A Study on the Factors Influencing the Income Gap between Urban and Rural Areas Based on State-space Model

Xiaofang ZOU,Xueqin JIANG

1.School of Economics,Yangtze University,Jingzhou 434023,China;2.Research Center for Rural Development in Hubei Province,Jingzhou 434023,China

1 Introduction

The widening income gap between urban and rural areas has become a major social problem plaguing China's economic development.China's income gap between urban and rural areas is the largest in the world(Li Shi,2004)[1].Data show that in 1981,the per capita disposable income of urban residents was 500.4 yuan,while the per capita disposable income of rural residents was223.4 yuan,with the urban-rural income ratio of 1.98∶1;in 2013,the per capita disposable income of urban residents was 26955 yuan,while the per capita disposable income of rural residents was 8896 yuan,with the urban-rural income ratio of 3.03∶1.The per capita disposable income of urban residents increases at average annual growth rate of 13.27%,while the per capita disposable income of rural residents increases at an average annual growth rate of12.20%.Since the disposable income of rural residents has a small base and the annual growth rate of disposable income of rural residents is lower than that of urban residents,the income gap between urban and rural areas shows a growing trend.This has restricted the healthy and stable and sustainable development of China's economy.Therefore,many scholars are highly concerned about the reasons for income inequality.Lu Ming,Chen Zhao(2004)[2]believe that the local government often adopts the urban-biased economic policies in order to pursue shortterm economic growth,which is an important reason for the expanding gap between urban and rural areas.Pan Xihong et al.(2013)[3]point out that the property income growth is conducive to narrowing the income gap between urban and rural areas in China,while the rising level of the marketization exacerbates the income gap between urban and rural areas.Li Xuesong(2013)[4],Chen Anping(2009)[5],Ma Guangrong(2010)[6]and Li Lingli(2013)[7]maintain that the fiscal decentralization exacerbates the income gap between urban and rural areas.Yu Weifeng(2011)[8],Yao Yaojun(2005)[9]and Qiao Haishu(2009)[10]study the relationship between financial development and the income gap between urban and rural areas.Through these studies,it is found that these scholars mostly use regression analysis,cointegration analysis and other methods,but few of them integrate a variety of methods to study the factors influencing the income gap between urban and rural areas.Therefore,this paper uses the stepwise regression method to analyze the main factors affecting the income gap between urban and rural areas,then carries out the stationarity test of the variables and uses cointegration test method to test the long-term equilibrium relationship between the variables and the urban-rural gap,and finally builds the state-space model to estimate the degree of dynamic impact of various factors in different periods on the income gap between urban and rural areas.

2 Variable description and data sources

Urbanization level(X1),level of socio-economic development(X2),urban investment(X3),fiscal decentralization(X4),education level(X5),level of industrialization(X6),financial development scale(X7),financial development efficiency(X8)and foreign trade(X9)are all likely to have an impact on income gap between urban and rural areas(Y).Therefore,we choose Y as the dependent variable,to study the nine factors of X1,X2……X9on the income gap between urban and rural areas.For the income gap between urban and rural areas(Y),we employ the ratio of per capita disposable income of urban residents to per capita disposable income of rural residents to measure the income gap between urban and rural areas,and all indicators deduct the price impact.For urbanization level(X1),it is denoted by the propor-tion of the urban population to the total population.For level of socio-economic development(X2),we use the growth rate of per capita GDP to reflect it.For urban investment(X3),we use the ratio of urban fixed assets investment to total social fixed assets investment to represent it.For fiscal decentralization(X4),we use the proportion of local fiscal expenditure to total fiscal expenditure to represent it,and the higher the proportion of local fiscal expenditure,the stronger the the governmental preference for city.For education level(X5),it is represented by the proportion of the population with the education level of senior high school or higher to the total population.For level of industrialization(X6),it is represented by the ratio of added value of the secondary industry to GDP.For financial development scale(X7),we use the proportion of balance of deposits and loans of financial institutions to GDP to represent it.For financial development efficiency(X8),we use the ratio of savings to loans to measure the efficiency of financial intermediaries.For foreign trade(X9),we use the ratio of total imports and exports to GDP tomeasure it.In this paper,the data used are the time-series data from 1981 to2012,and the data are from the website of International Bureau of Statistics and China Statistical Yearbook.In order to ensure comparability of data and eliminate heteroscedasticity,we carry out the logarithmic processing of the data.

