Chinese Movie Fortunes of 2015

by+Catherine+Liu

In 2014, Chinese movies witnessed extreme weather, both fair and foul. Despite the fact that broken box office records fell constantly, the work was roundly criticized for lacking awareness. But does artistic expression really matter when numbers keep moving up?

Chinese movie production, which has just started moving forward, is facing great challenges. The record of box office approximating 30 billion yuan is drawing more capital from a wider range of channels. The operation mode is being transformed and overturned by participation from three titans of Chinas internet: Baidu, Alibaba and Tencent (BAT). Traditional movie producers stand at the crossroads. Domestic capital for movie and television production has been drained overseas.

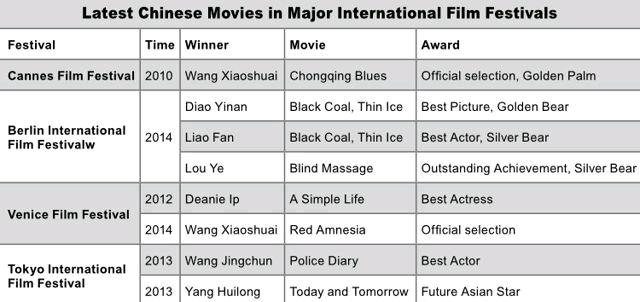

Refreshing Global Patterns

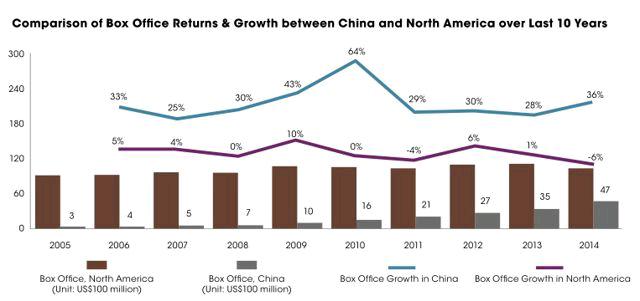

The January 6, 2015 report on the market influence of Chinese movies released by EntGroup, a research institute of Chinas entertainment industry, reveals that Chinese spectators watched 388 domestic movies in 2014, which made 29.6 billion yuan (US$4.96 billion), an increase of 36 percent over 2013, while the box office in North America made US$10.3 billion, a drop of 6 percent – and the same thing happened in many other countries including Japan, Britain, Germany, Russia, and Australia.

In terms of global box office last year, movies made US$37.5 billion, an increase of US$1.6 billion, 75 percent of which was contributed by China – the main engine for box office growth on the planet.

With regards to the contributions of Chinese-made and imported movies to Chinas box office, 16.155 billion yuan was earned by 308 Chinese movies, accounting for 54.51 percent, compared to 13.484 billion yuan from 80 imported films. Coun- tries like Japan and South Korea split their market shares nearly exactly half-and-half between domestic and imported movies. Some 80 percent of Indias box office was taken by domestic movies. Less than 50 percent of the box office in France, forerunner of movie production in the world, and other European countries, came from domestic movies.

Since the implementation of new policies for Chinese and American movies in 2012, Chinas annual imported movie quota has increased to 34 from 20. Chinese-made movies have held half of the market over the last two years despite the strength of mega-blockbusters such as Transformers: Age of Extinction.

Still, the Chinese market has exerted a more-than-subtle influence on Hollywood. Transformers: Age of Extinction, for instance, made US$1.07 billion globally, 240 million from the United States, and 320 million from China – about 30 percent of its total global box office. Paramount, the investor, admitted that the Chinese market contributed remarkably to shrinking its pay-back period.

The Chinese markets decisive role in Hollywood has attracted increasing numbers of film makers to hunt for cooperative opportunities in China. Universal Studios announced the establishment of its China office in July 2014, the last of the six major Hollywood studios to set up shop in the country.

In 2017, China will open its door wider to welcome more movies from all corners of the world, offering greater opportunity for overseas companies. Chinese filmmakers are more concerned with producing internationally competitive movies instead of just watching imports grow.

Europe has counted more on Chinese market than expected. Over the last few years, many European film festival organizers have visited China, inviting more Chinese movies and producers to attend various campaigns during their festivals in hopes of diversifying collaboration with the Chinese government and related associations and enterprises. European directors have also frequently shifted cooperation from Hollywood to China. The best example is director Jean Jacques Annaud from France, who collaborated with Chinese partners on The Wolf Totem, which will be released in 2015.

Studios of the Future

“Intellectual property” has been mentioned frequently in 2014 whether in realms of internet literature, cartoon games, or e-books, which have all been acquired by major movie and television producers in China. Baidu Literature and Tencent Literature, established in 2014, are integrating online literary resources for their own movie companies or other movie and television producers, enabling possibilities for greater development of coveted movie brands and optimal industrial chains.

Listed companies from traditional industries are enthusiastic about acquiring film and television companies. During the first half of 2014, 13 such deals took place, worth 21.3 billion yuan, accounting for 43 percent of the total merger volume of the cultural industry. However, most purchasers know little about movie and television production and have no intention to accelerate development of the film industry. Consequently, merger and integration can be risky for both sides.

Listed film and television companies are reshaping patterns of the industrial chain. Leading listed companies includ- ing Huayi Bros. Media Group, Bona Film Group Ltd., and Enlight Media completed several rounds of merger and investment in 2014. Huayi Bros. Media Group, for example, purchased Yinhan Games to get a piece of the highly-profitable online gaming industry. Enlight Media also bought shares of several game developers. They built their own “ecosphere” for development and transformation through leverage of capital.

The three internet giants, Baidu, Alibaba and Tencent (or BAT), have intervened in the movie industry with massive capital. Last year is believed to have brought an explosion for internet companies attaching to the movie and television industry. iQiyi, a subsidiary of Baidu, successfully co-produced Gone with the Bullets, which is contending for the Golden Bear at the upcoming 65th Berlin Film Festival. Alibaba purchased culture.china.com.cn to found Alibaba Pictures Group Limited and became a shareholder of Youku. Tencent and Youku established Tencent Pictures and heyi.com respectively. Nevertheless, the role that BAT and video websites are playing is mainly one of financing and channels, while production, the fundamental task of movie and television companies, remains weak. Experts believe that it will take at least three years to mature.

Major state-owned companies are striving for holistic public offerings. Representative companies such as China Film Group and Shanghai Film Group Corporation have applied for IPOs many times, and Shanghai Media Group (SMG) is accelerating listing of their subsidiaries. The burden on state-owned film enterprises is heavy due to their complicated organization and major responsibilities coupled with great pressure from private companies and BAT, which has weakened their market sensibility.

Co-production has become a trend for the Chinese movie industry. Experts predict that by 2017, China will open its door wider to the outside world with favorable policies for co-production of movies and television. Policies for greater co-production between China and South Korea have already been finalized, and its not too far from concrete policies for cooperation between China and the United States.

Moreover, Chinese movie companies are exploring derivative markets for movies to create their own “ecospheres,” and their values are expected to explode within five years and give birth to major players in the Chinese movie industry.

China Pictorial2015年2期