A Turning Point in Sight

By+Zhou+Xiaoyan

Pan Shiyi, a real estate tycoon, said at the China Entrepreneurs Forum held in Beijing on May 23 that Chinas residential housing market would hit the iceberg very soon.

“After the collision, risks in the property market will result in more serious risks in the financial sector,” Pan said.

Pan may be exaggerating, but risks in the housing market are real.

Following a strong performance in 2013, Chinas real estate market has shown signs of cooling down. Prices have been dropping, sales have slowed, new construction has dropped off sharply and banks have become increasingly cautious about lending to developers and home buyers.

In Beijing, the barometer of Chinas overall property market, home sales declined by almost half to a nine-year low in the first half of 2014. There were 22,782 new homes sold in Beijing in the first six months (as of June 26), a slump of 48.7 percent over the same period last year, according to data from property agency Centaline Group.

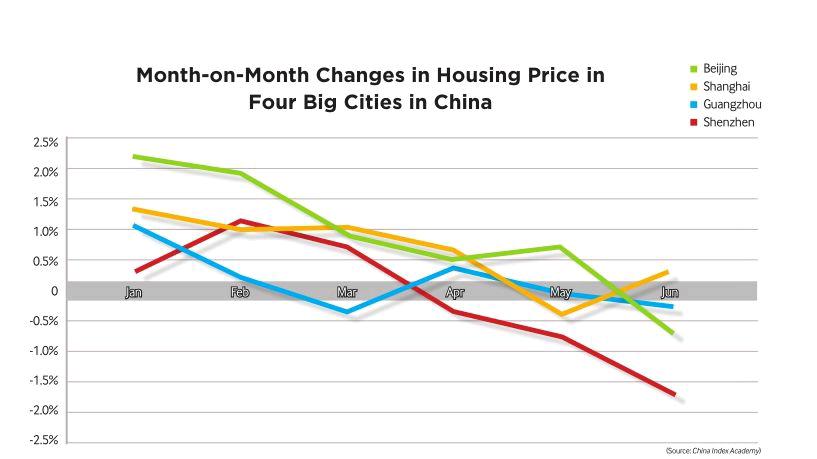

In May, 35 out of a statistical pool of 70 major cities saw month-on-month drops in new home prices. Only 15 cities saw month-onmonth increases, according to data from the National Bureau of Statistics (NBS).

Average prices in the countrys 100 biggest cities fell 0.5 percent in June from May, the second consecutive monthly drop this year, ac-cording to the China Index Academy Ltd., a Beijing-based research institute wholly owned by SouFun Holdings Ltd. In May, average prices edged down 0.32 percent from April.

In the first five months of 2014, real estate investment, which affects more than 40 other sectors from cement to furniture, rose 14.7 percent year on year, down from the 16.4 percent in the first four months and 20.6 percent in the same period of last year. Newly started property

construction fell 18.6 percent year on year, the fourth consecutive period of decline. Property sales dropped 7.8 percent year on year in terms of floor space and fell 8.5 percent in terms of value, according to data from the NBS.

“The risk of a more persistent and sharper downturn in the property sector is now the biggest threat facing Chinas economy in 2014 and 2015,” Wang Tao, an economist at UBS Bank, said in a research note.

Analysts say that the real estate sector, which accounts for more than 15 percent of Chinas GDP, could determine the severity of the economic downturn.endprint

However, evidence of a housing market crash remains thin, partly owing to the ongoing urbanization drive and faster-than-ever wage increase. Analysts think this round of real estate market adjustment may signal a change in growth drivers for the worlds second largest economy.

local bailout

Several factors have contributed to the recent price fall.

“High inventories in some cities and promotions recently undertaken by some developers, together with unclear market expectations that kept buyers staying on the sidelines, have led to prices falling,” said Liu Jianwei, a senior statistician at the NBS.

NBS data showed China had 352.8 million square meters of unsold homes at the end of May, over three times last years average monthly sales.

Owing to a stock market that has been bearish for some time, many Chinese believe the best way to keep their money from depreciating is to buy property.

Chinas vacancy rates were around 22.4 percent, suggesting a considerable overhang of inventory, according to the China Household Finance Survey carried out by Southwestern University of Finance and Economics.

In Hohhot, capital of north Chinas Inner Mongolia Autonomous Region, housing stock is close to 120,000 units, while monthly sales are running at about 1,000, according to data from Centaline.

At the end of June, Hohhot became the first city in China to put an end to restrictions on home purchases. Centaline estimated that more than 30 cities may follow suit within this year.

Some cities have taken a different track by offering easier access to local hukou—permanent residential permits—to boost sales, such as Wuhan, capital of central Chinas Hubei Province; Haikou, capital of south Chinas coastal Hainan Province; and Wuxi, in east Chinas Jiangsu Province.

In Hangzhou, capital of east Chinas Zhejiang Province, where home prices fell the most in May among the 70 major cities monitored by the NBS, several property developers have given homebuyers an option to sell back their apartment in several years for prices above the purchase price, in order to lift lackluster sales.

In Guangzhou, capital of south Chinas Guangdong Province, almost 20 housing developments have rolled out no-down-payment plans to boost sales, according to a report from Nanfang Daily.

The Central Government has made tacit acknowledgement of the lifting of property curbs by local governments.endprint