Why “Double Engines”?On the Economic Effects of Public Investment

Chen Haoqiang,Zhang Wenguang(School of Government Beijing Normal University,Beijing 100875)

Why “Double Engines”?On the Economic Effects of Public Investment

Chen Haoqiang,Zhang Wenguang

(School of GovernmentBeijing Normal University,Beijing100875)

Based on statistics from 1990 to 2013,using correlation analysis,co-integration analysis,Granger test method and the impulse response function etc.,we concluded by re-examining the economic effects of public investment that:Public investment,labor inputs and private investment have positive output elasticity,thus the effect of public investment on economic growth can’t be neglected.However,we must adjust the structure,especially lay emphasis on the public goods and public services;The contribution of labor input to economic growth is relatively low,we should increase investment in education and health care,improve the quality of workers,stimulate innovation and entrepreneurial drive to improve total factor productivity.“Double Engines” strategy will become a long-term focus of policy adjustment.

double engines;public investment;private investment;economic growth

Ⅰ.Introduction

On 2015 Davos World Economic Forum,China put forward the proposal of making good use of double engines to maintain medium-to-high speed of growth and achieve medium-to-high level of development.The proposal of “Double Engines” arouses wide attention and reexamination on the economic effects of public investment.In theory,on the one hand,the increase in public investment will directly increase aggregate demand.When aggregate demand exceeds aggregate supply,economic development can be positively promoted.On the other hand,external positive effect is more significant in public investment related area.In empirical analysis,initial studies focused on the positive aspects of public investment,especially the increase in infrastructure areas promoted private investment as well as the country’s economic growth.With the update of dynamic data in economic growth,and the debate on China’s economic growth momentum conversion,reexamination of the economic effects on public investment is urgently needed.

Ⅱ.Literature review at home and abroad

From the perspective of empirical analysis,different data,different analytical models and methods will draw different conclusions.R.Milbourne,G.Otto,G.Voss(2003) studied the effect of public investment on economic growth by using Solow-Swan growth model,and noted that public investment did not significantly affect the level of per capita output under steady state,yet contributed a lot to economic growth.Yannis Psycharis,Vassilis Tselios(2012),who analyzed the influence of Greek government’s public investment on regional economic growth,pointed out that the per capita public investment will have a long-term positive effect on regional economic growth,among which education and infrastructure got the max spillover effect.Moreover,the external impact of public investment on regional economic development is more important than the direct impact of public investment.

There are also a few foreign scholars who believe that the public investment hinders economic growth.Eduardo and Christian Daude(2008),who studied the effect of public investment among 116 low and middle income countries,pointed out that public investment crowded out part of private investment,which has a negative effect on the country’s economic growth to a certain extent.Some scholars demonstrated that the two factors are unrelated.F.Carson Mencken and Charles M.Tolbert(2009)found that despite public investment expenditure has a positive effect on private capital accumulation,it does not directly affect the results of economic development.

In terms of the specific components of public investment,that is,how does the structure of public investment affect economic growth,foreign scholars have different conclusions.Baffes and Shah(2000)pointed out that different types of public investment result in different output elasticity.The descending order is:Science and education,public services,infrastructure。Demetriades and Mamuneas(2001) divided public investment into basic industries input and non-basic industry input,and the output elasticity range of public input is limited between 0.52% to 2.15%.By studying Irish( 1970-1998) public input and unit capital investment efficiency,Diego Martinez and Jose Manuel(2003)pointed out that public investment in research has a positive role in promoting economic growth,while public investment in health and education did not.The study of Nazmi and Ramirez(2003)shows that private investment and public investment both have a positive role in promoting economic growth,but consumer demand in government expenditures has a negative effect on private investment and economic growth.

Domestic scholars studied the relationship between public investment and economic growth from three main aspects.(1)Economic growth effect of public investment.The basic conclusion is that public investment promotes economic growth.Wan Daoqin,Yang Feihu (2011) believe that public investment is the basic condition for the formation of social productivity,it drives private investment,which is a necessary factor in promoting sustained economic growth of the whole society.In the short term,public investment contributes to GDP growth,whose expansionary effect is obvious.However,in the long term,public investment is crowding out private investment,which will inhibit the growth of GDP.Wang Wei (2010) derived that the output elasticity of public capital (0.54) is higher than the output elasticity of private capital (0.35).Wang Fangjie (2012) estimated that the output elasticity of public investment is 0.52,yet that of the private investment is 0.43.(2)Dynamic effects of public investment on private investment.Hu Wenxiu,Kong Tingting (2014) analyzed the dynamic effects of government investment,broad money supply,GDP and tax on private investment by using variable parameter state space model.They pointed out that macroeconomic fluctuations affect the impact of government investment on private investment.Expansionary fiscal and monetary policies can bring short-term driving effect and long-term crowding out effect on private investment.(3)Regional effects and period effects of public investment.Xiang Linlin (2013) pointed out that the increase of public investment in the western region can actively promote economic growth.The impact in the long term is more significant than in the short term.Different economic structure and investment structure can lead to different output elasticity of public investment,and contribution rate of economic growth of public investment will continue to decrease in the future.Sha Zhihui (2012) examined how public investment in western minority areas affects regional economic development.She noted that public investment and economic growth in the western minority areas have the almost synchronous growth rate.Public investments bring 0.56%-0.99% provincial GDP per capita growth,which has a greater contribution to GDP added value and economic growth in the western region.Zhang Xueliang (2012) found that the output elasticity of transport infrastructure on regional economic growth is between 0.05 and 0.07.In addition,capital stock of labor and other public-sector have a greater elasticity to regional economic growth.In conclusion,whether at national level or at regional level,public investment can promote economic growth.

