Greater Use of RMB in Global Payments Imminent

By+HU+JIANGYUN

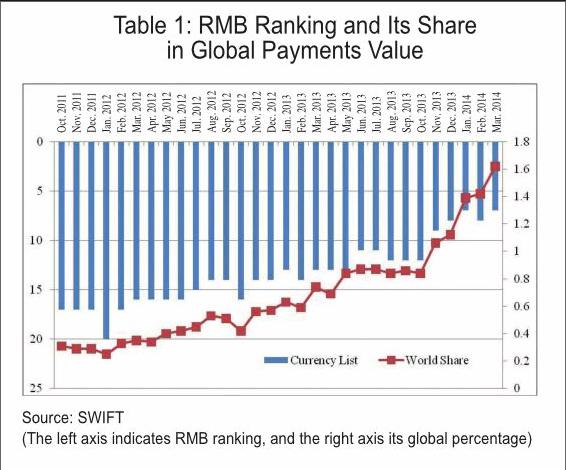

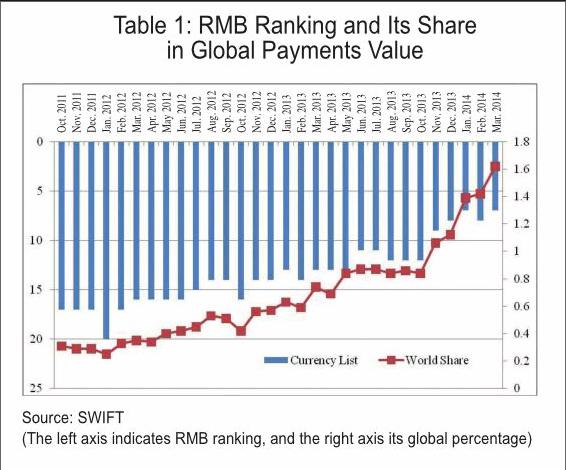

ON April 28, 2014, the Society for Worldwide Interbank Financial Telecommunication(SWIFT) released its latest ranking of currencies used in global payments, Chinas Renminbi (RMB) ranked seventh, its activity share in payments value standing at 1.62 percent.

Table 1 shows the rise of RMB in global payments: It ranked 17th in the fourth quarter of 2011, before slipping down to 20th in January 2012. Subsequently, its share in worldwide payments value climbed steadily, but still at a rate of below one percent up until November 2013. Since that month, the share of Chinas RMB in global payments value has gained by more than one percent, remaining among the top 10 most-used currencies, with its best performance ranking sixth, its share in global payments value standing at 1.62 percent.

Why the Increasing Use of RMB Globally?

The RMB is still a young global payments currency, but it has risen strongly over past years.

In April 2009, the Chinese government kicked off a pilot program of RMB settlement for cross-border trade in several mainland cities including Shanghai, Guangzhou, Shenzhen, Zhuhai and Dongguan, with trade partners Hong Kong, Macao and ASEAN countries. In June 2010, this program was extended to 20 provinces/autonomous regions and municipalities including Beijing; 18 more joined three months later, with trade partners extending to all other countries and regions.

In August 2011, the Peoples Bank of China (PBC), the Ministry of Finance, the Ministry of Commerce, the General Administration of Customs, the State Administration of Taxation and the China Banking Regulatory Commission jointly issued a notice on expanding crossborder RMB settlement services to the whole of China.

Meanwhile, China signed currency-swap-for-trade agreements with many countries and regions worldwide: with the Republic of Korea in 2008; with Hong Kong SAR, Malaysia, Belarus, Indonesia and Argentina in 2009; with Iceland and Singapore in 2010; with New Zealand, Uzbekistan, Mongolia, Kazakhstan, Russia, Thailand and Pakistan in 2011; with the UAE, Turkey, Australia and Ukraine in 2012; and with Brazil, the U.K., Hungary, Albania and the European Central Bank in 2013.

