Institutional Environment, Blockholder Characteristics and Ownership Concentration in China*

Xingqiang Du** and Zongfeng Xiu

aManagement School, Xiamen University, China

bBusiness School, Central South University, China

Institutional Environment, Blockholder Characteristics and Ownership Concentration in China*

Xingqiang Dua,** and Zongfeng Xiub

aManagement School, Xiamen University, China

bBusiness School, Central South University, China

Using a sample of China’s A-share listed companies for the period 2001-2004, this paper investigates the influence of institutional environment variables, including the process of marketization, level of local government intervention, and local legal environment, on blockholder characteristics and ownership concentration, and the relation between the endogeneity of ownership structure and institutional environment. Our results indicate that the effects of these variables on ownership concentration are (1) positive for listed companies controlled by state asset management bureaus af filiated with local governments, (2) negative for listed companies controlled by state-owned enterprises af filiated with local governments and (3) unclear for listed private companies.These variables also positively affect the degree of privatization of listed companies in China.

JEL classification: G32; G34; G38

Institutional environment; Ownership structure; Local governments; Blockholder

1. Introduction

Investigation of how the ownership structure of listed companies in China is determined will provide a better understanding of this transitional market economy and the reform of state-owned enterprises (SOEs) in China. Ownership concentration, blockholder characteristics, and the pyramid structure constitute three important aspects of the ownership structure of China’s listed companies. Fan, Wong and Zhang (2009) study the causes and economic consequences of the pyramid structure, and Xia and Chen (2007) examine endogenous determination among the level of government control, ownership concentration and modes of government ownership of China’s stateowned listed companies. Based on these studies, this paper explores how ownership concentration and blockholder characteristics are determined in China.

Endogeneity of ownership structure has long been a topic of interest (see, for example, Leland and Pyle (1977) and Demsetz and Lehn (1985), among others). As a significant component of contract structure, and because of its importance in the reform of SOEs, ownership structure has been a core concern of academics and practitioners in China, with domestic scholars including Zhu and Song (2001), Wang et al. (2001), Feng et al. (2002), and Li (2002) among the early researchers of the endogeneity problem. Chen et al. (2004) review domestic and foreign papers on ownership structure and document that endogeneity is a ‘problem of origin.’ Zheng and Wei (2006) point out that whereas Chinese scholars focus mainly on firm performance to study the endogeneity of ownership structure, the formation and adjustment of ownership structure are not driven by performance alone. They maintain that the interaction between control rights and performance should also be taken into consideration. Zheng and Wei (2006) argue that the most reasonable approach to investigate the endogeneity of ownership structure issue is to check the formation of the ownership structure at the time of the IPO, and assert that the formation of the IPO ownership structure of listed companies is the result of the choice of the controlling shareholders among the types of internal capital markets. Xia and Chen (2007) study the influence of the institutional environment on the ownership structure of listed companies controlled by local governments. They investigate neither the possible impacts of the different modes of local government ownership and micro-level factors of listed companies on ownership structure, which may be important, nor the ownership structure of listed private companies.

The influence of the institutional environment on corporate governance structure has become a hot research topic at home and abroad. This is closely related to new institutional economics, which emphasizes that institutions have decisive impacts on contract structure (Coase, 1937; Alchian, 1965; Demsetz, 1967; North, 1981). La Porta et al. (1998, 1999, and 2000) examine the influence of law and investor protection on corporate governance structure, financial policy, and accounting information in different countries, focusing on the relationship between legal protection and ownership concentration. Dyck (2000), Himmelberg, Hubbard and Love (2002), and Boubakri,Cosset and Guedhami (2005) provide cross-country comparative research evidence of the relationship between legal protection of investors and ownership concentration, which basically supports the hypotheses of La Porta et al. (1998, 1999, and 2000) of the relationship between law and finance. However, these studies conduct only a horizontal comparison of the differences in legal protection of investors and contract structure among different countries, and do not take into consideration that the institutional environments in different regions within a single country can be different. Hence, domestic scholars in China, including Xia and Fang (2005), Sun et al. (2005), Xin and Xu (2007), Xia and Chen (2007), Luo and Tang (2009), Wang, Wong and Xia (2008), and Fan, Wong and Zhang (2009), among others, extend the abovementioned research by considering the impact of the regional institutional environment on contract structure. On the basis of these studies, this paper explores the relation between institutional environment and ownership structure to determine whether the regional institutional environment has an impact on the choice of ownership concentration and blockholder characteristics among listed companies in China, and if so, how.

Based on the theory of ultimate property rights, Liu, Sun and Liu’s (2003) classification of final controllers and Xu, Xin and Chen’s (2006) classification of blockholder characteristics, this paper investigates the influence of institutional environment variables, namely, marketization, government intervention, and legal environment indexes, on blockholder characteristics and ownership concentration, and the relation between the endogeneity of ownership structure and institutional environment, using the data of A-share listed companies in China from 2001 to 2004. The effects of the abovementioned institutional environment variables on ownership concentration are (1) positive for listed companies controlled by state asset management bureaus af filiated with local governments, (2) negative for listed companies controlled by SOEs af filiated with local governments, and (3) unclear for listed private companies.These variables also positively affect the degree of privatization of listed companies. In brief, the results show that the regional institutional environment affects the ownership concentration and blockholder characteristics of listed companies in China.

This paper contributes to the literature by examining in greater depth the problem of the endogeneity of ownership structure, and provides empirical evidence of the relation between the endogeneity of ownership structure and the institutional environment. First, the classification of blockholders is more detailed, and local state asset management agencies, local SOEs, and private enterprises are comprehensively studied, building on the research of Xia and Chen (2007). Second, after controlling for endogeneity of ownership concentration and blockholder characteristics using a simultaneous equation model (SEM), this paper examines the impact of the institutional environment on such characteristics.

2. Institutional Background, Theoretical Analysis, and Hypotheses

Liu, Sun and Liu (2003) classify the controlling shareholders of China’s listed companies into three categories: directly controlled, indirectly controlled, and not controlled by the government. Based on the theory of ultimate property rights, different intermediate controlling shareholders represent different economic attributes, agent monitoring behavior, and professional knowledge. They can be governmental agencies, state-owned enterprises or private enterprises. As a result, their motives in controlling subordinate companies and economic consequences are significantly different. According to the statistical results of Liu, Sun and Liu (2003), in contrast to other emerging markets and countries with a transitional economy in which private ownership dominates the ownership structure, as of 2001, 84.1% of China’s listed companies were ultimately controlled by the government, either directly (8.5%) or indirectly (75.6%) through a pyramid structure. On average, the largest shareholder of each listed company held approximately 44% of the total shares, which is consistent with the sample observations of this paper. To examine what determines the government’s choice of both the controlling mode and ownership concentration of listed companies, this section carries out a theoretical analysis of the relationships among the regional institutional environment, blockholder characteristics, and ownership concentration, under the institutional background in China.

2.1. Regional Institutional Environment and Ownership Concentration

In the process of China’s transition from a planned to a market economy, there has been a shift from centralization to decentralization of government power, which has allowed local governments to gain financial and economic autonomy. Shleifer (1998) observes that local governments will take advantage of government ownership to pursue their political goals, which leads to the unsatisfactory performance of SOEs. Lin, Cai and Li (1998) document that one of the main problems of companies in transitional economies is that they are committed to carrying out multiple governmental goals, including economic development, employment, social endowment and social stability, which imposes a policy burden on such companies.

To achieve the abovementioned goals, local governments are motivated to relax their control over their subordinate enterprises, which leads to a change in the form of local government control and ownership concentration. Therefore, the determination of the ownership structure of listed companies controlled by local governments is endogenous to the motives of those local governments to control SOEs. In addition, motives are affected by the regional institutional environment. According to Fan et al. (2003), China’s market-oriented reforms have resulted in decisive progress, but large gaps still exist among different regions. They propose that the process of marketization be divided based on five aspects: ‘relationship between government and market,’ ‘development of non-state-owned economy,’ ‘degree of product market development,’ ‘degree of element market development’ and ‘development of market intermediaries and legal environment system’. Three institutional variables, the process of marketization (INDEXMAR),relationship between government and the market (INDEXGOV) and development of market intermediaries and the legal system (INDEXLAW), are important components of the regional institutional environment which affect a local government’s choice and adjustment of the ownership structure of the companies under its control. The process of marketization and market competition can be substituted for each other to a certain extent. Market competition creates a choice between ‘survival’ and ‘death’ for companies. In the face of this choice, companies, regardless of the ownership type, have to improve their corporate governance and enhance their ef ficiency to survive and develop (Liu and Li, 1998). The optimization of ownership concentration is an important way to improve corporate governance.

At its formation, China’s securities market was given the important mission of helping in the reform of SOEs. As a result, most of the listed companies at that time were created through the restructuring of such enterprises. To maintain the dominant role of public ownership, state control, either direct or indirect, became a popular ownership pattern of these newly listed firms. In general, local governments have chosen the mode of direct control (the blockholder is the local state asset management bureau) to achieve their political and economic goals, which makes it easier for these governments to intervene in the activities of, and gain more benefits from, listed companies.

At the same time, because the administrative agent and the power of control over SOEs cannot be transferred with a consideration (Zhang, 1998; Du, 2002), there is a higher degree of ownership concentration in local-government-controlled listed companies. Of course, in regions where the process of marketization is moving more quickly, the level of local government intervention in listed companies is lower and the legal environment is better. As a result of the influence of regional privatization, local governments, to gain more effective control of listed companies, will also keep a higher percentage of ownership in those companies that they directly control to improve decision efficiency and reduce decision costs to deal with fierce market competition. Accordingly, the concentration of ownership becomes a property rights barrier in the merger and acquisition (M&A) activity of local SOEs, because in the regions that possess a better institutional environment, the market is more developed, and the concentrated ownership structure will be helpful in preventing potential threats against the existing control power.

Regarding listed companies indirectly controlled by local governments (the blockholders are local SOEs), following SOE reform strategies, including ‘decentralization of power and transfer of profits’ and ‘seize the big and free the small,’ and considering the restriction of political costs, the establishment of local government credit and the promotion of government image, local governments are more inclined to compel their indirectly controlled listed companies to actively participate in regional product market competition. In regions in which the process of marketization is moving more quickly, as noted, the level of local government intervention in listed companies is lower and the legal environment is better; hence, those listed companies will face more fierce marketcompetition, and their operation and maintenance will require more specialized and professional knowledge, which increases the cost of the local governments to intervene in the operation of the companies. To some extent, all of these factors reduce the motivation of local governments to control SOEs (Jensen and Meckling, 1992). Of course, in regions with more intense market competition, more information is available to monitor the managers of SOEs, and thus it becomes easier for the government to supervise the companies after the relaxation of its control (Lin et al., 1997). The lack of incentives to control firms and the low costs of information collection and government supervision motivate those local governments to reduce the percentage of ownership in indirectly controlled companies. In support of the foregoing logic and theoretical analysis, Fan, Wong and Zhang (2009) find that in regions with a lower fiscal deficit, lower unemployment, a government with more long-term goals, faster marketization process and better legal environment, there is a greater hierarchy between companies controlled by local government and their ultimate controllers. A potential consequence of greater hierarchy in the control chain is the decentralization of the ownership structure. They believe that the increase in the hierarchy is an alternative means for the separation of power while the transfer of state-owned shares is limited.