3 Empirical analysis

3.1 Stepwise regression analysis In order to analyze the impact of eight factors such as urbanization level(X1)and level of socio-economic development(X2)on the income gap between urban and rural areas(Y),we first establish a multiple linear regression equation including the above eight dependent variables:

whereα0is the constant term;βiis the coefficient of independent variable Xi;μtis the error term.

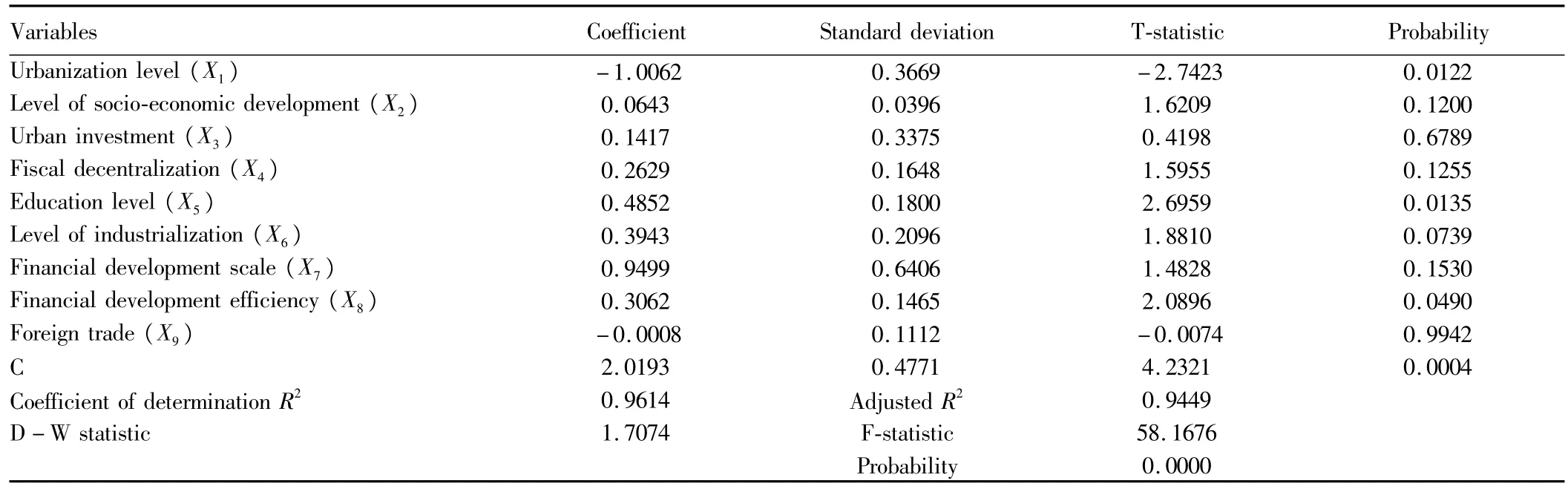

We use the Eviews software for multiple regression analysis,and the regression results are shown in Table 1.

Table1 The least-squares parameter estimation results

The coefficient of determination R2=0.961 4,indicating that the overall regression effect of the model is good and 96.14%of changes in the income gap between urban and rural areas can be explained by the changes in the nine independent variables.The adjusted coefficient of determination R2=0.9449,indicating that the model is highly fitted.However,T test values of coefficient of X2,X3,X4,X6,X7and X9are not significant,suggesting that there is multicollinearity in the model.In order to eliminate the effects of multicollinearity,we use stepwise regression way to find the main factors affecting the income gap between urban and rural areas,and get corrected model using stepwise regression analysis as follows:

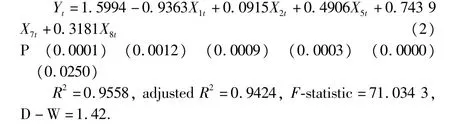

After stepwise regression analysis,it is found that R2of equation(2)is0.9558,indicating that95.58%of the changes in the income gap between urban and rural areas can be explained by the model,and the T-test results of X1,X2,X5,X7,and X8are significant,so urbanization level(X1),level of socio-economic development(X2),education level(X5),financial development scale(X7)and financial development efficiency(X8)are the main factors affecting the income gap between urban and rural areas.The regression results show that the improvement of urbanization level can help significantly narrow the income gap between urban and rural areas;socio-economic development,improvement of education level,financial development,scale expansion and improvement of efficiency have all significantly expanded the income gap between urban and rural areas.Therefore,to narrow the income gap between urban and rural areas,it is necessary to accelerate the urbanization process,strive to improve farmers'income,increase investment in rural education,and improve the non-equilibrium of financial development.

