New Moves on Economic Structural Reform

PRIORITIES for deepening economic structural reform were identified at an executive meeting of the State Council on May 6. Further reforms will be conducted in nine key areas: the administrative system, finance and taxation, banking, investment and financing, prices, peoples livelihood, coordinated urban and rural development, agriculture and rural areas, and science and technology. At the meeting it was decided to abolish more administrative examination and approval processes or delegate such powers to local governments.

“These arrangements that cover reform priorities for this year intend to improve the ‘fundamentals of Chinas economy and society in the long term and boost its long-term growth prospects,” said Wang Jun, a senior research fellow with China Center for International Economic Exchanges.

Decentralization

Since China ushered in its new cabinet, government leaders have publicly promised to “cancel no less than one third of matters subject to government examination and approval,” or more than 500 out of the 1,700 such matters that were currently handled by organizations under the State Council.

“The reform focuses on handling the relationship between government and market soundly. The reforms are clearly market-oriented,” said Jia Kang, director of the Research Institute for Fiscal Science of the Ministry of Finance. Decentralizing this responsibility and reforming the market environment has become the key to reinvigorating the private sector. These promises have already started to be fulfilled, with a total of 133 matters chosen for this project at State Council meetings held on April 24 and May 6.

Chi Fulin, president of China Institute for Reform and Development, said that it is no easy job for a government to whittle down its own powers, but it must if it wants to enhance the vitality of the market. He added that reforms to administrative examination and approval procedures, finance and taxation and government institutions are necessary to redirect government functions toward creating a sound market environment and providing basic public services.

The slowdown of Chinas economic growth is generally due to the markets allocative mechanisms not being given full play. At the 18th National Congress of the Communist Party of China the underlying issue for economic structural reform was clarified as how to balance the role of the government and that of the market.

According to Gao Peiyong, president of the National Academy of Economic Strategy under the Chinese Academy of Social Sciences, balancing the role of the government and that of the market in China relies on government taking the initiative. In order to deepen reforms, those on the government are urgently needed, he said. Finance and taxation could become a priority for economic structural reform as it has a direct bearing on government functions and affects socioeconomic development in general.

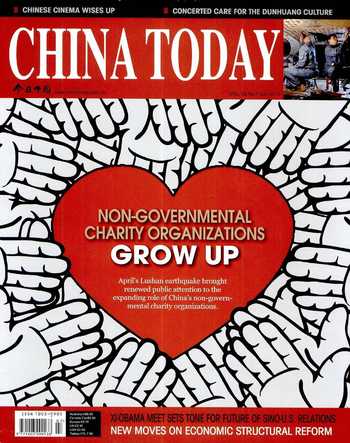

The recent State Council executive meeting also called on the government to purchase services from non-governmental organizations (NGOs) as part of the decentralization process.

Zhang Juwei, director of the Research Center for Labor and Social Security under the Chinese Academy of Social Sciences, said that as the government cannot directly provide all public services, the employment of NGO resources could become a good method to ensure the provision of social security and elderly care. The move could also facilitate the transformation of government functions, accelerate the construction of a service-oriented government, enhance social management capacity and increase the efficiency and quality of public services.

Beijing is one of the earliest cities to pilot this strategy. At the beginning of 2010, an annual fund was earmarked for purchasing services from NGOs. In 2010, the Beijing Municipal Peoples Government paid more than RMB 40 million for nearly 300 NGO services. In 2011, the fund was raised to RMB 50 million which financed a further 363 transactions.

Private Overseas Investment

As part of the priorities set for economic structural reform, the recent State Council meeting decided to establish a mechanism to facilitate individuals to invest overseas. Although the move may cause the outflow of private capital, establishing such a system is an important measure to further economic reforms. In the long term, this system will be conducive to creating new channels for domes- tic investors, achieving capital-account convertibility of the RMB and dissolving and dispersing domestic financial risks.

