From Need to Want

By Li Fangfang

Gao Yuning finds it hard to explain to his students who were born in the 1990s and beyond why Chinese people used to“buy” products with food stamps.

“My young Chinese students may have heard from their parents about what life was like in that period, but for my students from the West, they have no idea at all,” Gao told Beijing Review. “The use of food stamps was based on a shortage economy.” Gao, in his late 30s, received his PhD in economics from the University of Cambridge in 2011 and currently works for Beijing-based Tsinghua University as an associate professor.

Beginning in the 1950s and lasting until the 1980s, China suffered severe shortages of food and goods as the country focused on postwar reconstruction after the founding of the Peoples Republic of China in 1949. Throughout the country and in every household, people lived a frugal lifestyle. The Central Government had to issue various ration books for people to receive food and life necessities, including oil, meat, clothes and bicycles. This system ensured that the distribution of supplies was done on as equitable a basis as possible.

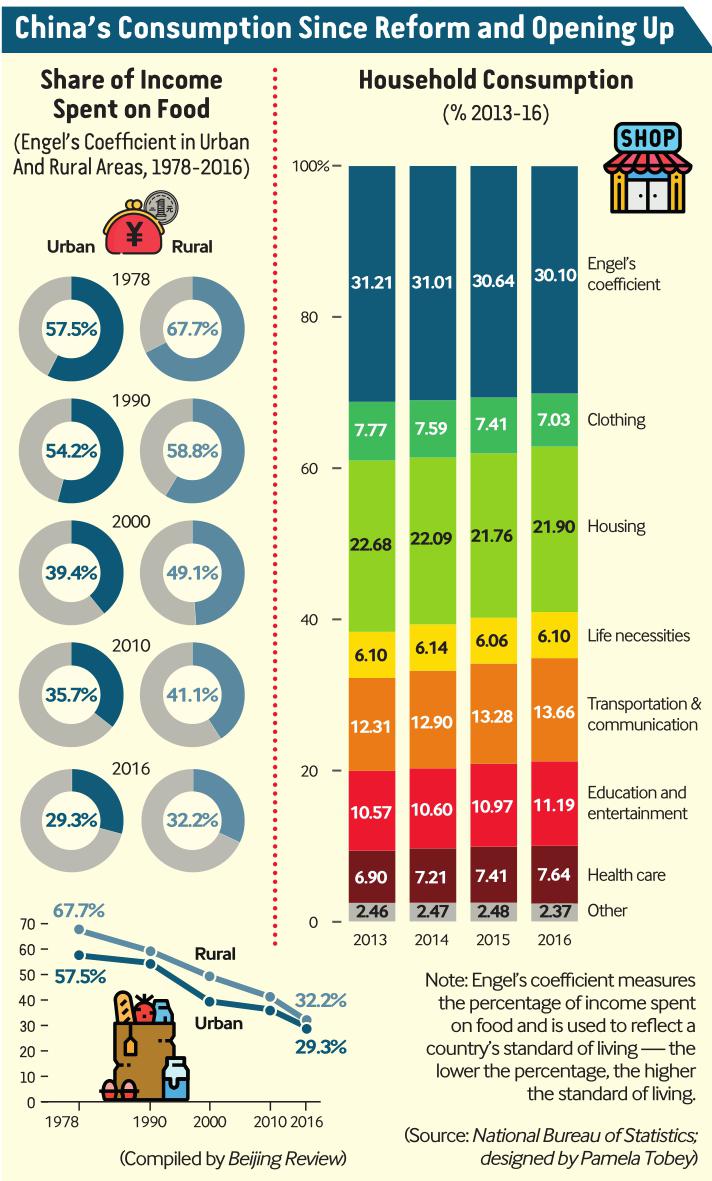

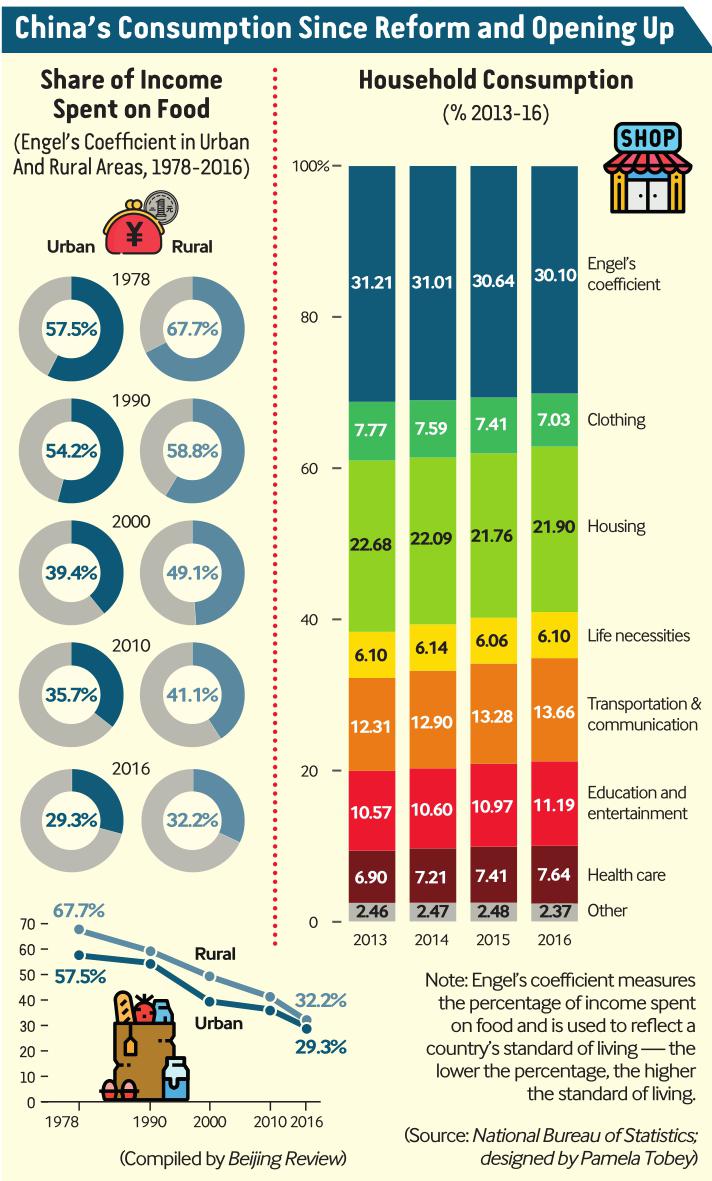

Things began to change in 1978, the first year of reform and opening up. Structural reforms were carried out in rural areas and cities; private enterprises began to boom and the market economy became more active. Ration coupons finally stopped being issued and became a part of Chinas history around 1993, marking the end of a shortage economy.

Gao described the three main stages Chinese consumers have experienced in the past decades. First, during the ration coupon era, people underwent shortages and grew to know suffi ciency. In the 1990s, they began to accumulate their wealth and preferred more rather than less, and bigger rather than smaller. In recent years, Chinese people, particularly in big cities, have started to seek a higher quality of life, materially and spiritually.

Following Japan and the United States, a growing number of young urban dwellers in China choose to fund their lifestyles with installment payments as the country grows from shortages to affluence with a larger middleincome group.

Generation gap

In current Chinese families, it is apparent that there are many differences between parents and children around consumption and their derivatives. In September 2017, when Apple Inc. opened reservations for its iPhone X, it was like a carnival for Chinese millennials.

“I hate to hesitate when I see something I want. I need to have it now,” Zhao Qijun, one of the Chinese millennial urban consumers who are jumping onto the buy-now-pay-later bandwagon, said to China Daily. “I really like how its camera is capable of making photos look much more professional. I cannot afford to miss out on the phone.”

Actually, Zhao couldnt afford the smartphone at its $999 price tag. But it wasnt a problem for the 25-year-old because consumer credit services, like Chinese tech giant Alibabas affi liate Ant Check Later, allow users to pay for their purchases in installments.

At the end of 2017, products purchased by installment ranged from 3C (computer, communication and consumer electronics) items to daily necessities, according to a report by Fenqile, an installment shopping platform. This method of payment, however, lowers customers sensitivity to prices, making it more acceptable to purchase expensive, quality products, said the report.

In contrast to Zhao, who is paying for in- stant happiness, some people prefer to buy a dream via installments. Zhu Guangyuan was born in the rural area of Chifeng City in Inner Mongolia Autonomous Region. His diligence led him to a college in the region; however, after graduation, he found himself unemployed.

