Growing Strong in the Practice of“Going Global”

ERIC WONG

REN Xiaojian, CEO and director of the board of the Creat Group, concluded after analyzing the challenges and opportunities for Chinese private enterprises in the global financial crisis, “The capital support represented by the RMB 4 trillion government stimulus package is basically a feast for large and medium-sized state-owned enterprises. The governments resource allocation policy is basically inclined towards state-owned enterprises, and the enterprises in monopolistic industries are basically all state-owned. In contrast,most private enterprises are engaged in highly competitive industries. Seen from this perspective, as the global financial crisis spreads from the virtual to real economy, the private economy has been most vulnerable to damage.”

As a private enterprise founded 17 years ago, the Creat Group has blazed a trail in going global while keeping its feet firmly planted in China. In other words, the company has pursued a unique mode of development.

Financial Pioneer

In the summer of 1992, Ren Xiaojian, Zheng Yuewen and four other partners jointly founded the Creat Group.

“Creat Group is deeply involved in finance – in fact I can say the group was one of the earliest Chinese private enterprises investing in this area. If there was a list of private enterprises that have significantly contributed to Chinas financial reform, the Creat Group would be at the top,” claims Ren.

Ren Xiaojian has good reason to make these claims. In 1993, the Creat Group participated in Chinas first private shareholding commercial bank, China Minsheng Banking Corporation. The bank was also the first of its kind serving private enterprises. At least six people on the 2008 Hurun Finance Rich List were shareholders in Minsheng. In 1995 the Creat Group participated in the listing of Huaxia Bank, and jointly founded Xiangcai Securities Co., Ltd. The Creat Group was also the initiator of two of the four insurance companies approved by the State Council.

The groups sound financial grounding and wealth of talent meant that it took timely measures to guarantee its investments when the subprime loans crisis occurred, successfully minimizing its losses. Meanwhile, it grasped an opportunity to invest in Australias mining industry.

Stories of Investment

In the 1990s, the Creat Group was active in the financial field. Later, it turned to industrial investment, and has now been in this field for more than a decade. Four enterprises under the group are listed on the stock market.

Ren Xiaojian explains that the Creat Group initially engaged in finance mainly because of the educational background of its shareholders. Of the six founding partners, five were from the finance industry. Engaging in familiar activities is always the first choice for a start-up enterprise. But China is a latecomer to the market economy and the government has always been on guard against the financial liberalism of developed nations in the West. As a private enterprise, it has been neither realistic nor rational to make finance its main business, given the policy environment, market conditions and the enterprises capabilities.

China is a big country with a population of 1.3 billion. The best way to participate in the international division of labor is to develop the manufacturing industry, expand exports and conduct international trade. With this in mind the government has long formulated policies to support the development of the manufacturing industry. The Creat Group is moving with this trend by actively participating in industrial investment focused on manufacturing, and creating a combination of industry and capital. Therefore, Ren Xiaojian holds that the Creat Group is neither merely a financial investor, nor an industrial investor, but something in between.

In 1995, the Creat Group began to pay attention to agricultural industrialization and green agriculture, investing in the Ruyi Group, which was later listed on the Shanghai Stock Exchange. It was the earliest Chinese enterprise engaged in the processing and export of green vegetables.

In February 2001, after Pinggao Electric was listed on the Shanghai Stock Exchange, Ren Xiaojian actively participated in urging Pinggao and Japans Toshiba to establish a joint venture. Ren later became president of Pinggao-Toshiba. The joint venture has become a first-rate manufacturer of combined electric equipment of the enclosed type, making Pinggao Electric a pillar manufacturer of key technical equipment in Chinas national electrical sector.

In April 2003, Yantai Andre Juice was listed on the Hong Kong Stock Exchange. Zheng Yuewen, then chairman of the board of the Creat Group and vice-chairman of All-China Federation of Industry and Commerce, went to Hong Kong with Ren Xiaojian to attend the inauguration ceremony. Six years later, Andre has evolved into the worlds largest apple juice processing enterprise. More than 90 percent of its products are exported to Europe and the United States.

In June 2008, prior to the outbreak of the global financial crisis, Shanghai RAAS Blood Products Co., Ltd. was listed on the Shenzhen Stock Exchange. This is a Sino-U.S. joint venture specializing in R & D and production of blood products. It is now Chinas largest exporter and the most advanced producer of blood products in Asia.

These four success stories have made Creat an outstanding example of domestic industrial investment, and also laid the foundation for the groups overseas expansion.

Exploring Ways to “Go Global”

By 1996, “go global” appeared to describe the general direction of Chinese enterprises. Since 2000, more and more Chinese enterprises have taken this road. Their activities are no longer confined to the export of products and labor, but now include overseas investments, mergers and acquisitions.

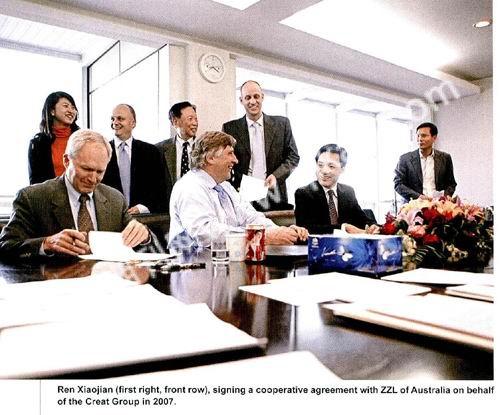

In 2007, based on its experiences investing in domestic mining, the Creat Group invested in Zeehan Zinc Limited (ZZL) of Australia, through the London Alternative Investment Market (AIM) – a submarket of the London Stock Exchange. The investment is in the form of equity shares and convertible debts. This is Creats first investment in an overseas industry. It provided a good opportunity for Creat to familiarize itself with international business, cross-cultural management and international legal systems.

In October 2008, with the outbreak of the global financial crisis, the price of bulk goods in the international market plummeted, followed by the price of mining shares, which dropped nearly 70 percent. Zeehan Zinc Limited was greatly affected. Creat Group took the opportunity to enhance their communication with shareholders, and injected capital into ZZL, stabilizing its managerial personnel and the price of its shares.

Ren Xiaojian remarks, “The Creat Group aims to promote ZZLs long-term development, not merely follow the short-term rise or fall of share prices. When ZZL is going well, Creat will have a stable basis for further growth. It is a platform for financing, mergers and acquisitions, and industrial development. Thus, the road to Creats internationalization will be widened.”

Ren Xiaojian holds that a strategist should be farsighted, and he should not set his eyes on just one time and one place. Even though there are great challenges ahead, going global is the only way for Chinese private enterprises to grow strong. The financial crisis is providing opportunities for this to happen.