Empirical Study of the Relations between Executive Compensation Gap and R&D Investment in Pharmaceutical Manufacturing Enterprises

AbstractObjective To study the correlation between executive compensation gap and R&D investment of pharmaceutical manufacturing enterprises in China by taking 53 pharmaceutical manufacturing companies in Shanghai and Shenzhen stock exchanges from 2015 to 2017 as research samples. Methods Multiple linear regression methods was used to study the relationship and influence between executive compensation gap and R&D investment in pharmaceutical manufacturing industry based on championship theory and principal-agent theory. Results and Conclusion There is a significant positive correlation between executive compensation gap in pharmaceutical manufacturing industry and enterprise R&D investment. Listed pharmaceutical manufacturing enterprises should design reasonable salary gap between senior executives and carry out reasonable research and development activities to promote the sustainable development of pharmaceutical manufacturing enterprises. This study provides theoretical basis for optimizing executive compensation gap and increasing R&D investment in pharmaceutical manufacturing industry.

Keywords: executive compensation gap; R&D input; pharmaceutical manufacturing company

The arrival of the economic era will further promote the construction of China’s innovation. As the main body of national innovation, the senior managers of enterprises are the actual operators of innovation.Dominating the production and operation of enterprises, senior executives are the decision-makers of research and development (R&D) investment in enterprises. The amount of R&D investment in enterprises is also determined by them. In recent years,salary incentive has become more and more important in improving business efficiency and R&D efficiency.With the continuous increase of salary, the pay gap is changing among managers at different levels. The economic consequences caused by the salary gap have attracted the attention of relevant departments and academia[1]. At the present stage, the main body of R&D investment is mainly concentrated in high-tech enterprises such as information technology, biological medicine and chemical industry. Compared with other industries, the disclosure of R&D expenses of pharmaceutical manufacturers is consistent and more complete. Therefore, studying the relationship between executive compensation gap and R&D investment at the level of pharmaceutical manufacturing enterprises has certain theoretical reference value and practical significance for promoting the independent innovation ability of pharmaceutical manufacturing industry.

1 Literature review and research hypothesis

The studies of foreign scholars Goel & Thakor(2008) and Kini & Williams (2012) show that salary gap can increase R&D investment in enterprises[2].Goel & Thakor (2008) thought that in order to win the tournament competition, the management tended to choose the investment projects with higher risks[3]. Wang Dongqing and Guo Xiang(2016) studied from the perspective of tournament theory and manager power theory, and their research showed that the increase of salary gap would increase R&D expenditure in enterprises[4]. Wei Wei and Zhang Shukai (2015) took 509 manufacturing enterprises in SME and GEM board as samples, and the results showed that the increase in the gap of executive compensation would reduce the R&D investment in small and medium size enterprises, and the gap of executive compensation had a negative correlation with the R&D investment in enterprises[5]. Gong Na and Liu Qingquan (2015) took the private listed companies in China in 2012 as research samples, and they found that the salary gap made senior executives prefer risks. It means that the increase in the salary gap of senior executives in private listed companies will greatly increase the investment in research and development of enterprises[6]. Ran Qiuhong and Liu Pingfen (2015) took non-financial listed companies in Shanghai and Shenzhen stock market as research samples, and their research showed that the internal compensation gap of senior management teams was negatively correlated with R&D investment.Besides, the degree of product market competition would strengthen the negative impact of internal compensation gap of senior management teams on R&D investment in enterprises[7].

The R&D is the core competitiveness of an enterprise. Since senior executives are the decision makers of the research and development of an enterprise, the reasonable executive compensation gap is an important factor affecting the investment in research and development. The tournament theory holds that managers are the competitors of the tournament, and the pay gap of executives at different levels is the prize of the game for enterprises. The executives who are promoted to a higher level are the winners of the competition, and they can get all the bonuses when they win. In order to obtain promotion opportunities and higher salaries, senior executives will pay more attention to their work. Therefore, they will improve the company’s core competitiveness and optimize the allocation of resources. Motivated by the gap in executive compensation, senior executives will work hard to formulate long-term strategic goals with passion and creativity. Therefore, they will attach great importance to research and development with big investment. According to the tournament theory, the salary gap will increase with the promotion of ranks[8].As the pay gap widens, executives keep setting goals to reach the winning end of the tournament. The salary gap will stimulate the enthusiasm of senior executives who will increase the investment in the research and development of the enterprise. They strive to improve the economic value of enterprises to maximize shareholder value. Therefore, hypothesis 1 is proposed in this paper.