China also advanced RMB settlement under capital accounts. In January 2011, it commenced a trial program with RMB settlement for direct foreign investment. The PBC and the State Administration of Foreign Exchange co-formulated a statute on this issue, followed by Measures for the Administration of Renminbi Settlement Matters Relating to Foreign Direct Investment, released by the PBC in October 2011. These statutes set down explicit rules for RMB settlement for cross-border investments.

By settling their international transactions in RMB, Chinas transnational businesses can better hedge exchange rate risks and save costs by avoiding derivatives that arise in the process of non-local currency settlement. For instance, banks charge 2.5 percent of the value of the purchase, and 5 percent of U.S.-dollar sales for three-month delivery. When using RMB for settlement, Chinese businesses with overseas operations can omit one exchange in the former local currency-U.S.dollar-local currency process, and hence cut costs. It also saves time and improves efficiency of capital use.

The Chinese government has also introduced measures to facilitate RMB settlement. September 2010 saw the promulgation of Measures for the Administration of Renminbi Settlement for Cross-border Trade, and Rules for the Implementation of the Measures. China has relaxed its control over foreign exchange over the past years, making RMB settlement easier. In May 2013, the PBC released rules governing a pilot program for domestic securities by RMB-qualified foreign institutional investors (RQFII), which promotes the establishment of more RQFIIs. In July 2013, the PBC adopted simplified measures for cross-border RMB business and amended the relevant rules. In December that year, the Ministry of Commerce announced the Notice on Relevant Issues of China Foreign Direct Investment outward, and the State Administration of Foreign Exchange issued the Adjustments of the Management of RMB-Foreign Exchange Derivatives Business, simplifying procedures for foreign-exchange swap transactions. In April 2014, the State Administration of Foreign Exchange issued the Notice about Several Issues Concerning Collective Operation of Foreign-exchange Capital of Multinational Corporations (for Trial Implementation), which allows multinational businesses to freely transfer money between domestic and overseas bank accounts within stipulated sums.

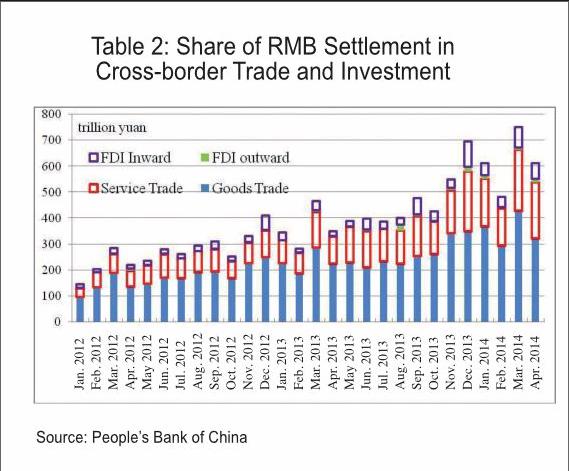

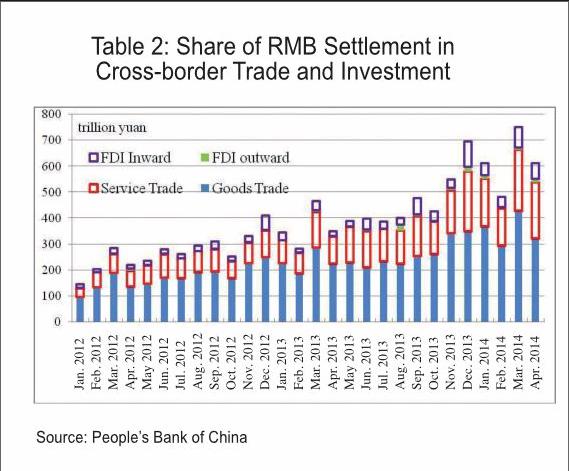

The above measures have substantially boosted RMB use in international trade and investment. The volume of RMB settlement for cross-border trade reached RMB 2.08 trillion in 2011, marking a 3.1-fold growth over the previous year. The figure continued to rise in 2012, to RMB 2.94 trillion, gaining 41 percent year-on-year, and then RMB 4.63 trillion in 2013, up 57 percent. In the first quarter of 2014 the volume of cross-border RMB settlement hit RMB 1.65 trillion, surging 65 percent year-on-year.

