Outbound Chinese Capital Spurs European Economy

THE European Unions advanced technology, skilled labor force, transparent legal environment, and relatively easy market access make it the preferred investment destination for Chinese investors. European countries, meanwhile, welcome investment from Chinese enterprises, because it promotes economic recovery and growth and creates more employment opportunities. At present, China occupies one tenth of the global economy, yet its outward investments account for just 1.5 percent of the global total FDI. Chinas investment potential in Europe is consequently enormous. New York-based international advisory body Rhodium Group estimates that between 2012 and 2020, Chinas accumulated FDI in Europe will reach between US$250 billion and US $500 billion.

Increasing investment in Europe will give China access to the continents high technology and advanced managerial experience, dilute the risks associated with its vast foreign exchange reserves, and also help diffuse dissatisfaction among certain Europeans over the longstanding problem of trade defi cits.

Investment in Core Countries

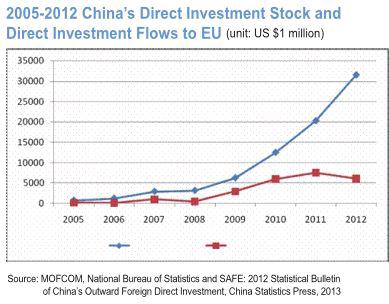

In 2005, Chinas FDI in the EU totaled US $768 million, accounting for just 1.3 percent of its FDI as a whole, according to the 2012 Statistical Bulletin of Chinas Outward Foreign Direct Investment, released by the Ministry of Commerce and National Bureau of Statistics. One year later, investments in Europe had reached US $1.275 billion, a year-on-year growth of 66 percent. Contrary to what might be expected, after the outbreak of the European debt crisis, China increased rather than reducing its EU investments, so bringing about a surge in development. Those in 2009 reached US $6.278 billion, almost double the 2008 amount. By the end of 2012, Chinas FDI stock in the EU stood at US $31.538 billion, a 40-fold increase over the 2005 level, accounting for 5.9 percent of Chinas total FDI.

Although the years 2005 to 2012 saw fluctuations in Chinas direct investment flows to the EU, it nonetheless fundamentally appeared as a rising trend. A historical change occurred in 2010, when Chinas FDI flows to Europe exceeded those from the EU to China, peaking at US $7.561 billion in 2011 – almost 60 times that in 2006. Growth of Chinas investment in Europe was apparent in the escalation of Chinese enterprises entering Europe. In 2010 there were 4,525 Chinese direct investment enterprises on the continent with total assets of €15.178 billion. By the end of 2012 they had proliferated to 7,148, registered in 35 European countries, with assets worth €87.8 billion, according to the Euro-China Investment Report 2013/2014 released by the Antwerp Management School.

Although Chinas investment in Europe has ballooned, it nonetheless remains at the initial stage, both sides figuring equally low on the bilateral investment scale. There is consequently huge potential for growth. Ministry of Commerce statistics show that, in 2012, Chinas FDI stock in the EU totaled US $31.538 billion, accounting for 5.9 percent of its global sum, and that the countrys investment flows to the EU amounted to US $6.12 billion, accounting for seven percent of its world total. During the same period, Chinas FDI stock in the U.S. totaled US $17.08 billion, its investment flows there amounting to US $4.048 billion. At the end of 2012, EU direct investment stock in China stood at €118.1 billion, less than one percent of the EUs total FDI, according to Eurostat information on EU direct investment in China. The stocks of EU FDI in the U.S., meanwhile, totaled€1.7 trillion, accounting for 13.4 percent of EU outward FDI. The year 2012 saw an increase in net flows of EU FDI to China of €15.516 billion, accounting for 3.7 percent of the total, as compared to an increase in net flows to the U.S. of€62.903 billion, accounting for 15 percent of total net flows of EU FDI. The bilateral FDI disparity between China and the EU and their economic aggregates is thus clear. Both sides hence have ample scope for increased investment.

The pentagon-shaped area comprising the five cities of London, Hamburg, Munich, Milan and Paris possesses ad- vanced technologies and strong industrial competitiveness that most attract foreign investments. As Chinese investors are drawn to companies with advanced technologies and famous brands, they tend to select those in Europes core countries, such as UK, France and Germany.