Accordingly, it can be expected that in regions with poorer investor protection, blockholders are more likely to encroach on the interests of the listed companies. To achieve their economic goal, local SOEs are more likely to become involved in related party transactions with listed companies through a more concentrated ownership structure. In fact, such transactions between listed companies and their controlling shareholders are a common phenomenon in China’s securities market, and are an important means by which blockholders tunnel listed companies (Li et al., 2004; He and Liu, 2005). Poor investor protection often breeds and contributes to the occurrence of tunneling. In other words, the regional institutional environment affects the ownership structure of listed companies and their economic consequences.

Based on the foregoing theoretical analysis, Hypotheses 1 and 2 are proposed as follows:

H1: Ceteris paribus, for listed companies controlled by state asset management bureaus af filiated with local governments, the better is the regional institutional environment, the higher is the blockholder shareholding and the more concentrated is the ownership structure.

H2: Ceteris paribus, for listed companies controlled by SOEs affiliated with local governments, the better is the regional institutional environment, the lower is the blockholder shareholding and the less concentrated is the ownership structure.

Since the reforms and opening up, China’s main task is economic development and social stability (the central government also uses these standards to evaluate local governments), and the latter is closely related to local economic development. The decentralization reforms that were launched in the 1980s led to competition acrossregions, which triggered the privatization of public enterprises in the 1990s (Zhang and Li, 1998). As a result of the intense cross-regional product market competition, every region must reduce product costs as much as possible to maintain the minimum market share required for survival. The more intense is this competition, the higher is the degree of privatization. In regions where the process of marketization is moving more quickly, as noted, the level of local government intervention in listed companies is lower and the legal environment is better; hence, product market competition and the fight to control market power are much fiercer. To maintain market superiority in this business environment, higher blockholder shareholding and a more concentrated ownership structure are required of listed private companies.

The analysis above is only one of the many possible explanations of the ownership concentration of listed private companies. The empirical analysis of Zhu (2004) indicates that although the increasing competition across regions will surely accelerate the privatization process of SOEs in related regions, the wide restructuring of public enterprises since the 1990s has not been promoted mainly by interregional competition. Rather, the main motivation of local governments to promote privatization is based on two aspects of local public finance: (1) financial pressure and dif ficult budget constraints due to the 1994 tax-sharing reform; and (2) the development of non-state-owned entities and the increase in the proportion of such entities, significantly improving local public finance. Therefore, in regions where the process of marketization is moving more quickly, non-state-owned companies are developing more rapidly and make up a greater proportion of businesses. In these regions, the pressure on public finance is lower, so the degree of local government intervention in privately owned enterprises is lower and the degree of private property protection is higher. All of these factors lead to lower ownership concentration.

Chen, Li and Su (2005) conduct research into the causes and consequences of the political connections established by listed private companies. They find that in regions with more serious fiscal deficits and arbitrary government actions, which are characteristics of a poor institutional environment, companies tend to establish political connections. Those that have done so often adopt centralized ownership and board structures. In these regions, ownership structure is more concentrated, which contrasts the previous view that the better is the regional institutional environment, the higher is the degree of ownership concentration.

Based on the foregoing discussion of the two competing theories of how the regional institutional environment affects the ownership structure of listed private companies, we propose Hypotheses 3a and 3b as follows:

H3a: Ceteris paribus, for listed private companies, the better is the regional institutional environment, the higher is the blockholder shareholding and the more concentrated is the ownership structure.

H3b: Ceteris paribus, for listed private companies, the better is the regional institutional environment, the lower is the blockholder shareholding and the less concentrated is the ownership structure.

2.2. Regional Institutional Environment and the Privatization of Listed Companies

The economic motives and actions of local governments to control SOEs have changed since decentralization in the 1980s as well as the public finance reforms and increase in market competition across regions in the 1990s.

China’s economic reforms since 1979 can be seen as the reallocation of the power of control and the rights to share in economic residuals from the central government to local governments, and from local governments to managers of enterprises. The former process can be considered decentralization and the latter deregulation (Zhang and Li, 1998). Some Chinese scholars also call the former administrative decentralization and the latter economic decentralization. The development of the public finance and taxation systems since the establishment of the People’s Republic of China (PRC) can be roughly divided into three stages: (1) before 1978, a centralized fiscal system with unified revenue and expenditure; (2) from 1978 to 1993, gradual decentralization of power and the development of a system of revenue sharing and contracted finance1China’s local decentralization policies include the fiscal contract system and transference of the supervision of SOEs to local governments. The former was established in the 1980s and continued until 1993. Under this system, a lower-level government had to remit a fixed amount or proportion of its revenue to the higher-level government, and the rest could be used at the discretion of the local government. This system ended the history of arbitrary transfer payments among governments of different levels and different regions. Most SOEs were owned by local governments until the end of 1983, and up to 1994, local government on all levels controlled 65% of the total assets of these enterprises (China Reform Foundation, 1997).; and (3) in 1994, tax-sharing reform (Zhang and Gong, 2005). Under the new tax system, all taxes are divided into central government, local government and shared taxes. State and local taxation bureaus are established to levy taxes separately. In this way, the administrative authority of the central and local governments and the scope of their expenditures are determined. Since the 1994 tax-sharing reform, the central government’s fiscal revenue as a percentage of GNP has increased and the pattern of revenue received by the central and local governments has been reversed. More fiscal revenue is now in the hands of the central government. However, the pattern of expenditure by the central and local governments has not changed much. Although more fiscal revenue is directed to the central government, the burden of financial expenditure is still left to local governments (Yin et al., 2006). Thus, local governments have the incentive to pursue more fiscal revenue. The decentralization policy enables local government of ficials to control the local economy, establish new enterprises and use self-raised funds to make investments, among other activities. More importantly, the power to manage and restructure local enterprises allows them to share in the residual claims of those enterprises and participate in their management. This institutional arrangement further motivates local governments to pursue more fiscal revenue, and triggers competition among them, which contributes to the marketization of the whole economy. The Chinese experienceshows that the ‘invisible hand’ not only is very effective in the allocation of resources but also plays a role in the creation of institutions. Following on decentralization, market competition has led to the self-reinforcing process of privatization (Zhang and Li, 1998).

One of the costs China has paid for its economic reforms and opening up is the everincreasing gap between incomes. The gap between urban and rural incomes and that between regional incomes constitute the most important disparity, and continues to grow (Lu and Chen, 2004). Traced to their source, these income gaps, to some extent, are related to the economic decentralization reform discussed above. The various Chinese regions are very different in their historical and geographical conditions and policies.

Regarding interregional competition, because of their relatively advantageous conditions, the eastern regions have achieved relatively better economic development. This advantage is self-reinforcing. Once the more developed regions have obtained a superior position, it is difficult for less developed regions to catch up with them (Wang et al., 2007). In an empirical study, Zhang and Gong (2005) find that fiscal decentralization positively influences economic growth in the eastern and the more developed regions whereas its influence on economic growth in the central and western regions is insignificant or even negative. This difference in the effects of fiscal decentralization among various regions widens the gaps among them. In addition, the degree of privatization is higher in the coastal than in the inland regions because the transaction costs of the former are lower (which promotes interregional competition) and more importantly, they have greater autonomy than the latter. Similarly, the degree of privatization in the northeast and southwest regions is lower because the dominant number of SOEs in these regions suppresses competition and there are fewer private enterprises in adjacent areas (Zhang and Li, 1998).

Economic decentralization under political centralization provides local governments with the motivation to develop their economies, promote marketization at the local level, and facilitate privatization in competitive fields. However, the relative performance evaluation that is endogenous to this incentive structure causes some problems, including the growing income gap between urban and rural areas and among regions, market segmentation among regions and loss of equity in public utilities (Wang et al., 2007). A direct economic consequence of the economic decentralization policy is that in the eastern coastal regions or regions with a better institutional environment, the degree of privatization is higher and the possibility is greater that the blockholders of listed companies are private enterprises. In the central and western regions or regions with a poorer institutional environment, the possibility is greater that the blockholders of listed companies are SOEs.

Based on the foregoing discussion, we propose the following hypothesis on the relationship between the regional institutional environment and the blockholder characteristics of listed companies:

H4: Ceteris paribus, the better is the regional institutional environment, the higher is the degree of privatization of listed companies.

3. Research Design

3.1. Sample Selection and Data Source

3.1.1. Sample Selection

The sample selection process is as follows:

(1) Financial companies are excluded because of the special nature of the financial industry;

(2) Companies that issue B or H shares at the same time are excluded because they are subject to both domestic and overseas regulations, in contrast to those companies that issue only A shares, and also because this will facilitate the calculation of the value of the sample companies;

(3) IPO companies are excluded in order to calculate the market risk and control for the influence of the window dressing of financial data in the year of the IPO;

(4) Companies for which data, such as the ultimate controller and blockholder characteristics, are missing are excluded; and

(5) For the purpose of this research, the paper examines only listed companies that are controlled by state asset management bureaus affiliated with local governments, SOEs af filiated with local governments or private enterprises. All other companies are excluded.

The research period is from 2001 to 2004 for the following reasons:

(1) In China, listed companies provided information about the ultimate controller from 2001, and this study concerns the ultimate controller;

(2) We can control for the influence of the accounting performance of listed companies because of the implementation of the Accounting Regulations for Business and Enterprise from 2001;

(3) Non-tradable share reform was launched on April 29th, 2005. This mandatory institutional change has resulted in significant changes in the ownership structure of listed companies. Therefore, we do not take into account samples after 2005;

(4) The approval system for IPOs was adopted in 2001, and we need to control for the possible influence of the share issuance system on the ownership structure of listed companies; and

(5) The NERI Index of the Marketization of China’s Provinces: 2006 Report (Fan, Wang and Zhu, 2007) provides the only marketization index of the various regions in China from 2001 to 2005. The base period for the computation of the index is 2001, and thus the data for the five years are comparable.

