Female CFOs and loan contracting:Financial conservatism or gender discrimination?-An empirical test based on collateral clauses

Xixiong Xu,Yaoqin Li,Mengmeng ChangSchool of Economics&Business Administration,Chongqing University,China

Female CFOs and loan contracting:Financial conservatism or gender discrimination?-An empirical test based on collateral clauses

Xixiong Xu*,Yaoqin Li,Mengmeng Chang

School of Economics&Business Administration,Chongqing University,China

ARTICLEINFO

Article history:

Accepted 12 October 2015

Availableonline12November2015

JEL classification:

G21

G32

J16

Female CFOs

Loan contracting

Collateral clauses

Financial conservatism Gender discrimination

ABSTRACT

Based on signaling and gender discrimination theory,we examine whether chief financial officer(CFO)gender matters to bank-firm relationships and the designing of collateral clauses in bank loan contracting,and explore the potential path of influence.Data taken from Chinese listed companies between 2009 and 2012 indicate that(1)female-CFO-led firms are less likely to obtain credit loans than male-CFO-led firms;(2)female-CFO-led borrowers are more likely to be required to provide collateral for loans than male-CFO-led borrowers;and(3)banks are more inclined to claim mortgaging collateral when lending to female-CFO-led firms and prefer to guarantee collateral when lending to male-CFO-led firms.Female-CFO-led borrowers seem to be granted more unfavorable loan terms than male-CFO-led borrowers,supporting the hypothesis that female CFOs experience credit discrimination.Further analysis reveals that regional financial development helps to alleviate lending discriminationagainstfemaleCFOs.Furthermore,femaleCFOsin SOEs are less likely than their non-SOE counterparts to experience gender discrimination in the credit market.

©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

Many studies have shown that financial development plays an important role in promoting economic growth(Rajan and Zingales,1996;Levine,2005).However,compared with Western countries,the security market in China is less developed and the financial system is dominated by the banking sector(Chen et al.,2013;Gou et al.,2014).Under these conditions,bank loans are major sources of corporate financing,even for large public companies.For instance,the average ratio of the volume of bank loan financing to GDP from 1990 to 2008 in China was 82.4%,and the average ratios of equity volume and bond financing to GDP were only 0.81%and 0.76%,respectively.1Data source:http://www.pbc.gov.cn/publish/html/kuangjia.htm?id=2013s01.htm.In fact,even in the United States,the volume of bank loan financing is much larger than that of equity and bond financing combined.Given the economic significance of bank loans in allocating capital to corporations,considerable effort has been made to investigate the determinants of bank loan contracting(e.g.,Qian and Strahan,2007;Graham et al.,2008;Chava et al.,2009;Hasan et al.,2012;Ge et al.,2012).Different from the current literature,this study focuses on the effect of CFO gender on bank-firm relationships and attempts to explore whether and how female CFOs exert a significant influence on the designing of bank loan terms.

Over the past decade,the number of female executives(especially female CFOs)has increased dramatically.2As their education levels and social status improve,female executives are playing an increasingly important role in corporate decisions.The significant increase in female CFOs has also attracted considerable attention from academics.An emerging stream of literature is beginning to investigate the systematic differences between male and female CFOs in terms of their accounting,financing and investment decisions (Francis et al.,2013).For example,studies have indicated that firms with female CFOs adopt more conservative accounting policies(Francis et al.,2014),are less likely to manipulate earnings(Chava and Purnanandam,2010;Liu et al.,2015)and are less likely to make significant acquisitions but more likely to decrease leverage levels than firms with male CFOs(Huang and Kisgen,2013).

In the bank loan literature,accounting information is an important standard that banks rely on to assess borrowers'credit risk.Earlier studies find that when banks initiate private debt,they are very sensitive to various accounting information attributes,such as operating accruals(Bharath et al.,2008)and conservatism (Sunder et al.,2009;Zhang,2008).Assuming that female CFOs are more likely to report high-quality and conservative earnings than male CFOs,as documented in earlier studies,banks should realize the benefits of female CFOs in providing more reliable and conservative accounting information to lenders(Francis et al.,2014)and thus reward borrowers under the control of female CFOs with favorable loan terms.

However,finance studies have long suggested the notion of credit discrimination,which indicates that discrimination in the credit market occurs when the decisions lenders make in relation to loan applications are influenced by personal characteristics that are not relevant to the transactions,such as the gender or race of the top executives of the borrowing firm.In the classical model adopted by Becker(1957),discrimination arises due to the taste-based preferences of the lender,who is willing to pay a price to avoid being associated with certain groups of borrowers.Alesina et al.(2013)provide evidence that female-managed firms are less likely than their male-managed counterparts to obtain bank loans and are charged higher interest rates when loan applications are approved.Similar results are presented by Bellucci et al.(2010),who find that female entrepreneurs face tighter credit availability.Thus,the presence of credit discrimination against women reveals that banks may charge higher loan prices and require stricter non-price terms when lending to female-CFO-led companies.

An important implication of the preceding discussion is that female CFOs may not necessarily obtain favorable or unfavorable loan contracts.Therefore,the direction of the relationship between the two remains an open empirical question.The main purpose of this study is to explore whether and how CFO gender influences the designing of collateral clauses in bank loan contracts.Examining this issue in the Chinese setting is interesting and important for several reasons.First,bank loans are a major source of external financing in

2For example,among the major U.S.corporations in 2005,7.5%of chief financial officers(CFOs)and 1.5%of chief executive officer (CEOs)were women,versus 3.0%and 0.5%in 1994,respectively.According to Grant Thornton's‘‘Report on International Business Questionnaire,”the ratio of female executives in Chinese companies was about 25%,an amount larger than the global average(21%).China.Thus,it is economically important to investigate the effect of CFO gender on bank-firm relationships and the designing of bank loan contracts.Second,this question has attracted some attention in the bank loan literature,which broadly focuses on interest rates,maturities,loan size and possible covenants,while leaving the nature of collateral clauses in the background.However,due to the weakness of the credit environment in transitional China,collateral requirements are common terms in bank loan contracts.Therefore,this paper helps us to gain additional insights into the determinants of loan contracts in emerging and transitional economies such as China,which may differ systematically from those predicted in developed economies.

From the perspectives of signaling theory and gender discrimination theory,we investigate the effect of CFO gender on the designing of collateral clauses in bank loan contracts and explore the potential path of influence.Using a sample of Chinese listed companies from 2007 to 2012,we find that CFO gender does affect bank loan contracts and that the collateral clauses granted to female-CFO-led companies are much stricter than those granted to their male-CFO-led counterparts.In our sample,firms with female CFOs are less likely to gain credit loans than firms with male CFOs and are more likely to be required to provide collateral if their loan applications are approved.Furthermore,loans given to female-CFO-led companies are more likely to be required to provide stricter pledging collateral or mortgaging collateral.On the contrary,loans given to male-CFO-led companies are more likely to provide looser guaranteeing collateral.Our empirical results provide support for the hypothesis of credit discrimination against female CFOs.Further analysis reveals that reform through market-oriented financial development helps to alleviate lending discrimination against female CFOs in the Chinese credit market.In addition,compared with female CFOs in non-SOEs,female CFOs in SOEs are less likely to suffer from gender discrimination in the credit market.

Our study makes two main contributions to the literature.First,it extends studies of the relationship between accounting information and bank loan contracting.It is well established that banks are the most important providers of external capital to corporations around the world.Accordingly,finance scholars have devoted considerable effort to understanding the factors that affect bank loan terms.Studies show that bank loan contracts are significantly influenced by borrowers'accounting quality and financial reporting transparency(Bharath et al.,2008;Armstrong et al.,2010),conservatism in financial policies(Sunder et al.,2009)and internal control weaknesses(Kim et al.,2011a),and country-level legal environments such as creditor rights and legal enforcement(Qian and Strahan,2007;Bae and Goyal,2009;Ge et al.,2012).This study attempts to relate bank loan decisions to the gender of the top executives of borrowing firms,and focuses on the effects of female CFOs on the designing of collateral clauses from the perspectives of both signaling theory and gender discrimination theory.Consistent with the gender discrimination hypothesis,our empirical results suggest that bank loan contracts granted to female-CFO-led companies are more unfavorable than those granted to male-CFO-led companies.In addition,regional financial development is helpful in mitigating lending discrimination against female CFOs.Our study expands and deepens the theoretical understanding of the determinants of bank loan contracts and provides evidence of the existence of gender discrimination in the Chinese credit market.