With the continuous increase of public investment stock,re-examination of the relationship between public investment and economic growth is necessary.

Ⅲ.Empirical analysis

1.Economic growth of the gross scale of public investment

(1)Model building

(2)Data selecting

As an important indicator of economic evaluation,GDP can effectively represent the amount of output (Yt).Herein GDP data is obtained from “China Statistical Yearbook”.Public capital investment(Gt) has the following components:Production and supply industry of electricity,Gas and water;Traffic,storage and postal industry;Scientific research,technical services and geological prospecting;Water conservancy,environment and public facilities management;Resident services and other services,and eight fixed asset investment:education,health,social security and social welfare,culture,sports and entertainment,public administration and social organizations and other sectors.Although there is private investment in above sectors,the proportion is very small.Private capital investment (Kst) takes part in competitive fields,this paper studied eight sectors:real estate,agriculture,forestry,animal husbandry and fishery,finance and insurance,mining,construction,manufacturing,wholesale,retail and catering.In this paper,the number of employees in a year represents labor input(Lt)Kt=(1-δ) Kt-1+It.Wherein Kt represents the capital stock of period t.It represents investment in t period,δ represents the geometric depreciation rate.Data is gained from investment flow data from 1990 to 2013.Private and public capital stock is calculated by perpetual inventory,assuming that private capital depreciation rate is 5%,public capital depreciation rate is 3%.International common methods is conducted:using K0=I0/(g+δ) to calculate the capital stock of base year.Wherein represents the average annual growth rate of investment in the sample period.

(3)Empirical test

a.Correlation test

The purpose of correlation test is to explore if there is any correlation between variables X and Y.This paper conducted eviews6.0 to explore the relativity of public investment and GDP and obtained the correlation coefficient between the two variables is 0.994617,and the probability of irrelevance is 0.That is,there is a significantly positive correlation between public investment and economic growth.