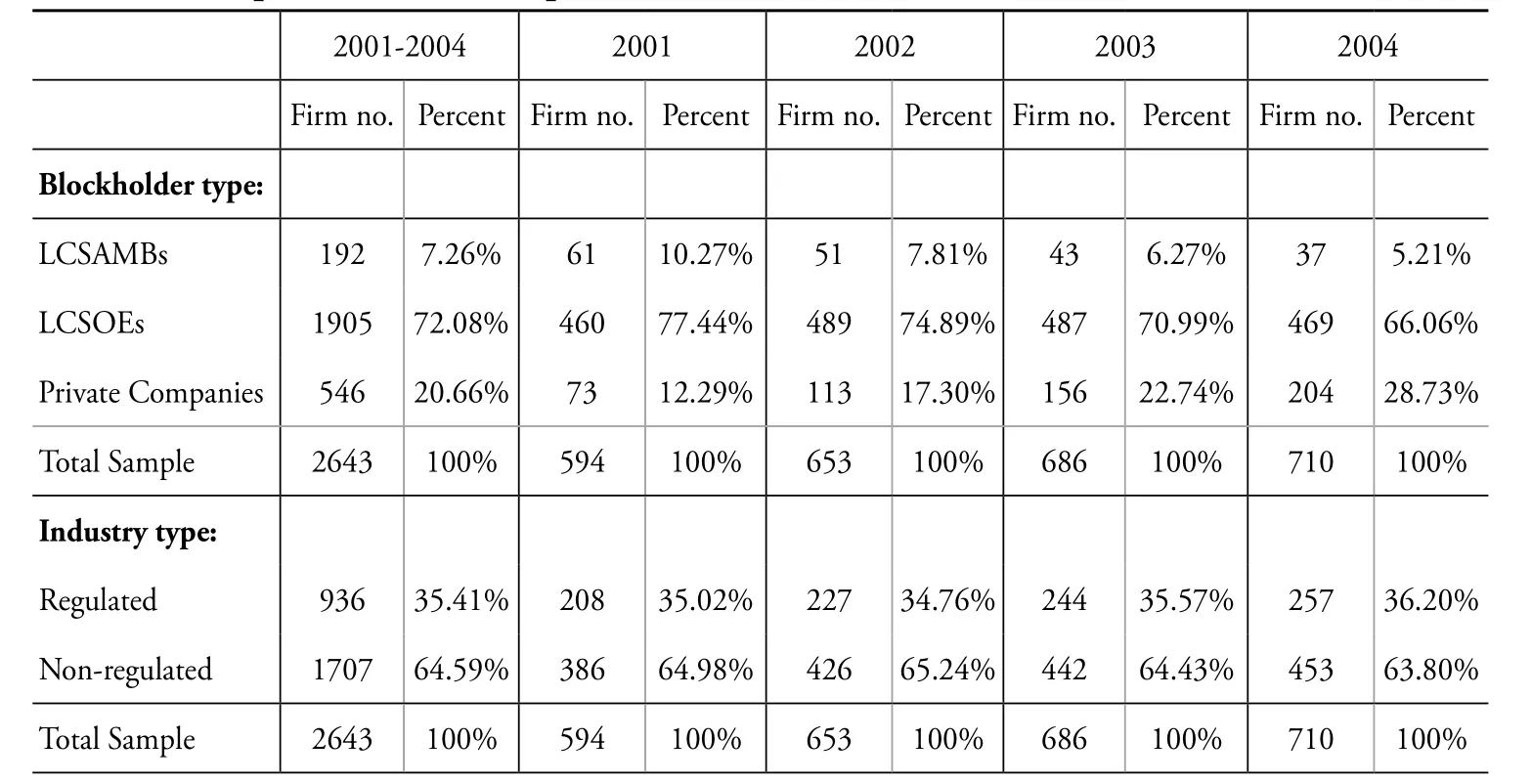

We then delete the top and bottom 1% of each continuous variable to exclude the effects of outliers. In total, we have 2,643 firm-year observations for the three types of blockholders: 192 where blockholders are state asset management bureaus af filiated with local governments, 1,905 where they are SOEs af filiated with local governments and546 where they are private enterprises. Table 1 shows the composition of the sample.The percentages of the sample companies controlled by state asset management bureaus or SOEs affiliated with local governments decrease whereas the percentage of those controlled by private companies increases during the sample period, with the progress in the reform of the property rights system. The percentage of sample companies in regulated industries does not change significantly over the sample period.

Table 1. Composition of the Sample

3.1.2. Data Sources

Ownership structure and financial data are taken from the Wind system, and the data about ultimate controller, industry and registration region are taken from the CCER system. We check the data from one source against those from the other, especially the data about the industries in which the listed companies are engaged, and whether the registration region changes. In addition, we do one-by-one adjustment to the samples when the blockholders are different from the ultimate controllers by examining the‘Changes in Ownership and Information about Shareholders’ section in their annual reports. The annual reports are taken from the Wind system or Juchao information network, which is an information disclosure website designated by the China Securities Regulatory Commission (CRSC).

The institutional environment data are taken from the NERI Index of the Marketization of China’s Provinces: 2006 Report (Fan, Wang and Zhu, 2007). The report divides the process of marketization based on five aspects: ‘relationship between government and market,’ ‘development of non-state-owned economy,’ ‘degree of productmarket development,’ ‘degree of element market development’ and ‘development of market intermediaries and legal environment system.’ The marketization index is obtained using principal component analysis based on these aspects. Following previous researchers (Sun et al., 2005; Xia and Fang, 2005; Fang, 2006; Xia and Chen, 2007; Lei and Liu, 2007; Xin and Xu, 2007; Wang et al., 2008; Fan et al., 2009), we use the marketization, government intervention and legal environment indexes provided by Fan et al. (2007) as proxy variables of the institutional environment. As these indexes are relatively stable for various regions and all years, other studies that adopt this approach usually use the index of the base period. To improve the accuracy of our results, we use the index of each year, and also perform robustness tests using the method adopted by other researchers.

3.2. Model and Variable Design

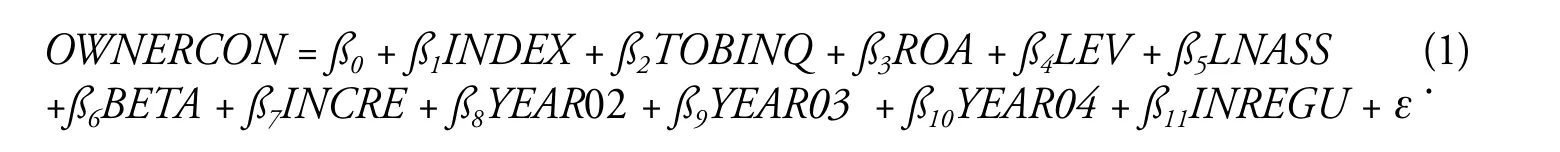

Based on the foregoing analysis, this paper uses the following multiple regression model:

Model (1) is a single regression equation, and its main purpose is to examine how the institutional environment influences the three types of ownership concentration in listed companies. OWNERCON is a continuous variable, and therefore we use the OLS regression. We use Newey-West adjustment to control autocorrelation and heteroskedasticity.

Models (2) and (3) constitute a simultaneous equation model (SEM) of ownership concentration and blockholder characteristics. Our purpose is to examine whether the institutional environment influences blockholder characteristics, taking into account the endogeneity between such characteristics and ownership concentration. Because PRIVAT (blockholder characteristics) is a dummy variable, we use binary probit regression analysis in Model (2) and use Huber-White adjustment to control heteroskedasticity.The definitions of all variables are given in Table 2. It should be noted that there are two ways to run SEM regression: the single-equation and system estimation methods. Based on the characteristics of Models (2) and (3), we use the former, specifically, the two-stage estimation method. The instrument variable (IV) of PRIVAT is the dummyvariable EAST and the IVs of the dependent variable OWNERCON are TOBINQ and ROA. Among all coefficients, ß0is the intercept, ß1to ß12are the coefficients of the independent variables and ε is the residual error.

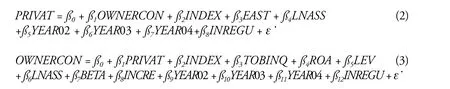

Table 2. Definitions of the Main Variables

3.3. Descriptive Statistics

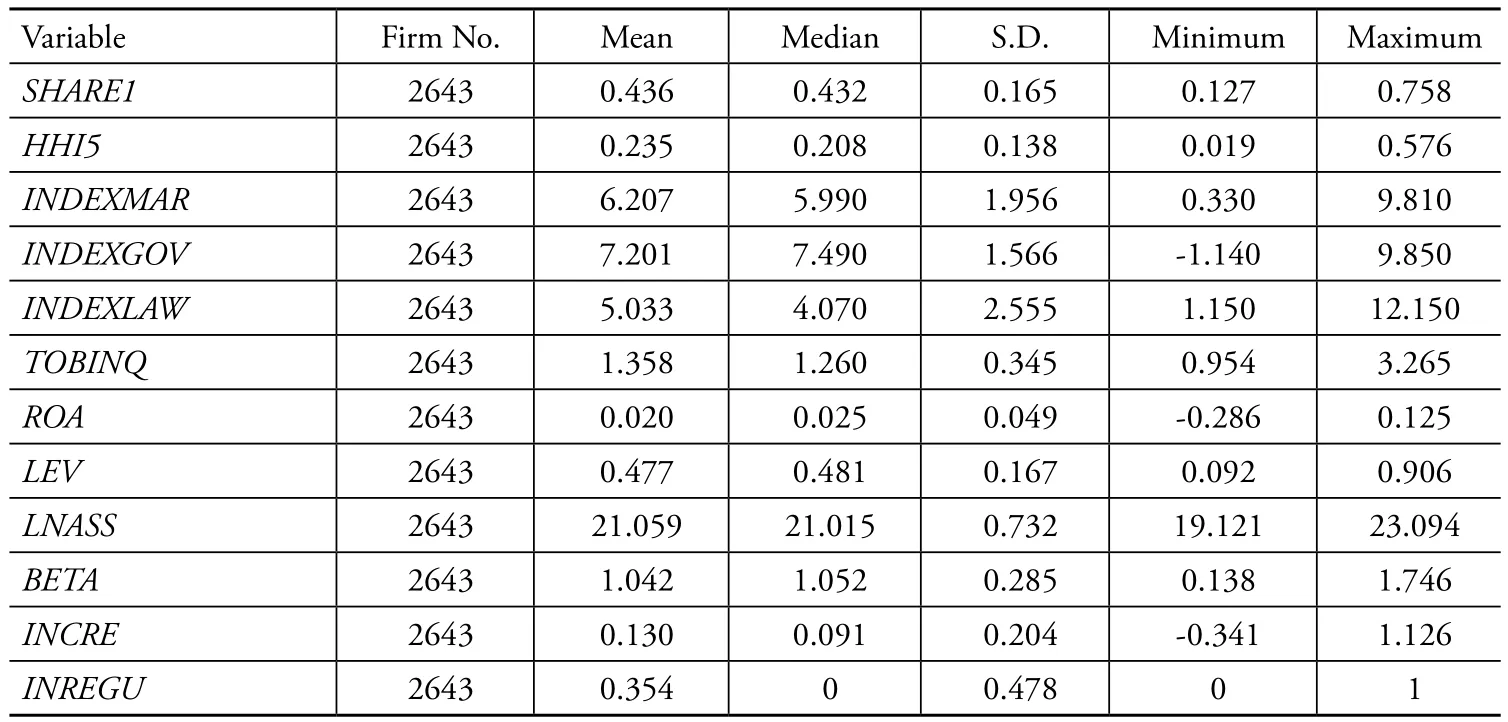

Table 3 shows the descriptive statistics of the main variables. The mean (median) of SHARE1 is 0.436 (0.432), and the mean (median) of HHI5 is 0.235 (0.208), which shows that blockholder shareholding is high and ownership structure is concentrated.The maximum, minimum, standard error and discrete degree of the legal environment index, INDEXLAW, are greater than those of the marketization index, INDEXMAR, and government intervention index, INDEXGOV, which means that there is a huge difference in the legal environment index among the regions. The maximum and minimum of these three indexes represent the obvious differences in institutional environment between the coastal regions in the east and the undeveloped regions in the west. From the descriptive statistics of TOBINQ, ROA, LEV, LNASS, BETA, and INCRE, we can see that there are also huge differences among different listed companies.

