Analysis of the Southern China Tilapia Production and Economic Benefits of Different Breeding Patterns in 2018

Lirong BAI Dahui YU

Abstract Cost-benefit analysis and breakeven point were used to analyze the production cost and economic benefit of tilapia pond monoculture and polyculture. From the aspects of tilapia production and economic benefit, this paper summarized the current production status and the characteristics of tilapia industry development and analyzed its developing trend. The results indicated that feed cost, pond rates and labor cost are the main production costs, and the production cost of polyculture is significantly lower than that of monoculture. Through comparative analysis, it is proposed that the tilapia industry should be reasonably guided to the intensive, standardized and pollution-free direction. Specifically, it is necessary to improve the coverage of improved varieties, strengthen disease prevention and control and promote the healthy farming model of tilapia. We also should strengthen the training of tilapia production techniques and the quality and safety testing of tilapia products, and accelerate the development of tilapia industrialization, so as to promote the sustainable and healthy development of tilapia industry.

Key words Tilapia; Breeding pattern; Production status; Economic benefit; Development trend

Tilapia has been listed as one of the six major human foods by the Food and Agriculture Organization of the United Nations. The demand for tilapia in the international market has increased year by year. Tilapia culture is one of the industries with higher efficiency in Chinas aquaculture industry. Its development not only can achieve the effects of providing consumers with high-quality animal protein, ensuring national food safety, increasing employment opportunities, increasing fishermens income and increasing foreign exchange earnings, but also can promote the development of related industries such as feed and refrigeration, processing, physical distribution and fishery equipment of aquatic products[1]. In 2003, the tilapia industry was identified as a dominant industry by the Ministry of Agriculture. China has become the worlds largest producer of tilapia in the world for many years. In 2018, Guangdong Province, Guangxi Zhuang Autonomous Region, Hainan Province and Fujian Province were still the main tilapia breeding areas. In addition, Zhejiang, Hebei, Henan, Shandong, Sichuan, Liaoning and other places also culture tilapia in a certain scale. The culture methods include pond culture, cage culture, flow culture and reservoir culture. Among them, the proportion of pond culture is the highest, and the culture modes mainly include monoculture, polyculture and comprehensive management[2].

In recent years, due to the effects from the competition of tilapia export trade and the bacterial diseases in adult fish culture, the volume of purchase of raw fish in tilapia processing plants has decreased[3], and the quality standards for products exported to Europe and the United States have been continuously improved[4]. As a result, the production cost of tilapia continues to rise, and the farming risk also shows an upward trend. The economic benefits of tilapia aquaculture production continue to decline, and the enthusiasm of farmers has been affected. Some farmers reduce the fry input, and even begin to culture other species, which has seriously affected the sustainable development of tilapia industry. Based on the field research data of main tilapia producing areas in China, this paper made a preliminary analysis on the production situation of main tilapia producing areas in China, the impact on the market supply, the production tendency and causes, and the production cost and benefit, and put forward the problems and countermeasures in the development of tilapia industry.

The Production of Tilapia in the Main Producing Areas and the Impact on Market Supply

The production of tilapia in the main producing areas

In 2018, the amount of produced tilapia and the income in the main producing areas were the highest in Guangdong Province, which were 5 327 921 kg and 44.63 million yuan, respectively, and the lowest in Fujian Province, which were 104 114 kg and 890 000 yuan, respectively. The comprehensive price was the highest in Guangxi Zhuang Autonomous Region, which was 9.76 yuan/kg (Table 1).

The impact on market supply

Concentrated aquaculture production areas restricts consumption and circulation

At present, the aquaculture production areas of tilapia are too concentrated, mainly concentrated in Guangdong, Hainan, Guangxi Zhuang Autonomous Region, Fujian Province and Yunnan Province. The production of tilapia in these provinces far exceeds local demand[5-6]. Meanwhile, the demand for tilapia in Sichuan, Inner Mongolia, Qinghai, Liaoning and other inland areas is relatively high. Due to restrictions on the transportation and sales of tilapia, tilapia products are more expensive in inland areas. However, in these areas, due to the price reasons or the purchase time limit, the sales of tilapia are relatively lower, which restricts the sales and circulation of tilapia products.

The export market is too concentrated, and the ability to withstand market risks is weak

Tilapias export markets in China are too concentrated, mainly including United States, Mexico and Russia. The huge demand in the international market has prompted the rapid development of Chinese tilapia industry. At present, the sales of tilapia are mainly in the international market, and more than 70% of the total tilapia production is sold to the international market. Chinas tilapia industry has always relied on the development model of the international market as the leading basis for aquaculture production. The processing plants mainly purchase tilapia according to the orders of foreign distributors for simple product processing. As a result, the profits of Chinas tilapia industry are greatly restricted by foreign investors. The excessive concentration of export markets is not conducive to resisting the risks of the international market, which seriously restricts the healthy and sustainable development of tilapia industry.

