Banking Around the World

By LAN XINZHEN

Banking Around the World

By LAN XINZHEN

Chinese banks expands its “going out” strategy but faces challenges in establishing a presence in foreign markets

The world’s biggest lender by market value, the Industrial and Commercial Bank of China (ICBC), and the Hong Kong-based Bank of East Asia signed an agreement in which ICBC would pay$140.23 million to buy an 80-percent interest in Bank of East Asia USA, the Hong Kong bank said on January 23.

The acquisition will enable ICBC to establish a solid presence in the United States. With a commercial bank license in the United States, ICBC can further expand its retail banking business and operating network and ultimately enhance its market position, ICBC Chairman Jiang Jianqing said.

The successful completion of the transaction will not only establish a good foundation for the provision of holistic fi nancial services by a Chinese mainland bank in the United States, but it will also mark a new era of cooperation between China and the United States and have a positive impact on Sino-U.S.trade relations, Jiang said.

In hopes of expanding of its operations across Europe, ICBC just opened five new branches in major European cities—Amsterdam, Brussels, Paris, Madrid and Milan—in January. The banking giant already has branches in Moscow, London, Frankfurt and Luxembourg.

ICBC is not alone in its recent strides overseas. Bank of China (BOC) also opened branches in Brussels and Dusseldorf in December to meet the momentum of brisk Sino-European economic and trade cooperation. The Chinese banking industry is in the midst of its “going out” strategy, said BOC Chairman Xiao Gang.

An outbound trend

China’s integration into the world economy requires its banking industry globalization, said BOC President Li Lihui at the fi fth 21st Century Annual Finance Summit of Asia held last November in Beijing.

Chinese enterprises accelerated their“going out” paces after the global financial crisis in 2008. BOC was among them. In general, Chinese banks not only provided capital support for Chinese enterprises’ overseas investment, they also helped improve their banking business, achieving a win-win result, said Li.

Banks should provide follow-up financial services for the international operations of enterprises, said Li. In this sense, the Chinese banking industry should also improve its management ideas and levels, and stick to the path of globalized development.

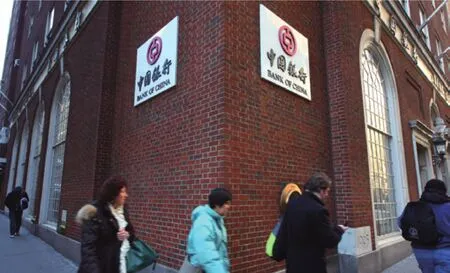

YUAN IN THE U.S.: Pedestrians pass by Bank of China’s New York branch, which now allows companies and individuals to buy and sell the yuan

GOING GLOBAL:ICBC Chairman Jiang Jianqing(third left) and Belgian Prime Minister Yves Leterme (third right) attend the unveiling ceremony of ICBC’s Brussels branch on January 19

By the end of 2009, Chinese banks had established more than 1,200 overseas branches in 32 countries and regions, said Xiao. The Chinese banking industry’s overseas assets totaled more than $270 billion in 2009. That number was only $9 billion in 1985.

Cao Honghui, a researcher with the Institute of Finance and Banking at the Chinese Academy of Social Sciences(CASS), said China’s economic restructuring requires expanding both domestic demand and the external market, as well as increasing outward direct investment, and the Chinese yuan also expands its global reach, all of which propelled Chinese banks to branch out.

While the yuan expands its global reach,Chinese banks found a propellant to go global. The People’s Bank of China, the central bank, launched the pilot program of yuan settlement in cross-border trade in 2009. In its latest move, it announced in January that quali fi ed enterprises could settle their overseas direct investment in the yuan. All these measures need support and cooperation of Chinese banks’ overseas branches.

The post-crisis era, Cao said, will present the best opportunities for Chinese banks to expand overseas because many international fi nancial institutions will need time to regain their footing. Emerging economies have become the major power driving the global economy. So, quali fi ed Chinese commercial banks should improve their competitiveness by expanding overseas, Cao added.

Chinese banks usually conduct their overseas expansion through establishing overseas branches and acquiring overseas banks.

Compared with their foreign counterparts, Chinese banks have a much lower level in global operations. According to Li,the overseas business revenue of China’s fi ve major state-owned banks accounted for only 6 percent of their total business revenue,while that of European and U.S. banks stood at 35 percent.

In an effort to improve their presence in overseas sectors, Chinese banks used mergers and acquisitions (M&A) as a shortcut.What should be noted is that ICBC started its foreign expansion by acquiring some banks in East Asia and South Africa. Given the fact that the U.S. market was a major player in the international financial market, ICBC’s takeover of Bank of East Asia USA is considered a big stride into the global market.

As for Chinese banks’ overseas ambitions, banking regulators showed their support. M&A should be an important means for Chinese banks to expand overseas, along with establishing overseas branches, said Wang Zhaoxing, Vice Chairman of China Banking Regulatory Commission. The commission will also promote Chinese banks’development in their overseas target markets while allowing foreign-funded banks to conduct business in China in line with the principle of mutual bene fi t and equal status,said Wang.

No easy job

“Overseas expansion is an imperative trend for Chinese banks, but the difficulties should never be neglected,” said Lu Zhengwei, chief economist at Industrial Bank Co. Ltd.

Dif fi culties will be both internal and external, Lu said.

Internally, Chinese banks are not fully prepared for going global and the biggest problem is a lack of professional talents,especially talents familiar with foreign finance and law, said Lu. Meanwhile,they lack a profit model. Take BOC for example. Few of its overseas branches are capable of turning a pro fi t.

Externally, foreign financial regulators impose much stricter restrictions and protectionism also prevails, said Lu.

Another state-owned commercial bank—China Construction Bank (CCB)—submitted an application to establish a subsidiary bank in New York to the Federal Reserve as early as 1993 and didn’t get permission until May 2009, said Mao Yumin, Director of Investment and Wealth Management Banking at CCB.

Not all banks are quali fi ed to go abroad,said Xiao. Those banks, he said, who are quali fi ed should meet fi ve requirements: excellent corporate governance mechanism and risk management capability; strong capital reserve; high profitability; worldwide customer base; and international talents familiar with overseas markets and regulations.

Chinese banks’ overseas branches are mainly located in regions like Hong Kong,Macao and Singapore, which have similar cultural background with the Chinese mainland, said Li. Only a few of branches are in New York and London. And their business scope, operational scale, customer base and market in fl uence are all limited.

One reason is Chinese banks’ lack of professionals familiar with foreign fi nancial culture and investment rules, said Li. In addition, Chinese banks’ risk management ability needs to be improved, and their systems,technologies and experiences still fall behind their international counterparts.

For most Chinese banks, the most urgent and important task is not “going out,”but fostering high-caliber professionals and improving management skills, to get fully prepared for overseas expansion.