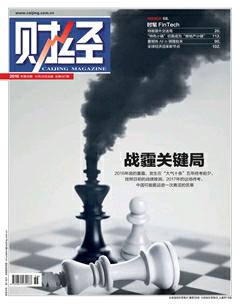

Cover Story

Battle Lost in the War on Pollution

The Chinese government formally “declared war” on air pollution in 2014. PM2.5, inhalable particulate matter which can carry a large number of harmful substances into the human body, has now been designated as the most threatening danger to public health. Coal, motor vehicles, industry, and dust are the four main sources of PM2.5.

Air pollution control policies as well as environmental and energy research have both shown that coal, on which Chinas economic growth has been dependent, is a key battlefield in the war against smog. This anti-pollution campaign, from beginning to end, is an internal battle. With Chinas current severe air pollution situation, it is important to strictly enforce the law and truly supervise polluting companies and polluting behavior.

FinTech Moving Into the Mainstream

The Internet finance era is over, and a new era of Fintech is on the horizon. Fintech stands for “finance+technology”; its original meaning “financial technology” implies a business model that adopts high technology to promote more efficient financial services.

Among FinTechs many applications, blockchain (distributed databases) and artificial intelligence technology are considered the core. The application of blockchain technology in the financial field is especially important. For all kinds of new financial innovations, risk is the utmost concern of most parties, particularly with a subversive innovation such as blockchain. Global regulators are closely watching FinTechs development, and they need to find a balance between innovation and risk prevention.

Global Economy Ushers in a New Node

The Trump government and the Republican-led Congress are hoping that a large fiscal stimulus will boost the U.S. economy. Mr. Trumps victory in the U.S. presidential election set off a stock market rally and a simultaneous crash in the bond market. Seeing the stock market in full swing reminds people that the pervasive pessimism that has endured since the 2008 financial crisis seems to have passed. Inflation expectations are heating up not only in the United States but also globally, and bull markets are still bubbling.

The global economy driven by the U.S. dollar and U.S. stocks seems to have signs of warming. However, the crux of the issue lies in whether the positive turn in the capital market can translate into a fundamental turn for the better for the economy itself.

Chinas Economy in 2017: Emphasizing Stability and Reform

With the double-sided attack of increased international uncertainties and various domestic financial risks, the space for Chinas economic growth has become narrow. A number of institutions predicted that Chinas economic growth target in 2017 will remain between 6.5-7 percent. Preventing financial risks, curbing asset bubbles, and continuing to reduce leverage will be the primary tasks of government regulation next year. In addition, various reforms using state-owned enterprise reform and fiscal and tax reform as breakthrough points will also be key tasks in 2017.

Private investment trends will become an important indicator of Chinas economic vitality in the coming year. The main issue will be how to encourage private investment and promote the policy implementation of supply side structural reforms.

Tens of Billions in Tax Revenue Lost in E-commerce Annually

The overall business tax revenue erosion gap in the e-commerce industry is increasing year by year and has already reached the order of tens of billions of yuan annually. Achieving fair and reasonable taxation in the field of e-commerce is not easy. The virtualization of e-commerce transactions has broken the traditional tax registration system which has industrial and commercial registration as a prerequisite, plunging the C2C model into a blind tax area due to imperfect legislative and tax regulatory mechanisms and other factors.

Researchers in the field of tax law generally believe that a portion of special tax incentives should be subject to tax classification supervision. The realization of this path should be to implement a “withholding” system toward sellers in actual compliance with tax standards to prevent the loss of tax revenue.