Tilapia Production Costs and Benefits

To scientifically reflect the overall production situation of tilapia, this study used random sampling to acquire micro production and management data of tilapia pond culture in main producing areas in 2018, and analyzed the production costs and economic benefits of different tilapia pond culture modes. The results provide a theoretical basis for assessing the economic benefits of tilapia industry.

Analysis of production cost in tilapia culture

The cost of tilapia farming is divided into fixed cost and variable cost. The total fixed cost does not change with the change of output, and the total variable cost is proportional to the output. The fixed cost includes the depreciation of equipment and the salary of management personnel. The variable cost includes the fry fee, feed cost, medicine cost, water quality regulator cost, labor cost, pond rates, fuel cost, sales expenses, etc.[10]. The production cost of tilapia is affected by nature, ecology, social and economic condition, aquaculture area, aquaculture scale, aquaculture technology and management experience. The production costs of different farming modes are also different.

In this study, the production costs of two different culture modes were evaluated and compared, using the research examples in the main producing areas.

Monoculture mode

The monoculture mode of tilapia pond culture is mainly distributed in the four main producing areas in southern China. The economic development levels of different provinces are different, and there are also some differences in the cultivation and management level of tilapia, as well as in production costs. Through on-the-spot investigation, the costs of tilapia pond monoculture in the 4 provinces were calculated with 6 months as a culture cycle. It was found that the average output of monocultured tilapia in the main producing areas in 2018 was 16 355 kg/hm2, and the production cost was about 135 900 yuan/hm2.

In 2018, the average outputs of tilapia in Guangdong, Guangxi Zhuang Autonomous Region, Hainan Province and Fujian Province reached 16 605, 15 790, 16 490, and 16 535 kg/hm2, respectively, and the production costs were about 130 687, 144 759, 130 520, and 137 470 yuan/hm2, respectively. The profits were about 22 079, 25 773, 42 625 and 17 959 yuan/hm2, respectively, and the monoculture mode can reach breakeven when the sale prices reached 7.9, 9.2, 7.9 and 8.3 yuan/kg, respectively. Among the four main producing areas, the cost of tilapia farming in Guangxi Zhuang Autonomous Region was the highest, which was probably due to the lack of advanced farming techniques, and the lowest cost of tilapia farming in Hainan Province might be due to its higher tilapia farming level (Table 2).

In the monoculture mode, the feed cost, pond rates and labor cost accounted for more than 88% of the total cost of aquaculture production, and were the most important production expenditure items, of which the proportion of feed cost was the highest in the production cost (70%-76%). The fry fee, pond rates, utilities, fuel cost, labor cost and others accounted for 24% to 30%. Comparing the proportions of culture cost in total cost in the main producing areas, it can be found that Fujian Province had the highest proportion of feed cost in production cost (75.75%), probably because most tilapia feed plants are located in Guangdong Province, resulting in higher feed transportation cost which correspondingly increases the farming cost of tilapia. The fry fee in Guangxi Zhuang Autonomous Region was higher, which might be due to that there are a small number of large fry farms in the region, and most of the tilapia fry are transported by air from Hainan and Guangdong provinces, resulting in higher transportation cost for tilapia culture in Guangxi Zhuang Autonomous Region, which correspondingly increases the production cost of tilapia culture. In Guangdong Province, the pond rates accounted for the highest proportion of the production cost (13.24%), and the proportion of labor cost was also the highest (7.61%). Due to the relatively developed economic level in Guangdong Province, the pond rates and labor cost were higher (Table 3).

Polyculture

With the increase in production costs such as labor cost and pond rates, the profit margin of the farming mode using the full-price compound feed is compressed, and farmers are less motivated, so the tilapia fry input is affected to some extent. Some farmers adopt the polyculture mode to withstand the risk of farming, and the output per unit area has increased by about 25%. The tilapia polyculture is to mix tilapia with Litopenaeus vannamei, Colassoma brachypomum, Cyprinus carpio, Carassius auratus and the four major Chinese carps (Mylopharyngodon piceus, Ctenopharyngodon idellus, Hypophthalmichthys molitrix, Aristichthys nobilis). Polyculture is mainly adopted in partial farming areas among the main producing areas of tilapia including Guangxi Zhuang Autonomous Region, Guangdong Province, Hainan Province and Fujian Province, and rarely distributed in the farming areas such as Hebei Province and Henan Province. In 2018, the average output of tilapia polyculture in the main producing area was 15 440 kg/hm2, and the average production cost was about 126 100 yuan/hm2.