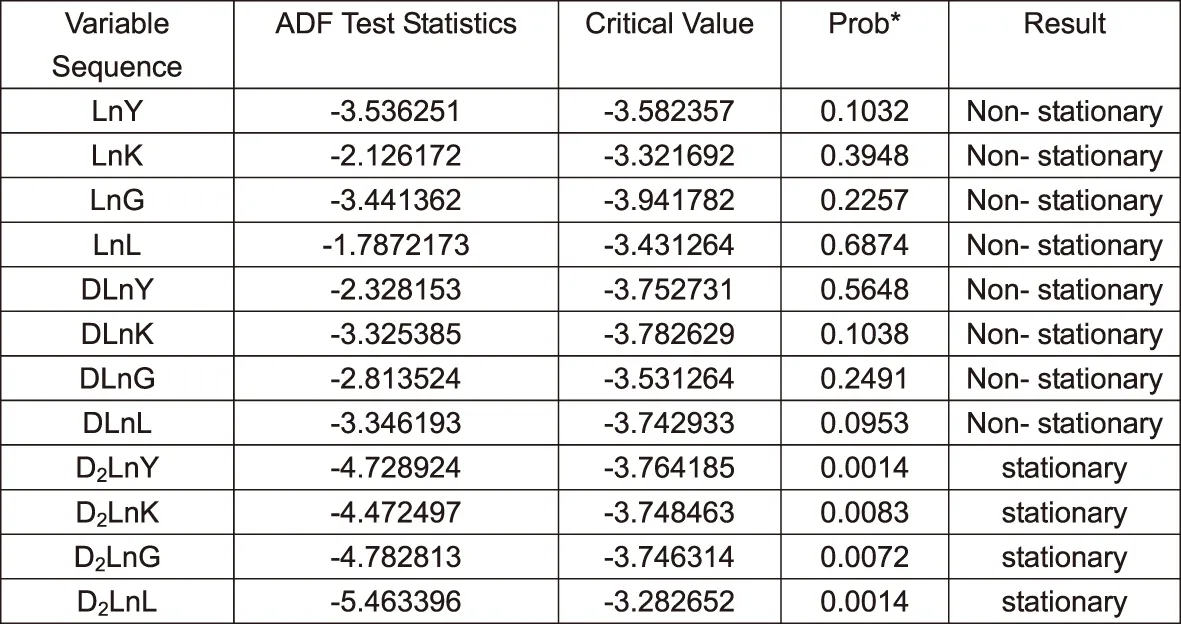

b.Unit root test

By using ADF unit root test method to determine the lagged variable by AIC and SC criteria,and to determine whether constant term and time trend are included by using the linear differential sequence diagram of the first and second order of each variable.By using Eviews6.0,the first difference of variable sequence LnY,lnK,lnG,lnL is DLnY,DLnK,DLnG,DLnL,and the second difference is D2LnY.D2LnG.D2LnK.D2LnL.The stationary test can be show in Table 1.

Table 1Result of unit root test

The data presented in the table indicates that test statistic of original horizontal sequence is larger than 0.05 level threshold,that is,the sequence is non-stationary,which is in accordance with the unit root hypothesis.The test statistic of the first order differential sequence is larger than critical value,which,in accordance with the unit root hypothesis,is non-stationary sequence.The test statistic of the second order differential sequence is smaller than critical value,which,different from the unit root hypothesis,is stationary sequence.That is,the original sequence is second order integrated sequence.It is thus clear that traditional regression analysis can’t achieve the purpose of effective analysis and testing,which needs co-integration test.

c.Co-integration test

In order to make co-integration more credible statistically,the first step is to determine the lag order L.Under the condition of unconstrained VAR(P)model,and the residual analysis of VAR mode and AIC,SC criterion,we can find the optimal autoregressive of VAR (P) by testing corresponding values of different VAR (P) model.

Table 2Optimal lag order of VAR model

The residual analysis and AIC criterion in the above table show that the optimal lag period of unconstrained VAR model is 2,and the lag order of co-integration model is 1.

This paper selected maximum likelihood method to conduct co-integration test,so as to determine the long-term relationship among LnY LnK,LnG,LnL.

Table 3Johansen and Johansen & Juselius

The results can be seen in the above table:there is a co-integration relationship among the variables LnY,LnK,LnG and LnL.The four variables exist long-term stable equilibrium relationship.The co-integration equation is:

LnGDP= 0.2143LnG+ 0.1135LnL+ 0.6437LnK+ 17.4274

1.0000 (0.1324) (0.0737) (0.3254) (5.8135)

d.Granger Causality Test

This paper conducted examination on the causal relationship between every two variables of DLnY,DLnX,DLnY and DLnL.The results can be seen below:

Table 4Result of Granger Causality Test

Result of Granger Causality Test indicates that,from 1990 to 2013,and between public investment and GDP,if public investment appears only,it is because of GDP Granger,but GDP is not affected by public investment Granger,which present a one-way causal relationship;the relationship between public investment of private investment is only a one-way causal relationship from the former to the latter.

2.Economic growth effect of public investment structure

(1)Model establishment

To further explore the relationship between public investment and economic growth,the paper established static and dynamic model respectively.

a.Static model

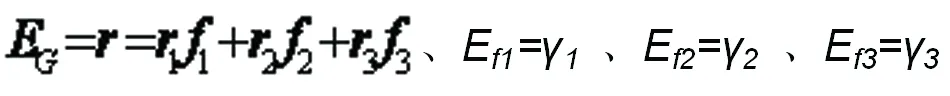

Respectively taking Log function on botisides,we get aggregate production function with structure variablei:

Structure of public investment and output elasticity of three variables can be expressed as:

The structure output elasticity in the above formula is to measure,with a certain proportion of public investment,the increased percentage of GDP brought by 1% increase in one investment project,so as to analyze how the structure of public investment affect economic growth.

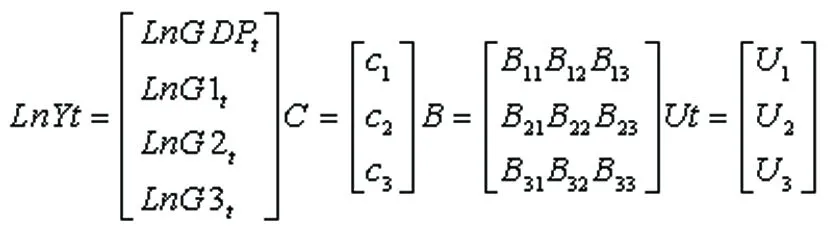

b.Dynamic model

In order to investigate the long-term dynamic effects of the various components of public investment on economic output,we selected the unstructured VAR model.The specific form is:

Among which:

Wherein,Uit~N(0,σ2),Ln represents the natural logarithm,the lag phrase of variable is 2.