Hypothesis 1: the salary gap of senior executives in pharmaceutical manufacturing industry is positively correlated with R&D investment. The greater the salary gap of senior executives in pharmaceutical manufacturing industry is, the larger the R&D investment of enterprises will be.

Because of the separation of ownership and management rights of the enterprise, senior executives are the actual managers to fulfill enterprise’s goals and realize its social value. In the principal-agent theory, the owner of the enterprise is the principal,while the manager of the enterprise is the agent. The former wants to maximize profits, while the latter wants to maximize his own interests during his tenure of office[9]. Because of information asymmetry,managers tend to run enterprises in ways conducive to them. Therefore, it is important to design a reasonable executive compensation system to measure the marginal output value of executives. As a sunrise enterprise, pharmaceutical manufacturing company has such characters as large investment amount, high risk, long return time, high risk and uncertainty in R&D. Therefore, a large number of senior executives are required to formulate R&D strategies jointly. On one hand, the salary gap will have negative influence on executives because they think that their efforts and gains are not matched. Therefore, they are less willing to take the risk of R&D of enterprise. In addition, the unsatisfied executives will not pay attention to the overall interests of the enterprise. As a result, they will not work passively, which will inevitably hinder the R&D investment of the enterprise. On the other hand,upper echelon theory puts forward that executives are the strategic decision makers of enterprise.However, the complexity of the internal and external environment will limit the managers’ cognition, and it is impossible for them to have a comprehensive understanding of enterprise. Therefore, the R&D of an enterprise inevitably needs team collaboration of senior executives, such as their professional knowledge and management skills. When a large gap in executive compensation is formed among senior executives, it will reduce their willingness to cooperate, affecting the strategic choice of R&D and the profit of enterprises.Therefore, this paper proposes hypothesis 2.

Hypothesis 2: there is a significant negative correlation between executive compensation gap and R&D investment in pharmaceutical manufacturing industry. The higher the executive compensation gap in pharmaceutical manufacturing industry is, the smaller the investment in R&D will be.

2 Sample selection and variable definition

2.1 Sample selection and data sources

In this paper, A-share listed pharmaceutical manufacturing companies in Shanghai and Shenzhen stock exchanges with large R&D investment and relatively complete information disclosure are selected as samples. Regarding the continuity and delay of executive compensation and R&D investment, three years from 2015 to 2017 are selected as the research period. As to the accuracy of the data, the following process is carried out on the data. Firstly, data of ST and ST* are deleted. Second, data with incomplete information such as unclear investment in R&D and executive pay gaps are eliminated. In the end, the number of samples is 53, which is processed through SPSS21.0 and Excel software.