As early as 2007, the State Administration of Foreign Exchange planned to allow Chinese individuals to invest in securities in overseas markets and launch a pilot program on direct purchase of H-shares (shares of mainland companies traded on the Hong Kong Stock Exchange). However, these plans were suspended. In recent years, Chinese investments in foreign markets have been mainly conducted through domestic institutional investor schemes, and demand from individuals has grown strongly.

At an internal meeting at the beginning of this year, Chinas central bank, the Peoples Bank of China, made it clear that this year it will expand pilot programs of RMB qualified foreign institutional investors, prepare a domestic individual investors(QDII2) pilot scheme and increase the scale of individualsinvestment overseas.

Urbanization

The May 6 State Council meeting also decided to conduct research into a medium and long term development plan this year for the countrys new approach to urbanization, which focuses on high quality and people-oriented urbanization. This plan includes new administrative regulations for residence permits, household registration system reform and the refining of public services and social security processes.

Yuan Xilu, a senior official of the Planning Department of the National Reform and Development Commission, said that the urbanization development plan will cover more than 20 city groups, 180 prefecture-level cities and 10,000 towns. Analysts point out that it will be written in the plan as a development strategy to link all the cities in a city group with railways to tap development synergy among them.

New urbanization policies on population administration have also attracted a lot of attention. Huang Ming, vice -minister of Public Security, said that a regulation on the administration of residence permits has been delivered to the State Council. It will gradually allow migrant workers who have lived in a city for a long time and hold a social security account there to register their household there.

Protecting Shareholders Interests

Priorities set at the recent State Council meeting also include requirements on policies to protect the interests of small and medium-sized investors.

Statistics show that more than 80 percent of investors in Chinas A-shares (which are sold exclusively to Chinese investors on the Shanghai and Shenzhou stock exchanges) market fall into this category. However, when their interests are violated there are no effective institutions or policies to protect them.

Liu Junhai, a law professor specializing in civil and commercial law at Renmin University of China, said that investors are the cornerstone of the entire capital market, but investors interests are not suffi ciently protected in Chinas capital market. This has often dampened investor confidence and hampered the interests of small and medium-sized investors. Even after reform of trading shares of listed companies, investors continue to suffer from losses caused by false statements, insider trading and market manipulation.

In recent years, the China Securities Regulatory Commission(CSRC) has increased measures to protect investors and set up an investor protection bureau. The commission has also required securities companies to regard protecting investors as imperative. However, the interests of small and medium-sized investors have yet to be effectively protected and more changes must be made.

Analysts predict that the protection of shareholders is expected to achieve a breakthrough this year thanks to the State Councils clear mandates. In terms of allowing individuals to invest overseas, the first batch of pilot programs were initiated last year in cities including Wenzhou and Shenzhen. It is expected that they will be expanded this year. Millions of investors are anticipating progress.

Balancing the Capital Market

For a long time, Chinas capital market has been criticized for the unbalanced development of its stock and bond markets, the latter of which is too small proportionately.

The May 6 State Council meeting announced that fi nance such as bonds, securities and trusts would be developed and standardized. Analysts predict that this policy will help strike a balance between investment and healthy and sustainable development.

In recent years, the CSRC has been working to develop Chinas bonds market to achieve balanced development of the stock and bond markets. As well as corporate bonds, the CSRC has launched private placement bonds for small and medium-sized enterprises (SME). By the end of March, 66 securities companies had issued a total of 171 SME private placement bonds, raising a total of RMB 19.949 billion.

It is estimated that development of the bond market will be a highlight of the capital market. The Shanghai Stock Exchange said that it will continue to enlarge its bond market, integrate its trading systems and establish the comprehensive rating system. It will meanwhile continue to exploit the synergy between stock and bond markets, support commercial banks in replenishing capital by issuing long-term subordinated debt or preferred shares, and explore new products such as asset-backed securities and credit insurance products. These measures will ensure that the bond market will become more innovative.