GBA Business Environment Reflects Improving Mood

By Kelvin Lau

Recovery carries on

The GBA Business Confidence Index (GBAI), which is based on quarterly surveys of over 1,000 companies operating in the Guangdong-Hong Kong-Macau Greater Bay Area (GBA) conducted in collaboration with the Hong Kong Trade Development Council (HKTDC), shows that business confidence has further improved in Q2-2021, which bodes well for a strong start to H2-2021. The GBAIs ‘current performance index for business activity has extended its uninterrupted uptrend since the GBAIs launch a year ago, to 58.7 in Q2-2021 from 53.0 in Q1. Sub-indices for production/sales, new orders and profits showed the strongest improvements, with the latter being thanks to respondents abilities to raise prices to maintain margins. The more forward-looking ‘expectationsindex eased q/q (to 59.3 from 62.7); however, this is from a very high Q1 level and was bound to normalize with continued recovery. If anything, having the expectations index and all key components remain above the 50 neutral mark suggests that the region should be able to handle rising inflation and policy tapering risks well in H2.

Respondents have seen credit conditions improving, as a stronger business performance generates a better cash flow. By industry, we can see many similar drivers behind another strong quarter of performance for manufacturing and technology respondents. By city, Shenzhen has managed to outperform Guangzhou this time, possibly due to the formers higher innovation and finance content, and the latters recent resurgence in COVID cases. From a thematic point of view, all 11 GBA cities are expected to see an increase in respondent presence in the next three years, which is a good sign for intra-regional integration, with the top three drivers being talent, infrastructure and population size. Just over half of our respondents said that they are experiencing higher operating costs, with the most exposed being the manufacturers. Around two-thirds of respondents have yet to see a rise in pressure to implement environmental protection measures.

Detailed findings of the GBAI survey for Q2-2021

Our latest GBAI was conducted between late April and early June, during a period in which accelerated vaccine rollouts further fuelled the global recovery, adding to an already strong domestic recovery. This was accompanied by an evident rise in inflation, including in the U.S. and China. We expect the latest survey results to help answer key questions, including those regarding the sustainability and broadness of the current recovery, and how much of such recovery optimism will be marred by rising costs squeezing profit margins – all through the lens of GBA companies.

Current performance index shows accelerated growth: The GBAI current performance index for business activity extended its uninterrupted uptrend since its launch a year ago, rising to 58.7 in Q2 from 53.0 in Q1 (Figure 1). This not only indicates a sustained strong post-COVID recovery momentum, but also indicates continued acceleration by moving further away from the 50 neutral mark. Six of the eight GBAI sub-indices rose q/q for a second straight quarter, led by ‘production/ sales (+15.6pts), ‘new orders (+12.7pts) and ‘profit (+8.5pts). ‘Prices of finished goods and services (+2.5pts) continued to see the highest print (66.3) among key components; the rest sat comfortably above 50, which is consistent with an expansion in activity.

All of this confirms that the demand recovery story has strengthened of late, so much so that our respondents have generally been able to pass on at least some of the higher costs to their buyers; hence, the evident upward pressure on prices of finished goods and services, leading to an improvement in their profits. They have also been stocking up their raw material inventories (+3.7pts), a likely reflection of lingering supply shortages and rising commodity prices.

Respondents expect strong recovery to extend into Q3: The GBAI expectations index for business activity eased to 59.3 from a record 62.7 in Q1. Seven of the eight sub-indices fell q/q, with ‘new orders being the only exception (+1.3pts to 67.5, the highest of all components, confirming the expectations of a strong pipeline as the global recovery expands). The drop in the expectations gage is unsurprising, given that it is a measure of optimism relative to prior levels, which were already very high. This is also in line with our view of growth likely easing in H2 from a strong H1 amid looming inflation and policy tapering headwinds (e.g. a likely easing of nationwide total social financing growth to 10-11% y/y this year from 13-14% in 2020); the fact that all eight sub-indices stayed well above 50 indicates continued expansionary momentum in the GBA.

Respondents have seen net improvement in financial conditions: For the first time since the GBAIs launch a year ago, the current performance index for credit rose above 50 in Q2 (Figure 2). This is despite worsening drag from a further deterioration (i.e. higher prices) in both the bank and non-bank financing cost sub-indices, and also less willingness for banks to lend. However, this is more than offset by easing cashflow stress (as reflected in the q/q jumps in surplus cash and receivables turnover sub-indices, by +5.8pts and +7.2pts, respectively). Our expectations index for credit, which stayed above the 53 handle, suggests that such trends will likely persist in Q3. All this echoes the tapering concerns mentioned earlier, while supporting the case for policy makers to stick with the stabilizing leverage agenda for longer, given that businesses now have to face macro tailwinds to weather less cheap financing.

