Developing Venmo Scan in Store Service in the United States

Eileen Shunyi Yu Maggie Jue Gong

【Abstract】With the increased prominence and use of technology within the society, becoming completely cardless is a trend now as well as in the future. In recent years, the emergence of cell phone payment provides a lot of convenience in people’s daily life. In China, people are able to go out without a wallet, and use Wechat or Alipay to call taxis, buy products, and so on. Therefore, we want to open a similar payment service for the U.S. market. By creating a new feature for Venmo, people can pay in store with their cell phones instead of with their credit cards or cash. The research aims to evaluate people’s attitudes and using habits of the cell phone payment. In order to evaluate this, the researchers created a 27-question survey that was released to a convenience sample to address questions concerning the preference of users regarding cell phone payment plans as well as desired features. The survey received 262 responses, which indicated that with some modifications, Venmo has some potential to be the most popular and convenient cell phone payment app in the United States.

【Key words】Venmo Scan; Store Service; the United States; The Cell Phone Payment

【作者簡介】Eileen Shunyi Yu, Maggie Jue Gong, Boston University College of Communication, M.S. in Advertising.

1. INTRODUCTION

The rapid development of the cardless cell phone payment apps changed customer behaviors with regards to credit card and cash usage in various situations. In order to attract more customers, many brands started to develop their own cell phone payment plans, which did not achieve the same popularity or success as in other countries. For example, Apple Pay, Google Pay and Samsung Pay still cannot be dominant cell phone payment apps in the market because they have restrictions on devices. Therefore, this research is going to find out the motivations and practices of consumers in order to best address their needs and help Venmo become the most popular and convenient app to use both online and in stores.

The book, Paying with Plastic: The Digital Revolution in Buying and Borrowing, analyzes how credit card have revolutionized and optimized people’s living standards. For example, it explains how economic forces and technology shaped the bank industry. Moreover, it talks about how people who work in different fields react to the credit card payment method. The book also discusses the main issues of the credit card industry in recent years, such as the dominance of VISA and Mastercard that continues to impede the development of other credit card companies (Evans, D. S., & Schmalensee, R. 2005)

According to the article An Inconvenient Apple Pay, Webster uses the research data to indicate that the consumer usage of Apple Pay is really low. Surprisingly, consumers do not worry about the safety issues of Apple Pay, but they find that there are not many stores participating. Therefore, they are happy with using the plastic cards. “No consumer interest means no merchant interest.” It becomes a downward cycle where 19 out of 20 people who have used Apple Pay before just stop using it afterwards. (PYMNT.com, Webster, K, April.10th, 2017)

In contrast, the article, When One App Rules Them All: The Case of Wechat and Mobile in China, shows that Wechat, one of the leading messaging app in China, has the app-within-an-app model, which allows consumers to pay vendors or friends using the “wallet” feature. What consumers have to do is to simply link their credit cards to the app, and they can not only use it online but also offline via QR codes at restaurants, hotels, and stores in order to transact payments. The app is so successful that nowadays, at least one out of five active Wechat users also use Wechat wallet, and the majority of stores in China has the “scan QR code to pay” service. (Chan, C, Aug.6th,2015)

1.1 Statement of Problem

This research aims to further understand the cardless market, and the development of a more comprehensive online and in-store solution based on an app. The app we chose, Venmo, already has a great number of loyal customers, which will have the advantage when we are marketing for new features.

The challenge of developing such an app combining various features involves examining both businesses and consumer insights. A lot of businesses started making their own apps for in-store scan purchases, and the big brand apps such as Apple Pay, Samsung Pay, and Google Pay have been in the market for many years around the world. However, none of these has been universally used in the United States. People still prefer to use cards and cash while using different individual apps such as Uber, Grubhub, and so on. The ideal solution is to create a platform combining all the services in one app with an emphasis on in-store scan payment. Due to the competition and difficulties to cooperate with other apps and businesses, it is difficult to create a completely new platform. And that’s one of the reason we chose Venmo. Similarly, with so many existing platforms, it is imperative to find out what drives consumers to use cell phone payment plans, and what are the concerns on the opposite side.