The average outputs of tilapia in Guangdong, Guangxi Zhuang Autonomous Region, Hainan Province and Fujian Province in 2018 were 16 055, 13 511, 15 989 and 16 205 kg/hm2, respectively, and the average production costs were 129 900, 129 560, 115 985 and 128 842 yuan/hm2, respectively. The profits were about 19 412, 17 710, 51 900, 29 967 yuan/hm2, respectively, and the polyculture mode can reach breakeven at the guaranteed prices of 8.0, 9.6, 7.3 and 8.0 yuan/kg, respectively. In the polyculture model, the farming cost of tilapia in Guangdong Province was the highest, and the farming cost of tilapia in Hainan Province was the lowest (Table 4).

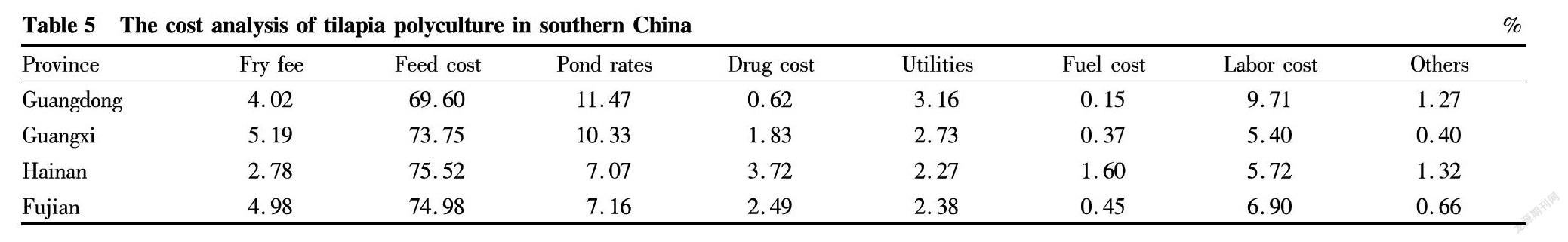

In the polyculture mode, feed cost, pond rates and labor cost still accounted for a large proportion, and these three items accounted for more than 88% of the total aquaculture production cost together, each accounting for 70%-76%, 7%-12% and 5%-10%, respectively. The proportions of aquaculture cost items in the total cost in the main producing areas showed that the proportion of feed cost in the production cost in Hainan Province was the highest, at 75.52%; the proportions of pond rates and labor expenses in the production cost in Guangdong Province were the highest; and the proportion of fry fee in the production cost in Guangxi Zhuang Autonomous Region was the highest, at 5.19% (Table 5).

Situation and Existing Problems of Tilapia Production

Situation and tilapia production

Low coverage of improved varieties, and the varieties tending to be single

Tilapia fry are the key factor restricting the development of their industry. The quality of fry directly determines the production and quality of tilapia. Due to the complex sources of tilapia parents, the quality of tilapia germplasms varies greatly. The tilapia fry system is not perfect, the level of improved fry is not high, and the coverage of improved varieties is generally low[7]. In addition, after years of research on tilapia breeding and variety selection, it is found that the growth rate of tilapia is significantly better than that of other cultured species; and except Hainan Province, Yunnan Province and a few inland provinces, tilapia culture in other regions is mainly based on the JIFT strain in several years. It is estimated that the proportion of JIFT tilapia is as high as 80% or more[1], which leads to the cultured tilapia breeds being too single to meet the market demand.

Poor farming techniques and lack of safety supervision

The production of tilapia is mainly based on cooperatives and farmers. The production techniques are relatively backward, and the awareness of operation norms is not strong. The farming techniques and management are extensive, and have the problems of blindly pursuing production and not paying attention to quality. There are certain deficiencies in screening for high-quality fry, selection of feed production, water quality monitoring, disease prevention and control, and quality and safety control of pollution-free products, resulting in uneven quality of tilapia products. Moreover, due to the impact of tilapia market prices, in order to reduce farming cost, some areas adopt the traditional integrated aquaculture mode, the production management of which is not standardized and faces the problems of over-dosing and multi-class abuse of antibiotics. Some small tilapia processing plants lack effective drug residues and microbiological testing systems, and the quality and safety supervision departments are relatively weak, resulting in unsafe food safety for tilapia.

A survey of Chinas tilapia export products shows that there are significant gaps in product varieties, specifications, prices and quality with other countries. The return of tilapia products is on the rise, which also indicates that there is no effective product quality and safety supervision system in various production links including broodstock breeding, fry screening, adult fish culture, processing and circulation[8].

