An Unchanged Stand

By Sherry Qin

Ahead of the 13th round of bilateral trade talks between China and the U.S. in Washington, D.C., economists and entrepreneurs warned that U.S. President Donald Trump has set off a full-blown trade war by imposing several rounds of tariffs on Chinese goods, accusing China of “intellectual property theft” and sanctioning Chinese companies, thereby putting the global economy in danger.

Chinese Vice Premier Liu He led a delegation for another round of high-level consultations with U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin on October 10-11.

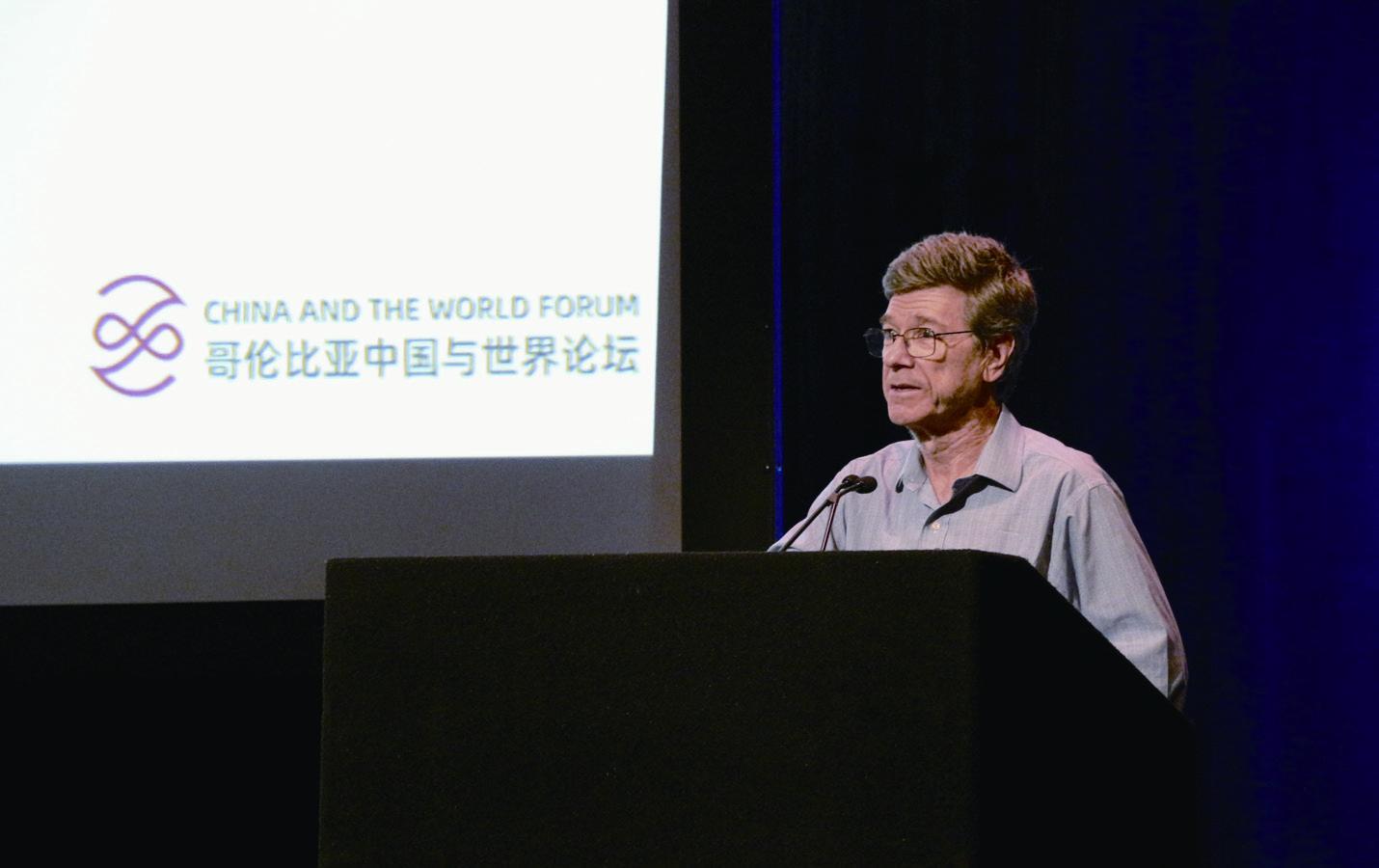

“This is not only a trade war; this is more and more looking like a signifi cant decoupling, across issues from trade, education, technology and now financial flows,” Tom Orlik, chief economist of Bloomberg Economics, said at the 2019 China and the World Forum held at Columbia University in New York City on September 28.