Hence, this research intends to understand the desired features of the cell payment plans as well as the general market possibility for such a product.

1.2 Objectives of Study

Based on the literature review, Apple Pay or Samsung Pay does not have the advantages to survive in the U.S. market, whereas cell phone payment platforms in China are relatively mature. For this research, we want to improve the disadvantages of the existing cell phone payment platforms, and find out more measurable constructs that can improve the new product within Venmo. These constructs will evaluate the effectiveness of such an app as well as the potential marketability of it.

In order to further evaluate the potential for this product and its needs, a survey was designed with the following hypotheses in mind:

What are the factors that influence people using/not using cell phone payment?

What features will impact people in the United States to use this product?

How can we improve the product based on the existing cell phone payment services?

The full proposal for this research is available in Appendix B.

2. METHODOLOGY

2.1 Approach

The methodologies of the research contain both quantitative and qualitative research. For qualitative research, we did 10 one-to-one interviews. The reason for choosing in-depth interviews over focus groups is that people tend to be affected by other people’s answers, and questions involving financial behaviors are more secret and personal. The participants are from different areas of the United States from different age groups. The purpose of the interview is to learn the in-depth thoughts of people’s general smartphone usage, credit card habits, spending habits, perception of new technology, and their experiences on the current cell phone payment apps. For the qualitative research, we created a 27-question survey on Qualtrics survey software, containing rating questions as well as multiple choice questions in order to learn the thoughts of general sample size. This survey was pre-tested by 10 individuals to ensure question comprehensibility and to prevent researchers’ bias as well. The final questionnaire is listed in Appendix D.

Respondents were gathered through online convenience sampling. The survey was released on November 9th, 2017 and closed on November 20th, 2017. The sample was actively solicited and all names or identifying information is kept anonymous to ensure participant confidentiality. Researchers recruited both interview and survey participants through emails and social media such as Facebook, Twitter, Instagram, and Wechat.

The measurable constructs of the research are :

a. Convenience

b. Accessibility

c. Variety of services

d. Promotion

e. Security

2.2 Sampling Unit

The sample unit for our non-probability sample consisted of people who used to or are currently living in the United States. Since most cell phone payment plans are available on websites, most people use it on smartphones, and the purpose of our research is to specifically expand the scan in-store service. This sample unit is broad enough for demographic purposes. For analysis, the interviews and questionnaire asked specific questions about age, race, education level, location and gender, as these factors could be relevant to the perceptions of cell phone payment plans during both qualitative and quantitative studies.

2.3 Sample Size

The survey was closed after 262 responses were obtained. Even though this sample size was not large enough to generalize on the whole population in the United States, it still provided sufficient information on trends for us to evaluate consumer insights and develop the full potential of Venmo app. The sampling frame was people who have smartphones.

