A study on the influencing factors of financial security

常越 赖含 谢淳澍 陶林汝 田若玮

Abstract:This study uses Binary logit model to explore the factors that affect financial fraud of silver-haired people in Tianjin. With the development of market economy mechanism and capital market, some problems emerge, such as inefficient legal system and poor force of supervision, which lead to more and more financial fraud (Zou keyue,2019). The proportion of people aged over 60 is up to 17.3% and aged over 65 is 11.4% in China, which reached about 240 million and 158 million respectively by 2017 according to State Statistics Bureau. Among them, the elderly who suffer from financial fraud account for a large proportion. The results indicate that the old man s desire for cheap will have a certain impact on their financial fraud. Moreover, The frequency with which children accompany the elderly also affects the financial scams suffered by the elderly.

1.INTRODUCTION

Alone with the rapid economic advancement, some problems threaten the social stability and financial security. Zhou qi (2010) believes with the deepening of financial openness, the excessive expansion of the virtual economy and the accelerated development of financial innovation make the financial system more vulnerable and easily induce a variety of unprecedented exogenous financial risks. AS a result, financial crises happen frequently and endanger the financial security of the country. Wang bin (2012) points out the direct cause of the national financial risk from two hands. On the one hand, the real economy appears the bubble, and the contradiction between the commercial banks and the government are expanding generally. On the other hand, institutional investors, such as mutual funds and hedge funds in the international market, those who contain large amount of funds and obey few legal constraints, they can attack the economy with financial loopholes by using the financial leverage, thus causing the financial security crisis of the country.

At the same time, aged population is expanding gradually. Experts predict around 2050, senior citizen would up to 4.87billion. It is uneasy to maintain their standard of living after retirement regardless of owning pension. Therefore, in order to improve life quality and increase living income, more and more elderly people need financial planning (Chen jing, Ma yanqi, 2019). Furthermore, Some offenders utilize senior citizens the disadvantages, such as having difficulties adapting to social challenges, to cheat out of money in kinds of excuses (Xia yu,2019).

Chen jing and Ma qiyan (2019) think offenders have easy access to empty nest elderly, because they lack family care and love and are eager to improve life quality. However, we find that the degree of children accompany with elderly have a not-so-obvious influence on financial fraud. Whats more, Li chong(2020) surveys that young people range from 18 to 22 are prone to be defrauded. But our conclusion is that the elderly group is more vulnerable to fraud instead of the young. This study makes two contributions to the extant literature. First, this study uses Binary Logit model to find out the relationship between old people and education, the time family accompany with and other factors. Second, this study identifies the most widespread form is health supplements fraud in elderly. This research findings also have important research implications. According to the forms of fraud, we could provide the corresponding reference for improving financial security.

The study is organized as follows. Section 2 outlines the theories that underlie the factors. Section 3 outlines and describes the data. Section 4 analyze data. Section 5 summarizes and discusses the empirical findings. Section 6 concludes.

2. LITERATURE REVIEW

This section mainly summaries the relevant literature about current status of financial fraud, factors Influencing Financial Fraud.

