Robotics Transformation

by+Wang+Yin

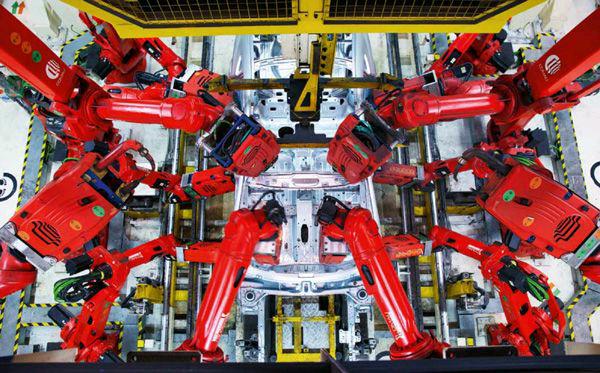

Li Gang first began managing the China operations of Swiss Asea Brown Boveri (ABB) in 1994. As a member of an investigating group organized by the former Ministry of Machine Building Industry, he met dozens of major Chinese auto producers.“Most managers couldnt imagine replacing manual labor with robots because the former was so cheap,” recalls Li.

Twenty years later, employers tunes have changed. Last year, statistics from the International Federation of Robotics (IFR) showed that in 2013, China became the worlds largest consumer market for industrial robots: Chinese manufacturers purchased 36,560 robots, around 20 percent of the worlds total that year.

However, the Chinese consumer market is not dominated by local Chinese enterprises. Rather, top sellers are ABB from Switzerland, Fanuc and Yaskawa from Japan, and KUKA from Germany, which accounted for 53.8 percent of the total consumption in 2013. Another statistics from www.cinic.org.cn shows that of all the robots sold in China in 2012, only 1,112 were made by Chinese enterprises, while 25,790 were made by foreign producers or sino-foreign joint ventures, a sharp contrast between 4 percent and 96 percent.

SIASUN, a robot producer in Shenyang, Liaoning Province in northeast China, was established at the turn of this century. The same year, Germanys KUKA established a subsidiary in Shanghai, which has grown into KUKAs largest branch and one of the four giants dominating the Chinese industrial robot market. Today, SIASUN has become a leader in Chinese industrial robot production, yet still has a long way to go to catch up with its global competitors in overall quality.

Great Potential

What are SIASUNs strengths and weaknesses? “Our competitiveness in industrial robots is related to design, technology, and brand effect,” asserts Qu Daokui, president of SIASUN Robot & Automation Co., Ltd.

As Chinas first enterprise to specialize in the development and production of robots, SIASUN wrote the first page of Chinese independent development of industrial robots. However, the firm has taken some time to mature in terms of the qualities Qu mentioned.

In 2012, the density of robots in Chinas manufacturing sector was 23 per 10,000 people, compared to 396 per 10,000 in South Korea. The potential of the Chinese market is beyond imagination. According to Chinas State Statistics Bureau, the annual pay of the employees in manufacturing was 15,700 yuan in 2005, and rose to 41,500 yuan in 2012. Meanwhile, the cost of industrial robots has dropped by 50 percent over the last decade. Rising labor costs will surely increase the utilization of robots, which are now more affordable.

“Today, China has seen rapid development in the production of industrial robots,” explains Cai Hegao, designer of Chinas first arc welding robot, academician of the Chinese Academy of Engineering, and honorary director of Robotic Research Institute under Harbin Institute of Technology. “But who will emerge on top? Success is measured by the scale of production, which puts KUKA, ABB, and Yaskawa currently on top.”

“Over the last 50 years, China has produced some 1.6 million robots,” continues Qu. “Even if we produced 16 million, they wouldnt satisfy industry,” Cai adds. “Only when China is equipped with 3 million industrial robots can it catch up with the United States in production efficiency. Foreign companies can hardly satisfy demand. Thats why China has so much potential to develop its own industrial robot industry.”

Window of Opportunity

As Qu Daokui illustrated, the “big three” enterprises specializing in robots dominate the industrys technology, personnel, and capital. “An enterprise cant do anything without financial support,”Qu notes. SIASUNs 2013 year-end report showed that the company earned 1.32 billion yuan. The same year, revenue of other world giants were: US$41.8 billion for ABB, US$6 billion for Fanuc, US$3.8 billion for Yaskawa, and US$2.4 billion for KUKA. SIASUN lags far behind despite the fact that these companies all have more diverse operations.

“China needs large-scale producers,”declared Qu Daokui. “Not purely scale of production, but comprehensive strength.”The only way for Chinese manufacturers to compete with the industry leaders is to enhance comprehensive strength as soon as possible. For governments both central and local, “the priority is to foster world-class enterprises.”

The good news is that Chinese companies and global giants stand nearly comparable in many aspects thanks to global industrial restructuring and upgrades as well as the transformation and upgrade of robotic products. But Chinese robot producers still face stiff challenges.

The drastic mode transformation of the manufacturing industry, however, has offered unprecedented opportunity for Chinese companies. “Demand for all types of robots, industrial, specialized, and service, is increasing at a breakneck speed,” Qu explains. “Had we maintained the earlier slow pace of development, we would surely have missed the opportunity.”

Still, the robotics industry is entering a new age in which the formerly non-intelligent robots are wising up. “Were about to see the golden age for all robotics enterprises,” Qu predicts. “Everyone is going to step into a brand new realm simultaneously, leaving no one as a follower.”

Even so, the opportunity is fleeting.“Our window to reach the top is still eight to ten years, during which time the market may have already been won,” Qu admits.“We might fall into the same cycle of chasing others if we miss it.”

China Pictorial2015年2期