An enrollment notice from a Beijingbased computer training organization caught his eye, but he couldnt afford the tuition fee. For him, an installment plan was the best choice at the time. By borrowing 16,300 yuan ($2,400) from an installment platform, Zhu only had to pay part of the interest for the fi rst six months and the capital and the rest of the interest in the ensuing 12 months. The training was actually a prelude to his fi nding a decent job in his hometown, making it possible for him to eventually buy his own apartment there.

“Its easier to pay back with interest than to borrow from friends as a favor,” Zhu said in a documentary about young Chinese people with a lifestyle of consuming today and paying tomorrow. Traditionally, people lend money based on the borrowers reputation and their level of familiarity. Therefore, those born rich or who have money have many more resources at their disposal, making this method unfair.

Gao described a profound change that is taking place in China from a society of personal relationships to one of individual credibility, which will make the evaluation system more objective and fairer.

In a survey conducted by Ant Financial, most young urban people said they were comfortable borrowing money to fund their lifestyles. This included taking enrichment classes, attending gym classes and even tipping online bloggers. In addition, Fenqile reported this year that the pattern of installment payment usage is moving from firsttier cities in Chinas coastal region to secondand third-tier cities.

“This phenomenon is largely due to the fact that millennials are growing up in an environment of surplus,” explained Mei Feng, Vice Secretary General of the Beijing Youth Chamber of Commerce.

In Gaos view, young people have a broader sense of products which include not only tangible items, but also services. “They are willing to pay for the happiness they may acquire from an item or experience,” he said.“While the older generation may still consider whether to catch a taxi or take a bus when it comes to buying a service.”

Consumption upgrade

Historically, China is not unique in terms of its current consumption upgrade. As a researcher with a main focus on international economics and development, Gao compared Chinas current development to the United States in the 1920s and Japan in the 1970s-80s.

“In the 1970s, the Japanese language was everywhere in Italian luxury stores,”Gao said. “And the U.S. magazine National Geographic boom was due to its domestic demand for overseas tourism.”

Currently, Chinas fashion consumption accounts for 30 percent of the worlds total, making it the top luxury consumer country, according to Chen Wenling, chief economist with the China Center for International Economic Exchanges. She said fashion consumption by means of overseas travel or e-commerce platforms is one of the main characteristics in the current consumption structural change.

The main reason behind the consumption upgrade, from the perspective of economic development, is the change in the countrys income structure due to its economic growth. The emergence of a middleincome group has become the main driving force of the consumption upgrade. What has come with the income structure upgrade is the tendency for peoples consuming preferences to be differentiated, according to Gao.

Along with high-end consumption, the recent public offering of Chinese unicorn Pinduoduo also reminds the world of the increasing consumer power of a large number of low-income Chinese people.

“The consumption upgrade does not only refer to the middle-income group,” Gao said. “It is what is meant to build a moderately well-off society in all aspects.”