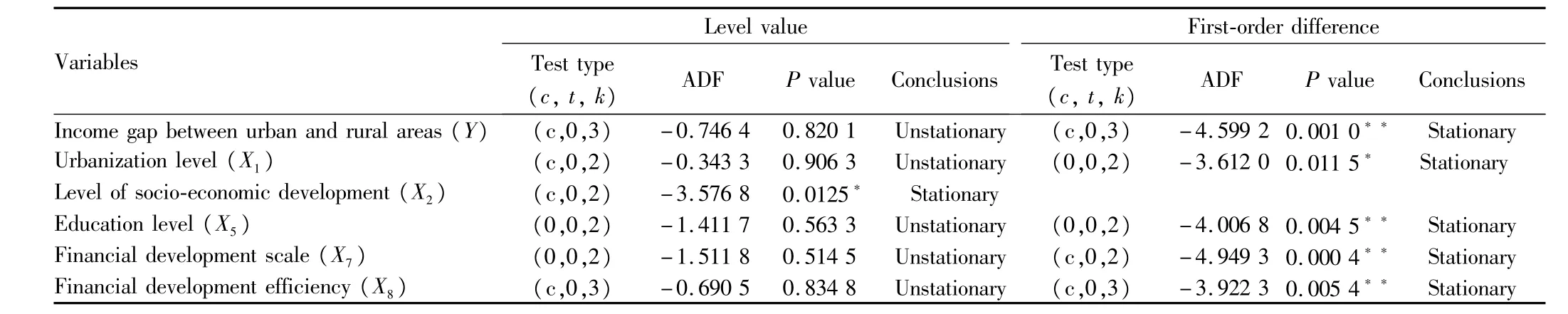

3.2 Cointegration In this paper,we select the commonly used ADF method to test the unit root of various variables,and the indicators selected in this paper are the ratios of different time series,so the test pattern only contains the intercept,and does not include the trend.The lag order is determined by the AIC criteria.The unit root test results are shown in Table 2.

Table 2 ADF test results of each sequence

As can be seen from Table 2,at the 5%significance level,the income gap between urban and rural areas(Y),urbanization level(X1),education level(X5),financial development scale(X7)and financial development efficiency(X8)are unstationary series,and after the first-order difference,they are all stationary time series.Therefore,income gap between urban and rural areas(Y),urbanization level(X1),education level(X5),financial development scale(X7)and financial development efficiency(X8)are all integrated of 1 time series,namely I(1)series.At the 5%significance level,the level of socio-economic development(X2)is stationary time series,that is,the variable X2is I(0)series.According cointegration theory,we can see that all of the variables are I(1)time series.If the variable is the same order single whole series,there may be cointegration relationship,and it is necessary to further examine whether there is cointegration relationship between the variables.The cointegration test results are shown in Table 3.

Table3 Cointegration test results of variables

From Table 3,it can be found that according to the trace statistic test and the maximum eigenvalue test,the relationship between the income gap between urban and rural areas(Y)and the five variables(urbanization level X1,level of socio-economic development X2,education level X5,financial development scale X7and financial development efficiency X8)is constrained by four cointegration equations,which means that there is a stable longterm cointegration relationship between the income gap between urban and rural areas and the five variables.Therefore,we can build the model to examine the quantitative relationship between them.

3.3 State-space model Equation(2)and equation(3)analyze the long-term and short-term impact of urbanization level,socio-economic development,education level and financial development on the income gap between urban and rural areas,but the coefficient of independent variable is a constant,which fails to reflect the impact of unpredictable variables on the income gap between urban and rural areas.Therefore,this paper will establish the state-space model to analyze the impact of unobserved variables on the income gap between urban and rural areas.The statespace model is as follows:

where sυ1,sυ2,sυ3,sυ4and are the state vectors of the model,which are the time-varying parameters of urbanization(X1t),level of socio-economic development(X2t),education level(X5t),financial development scale(X7t)and financial development efficiency(X8t),respectively,and these state vectors are assumed to follow AR(1)model;μtandεtare the random disturbance term of measurement equation and state equation,and they are assumed to follow the normal distribution with mean of 0,variance ofσ2and cov(μ,t)=g.

