Bayesian Analysis of Small Multi-frequency Investment of Agricultural Products

Fengying WANG

School of Information,Beijing Wuzi University,Beijing 101149,China

1 Introduction

The price of agricultural products is affected by climate,production,quality,transportation,delivery,demand,storage duration,season and many other factors,which causes most enterprises to adopt the small multi-frequency ordering pattern for agricultural products,and usually they do not place a large order.In this ordering pattern,the investment enterprises are often faced with many uncertainties,bringing a great risk to enterprises' investment.To ensure the maximum returns to investors,it is necessary to develop a scientific and rational scientific and decision.The correctness of decisions is directly related to expected returns after making decision,so it needs a scientific approach to provide a less risky solution for investment decision.Generally,in order to improve the accuracy of decisions,there is a need to conduct relevant sampling experiments before making decisions,and the decision-makers first understand various factors that influence the decision and then make decisions based on the information provided by sampling results.Bayesian approach is very useful to solve similar risk decision problems.In Bayesian decision,the decision variables are usually composed of discrete and continuous variables.Taking discrete decision variables for example,this paper uses mature Bayesian decision theory to discuss the optimal decision for the small multi-frequency investment pattern of agricultural products,in order to provide a reference for the investment decision of agricultural enterprises.

2 Basic theory

2.1 Bayesian decisionBayesian decision theory is a theory about how to make a choice under risk conditions or in the face of uncertainty[1-2].A prior probability distribution,often simply called the prior,of an uncertain quantity is the probability distribution that would express one's beliefs about this quantity before some evidence is taken into account.For example,the prior could be the probability distribution representing the relative proportions of voters who will vote for a particular politician in a future election.The unknown quantity may be a parameter of the model or a latent variable rather than an observable variable.Bayes' theorem calculates the renormalized point wise product of the prior and the likelihood function,to produce the posterior probability distribution,which is the conditional distribution of the uncertain quantity given the data.Bayesian decision is the risk decision,and although decision-makers can not control the changes of objective factors,they can grasp the possible states of changes and probability distribution of each state.In general,an investment activity may facemultiple natural statesθ1,θ2,…,θn,and decision-makers can estimate the possibility of each state based on previous investment statistics,namely priori probabilityThere are many action programs to be taken by decision-makers:a1,a2,…,am,denoted as action set

2.3 Decision function[4]In the given Bayesian problem,a mapδ(x)from the sample spaceto the action setλ={a1,a2,…,am}is called a decision function of this problem.

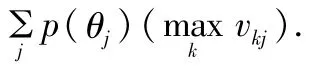

2.4 EVPI(Expected Value of Perfect Information)[3]The evaluation standard of Bayesian decision is the maximum expected return principle,or the minimum expected loss principle.In general,the minimum expected loss principle is equivalent to the maximum expected return principle.And there is:

Formula(2)is defined as EVPI.

3 Research methods

In the Bayesian decision,the priori analysis is generally conducted and then the sampling is done to increase the amount of information.According to the new information,the probability is corrected for posteriori analysis.Posteriori analysis is the main method for Bayesian decision to perform statistical analysis.

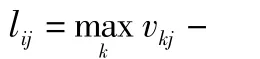

3.1 Priori analysisFirstly,the probability P(θ1),P(θ2),…,P(θn)of the natural state(θ1),(θ2),…,(θn)is estimated,and the action sethat can be used by decision-makers is determined.The payoffmatrix V=(vij)and loss matrix L=(lij)are calculated.In accordance with theminimum expected loss principle,the priori expected loss of various action plans is calculated:

3.2 Posteriori risk analysisIf there is a decision function to make it have the minimum posteriori risk among all decision-making functions,this decision function is the optimal decision function under the posteriori risk criterion,namely the Bayesian decision function.The Bayesian decisions made according to posteriori risk criteria consist of four parts:adding new information;revising probability;determining the optimal decision function;calculating the additional information value.

