UFI Global Barometer provides 2020 results and shows positive signs regarding a quick recovery in 20211

Snow Xia

On 26 January 2021, UFI released the latest edition of its flagship Global Barometer research, which takes the pulse of the industry. Results highlight the severe impact of the COVID-19 pandemic on the exhibition industry worldwide, in 2020. There are also positive signs regarding a quick recovery in 2021.

Size and scope

This 26th edition of UFIs bi-annual industry survey was concluded in December 2020, and includes data from 457 companies in 64 countries and regions. It was conducted in collaboration with 20 UFI Member Associations: AAXO (The Association of African Exhibition Organisers) ,TEA (Thai Exhibition Association) in Thailand, UBRAFE(Uni?o Brasileira dos Promotores Feiras) in Brazil and UNIMEV(French Meeting Industry Council) in France.

The study also includes outlooks and analysis for 24 countries and regions – Argentina, Australia, Brazil, China, Colombia, France, Germany, Hong Kong, India, Italy, Japan, Malaysia, Mexico, Peru, Russia, Singapore, South Africa, South Korea, Spain, Thailand, Turkey, the UAE, the UK and the US – as well as an additional five aggregated regional zones.

Overall key findings

- 44% of companies benefited from some level of public financial support; for the majority this related to less than 10% of their overall 2019 costs.

- 54% of companies had to reduce their workforce, with half of these by more than 25%.

- 10% of companies will have to consider permanently ceasing operations if there are no events for the next six months.

- As expected, the “impact of the COVID-19 pandemic on the business” is considered the most important business issue (stated by 29% of companies, a 2% increase on six months ago). The “impact of digitalisation” (11%) and “competition with other media” (7%) have also increased (+1% and +2% respectively), while the “state of the economy in the home market” (19%) and “global economic developments” (16%) have decreased, but remain amongst the top three concerns.

- When asked what element would most help with the “bounce back”of exhibitions, the majority of companies, ranked “readiness of exhibiting companies and visitors to participate again” (64%), “lift of current travel restrictions” (63%) and “lift of current public policies that apply locally to exhibitions” (52%) as key factors.

Operations since 2020 – reopening exhibitions

Results show that the periods when most companies reported “no activity” in 2020 were limited to March-June for the Asia-Pacific region, April-June for North America, and April-September for Central and South America and the Middle East and Africa. In Europe, there was an initial period of inactivity in April-August, followed by another period in November-December.

Globally, between April and August 2020, more than half of all companies reported no activity. This situation changed from September, where the majority of companies declared some operations, at reduced levels for most. Looking ahead to 2021, the share of companies expecting a return to “normal” activity is expected to grow from 10% in January to 37% in June.

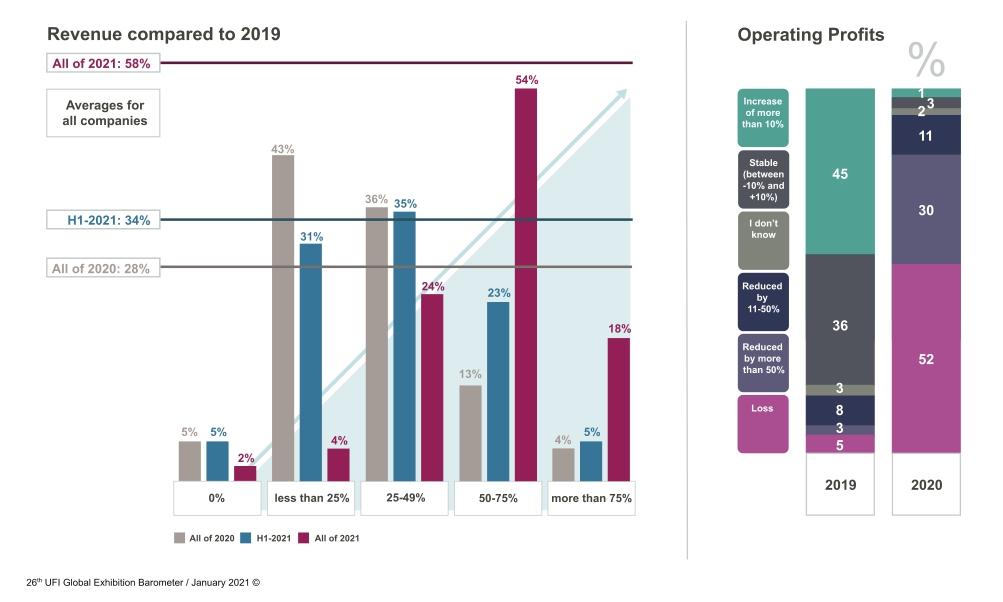

Turnover – operating profits

- The revenue drop for 2020 was the highest for companies in Central and South America and the Middle East and Africa (who respectively only achieved 23% and 24% of 2019 revenue levels). Companies in the Asia-Pacific region (27% of 2019 levels), Europe (32% of 2019 levels) and North America (36% of 2019 levels) are at or above global averages. The 2021 perspectives are rather similar for all regions: who are expecting to achieve between 32% and 37% of last years revenue for H1-2021, and between 55% and 60% for all of 2021.

- In terms of profits, the share of companies who faced a loss for 2020 varies from 47% in the Asia-Pacific region and Europe, to 50% in North America, 58% in the Middle East and Africa, and 64% in Central and South America.

Public financial support – workforce and perspectives

- The number of companies receiving public financial support is higher in Europe (54% of companies) and the Asia-Pacific region (53%), than in Central and South America (35%), North America (31%) and the Middle East and Africa (13%).

- The share of companies forced to reduce their workforce is higher in the Middle East and Africa (73% of companies), North America (61%) and Central and South America (56%), than in Europe (52%) and the Asia-Pacific region (49%).

- The proportion of companies believing they will need to close if business doesnt resume within the next six months varies from 5% in North America, to 6% in the Asia-Pacific region, 10% in Central and South America, 14% in Europe and 17% in the Middle East and Africa, while the proportion of companies who believe they will cope ranges from 26% in Europe to 40% in the Asia-Pacific region.

Future exhibition formats

The report also highlights two significant regional differences in relation to possible trends driving the future format of exhibitions:

- The claim “COVID-19 confirms the value of face-to-face events”was more widely agreed with in the Middle East and Africa (70% of companies), the Asia-Pacific region (69%) and Europe (67%), than in North America (55%) and Central and South America (53%).

- While, there were stronger opposing views for the claim “virtual events replacing physical events”, with 74% of companies in Europe disagreeing, compared to just 57% of companies from North America.

In line with UFIs objective to provide vital data and best practices to the entire exhibition industry, the full results can be downloaded at www.ufi.org/research. The next UFI Global Barometer survey will be conducted in June 2021.