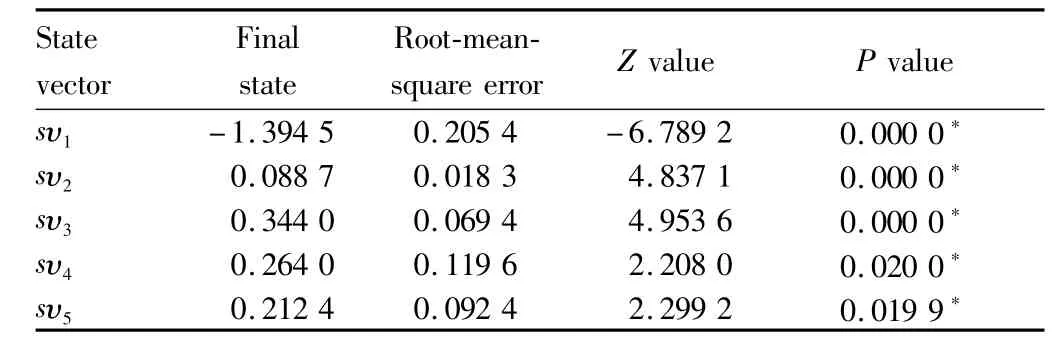

The Kalman filtering is used to analyze the state-space mod-el,and the results are shown in Table 4.It can be found from Table 4 that the estimated values of the state-space model with the variable parameters pass the test,and the model is correctly assumed.

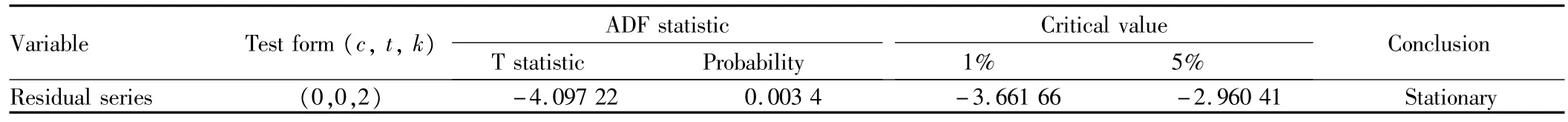

Then we carry out the unit root test of the residuals of statespace model,and the results are shown in Table 5.

Table5 shows that the estimated residual of state-space model at the 1%significance level is the stationary time series.Therefore,the Kalman filter estimation results of state-space model is effective.

Table 4 The estimates and statistics of the state-space model

Table5 ADF test results of residual series of state-space model

3.4 The empirical analysis based on state-space model

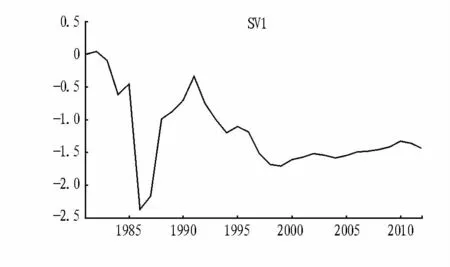

3.4.1 The impact of urbanization on the income gap between urban and rural areas.From sυ1in Fig.1,it can be found that in the period 1981-2012,the time-varying elasticity of the level of urbanization in China to the income gap between urban and rural areas was negative,indicating that the improvement of the level of urbanization can effectively ease the pressure of income gap between urban and rural areas,which is consistent with the results of the regression analysis.The value of sυ1underwent great volatility in the period 1981-1999,reaching a maximum value of0.041 in 1982,but then quickly dropping to its lowest point(-2.3655)in 1986,indicating that in the year,when the level of urbanization increased by 1%,the income gap between urban and rural areas would decrease by 2.3655%.Subsequently,it quickly rebounded to-0.3386 in 1991,and in the period 1992-1999,the elasticity of the level of urbanization in China to the income gap between urban and rural areas showed a downward trend,and fluctuated from -1.4 to-1.6 later,indicating that when the level of urbanization increased by 1%,the income gap between urban and rural areas would decrease by 1.4%to 1.6%.In the early period of urbanization,the rural surplus labor was transferred to cities,the non-agricultural income of farmers increased,and the income gap between urban and rural areas was rapidly narrowed.But with the advance of urbanization,the industrial structure was constantly upgraded and adjusted and it made great demands on the quality of labor,leading to the structural unemployment of agricultural labor force transferred to cities,so that the income gap between urban and rural areaswas narrowed slowly.