Table 3. Descriptive Statistics of the Main Variables

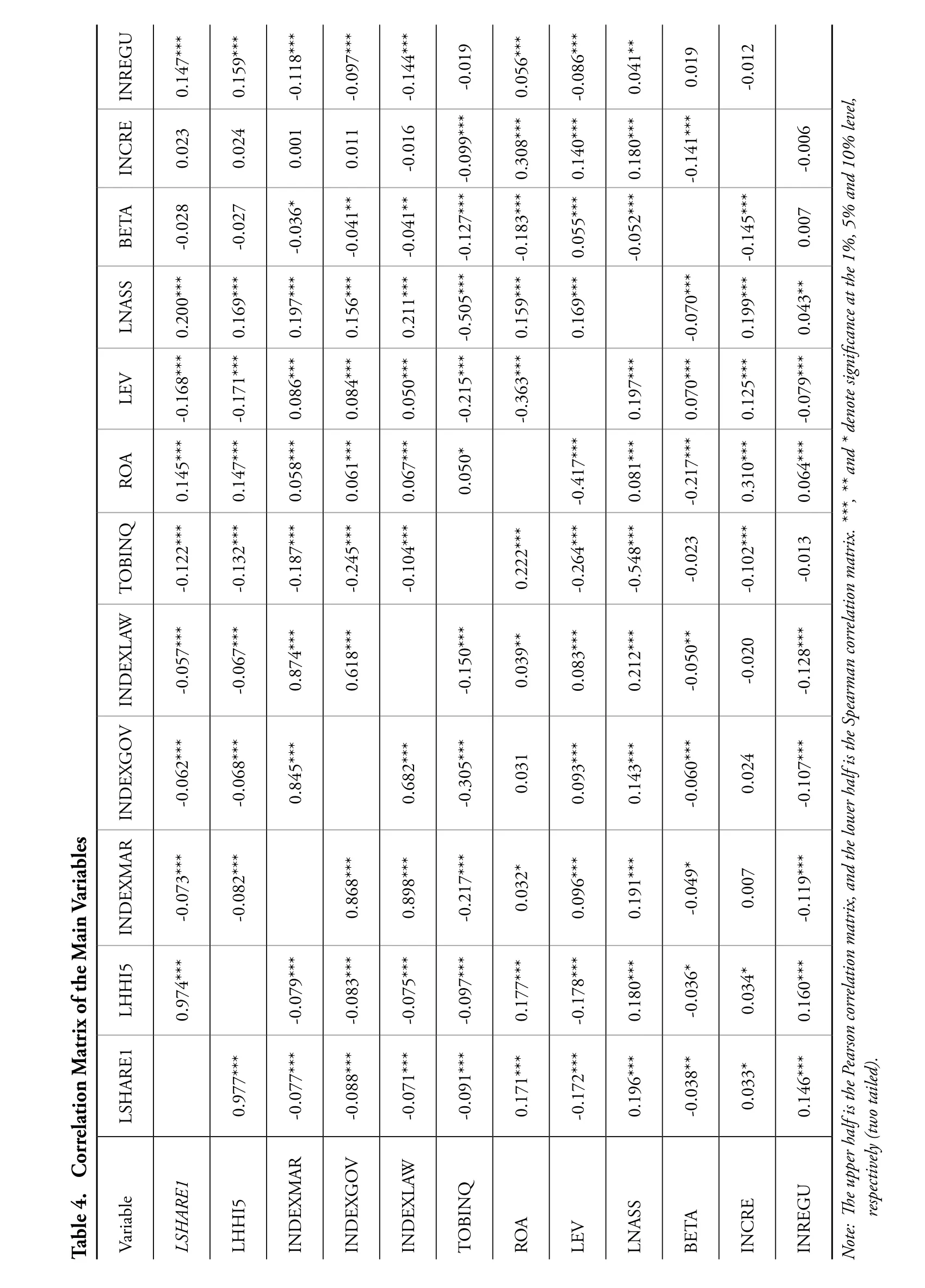

As Table 4 (correlation analysis) shows, the institutional environment variables INDEXMAR, INDEXGOV, and INDEXLAW are negatively correlated with LSHARE1 and LHHI5 at the 1% level. For INDEXMAR, INDEXGOV, and INDEXLAW, each pair is highly positively correlated. This is mainly influenced by geographic location. In regions where the process of marketization is faster, the government intervention and legal environment indexes are also higher. This means that to control multicollinearity, these three variables should be examined separately in regression analysis. LSHARE1 and LHHI5 are negatively correlated with TOBINQ and LEV at the 1% level, positively correlated with ROA and LNASS at the 1% level, but do not have a stable correlation with either BETA or INCRE. They are positively correlated with INREGU at the 1% level, which means that industry type is an important variable for ownership structure research.

?

4. Empirical Results and Analysis

4.1. Multiple Regression Analysis of Institutional Environment and Ownership Concentration

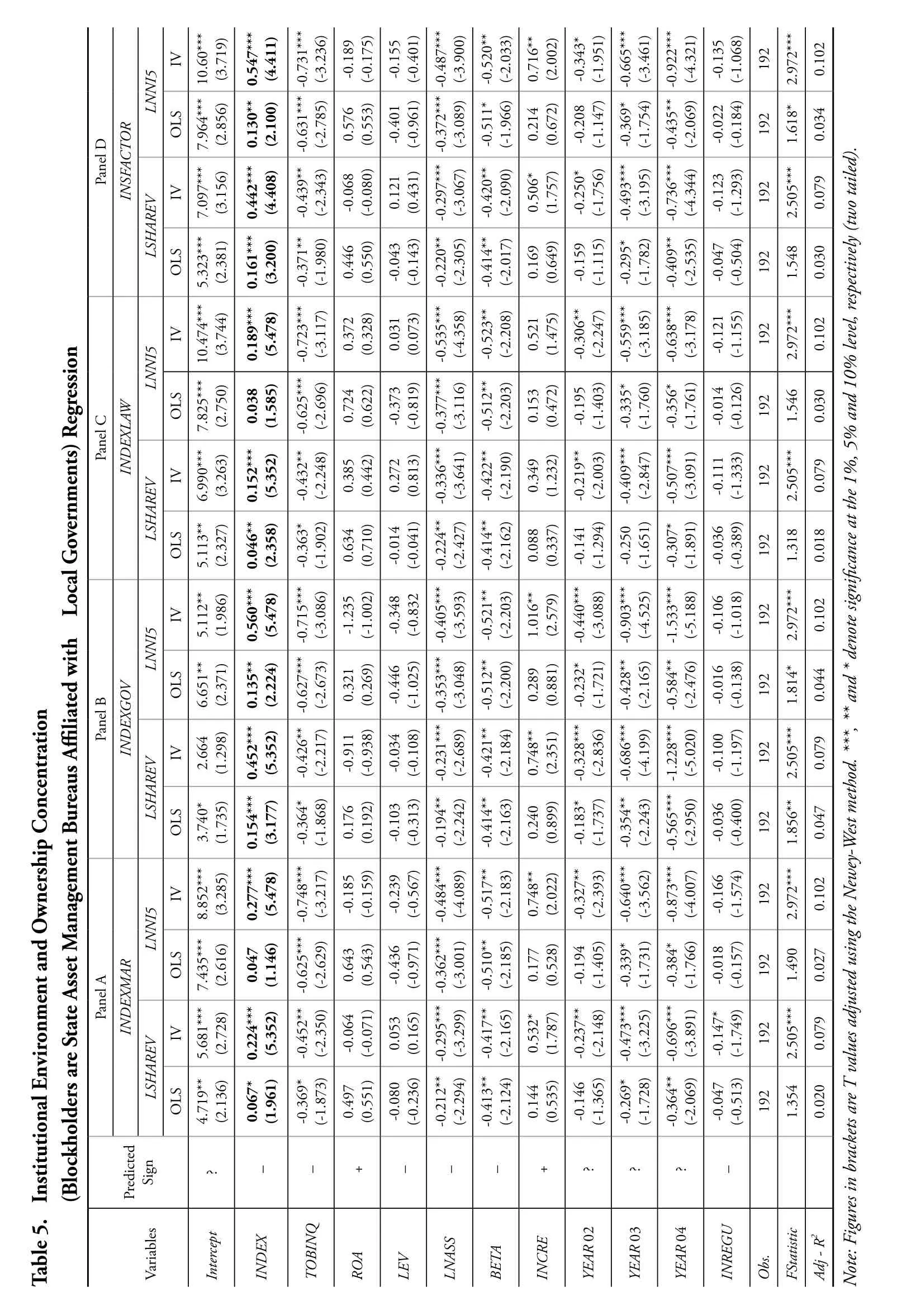

Tables 5, 6, and 7 show the results of multiple regression analysis, using the ordinary least squares (OLS) and instrumental variable (IV) regression of local state asset management agencies, local state-owned enterprises and private enterprises, respectively, and report the influence of the institutional environment variables INDEXMAR, INDEXGOV, INDEXLAW, and INSFACTOR on ownership concentration. The marketization process and local government intervention and local legal protection levels all affect the selection of the ownership structure of listed companies. However, the choice of governance structure of listed companies may also affect the economic behavior of local governments when they are trying to improve the regional institutional environment. To reduce the endogeneity problem of regional institutional environment variables, this paper borrows the research idea of Fan et al. (2009) and the method of Xia and Chen (2007), and uses the following dummy variable as the instrumental variable of regional institutional environment: if a listed company is registered in Dalian, Qinhuangdao, Tianjin, Yantai, Qingdao, Lianyungang, Nantong, Shanghai, Ningbo, Wenzhou, Fuzhou, Guangzhou, Zhanjiang, Beihai, Yingkou, Shenzhen, Zhuhai, Shantou, Xiamen, or Hainan, then the value is 1; otherwise, it is 0. These regions took the lead in China’s opening up, which has resulted in their having a better institutional environment than those of other areas. In contrast, the geographic location of listed companies does not directly affect their ownership structure.