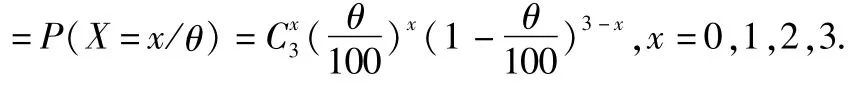

3.2.1 Adding new information.Through s observations(or surveys)of observable random variable X,a sample x=(x1,x2,…,xs)is obtained,and it is just the new information collected from market activities.At the same time,by the data,the conditional probability P(x/θ)of different sample values in various natural states is obtained(θvalue:θ1,θ2,…,θn;x value:x1,x2,…,xs).

3.2.2 Revising probability.Based on the known priori probability P(θ)and conditional probability P(x/θ),the Bayesian formula is used to get the posteriori probability ofθunder given sample x:

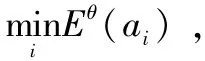

3.2.3 Determining the optimal decision function.Based on the posteriori revised probability obtained P(θ/x),the posteriori expected loss of various action plans is calculated.

It is the posteriori risk.In any decision functionδ(x),if there is decision functionδ0(x)to make it have the minimum posteriori risk,thenδ0(x)is the optimal decision function under the posteriori risk criterion.

3.2.4 Calculating the additional information value.EVPI is decision-makers' expected loss or return when fully grasping the information,and it is based on priori probability.After obtaining sample information,in the discussion on the basis of posteriori probability,the posteriori EVPI can be obtained similarly.The posteriori EVPI is still the random variable dependent on sample x,and the marginal distribution of sample x is used to once again calculate the mathematical expectation on posteriori EVPI to eliminate the randomness and get the expected value of posteriori EVPI.Under normal circumstances,obtaining sample information will increase decision-makers' understanding of stateθ,and the expected loss during the decision-making process will lower.The amount of reduction is called EVSI(Expected Value of Sampling Information):

EVSI=Priori EVPI-Expected value of posteriori EVPI.

EVSI value is the return brought to decision-makers after obtaining the sample information,and it is the value of new supplementary information.It should be noted that the supplementary information is often uncertain,so such information is incomplete,and it is also known as sampling information.Compared with complete information,the supplemental information value is not greater than the complete information value.

4 Empirical analysis

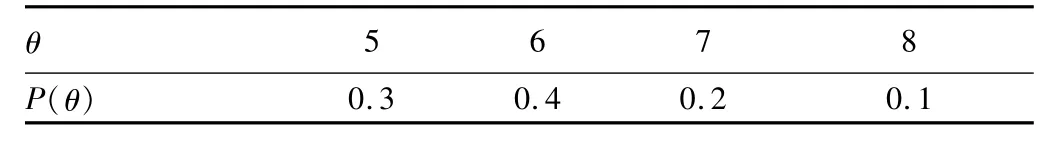

One agricultural enterprise wants to add an investment project related to green organic agricultural products.Market experience shows that the probability of investment failures in one hundred investment activities per year(θ)is shown in Table 1.For every failure,it is assumed that the company has to pay an average loss of 4000 yuan.For carrying on the project,the annual fixed cost is 100000 yuan.In every investment activity of this company,it will generate profit of 350 yuan,and it can make investment 1000 times annually.The EVPI value is calculated.In addition,investors sample three investment activities from one hundred investment activities for survey,and decide whether to proceed with the investment project according to the number of investment failures(x),to find the optimal decision function and calculate EVSI.

4.1 Calculating EVPIBased on the actual situation,the company is faced with the choice of two programs of action:a1do not increase the investment project;a2increase the investment project.After calculation,it is easy to get the payoffmatrix V=(vij)and loss matrix L=(lij):

The priori expected loss of a1and a2is as follows:

Under the priori expectation criteria,α2is the best program of action,so the EVPI=13000 yuan/year.

