CHINA NONFERROUS METALS MONTHLY

Zijin Mining Realizing “Bottom-Fishing” M&A Against Trend

In 2022,the price of domestic mining assets was near the bottom,and Zijin Mining realized bottomfishing M&A against trend.3/4 of its M&A capital was used for domestic mining acquisition.In 2023,the price of domestic mining assets has been rising gradually,and mining rights will get increasingly valuable.Wang Jingbin,Chief Geologist of Zijin Mining made the above statement on the 2nd China International Mining Investment and Development Summit on March,30th.

Zijin Mining implemented bottom-fishing M&A strategy in 2022.The Company conducted 8 mineral resource M&As,of which 6 projects were about domestic M&A.Total M&A amount exceeded RMB 31.4 billion that year,and 75% of the total was used for domestic projects.From the perspective of mineral species,M&A projects cover 5 gold mine,2 lithium mines,and 1 molybdenum mine.In Q4 of 2022,Zijin Mining finished 4 gold mine M&A projects without a break,which helped the Company increase its gold equity resource reserves by 737 tons,and made it the company that boasts the biggest gold resource reserves in the country ahead of Shandong Gold Group.Zijin Mining is the biggest gold manufacturer and the second biggest copper producer in the country.It achieved a revenue of RMB 270.3 billion in 2022,a YOY increase of 20 %;net profit attributable to the parent company of RMB 20 billion,a YOY increase of 28%.The Company produced 880000 tons of mineral copper and 56 tons of mineral gold that year,respectively accounting for 47% and 19%of total yield in the country.

Waiting for the opportunity

H“Look more and act less,and wait for the opportunity”,“We kept waiting when the price was not reasonable,and waited for the opportunity to act”.That’s how Wang Jingbin described these lowprice M&As.He gave the example of Shapinggou Molybdenum Mine in Anhui and Sawaya'erdun Gold Mine in Xinjiang Zijin acquired in 2022.They had followed the two mineral deposits for nearly ten 10 years before they finally thought the price was suitable.He explained that mining industry in China had been going through a difficult time in terms of both policy and investment due to three years of pandemic control and five years of strict ecological protection.One of Zijin’s M&A strategies is to conduct against-trend or countercyclical M&As.Such opportunities can help to reduce cost.Shapinggou Molybdenum Mine is the monomer molybdenum mine with the biggest reserves globally,with planned annual capacity of 27200 tons of molybdenum.Zijin Mining acquired 84% of its equity at the consideration of RMB 5.91 billion in October,2022.Sawaya'erdun Gold Mine is a 100-ton-grade super-large gold mine that remains undeveloped and that is seldom seen in the country,with the gold reserves of 119.5 tons,in which the Company invested RMB 499 million;according to some prospecting,there are still potentials in the prospecting of deep deposit and surrounding area.

According to Wang Jingbin,in 2023,the price of domestic mining assets will gradually recover,and there is very few supply of mining rights in primary market,and mining rights will get more and more valuable in the future.Since the beginning of 2023,Ministry of Natural Resources has changed its tight attitude towards domestic mineral resources like it always did in the past years.According to an article issued on February,10th,a new round of prospecting breakthrough action will be launched in 2023,and strategic mineral resources in short supply will be the focus.Ministry of Natural Resources also established the “office of a new round of prospecting breakthrough action”,which demonstrates the determination to strengthen policy support and mechanism improvement;this is a big decision that our country has made,under the new development pattern of “domestic circulation as the mainstay and dual circulation of domestic and foreign markets”,and after judging the hour and sizing up the situation.

Expanding M&A profits

According to further information from Wang Jingbin,the purchasing behavior of Zijin Mining is not just about high frequency and simple purchasing.He gave the explanation that M&A projects with normal profit are just for the expansion of enterprise scale.Zijin Mining conducts M&As for the purpose of acquiring excess M&A profits.Apart from conducting low-price M%As,Zijin Mining also expands M&A profits through prospecting and increasing reserves,and efficient development and strategic coordination.He gave the example that the Company acquired 50.1% of the equity of Tibet Julong Copper Mine at the rate of RMB 3.883 billion in 2020.This is the biggest copper mine under construction in the country,with total copper reserves of 10720000 tons,and associated molybdenum of 620000 tons.There are a great deal of low-grade copper resources in the mine district of Julong Copper.After the M&A,Zijin Mining has made additional prospecting,and discovered that the reserves of copper metal,associated molybdenum and silver has increased by 100%-200%.According to Wang Jingbin,Zijin will make additional prospecting after business transaction so as to make timely rearrangement for mine development based on updated reserves.“The original resources are already included in the value of assessment,and the newly found reserves are additional profits.”