The thought that emerged from the forum was that with China in an economic transition, its future growth would be less dependent on exports and more on domestic consumption.

False rationale

Jeffery Sachs, a noted economist and professor at Columbia University, talked about the false rationale behind the trade war, from Trumps trade deficit theory to the America First ideology. “Economics is not a zero-sum game,” he said.

Regarding the U.S. accusation of currency manipulation against China, Sachs said, “We have laws and rules and def initions for a currency manipulator. The Treasury[Department] has set quantitative guidelines to assess that allegation. China does not qualify in any way.”

“It is a deliberate and incredibly stupid way to divide the world, for no reason other than the crazy idea that one country with 4.4 percent of the population of the world should somehow be the predominant primacy country of the world,” Sachs said.

Recently, there were also reports about the U.S. considering sanctions on more Chinese companies. Responding to them, Chinese Foreign Ministry spokesperson Geng Shuang said at a press conference in Beijing on October 8 that “by taking this move, the U.S. violates the basic norms governing international relations, interferes in Chinas internal affairs and undermines Chinas interests, which we deplore and fi rmly oppose.”

“If there is not a good feeling of political stability and trust in a relationship, then business people cant take the chance,” Daniel Rosen, founding partner of the Rhodium Group, a U.S. economic research fi rm, told Beijing Review.

While both countries have suffered from the trade war, Orlik said China has more policy room and measures compared to the U.S., since with the presidential election ahead, the opposition would prevent Trump from implementing populist measures. In September, U.S. manufacturing contracted to the lowest level in a decade.

Resolute on reform

The experts agreed that China is on an irreversible road of reforming its fi nancial market. Orlik said China has increasingly liberalized its currency exchange rate and interest rate, with a long-term trajectory toward a more accessible capital market.

In July, Chinas central bank expanded the role of foreign credit rating agencies in the bond market to free up markets in fi nancial services. The move aimed to meet the diverse needs of international investors and improve the quality of Chinas rating industry. In September, the Chinese authorities announced that quota restrictions on two major inbound investment programs—the dollar-denominated Qualified Foreign Institutional Investor program and the Renminbi Qualifi ed Foreign Institutional Investor scheme—would be scrapped to provide qualifi ed foreign investors unrestricted access to the second largest capital market in the world (See page 38).

China will soon release a national regulation on bettering the countrys business environment. It aims to establish a basic framework of norms for a business environment that treats all market players—domestic and foreign—as equals, and to provide institutional safeguards, in the form of government regulation, for investment and business operation by all types of market players.

“Introducing this regulation now is critical for consolidating our achievements in the reform of government functions in recent years. It is also a key measure for tackling the downward economic pressure and attracting more foreign investment,” Premier Li Keqiang said at an executive meeting of the State Council, Chinas cabinet, on October 8.

A new engine

Peter Walker, a former senior partner at McKinsey & Company, pointed out that Chinas economy today is mainly driven by domestic consumption, rather than trade. “The importance of exports to the U.S. to Chinas GDP has been shrinking dramatically in the last 10 years. So when we think we can hurt China by limiting its exports, its not the reality,” Walker said.

Exports of goods and services accounted for 36.04 percent of Chinas GDP in 2006, at their peak, according to the World Bank. In 2018, the weight of exports sharply declined to 19.51 percent while the GDP maintained a steady 6.6 percent growth. This year, GDP growth recorded 6.3 percent in the fi rst six months, in line with the government-announced annual target of 6-6.5 percent.

In the past 40 years, China has transformed from an agriculture-centered economy to a manufacturing-centered economy, and is poised to become a technology-driven economy in the next decade, Walker told Beijing Review.

As part of the measures to be a technology- driven economy, China is expected to invest$184 billion in 5G by 2025, according to a report by Global System for Mobile Communications Alliance.

“Chinese companies like Alibaba and Tencent and the e-commerce platforms and epayment systems they are creating are really revolutionary,” Orlik said, adding that besides digitalization, they have built platforms which enable small businesses to access markets.

Walker called the Belt and Road Initiative a critical move for China to rid its dependence on the U.S. economy. “Thinking of the magnitude of the trade flows coming out of that from the rest of the world and reinforced by the fact that the U.S. is a guild left alone, we dont have the leverage to ask socalled European allies to play hardball with China,” he said.

In Beijing, Geng outlined the Chinese position, stressing that China was not seeking to score off any country. “As is stressed many times, the nature of China-U.S. economic and trade cooperation is mutually benefi cial, and it is the same with the trade talks,” he said. “It is natural that we have differences and frictions, but the key is to properly resolve them through dialogue and consultation based on mutual respect, equality and mutual benefi t. I believe the right approach is not seeking the upper hand, but working together in the same direction.”