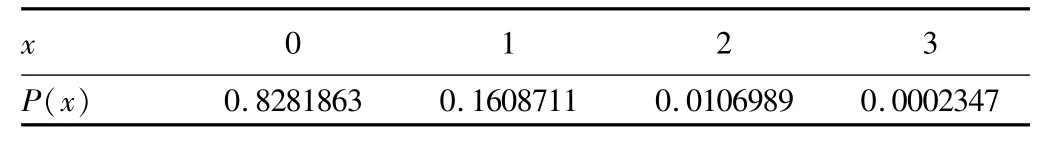

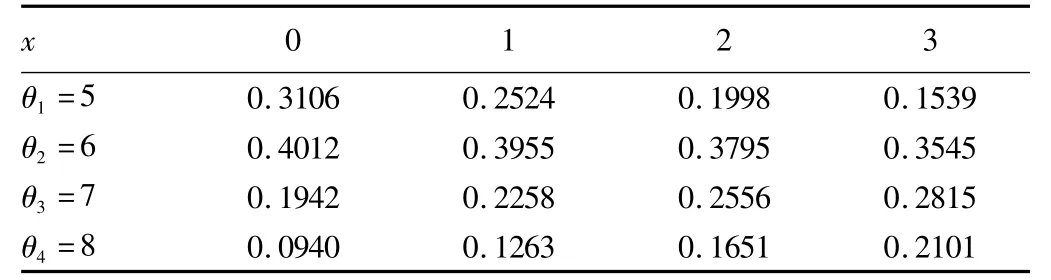

4.3 Revising probabilityAccording to priori probability P(θ)in Table 1,we can calculate the marginal probability of x,and the results are shown in Table2.From the marginal probability in Table 2 and formula(4),we can calculate the posteriori probability P(θ/x)under x=xi,as shown in Table 3.

4.4 Determining the optimal decision functionAccording to Table 3 and formula(5),we calculate the posteriori expected loss of each action program,and the results are shown in Table4.According to the minimum expected loss principle,we develop the best possible results for each possible sampling result x,to get the optimal decision function:

4.5 Calculating posteriori EVPI and EVSIFrom the posteriori expected loss results in Table 4,we can calculate posteriori EVPI,namely the minimum posteriori expected loss under each x value in Table 4:when x=0,posteriori EVPI=12406;when x=1,posteriori EVPI=15615;when x=2,posteriori EVPI=13875;when x=3,posteriori EVPI=14785.The expected value of posteriori EVPI is obtained by calculating marginal probability of x in Table 2 and posteriori EVPI expectation:

This suggests that the optimal decision functionδ0(x)made based on the sampling result x will reduce losses 61.5 yuan compared with the optimal action before sampling,and it is the gain brought by sampling to decision-makers.

Table 1 The probability of failures in one hundred investment activities per year(θ)

Table2 Marginal probability of x

Table 3 Posteriori probability under various x values

Table 4 Posteriori expected loss of action programs under various x values

5 Conclusions

In market economy,many problems are difficult to completely accurately predict,and the investors often make decisions in an uncertain state.Investors always hope that their decision is more convincing,the expected returns are higher,and expected losses are lower.Bayesian method is an effective method to solve such problem of decision making under risk.Through the discussion in this paper,it can be found that the Bayesian method makes full use of the general information,sample information,priori information and loss function,to calculate the optimal decision function and minimum posteriori expected loss,as well as the gain brought by sampling to decision-makers,there by making the whole decision-making process more convincing and scientific.

[1]ZHANG HX.Predict and decision-making[M].Shanghai:Shanghai Jiao Tong University Press,2014.(in Chinese).

[2]WANG MH.Bayesian decision method and its application[J].Journal of Shaoguan University(Social Science Edition),2014,35(10):8-12.(in Chinese).

[3]WANG FY,LIANG ZX.Analysis of decision-making in purchasing risk management based on mathematical expectation[J].Logistics Technology,2012,31(9):228-230.(in Chinese).

[4]ZHU ZF,MIAO JY.The application of Bayes decision[J].Journal of Taiyuan University,2007,8(3):74-76.(in Chinese).

Asian Agricultural Research2015年12期

Asian Agricultural Research2015年12期

- Asian Agricultural Research的其它文章

- Coupling Path of China's Modern Service Industry and Agriculture Based on Improved Entropy Method

- Effort Levels of Capital-constrained Retailer under Bank Financing

- Frontier and Evolution of Marketing Discip line Based on Scientific Metrological Analysis of Top 4 Marketing Periodicals in 2009-2013

- Changes in Net Barter Term s of Trade for Sino-Australian Agricultural Products after China's Accession to the WTO

- Systematic Analysis and Innovation for Development Policies of Beijing Seed Industry at Transformation Stage

- Effect of Agricultural Comprehensive Development on Increasing Income of Farmers in Jiangsu Hilly and Mountainous Areas