4.4.1. Test of Hypothesis 1

Table 5 shows the multiple regression results of listed companies, the blockholders of which are state asset management bureaus af filiated with local governments. It also shows the influence of the institutional environment variables INDEXMAR, INDEXGOV, INDEXLAW, and INSFACTOR on the two variables of ownership concentration, LSHARE1 and LHHI5.

The results of the OLS regression are given in Panels A-D of the table. When the dependent variables are LSHARE1 and LHHI5: the regression coefficients of INDEXMAR are 0.067 and 0.047, respectively, and whereas the former coefficient is significantly positive at the 10% level, the latter one is positive but not significant (Panel A); the regression coefficients of INDEXGOV are 0.154 and 0.135, and significantly positive at the 1% and 5% level, respectively (Panel B); the regression coefficients of INDEXLAW are 0.046 and 0.038, respectively, and whereas the former coefficient is significantly positive at the 5% level, the latter one is positive but not significant (Panel C); and the regression coefficients of INSFACTOR are 0.161 and 0.130, and significantly positive at the 1% and 5% level, respectively (Panel D).

The results of the IV regression (after controlling for endogeneity) are also given in the table. When the dependent variables are LSHARE1 and LHHI5: the regression coefficients of INDEXMAR are 0.224 and 0.277, respectively (Panel A); those of INDEXGOV are 0.452 and 0.560, respectively (Panel B); those of INDEXLAW are 0.152 and 0.189, respectively (Panel C); and those of INSFACTOR are 0.442 and 0.547, respectively (Panel D). All of these regression coefficients are significantly positive at the 1% level.

These regression results indicate that even if the endogeneity problem related to the institutional environment is considered, the influence of the institutional environment on ownership concentration still exists, as indicated by the significance level of the regression coefficients, R-squared2The regression results of Table 5 show that using the instrumental variable method, the regression model’s coefficient of determination increases. This means that to a certain extent, geographical location is the more explanatory instrumental variable for listed companies the blockholders of which are local state asset management agencies. However, this paper does not give a convincing explanation, as the anonymous reviewer notes.and significance level of the regression model. The research findings presented in Table 5 indicate that when the blockholders of listed companies are state asset management bureaus affiliated with local governments, in regions where the process of marketization is moving more quickly, the degree of local government intervention is lower and the degree of local legal protection is higher, blockholder shareholding is higher and ownership structure is more concentrated. Hence, Hypothesis1 is supported.

In addition, the financial characteristic variables TOBINQ, LNASS, BETA and INCRE have different impacts on the degree of ownership concentration, and the impacts of ROA and LEV on ownership concentration are insignificant; the regression coefficients of the annual dummy variables YEAR02, YEAR03 and YEAR04 show a significant decreasing trend, which to some extent reflects the influence of the local SOE reform strategy, namely, the decentralization of power and transfer of profits, on ownership concentration. The regression coefficient of the regulated industry dummy variable INREGU is negative but not significant, which means that to a certain extent the ownership concentration of these kinds of listed companies is less affected by industry characteristics.

?

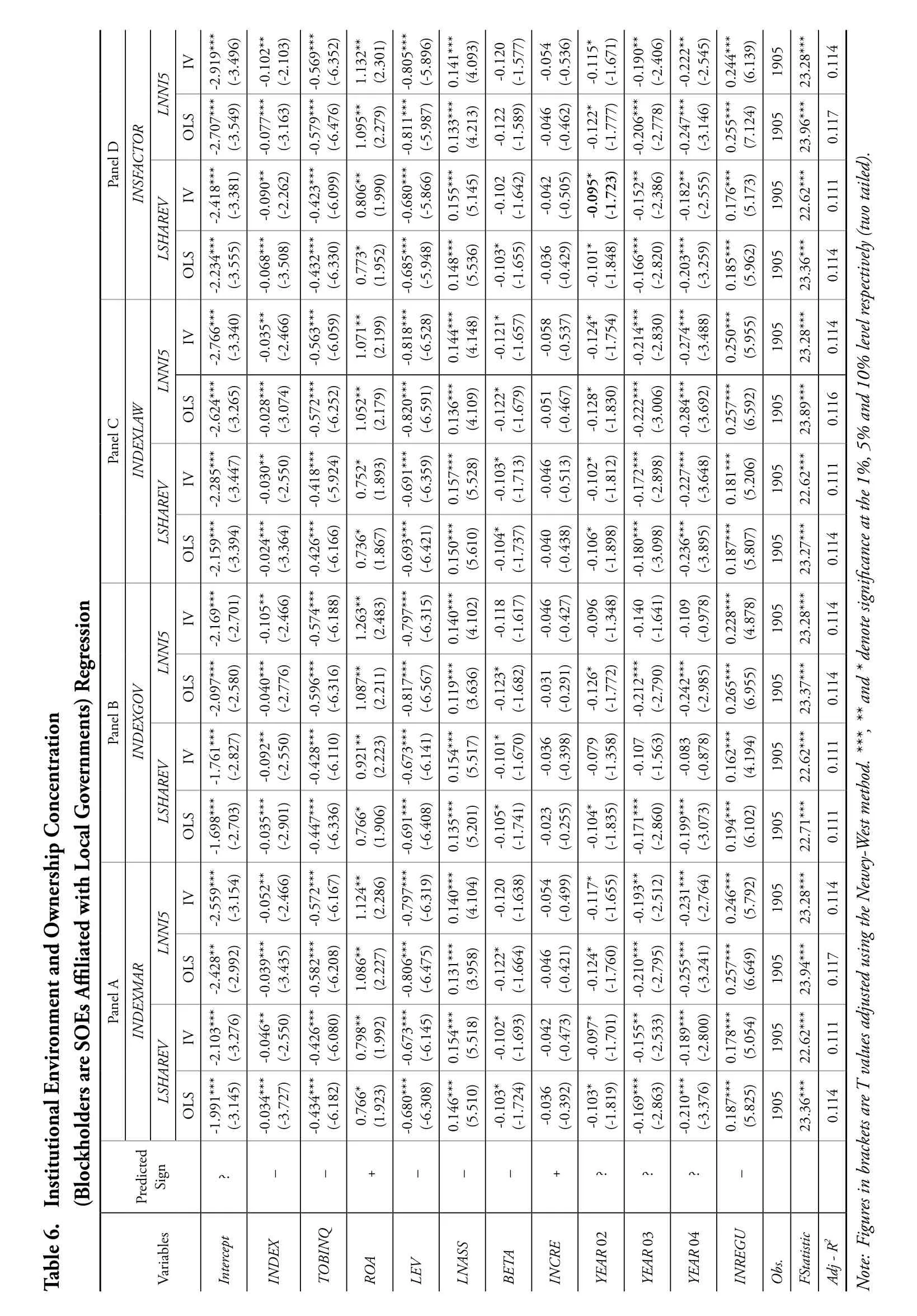

4.1.2. Test of Hypothesis 2

Table 6 shows the multiple regression results of listed companies, the blockholders of which are SOEs af filiated with local governments, and reports the influence of the institutional environment variables INDEXMAR, INDEXGOV, INDEXLAW, and INSFACTOR on the two variables of ownership concentration, LSHARE1 and LHHI5.

The results of the OLS regression are given in Panels A-D of Table 6. When the dependent variables are LSHARE1 and LHHI5: the regression coefficients of INDEXMAR are -0.034 and -0.039 respectively (Panel A); those of INDEXGOV are -0.035 and -0.040 respectively (Panel B); those of INDEXLAW are -0.024 and -0.028 respectively (Panel C); and those of INSFACTOR are -0.068 and -0.077 respectively (Panel D). All of these regression coefficients are significantly negative at the 1% level.

The results of the IV regression are also given in the table. When the dependent variables are LSHARE1 and LHHI5: the regression coefficients of INDEXMAR are -0.046 and -0.052 respectively (Panel A); those of INDEXGOV are -0.092 and -0.105 respectively (Panel B); those of INDEXLAW are -0.030 and -0.035 respectively (Panel C); and those of INSFACTOR are -0.090 and -0.102 respectively (Panel D). All of these regression coefficients are significantly negative at the 5% level.

These regression results indicate that even if the endogeneity problem relating to the institutional environment is considered, the influence of the institutional environment on ownership concentration still exists. In view of the significance level of the regression coefficients, R-squared and significance level of the regression model, the results are consistent with the situation where the endogeneity problem is not considered. The research findings presented in Table 6 indicate that when the blockholders of listed companies are state-owned enterprises af filiated with local governments, in regions where the process of marketization is moving more quickly, the degree of local government intervention is lower and the degree of local legal protection is higher, blockholder shareholding is lower and ownership structure is less concentrated. Hence, Hypothesis 2 is supported.

In addition, the financial characteristic variables TOBINQ, LNASS, BETA, ROA, and LEV all have certain impacts on the degree of ownership concentration, whereas the impact of INCRE on ownership concentration is insignificant; the regression coefficients of the annual dummy variables YEAR02, YEAR03, and YEAR04 show a significant decreasing trend under the influence of the local SOE reform strategy of decentralization of power and transfer of profits, which is in substantial agreement with the findings in Table 5; and the regression coefficient of the regulated industry dummy variable INREGU is significantly positive at the 1% level, which means that the ownership concentration of these kinds of listed companies is affected by industry characteristics.

Comparing the regression results of LNASS and INREGU in Table 5 with those in Table 6, we find that when the blockholders are state asset management agencies or SOEs af filiated with local governments, the SOE reform policies ‘seize the big and free the small’ and ‘allocation of administrative power between central and local governments

and sharing the profits’ have different impacts on the corporate governance structure of the listed companies under the different local government control modes. In the former mode, companies are directly controlled by the local government, and the regression coefficients of LNASS and INREGU are both negative, whereas in the latter, companies are indirectly controlled by the local government, and the regression coefficients of LNASS and INREGU are both positive. These findings complement and expand those of Xia and Chen (2007) regarding the ‘process of marketization, the strategy of state-owned enterprise reform and the government’s shareholding.’

?

4.1.3. Test of Hypothesis 3

Table 7 shows the multiple regression results of listed companies, the blockholders of which are private enterprises, and reports the influence of the institutional environment variables INDEXMAR, INDEXGOV, INDEXLAW and INSFACTOR on the two variables of ownership concentration, LSHARE1 and LHHI5.