Second,this study contributes to the gender literature.A proliferation of studies mainly focuses on the systematic differences between male and female executives in terms of their risk attitudes(Dwyer et al.,2002;Atkinson et al.,2003),accounting and financial policies(Huang and Kisgen,2013;Francis et al.,2014),leadership styles(Matsa and Miller,2011)and agency costs and governance efficiency(Chava and Purnanandam,2010;Adams and Ferreira,2009).Rather than concentrating on internal corporate decisions,this study relates the gender of top executives to banks'lending decisions from an outside perspective and provides evidence that CFO gender also greatly influences loan contracts,thereby expanding and furthering our understanding of the economic consequences of female executives.In addition,despite increasing concerns over whether gender plays a role in corporate decisions,the research has mainly focused on chief executive officers(CEOs)or chairmen.To the best of our knowledge,this study is one of the few to concentrate on the role of female CFOs.

The remainder of this study is organized as follows.The next section describes the theoretical model and presents hypotheses for empirical testing.Section 3 outlines the sample and empirical research design.Section 4 presents the results.Section 5 discusses the implications of the findings and limitations of the study.

2.Theoretical analysis and hypotheses

2.1.Bank loan contracts

Banks are the dominant suppliers of external finance in most economies around the world(Graham et al.,2008;Kim et al.,2011b)and thus play an important role in allocating capital to corporations(Francis et al.,2012).The security market in transitional China is especially underdeveloped.As a result,the banking system is much larger than the equity market,and firms rely heavily on bank loans for their external financing needs. Due to information asymmetry in the credit market,banks continually face severe default risk from borrowers.In the bank loan literature,accounting information is the primary resource for banks to evaluate and predict the riskiness of borrowers(Anderson et al.,2004;Armstrong et al.,2010).For example,earlier studies show a negative relationship between bank loan pricing and earnings quality(Bharath et al.,2008)and conservatism(Zhang,2008).Hasan et al.(2012)find that firms with more predictable earnings have more favorable loan contract terms.At the country level,Qian and Strahan(2007)indicate that borrowers in countries with strong creditor-protection environments enjoy loans with lower interest rates and longer maturities.

Although interest is an effective way to price credit risk,it also presents negative moral hazard problems (Stiglitz and Weiss,1981).Therefore,collateral requirements along with interest rates,maturities,loan size and possible covenants are common terms in bank loan contracts that compensate for higher default risks,facilitate monitoring and limit potential losses(Jime´nez et al.,2006;Qian and Strahan,2007).In practice,bank loans can be divided into two categories,including credit loans and secured loans,3In light of the variance in binding strength of collateral agreements,there are three types of collateral forms:(1)guaranteeing collateral,in which case a third party promises to bear the joint obligation when a borrower fails to repay a loan;(2)mortgaging collateral,which requires the borrower or a third party to provide real property as collateral for the loan;and(3)pledging collateral,which requires the borrower or a third party to provide movable property or a warrant as collateral for the loan.based on whether the borrowers are required to provide collateral.Collateral decreases the risk of debt in two important ways. First,it facilitates enforcement against a defaulting debtor.In case of a default,the creditor can seize the secured assets and satisfy the obligation.Second,it offers protection against competing claims by other creditors when an insolvent debtor faces liquidation.Collateral is therefore an important contractual device that influences the behavior of borrowers and lenders and the design of debt contracts(Cerqueiro et al.,2015).In fact,the use of collateral has become increasingly popular(Francis et al.,2012,2013).According to Chen et al. (2013),74%of the bank loans granted to Chinese listed companies have introduced collateral terms.A series of empirical results also show that collateral use is beneficial in decreasing the information asymmetry risk faced by commercial banks(Graham et al.,2008;Kim et al.,2011a).

2.2.Female CFOs and bank loan contracts:based on signaling theory

The behavioral differences exhibited between women and men are generally non-controversial.Gender differences in attitudes toward risk and risk-related behavior have long been studied in the sociology,psychology and economics fields.Most studies have supported the notion that women are more risk-averse than men (Knight,2002).This gender difference is evidenced by the typically safer play behavior of girls relative to boys and by women's more cautious behavior relative to men in terms of sex,recreational drug use,alcohol consumption,gambling and driving(Sapienza et al.,2009).According to‘‘behavioral consistency theory,”individuals behave consistently across different situations.Therefore,it is reasonable to suppose that firms behave consistently based on how their top executives behave personally.For example,looking at professional money managers,Dwyer et al.(2002)find that female managers take fewer risks than male managers in their mutual fund investments.

Given the dramatic increase in female corporate executives over the past decade,a stream of studies considers the effect of the gender of top executives on various corporate decisions(Graham et al.,2013).For instance,Ahern and Dittmar(2012)document that the introduction of mandatory board member gender quotas led to increases in acquisitions and performance deterioration in Norwegian publicly traded firms.Faccio et al.(2015)find that firms run by female CEOs have lower leverage,less volatile earnings and a higher chanceof survival than similar firms run by male CEOs.Huang and Kisgen(2010)concentrate on the effect of CFO gender on corporate financial decisions and indicate that firms under the control of female CFOs are less likely to make significant acquisitions and issue long-term debt.Furthermore,female CFOs are more likely to decrease leverage levels than male CFOs.A more recent study by Francis et al.(2014)documents that female CFOs tend to report more conservative accounting numbers than male CFOs.In addition,female CFOs appear to make less risky financing and investment decisions than their male counterparts.These results provide some supportive evidence that female CFOs are more risk-averse and conservative than male CFOs when making corporate financial decisions.

As mentioned previously,accounting information is a persistent standard that banks rely on to assess borrowers'credit risk.Studies have shown that when banks make lending decisions,they are very sensitive to various attributes of accounting information,such as operating accruals(Bharath et al.,2008)and conservatism (Sunder et al.,2009;Zhang,2008).Based on signaling theory,assuming that female CFOs are more likely to report high-quality earnings and adopt conservative financial policies than male CFOs,as documented in earlier studies,banks should realize the benefits of female CFOs in providing more reliable and conservative accounting information to lenders.Thus,we conjecture that banks should acknowledge the positive gender effect and reward borrowing firms under the control of female CFOs with more favorable lending terms.

In addition to the risk associated with the availability of credible information,bank loan decisions are influenced by agency risk,which is mainly derived from the opportunistic activities of borrowers(Chava et al.,2009;Ge et al.,2012).Corporate executives are supposed to act in the interests of shareholders,but not necessarily in the interests of debt holders.Agency theory of debt implies that shareholders have incentives to transfer wealth from debt holders to shareholders(Jensen and Meckling,1976).The business ethics literature normally suggests that women are more ethical than men in their attitudes and behavior(Ruegger and King,1992;Nguyen et al.,2008).As a result of these personality characteristics,female executives are generally less likely to exhibit opportunistic behavior than their male counterparts(Srinidhi et al.,2011).Based on this logic,borrowers with female CFOs enjoy more favorable loan terms than those without female CFOs,as female CFOs help to mitigate conflict between shareholders and debt holders and thus decrease the default risk ex post.

Banks should collectively recognize the benefits of female CFOs in decreasing information risk ex ante and default risk ex post and reward borrowers under the control of female CFOs with more favorable loan contract terms.The empirical research also provides proof of this judgment.For example,using a sample of S&P 1500 companies from 1994 to 2006,Francis et al.(2013)find that firms with female CFOs enjoy bank loan prices about 14 basis points lower on average than firms with male CFOs.In addition,loans granted to female-CFO-led companies have 9%longer maturities and are about 8%less likely to be required to provide collateral than loans granted to male-CFO-led companies.