Rhodium Group statistics show that, from 2000 to 2011, Chinas newly increased FDI in the EU added up to US$20.957 billion (with 573 new projects), with that in France to US $5.722 billion(with 70 projects); that in the UK to US$3.684 billion (95 projects); and that in Germany to US $2.543 billion (146 projects). Ministry of Commerce data show that at the end of 2001, Chinas direct investment stock reached more than US$1 billion in six EU members, namely, Luxembourg (US $8.978 billion), UK(US $8.934 billion), France (US $3.951 billion), Germany (US $3.104 billion), Sweden (US $2.408 billion) and the Netherlands (US $1.108 billion).

All six countries are located in the core area. It is worth mentioning that before 2007, China had next to no investments in Luxembourg, but by the end of 2009 its investments there had snowballed to US $2.271 billion – 53 times that in 2008. Luxembourg is a strategically located, world famous financial center, with clear advantages in modern service industry, high-end manufacture, high technology and modern logistics. Chinese enterprises might hence consider Luxembourg a suitable platform for establishing trade and investment cooperation with countries in this core area of Europe.

Focus on Service and Manufacturing

The distribution of Chinese investment in Europe covers almost all the fields that agriculture, industry and service encompass. Within the EU industrial structure, the service industry accounts for 71 percent, industry for 27 percent and agriculture for two percent. Service and manufacturing are consequently the focus of Chinese investment in Europe. In 2012, the three sectors in the EU in which China held the highest FDI stocks were the rental and commercial industry, finance industry and manufacturing industry, according to Ministry of Commerce statistics. To be specific, Chinas direct investment stocks in the rental and commercial industry stood at US $9.667 billion, accounting for 30.7 percent of the total, mainly distributed in Luxembourg, the U.K. France, Germany, Sweden and the Netherlands. FDI stock in financial industry amounted to US $6.638 billion, accounting for 21 percent of the total, mainly distributed in the U.K., Luxembourg, Germany, France, Italy and Hungary. And at US $6.302 billion, manufacturing industry FDI stock accounted for 20 percent of the total, mainly distributed in Sweden, the U.K., Germany, the Netherlands, France, Italy, Spain, Austria and Hungary. It is notable that although the EU has limited natural resources, certain transnational mining companies either go public or set up their headquarters in Europe. Cooperating with those companies has given Chinese enterprises the chance to invest in the mining sectors of EU countries. In 2012, therefore, Chinese FDI stock in EU mining sectors reached US $3.793 billion, accounting for 12 percent of the total, mainly distributed in France, the U.K., the Netherlands and Luxembourg.

The two broad divisions of international FDI consist of establishment of new overseas subsidiaries (greenfield investments) and acquisitions of controlling stakes in existing companies (mergers and acquisitions – M&A). Chinas investments in Europe have mainly been the latter. From 2000 to 2011, Chinas FDI in the EU totaled US $20.958 billion, greenfield investments accounting for US $5.307 billion, or 25.3 percent, and M&A for US $15.65 billion, or 74.7 percent of the total, according to Rhodium Group statistics.

The types of Chinese investors in Europe include state-owned enterprises, mixed ownership companies, private companies and individuals. As regards investment scale, state-owned enterprises and state-owned holding companies are at the higher end. From 2000 to 2011, Chinas FDI in the EUs 27 countries totaled US $20.958 billion, among which US $15.151 billion was from stateowned enterprises and sovereign wealth fund, accounting for 72 percent of the total, as compared with US $5.807 billion from private enterprises and private holding companies, accounting for 28 percent. Since the establishment of the socialist market economy, Chinese private enterprises have grown stronger and played a more important role in Chinas FDI. Private enterprises and private holding companies completed 573 investment deals in the EU from 2000 to 2011, making up 63 percent of the total, according to Rhodium Group statistics.