Zijin Mining did not make swift deployments in new energy metal lithium.The Company did not make its first deployment in lithium resource until 2021.Under this circumstance,Zijin Mining managed to increase project profits through efficient development and fast commissioning.Zijin Mining completed the transaction of Argentina 3Q salt lake in January,2022.The construction was started in March,and the project will be completed and go into operation by the end of this year,which just took two years.Sun Jingwen,Deputy Director of Minmetals Securities Research Institute,ever introduced that it normally takes 24 months for a brand new salt lake project to progress from financing,personnel arrangement,construction completion to going into operation.Plus one year of climbing debugging,normally it takes about three years.According to a responsible person from a leading domestic lithium enterprise that makes arrangement in lithium salt lake project in Argentina,Zijin Mining is faster than ordinary domestic mining companies in terms of developing new projects relying on its rich experience in overseas prospecting.

“Just earn back what we should earn”,summarized by Wang Jingbin.In the meantime,to integrate the area surrounding manufacturing mine,especially the resources within the radius of 15km to 20km surrounding the mine.Scale effect can help to reduce purchasing and managing cost.In terms of Zijin’s thoughts on M&A in the future,according to Wang Jingbin,Zijin Mining puts its priority on gold,copper and lithium projects,and strategic minerals that are always in short supply.In terms of projects,the Company mainly has its eyes on big mature projects,such as big projects in operation or going to be put into operation,and the ones with sufficient cash flow.The Company is also considering acquiring medium-size mining companies,and it is seeking such opportunities these years.In terms of selecting region,Zijin Mining tends to select OBOR countries,or the important countries in global metallogenic zone;the Company also attaches great importance to the countries where it already has established projects,such as Democratic Republic of Congo and Serbia.

The Cost of Lithium Battery System Might Get Lower Than The Cost of Pumped-Storage Energy Around The Year of 2030

AAs lithium ion battery technologies develop and as the cost declines,and with the big possibility that the cost of constructing pumped-storage energy will rise in the future,the life cycle cost of lithium ion battery hopefully might get lower than that of pumped-storage energy around the year of 2030.Huang Bibin,Deputy Director of the New Energy Institute of State Grid Energy Research Institute,made such prediction on March,29th.According to him,so far,life cycle cost of lithium ion battery is RMB 0.5-0.6/kWh,while the cost of pumped-storage energy is about RMB 0.21-0.25/kWh.In short term and medium term,new energy storage modes are not that satisfactory in economic strengths,and we still need to overall develop pumped-storage energy,conduct thermal power flexibility transformation and demand response to flexibly regulate resources,so as to realize effective supplementation.However,initial investment cost of pumped-storage energy power station is closely related to site selection,which will hamper the cost-effectiveness of site selection of new projects in the future,and might increase the initial investment cost as well as the cost of new pumped-storage energy projects;in the long run,as technologies develop and as the cost declines,by 2030,the life cycle cost of lithium ion battery hopefully might get lower than that of pumped-storage energy.Late-model energy storage modes will play an important role in power system regulation.

Late-model energy storage modes include electrochemical energy storage,compressed air energy storage,liquid flow battery and sodium ion battery and so on.Among them,electrochemical energy storage,i.e.lithium ion battery is playing the leading role.Under the guidance of “carbon neutrality,carbon peak”,China’s power system is under the transformation to a new power system that deems new energy as the leading role,and energy storage is an important part in flexibly regulating power.So far,the most commonly seen energy storage technology is pumped-storage energy,which works in the way of converting energy between electric energy and potential energy of water.Energy storage capacity depends on the height difference between the upper and lower reservoirs and reservoir capacity.This is the most sophisticated and the most large-scale energy storage technology currently.Late-model energy storage technologies are developing very fast,but the scale is yet to be expanded.

According to an announcement released by Zhongguancun Energy Storage Industry Technology Alliance in January this year,as of the end of 2022,cumulative installed capacity of electric energy storage projects put into operation in China had reached 59.4GW,a YOY increase of 37%,among which,the proportion of cumulative installed capacity of pumped-storage energy was 46.1GW,accounting for 77.6%;the proportion of cumulative installed capacity of late-model energy storage was 12GW,accounting for 20.2%.Driven by technology development and cost reduction and other factors,late-model energy storage modes are developing fast,especially electrochemical energy storage that is represented by lithium ion battery.This kind of energy storage has been commercialized.As of the end of 2022,the installed capacity of late-model energy storage projects that were put into operation nationwide had reached 8700000 KW,and the average energy storage duration was about 2.1 hours,and the proportion of lithium ion battery energy storage was 94.5%.Thermal Power Generation is an important journal in thermal power discipline and energy power technology in China.The Journal published one article in August,2021,which indicates that life cycle levelized cost of electricity of energy storage of lithium iron phosphate battery is significantly higher than that of pumped-storage energy and compressed air energy storage,mainly due to the reason of higher initial investment of battery energy storage,and the fact that all batteries need to be renewed for at least once within life cycle of power station because of the restriction of battery cycle life,and this leads to an increase in replacing cost.Equipment cost needs to be further reduced for the energy storage of lithium iron phosphate battery,and battery cycle life needs to be further prolonged so that its competitiveness can be well enhanced.