3. RESULTS

3.1 Demographics

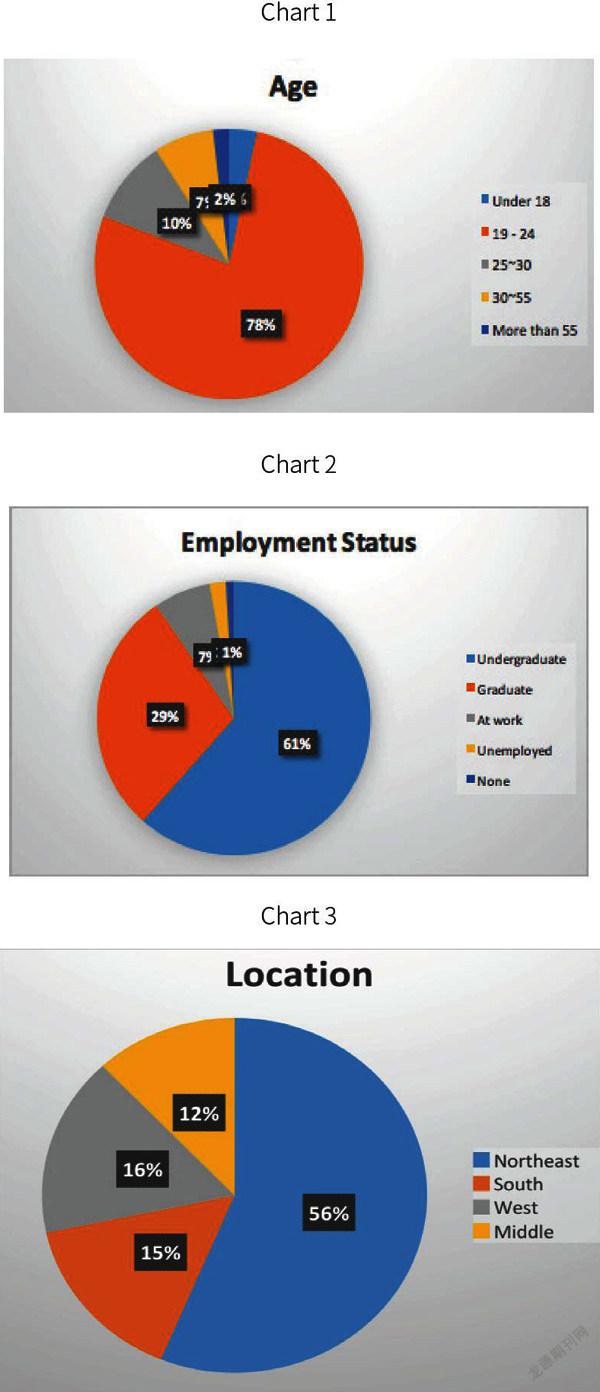

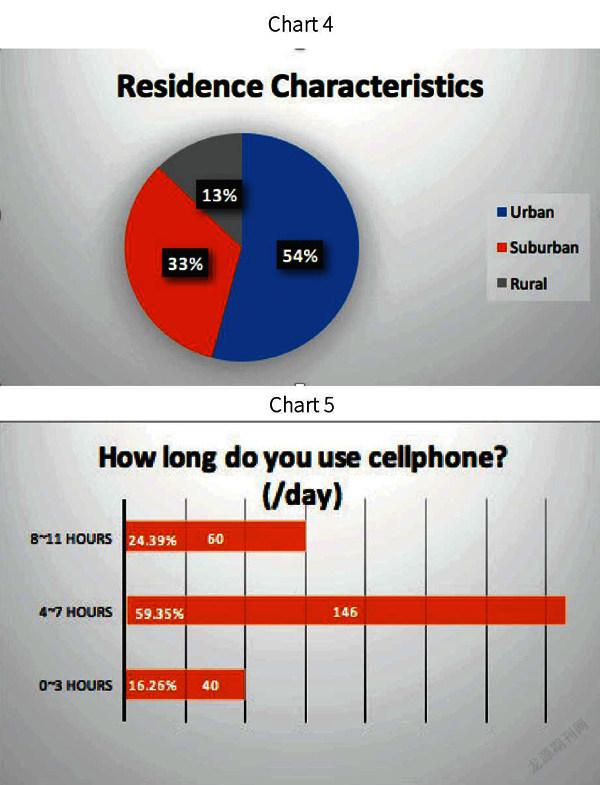

From the bar charts above, it is clear that most of the survey respondents are from a very young age group: 78% of the respondents are 19-24 years old. It is also demonstrated in the chart of “Employment Status” where 61% of the survey respondents are undergraduate students. In previous research, “Children and young adults under 25 are significant users of new information technologies.”Since younger people may be more familiar with technologies, it would increase the success rate if the new cell phone services first target young people in the United States. Similarly, the statistics shows that 54% of the respondents are living in urban areas where there are more shopping malls and stores. Also, people from urban areas are more likely to be involved in technologies, which implies that this group of people may be more fond of the cell phone payment, either online or in store. Interestingly, 56% of the respondents are from Northeast parts, whereas the number of respondents from South, West, and Middle area ranged between 12-16%. This is a limitation of the convenient sample since most of the people we reached are living in the northeast part of the United States. The sample size can be expanded for future research.