The results of the OLS regression are given in Panels A-D of the table. When the dependent variables are LSHARE1 and LHHI5, the regression coefficients of INDEXMAR are 0.018 and 0.010 respectively, and whereas the former coefficient is significantly positive at the 10% level, the latter one is positive but not significant (Panel A); the regression coefficients of INDEXGOV are 0.024 and 0.011 respectively, and whereas the former coefficient is significantly positive at the 5% level, the latter one is positive but not significant (Panel B); the regression coefficients of INDEXLAW are 0.018 and 0.017 respectively, and whereas the former one is significantly positive at the 10% level, the latter is positive but not significant (Panel C); and the regression coefficients of INSFACTOR are 0.044 and 0.030 respectively, and whereas the former one is significantly positive at the 10% level, the latter is positive but not significant (Panel D).

The results of the IV regression are also given in the table. When the dependent variables are LSHARE1 and LHHI5, the regression coefficients of INDEXMAR are -0.026 and -0.054 respectively (Panel A); those of INDEXGOV are -0.037 and -0.077 respectively (Panel B); those of INDEXLAW are -0.018 and -0.039 respectively (Panel C); and those of INSFACTOR are -0.048 and -0.100 respectively (Panel D). None of these regression coefficients is significant.

These regression results show that when the dependent variable is LSHARE1, if endogeneity is not controlled, then the impact of the institutional environment on listed companies, the blockholders of which are private companies is significantly positive. However, it is negative but not significant after endogeneity is controlled. When the dependent variable is LHHI5, if endogeneity is not controlled, then the impact of the institutional environment on listed companies, the blockholders of which are private companies is positive but not significant. However, it is negative but not significant after endogeneity is controlled. Therefore, we can infer that the impact of institutional environment on these listed companies is related to the endogeneity of the regional institutional environment. Possible reasons include the following:

(1) Hypothesis 3 involves two competing theories-when the regional institutional environment is better, listed companies often choose a more concentrated ownership structure when the product market competition and the fight for control power are taken into account. However, after considering political connections and level of economic development, when the regional institutional environment is better, listed companies usually do not choose a concentrated ownership structure. These two factors interact with each other, and thus may affect the significance of the regression coefficient of institutional environment to ownership concentration. Nevertheless, judging from the direction and relative significance level of the regression coefficients in this paper, thetheory of Chen, Li and Su (2005) seems to have more explanatory power than that of Zhang and Li (1998). This provides insights for further study of the determining factors of the ownership structure of listed private companies.

(2) In contrast to state-owned enterprises, which are controlled by various levels of government, private companies do not bear policy burdens, assume less historical liability and are subject to less local government intervention. Hence, changes in the regional institutional environment will not have a significant influence on their choice of ownership concentration. The important factor that determines their ownership structure may be the needs of the listed private companies themselves. For example, the choice of private companies as controlling shareholders of the internal capital market style (this will affect the formation of ownership concentration at the time of the IPO (Zheng and Wei, 2006)) and actions of the ultimate controllers in pursuing maximum private interest through the power of control are more direct factors than is the regional institutional environment in affecting the choice of listed private companies of ownership concentration. This may provide one clue for further study of the phenomenon of tunneling or benefits transfer in private companies.

?

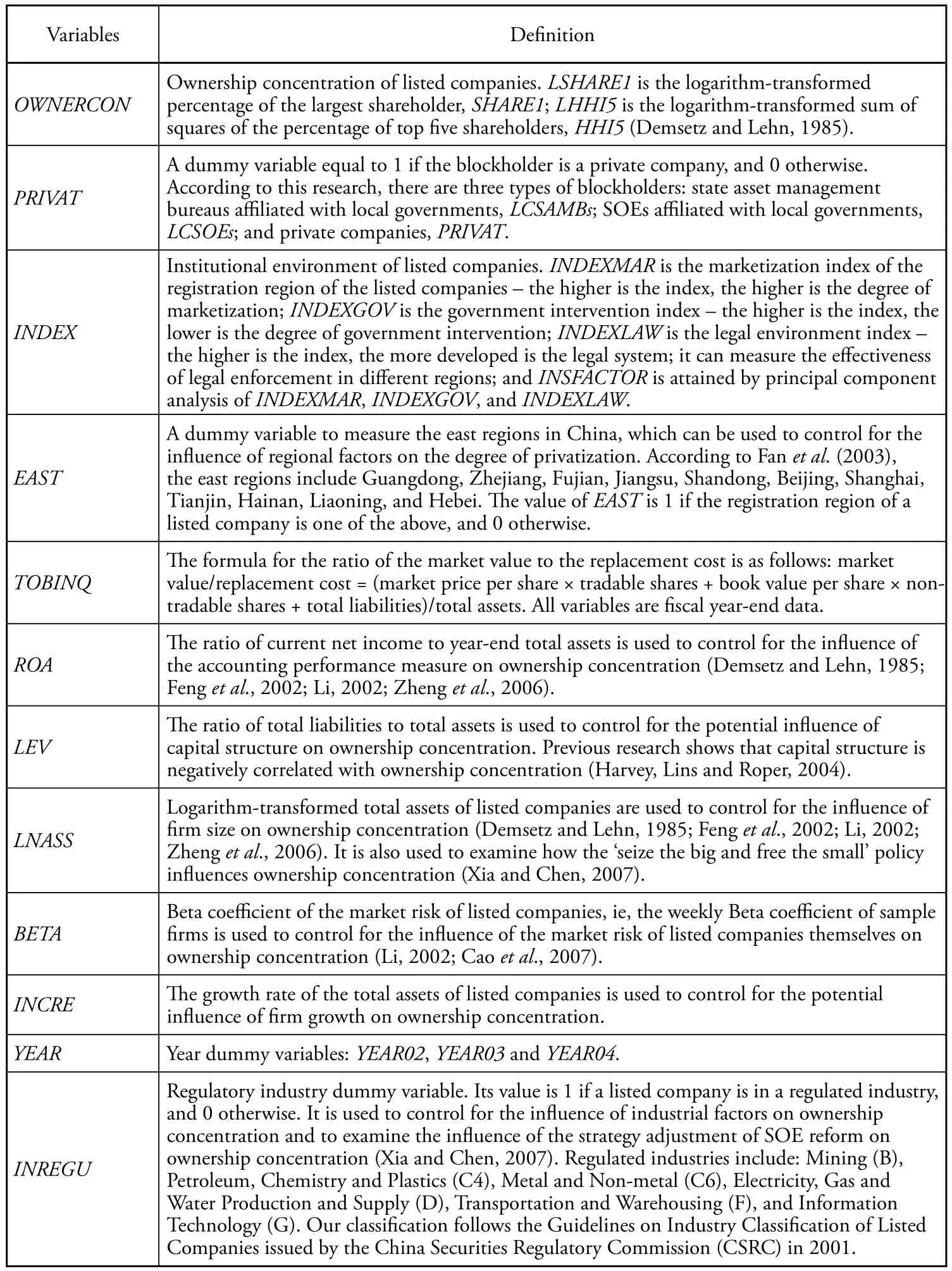

4.2. Multiple Regression Test of Institutional Environment and Privatization of Listed Companies: Test of Hypothesis 4

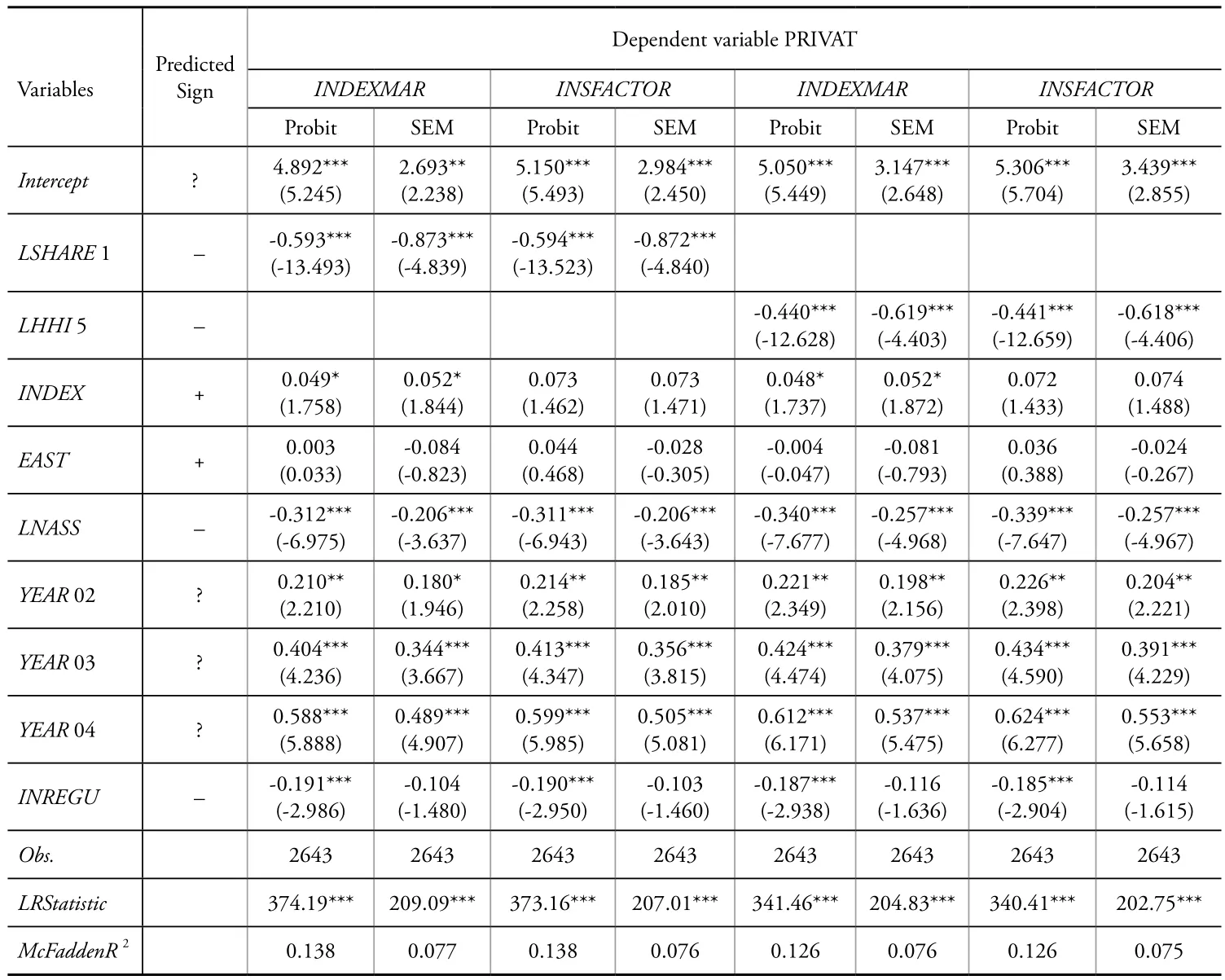

The main purpose of the simultaneous equation model of ownership concentration and blockholder characteristics in Models 2 and 3 is to study whether the regional institutional environment affects the blockholder characteristics of listed companies after the endogeneity between such characteristics and ownership concentration has been taken into account. Table 8 gives the multiple regression results of how the institutional environment affects these characteristics and reports the separate influence of the institutional environment variables INDEXMAR and INSFACTOR on blockholder characteristics under the probit model and SEM, respectively. The test of the endogeneity of ownership concentration has been reported in the previous section and so we do not report here the regression results of SEM (3) when the dependent variables are LSHARE1 and LHHI5.