(1)Current status of financial fraud

Gan Li and Yin Zhichao (2015) believed that according to the China Household Financial Survey (CHFS), 57.60% of residents had experienced various forms of fraud including telephone fraud, SMS fraud, online fraud and face-to-face fraud in 2015, of which 5.8% were residents Suffering financial losses in fraud [1].Wang Fudong(2020)believed that in recent years, with the continuous development of Chinas financial market, the resulting crimes in the financial field have also increased. Compared with the past, the common form of crime in the financial field has been combined with the Internet in the new situation, and it has appeared in peoples sight in its new form. Its criminal methods are more novel and diverse, and it is extremely deceptive. China s vital interests and the socialist financial order have caused serious damage [2]. Wu Mingxia(2020) believed that the frequent occurrence of financial fraud in todays society has caused a huge impact on peoples lives, and also caused considerable damage to peoples economic interests and psychology. [3] Xue qiang (2015) believed that the survey data, showing that fraud by impersonating public security, telecommunications, post office and other departments is the most direct way to make the respondents feel the most, and it has almost reached nearly half of the respondents. The wide range of involvement and the great threat have become a public hazard to the society. The second reason is to borrow the lottery, the third ranked way of fraud is disguised as a bank website, customer service phone, in addition, there is a way to send information fraud. Taking advantage of high returns, stealing credit CARDS, identity CARDS and using new technology to commit fraud were also among the forms of financial fraud the respondents encountered. [4] Chen Jing, Ma Qiyan(2019)believed that accompanied by the increasing demand for investment and wealth management by the elderly, this group has become a hard hit area for financial fraud. For example, in 2014, a huge fund-raising fraud case in Hubei involved more than 1,000 elderly people in five places, including Shanghai. In 2016, a mega-fund-raising fraud case in Guangdong involved 16 provinces across the country, involving nearly 10 billion yuan, and more than 230,000 victims, most of whom were elderly people, even some elderly people. Many statistics show that the elderly have become the main target group for financial frauds such as illegal fund raising. Some fraud “routines” have typified characteristics, which reflects the shortcomings of some elderly financial consumers in terms of investment, wealth management and other aspects. [5]

(2)Factors Influencing Financial Fraud

Li Yuanyuan, Shan Chengyun(2020)believed that personal characteristics, family characteristics, economic characteristics, health conditions and psychological characteristics of middle-aged and elderly people are important factors that affect whether they are deceived. Among them, age and deception rate have an inverted U-shaped relationship. They live alone, have little contact with their children, and need to be children. Middle-aged and elderly people who provide financial assistance, have many financial assets, have no real estate, have debts, self-assess health, poor daily living ability, strong instrumental daily living ability, and depression are more vulnerable to deception. Among the deceived middle-aged and old people, the main factors that affect the amount of the deceived amount are personal characteristics, economic characteristics and social security conditions. Older people lose more. [6] Duan Zhenwen (2013) believed that the main influencing factors of Chinas financial security problems are Banks, credit, capital market, exchange rate and talents.[7] Wang Fudong(2020) believed that the reason for the frequent occurrence of financial frauds is that residents investment desire is growing but the investment channels are too narrow. The current situation of legal construction and economic supervision cannot meet the needs of modern markets. Residents awareness of prevention is weak. Great deception. [8]Greedy and cheap psychology, and the lack of companionship of children will affect the elderly suffer financial fraud. Therefore, make the following assumptions.

Hypothesis 1: Greedy and cheap psychology, and less company with children will have an impact on financial fraud for the elderly.

Hypothesis 2: Greedy and cheap psychology and less company with children will not affect the financial fraud of the elderly.

3.DATA ANALYSIS AND METHODOLOGY

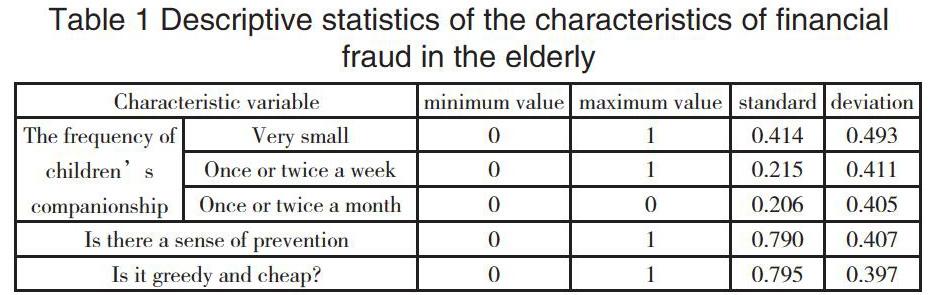

The logit model was chosen because of the extremely high probability of the factors influencing the occurrence of the model study event. In the process of studying the factors affecting the financial fraud of the elderly in silver, we speculate that the elderlys awareness of prevention, the frequency of their companionship, and whether they are cheap or not have a crucial impact on whether the elderly suffer financial fraud.