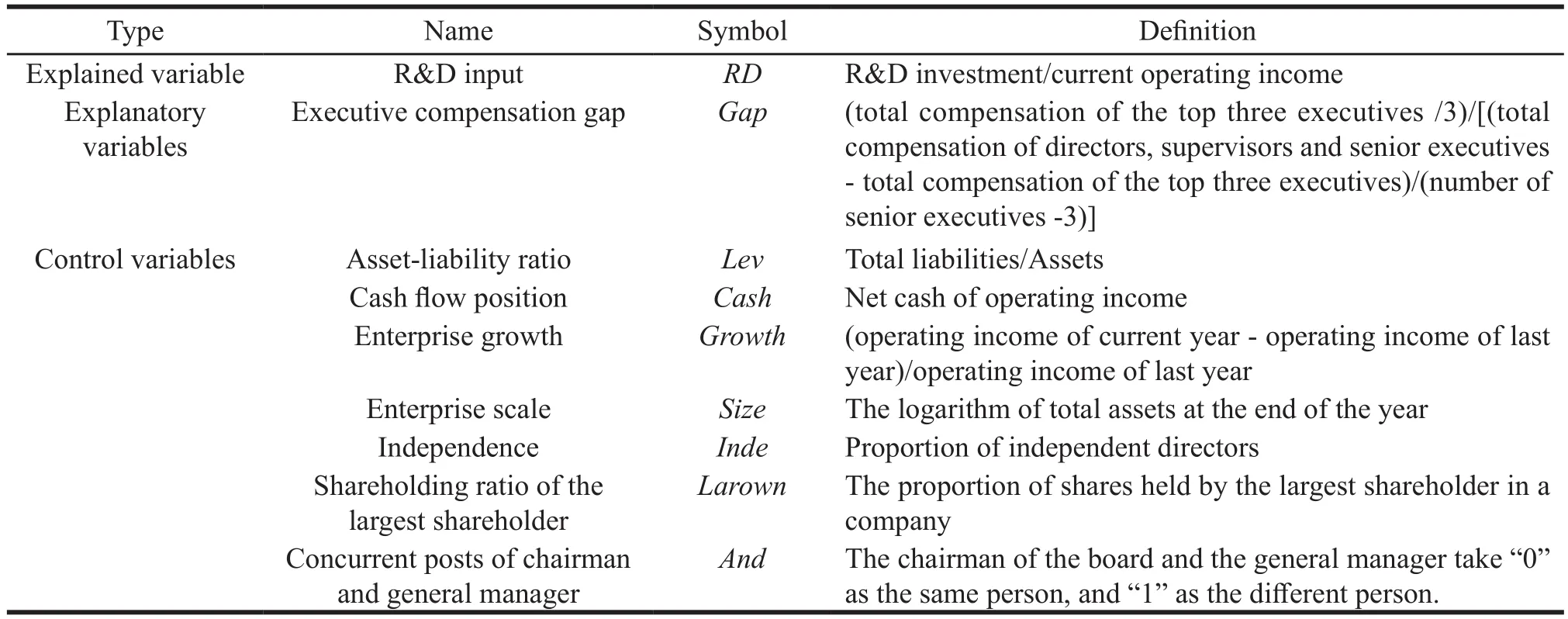

2.2 Variable definitions

Independent variable is the executive compensation Gap. There are three definitions of executive compensation gap in China. First, the third or fifth executive manager’s pay is used to make a comparison with of the rest of the executives’ salaries.Second, logarithm of the subtraction of the third or fifth executive’s salary by the total executive compensation is taken. Third, compare the CEO’s salary with the total executive compensation, and the executive compensation gap is calculated. This paper uses the first method to calculate the executive compensation gap. That is, the average executive compensation of the top three is compared with the total average executive compensation. The larger G is, the greater the gap in executive compensation will be.

Dependent variable is the investment of R&D.The indicators of R&D investment include R&D investment/current operating income, R&D investment/total assets, R&D investment/market value, and the natural logarithm of R&D investment. According to China’s revised Accounting Standards for Enterprises No. 6 - Intangible Assets in 2016, the research and development input selected in this paper includes capitalized expenditure and fee-based expenditure.That is the total of the development expenditure of the balance sheet and the research and development expenditure of the income statement. At the same time,research and development input is highly correlated with current operating income. Therefore, this paper selects research and development input/current operating income as the measurement index.

According to the existing literature research,this paper introduces capital structure, company growth, enterprise size, cash flow status and others as the control variables of the multi-linear model. The specific contents of variable definitions are shown in Table 1.

Table 1 Variable definitions

3 Model construction and empirical analysis

3.1 Model building

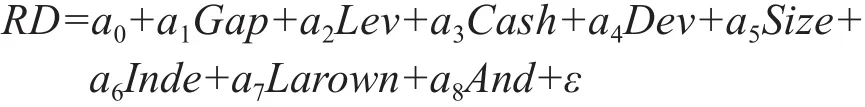

In order to study the impact of executive compensation gap in pharmaceutical manufacturing industry on R&D investment in an enterprise, this paper uses statistical software SPSS21.0 to establish the following model based on theoretical analysis,assumptions and variable definitions:

3.2 The empirical analysis

3.2.1 Descriptive statistics

Descriptive statistical results of main research variables are shown in Table 2. According to the data, the minimum value, maximum value and mean value of R&D investment in the pharmaceutical manufacturing industry are 0, 0.09314 and 0.0155.It can be seen that the amount of R&D investment in China varies greatly. The minimum value of executive compensation gap is 0, the maximum value is 12.8284, and the mean value is 7.8092, indicating that the executive compensation gap in China’s pharmaceutical manufacturing industry is large.