3.2 Cell Phone Using Behavior

To measure how frequent people used their smartphones and what role they played in their daily lives, we asked them how many hours they use their smartphones every day and how they use them. From Chart 5, there are 146 out of 246 people who use their smartphones 4 to 7 hours every day; both median and the mode also fall into this column. This shows that most people are familiar with their smartphones and depend on their smartphones in their lives.

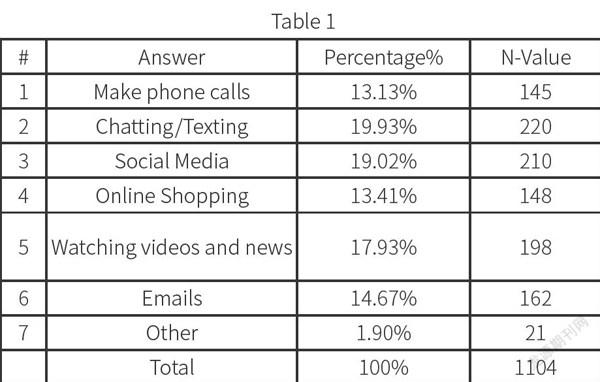

Furthermore, we asked people how they use their smartphones. According to Table 1, chatting/texting, social media, and watching videos and news are the top three choices, which matches our qualitative results that we extracted from the interviews. In addition, during the interviews, people said they chat and text via social media apps more often than via phone text. Therefore, among the top three choices, social media may be the most popular and effective platform for marketing the new services.

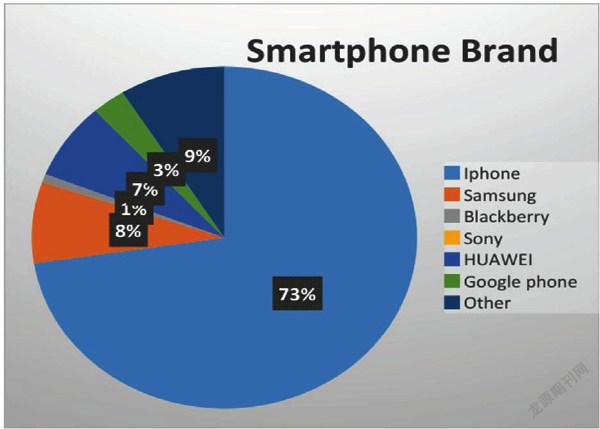

Webster (Lit review section) indicates that iPhone users who tried Apply Pay before think it is very inconvenient. However, interestingly in Chart 6, 73% of the respondents are iPhone users, which shows that if a better cell phone payment service than Apple Pay is developed and could be downloaded on iPhone, more people would likely switch from Apple Pay to the new service of Venmo.

3.3 Current Cell Phone Payment Preference

Since Webster’s research shows that most people have Iphone but not many people using it, we want to see if it is also true among our respondents. Thus, we ask the current or previous cellphone payment users that what specific cellphone payment app they use and how frequent they use cellphone payment. From Chart 7, only 13.6% respondents use Apple Pay. Therefore, Apple Pay is not very common. However, 23.92% of them use Wechat , a Chinese cellphone payment app, reflected what we found in Chan’s research that Wechat becomes popular nowadays. The second of the cellphone payment app that people use is Venmo, implying there is a big future for Venmo to develop the new payment service that allow people scan their phone in the stores. Also, from Table 2, 49.23% people often use cell phone payment. Thus, it is predictable that if cellphone payment becomes more convenient, people will use it more.

In order to find out more about the preference among current users, we aim to find out which service do they like. Thus, we ask people to value any of the six elements in Table 3 ( 0 is the least important and 100 is the most important). Most people choose transfer money to others. Since Venmo has already had the service, we would definitely keep it and improve it better.

3.4 Payment preference

From the results in “current cellphone payment preference” section, it shows that most users use the cellphone payment often and among different cell-phone payment app, most people use the ones they believe are convenient. What about people who never try the cellphone payment before?

