Investing in China Still Top Choice for Foreign Firms

Investing in China still holds great appeal for foreign investors as their top choice since the countrys economic strength and business infrastructure offer opportunities not to be missed despite trade uncertainties.

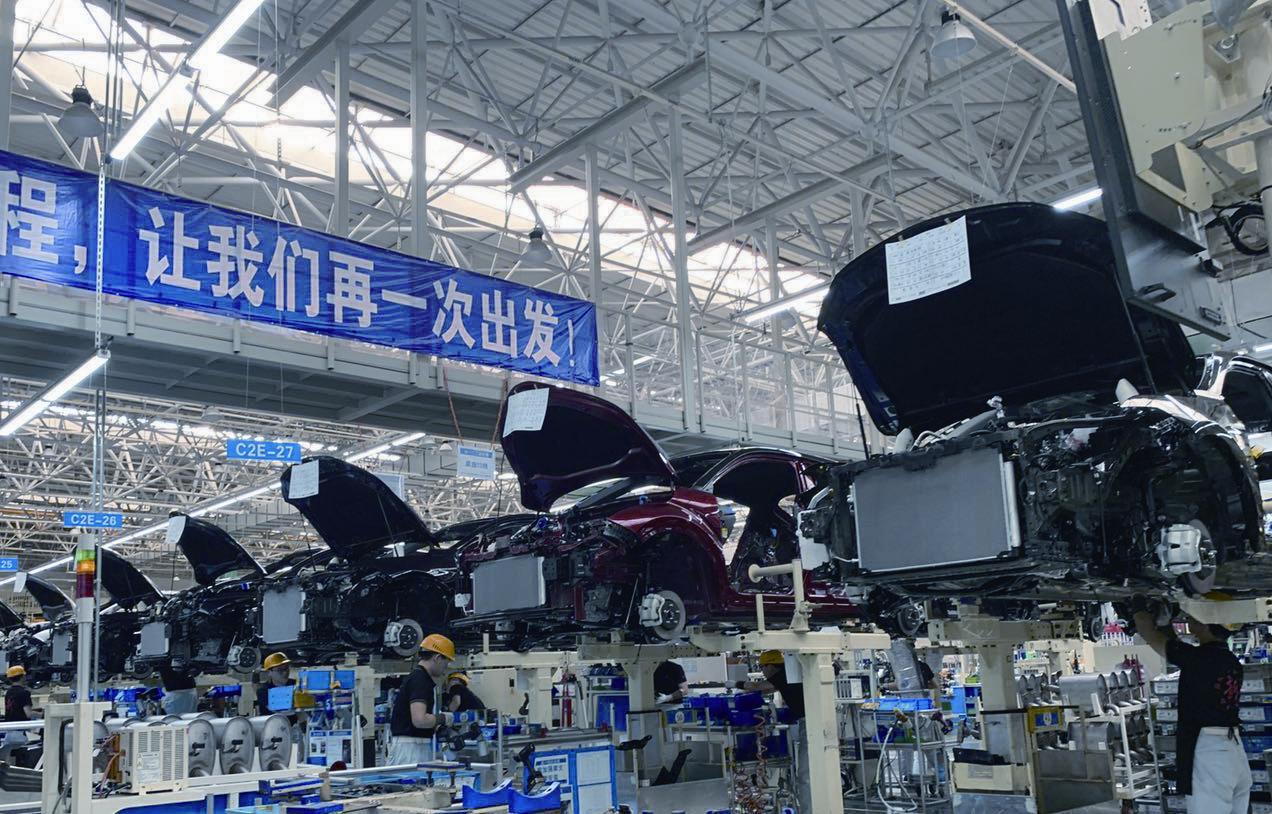

Over four decades of reform and opening up and its ascent to a global manufacturing powerhouse, China has accumulated several advantages as a destination of foreign investment.

Denis Depoux, managing partner at consulting fi rm Roland Berger Greater China, sees an “incomparable investment environment” for foreign companies in China.

An integrated industry system, efficient infrastructure, a huge domestic market, welleducated human resources, a considerable economic growth rate as well as the application of new technologies are all part of the allure of China, Depoux said.

“We see many of our clients looking into new investments in China with a different angle: how to design, develop and test new products or services in an incredibly reactive and innovation-savvy Chinese market, how to tap into the vivid innovation ecosystem to develop products faster, for the Chinese market but also for other markets,” he said.

Foreign investors have shown faith in the Chinese economy in spite of international trade uncertainties. Foreign direct investment (FDI) in China rose 6.9 percent year on year to 604 billion yuan ($84.7 billion) in the January-August period, Ministry of Commerce data showed. In U.S. dollar terms, FDI infl ow grew 3.2 percent.

Last year, Chinas FDI grew by about 4 percent, in contrast to a 13-percent slide in global FDI flows, according to a report from the United Nations Conference on Trade and Development.

European companies continue to see solid revenue growth in China, according to the Business Confidence Survey 2019 conducted by the EU Chamber of Commerce in China.

“China remains a top investment destination for most of our members, with over 50 percent of the surveys respondents planning some form of expansion in China this year,”Adam Dunnett, secretary general of the chamber, said.

The 2019 U.S.-China Business Council survey showed that for the councils member companies, the Chinese market remains a priority over other markets due to its signifi cance as a driver of revenue growth. Some 97 percent of its surveyed member companies reported increased profi tability in China in 2019.

Chinas attractiveness is partly defined by the global importance of its economy. It has been the biggest engine of global economic growth since 2006. Its foreign trade in merchandise tops the world, while both its FDI and outbound direct investment rank second.

China is also the only country that possesses all the industrial categories in the United Nations industrial classification. Its transporta- tion infrastructure leads the world, with the largest networks of high-speed railways and expressways in terms of mileage.

For decades, foreign firms have established well-functional local supply chains and hired workers, well-experienced engineers and managers in China, making it “easier said than done” to shift their business to alternative countries or regions in the short term, Depoux said.

While acknowledging that trade uncertainties do affect business confidence, he said in the long run, this will only accelerate the need for China to further localize some supplies, which will create opportunities for both domestic and multinational companies across all sectors.

The Chinese economy is presenting new prospects of profi t growth for foreign investors as it transforms to high-quality development and experiences consumption upgrade.

“For many companies, China is now their largest market,” Dunnett said. “The new areas of interest and cooperation include Chinas increasing innovation prowess, its demand for environmental technologies. European companies are all keen to be part of these developments.”

Accelerated efforts to open up the market and improve the regulatory environment are expected to strengthen foreign fi rms commitment.

Zhang Xinsheng, Executive Chairman of Shell Companies in China, said his company is benefi ting from measures to ease foreign investors access to the oil and natural gas sector.

“China has made solid and encouraging efforts to improve the business environment, which has created more opportunities for foreign investors and offers more choices to consumers,” Zhang said.

With the foreign investment law going into effect next year and the latest steps in shortening the negative list for foreign investment, setting out clearly which sectors are out of bounds for foreign investors, a significant improvement in the investment environment is foreseeable, according to Zhang Yansheng, a researcher with the China Center for International Economic Exchanges.

“We expect a possible new wave of foreign investment fl owing into China in the future,” he said.