Based on the binary Logit model, the factors affecting financial fraud of silver-haired people are studied. It is preliminarily assumed that the dependent variable is whether the elderly in silver hair are financially defrauded, if they have suffered financial. For scam, define y=1; otherwise y=0. Let the probability of y=1 be p, then the probability function of y is:

f(y) = xy (1- x) 1- y , y∈ {0,1}

Where x is a function of various influencing factors, is, independent variables. The binary Logit model sets x as an independent variable as follows:

P=( exp (β0+ β1X1+ ... + βk Xk))/(1+exp (β0+ β1X1+ ... + βk Xk))(1)

Among them, β1 is the coefficient, and Xi is the independent variable, that is, the variables affecting the financial fraud of the elderly. Among them, the symbol of βi characterizes the influence of the variation of the independent variable Xi on the selection probability p. If βi is positive, then the increase of the independent variable Xi has a positive influence on the selection probability p. For (1) further deformation is available:

Ln( P(Y=0))/(P(Y=0))=β0+β1X1+ ... +βk Xk (2)

Where the left side of the equation is the logarithm of the ratio of the probability of occurrence of the event to the probability of non-occurrence (the ratio of chances). According to the right side of the equation, we can find that the regression coefficient βi is the ratio of the opportunity caused by the change of one unit of the independent variable Xi. The logarithmic change value.

The parameter estimates are obtained by maximum likelihood estimation. Based on the obtained regression equations, it is also possible to predict the probability of a silver-haired old man with certain characteristics (represented by a set of independent variable values) suffering financial fraud.

Table 1 Descriptive statistics of the characteristics of financial fraud in the elderly

4. EMPIRICAL ANALYSIS AND DISCUSSION

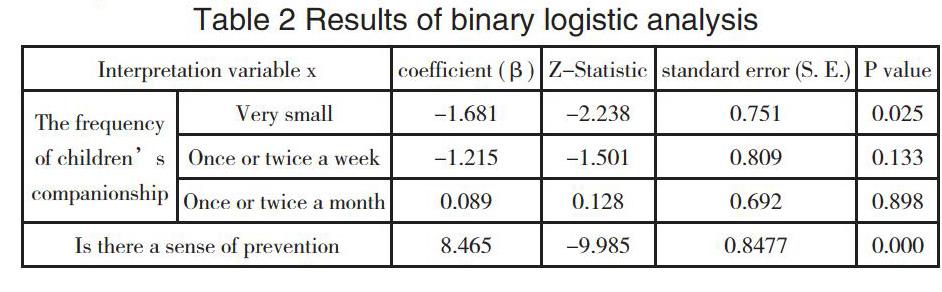

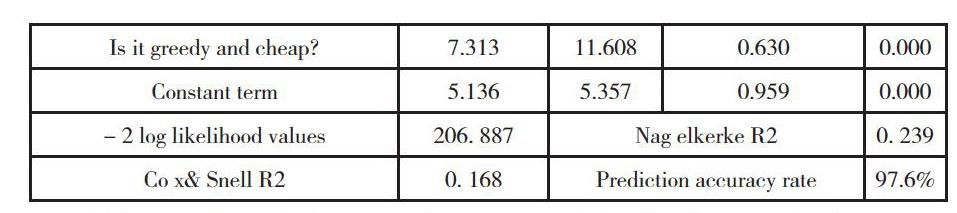

Precautionary awareness has a positive impact on the financial fraud of the elderly. The regression coefficient of this variable is -1.781 and is significant at the 5% level. This shows that older people with a stronger sense of prevention are less likely to suffer financial fraud. According to the previous theoretical analysis, there are two main reasons for this. First, the elderly have a strong sense of prevention, and they will be more vigilant about financial fraud, and will consider the scams rhetoric, thus reducing the probability of the elderly being financially defrauded. On the other hand, older people with a strong sense of prevention consciously understand the possibility of learning related financial prevention knowledge, so the older people who are more aware of prevention have a lower probability of being subjected to financial fraud.