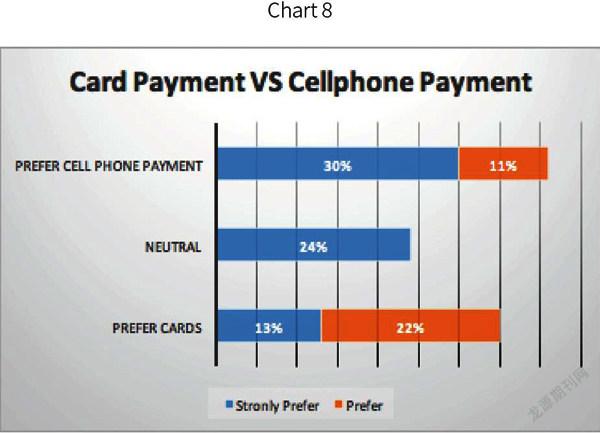

In order to find out whether the new product can attract both current cellphone payment users new users, we ask them which one do they prefer, cell phone payment or card payment. From Chart 8, 41% respondents prefer cellphone payment, and a quarter of them (30% of all respondents) are strongly prefer cellphone payment. However, only 35% people prefer cards. Therefore, since most people support cellphone payment, the new product do have potential to develop and we expect it will be a big market for it.

3.5 Factors of App Selection

Based on previous research, we came up with the constructs such as security, convenience, and promotions. Thus, it is important to find out how people value these elements. We ask people to rate any of the eight categories in Table 3 from 0-100 (0 represents the least important and 100 represents the most important). The result shows that most people value security, convenience, and number of the stores. Also, from the mean, convenience and security are the ones that people concern the most, which match the findings in qualitative research. Thus, for future development of the product, security and convenience will be the most important things that we should pay attention to.

3.6 Motivation/Promotion

Besides security and convenience, promotion is also an important construct for the research. Two multiple choice questions are developed based on motivation: What is the best way for you to receive information or promotions about the app(new service) and What kind of promotions will motivate you to do cell phone payment.

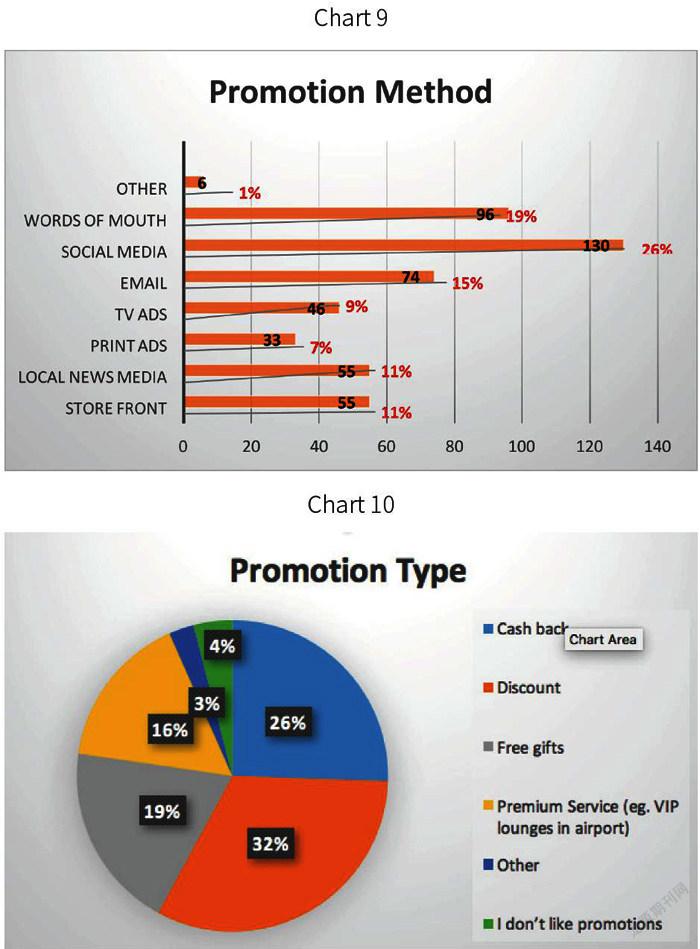

The result of the first question is shown in Chart 9. It is glad to see that 26% of people want to hear the promotion via social media, which match with the findings in Table 1 that people are mostly like to use their smartphone for social media purpose. Thus, social media would be one of the most effective way for advertising and marketing the product.

