Outlook for Investment from Insurance Institutions in the Belt and Road Initiative

By Jia Zhengxiang

Chinese insurance companies has been adopting offshore capital operation practices, according to regulation and supervision policies on overseas investment, since 2012 when the former China Insurance Regulatory Commission (CIRC) relaxed the restrictions on offshore asset allocation of funds of insurance companies, encouraging insurance companies to actively diversify their global asset portfolios.

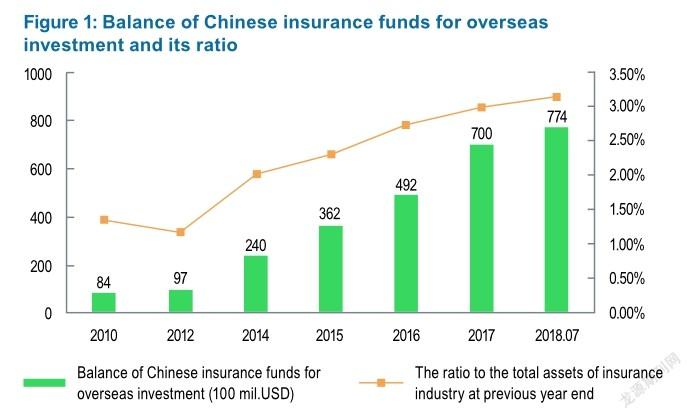

As statistical data has showed, as of the end of the first half of 2019, more than 50 Chinese insurance institutions had conducted overseas investment business through QDII and so on, resulting in a hike in the total amount of outbound investment by Chinese insurance companies from USD 8.4 billion in 2010 to USD 46.27 billion at the end of 2016, which was still a very small amount compared to the overall balance of insurance funds. According to official data, the total assets of the insurance industry were RMB 16.75 trillion at the end of 2017, while the balance of Chinese insurance funds for overseas investment reached USD 77.4 billion by the end of July 2018, which was equivalent to approximately RMB 510 billion, only accounting for 3.04% of the total assets at the end of the previous year, and still far below the restrictions which state that the amount of overseas investment should not exceed 15% of the total assets at the end of the previous year. This was also far lower than that in insurance markets in developed countries such as the U.S., the U.K. and Japan. As such, there is great potential for Chinese insurance funds in the overseas investment market.

Overseas investment by Chinese insurance funds focuses on three categories: stock, equity and real estate

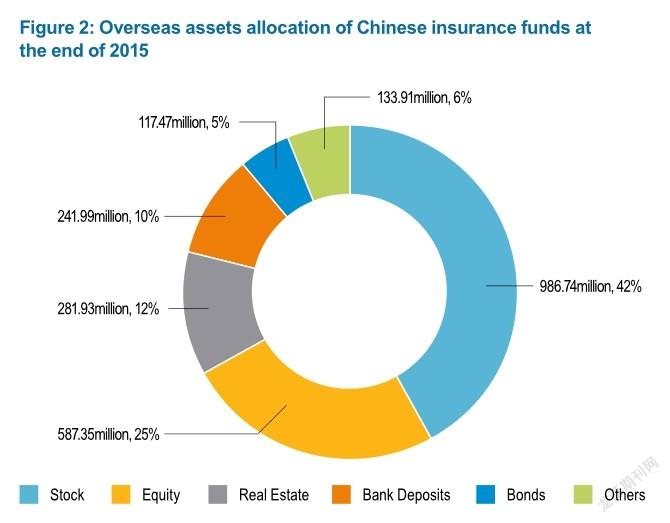

From the perspective of investment variety and regional distribution, the investment from Chinese insurance funds is highly concentrated within the three categories of stock, equity and real estate, although many overseas investment products are also on the list of choices (which ranges from monetary market products, equity, and fixed income products to real estate).

At the end of 2015, the top three overseas investment products held by Chinese insurance funds with the largest outstanding balances were stocks (24%), equity (24.8%) and real estate (12.4%), totaling 79%. Judging from trends in recent years, the proportion of equity and real estate has gradually increased. According to the China Banking and Insurance Regulatory Commission(CBIRC), as of the third quarter of 2018, traditional investments such as bank deposits, stocks, bonds, and funds accounted for approximately 47% of the total amount of overseas investment, and alternative investments such as equity investment funds and real estate accounted for approximately 52%. To be specific, stocks were mainly H-shares listed on the Main Board of the Hong Kong Stock Exchange, with only a small amount of foreign secondary market stocks; the proportion of overseas real estate rose rapidly, as large financial institutions have significantly increased their investments in overseas real estate since 2013.

Geographically, the overseas investment from Chinese insurance funds has been concentrated in developed markets such as Hong Kong, Europe, the U.S. and Australia, taking the form of stocks in Hong Kong, and the form of real estate and equity in Europe and the U.S.