Low industrialization level

At present, the research, broodstock, fry, cultivation, nutrition and feed, processing and sales of tilapia industry in China are basically in an independent state[9], and the level of the industrial chain is low. The enterprises are not strong in strength, and located at an industrialization level, and there are fewer leading enterprises with leading role. All these limit the formation of tilapia industrialization pattern.

Serious loss caused by diseases

Tilapia streptococcosis is one of the bottlenecks that limit the healthy and rapid development of tilapia industry. Guangdong Province, Hainan Province, and Guangxi Zhuang Autonomous Region are areas with high incidence of diseases among tilapia culture areas. Due to the high water temperature in summer and autumn, some streptococcal diseases have appeared in some tilapia farms. The incidence in harmed farms is generally 20% to 70%, and the mortality rate is as high as 80% or more. All kinds of tilapia can be affected, and small-sized fish species and juvenile fish are more common, causing a large loss in farming. The number of resistant strains in diseased fish increases, and with the enhancement of drug resistance, the prevention and treatment effect is not good. Many farms have increased the dose of antibiotics, which can inhibit the proliferation of bacteria in the short term, but increases the load of tilapia liver and pancreas, and seriously affects the food safety of tilapia. Streptococcal diseases have a wide epidemic area and long duration, and have become the most serious disease in tilapia culture.

Problems with tilapia culture

Poor quality of cultured fry results in degradation of good traits

The improved tilapia variety and fry breeding farms in China are mainly located in Guangdong Province, and the number of produced improved JIFT and hybrid tilapia fry with a male rate over 95% is less than 1 billion, and there are only 2 to 3 parent production farms capable of producing improved tilapia with a male rate over 95%, which have the annual production no more than 200 million tails[11]. Therefore, it is estimated that the coverage of good variety and fry in tilapia culture in China is low, and the quality of cultured fry is not good. Furthermore, the selected tilapia generally undergoes significant degradation after 3 to 4 years of cultivation, resulting in slowed down growth rate, reduced stress resistance, weakened disease resistance, and decreased survival rate. The lack of tilapia fry and the degradation of germplasms severely restrict the industrialization of tilapia in China.

Farming costs continue to rise and profit margins are compressed

As the price of animal protein feedstock has been at a relatively high price, the price of tilapia compound feed has increased year by year, resulting in the continuous increase of tilapia culture cost. As a result, the economic benefits of tilapia culture are reduced, and the enthusiasm of farmers is not high. The price of commercial tilapia is affected by many factors, and the fluctuation is large. When the price of commercial fish is the lowest, the price of adult fish above 500 g/tail is only 4-6 yuan/kg, which is lower than the production cost, resulting in the loss of farming; and when the market condition is improved, the price is about 8-10 yuan/kg, and the profit for farmers is also low.

Countermeasures and Recommendations

Improving coverage of improved varieties

The variety improvement of tilapia is the focus of its industrial development. First, we should enhance the construction of improved variety bases, and actively encourage and support other enterprises and cooperatives to develop improved variety production, so as to accelerate the breeding of elite tilapia varieties. We also should strive to improve the coverage of improved tilapia varieties, regulate the production and management of improved varieties, and promote the healthy development of the aquaculture industry of tilapia.

Strengthening disease prevention and control efforts

The aquatic products and fishery functional departments should establish a long-term mechanism for the prevention and control of tilapia diseases, strengthen publicity efforts, and raise the awareness of farmers to "mainly prevent the disease and focus on prevention rather than curing the disease". Tilapia streptococcosis is the bottleneck of tilapia culture. It is necessary to strengthen the scientific research on the prevention and control technology of streptococcal diseases, and carry out systematic research from the aspects of farming mode, water quality regulation and vaccine research and development. It is also necessary to establish major epidemic disease prediction and emergency plans. Every summer is the high season of tilapia diseases, and relevant departments should issue disease warnings in advance for early prevention and early control.

Promoting healthy farming of tilapia

The polyculture techniques of tilapia with other freshwater fish can be promoted, as well as the new healthy farming modes such as "fish and shrimp polyculture", "fish and crab polyculture" and "fish and vegetable symbiosis", thereby guiding tilapia industry to develop to a scientific and standardized ecological farming mode.

Strengthening tilapia aquaculture production technology training

Functional government departments related to fisheries and aquaculture should increase investment in science and technology, improve the level of employment of farmers through technical training, and adopt a green, intensive industrialized and standardized healthy development model[12]. It is necessary to formulate a comprehensive training program for tilapia culture techniques, and strengthen multi-channel and multi-faceted training, so that aquaculture enterprises and farmers can fully grasp the technical requirements of all links of aquaculture including processing, fishing and transportation required by processing export enterprises, and the tilapia products can meet the quality and safety standards of processing and exporting enterprises.