The result of the second question is shown in Chart 10. Among all promotion types, 32% of people like discount and 26% of them like cash back. Therefore, in order to attract more users, discount and cash back will be good methods.

3.7 New Features

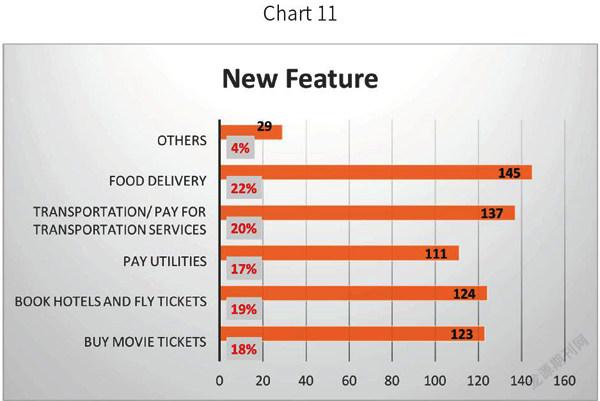

In Chan’s article, it shows how Wechat conducts the app-within-an-app model. It allows the single app to be associated with other functional apps such as travel app, and food delivery app. The model works well with Wechat, thus, we want to find out if it is also a good strategy for Venmo. We ask people what new features they are expecting in the new product. From Chart 11, the five elements have very similar percentages: 22% chose food delivery, 20% of them chose transportation services such as Uber, 18% chose movie tickets purchase, 17% chose utility payments, and 19% of them chose hotel and flight booking. Therefore, if possible, we would include all of the new features in our product.

3.8 Cross-tabulation

In order to obtain a more comprehensive understanding of the result data, the variables were examined using cross tabulations. The variables examined included are as follows:

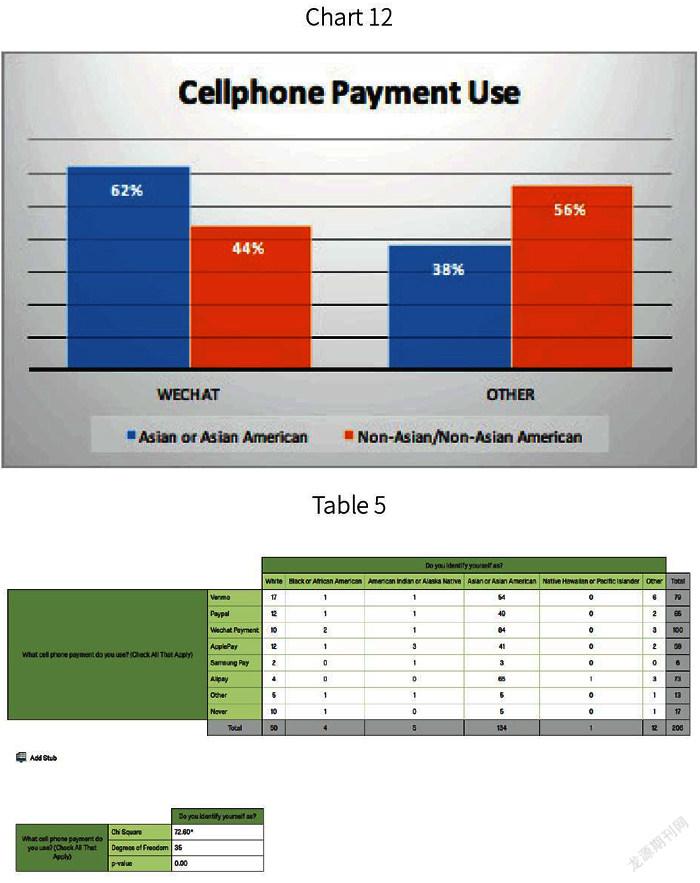

A.Is there a statistically significance of race to cellphone payment types?