Based on the aforementioned analysis,we argue that the transmission of financial conservatism signals in the credit market is a possible mechanism through which CFO gender influences bank lending decisions.Thus,we propose our first research hypothesis as follows.

Hypothesis 1.According to signaling theory,all else being equal,banks grant borrowers with female CFOs more favorable loan contract terms than borrowers with male CFOs.

Although default risk is the key determinant of loan contracts,many studies have also shown that females are discriminated against in the credit market.4Many studies have considered discrimination in the credit market.For a detailed survey of this literature,see a study by Blanch et al. (2003).Becker(1957)uses the term‘‘taste-based”discrimination,whereby minorities,low-income families and women,among others,receive disparate and less advantageous treatment than their counterparts.A large number of investigations have focused on the role of race,ethnicity and gender as determinants of credit applications,loan denials,charged interest rates and other types ofrestricted access to finance(Cavalluzzo et al.,2002;Blanch et al.,2003;Cavalluzzo and Wolken,2005).In the classical model proposed by Becker(1957),discrimination arises due to the taste-based preferences of the lender,who is willing to pay a price to avoid being associated with certain groups of borrowers.He also notes that such discrimination tends to vanish with competition between lenders,as they are no longer able to bear the cost of the non-economically motivated choices.

In terms of gender-based discrimination in the credit market,Cavalluzzo et al.(2002)report evidence of a credit access gap between firms owned by white males and white females in the United States.Using the crosscountry Business Environment and Enterprise Performance Survey(BEEPS),Muravyev et al.(2009)also note that female-managed firms are less likely to obtain bank loans than their male-managed counterparts.In addition,their analysis suggests that female entrepreneurs are charged higher interest rates when their loan applications are approved.Extending these studies,Ongena and Popov(2013)identify the causal effect of gender bias on access to finance through a cross-country sample and find that female-owned firms in countries with a higher gender bias are more frequently discouraged from applying for bank credit and more reliant on informal finance.They emphasize that these results are not driven by credit risk differences between female-and male-owned firms in countries with high gender biases.

Gender discrimination is also a severe social problem in contemporary China.Despite the declaration that women hold up half the sky,China has followed patrilineal rule and a male power system since ancient times. As a result,women can only occupy a subordinate position in both their families and the social system. Although the women's revolution that accompanied the establishment of the People's Republic of China led to a great improvement in their social status,women continue to experience an obvious gender bias in terms of job availability,promotion opportunities and social identity(Qing and Zheng,2013).In fact,as a defective social norm in China,gender discrimination has permeated into various social and economic activities.As a result,women must expend more effort than their counterparts to achieve the same success.The gender bias hypothesis simply implies that banks may charge higher loan prices and require tighter nonprice terms when lending to female-CFO-led companies.

However,social capital also plays an important role in financial development(Guiso et al.,2004).Due to the prevalence of‘‘guanxi”and the weaker institutional environment in transitional China(Peng and Luo,2000),the effect of relational networks and social capital on corporate financing behavior is more severe and explicit(Talavera et al.,2012).In contrast to their male counterparts,women are much shier and more reluctant to build relationship networks,which decreases the chances of success for female CFOs competing for scarce financial resources.

Taken together,we argue that gender bias is another possible substitutive mechanism through which CFO gender affects bank lending decisions.Thus,we propose our second research hypothesis as follows.

Hypothesis 2.According to gender discrimination theory,all else being equal,banks grant borrowers with female CFOs more unfavorable loan contract terms than borrowers with male CFOs.

3.Research design

3.1.Data and sample

The sample comprises A-share listed companies in the Shanghai and Shenzhen stock markets from 2007 to 2012.According to our research objectives and consistent with similar studies,we select our sample based on the following criteria.First,due to their specific capital structures and debt covenants,we exclude companies in the banking,insurance and other financial industries.Second,we exclude companies that also issue B and H stocks to eliminate the effects of financial environment and regulatory policy on bank loan contracts.Third,we exclude firm years in which no loans were provided by banks.Fourth,we exclude firms whose CFOs changed in a given year.Fifth,we exclude firm years if the data required to measure the firm-specific control variables are unavailable.These criteria ultimately yield 5312 firm-year observations.The gender information of top executives is collected manually from annual reports,and the bank loan information is collected by hand from borrowers'annual report notes.Other accounting and financial data are taken from the CSMAR and WIND databases.

只有老太医和乔十二郎两人内心清楚:那天李武岗喝下的海狗油,有股特别的香气,那不是海狗油,是效力强大的燃油和火药;那天吸附在李武岗后背上的十二只火罐,每只罐底外部都额外加了点燃的艾绒,名曰增强药力,其实那是构造奇特的引信。

Table 1 Variable definitions.

3.2.Variable measurement

Bank loan contracts include not only price terms(i.e.,loan interest rates)but also non-price terms,such as loan size,maturity,collateral requirements and restrictive covenants.In this study,we focus on the effect of gender on collateral terms.In particular,we construct three dependent variables to capture the characteristics of the collateral clauses of bank loan contracts,denoted by Collateral,Collateral-ratio and Collateral-intensity,respectively.The first dependent variable is Collateral.It is an indicator variable that takes the value of 1 if a company obtains credit loans from banks in a given year and 0 otherwise.The second dependent variable is Collateral-ratio,which is defined as the proportion of the volume of secured loans to the total volume of bank loans.Finally,the third dependent variable is Collateral-intensity,which represents the restrictive intensity of the clauses of three different types of collateral.In our main tests,we adopt Guar-collateral,Mort-collateral and Pled-collateral to proxy for Collateral-intensity,which represents the ratio of the volume of guaranteeing,mortgaging and pledging collateral loans to the total volume of secured loans,respectively.In our study,the main independent variable is CFO-gender,5In practice,CEOs and chairmen take ultimate responsibility for corporate decisions.Therefore,in our robustness checks,we introduce Chair-gender and CEO-gender as alternative testing variables to explore whether CEO and chairman gender influences bank loan contracts.However,we do not find that the presence of female CEOs and chairmen affects the collateral terms considered in our study.which equals 1 if the CFO position is held by a female executive and 0 otherwise.All of the variables are defined in Table 1.