Consistently positive messages from manufacturers: By industry, the current performance and expectations sub-indices for ‘manufacturing and trading did not see the biggest q/q jump in the headlines (that would be ‘professional services), and neither was this the highest scoring sector (that goes to‘innovation and technology). However, manufacturers have been building on an already impressive Q1, after being the clear outperformers prior to this, while‘professional services have caught up, after having been the previous underperformers; technology respondents are also rebounding from a small Q1 setback, possibly due to earlier worries over tighter regulatory scrutiny. In contrast to this, retailers gains appear more modest after a solid start to the year, possibly held back by the recent disruption from a resurgence in COVID cases.

When looking more closely at the manufacturing and technology respondents, we can see many similar drivers behind their strong index performance. For example, based on their respective expectations sub-indicators, they are clear leaders in terms of ‘production/ sales, ‘new orders, ‘profits and ‘finished goods/services prices. They also expect the strongest pressure from rising financing costs among all sectors, which can only be offset by their outperformance in ‘receivables turnover, underpinning their overall positive outlook on financial conditions.

This complements findings from a separate annual GBA survey that we recently conducted, where we asked our 220+ manufacturing clients operating in the region how they see their 2021 business outlook. Results point to a broadbased recovery across orders, sales, hiring, wages and capex in 2021, with larger companies likely to keep outperforming smaller ones. On the other hand, this annual survey also illustrated the weak appetite for investing in key innovations beyond the usual capex; with that being said, our latest GBAI sub-indices for ‘innovation and technology showed the sector to still be leading among all industries, which should help ease some of this concern, suggesting that Chinas innovation drive remains alive and kicking.

Divergence betweenShenzhen and Guangzhou: Traditionally, respondents can be generalized into three main city groups based on their similar index performances, which is possibly due to their similar economic structure and drivers: the core mainland cities (Shenzhen and Guangzhou), the non-core mainland cities (including Foshan and Dongguan) plus Macau, and Hong Kong. Over the past year, we have seen the first two groups alternate as the quarters outperformer, while Hong Kong has persistently underperformed. This time was no exception, with the non-core cities regaining top spots across most sub-indices; Foshan was particularly strong following a disappointing Q1, reflecting some catch-up play. Foshan and Dongguans improvements could also be reflections of the global recovery story, as they are heavily integrated with and a core part of the GBA export sectors extensive supply chain.

Catching our eye this time was the divergence between Shenzhen and Guangzhou. The current performance sub-index for Shenzhen stood at 63.1 in Q2, second only to Foshans 65.9; in contrast, Guangzhous was 8.3pts lower at 54.7, beating only Hong Kongs 45.1. The difference between the two cities is particularly large for many current performance sub-components(especially professional services), giving the city an edge this time. We note that the gap between Shenzhen and Guangzhou has narrowed materially for the expectations indices, meaning that the factors that affected Guangzhou in Q2 are likely to be shortlived, according to our respondents.

Meanwhile, Hong Kong is quietly improving, despite remaining a sluggish. Its current performance index for business activity finally broke above 40 for the first time in Q2, while the corresponding expectations index stayed above 50, albeit only marginally. Our previous scores for Hong Kong suggested a bottoming out economy, which was best reflected in the fall in local unemployment (on a seasonally adjusted, 3mma basis) for three consecutive months as of May, which was mainly driven by the unwinding of social distancing measures. We believe that a continued global recovery, together with an acceleration in the vaccination pace extending recent stretches of zero daily local untraceable COVID cases, will mean more catching up to come.

Key takeaways from our thematic questions

Our thematic questions this time focused on: (1) our respondents plans for business expansion in the next three years, including which cities they will be operating in by then and why; (2) how they are coping with higher operating costs; and (3) how the need to step up environmental protection efforts are impacting/will impact their profits and business plans. We have listed our key findings below.