Table 2 Main descriptive statistics

3.2.2 Correlation analysis

The correlation between variables is shown in Table 3. Research and development investment in pharmaceutical manufacturing industry is positively correlated with executive compensation gap.Moreover, the difference between the R&D investment of pharmaceutical manufacturing industry and the executive compensation has passed the significant test of 0.01, which indicates that the greater the gap between the executive compensation of pharmaceutical manufacturing industry is, the larger the enterprise’s R&D investment will be. In other words, the gap in executive pay in pharmaceutical manufacturing helps companies invest more in research and development.

Table 3 Pearson correlation coefficient of variables

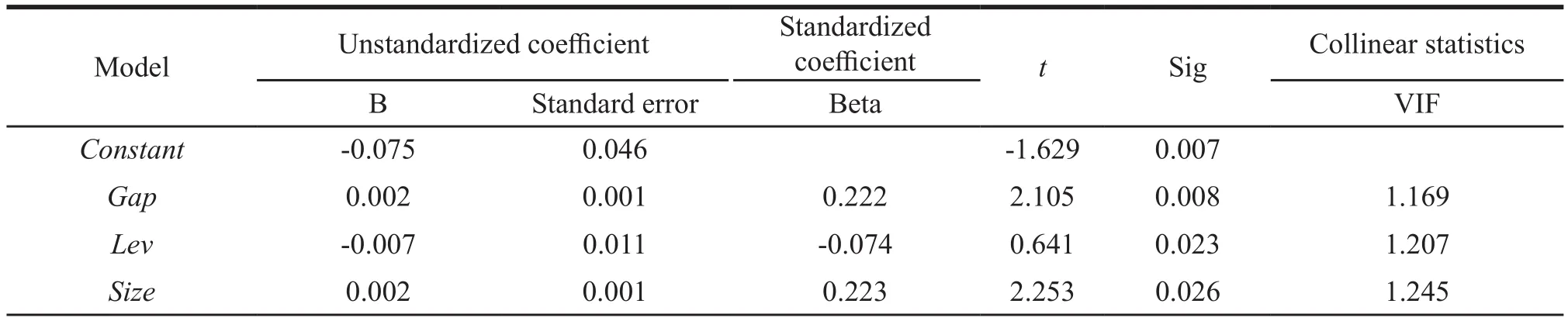

3.2.3 Multiple regression analysis

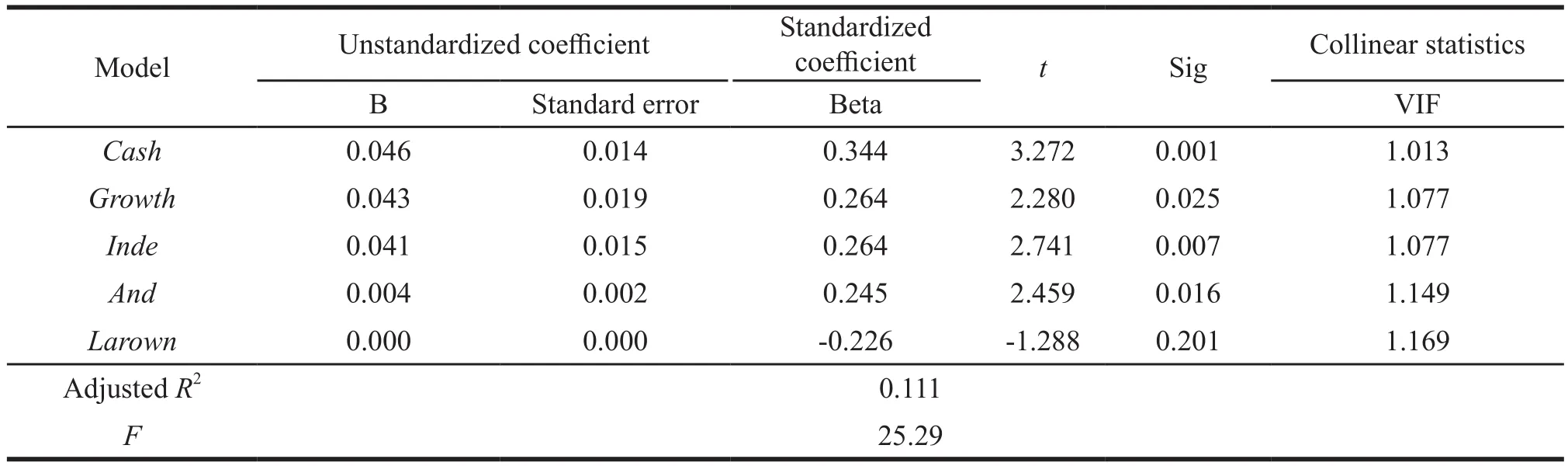

Table 4 is the regression result analysis of executive compensation gap of pharmaceutical manufacturing industry on R&D investment in an enterprise. It can be seen from the table that the goodness of fit of the adjusted equation is 0.111,indicating that 11.1% of the change of the independent variable of the equation of R&D investment can be explained by the independent variable. All the Sig values in the table are less than 0.05, indicating that the independent variables and control variables of the whole model can affect the R&D input of the enterprise significantly. At the same time, the impact coefficient of executive compensation gap and R&D investment in pharmaceutical manufacturing industry is 0.002, which is greater than zero, indicating that executive compensation gap in pharmaceutical manufacturing industry has a significant positive correlation with R&D investment. It means that the greater the executive compensation gap in pharmaceutical manufacturing industry is, the larger the enterprise R&D investment will be. So null hypothesis 2 is not true, and hypothesis 1 is true. Meanwhile, VIF in the table is all less than 2, indicating that there are no common influencing factors among variables.

Table 4 Regression analysis of executive compensation gap and R&D investment in pharmaceutical manufacturing industry

Continued Table 4

4 Research conclusions and suggestions