3.3.Model specification

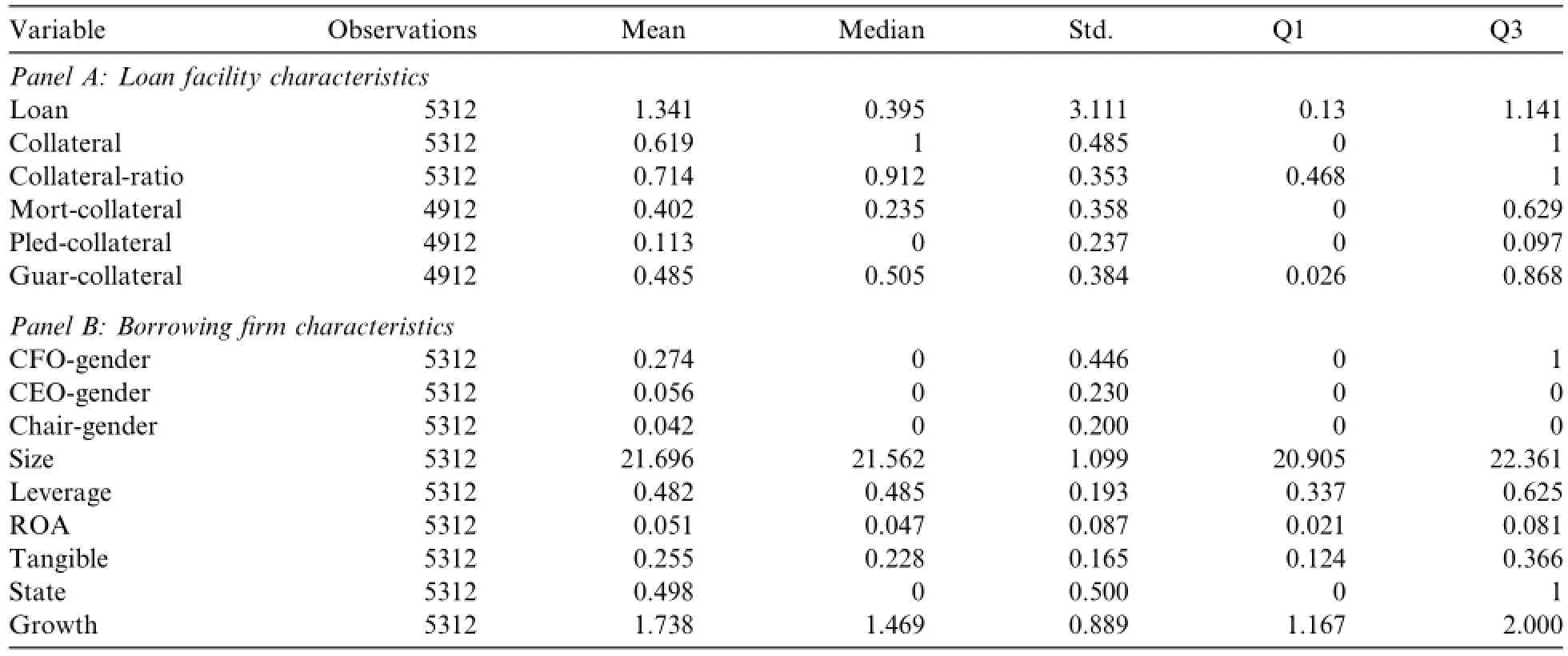

Table 2 Descriptive statistics.

We specify the following regression model to evaluate the effect of CFO gender on the collateral terms of bank loan contracts: where all of the variables are as defined in Table 1.The dependent variable,LoanContract,refers to one of the following three bank loan collateral measures:Collateral,Collateral-ratio or Collateral-intensity.The main test variable,CFO-gender,represents the gender of the CFO of the borrowing firms.In a robustness test,we also examine the effects of CEO and chairman gender on the collateral terms.

Following studies of bank loan contracts(e.g.,Francis et al.,2013;Chen et al.,2013),we control for several firm characteristics that may affect collateral terms in the regressions.We begin by using the natural logarithm of a firm's total assets to measure firm size.We use Growth,which is measured as the market value of equity plus the book value of debt divided by the total assets,as a proxy for the firm's growth opportunities.We also control for Leverage,which is measured as long-term debt plus current debt divided by total assets;ROA,which is measured as the ratio of net income to total assets;and Tangible,which is measured as fixed assets divided by total assets.We also introduce State into the regression model to control for the influence of the nature of the ultimate owners on the bank loan contracts.In addition,to address potential endogeneity concerns,all of the control variables used in this model take a lagged value of one year.Finally,we use industries dummies to control for the potential differences in loan contracting across industries.

4.Empirical results

4.1.Descriptive statistics

Table 2 reports the summary statistics for the main variables used in this study.As shown in Panel A of Table 2,in our sample,the average loan amount is 1.341 billion yuan,and 61.9%of Chinese listed companies obtained credit loans from banks.Looking at the bank loan characteristics,71.4%of the loans in our sample use collateral(security).Furthermore,the means of the Collateral-intensity measures such as Guar-collateral,Mort-collateral and Pled-collateral are 0.485,0.402 and 0.113,respectively.This suggests that guaranteeing collateral is the most frequently used collateral mode and that pledging collateral is the least used.

According to Panel B of Table 2,the mean values of CFO-gender,CEO-gender and Chair-gender are 0.274,0.056 and 0.042,respectively.These numbers indicate that 27.4%of the CFO positions of the companies in our sample are held by woman,a figure much larger than the 4.9%figure found in the U.S.setting by Francis et al. (2013).In addition to female CFOs,5.6%of CEO positions and 4.2%of chairman positions are held by female executives,respectively.Female executives account for more than one third of top management teams,implying that female executives are playing an increasingly important role in corporate decisions.

Table 4 Univariate testing.

Note:This table reports t-statistics for the differences in means of each variable across firms with male and female CFOs.

*Indicate significance at the 10%level.

**Indicate significance at the 5%level.

***Indicate significance at the 1%level.

Table 3 reports a Spearman correlation matrix for the variables included in our regression analyses.Our test variable CFO-gender is significantly negatively correlated with our measure of bank loan amount(Loan)and the indicator of the likelihood to obtain credit loans(Collateral).However,it displays a positive correlation with the use of collateral requirements(Collateral-ratio),suggesting that firms with female CFOs are less likely to obtain bank loans and especially credit loans than firms with male CFOs.In terms of the correlations between CFO-gender and Collateral-intensity,CFO-gender is significantly and negatively associated with Guarcollateral but significantly and positively associated with Mort-collateral.The coefficient between CFO-gender and Pled-collateral is also positive but not significant.All of these results indicate that the loan contracts granted to female-CFO-led companies are more rigid than those granted to male-CFO-led companies,which provides preliminary support for the hypothesis about discrimination against female CFOs in bank lending decisions.

In addition,Table 3 shows that although Loan has significantly positive correlations with both Size and State,Collateral has significantly negative correlations with both Size and State.This implies that compared with small-scale enterprises and non-SOEs,large-scale enterprises and SOEs obtain more bank loans and are less likely to be required to provide collateral.

4.2.Univariate testing

Table 4 provides univariate comparisons of the bank loan terms between firms with female CFOs and their counterparts without female CFOs.Consistent with Hypothesis 2,the mean of the loan amount for firms with female CFOs is 1.043 billion yuan and that for firms with male CFOs is 1.453 billion yuan.The mean difference is 0.410 and is significant at the 1%level.The Collateral-ratio means differ significantly between the female-and male-CFO-led firms.On average,the borrowers with female CFOs are less likely to obtain credit loans and thus have bigger proportions of secured loans than the borrowers with male CFOs.More importantly,the firms with female CFOs are significantly more likely to use mortgaging collateral,and the firms with male CFOs are more inclined to provide guaranteeing collateral.In terms of pledging collateral,we find no significant differences between the two types of sample firms.Table 4 also indicates no significant difference in key firm characteristics such as asset size,growth opportunities and earnings capacity across the subsamples,which are the main predictors of loan default risk.

In summary,the univariate tests suggest that banks provide more favorable loan terms to borrowers with male CFOs.The results also indicate that the difference in loan contracts between borrowers with and withoutfemale CFOs is not caused by variance in the loan default risk,but is rather derived from banks'lending discrimination against female CFOs.This provides further support for Hypothesis 2.

4.3.Multivariate test results

We begin our multivariate regression tests by testing how female CFOs affect bank loan contracts.We then examine how regional financial marketization relieves banks'lending discrimination against firms with female CFOs.Furthermore,we attempt to investigate whether the state-owned property right of borrowers is helpful in alleviating credit discrimination against female CFOs.Finally,we conduct a series of robustness checks using different statistical methods,including Heckman's two-stage approach,a propensity score-matching approach and the differences-in-differences approach.

4.3.1.Female CFOs and bank loan contracts

Based on the preceding basic model,we explore the effect of female CFOs on collateral terms using several different dependent variables.Table 5 reports the regression analysis results.