Impact on the European Economy

The outbreak of the global financial crisis and the European debt crisis dramatically reduced European enterprisesliquidity. Chinese enterprises, however, bucked the trend by significantly stepping up their investments in Europe, so alleviating to some extent European companies financing difficulties and liquidity shortages. From 2009 to 2011, Chinas FDI in Europe steadily climbed, reaching US $2.966 billion in 2009, fivefold that in 2008, and hitting US $7.561 billion in 2011.

Statistics from various sources show that Chinas investment has expanded employment opportunities in European countries. Chinese Ministry of Com-merce statistics show that by the end of 2012 Chinas FDI in the EU had set up around 2,000 enterprises employing 42,000 locals. By the end of 2012, Chinese enterprises in Europe had grown from 4,525 in 2010 to 7,148. Jobs for locals consequently soared from 27,381 to 123,780, according to the Euro-China Investment Report 2013/2014 released by the Antwerp Management School. An analysis of these figures from an investment theory perspective shows that jobs resulting from M&A projects are on a smaller scale than those from greenfield investments. But what must be taken into account is that Chinese enterprises conducting M&A deals usually allow companies to retain their original operational systems, and never lay off employees. On the contrary, after expanding the operational scale, they add new positions. For instance, in 2010, Chinas Geely signed a purchase deal with Volvo worth US $1.8 billion. Geely both preserved the existent 16,000 jobs and boosted investment in relevant industries in Sweden and other European countries, so creating new jobs. It is a fact that small European enterprises that have either merged with or been acquired by Chinese enterprises enjoy improved business and expanded scale, and hence hire more workers. For example, after its takeover by the Beijing No.1 Machine Tool Plant the German mechanical manufacturing company Waldrich Coburg increased its employees from 500 to 800.

In recent years, domestic and external factors have caused lackluster industrial competitiveness and declining labor productivity in European countries. Since the European debt crisis, Europe has experienced slowing economic growth and serious social problems that have impeded development of its advantageous industries. A typical example is that of depleted traffic in the Port of Piraeus, Greeces largest container port.

On June 12, 2008, the China Ocean Shipping Group (COSCO) won the privatization tender for a 35-year concession to run Piers 2 and 3 at Piraeus Port for a price of € 3.4 billion. After signing the relevant agreements with the Piraeus Port Authority, on September 30, 2009, COSCO started managing the two container terminals. The group provided retraining for Greek port workers that streamlined their efficiency, enabling them to up their rate of loading and unloading from six to 22 standard containers per hour, so surpassing the European port average. Dora Bakoyannis, then Greek Minister of Foreign Affairs, said in an interview with Xinhua News Agency that COSCOs operation of Piraeus Port in the coming 35 years is expected to earn Greece €4.3 billion in revenue and create about 1,000 jobs, as well as achieving a 2.5-fold increase in the ports handling capacity.

Chinas investments thus help European companies to expand their share in the global market. In August 2012, Chinas Sany Group bought the world famous German engineering machinery manufacturer Putzmeister, established in 1958, a company whose concrete pumps had sold well around the globe since the 1970s. In 2009, Sany Group surpassed Putzmeister to become the worlds largest concrete machinery manufacturer in terms of sales volume. After completing the acquisition, Sany Group helped Putzmeister expand its scope of products from concrete pump vehicles to mixer vehicles and cement mixers, so extending the product line. As Putzmeister CEO Norbert Scheuch said, “The acquisition has perfectly enriched our product combination.”KHL Group, a world leading supplier of international construction information, also believes that the acquisition has enabled Putzmeister to expand its influence in the global concrete machinery market.

Chinese investments are conducive to raising the asset value of European enterprises. Market rules stipulate that prices climb as demand increases. Although the European debt crisis lowered the stock price of certain European enterprises, the arrival of Chinese enterprises on the continent raised the demand for European assets and consequently their price. Governments of European countries having the advantage when selling the stock equity of public sectors, transactions are completed at a higher price.

To promote Chinese investments in Europe, China and Europe are negotiating bilateral investment agreements. Their focus on market access and investment protection, emphasis is laid on the principle of reciprocity in terms of investment policy and market openness. Investors are moreover expected to observe relevant social and environmental standards and fulfill their corporate social responsibilities.