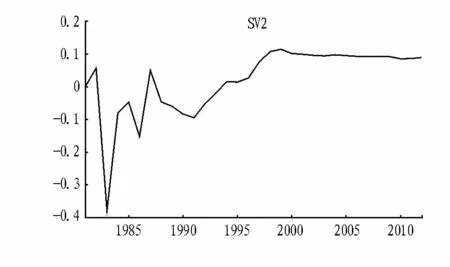

3.4.2 The impact of level of socio-economic development on the income gap between urban and rural areas.From sυ2curve in Fig.2,it can be found that the elasticity of the income gap between urban and rural areas to the growth rate of GDP was negative in the period 1983-1993,and positive in the rest of the years.In the period 1982-1992,the township enterprises as the vanguard of the reform entered the first peak period of development,and the development of township enterprises contributed to the absorption of a large number of rural surplus labor forces,thus narrowing the income gap between urban and rural areas.After 1994,China entered the phase of market economic reform,and with the rapid economic growth,the income gap between urban and rural areas is also expanding.In the long run,the improvement of level of socioeconomic development has a positive impact on the income gap between urban and rural areas;the rapid GDP growth may expand the income gap between urban and rural areas.However,in the period 1998-2012,the sυ2value showed a gradual downward trend,indicating that with the improvement of growth rate of GDP,the income gap between urban and rural areas showed a gradual decreasing trend,and China was at the vertex of inverted U-shaped curve(Liao Xinlin,2012)[13].

Fig.1 The time-varying elasticity of the level of urbanization in China to the income gap between urban and rural areas

Fig.2 The time-varying elasticity of the socio-econom ic development to the income gap between urban and rural areas

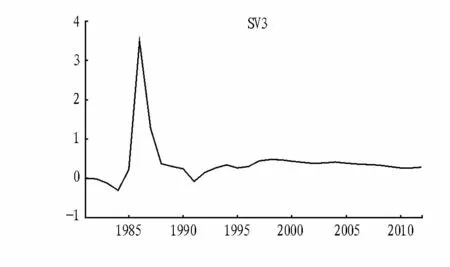

3.4.3 The impact of education level on the income gap between urban and rural areas.As can be seen from Fig.3,it can be found that the time-varying parameter sυ3is positive,indicating that the education level has a positive impact on the income gap between urban and rural areas,and with the improvement of education level,the income gap between urban and rural areas is gradually expanded.This shows that there is inequality in education and human capital accumulation between urban and rural residents in China and the investment in urban educational resources has a clear bias in favor of the city,thereby restricting the improvement of the level of human capital and income growth of farmers,eventually expanding the income gap between urban and rural areas.In the period 1982-1991,there was a large fluctuation,and the maximum value of sυ3was 1.0645 in 1986,indicating that the when the education level increased by 1%,the income gap between urban and rural areas would increase by 1.0645%.It dropped to the lowest value of 0.2874 in 1991,indicating that when the education level increased by 1%,the income gap between urban and rural areas only increased by 0.2874%.Subsequently,the value of sυ3was maintained in the range from 0.36 to 0.47,indicating that when the education level increased by 1%,the income gap between urban and rural areas in China would increase by 0.36%to 0.47%.This is consistent with the equilibrium results in the regression model analysis.

Fig.3 The time-varying elasticity of the education level to the income gap between urban and rural areas