In Column(1)of Table 5,we test how the presence of a female CFO affects a firm's likelihood of obtaining credit loans,using an OLS regression.The estimated coefficient of CFO-gender equals-0.016 and is significant at the 5%level,indicating that firms with female CFOs are less likely to receive unsecured loans from banks than firms with male CFOs.Using Collateral-ratio as the dependent variable,Column(3)of Table 5 shows that the regression coefficient of CFO-gender is 0.026 and significant at the 1%level.Therefore,the secured loan ratio of firms with female CFOs is significantly larger than that of firms with male CFOs.In addition,to further investigate the influence of female CFOs on the Collateral-intensity of collateral terms,we introduce the proxies of three collateral forms(i.e.,Guar-collateral,Mort-collateral and Pled-collateral)individually as dependent variables.As shown in Columns(6)and(7)of Table 5,the coefficients of CFO-gender are-0.031 and 0.026,respectively,and both are significant at the 1%level.Looking at Pled-collateral,the coefficient of CFO-gender is also positive but insignificant,perhaps because the number of pledging collateral cases in our sample is too small.6Relative to the frequent use of mortgaging and guaranteeing collateral,pledging collateral is used far less often.In our sample,only 11.3%of the secured loans adopt pledging collateral.These results imply that firms with female CFOs are more likely than firms with male CFOs to be required to provide mortgaging collateral,but less likely to use guaranteeing collateral. Therefore,the restriction of collateral clauses granted to female-CFO-led companies is more rigid than those granted to male-CFO-led companies.Thus,Hypothesis 2 is confirmed.

In terms of the control variables,State is significantly positively related to Collateral but significantly negatively related to Collateral-ratio.At the same time,the association between State and Guar-collateral is significantly negative and that between State and Mort-collateral is significantly positive.These results mean that the property characteristics of borrowing firms have an important effect on the designing of collateral terms in bank loan contracts.In contrast to non-SOEs,it is much easier for SOEs to apply for credit loans from banks,and SOEs also enjoy the benefits of better collateral clauses.Our findings are consistent with those of Fang (2007),who argues that‘‘[t]here exists credit discrimination against private firms in Chinese bank loan decisions.”Lu et al.(2012)also suggest that the big four state-owned banks still dominate the banking sector in China,favor SOEs and private firms with political connections in their lending decisions and discriminate against other non-SOEs such as small-town and village enterprises and other private firms.

In addition,as firm size increases,the probability of borrowers obtaining credit loans increases significantly and their secured loan ratios decrease significantly.Moreover,large-size borrowing firms are inclined to adopt guaranteeing collateral with looser restrictions.In contrast,small-size borrowing firms are more likely to adopt mortgaging collateral with stronger constraints.These results are in line with the findings of Lin and Sun(2005)and provide some evidence of the financing dilemma faced by medium-sized and small enterprises in China.

In the previous OLS regression,although we control for various observable firm characteristics that have been widely used in other studies,unobservable time-invariant factors could nevertheless affect the collateralterms of bank loan contracts.For example,firms with female CFOs probably behave worse in terms of profitability and thus have greater default risks,inducing banks to decrease their credit loans and claim stronger collateral constraints.This effect is caused by the borrowers'characteristics rather than gender discrimination in the credit market.To deal with this issue,we apply a fixed-effect regression to Eq.(1).The results are shown in Columns(2)and(4)of Table 5.After controlling for the firm and year fixed effects,the effect of female CFOs on firms'likelihood of obtaining credit loans increases to 0.038 from 0.016,and its effect on the secured loan ratios increases to 0.057 from 0.036.Both effects remain economically and statistically significant.

Taken together,the results in Table 5 indicate that CFO gender does matter to bank loan contracts.Banks tend to discriminate against female CFOs,grant firms with female CFOs unfavorable loan contracts and especially impose stronger restrictions on collateral clauses.The empirical results are consistent with Hypothesis 2.

4.3.2.Does financial development alleviate credit discrimination against female CFOs?

Many researchers concentrate on how cross-country differences in laws and their enforcement affect bank loan contracting and find that institutional environments have an important effect on bank loan terms(e.g.,Bae and Goyal,2009;Qian and Strahan,2007;Ge et al.,2012).Although our previous test provides preliminary support for the hypothesis about credit discrimination against female CFOs,such discrimination should ultimately disappear with competition between lenders,as they are no longer able to bear the cost of noneconomically motivated choices(Becker,1957;Muravyev et al.,2009).Consistent with the view that firms facing less product market competition are more likely to discriminate(Orley and Hannan,1986;Kuhn and Shen,2013),we have good reason to believe that the enhancement of regional financial marketization and competition in the banking industry leads to a decrease in lending discrimination against female CFOs. The degree of financial marketization in different regions(provinces)of China varies greatly and derives from their great differentiation in geographical location,resource endowment and even public policy(Lu and Yao,2004;Fan et al.,2011).This provides a unique scenario for determining whether improved financial marketization is beneficial in decreasing gender discrimination in bank loan decisions.

To examine whether the association between female CFOs and the collateral features of loan contracts is conditional on the development of a region's financial marketization,we add the interaction term of CFO-gender and Market,which is the indicator variable for provincial-level financial development,to Eq.(1).Table 6 summarizes the results when we include the interaction term CFO-gender*Market in Eq.(1).As shown in Column(1),CFO-gender is negatively associated with Collateral,and the associationis marginally significant at the 10%level.The estimated coefficient of the interaction term,CFO-gender*Market,is positive and significant at the 5%level.The results suggest that banks are less likely to offer credit loans to firms with female CFOs,and the effect of female CFOs on firms'likelihood of obtaining unsecured loans decreases with the development of regional financial marketization.In Column(2)of Table 6,the coefficient of CFO-gender is 0.042,significant at the 5%level,and the coefficient of the interaction term CFO-gender*Market is-0.002,significant at the 1%level.The results indicate that banks tend to claim collateral when lending to firms with female CFOs,and the effect of female CFOs on the proportion of secured loans is stronger in provinces with weak financial marketization than in provinces with strong financial marketization.

Table 6 Female CFOs,regional financial development and loan collateral.

Looking at Collateral-intensity,Columns(3)-(5)of Table 6 report the regression analysis results using Guar-collateral,Mort-collateral and Pled-collateral as the dependent variables,respectively.The coefficient of the interaction term CFO-gender*Market is 0.001 in the Guar-collateral regression model,significant at the 5%level,and-0.001 in the Mort-collateral regression model,significant at the 5%level.These results indicate that when the level of regional financial marketization is low,the negative association between female CFOs and the use of guaranteeing collateral and the positive association between female CFOs and the use of guaranteeing collateral are significantly enhanced.According to Column(5),the coefficients of CFO-gender and the interaction term are positive but not statistically significant,suggesting that the effect of female CFOs on the use of pledging collateral does not differ significantly between firms in regions with different financial development.

Taken together,the results in Table 6 indicate that the discrimination effect against female CFOs on collateral terms is more pronounced in regions with weak financial marketization.In this sense,our findings suggest that financial marketization reform is beneficial in alleviating gender discrimination against firms with female CFOs in the Chinese credit market.

4.3.3.Do property rights matter to credit discrimination against female CFOs?

Although the number of collective,private and foreign banks has continued to grow in the past decade,the banking sector in China is characterized by a lack of competition,the dominance of state-owned banks,7In China,the big four state-owned banks still dominate the banking sector,which include the Agricultural Bank of China(ABC),Bank of China(BOC),Industrial and Commercial Bank of China(ICBC)and People's Construction Bank of China(CBC).lending discrimination against non-SOEs and a lending preference exhibited toward SOEs(Kim et al.,2015). Many studies have noted that because of state or government interventions in the financial markets,stateowned banks favor SOEs and private firms with political connections in their lending decisions while discriminating against other non-SOEs such as small-town and village enterprises and other private firms(Fang,2007;Lu et al.,2012).This means that banks consider the property right status of borrowers as a key factor in their lending decisions and tend to offer SOEs more favorable terms.Thus,we divide the sample into two categories and go further to determine whether there is a significant difference in the gender discrimination effect between SOE and non-SOE borrowers.

