A Lesson for the West

THE tumultuous situation in the world economytoday and the economic consequencesof the geopolitical crises in Ukraine and inthe Middle East have serious implicationsfor the world economy. The sanctions and other restrictionsplaced on Russia and the increasing viewin the United States and Europe of China as a rivalrather than a partner have led to measures that arehaving a more negative effect on the countries imposingthem than on the intended recipients.

While stock market gyrations often give the impressionof an uptick, the real economy of the UnitedStates is in dire straits with rampant inflationand the major question determining the outcomeof the U.S. presidential elections is which party canavert a plunge into chaos.

The U.S. Congress, aware of the widespread voterdissatisfaction, has issued a flurry of new anti-Chinameasures, trying to portray China as the cause ofU.S. economic woes rather than their own mistakenpolicies, but not everyone is taking the bait.

A recent study by the Wharton School at theUniversity of Pennsylvania clearly shows that thisanti-China wave is threatening the loss of Chinesescholars and scientists working and studying in theUnited States and making valuable contributions invarious areas of knowledge. Many business leaders,represented in particular by the U.S.-China Business"Council, have expressed their growing concernat the recent tariffs imposed by the Department ofCommerce on China under Section 301, raising therate between 25 and 100 percent, stating that thesewill have more deleterious effects on Americanbusinesses than on China.

It is also clear that the anti-China measures willhave a negative effect on U.S. consumers. Increasedtariffs will only lead to even greater inflation of theprices of food and other essentials. While all thistalk about creating alternative supply chains soundsnice, revamping the economy into any new structuremay take years, or may prove to be impossiblewithout massive austerity. For American farmers,trying to restrict trade with China will only lead tomore farm foreclosures. There is no replacement atthe present for the huge Chinese market of 1.4 billionpeople, so downsizing agriculture productionwill become inevitable.

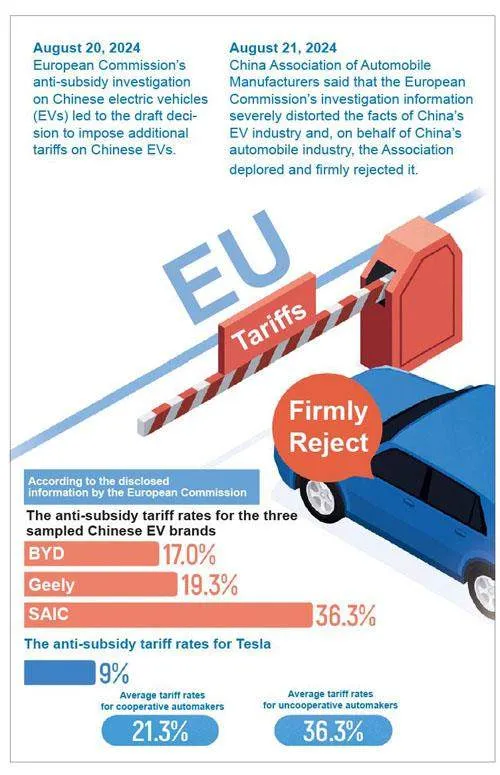

The situation is even more precarious in Europe,which is suffering the direct effects of thewar in Ukraine, cutting off crucial energy suppliesfrom Russia and imposing greater trade restrictionson China. The underlying economic realityof these measures has already led to a significantsplit between the EU and individual countries likeGermany, Hungary, and Spain, which have raisedtheir voices against the draconian policies beingput forward by the EU.

Ultimately, the economic reality will take precedenceover the geopolitical intentions of the Brusselsbureaucracy if Europe is to avoid falling into adepression.

Meanwhile, faced with these temporary headwinds,China is trimming its sails to meet themhead-on by unveiling a package of incrementalpolicies designed to strengthen counter-cyclicalmacro policy adjustment, expand effective domesticdemand, increase efforts to help enterprises,stabilize the real estate market, and boost thecapital market.

Zheng Shanjie, head of the National Developmentand Reform Commission (NDRC), said at apress conference on October 8 that a raft of reformmeasures conducive to economic developmentwill be rolled out, including a new negative listfor market access and mechanisms to ensure in"creased investment in future industries. China willexpand the catalogue of industries that encourageforeign investment, unveil a new group of majorforeign-invested projects and make its visa-freetransit policies more open, according to Zheng.

Projects which were on the drawing board havenow been front-loaded in order to bring them intoplay earlier than planned. The People’s Bank ofChina, China’s central bank, has reduced the"reserveratio and interest rates to encourage investment.China will also broaden the area and scopeof special treasury bonds to be used as projectcapital for local governments.

The goal is to maintain the momentum of theChinese economy until many of the tensions havebeen resolved.

While the present policy of the West is orientedtoward more restrictive measures on China’s development,this will come back to haunt thosegovernments. The fact of the matter is that theChinese economy is in much better shape thanthe economies of the West. The economy of theUnited States, the biggest debtor in the world, hasbecome a veritable bubble economy, and feedingthat bubble will prevent any major funding forinfrastructural development. Only major financialreform will prevent the debt from sucking up newfunding intended for investment in the physicaleconomy. It will also necessitate an end to thecontinual outflow of money to the non-productiveand destructive war economy. Unfortunately,these measures are just not on anybody’s agendaat the moment.

For the European nations, the situation is evenmore critical. East-West trade has increasinglyserved as the lifeblood of the European economyover the last few decades. Germany, in particular,has benefited enormously from the Belt and RoadInitiative, in spite of not being officially a part ofit. “De-coupling” under the rubric of “de-risking”threatens the risk of depression, and there areclear signs that industrial Germany is not preparedto fall on its sword for the sake of fulfillingAnglo-American geopolitical aims.

In addition, China has the support and the cooperationof the countries of the Global South, whowere never enamored with the “American Dream.”The growing influence of mechanisms like BRICSand the G20 on the global arena represents theemergence of a new political order with which theadvanced Western countries must ultimately learnto live with.