In Table 8, the dependent variable of the regression model is PRIVAT. In the probit model, when the variables are LSHARE1 and LHHI5: the regression coefficients of INDEXMAR are 0.049 and 0.048 respectively, and both are significant at the 10% level; and the regression coefficients of INSFACTOR are 0.073 and 0.072 respectively, but both are insignificant. In the SEM, when the variables are LSHARE1 and LHHI5: the regression coefficients of INDEXMAR are 0.052 and 0.052 respectively, and both are significant at the 10% level; and the regression coefficients of INSFACTOR are 0.073 and 0.074 respectively, and both are significant at the 15% level. These regression results indicate that in regions with a better institutional environment, China’s listed companies are more likely to be private enterprises. Hence, Hypothesis 4 is supported. The results using the IPO sample (Table 9) also support this hypothesis.

The regression coefficients of the ownership concentration variables LSHARE1 and LHHI5 are all significantly negative for both the probit model and SEM. This indicates a systematic difference in the ownership concentration between listed private and listed local state-owned companies. The regression coefficient of the eastern area dummy variable, EAST, is insignificant, which is mainly caused by the multicollinearity between EAST and INDEXMAR and INSFACTOR. The single regression result of EAST and the dependent variable PRIVAT is significantly positive; therefore, EAST remains as an effective instrumental variable of PRIVAT. The corporate size variable, LNASS is always significantly negative at the 1% level, which means there are systematic differences in size between listed private and listed local state-owned companies. This is mainly due to the reform policy of ‘seize the big and free the small.’ The regression coefficients of the regulated industry dummy variable, INREGU are significantly negative at the 1% level, but they are insignificant in the SEM. One possible reason is that among the estimates in the second phase of the SEM, LSHARE1 and LHHI5 include most of the influence of regulated industry. The regression coefficients of the annual dummy variables YEAR02, YEAR03 and YEAR04 show a significant increasing trend. As SOEs are restructured and listed, private enterprises gradually become the dominant type of blockholder of listed companies at the time of the IPO.

Table 8. Regional Institutional Environment and Privatization of Listed Companies Regression

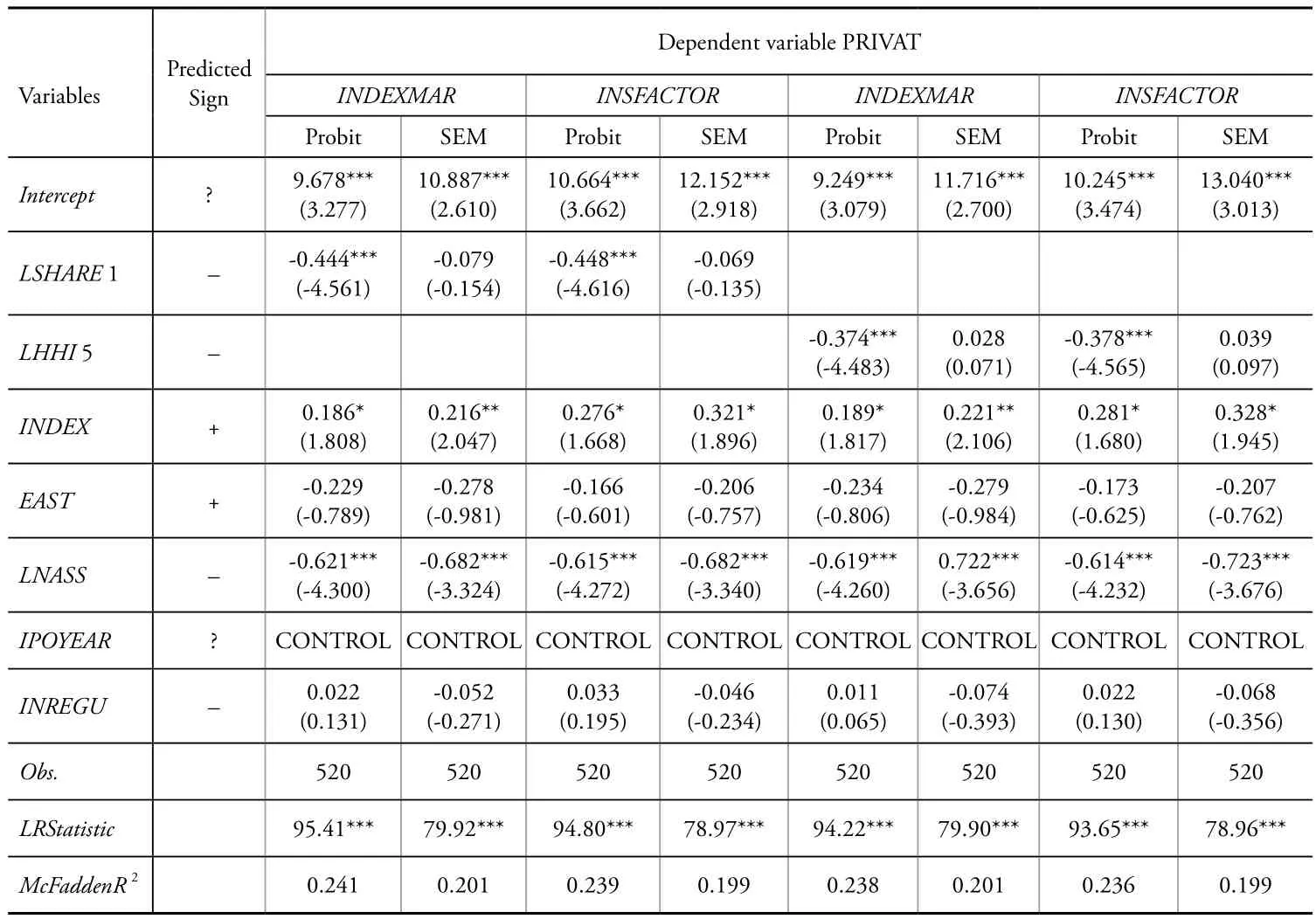

Table 9 shows the results of further testing using the IPO sample for the 1997-2003 period. The institutional environment data of Fan et al. (2007) starts in 1997. To use actual institutional environment data, this paper selects 520 IPO samples for this period, of which 47 have blockholders that are state asset management bureaus af filiated with local governments, 407 have blockholders that are SOEs af filiated with local governments, and 66 have blockholders that are private enterprises. The market risk BETA data come from the data two years after the IPO, the growth indicator data come from the data one year after the IPO and other financial indicator data come from the data at the end of the year of the IPO. It is found that after controlling for the endogeneity between ownership concentration and blockholder characteristics, the effects of the regional institutional environment on the privatization of listed companies are still significantly positive, which provides further support for Hypothesis 4. The use of IPO samples in the analysis provides us with a new research perspective. With the development and improvement of China’s capital market, and the improvement of the availability of data and sample size, the tests of this issue will be more robust.

Table 9. Regional Institutional Environment and Privatization of Listed Companies Regression (IPO Sample)

5. Sensitivity and Robustness Testing

We conduct the following sensitivity analysis to check the robustness of the results.

5.1. Deletion of the Sample Observations of Listed Companies Located in Shenzhen and Shanghai

As Xia and Chen (2007) document, compared to other regions, the practice of the reform and opening up policy and the reform of SOEs in Shenzhen and Shanghai are rather special. In addition, as stock exchanges are located in Shenzhen and Shanghai, it is possible that the corporate governance structure of listed companies in these two cities is different to companies in other regions. Among the 2,643 observations in this research, 80 are in Shenzhen and 212 in Shanghai. Therefore, we delete these observations to ensure that the results are not solely induced by them. The main results remain the same. In addition, to take into account that some listed companies may be registered in one region but operate in another and could thereby influence the results, we exclude those listed companies. The results remain the same.

5.2. Institutional Environment Data

The institutional environment data are obtained from the NERI Index of the Marketization of China’s Provinces: 2006 Report (Fan, Wang and Zhu, 2007) which takes 2001 as the base year to develop relative indexes in various regions from 2001 to 2005. As the three indexes used in this study (marketization, government intervention and legal environment) are relatively stable in all years, almost all of the previous studies that adopt this presumption use the index of the base year. We also use this method for robustness testing, which can reduce the endogeneity of the institutional environment.The results remain unchanged.

We also use the government effectiveness index from the document ‘Government Governance, Investment Environment and Harmonious Society: The Enhancement of Competitiveness of 120 Cities in China’ issued by the World Bank (October, 2006) as a proxy variable of the institutional environment. The analysis shows that our main results remain the same. This index includes the average number of days that enterprises have to deal with key governmental agencies every year, the access to bank loans of small and medium-sized private enterprises, confidence in property rights protection and contract rights and confidence in courts. Among them, confidence in property rights protection and contract rights and in courts concern, in essence, investor protection.

5.3. Other Relevance Tests

As the blockholder characteristics and ownership concentration of listed companies do not change significantly after their IPOs, we use companies the IPOs of which took place from 1997 to 2003 as samples to run regressions as in Tables 5, 6 and 7. The results remain unchanged.

To reduce the possible adverse influence of endogeneity between ownership structure and financial measures, we use financial measures of the previous year to test the hypotheses. We also use the accounting performance measure ROA or ROE, market performance measure TOBINQ or P/B (price to book value ratio) and other growth and market risk measures to conduct combined tests. Finally, we use annual data to run regressions. In each case, the results do not change.

6. Conclusions and Directions for Further Research

This paper uses China’s A-share listed companies from 2001 to 2004 as the research sample. It investigates the influence of institutional environment variables, namely, the process of marketization, level of local government intervention and local legal environment, on the ownership structure of listed companies. It further examines the hypothesis that corporate governance structure is endogenously determined by the institutional environment. The results show that in regions where the process ofregional marketization is moving quickly, the level of local government intervention is lower and that of local legal protection is higher: (1) if the blockholders of listed companies are state asset management bureaus af filiated with local governments, then blockholder shareholding is higher and ownership structure is more concentrated; (2) if the blockholders of listed companies are SOEs affiliated with local governments, then blockholder shareholding is lower and ownership structure is less concentrated; (3) if the blockholders of listed companies are private companies, then the influence of the regional institutional environment on ownership concentration is insignificant; and (4) the degree of privatization of Chinese listed companies is higher. The findings indicate that the regional institutional environment affects the choice of blockholder type and ownership concentration of listed companies. The results remain the same after controlling for the endogeneity problem related to institutional environment variables using the instrumental variable method and a series of robustness tests.