Table 7 presents the regression results by group.In the non-SOE group,the regression coefficient of CFO-gender to Collateral and Collateral-ratio is-0.153 and 0.026,significant at the 5%and 1%levels,respectively. However,in the SOE group,neither of the coefficients is significant.This means that non-SOEs with female CFOs have a significantly lower likelihood of obtaining unsecured loans than those with male CFOs.However,there is no significant difference between SOEs with female CFOs and those with male CFOs.When the dependent variables are Guar-collateral,Mort-collateral and Pled-collateral,all of the regression coefficients of CFO-gender are significant in the non-SOE subsample but insignificant in the SOE subsample,which implies that the state-owned property of borrowing firms is also helpful in decreasing the gender discrimination in collateral clauses faced by female CFOs.

In summary,our findings indicate that the property right status of borrowing firms has an important influence on the gender discrimination effect in the credit market.Different from the obvious discrimination shown against female CFOs in non-SOE borrowers,the gender discrimination effect in SOE borrowers is insignificant.

Table 8 Female CFOs and loan collaterals:Subsample regressions based on regional discrimination culture.

4.3.4.Robustness checks

We conduct the following robustness checks to improve the reliability of our empirical results.

4.3.4.1.Further analysis of the gender discrimination effect in bank loan contracts.Our earlier analysis indicates that banks tend to offer unfavorable collateral terms to borrowing firms under the control of female CFOs. However,this may not be caused by the gender discrimination against female CFOs,but rather the banks' rational evaluation of the differences in the decision-making abilities and default risk between male and female CFOs.To address this concern and confirm the existence of a gender discrimination effect,we draw regional discrimination culture into our analysis framework.As mentioned by Gao and Lin(2014),corporate decisions are likely to be influenced by local cultural norms.In line with this argument,we conjecture that borrowing firms in provinces with stronger gender discrimination cultures should exhibit more credit discrimination against female CFOs.

Following the approach of Gao and Lin(2014),we use the province-level sex ratio at birth as a proxy of local discrimination culture8Gender discrimination is deeply rooted in the traditional Chinese culture norms of‘‘parental preference for sons so as to carry on the family line.”At the same time,due to the strict family planning policy,many parents adopt inexpensive technology to screen the sex of a fetus(Ultrasound B in particular)and perform sex-selective abortions,which leads to a severe sex ratio imbalance.More importantly,there is great variation in the gender discrimination cultures across different provinces in China.Relative to north China,discrimination against girls is much more serious in south China,where the patriarchal clan culture prevails.Following the approach of Gao and Lin (2014),we use the newborn male-to-female ratio as our primary measure of gender discrimination and find that the top two provinces with the highest sex ratios are Jiangxi(1.257)and Hainan(1.233)and that the two provinces with the lowest sex ratios are Xinjiang(1.060)and Shaanxi(1.071).and divide our sample into two groups based on the mean value(high-level discriminative regions vs.low-level discriminative regions).As shown in Table 8,the various collateral terms granted to borrowers with female CFOs are more unfavorable than those granted to borrowers with male CFOs in provinces with stronger gender discrimination.However,the difference between borrowers with female CFOs and those with male CFOs in provinces with low-level gender discrimination is insignificant. Sub-group regressions further indicate that the effect of CFO gender on bank loan contracts is mainly a result of the gender discrimination effect,which is also consistent with the preceding prediction and provides further support of Hypothesis 2.

4.3.4.2.Test of potential endogeneity problems.Endogeneity is a large concern in the study of gender issues. For instance,female CFOs may not be randomly assigned to firms.Firms with conservative financial policies and good credit records may be more likely to hire female CFOs.In addition,unobservable time-variant ortime-invariant factors may be correlated with the collateral terms of bank loans.Furthermore,the causality problem makes our results hard to interpret.We conduct a series of econometric analyses to address potential endogeneity issues.

Table 9Female CFOs and loan collateral:Propensity score-matching results.

First,to compare the two groups of firms(male-and female-CFO-led firms)fairly,we construct matched male CFO firms using a propensity score-matching approach.Following Francis et al.(2013),we begin our matching with a logistic regression of the female CFO dummy variable on industry,year,firm size and leverage.We then use the propensity scores obtained from the logistic estimation and perform a one-to-one nearest-neighbor match with replacements.This procedure ensures that each female CFO firm is paired with a male CFO firm.We then obtain a new pooled sample that includes 1456 observations with female CFOs and 1456 matched observations with male CFOs.As shown in Table 9,the collateral clauses given to firms with female CFOs are more rigorous than those given to firms with male CFOs.The results are consistent with those reported in Table 5,implying that the main conclusions remain qualitatively unchanged even when we use alternative matching methods.

Second,we use Heckman's two-stage self-selection model to control for the self-selection bias induced in a firm's choice to hire a female CFO.According to Gao and Lin(2014),firms in the provinces with stronger gender discrimination have fewer female top managers.Similarity/attraction theory and many studies have also suggested that firms are more likely to hire female CFOs when their boards of directors are dominated by women(Adams and Ferreira,2009).Hence,we choose the sex ratio at birth(Sex-ratio)of the province in which the firm is headquartered and the ratio of women members on the firm's board of directors (Female-director)as instrumental variables.We then estimate the 2SLS model based on Eq.(1).

In the first stage,we run a probit regression using Female CFOs as the dependent variable.According to the first-stage regression results,the estimated coefficients of Sex-ratio and Female-director are-0.507 and 0.817,respectively.Both are significant at the 1%level,suggesting that our selection of instrumental variables is reasonable.In the second stage,we run OLS and logit regressions.As shown in Table 10,the estimated coefficients of CFO-gender in Columns(1)-(5)are-0.193,0.406,-0.648,1.246 and-0.597,respectively.They are significant at the 1%level,suggesting that our results hold after considering the endogeneity of the choice of female CFOs.

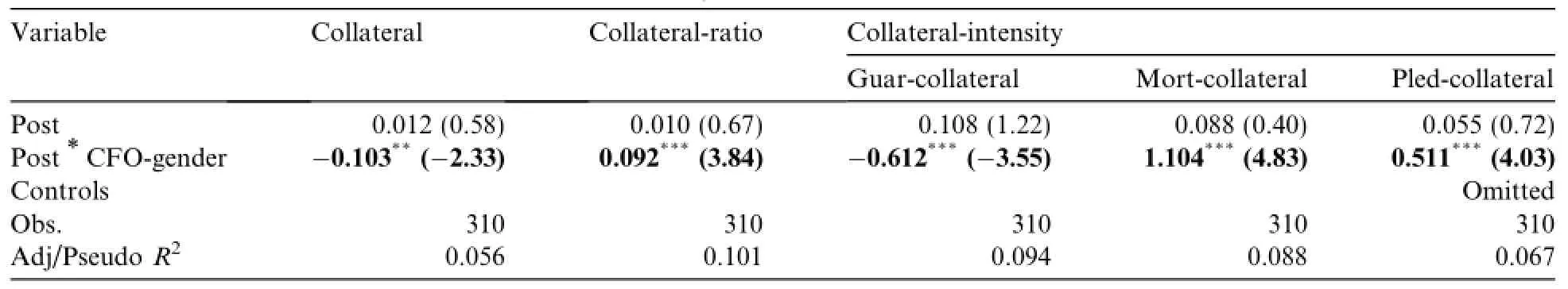

Third,similar to Francis et al.(2013,2014),we trace the firms that changed their CFOs from male to female (treated group)and from male to male(control group)and apply the difference-in-difference approach to mitigate any unobservable time-variant factors that may affect the estimated influence of female CFOs.

Table 10 Female CFOs and loan collateral:Heckman two-stage model results.

Table 11 Female CFOs and loan collateral:Difference-in-difference regression results.