This paper takes A-share listed pharmaceutical manufacturing companies in Shanghai and Shenzhen stock exchanges from 2015 to 2017 as research objects, and tests the relationship between executive compensation and R&D investment in pharmaceutical manufacturing industry on the basis of principalagent theory and tournament theory. It is found that the gap of executive compensation in pharmaceutical manufacturing industry is positively correlated with R&D investment, which indicates that tournament theory is more suitable for the management practice of pharmaceutical manufacturing industry than principalagent theory. The above conclusions have guiding significance for optimizing the executive compensation gap in China’s pharmaceutical manufacturing industry. At the same time, based on the above research conclusions, this paper also puts forward the following suggestions for the executive compensation gap in pharmaceutical manufacturing industry. First,the executive compensation gap in pharmaceutical manufacturing industry is positively correlated with the R&D investment of enterprises, but this gap should be moderate. Due to the high risk of R&D investment,it is necessary to increase executive compensation and maintain a certain gap. Second, at present, compared with some foreign-funded enterprises, investment in R&D in China’s pharmaceutical manufacturing industry is far from enough, leading to a lack of core competitiveness of enterprises. Therefore, China’s pharmaceutical manufacturing enterprises should improve their technological innovation ability to stimulate the development of enterprises. Thirdly,listed pharmaceutical manufacturers should formulate reasonable salary indicators, disclosing the complete information of executive compensation gap to improve its transparency so that the executives can learn the detailed information of the compensation gap in time. Then they can run enterprises with passion and confidence. Fourth, the executive compensation gap and the R&D investment of enterprises in pharmaceutical manufacturing industry will be affected by the management environment of enterprises. Therefore, enterprises should have reasonable governance methods to provide better guarantee for their R&D investment and improve their independent innovation ability continuously.

- 亚洲社会药学杂志的其它文章

- Information for Authors

- Regulation of Drug Clinical Trials in China: Course and Development Trend

- Pharmacy Service in Private Hospitals: Problems and Countermeasures

- Licensed Pharmacists in Pharmaceutical Retail Enterprises in China:Problems and Countermeasures

- Analysis of the Current Situation of Active Pharmaceutical Ingredient (API) Export in China

- Risk Control Strategy in the Research and Development of Pediatric Drugs