Strengthening the quality and safety testing of tilapia products

Quality safety is a key issue in the healthy development of tilapia industry. Establishing a sound product quality inspection system will help to enhance the recognition of tilapia products in the international market, and contribute to the implementation of the brand strategy. It is necessary to promote the establishment of an operational quality and safety traceability system as soon as possible to enhance the international competitiveness of tilapia products.

Speeding up the pace of tilapia industrialization

It is necessary to further strengthen the guidance of the industrialization of tilapia aquaculture, promote the construction of the tilapia aquaculture industrial chain, and improve the framing efficiency of tilapia. We will comprehensively promote and support the preferential policies for the development of tilapia industry, and encourage aquaculture enterprises, farmers and scientific and technical personnel to participate in the shareholding cooperative enterprises of tilapia aquaculture production through various production factors such as land, aquaculture water surface, technology and capita, so as to improve the industrialization, scale and marketization of tilapia aquaculture production, maximize the benefits of tilapia aquaculture production and minimize risks.

References

[1]YUAN YM, YUAN Y, DAI YY, et al. Production status and development trend analysis on tilapia industry in 2013[J]. Chinese Fisheries Economics, 2014, (1): 149-156. (in Chinese)

[2]CHEN LS. Policy recommendations for the sustainable development of Chinas tilapia industry[J]. Scientific Fish Farming, 2011(11): 1-4. (in Chinese)

[3]YUAN YM, YUAN Y, HE YH, et al. Trend analysis on tilapia industry development in China[J]. Chinese Fisheries Economics, 2013, 31(3): 127-132. (in Chinese)

[4]ZHANG Y, JIANG GZ, ZHANG Q. The development status, problems and countermeasures of the tilapia processing exports in Guangxi Zhuang Autonomous Region[J]. Journal of Agriculture, 2013, (9): 44-49. (in Chinese)

[5]CHEN SJ, LI LH, YANG XQ, et al. Analysis of the status quo of Chinas tilapia industry and measures to improve the competitiveness of tilapia exports[J]. South China Fisheries Science, 2007, 3(1): 75-80. (in Chinese)

[6]DAI YY, YUAN YM, YUAN Y, et al. Analysis on the status quo and existing problems of Chinese tilapia distribution model[J]. Jiangsu Agricultural Sciences, 2014, 42(10): 401-404. (in Chinese)

[7]ZHANG HY, YUAN YM, HE YH, et al. Analysis and suggestions on production and trade of tilapia in China[J]. Chinese Fisheries Economics, 2015, 33(3): 95-100. (in Chinese)

[8]DI G. Discussion on the development of tilapia industrialization in China[J]. Chinese Fisheries Economics, 2002, (4): 17-18. (in Chinese)

[9]LEI GY, CAO JM, WAN Z, et al. Analysis on the status quo of the development of tilapia industry in Guangdong Province in 2008[J]. Guangdong Agricultural Sciences, 2009, (7): 240-243. (in Chinese)

[10]YUAN Y, YUAN YM, DAI YY, et al. Analysis on production cost and economic benefit of pond culture model in main producing areas of tilapia in China[J]. Jiangsu Agricultural Sciences, 2016, 44(2): 470-474. (in Chinese)

[11]WANG YM, CAO JM, CHU XL, et al. Development situation and countermeasures of Guangdong tilapia industry in 2013[J]. Guangdong Agricultural Sciences, 2014, (8): 12-16. (in Chinese)

[12]LI QY, LIU HN, WU K. Analysis and countermeasures on the characteristics and obstacles of tilapia export to European[J]. Journal of Shanxi Agricultural Sciences, 2010, 38(8): 84-87. (in Chinese)

- 农业生物技术(英文版)的其它文章

- Dynamic Monitoring and Control Measures of Spodoptera frugiperda (J.E.Smmith) in Low Latitude Plateau Sugarcane Areas

- Control Effects of a New Sex Pheromone Trap and Biological Agents on Sesamia inferens Walker and Argyroploce schistaceana (Snellen)

- Comparative Study on Grain Cadmium Content and Yield in Different Rice Varieties

- Simulation Experiment of Air Temperature Variation in Multi-film Covering at Night

- Identification of Growth-promoting Bacteria from Rhizosphere of Pastures and Their Effects on Growth of Lotus corniculatus L.

- Evaluation of Ecological Environment Quality of Typical Forest Parks