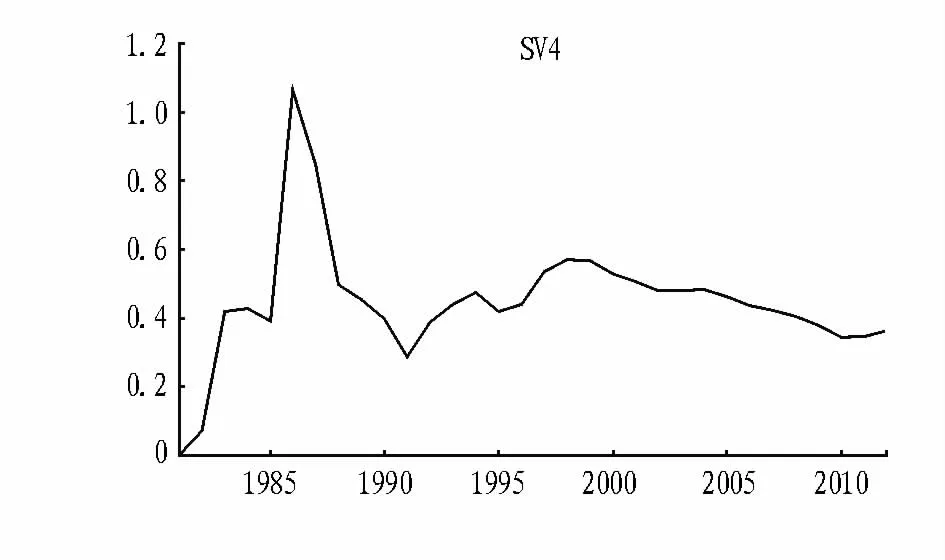

3.4.4 The impact of financial development scale on the income gap between urban and rural areas.As can be seen from Fig.4,the time-varying elasticity sυ4was negative in 1982,1083,1984 and 1991,and positive in other years.It shows that the expansion of financial development scale has a positive impact on the income gap between urban and rural areas,and with the expansion of China's financial scale,more than 70%of financial resources flow into city,and a large number of agricultural loan funds have been illegally occupied,thus seriously impeding the development of agriculture and rural economy,and widening the income gap between urban and rural areas.From Fig.4,it shows that sυ4reached the maximum of3.4908 in 1986,indicating that when the financial development scale increased by 1%,the income gap between urban and rural areas would increase by 3.4908%.Subsequently,the elasticity of income gap between urban and rural areas to financial development scale showed a rapid downward trend,reaching-0.0756 in 1991.After 2000,sυ4showed a slow decline,fluctuating in the range of 0.28 to 0.38,indicating that when the financial development scale increased by1%,the urbanrural income would increase by 0.28%to 0.38%.

Fig.4 The time-varying elasticity of financial development scale to the income gap between urban and rural areas

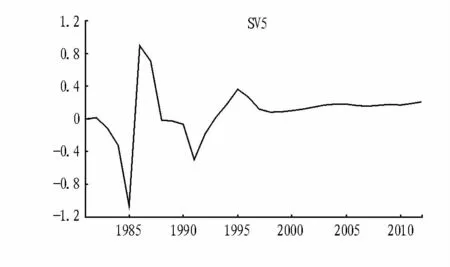

3.4.5 The impact of financial development efficiency on the income gap between urban and rural areas.As can be seen from Fig.5,the elasticity of the income gap between urban and rural areas to financial development efficiency(sυ5)was negative in the period 1982-1992 except1986 and 1987,and positive from 1993 to 2012.In the period 1981-1997,sυ5underwent large fluctuations,first increasing from -1.0628 in 1985 to 0.8946 in 1986 and then dropping to-0.4953 in 1991.After 1997,the value of sυ5remained in the range of 0.08 to 0.18,suggesting that when the financial development efficiency increased by 1%,the income gap between urban and rural areas would increase by 0.08%to0.18%.In the long run,the financial development efficiency has positive effects on the income gap between urban and rural areas,because unlike the diverse financial institutions in urban areas,there are limited types of financial institutions and single financial products in rural areas,and the financial business is only based on savings,lacking appropriate investment channels,so that the rural residents can not efficiently use financial institutions to expand reproduction and increase income.Therefore,the dual structure of urban-rural financial markets also constantly expands the income gap between urban and rural areas.

4 Conclusions and recommendations

Fig.5 The time-varying elasticity of financial development efficiency to the income gap between urban and rural areas

4.1 Conclusions Through the use of stepwise regression analysis,this paper selects five major factors(urbanization level,socio-economic development,education level,financial development scale and financial development efficiency)from a number of factors that affect the income gap between urban and rural areas.95.58%of changes in the income gap between urban and rural areas can be explained by the changes in these five factors.The cointegration test results indicate that there is a long-term equilibrium relationship between these five variables and the income gap between urban and rural areas.The improvement of urbanization level can help significantly narrow the income gap between urban and rural areas;socio-economic development,improvement of education level,financial development,scale expansion and improvement of efficiency have all significantly expanded the income gap between urban and rural areas.The state-space model estimates the dynamic path of impact of various factors on the income gap between urban and rural areas in different periods.The empirical results show that the urbanization level has a long-term negative impact on the income gap between urban and rural areas,indicating that the improvement of urbanization level can effectively ease the pressure on the income gap between urban and rural areas.In the long run,the improvement of level of socio-economic development,education level,financial scale and financial efficiency all has a positive impact on the income gap between urban and rural areas.