As can be seen in Table 2, during the period from January 2012 to April 2014, the volume of RMB settlement for cross-border trade climbed from RMB 128.4 billion to RMB 536.6 billion, and that for foreign direct investment (FDI) multiplied from RMB 15.2 billion to RMB 75.9 billion. Breaking it down, the volume of RMB settlement for cross-border commodity trade soared –from RMB 95.1 billion to RMB 321.2 billion over the period; while that for service trade and other items under the current account swelled – from RMB 33.3 billion to RMB 215.4 billion; that for outward FDI – from RMB 1.7 billion to RMB 15.6 billion; and that for inward FDI –from RMB 13.5 billion to RMB 60.3 billion.

Paths to RMB Becoming More Accepted

Despite all the advances made over recent years, Renminbi usage in global payment remains at a low level when compared with the U.S. dollar, euro, British pound, Japanese yen, Australian dollar, and Canadian dollar. A SWIFT report of April 2014 shows that these currencies international shares are, respectively, 40.19 percent, 31.78 percent, 9.24 percent, 2.49 percent, 1.84 percent, and 1.83 percent. Thus the RMB has a lot of catch-up to do.

But Chinas currency is destined to be increasingly used globally, as the countrys economic, trade and investment strength continues to grow. At present, the international status of the RMB is incommensurate with the status of the Chinese economy. With a share of 13 percent, China topped the worlds commodity trade last year. But the use of RMB in transaction settlement re- mains low, at 6.6 percent, 8.4 percent and 11.7 percent, in 2011, 2012 and 2013, respectively. Even at the highest record, of 11.7 percent, half of the settlements were not RMBdenominated.

Similarly, China has now become a major source of foreign investment worldwide, but outbound FDI in RMB accounts for only 4.2 percent, 5.3 percent and 15.3 percent of its total FDI in the 2011-2013 period. It is foreseeable that there will be much room for growth in the coming years if Chinas economy continues upward growth, and its reforms on exchange rates and interest rates are deepened.

Qu Hongbin, chief economist for China at HSBC Holdings Plc, said that by 2015, one third of Chinas international trade will be settled in RMB, which will catapult it to the top three global payments currencies for trade. This is an optimistic forecast, but still no one can deny the trend that the RMB is steadily gaining weight in global payments, despite fluctuations.

The establishment of the China (Shanghai) Pilot Free-Trade Zone will give the RMB another shot in the arm. It will lay groundwork for its capital accounts convertibility, marketization of interest rates and crossborder use, while exploring reforms in Chinas foreign exchange management with a global vision. It is therefore expected to serve as an “offshore” RMB financial market within Chinese borders, and propel cross-border usage of RMB to new levels.

More countries and regions are upbeat about the increasing usage of RMB in global payments. A 2013 report by HSBC on RMB business among transnational companies worldwide shows that nearly half (48 percent) of businesses interviewed said they have a good knowledge of internationalization of the RMB, with the highest rate in Hong Kong and the U.K., at 72 percent and 56 percent, respectively. The figure stands at 44 percent for both the U.S. and Germany.

Of the companies covered by the survey who use RMB for transactions, 73 percent expect an increase in cross-border RMB business in the coming five years, and nearly 30 percent look forward to a growth rate of more than 20 percent. The two incentives for using RMB are: demand from trade partners, and the desire to lower risks. Almost half, or 48 percent, of the respondents opt for RMB settlement to reduce foreign exchange risks or to cut costs; 46 percent do so at the request of trade partners; and 42 percent believe RMB settlement is more convenient for daily business or accounting management. It is evident that RMB settlement brings win-win results to both parties in international trade. This is why Chinas currency is being more used in global payments.