This paper extends domestic research into the endogeneity problem related to ownership structure. The findings help us to further understand the reasons for the differences in ownership concentration and blockholder characteristics in listed companies under different modes of local government control in China. They indicate that to obtain a better understanding of the issues concerning listed companies in China, including governance structure, corporate performance, financial policies and accounting information quality, further in-depth research into the role of the regional institutional environment is required. In addition, the study adds to the knowledge of the ways in which institutional environment factors affect ownership structure within one country and in transitional and emerging market economies.

It should be noted that this paper studies only the cross-sectional differences among the ownership structures of the sample companies resulting from the influence of the institutional environment, and does not study directly the possible influence of institutional environment on the dynamic evolution of ownership structure. The following issues are worth further research attention: how blockholder characteristics, pyramid structure and ownership concentration affect each other under certain institutional environments, how the ownership concentration of private companies is determined and how the ownership structure of listed companies is dynamically determined following their IPOs.

Alchian, A., 1965. The basis of some recent advances in the theory of management of the firm. Journal of Industrial Economics 14, 30-44.

Boubakri, N., Cosset, J. C., Guedhami, O., 2005. Postprivatization corporate governance: The role of ownership structure and investor protection. Journal of Financial Economics76, 369-399.

Cao, T. Q., Yang, X. L., Sun, Y. G., 2007. Ownership structure and corporate performance: Measurement method and endogeneity. Economic Research Journal 10, 126-137. (In Chinese)

Chen, J. P., Li, Z., Su, X., 2005. Rent seeking incentives, political connections and organizational structure:Empirical evidence from listed family firms in China. Working Paper, City University of Hong Kong and Shanghai University of Finance and Economics.

Chen, X. Y., Chen, D. H, Zhu, K., 2004. Ownership structure and firm performance in China: A survey. China Accounting and Finance Review 4, 4-47. (In Chinese)

China Reform Foundation, 1997. Realistic option: An initial summary of reform practice of mid-sized and small-sized SOEs. Shanghai Yuandong Publishing House, Shanghai. (In Chinese)

Coase, R.,1937. The nature of the firm. Economica 4 (16), 386-405.

Demsetz, H., 1967. Toward a theory of property rights. American Economic Review 57 (2), 347-359.

Demsetz, H., Lehn, K., 1985. The structure of ownership: Causes and consequences. Journal of Political Economy 93, 1155-1177.

Du, X. Q., 2002. Research on property rights of accounting information. Dongbei University of Finance and Economics Press, Dalian. (In Chinese)

Dyck, A., 2000. Ownership structure, legal protections and corporate governance. Working Paper, Harvard Business School.

Fan, G., Wang, X. L., Zhang, L. W., Zhu, H. P., 2003. Marketization for China’s provinces. Economic Research Journal 3, 9-18. (In Chinese)

Fan, G., Wang, X. L., Zhu, H. P., 2007. NERI Index of marketization of China’s provinces: 2006 report.The Economic Science Press, Beijing. (In Chinese)

Fan, J., Wong, T. J., Zhang, T., 2009. Organizational structure as a decentralization device: Evidence from corporate pyramids. Working Paper, Chinese University of Hong Kong and City University of Hong Kong.

Fang, J. X., 2006. Evolvement of marketization and improvement of capital allocation ef ficiency. Economic Research Journal 5, 50-61. (In Chinese)

Feng, G. F., Han, B., Yan, B., 2002. The empirical analysis of the change of China’s listed companies ownership concentration degree. Economic Research Journal 8, 12-18. (In Chinese)

Harvey, C., Lins, K., Roper, A., 2004. The effect of capital structure when expected agency costs are extreme. Journal of Financial Economics 74, 3-30.

He, J. G., Liu, F., 2005. Large shareholder control, tunneling and investor protection: Evidence from related party transactions in listed firms’ acquisitions. China Accounting and Finance Review 3, 25-35. (In Chinese)

Himmelberg, C. P., Hubbard, R. G., Love, I., 2002. Investor protection, ownership, and the cost of capital. Policy Research Working Paper, World Bank.

Jensen, M. C., Meckling, W. H., 1992. Specific and general knowledge and organization structure in contract economics, eds. L. Werin and H. Wijkander, Basil Blackwell, Oxford.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., Vishny, R., 1998. Law and finance. Journal of Political Economy 106, 1113-1155.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., 1999. Corporate ownership around the world. Journal of Finance 54, 471-517.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., Vishny, R., 2000. Investor protection and corporate governance. Journal of Financial Economics 58, 3-27.

Lei, G. Y., Liu, H. L., 2007. The process of marketization, the nature of ultimate ownership and cash dividends. Management World 7, 120-128. (In Chinese)

Leland, H., Pyle, D., 1977. Informational asymmetries, financial structure, and financial intermediation. Journal of Finance 32, 371-387.

Li, T., 2002. State ownership of mixed ownership firms: Theoretical foundation of reducing government shareholding fraction. Economic Research Journal 8, 19-27. (In Chinese)

Li, Z. Q., Sun, Z., Wang, Z. W., 2004. Tunneling and ownership structure of a firm. Accounting Research 12, 3-13. (In Chinese)

Lin, Y. F., Cai, F., Li, Z., 1997. Suf ficient information and reform of state-owned enterprise. Shanghai Renmin Press, Shanghai. (In Chinese)

Lin, J. Y., Cai, F., Li, Z., 1998. Competition, policy burdens, and state-owned enterprise reform. American Economic Review 88 (2), 422-427.

Liu, S. J., Li, J., 1998. Beyond property right theory and firm performance. Economic Research Journal 8, 3-12. (In Chinese)

Liu, S. J., Sun, P., Liu, N. Q., 2003. The ultimate ownership and its shareholding structures: Does it matter for corporate performance? Economic Research Journal 4, 51-62. (In Chinese)

Lu, M., Chen, Z., 2004. Urbanization, urban-biased economic policies and urban-rural inequality. Economic Research Journal 6, 50-58. (In Chinese)

Luo, D. L., Tang, Q. Q., 2009. Research on institutional environment and performance of China’s private listed companies. Economic Research Journal 2, 106-118. (In Chinese)

North, C., 1981. Structure and change in economic history. Norton, New York.

Shleifer, A., 1998. State versus private ownership. Journal of Economic Perspectives 12, 133-150.

Sun, Z., Liu, F. W., Li, Z. Q., 2005. Market development, government influence and corporate debt maturity structure. Economic Research Journal 5, 52-63. (In Chinese)

Wang, H. L., Li, D. Q., Lei, D. M., 2001. Why do governments’ dump state enterprises? Evidence from China. Economic Research Journal 8, 61-85. (In Chinese)

Wang, Q., Wong, T. J., Xia, L., 2008. State ownership, the institutional environment, and auditor choice: Evidence from China. Journal of Accounting and Economics 46, 112-134.

Wang, Y. Q., Zhang, Y., Zhang, Y., Chen, Z., Lu, M., 2007. On China’s development model: The cost and benefits of China’s decentralization approach to transition. Economic Research Journal 1, 5-16. (In Chinese)

World Bank, 2007. Government governance, investment environment and harmonious society. China Financial and Economic Publishing House, Beijing.

Xia, L. J., Chen, X. Y., 2007. Marketization, SOE reform strategy and endogenously determined corporate governance structure. Economic Research Journal 7, 82-95. (In Chinese)

Xia, L. J., Fang, Z. Q., 2005. Government control, institutional environment and firm value. Economic Research Journal 5, 40-51. (In Chinese)

Xin, Y., Xu, L. P., 2007. Governance environment and consideration in share reform. Economic Research Journal 9, 121-133. (In Chinese)

Xu, L. P., Xin, Y., Chen, G. M., 2006. Ownership concentration, outside blockholders and operating performance: Evidence from China’s listed companies. Economic Research Journal 1, 90-100. (In Chinese)

Yin, X. G., Chen, G., Pan, Y., 2006. Tax sharing reform, government intervention and the ef ficiency of financial development. Journal of Finance and Economics 32 (10), 92-101. (In Chinese)

Zhang, W. Y., 1998. Non-compensatory loss of control right and barriers of property rights in SOEs mergers. Economic Research Journal 7, 3-14. (In Chinese)

Zhang, W. Y., Li, S. H., 1998. Inter-regional competition and the privatization of SOEs in China. Economic Research Journal 12, 13-22. (In Chinese)

Zhang, Y., Gong, L. T., 2005. The tax sharing reform, fiscal decentralization, and economic growth in China. China Economic Quarterly 5 (1), 75-108. (In Chinese)

Zheng, G. J., Wei, M. H., 2006. The endogenesis of ownership structure: Evidence from controlling shareholder’s internal capital market in China. China Accounting Review 4 (2), 189-204. (In Chinese)

Zhu, W. X., Song, Y., 2001. Equity structure and firm value: An empirical analysis of listed companies of household electric appliances industry. Economic Research Journal 12, 66-72. (In Chinese)

* This study was funded by grants from Key Projects of Key Research Institute of Humanities and Social Science of Ministry of Education (2009JJD790040) and the National Social Science Foundation of China (No. 07CJY010). We are grateful to the 2nd CJAR (China Journal of Accounting Research) Symposium and the valuable advice from an anonymous reviewer. We also thank Dr Yuyan Guan from City University of Hong Kong, Professor Feng Liu from Sun Yat-Sen University, Professor Xi Wu from Central University of Finance and Economics, and Jingwen Zhao, Guoqing Zhang, Zejiang Zhou and Zheng Chen from Xiamen University for valuable comments and advice, PhD candidate Jing Fang for assistance and Dr. Liying Sun for translation. All remaining errors are the sole responsibility of the authors.

** Corresponding author. Xingqiang Du: E-mail address: xqdu@xmu.edu.cn. Correspondence address: Department of Accounting, Management School, Xiamen University, Xiamen, China, 361005. Zongfeng Xiu: E-mail address: xiuzongfengxmdx@yahoo.com.cn. Business School, Central South University, Changsha, China, 410083.

China Journal of Accounting Research2009年2期

China Journal of Accounting Research2009年2期

- China Journal of Accounting Research的其它文章

- China-Related Research in Auditing: A Review and Directions for Future Research*

- Trade Credit, Future Earnings, and Stock Returns: A Self-Dealing Perspective*

- Performance Volatility and Wage Elasticity: An Examination of Listed Chinese A-share Enterprises*

- Corporate Governance and Accounting Conservatism in China*