As reported in Column(1)of Table 11,the estimated coefficient of Post,which captures the effect of maleto-male CFO transition on Collateral,is insignificant,indicating that there are no significant differences in the likelihood of obtaining unsecured loans between the pre-and post-transition periods for the firms in the control group.The estimated coefficient of the interaction term between Post and Female CFOs,which captures the incremental effect of male-to-female CFO transition on Collateral,is-0.103 and significant at the 5%level. Hence,compared with male CFOs,female CFOs decrease their firms'probability(10.3%)of gaining credit loans significantly after CFO transitions.Consistent results are also found in Columns(2)-(5)when we replace the dependent variable with Collateral-ratio,Guar-collateral,Mort-collateral and Pled-collateral,respectively. The results of the difference-in-difference approach demonstrate that our findings related to credit discrimination against female CFOs in collateral terms hold after considering the time-variant omitted variable bias.The results also suggest that female CFOs decrease their firms'likelihood of receiving unsecured loans and result in much tighter collateral terms in their bank loan contracts.

4.3.4.3.Effect of chairman and CEO gender.Considering that board chairmen and CEOs are the ultimate decision makers on important corporate affairs,we also confirm the robustness of our results in a changeregression,in which we investigate the effect of chairman and CEO gender on the collateral terms of bank loans.However,we do not find that the presence of female chairmen and CEOs significantly affects the collateral terms considered in our study,a finding similar to that of Huang and Kisgen(2013).In contrast with chairmen or CEOs,CFOs are the real executants of corporate financial policy and participate directly in negotiations with lending officers.As such,banks view CFOs rather than CEOs or chairmen as the primary executives who determine the quality of accounting information and default risk,which in turn affects their final lending decisions.The results are consistent with recent studies that have found a strong relationship between CFOs and the quality of firms'accounting information and leverage levels(e.g.,Jiang et al.,2010).Of course,the number of firms led by female chairman or CEOs in our sample is limited,which may also have some adverse effect on the empirical results.Therefore,our research conclusions on this point must be treated cautiously.

4.3.4.4.Additional collateral requirement terms.When signing loan contracts with borrowing firms,banks typically use collateral requirements together with other price and non-price terms,including interest rates,maturities,loan size and possible covenants.At the same time,borrowers probably actively provide more collateral to banks to seek favorable loan prices.To address this issue,we conduct an additional robustness test using the‘‘firm-year-bank loan case”observations as our sample.As firms do not typically disclose the detailed information of each loan,we gather only 2854 observations.Although not tabulated for the sake of brevity,the related results are qualitatively similar to those reported previously and thus provide additional support for Hypothesis 2.

4.3.4.5.Monetary policy.Bank loan decisions are influenced by a country's monetary policy to a great extent. Thus,we introduce the variable of monetary policy into our analytical framework and investigate the effect of CFO gender on bank loan contracts under different monetary policy conditions.Referring to the related literature,we adopt the annual rate of growth in broad money supply as our proxy for monetary policy.During a period of tightening monetary policy,the loan contracts granted to firms with female CFOs are more unfavorable than those granted to firms with male CFOs.On the contrary,CFO gender is not significantly associated with loan terms during a period of easing monetary policy.These results reflect that the loosening of monetary policy can relieve the lending discrimination faced by female CFOs to some extent.

4.3.4.6.Marketization in allocation of credit funds.We also use the‘‘marketization in allocation of credit funds”index as a substitutive measurement for competition intensity in the banking industry.The regression results(not tabulated for the sake of brevity)show that our inferences remain unchanged.

5.Conclusion

In this study,we examine whether CFO gender affects bank-firm relationships and the designing of collateral clauses in bank loan contracting.Based on both signaling theory and gender discrimination theory,we propose two opposing hypotheses to explain the effect of CFO gender on bank loan contracts and the potential paths of influence and then conduct empirical testing using data from Chinese listed companies.Our empirical results support the hypothesis about gender discrimination in the credit market.In our sample,compared with firms with male CFOs,firms with female CFOs face tighter credit availability and are more likely to be required to provide collateral despite the approval of their loan applications.Furthermore,banks prefer to claim mortgaging collateral when lending to companies under the control of female CFOs and are more inclined to require guaranteeing collateral when lending to companies under the control of male CFOs.This suggests that the collateral clauses granted to female CFOs are much more restricted than those granted to male CFOs.Further analysis reveals that regional financial development and the enhancement of competition in the banking industry are beneficial in alleviating lending discrimination against female CFOs.In addition,female CFOs of SOEs are less likely to suffer from gender discrimination in the credit market than female CFOs of non-SOEs.

Overall,our results suggest that banks do not recognize the benefits of female CFOs in decreasing the information risk ex ante and default risk ex post and reward them with more favorable loan contracts.Onthe contrary,banks discriminate against female CFOs in their loan decisions and thus claim much stricter collateral when lending to firms under the control of female CFOs.Gender discrimination is a serious obstacle to increasing the efficiency with which scarce credit resources are allocated and hurts the improvement of the financial market.In this sense,in addition to enhancing the legal institutions and financial marketization,eliminating the negative influence of gender discrimination and other unhealthy social norms is an urgent task in the process of improving China's financial reforms.This study deepens and expands our understanding of the determinants of bank loan contracts and contributes new knowledge to the gender literature.In addition,our study of the effect of gender discrimination provides a strong case for comprehending the important role informal rules play in the corporate decisions made within China's transitional economy.

Acknowledgments

We are grateful for the advice and comments provided by Yifei Xia and other participants at the China Journal of Accounting Research 2014 Symposium.We also appreciate the financial support received from the National Natural Science Foundation of China(Approval Nos.71102063,71572019 and 71232004)and the Fundamental Research Funds for Central Universities(Approval Nos.CQDXWL-2013-Z005 and 106112015CDJSK 02XK12).

References

Adams,R.B.,Ferreira,D.,2009.Women in the boardroom and their impact on governance and performance.J.Financ.Econ.94(2),291-309.

Ahern,K.R.,Dittmar,A.K.,2012.The changing of the boards:the impact on firm valuation of mandated female board representation. Quart.J.Econ.127,137-197.

Alesina,A.F.,Lotti,F.,Mistrulli,P.E.,2013.Do women pay more for credit?Evidence from Italy.J.Eur.Econ.Assoc.11(s1),45-66. Anderson,R.C.,Mansi,S.A.,Reeb,D.M.,2004.Board characteristics,accounting report integrity,and the cost of debt.J.Account.Econ. 37(3),315-342.

Armstrong,C.,Guay,W.R.,Weber,J.,2010.The role of information and financial reporting in corporate governance and debt contracting.J.Account.Econ.50(2-3),179-234.

Atkinson,S.M.,Boyce Baird,S.,Frye,M.B.,2003.Do female mutual fund managers manage differently?J.Financ.Res.26(1),1-18. Bae,K.H.,Goyal,V.K.,2009.Creditor rights,enforcement and bank loans.J.Finance 64(2),823-860.

Becker,G.S.,1957.The Economics of Discrimination.Chicago University Press.

Bellucci,A.,Borisov,A.,Zazzaro,A.,2010.Does gender matter in bank-firm relationships?Evidence from small business lending.J. Banking Finance 34,2968-2984.

Bharath,S.T.,Sunder,J.,Sunder,S.V.,2008.Accounting quality and debt contracting.Account.Rev.83(1),1-28.

Blanch,D.G.,Levine,P.B.,Zimmerman,D.J.,2003.Discrimination in the small-business credit market.Rev.Econ.Statistics 85(4),930-943.

Cavalluzzo,K.,Cavalluzzo,L.,Wolken,J.,2002.Competition,small business financing,and discrimination:evidence from a new survey. J.Bus.75(4),641-680.

Cavalluzzo,K.,Wolken,J.,2005.Small business loan turndowns,personal wealth and discrimination.J.Bus.78(6),2153-2177.

Cerqueiro,G.,Ongena,S.,Roszbach,K.,2015.Collateralization,bank loan rates and monitoring.J.Finance.http://dx.doi.org/10.1111/ jofi.12214.

Chava,S.,Livdan,D.,Purnanandam,A.K.,2009.Do shareholder rights affect the cost of bank loans?Rev.Financ.Stud.22(8),2973-3004.