(2)Data selection

This paper selected the data of public investment from 1991 to 2014 in “China Statistical Yearbook”,and divided them into three categories,namely public infrastructure projects,public services,education,research and development.If we subdivide the first and second category,the first category includes:electricity,transport,storage,post and telecommunications,gas and water production and supply,water conservancy management,geological prospecting,etc;The second category covers:culture,radio,health and sports,social security,social welfare,state organs,political parties,institutions and social groups,etc.

(3)Empirical test

Taking into account the fact that time series is affected by the price factor,we converted all data in 1990 as the base period.The sample period is still between 1990 and 2013.By using Eviews6.0,we estimated the following two regression equations.

Estimated results of static equation:

LnY=LnGDP=3.277+0.524f1LnGt+0.616f2LnGt+0.342f3LnGt

(0.272) (0.251) (0.338) (0.241)

Estimated results of vector autoregressive equation:

LnGDP= 0.985LnGDPt-1+ 0.275LnGDPt-2+ 0.158LnG1t-1+ 0.217LnG1t-2+ 0.612LnG2t-1+0.227LnG2t-2+0.083LnG3t-1+0.035LnG3t-2+2.263

LnG1= 0.617LnGDPt-1+ 0.368LnGDPt-2+ 0.189LnG1t-1-0.278LnG1t-2+ 0.721LnG2t-1-0.181LnG2t-2-0.047LnG3t-1-0.132LnG3t-2+3.848

LnG2= 1.023LnGDPt-1- 0.343LnGDPt-2- 0.861LnG1t-1-0.004LnG1t-2+ 0.373LnG2t-1+0.234LnG2t-2+0.025LnG3t-1-0.42LnG3t-2+2.690

LnG3=0.736LnGDPt-1-0.451LnGDPt-2- 1.178LnG1t-1+0.018LnG1t-2+2.347LnG2t-1+0.737LnG2t-2-0.257LnG3t-1-0.182LnG3t-2+0.373

Test result of all equations and overall evaluation index are shown below:

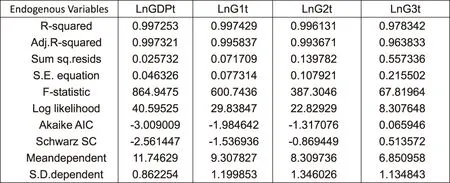

Table 5Test result of all equations and overall evaluation index

Through the analysis of the estimated results above,it is concluded that the three kinds of public investment play a positive role in promoting economic growth.The three results are:public infrastructure investment (0.524),education and R & D investment (0.342) and public service investment (0.616).Among them,public infrastructure and public services have a larger role in promoting economic growth,while the contribution of education and research is relatively small.

Ⅳ.Conclusions and suggestions

From the perspective of public investment structure,infrastructure investment takes the largest part in public investment,while public services and education and scientific research take a relatively small part in it.In addition,from data and impulse response image,short term effect of public investment on economic growth is more evident than that in the long term.In the empirical test between the total amount of public investment and economic growth,we found a long-term equilibrium relationship.The effect of private investment on economic growth is greater than that of public investment,because the structural defect in public investment reduces the output efficiency of public investment.Therefore,we should be wary of the unreasonably increase in the proportion of public investment,which will affect the total investment efficiency.Reasonable public investment can not only control debt risk,but also improve the overall operating efficiency of economy.It can be seen from the output elasticity of labor input,extensive labor input failed to improve economic efficiency.The key points under the new economy are to increase investment in education and health,enhance the quality of labor and increase total factor productivity.In addition,in the empirical test on the economic effects of public investment structure,we can find that every structure variable has a positive role in promoting GDP.From the aspect of effect point,direct effect of public infrastructure and public services is significant.Since investment in education and R & D has a long-term positive effect,there is a large space for public input in this regard.

At the turn of the old and new economy,based on the analysis of economic effects on public investment,the role of public investment can’t be ignored to maintain steady growth and structural adjustment.However,the investment space of traditional infrastructure-based investment pattern is small,and over-reliance on it will not be conducive to economic restructuring.Therefore,the new direction of Chinese economy is:improving public goods and services such as education and healthcare,improving the quality of labor,increasing R & D investment and enhancing total factor productivity,which is highly fit the strategy of “Double Engines”.Therefore,the focus of future policy adjustments are building a new engine,encouraging people to do business creatively and driving innovation;transforming traditional engines,increasing the supply of public goods and services and fill the “short board”.

About the author:Chen Haoqiang,postgraduate at Management School of Government,Beijing Normal University;Zhang Wenguang,Ph.D.,professor,doctoral tutor,dean of School of Government,Beijing Normal University.