(1) Race (condensed into two groups of people who are Asian or Asian American and people who are non-Asian or non-Asian American)

(2) Cellphone Payment types (condensed into two groups of people who use Wechat and people who do not use Wechat)

From Chart 12 and Table 5, it is clear that among 134 Asian, 62% of them use Wechat and 38% of them use other cellphone payment app. Among 74 non-Asian or non-Asian American, only 44% of them use Wechat. There are 56% of them use other cellphone payment App.

In table 5, the p-value is below 0.05, showing the statistically significance of race on people’s cellphone payment selection. Thus, it may be tricky for us to introduce the new product to the Asian group since they have already used a well-developed cellphone payment app, Wechat. The result also implies that it is necessary for us to learn from the advantages of Wechat and take a further step to improve them to a higher level.

B. Is there a statistically significance of new users to card payment preferences?

Users (two groups: people who use/used cellphone payment and the new users)

Payment preferences (two groups: prefer card and prefer cellphone payment)

From Chart 13 and Table 6, it is clear that among 192 current users, 67% prefer cellphone payment and 33% prefer cards and among 17 new users, 64% prefer cellphone payment and 36% prefer cards. Therefore, whether people use cell-phone payment before doesn’t affect their perspectives on cellphone payment since the two percentages are very similar. While in the cross table, the p-value is below 0.05, showing that there is a statistically significance of types of cellphone payment to the payment preference. Therefore, although new users (people who chose “Never” in table 6) is not the crucial element, others may be the significance elements.

4. DISCUSSION

4.1 Hypothesis Results

Research Question 1: What are the factors influence people using/not using phone payment?

According to our qualitative research, we came up with the constructs such as security, convenience, and promotions which value to people a lot. Later, in quantitative research, 197 of participants chose security as their priority concern with a mean of 74.14. Following with convenience with a mean of 76.48 and number of stores with a mean of 65.57. Therefore, these three factors play an significantly important role on influencing people’s choice on whether or not to use cell phone payment. Surprisingly, people are not very loyal to brand.

Research Question 2: What features will impact people in the United States to use this product?

Individuals seem to be attracted to transferring money to others feature (with a mean of 70.13 out of 100) as well as scanning in store feature (with a mean of 68.77 out of 100). This is exactly what we are expecting in our hypothesis, since Venmo is one of the most popular app to transfer money to others. And we are trying to develop the new scan in store service for Venmo. In terms of new features, based on our research, the five new features we listed have very similar percentages: 22% chose food delivery, 20% of them chose transportation services such as Uber, 18% chose movie tickets purchase, 17% chose utility payments, and 19% of them chose hotel and flight booking. Hence, if possible, we would include all of the new features in our product.

Research Question 3: How can we improve the product based on the existing cell phone payment services?

Wechat conducts the app-within-an-app model. It allows the single app to be associated with other functional apps. Not only Asians but also a lot of foreigners start to use Wechat because of its conveniency. Therefore, one of the improvement we are going to make is to improve the new features and services.Meanwhile, it’s important to improve the user-friendly interface and enhance the security level as well as cooperate with more stores in the United States. If majority of stores have cell phone payments and scan features, more people will use it.

4.2 Product Implications & Conclusion

People from 19~30 who are students or young professionals prefer using cell phone payment app than carrying cards around. According to the survey, most people prefer cellphone payment than other payment methods. Thus, it is highly possible to develop our new product. When looking at the data as a whole, it appears that people have very similar opinions no matter where they are from and regardless of their ages or gender. From the data collected, there appears to be significant needs and willingness for individuals to try this product.

