Slowing to a Trickle

By Zhou Xiaoyan

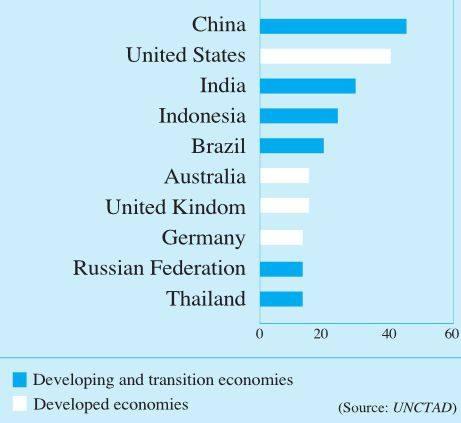

Foreign direct investment (FDI) in China reached a historic high of $124 billion in 2011, ranking second in the world only after the United States, according to the World Investment Report 2012 released by the United Nations Conference on Trade and Development (UNCTAD) in July.

However, FDI growth in China is facing a gradual slowdown. It stood at 8 percent year on year in 2011, less than the global growth of 16 percent and an 11-percent growth in developing countries, according to the UNCTAD report.

The downward trend has yet to correct itself in 2012. From January to May 2012, newly established foreign-invested enterprises in China numbered 9,261, a year-on-year decline of 12.16 percent. During that period, paid-in FDI was $47.11 billion, a 1.91-percent year-on-year decrease, according to the Chinese Ministry of Commerce (MOFCOM).

“Difficulties and uncertainties in the world economy have created a stumbling block as China tries to attract more foreign investment,” said Zhan Xiaoning, Director of the Investment and Enterprise Division at UNCTAD.

Behind the decline

Several factors are contributing to Chinas FDI slowdown, said Wang Chao, Vice Minister of Commerce, during a press conference on July 10.

The lingering eurozone debt crisis has added uncertainties and instabilities to the world economy and is one of the major reasons for Chinas FDI decline. Also, emerging economies are enjoying a faster growth, leading multinationals to shift their targets to places like India, Brazil and Russia. Increasing production costs in China, limited land resources and rising wages may be the biggest culprit as investors look elsewhere in the world to park their money, said Wang.

Four economies of the Association of Southeast Asian Nations (ASEAN)—Brunei Darussalam, Indonesia, Malaysia and Singapore—saw a considerable rise in overseas investment. Overall, as East Asian countries led by China have continued to experience rising wages and production costs, the relative competitiveness of ASEAN in manufacturing has been enhanced. Accordingly, some foreign affiliates in Chinas coastal regions are moving to Southeast Asia, said the UNCTAD report.

Amid the debt crisis turmoil, the destination of global FDI has been altered.

“Globally, European enterprises have had less ability for foreign investment since the crisis. Whats more, the United States has launched a campaign to retrieve U.S. capital and encourage it to flow back to the country to revitalize sectors such as manufacturing. U.S. enterprises also increased investment in Europe during the eurozone debt crisis. Emerging economies, such as India, Brazil and Russia, have become a new hotspot for multinationals strategic layout. All these elements have jointly changed the orientation of global FDI,” said Shen Danyang, spokesman for MOFCOM.

Better environment

FDI plays an important role in sustaining economic growth and providing employment opportunities. As the stream of FDI slows to a trickle, China may expect further slowdown of economic growth and increasing unemployment in the short run. In the long run, more attention should be paid to other effects of FDI besides the capital inflow, especially in research and development, technology transfer, competition and the demonstrative role of foreign companies, which are vital for Chinas transformation. In this sense, the quality of FDI is more important than quantity, said Liang Guoyong, economic affairs officer with the UNCTAD Investment and Enterprise Division.

More preferential policies should be issued to channel foreign investment into hitech enterprises in coastal regions, as well as central and western regions, said Wang Jinbin, Deputy Dean of the School of Economics at Renmin University of China.

In China, FDI to service sectors—such as entertainment and media, hotels, real estate, financial service and trade—has surpassed that to manufacturing, as a result of surging flows to non-financial services and a slowdown of FDI in the manufacturing industry. FDI in China has shown a preference for the service sector, with real estate, trade and business service attracting the most FDI, according to the UNCTAD report.

“The fact that Chinese service sectors attracted more FDI than manufacturing in 2011 marks a turning point for FDI in China, and the future will see a continuingly greater flow of FDI into Chinese service sectors,” said Liang.

“The policy support for FDI should be transferred from focusing on quantity to quality. We should pay more attention to hi-tech industries, headquarters of multinationals, research and development and brand management,” said Liang. “Moreover, we should see the importance of the service sectors development to Chinas next-step economic growth. A complete policy system to facilitate FDI in the service sector should be formulated.”

FDI in finance is expected to grow as the country continues to open its financial markets and as foreign banks, including HSBC(United Kingdom) and Citigroup (United States), try to expand their presence through M&As and organic growth, said Zhan.

“The Chinese Government will further implement proactive policies to encourage and expand the use of foreign investment. Moreover, the structure of FDI should be optimized and the level of utilizing FDI enhanced,” said Wang. “FDI inflow will be steered into emerging new industries, modern service sector, hi-end manufacturing sector, hi-tech sector, modern agriculture and energysaving and environmentally friendly sectors.”

MOFCOM, together with other concerned departments, is formulating an industrial index for foreign investment in Chinas central and western regions. “We plan to offer policy support and more stimulative incentives to guide FDI to these regions,” said Wang.

“In the long run, China still possesses very strong competitiveness in attracting foreign investment,” said Wang. “China has a stable political, social and economic environment. It also has enormous market potential. The closer enterprises are to the market, the more successful they are likely to become.”

The Chinese Government has worked full out to better the investment environment, which is a huge appeal to the world. The UNCTADs survey shows that China is still the most favorable investment destination of multinationals, which fully demonstrates for- eign investors faith in the Chinese market.

Opening up is a national policy, and attracting foreign investment is an important part of it. “During the past three decades, weve been constantly optimizing the investment environment through efforts such as the nine-month campaign against piracy launched by the State Council, simplified approval procedures and upgraded foreign-invested industrial parks,” said Wang.

“Besides, Chinese leaders have reiterated on many occasions that all legally registered foreign-invested companies in China shall be treated the same as Chinese enterprises,” said Wang.

The Central Government has issued a series of policies since the beginning of this year, aiming to sustain a steady growth of FDI for 2012, added Wang.n

Multinationals Top Prospective Host Economies for 2012-14

(Percentage of respondents selecting economy as a top destination)