4.2 Recommendations Based on these conclusions,we put forth the following policy recommendations:

(i)It is necessary to accelerate the reform of the household registration system,and encourage the transfer of surplus rural labor to urban areas while increasing investment in rural education,and promoting the equitable distribution of educational resources between urban and rural areas,to improve the human capital level of rural residents.There is a need to promote the urbanization and industrialization,foster new industries in the city,and promote the rapid growth of non-agricultural income of farmers,in order to narrow the income gap between urban and rural residents.

(ii)It is necessary to optimize the structure of social public expenditures,and increase financial support for agriculture.With the enhancement of the level of economic development,the income gap between urban and rural areas constantly rises in China,indicating that rural residents have not yet fairly shared the higher income brought by the economic development.Therefore,the local government should optimize the structure of social public expenditure,increase the spending on science,education,culture,hygiene and social security,strengthen the rural infrastructure construction,thereby increasing farmers'income and narrowing the income gap between urban and rural areas.

(iii)It is necessary to strengthen government support for rural finance,improve the rural financial system,give full play to the leading role of rural credit cooperatives,relax the rural financial market access conditions,foster new rural financial institutions,and establish a multi-level rural finance system,to improve the scale and efficiency of rural financial development,promote agricultural development and farmers'income,and narrow the income gap between urban and rural areas.

[1]LIS.Investigation on the gap between urban and rural incomes[J].Tribune of Villages and Townships,2004(8):21-22.(in Chinese).

[2]LUM,CHEN Z.Urbanization,urban-biased economic policies and urbanrural inequality[J].Economic Research Journal,2004(6):50-58.(in Chinese).

[3]PAN XH,FAN FZ,GUAN ZQ,et al.Property income growth,marketization process and China's urban-rural income gap——Empirical analysis based on panel cointegration model[J].Journal of Yunnan Finance and Trade Institute,2013(3):39-44.(in Chinese).

[4]LI XS,RAN GH.Fiscal decentralization,rural-urban income disparity and economic growth in China[J].Journal of Agrotechnical Economics,2013(1):86-94.(in Chinese).

[5]CHEN AP.Fiscal decentralization,rural-urban income disparity and economic growth in China[J].Finance&Economics,2009(10):93-101.(in Chinese).

[6]MAGR.The Chinese styleof decentralization,urban-biased economic policy and urban-rural disparity[J].Research on Institutional Economics,2010(1):10-24.(in Chinese).

[7]LILL,GU XJ,WANG DX.Fiscal decentralization,urbanization and income difference between urban and rural areas[J].Journal of Agrotechnical Economics,2013(12):4-14.(in Chinese).

[8]YUWF,WU LJ.Local government behavior,financial development and urban-rural income disparity——Based on inter-provincial panel data[J].Journal of Guangdong University of Finance,2011,26(5):12-22.(in Chinese).

[9]YAO YJ.The relationship among financial development,urbanization and urban-rural income inequality[J].China Rural Survey,2005(2):2-8.(in Chinese).

[10]QIAOHS,CHEN L.Reevaluation of the inverted U-shaped relationships between financial development and urban-rural income gap——an empirical study based on the county-level cross-section data in China[J].Chinese Rural Economy,2009(7):68-76.(in Chinese).

[11]LIBL.An income gap study between urban and rural areas based on statespace model[J].Statistics and Decision,2012(19):115-119.(in Chinese).

[12]CHEN BK,LIN YF.On development strategy,urbanization and income gap between urban and rural areas[J].Social Sciences in China,2012(4):81-102.(in Chinese).

[13]LIAO XL,WANG Y,CHEN N.Does the effect of inequality on growth present an inverted U curve?——Empirical evidences from transition economies[J].Finance&Trade Economics,2012(9):109-116.(in Chinese).

Asian Agricultural Research2014年9期

Asian Agricultural Research2014年9期

- Asian Agricultural Research的其它文章

- A Competitive Analysis on the Agricultural Products of China and Thailand in the U.S.Market

- Evaluation of the Trading Website for Agricultural Products in China

- Theory and Practice of Marine Regional Management in China

- Empirical Analysis of the Typical Breeding Pattern of Clam in Hongdao Town and the Preliminary Estimates of Costs and Benefits

- Evaluation of the Overall Level of New Urbanization in Hebei Province Based on Factor Analysis and GIS

- Evaluation of the Development of Circular Agriculture in Chongqing City Based on Entropy Method