Due to the restrictions of cell phone payment apps such as Samsung Pay and Google Pay, not many people use them because they don’t all have the phone required. However, most people use Venmo and Wechat which can be downloaded in all types of smartphones. Therefore, choosing Venmo as our product is a good strategy. Venmo is good to use on all the phones which should be a merit. Our product will be an upgrade version of the original Venmo, so the marketing part will not be a problem since the app has very high reputation in the United States already. Social media and words of mouth is the best way to get new users and build brand loyalty for millennials. On the other hand, cash back, discounts and free gifts are the top choices for promotion.

Focusing on developing new features listed in our research and cooperating more stores in the United States to increase accessibility can attract people to use our product. And more importantly, since there isn’t any dominant cell phone payment plan existed, Venmo has a huge market for scan in store service. Since consumers do not have brand loyalty, the only way for us to appeal new customers as well as maintain old customers is to raise security level, enhance user-friendly design and make it convenient to use.

4.3 Limitations of Study

Even though this study provides useful information, it is significantly limited by its sample size and sampling method. Only 262 respondents and 10 in-depth interview results is a small sample size due to limitations for the researchers. Having such a small sample size prevents the results from having an acceptance level of error within the study.

As the researchers had limited resources , the only method of conducting the survey and interviews was through a voluntary sample online, and specifically from our friends or community which may had similar background or interests with us. This means that the sample was a self-selected, non-probability sample and therefore may have an inherent bias. In addition, a lot of the respondents did not answer all the questions of the survey which may made the results not completely applicable to the population as a whole in the United States. This sampling method also makes it difficult to calculate or predict the overall error for the study. Despite this, it is helpful to have this information as it provides a basis for future studies as well as a starting point for product development.

4.4 Study Improvements for Future Study

This study could be improved by not only expanding the sample size as well as asking more detailed questions for people who have never used cell phone payments before. The current survey focuses more on people who already use cell phone payment services. But for places that do not have scan in store features before, people might find hard to answer our survey due to the lack of explanations. In addition, some of the questions posed to participants could be further evaluated through additional research. This would provide more information as to the motivations of consumers as well as their suggestions to our product.

Technically, the technical setup of survey on qualtrics can be improved. Instead of asking participants to rate from 0~100, using 1 to 5 scale will be a better choice. And it will be easier to do data analysis and cross tabulation, since the current two rating questions cannot be used for cross tabulation statistically. And we also suggest to make all the questions mandatory so that participants will not be able to skip so many questions, although this was not detrimental to my analysis.

One of the next steps of this research would be to repeat the study with a larger sample size. This would allow the study to be more accurate and provide more concrete details in regards to people’s using behaviors and attitudes on cell phone payment plans in the United States. In addition, it will confirm or deny the results of this current study. After that, the next step would be to conduct research with a more diverse age distribution that accurately reflects the population. This would allow the researcher to establish better differences, if any.

References:

[1]Evans, D. S., & Schmalensee, R.. Paying with Plastic: The Digital Revolution in Buying and Borrowing. Retrieved September 25, 2017[OL]. from https://books.google.com/books?hl=en&lr=&id=F7sMMrNUneoC&oi=fnd&pg=PR11&dq=why%2Bsome%2Bmerchants%2Bsay%2Bno%2Bto%2Bapple%2Bpay&ots=FDSL0Oib5f&sig=BUifDFCBIfgtHb7m-zDZqI7Lams#v=onepage&q&f=false,2005.

[2]Evans L. D.. A NATION ONLINE: HOW AMERICANS ARE EXPANDING THEIR USE OF THE INTERNET. Retrieved December 9, 2017[OL]. from https://www.ntia.doc.gov/legacy/ntiahome/dn/html/Chapter2.htm.

[3]Webster, K. (2017, April 10). An Inconvenient Apple Pay Truth. Retrieved September 25, 2017[OL]. from https://www.pymnts.com/news/payment-methods/2017/apple-pay-adoption-down-and-so-is-the-hype-mobile-pay-usage/.

[4]Chan, C. (2015, August 6). When One App Rules Them All: The Case of WeChat and Mobile in China. Retrieved September 25, 2017[OL]. from http://www.modernmoneynetwork.org/sites/default/files/biblio/Chan%20-%20When%20One%20App%20Rules%20Them%20All.pdf.