The greedy and cheap psychology is positively affecting the financial fraud of the elderly. The regression coefficient of this variable is 7.313 and is significant at the 5% level. This shows that older people who are more greedy and cheaper are more likely to suffer financial fraud. This is the same as Xue Qiang et al. (2015) and is consistent with theoretical expectations.

The degree of companionship has no significant effect on the probability of financial fraud in the elderly. The analysis of this reason is that the children are less likely to mention relevant information in the process of getting along with the elderly.

The above empirical results confirm that hypothesis 1 is correct. It proves that the research object has a sense of prevention, small greed, low frequency of companionship, and the regression coefficient of companion frequency is one or two times per month. The greedy and cheap psychology is positively affected by the fraud of the elderly, and the prevention consciousness is negative for the elderly to suffer financial fraud.

5. FINDINGS AND CRITICAL ANALYSIS

A. FINDINGS

Survey results show the vast majority of people believe that the elderly are more vulnerable to fraud than other age groups, and half of them believe that the elderly are more vulnerable to fraud.(Figures 3, 4)Among the 906 samples collected, 81.57% of the people thought that the elderly were the most vulnerable to fraud. Two-thirds of the elderly in their homes have not encountered fraud.(Figure 5)

One of the reasons affecting the elderly by fraud is the lack of cultural level of the elderly, nearly half of the elderly are at the primary school level. More than half of the people think the most common reason is that the elderly lack the awareness of prevention and covet small and cheap.(Figure 7, 10, 13)Among the 906 questionnaires surveyed, the number of people with primary school education accounted for 48.16%.

As for the reasons why the elderly suffer financial fraud, there are many factors from the angle of the old people, the most is greedy for small advantages, accounting for about 63.8%;Secondly, the lack of anti-fraud awareness, accounts for 58.94%, and the lack of cultural level of the elderly, loneliness and lack of companionship and other reasons.

According to the survey data of the attitude of the elderly when reminding the elderly to pay attention to fraud prevention, 45.7% of the elderly hold a very acceptable attitude. The means for the elderly to acquire financial prevention knowledge are mostly television broadcasting, so the form of television broadcasting can be used in propaganda.(Figure 15)

The most common form of fraud suffered by the elderly is product fraud, such as health care products and drugs, which accounts for more than 52% of the second largest proportion of telecommunication fraud, which shows that product fraud represented by health care products and drugs is rampant.(Figure 12)

According to the questionnaire, nearly 80% of the respondents believed that more family reminders, more accompanying, and more social publicity efforts played a role in preventing the elderly from financial fraud, and about 30% of the respondents believed that strengthening supervision by relevant departments would help the elderly to prevent financial fraud.(Figure15). From those figures we can get some inspiration: preventing financial fraud should be combined with the elderly them-selves, family, social three-pronged approach, multi-joint efforts.

B. Results compared with the relevant literature

(A)Findings which are consistent with the relevant literature.

In the form of the fraud, due to the direct way of telecommunication fraud, its coverage radiates to a large number of respondents, and the harm has become a social hazard. Xue Qiang (2015) put forward survey data showing that fraud by counterfeit public security, telecommunications, post offices and other departments is the most direct way for respondents to feel. In addition, the use of high returns, embezzlement of credit cards, identity cards and the use of new technologies for fraud is also one of the forms of financial fraud that respondents have encountered. This is basically consistent with the results of the survey in this paper, which shows that the telecom fraud (telephone, SMS, etc.) accounts for about 51.1%, financial fraud ac-counts for about 43.71%, and Internet fraud accounts for 22.19%.