Target fields of overseas investment for the insurance industry in China

Despite the challenges and difficulties of implementing overseas investment projects, this is still a general trend in the long run. Therefore, Chinese insurance institutions should establish a prudent and sound investment concept in accordance with regulatory policies, and then strategically carry out overseas investment under the guidance of serving the strategic needs of the Belt and Road Initiative.

1. Infrastructure

Chinese insurance funds are currently focusing on equity products. However, as the Belt and Road Initiative, Regional Comprehensive Economic Partnership (RCEP) and China-Japan-South Korea Free Trade Area advance, infrastructure will be an important field for Chinese insurance funds going abroad.

According to the forecasts provided by major international institutions in recent years, the gap between supply and demand of global infrastructure investment will be approximately USD 1 trillion or even higher yearly. It has been predicated by the G20 Global Infrastructure Center that, by 2040, global infrastructure projects will demand investment totaling USD 94 trillion, while there will be an investment gap of USD 15 trillion for various infrastructure projects across the world, which is equivalent to 16% of the total infrastructure investment demand. The huge gap in global infrastructure investment is also true in countries along the Belt and Road, making it difficult to meet the demand for infrastructure investment with only public funds and resources, and making it crucial to attract global funds.

Based on research and study data, China was the main investor in infrastructure construction projects along the Belt and Road in the last five years. From 2013 to 2018, China made direct investments of more than USD 90 billion in countries along the Belt and Road, constructed 82 economic and trade cooperation zones with a total investment of more than USD 30 billion, while accomplishing a turnover of more than USD 400 billion from contracted overseas engineering projects. As of the first quarter of 2019, the balance of loans from the ExportImport Bank of China (EIBC) to support the construction of the Belt and Road had exceeded RMB one trillion(approximately USD 154.5 billion). By the end of 2018, the China Export and Credit Insurance Corporation (Sino Sure) had provided support worth more than USD 600 billion for exports and investments in countries participating in the Belt and Road Initiative.

Chinese insurance funds should establish a long-term plan for investment in the Belt and Road Initiative, and should participate in the Belt and Road construction in two ways.

One way is to fund the Belt and Road construction through bundled and diversified investment in the forms of bonds, equity, funds and so on. However, it should be noted that Chinese insurance funds are commercial debt funds, and have to follow strict requirements for costs, returns and risks, so they should clearly understand that it is important to ensure the safety of the principal and the return of funds since the realization of the Belt and Road Initiative requires a long-term and complex process.

On the other hand, Chinese insurance institutions can provide risk protection for the Belt and Road Initiative through product innovation. In general, overseas investment projects and large equipment exports involve a huge amount of money, a long execution period and high credit risks. Therefore, insurance institutions should consider security measures such as buyers default insurance, special contract insurance, buyers export credit insurance, guarantee insurance for overseas investments, etc.

In addition, since there is a large funding gap in the Belt and Road projects, Chinese insurance institutions can provide investment services to support economic and trade cooperation and bilateral and multilateral interconnection in and among the Belt and Road member countries, through direct or indirect investment in the forms of equity, bonds and a combination of equity and bonds. They can also provide long-term funding support for large-scale investment projects in countries and regions along the Belt and Road.

While investing in infrastructure projects in countries along the Belt and Road, Chinese insurance funds can also provide investment banking services for enterprises which are “going out” in line with national development strategies. Besides developing investment plans for bonds, equity and real estate, asset-backing plans and other capital management products for suitable enterprises going-out, Chinese insurance institutions can also initiate and establish private equity funds such as M&A funds, mezzanine funds and real estate funds, in order to diversify financing services.

2. Real estate

Chinese insurance funds are actively buying overseas real estate assets, making it an important part of overseas asset portfolios. From the perspective of returns, real estate investment can provide a higher yield than low-risk fixed income products such as treasury bonds and investment grade corporate bonds. Real estate investments feature long payback periods, large input capital and high operational management requirements, and the comparatively high yields can be seen as a premium resulting from the factors mentioned above. In this way, investing in overseas real estate is conducive to playing to the unique advantages of insurance funds and to gain better returns.

Compared with the domestic market in China, the rental return of real estate projects in developed countries is stable and higher, making it more attractive to investors. Besides this, insurance funds are the same as real estate investment in many ways, for example, the long debt cycles, the large amount of funds involved and the stable income required. From the perspective of volatility, real estate investment can effectively reduce portfolio risk. Real estate has a low correlation with the prices of stocks and bonds, and has independent cycle and price trends, which is important for insurance funds to construct diversified asset portfolios and reduce the variance while maintaining stable yields. In terms of capital consumption, as the risk factors of almost all assets would increase under the framework of C-ROSS, investment properties and infrastructure equity plans are some of a few assets with lower risk factors, and require much less capital consumption than domestic properties, stocks and funds.