Chava,S.,Purnanandam,A.,2010.CEOs versus CFOs:incentives and corporate policies.J.Financ.Econ.97(2),263-278.

Chen,D.,Xiao,Z.,Dong,Z.,2013.The composition of the clannish control rights and the credit contract of banks:is it rent-seeking or efficiency?Econ.Res.J.9,130-142(in Chinese).

Dwyer,P.D.,Gilkeson,J.H.,List,J.A.,2002.Gender differences in revealed risk taking:evidence from mutual fund investors.Econ.Lett. 76(2),151-158.

Faccio,M.,Marchica,M.T.,Mura,R.,2015.CEO Gender,Corporate Risk-Taking,and the Efficiency of Capital Allocation.Working Paper.

Fan,G.,Wang,X.,Zhu,H.,2011.NERI Index of Marketization of China's Provinces 2011 Report.Economic Science Press.

Fang,J.,2007.Ownership,institutional environment and capital allocation.Econ.Res.J.12,82-92(in Chinese).

Francis,B.,Hasan,I.,Koetter,M.,Wu,Q.,2012.Corporate boards and bank loan contracting.J.Financ.Res.35(4),521-552.

Francis,B.,Hasan,I.,Park,J.C.,Wu,Q.,2014.Gender Differences in Financial Reporting Decision-Making:Evidence From Accounting Conservatism.Working Paper.Bank of Finland Research Discussion Papers.

Francis,B.,Hasan,I.,Wu,Q.,2013.The impact of CFO gender on bank loan contracting.J.Account.Audit.Finance 28(1),53-78.

Gao,H.,Lin,Y.,2014.Sex Discrimination and Female Top Managers:Evidence from China.Working Paper.

Ge,W.X.,Kim,J.B.,Song,B.Y.,2012.Internal governance,legal institutions and bank loan contracting around the world.J.Corporate Finance 18(3),413-432.

Gou,Q.,Huang,Y.,Liu,X.,2014.Do banks really discriminate against private firms?Manage.World 1,16-26(in Chinese).

Graham,J.R.,Harvey,C.R.,Puri,M.,2013.Managerial attitudes and corporate actions.J.Financ.Econ.109(1),103-121.

Graham,J.R.,Li,S.,Qiu,J.,2008.Corporate misreporting and bank loan contracting.J.Financ.Econ.89(1),44-61.

Guiso,L.,Sapienza,P.,Zingales,L.,2004.The role of social capital in financial development.Am.Econ.Rev.94(3),526-556.

Hasan,I.,Park,J.C.,Wu,Q.,2012.The impact of earnings predictability on bank loan contracting.J.Business Finance Account.39(7-8),1068-1101.

Huang,J.,Kisgen,D.J.,2013.Gender and corporate finance:are male executives overconfident relative to female executives?J.Financ. Econ.108(3),822-839.

Jensen,M.,Meckling,W.,1976.Theory of the firm:managerial behavior,agency costs and ownership structure.J.Financ.Econ.32(3),305-360.

Jiang,J.,Petroni,K.R.,Wang,Y.,2010.CFOs and CEOs:who has the most influence on earnings management?J.Financ.Econ.96(3),513-526.

Jime´nez,G.,Salas,V.,Saurina,J.,2006.Determinants of collateral.J.Financ.Econ.81(2),255-281.

Kim,J.B.,Ma,L.Z.,Wang,H.P.,2015.Financial development and the cost of equity capital:evidence from China.China J.Account. Res.8(4),243-277.

Kim,J.B.,Song,B.Y.,Zhang,L.,2011a.Internal control weakness and bank loan contracting:evidence from SOX Section 404 disclosures.Account.Rev.86(4),1157-1188.

Kim,J.B.,Tsui,J.,Yi,C.H.,2011b.The voluntary adoption of international financial reporting standards and loan contracting around the world.Rev.Acc.Stud.16(4),779-811.

Knight,J.,2002.Sexual stereotypes.Nature 415,254-256.

Kuhn,P.,Shen,K.,2013.Gender discrimination in job ads:evidence from China.Quart.J.Econ.128,287-336.

Lin,Y.,Sun,X.,2005.Information,informal finance and SME financing.Econ.Res.J.7,35-44(in Chinese).

Liu,Y.,Wei,Z.,Xie,F.,2015.CFO gender and earnings management:evidence from China.Rev.Quant.Finance Account.8.http://dx. doi.org/10.1007/s11156-014-0490-0.

Lu,F.,Yao,Y.,2004.Legality,financial development and economic growth under financial repression.Social Sci.China 1,42-55(in Chinese).

Lu,Z.,Zhu,J.,Zhang,W.,2012.Bank discrimination,holding bank ownership,and economic consequences:evidence from China.J. Bank.Finance 36,341-354.

Levine,R.,2005.Finance and growth:theory and evidence.Handbook of Economic Growth.

Matsa,D.A.,Miller,A.R.,2011.Chipping away at the glass ceiling:gender spillovers in corporate leadership.Am.Econ.Rev.101(3),635-639.

Muravyev,A.,Talavera,O.,Schafer,D.,2009.Entrepreneurs'gender and financial constraints:evidence from international data.J. Comp.Econ.37(2),270-286.

Nguyen,N.T.,Basuray,M.T.,Smith,W.P.,2008.Moral issues and gender differences in ethical judgment using Reidenbach and Robin's (1990)multidimensional ethics scale:implications in teaching of business ethics.J.Bus.Ethics 77(4),417-430.

Ongena,S.,Popov,A.,2013.Gender Bias and Credit Market Barriers for Female Entrepreneurs.Working Paper.

Orley,A.,Hannan,T.,1986.Sex discrimination and product market competition:the case of the banking industry.Quart.J.Econ.101,149-173.

Peng,M.,Luo,Y.,2000.Managerial ties and firm performance in a transition economy:the nature of a micro-macro link.Acad.Manage. J.43(3),486-501.

Qian,J.,Strahan,P.E.,2007.How law and institutions shape financial contracts:the case of bank loans.J.Finance 62(6),2803-2834.

Qing,S.,Zheng,J.,2013.Unequal pay or unequal job:effect of hierarchical segregation on gender earning differentials.China Econ. Quart.12(2),735-756(in Chinese).

Rajan,R.G.,Zingales,L.,1996.Financial dependence and growth.Am.Econ.Rev.83(3),559-586.

Ruegger,D.,King,E.W.,1992.A study of the effect of age and gender upon student business ethics.J.Bus.Ethics 11(3),179-186.

Sapienza,P.,Zingales,L.,Maestripieri,D.,2009.Gender differences in financial risk aversion and career choices are affected by testosterone.Proc.Natl.Acad.Sci.USA 106(8),15268-15273.

Srinidhi,B.,Gul,F.A.,Tsui,J.,2011.Female directors and earnings quality.Contemp.Account.Res.28(5),1610-1644.

Stiglitz,J.E.,Weiss,A.,1981.Credit rationing in markets with imperfect information.Am.Econ.Rev.71(3),393-410.

Sunder,J.,Sunder,S.V.,Zhang,J.,2009.Balance Sheet Conservatism and Debt Contracting.Working Paper.Northwestern University.

Talavera,O.,Xiong,L.,Xiong,X.,2012.Social capital and access to bank financing:the case of Chinese entrepreneurs.Emerg.Markets Finance Trade 48(1),55-69.

Zhang,J.,2008.The contracting benefits of accounting conservatism to lenders and borrowers.J.Account.Econ.45(1),27-54.

16 September 2014

*Corresponding author.

E-mail address:xuxixiong@cqu.edu.cn(X.Xu).

China Journal of Accounting Research2016年2期

China Journal of Accounting Research2016年2期

- China Journal of Accounting Research的其它文章

- Re-examination of the effect of ownership structure on financial reporting:Evidence from share pledges in China

- Troubled by unequal pay rather than low pay: The incentive effects of a top management team pay gap☆,☆☆

- Can media exposure improve stock price efficiency in China and why?