In the education level of the cheated elderly, the elderly with high education level have a wide range of knowledge, good discrimination ability, can deal with things calmly, and then the possibility of being deceived is low. Gao Fei (2015) pro-posed that the living conditions of the elderly with lower educational background, lower monthly income level are poor. on the one hand, they are prone to be greedy for cheap and dream of making money. On the other hand, their mental health level is lower, they are easy to produce psychological trust and dependence on the illusion of cheaters. The results show that the proportion of middle-aged and old people with high school education or above is the least, which is 17.39%. The number of people with primary school education and below is the largest, accounting for 48.16%. We have found that the elderly with low education level often lack knowledge in the management of physical health, and they do not know scientific health care methods when they have the desire to improve their physical condition. Such psychology is more likely to be implied by the meaning that “money can buy health”. But fortunately, most of the elderly are still willing to accept the education of financial prevention, which shows that in the future, we should increase the publicity of financial prevention knowledge for them.

In the form of response measures, we must strengthen the cultivation of legal awareness of the elderly in order to prevent the elderly from being cheated. Wang Yixiao (2017) believed that the state should establish a special green channel for the elderly to be deceived, crack down on public servants who do not abide by the law and enforce the law loosely, and further improve and develop the legal system. Children increase the number of communications and contacts with their parents, bringing the most direct and acceptable legal information knowledge to the elderly. Individually, the elderly should enrich their legal knowledge, oppose feudal superstition and strengthen their legal beliefs. This is consistent with the public suggestions on preventing the elderly from financial fraud shown in this survey. We should strengthen social publicity (73.73%), more family members accompany the elderly (73.51%), and improve the legal system (62.36%). Therefore, the prevention of financial fraud should be combined with the elderlys own level, family and society to work together.

(B)Findings conflict with the relevant literature

In terms of public awareness, 81.57% of people believe that the elderly are the most gullible group according to our survey results. At the same time, most people think that the elderly are cheated more seriously in todays society (53.2%). But Xu Ning(2018) put forward that “the elderly are easy to be cheated” is often the words many people like to mention after the occurrence of financial fraud. Based on this judgment, various anti fraud methods which can prevent the occurrence of fraud are summed up, but it is often against the will. In fact, it is a proposition and a misunderstanding that the elderly are easily deceived. Because most of the people who buy and use health care products are the elderly, so the people who are cheated are also the elderly, but we cant draw the conclusion that the elderly are easy to be cheated, which is the same as “teenagers are easy to be addicted to the Internet”, “unmarried young women are easy to be cheated when dating”, which can not only stand the scrutiny, but implying the discrimination and disrespect to the elderly.

Therefore, when we are seeking countermeasures, we should also try to get rid of the inherent idea that “the elderly are easy to be cheated”. Only by listening to the old peoples ideas, thinking for them, paying close attention to their health, changing filial piety into filial behavior, and providing scientific and effective maintenance methods for their health, can we fundamentally put an end to the occurrence of financial frauds.

Conclusions and Recommendations

From the statistics of the above survey, it can be known that the phenomenon of financial fraud in the elderly is quite common, and product fraud and its mania represented by health products and medicines. More than half believe that the main reason is that the elderly lack awareness and are coveting small cheap.

Through the construction of the model and data analysis, this study makes the following conclusions. First, the survey results show that the elderly have a weak sense of prevention. Among the people we surveyed, those who have been deceived often have a serious lack of awareness of information screening, have not established effective information acquisition and use habits, and have serious biases in the judgment of true and information. Second, the supervision of the relevant departments is not in place, and the financial justice system is still not perfect enough. Third, after a field visit, we found that Chinas current financial anti-fraud activities are not comprehensive, publicity and education are not enough, and publicity methods are too simple.

6. CONCLUSIONS AND RECOMMENDATIONS

From the statistics of the above survey, it can be known that the phenomenon of financial fraud in the elderly is quite common, and product fraud and its mania represented by health products and medicines. More than half believe that the main reason is that the elderly lack awareness and are coveting small cheap.

