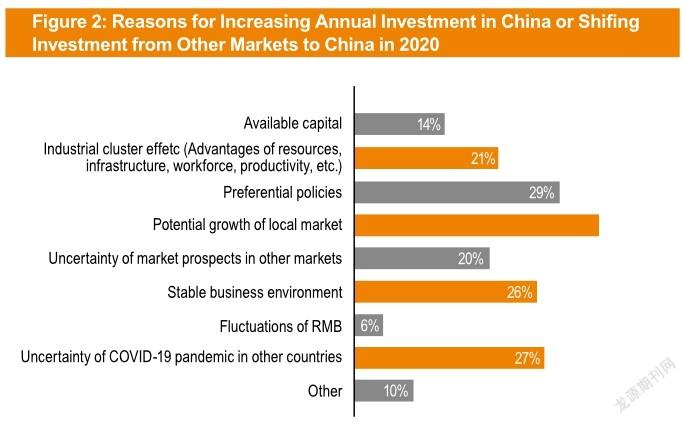

However, it is interesting to note that companies showed a strong determination to continue investing in China in 2020. In 2020, over 80% of the companies chose not to shift their investment out of China, accounting for an improvement of approximately 20% year on year. As for the companies that had intentions to move out, nearly 80% of them chose to shift less than 30% of their investment projects to countries outside of China. No company showed a desire to completely abandon China.

Most of the companies were able to realize profitability in China and remained confident in Chinas economic outlook. It is no wonder that they continue to utilize their profits from China and take advantage of Chinas preferential policies. Uncertainties caused by the COVID-19 pandemic in other countries is an important reason to maintain their reinvestment in China.

Almost 70% of the respondents claimed that they would reinvest in China in 2021, which marks a 10% drop compared with the number of companies actually making reinvestments in 2020. Compared with the research results from the past few years, the number of companies who would reinvest more than USD 250 million is only 4%, while the average over the previous five years was 7.2%. Most of the companies planned to reinvest with a low quota (below USD 10 million). 63% of the Chinese companies surveyed reported reinvestments of below USD 1 million, while 56% of American companies would reinvest within the range of USD 1 million to USD 10 million.

In terms of future expansion in the next three years, the vast majority of the respondents(65%) still plan to expand in China. However, as the COVID-19 situation may cast a long shadow, the proportion of companies who have expansion plans in China (in the next three years) fell to a new low compared to the levels seen in the past five years.

Guangzhou remains the top most preferred reinvestment destination in China. This is the fourth consecutive year that Guangzhou has ranked as the most popular city for investment in China in the survey. The other most favored reinvestment destinations by companies are Chinas top-tier cities of Shanghai, Shenzhen, and Beijing. Other popular investment destination cities include Dongguan, Chengdu, and Zhuhai.

However, the free trade zones in South China have become decreasingly attractive to investors in recent years. Only about a quarter of enterprises expressed an interest in investing in the South China Free Trade Zones. Nansha Free Trade Zone in Guangzhou was the most popular among the studied companies, followed by Qianhai in Shenzhen and Hengqin in Zhuhai.

A steadily increasing trend in the business environment

A steadily increasing trend in the the business environment in South China can be easily found in the results of this survey. While the number of studied companies rating the business environment in South China as very good or good was higher than the previous year, accounting for nearly 80%, those seeing a decline in the business environment accounted for only about 14%, a decrease of 6% year on year.

As in previous years, most of the companies explained that they chose South China mainly because of the potential for market growth, seconded by the advantage of its proximity to Hong Kong, Macao, and Taiwan. Better infrastructure than other places in China was the third reason. What is noticeable is that the shortage of qualified personnel, fierce local competition, and rising labor costs were the top three concerns for the majority of the companies in previous years. Fierce local competition dropped out of the top three major challenges last year. The results in this study were roughly the same as in the previous year, but the first challenge stated was rising operation costs, followed by rising labor costs, and the third challenge is the shortage of qualified personnel. This shows that the fierce local competition has eased, but also implies that talent and costs issues still remain unresolved.

More than half of the respondents from foreign companies considered the MOFCOM Order No. 3 of 2020 entitled Rules on Handling Complaints of Foreign-Invested Enterprises helpful. None of them felt disappointed by it.

Even though only a small number of the companies have appealed a case in Chinas intellectual property rights courts, most of those with such experience consider the establishment of the courts as “very helpful” or“somewhat helpful”.

Three quarters of the respondents claimed that their operations have been impacted by the visa and travel restrictions caused by COVID-19, with more than half of the companies being affected by Chinas visa and travel restrictions, while nearly 40% experienced U.S. restrictions. The impact of the travel restrictions on operations in China included the cancellation of all international business travel, followed by the cancellation of international events/meetings in China, and the absence of management due to executives being unable to return to China.

Most American companies are more willing to expand their Chinese domestic market

95% of respondents state that they will not decouple from China despite U.S.-China trade tensions. Generally speaking, companies are more optimistic about U.S.-China relations in 2021 compared to previous years. While Chinese companies (40%) are more optimistic, 53% of American companies hold a neutral attitude and 10% feel pessimistic about relations.

More than half of the companies claimed that U.S. tariffs have had a negative impact, but compared to the last two years, the negative impact was relatively moderated by a 12% decrease year on year. American companies were hurt the most by this, followed by companies from other countries (other than China and the U.S). However, more than 30% of Chinese companies were uncertain about it.

With regard to the reactions to and strategies regarding U.S.-China trade tensions, most of the respondents reported that they would be more willing to expand their Chinese domestic market, followed by reducing their import and export trade with the U.S. and exploring international markets other than the U.S. and China. Around half of the Chinese companies respondents would prefer to expand their Chinese domestic market and explore international markets other than the U.S. and China. American companies would also like to explore other markets (41%) and reduce imports and exports with the U.S. (21%).

Interestingly, adjusting the supply chain by sourcing components and/ or assembly inside China became the primary reaction to the trade dispute, which was then followed by sourcing components and/or assembly outside the U.S. and China. The number of respondents who sourced components and/or assembly inside China increased by 10% year on year, while the number of those looking to relocate some or all of their manufacturing out of China decreased by 15%. The number of American companies and other companies (other than Chinese companies) considering adjusting their supply chain by sourcing within China showed a 20% increase compared to last year, while the number of those looking to relocate some or all of their manufacturing out of China dramatically decreased by 25% and 38% respectively.

The number of companies reporting market share losses due to U.S.-China trade disputes fell to 42%. However, more than half of the respondents claimed no change in market shares due to trade tariffs, while 5% of companies said they had actually increased their market share.

- China’s foreign Trade的其它文章

- Chinese Elements Highlight the Charms of Fashion

- Post-epidemic Demand for Talent Illustrates New Trend

- The Number of Overseas Students Returning to China Has Doubled

- Insight into the Trends in Chinese Enterprises Affected by the Pandemic

- China and Thailand Discuss Innovative Investment Online

- Feet Firmly on the Gas Pedal in GBA