For a better allocation of overseas real estate assets, it is recommended to follow the rules as follows. First, choose mature commercial and office real estate with stable returns in core areas of major cities. Second, focus on countries and regions where there is a large and highliquidity market, in order to secure the safety of the funds. In addition, such properties can play the role of adverts. As such, insurance institutions can make strategic investment in real estate assets such as CMBS, REITs, asset packages of logistics and real estate mezzanine funds in developed economies.

For overseas equity investment, insurance institutions should give priority to equity projects with high relevance to the main insurance business, especially complementary assets, to realize strategic synergy with the overseas insurance business. They can learn from the practices of developed countries in carrying out overseas investment projects, and can invest in other fields based on their business strategy. Real estate is a good choice for overseas investment because of the abovementioned reasons. At the same time, insurance companies should pay attention to various risks when investing in overseas real estate, and should choose countries and markets with a stable political environment, and established laws and regulations, as well as market mechanisms.

3. Finance

The balance of overseas investment by Chinese insurance institutions in 2019 was approximately USD 70 billion, which is equivalent to approximately RMB 479.9 billion, accounting for 2.75% of the industrys total assets at the end of the last quarter. Equity products and equity investments had a major part in the asset portfolio, supplemented by various categories such as monetary market products, fixed income products and real estate. In terms of regional distribution, Chinese insurance institutions have invested mainly in Hong Kong and the U.S., covering traditional established and emerging markets, with hosted funds accounting for 97.9% of the balance of overseas investment. However, insurance funds from the United States, Japan and the United Kingdom feature a very different allocation of overseas investment assets.

As a whole, U.S. insurance institutions are more conservative, and by the end of 2018, fixed income products had taken the largest share in the overseas asset allocation of insurance funds, namely, 40% for life insurance funds and 53% for property insurance funds. Stocks came second, with 33% for life insurance funds and 28% for property insurance funds. In contrast, real estate took a share of less than 1%. Of the overseas investment made by the U.S., bonds took up the highest proportion. Because of the developed domestic capital market and high risks in the foreign market, U.S. insurance institutions manage to have an asset allocation mainly composed of domestic assets. At the same time, there is a much stricter regulatory system for insurance industry in the U.S., and both the federal and state governments have the right to negotiate on the proportion of overseas investment assets. Furthermore, risk capital also contributes to the conservative strategy for overseas investment.

Similar to the U.S., the Japanese insurance industry favors overseas assets with low risks, with bonds (U.S. treasury bonds ranked first) making up 80% of the overseas asset portfolio as of the end of 2018, while equity only accounted for 20%. However, unlike the U.S., the insurance funds from Japan had a relatively high and increasing proportion of overseas assets in the industrys total assets, and the proportion of stocks kept increasing, too. The relatively high ration of bonds in the overseas asset portfolio was mainly due to the strict supervision and regulation over Japanese insurance companies business operation and ability to pay. Moreover, since, in 2012, the Japanese government lifted the ratio of overseas investment to total assets of the insurance industry in Japan, Japanese insurance funds have had a higher risk appetite and a more vigorous overseas investment strategy.

U.K. insurance funds have a higher risk appetite for investment than those in the U.S. and Japan, and carry out overseas investment mainly through stocks, which is mainly due to the fact that their weak domestic economy could not satisfy the requirements for asset allocation, and that the low interest rate encouraged insurance institutions to go abroad and seek out higher yields. As of the end of 2018, stocks made up as high as 50% of the overseas asset portfolio, followed by corporate bonds(34%), and finally treasuries (16%). U.K. insurance funds invest in great amount in overseas assets and they are experienced in insurance investment, and the regulatory authorities place no restrictions on the allocation ratio of overseas assets for insurance funds.

As the analysis showed, the allocation ratio of overseas financial products by insurance funds is subject to many factors, such as the domestic financial market, the domestic economy and regulatory policies. According to research compiled by the Insurance Asset Management Association of China, in 2019, the overseas investment by Chinese insurance institutions was rational, steady, safe and in order. In another words, Chinese insurance funds held a prudent strategy for overseas investment in recent years, mainly because of the lessons they learned from aggressive overseas investment activities by individual insurance companies in previous years, as well as stricter industrial and regulatory policies and the increasingly complex global economic environment. Furthermore, with the maturing domestic financial market and diversified financial products, it is expected that the proportion of equity assets in the overseas asset portfolio of insurance funds will decrease and that of fixed income products and real estate assets will increase, but this depends on the changing market and regulatory policies.

- China’s foreign Trade的其它文章

- Fresh Food E-commerce Has Huge Potential for Development

- Housekeeping Service Industry Presents Super Opportunities for Investment

- China Becomes Top Machinery Exporter for the First Time

- A Growing Market for Mobile Medical Apps

- China’s Game Industry Exhibits“Smile Curve”

- China’s E-sports Market Is Undergoing Rapid Development