Through the construction of the model and data analysis, this study makes the following conclusions. First, the survey results show that the elderly have a weak sense of prevention. Among the people we surveyed, those who have been deceived often have a serious lack of awareness of information screening, have not established effective information acquisition and use habits, and have serious biases in the judgment of true and information. Second, the supervision of the relevant departments is not in place, and the financial justice system is still not perfect enough. Third, after a field visit, we found that Chinas current financial anti-fraud activities are not comprehensive, publicity and education are not enough, and publicity methods are too simple.

Based on the above analysis, we put forward the following countermeasures. First, from an individual perspective, the elderly need to be rich in legal knowledge, seek legal help in a timely manner, oppose feudal superstitions and strengthen legal beliefs. Family members should be more company and remind them from time to time. Second, strengthen law enforcement supervision in related industries. (1) Establishing a health food industry supervision system: Revising health food regulations, standardizing the entrusted processing of health products, improving the regulatory information system, and carrying out cleanup and update work. (2) Strengthen the supervision of the telecommunications industry: strengthen information industry management, and use industry organizations to maintain industry order. (3) Promote supervision of the financial industry. Improve related systems such as facilitating the reporting channels for the elderly and increasing penalties for fraud. Finally, from a social perspective, more publicity activities should be conducted to prevent fraud.

References

[1] Gan Li, Yin Zhichao, Tan Jijun. China Household Finance Survey Report 2014 [M]. Chengdu: Southwest University of Finance and Economics Press, 2015

[2] Wang Fudong. Analysis of the status quo and countermeasures of the crime of financial fraud [J]. Hebei Enterprises, 2020 (02): 133-135.

[3] Wu Mingxia. The impact of financial fraud risk information on economic behavior and decision-making [J]. Chinese Market, 2020 (04): 47-51.

[4] Xue Qiang. Survey on financial frauds encountered by Chinese people [J]. Financial Expo (Fortune), 2015 (11): 26-29.

[5] Chen Jing, Ma Qiyan. Financial consumption trends, problems and public management countermeasures for the elderly [J]. Modern Management Science, 2019 (03): 66-68.

[6] Li Yuanyuan, Shan Chengyun. Research on the Influencing Factors of Financial Fraud of Middle-aged and Elderly People in China——An Empirical Analysis Based on CHARLS2015 [J]. Southern Population, 2020, 35 (01): 13-26

[7] Duan Wenhui et al. Information awareness status and improvement strategies for the elderly [J], Library, 2016

[8] Wang Fudong. Analysis of the status quo and countermeasures of the crime of financial fraud [J]. Hebei Enterprises, 2020 (02): 133-135.

[9] Liu Aonan. Characteristics and prevention of financial fraud under the new situation [N] Futures Daily, 2018

[10]Wang Xinyu et al. Analysis on Risk Prevention and Governance of Rural Financial Fraud [J].Financial Education Research, 2017

[11] Zhang Lin et al. The relationship between social support and the tendency of the elderly to be deceived: an intermediary adjustment model [J]. Psychological and behavioral research, 2017

[12] Duan Bailong. Suggestions on preventing financial fraud [ N]. China County Economic News, 2016

[13] Wang Junmei. Older people are more susceptible to manipulation by financial fraudsters [J]. Chinese Journal of Social Sciences, 2016

[14] Cai Mingxi. On the status quo and effective measures of financial fraud [J]. Financial World, 2016

[15]Xu Wei et al. Social psychology based on cases of deceived elderly people [J], Chinese Journal of Gerontology, 2016

[16]Chen Jian. The Causes of Financial Fraud Cases and Countermeasures for Prevention and Control [J], Modern Finance 2013

[17]Kuang ning sheng. The Trend of Financial Fraud Crimes and Its Prevention [J].Jiangxi Social Sciences, 1999

[18] Yin Hongshan. Reflections on Anti-financial Fraud [J].Financial Times, 2006