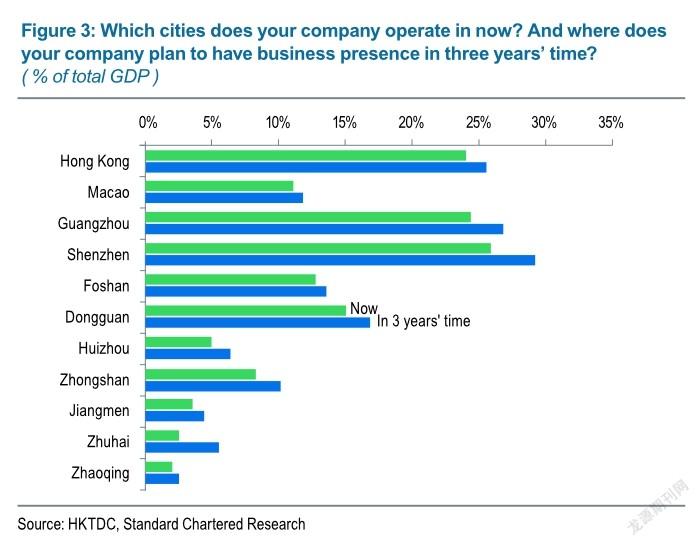

Expansion plans: Our first question was about which GBA cities our respondents are currently operating in, and where they plan to have a presence in three years time (Figure 3). For bigger cities that have their own sub-index (i.e. Shenzhen, Guangzhou Hong Kong, Foshan and Dongguan), they all expect the proportion of respondents already having a presence there to exceed their allotted survey sample size. All 11 GBA cities expect an increase in respondent presence in the next three years, with Shenzhen and Dongguan leading the core and bigger cities, and Zhuhai being way ahead of the remaining ones, which are bound to see proportionally bigger improvements due to their lower starting points. By industry, it is unsurprising that respondents presence in the fields of ‘innovation and technology, ‘financial services and‘professional services – be it now or in three years time – are mostly concentrated in Shenzhen, Guangzhou and Hong Kong, with Dongguan also being rather popular for technology companies, Macau for retail and wholesale, and Zhuhai acting as an up-and-coming destination for professional services. Manufacturers, in contrast, are the most diverse in terms of location.

When asked what their main considerations are for operating in these cities, the top three answers were: (1) quality and mobility of talent pool; (2) infrastructure and transport connectivity; and (3) population and spending power. Labor quality and talent availability have been a longtime priority, based on our prior surveys; this time too, it was the only answer that consistently ranked in the top three across all five of our industry categories. In particular, almost half (48%) of our technology respondents ranked talent availability first, making it a key longterm driver for the GBAs long-term innovation aspiration. It was unsurprising that infrastructure topped the list for manufacturers, and population size for retailers and professional services providers. Interestingly, financial openness and capabilities only ranked second for‘financial services (39.5%), with the first place going to ‘policy concessions and incentives (43.4%).

In term of our respondents plans for their companys operations in the GBA over the next one to three years, excluding those answering ‘not applicable, 54% said they would (be it marginally or materially) increase their workforce size; 52% would increase capital investment; 47% would focus on sales within the GBA; 47% would concentrate on sourcing with the GBA; 46% were concerned with R&D spending; 44% want to participate inoverseas investment; and 30% would focus on financing – all significantly more than those reporting decreases. Small sample sizes notwithstanding, ‘financial services relative to other sectors appeared slightly more eager to invest overseas, and unlike manufacturers who prefer ASEAN markets, the U.S., the U.K. and Singapore are their top choices.

Coping with higher costs: Just over half of our respondents (51.3%) said that they are experiencing higher operating costs. The impact across sectors, however, is far from even, with manufacturers clearly being the most impacted recently by global reflation drivers, including rising commodity prices and transportation costs, plus lingering supply-side bottlenecks; and by extension, a larger proportion of respondents from the more export-oriented GBA cities,such as Foshan, Dongguan and Huizhou, also reported higher costs.

Focusing just on those reporting higher costs, beyond higher raw material costs – which disproportionately affect manufacturers more – higher wages for existing staff was also a popular answer across all industry groups (accounting for almost 60% of all respondents), more so than the other usual suspects, such as transportation and rentals. In response to such pressures, the top three actions are to: (1) achieve savings on other expenses; (2) increase sales to offset smaller margins; and (3) pass on higher costs(partly or wholly) to buyers . Retailers are particularly keen to boost volumes to compensate for lost margins, while a relatively large share of ‘professional services (49%) and ‘innovation and technology (47%) respondents can/are planning to pass on higher costs. 21% of all respondents currently experiencing higher costs think it is very difficult to pass them on, with another 60% saying it is quite difficult.

Decarbonization and other pollution reduction methods: Finally, we asked our respondents whether they have felt pressure to engage in environmental protection in their operations. This could be decarbonization, other means for reducing pollution, or simply complying with policies that are expected to become more stringent over time. Only 18% said there is material pressure already, with another 15% seeing pressure beginning to rise. The rest accounts for two-thirds of our respondents, who see no pressure at the moment; we believe this group of respondents (and by extension the majority of GBA companies that they represent) will experience the pressure to take action on environmental protection rising evidently very soon, especially in terms of reducing carbon emissions.

China has pledged to achieve peak emissions by 2030 and carbon neutrality by 2060. This is an extremely challenging goal, in our view, given the countrys energy-intensive growth model and coal-dominant energy mix, and its short window in which to achieve net zero. All this means that China needs to undergo major economic transformation to reach such lofty goals, and the GBA will be asked to lead the way, much as with many other China aspirations. The good news is that not all changes are negative for businesses, and could also bring about new opportunities: a total 32% of respondents see the need to comply with environmental protection requirements having a positive impact on their profits and long-term business plans, which is a proportion twice the size of those seeing negative impacts.

- China’s foreign Trade的其它文章

- Fresh Food E-commerce Has Huge Potential for Development

- Housekeeping Service Industry Presents Super Opportunities for Investment

- China Becomes Top Machinery Exporter for the First Time

- Outlook for Investment from Insurance Institutions in the Belt and Road Initiative

- A Growing Market for Mobile Medical Apps

- China’s Game Industry Exhibits“Smile Curve”