As a component that occupies the biggest proportion in lithium ion battery cost,the price of lithium carbonate,a raw material,started to fall in mid-November,2022.The quotation was RMB 257000/ton as of March,29th,a YOY decrease of 45%.According to statistics,with the recovery of lithium price,overall speaking,the quotation of energy storage projects in January and February presented a MOM decrease,and 2-hour weighted average quotation of energy storage system respectively decreased by 9.82% and 2.18%.According to Huang Bibin,late-model energy storage technologies will grow into the trend of being diversified in the future.However,as the technologies of battery manufacturing,system integration and safeguarding get more developed,lithium ion battery energy storage will still remain the prevailing technical route;high-capacity and long-period energy storage technologies such as late-model compressed air and flow battery are under pilot demonstration.The two kinds of battery technologies will occupy bigger proportion in the future.

According to the statistics of State Grid Energy Research Institute,there are robust demands for late-model energy storage in peak shaving and peak in the medium run and short run.According to the given planning boundary,based on the actual utilization rate of 70%,installation demands for late-model energy storage in 2025 and 2030 will reach 50GW and 120GW,mainly distributed in Central China,Northwest China and North China.By 2030,late-model energy storage will get marketized development,and will be traded in electricity spot market and auxiliary service market;in terms of technical economy,the cost of electrochemical energy storage is the same level as that of pumped-storage energy,and flow battery and compressed air energy storage have been commercialized,and thermal storage and hydrogen energy storage have been put into pilot demonstration.

A significant problem that might hinder the development of late-model energy storage is blurry business mode.Currently,late-model energy storage is getting development in electricity market trading,new energy distribution and storage,peak shaving and valley filling,capacity sharing,and effective asset recovery of power grid.However,generally speaking,the profit is relatively low and there are uncertainties in profit making.

Li Peng,Deputy Director of Strategic Planning Department of State Power Investment Corporation,ever expressed his concerns that although energy storage project financing is a hot topic right now,power battery still is the first driving force for it.As for the utilization of energy storage in power system,the situation will grow into a confusion of trivialities if business model does not work in the end.“The energy storage technology suitable for power system is yet to be further developed;electrochemical energy storage is yet to be further improved in its performance as for the pain spot of frequency modulation and long life cycle;there still exists the problem of safety.” He states outright that it is inappropriate for us to become over-optimistic and spend excessive efforts in latemodel energy storage,for this will probably result in a big increase in power system cost and push up energy using cost in the society.This is contrary to the purpose of us developing new energy in the first place.

Huang Bibin gave the suggestion on the meeting:at the macro-level,to promote the coordinated development of power supply and power grid,new energy and energy storage,pumped-storage energy and late-model energy storage,and demand response and other adjustable resources in an integrated way;based on comprehensively evaluating cost investment and value of action,to scientifically formulate energy storage construction implementation scheme,reasonably identify scale deployment and construction time sequence,and avoid great increase in electricity using cost under the premise of securing power supply;to promote the development mode of “new energy+energy storage” so as to improve new energy utilization rate.Additionally,based on system regulation and actual needs of power grid construction and transformation,to identify grid-side energy storage development demands and incorporate it into local energy and electricity planning for coordinated implementation;to accelerate the formulation of implementation rules and incorporate gridside alternative energy storage into scope of transmission and distribution electricity price evaluation;to further widen peak-valley price difference to promote user-side energy storage development.

The 6th Largest Domestic Anode Material Manufacturer Partially Going Into Shutdown Due To Market Oversupply

As the growth in sales of NEV in domestic market started to mitigate,the sequelae of excess production expansion in domestic lithium battery industry in the past two years started to manifest itself.The 6th domestic largest domestic anode material manufacturer announced its partially going into shutdown due to the pressure of excess production capacity.Anode material manufacturer,Shangtai Tech made an announcement on March,27th,its production base in Shijiazhuang started to stop production gradually on March,28th.The Company has properly arranged and diverted employees,and has transformed and disposed related equipment.The Company will consider whether or not to resume operation according to market situation.

Anode materials are one of the major four components of power battery,and are playing the role of storing and releasing energy in batteries.Shangtai Tech was established in 2008.It was engaged in graphitization processing of anode materials in the first place,and transformed itself to manufacturing anode material R&D and production in 2017.Shipment of anode materials in 2022 was 107000 tons,and the net profit attributable to the parent company that year was likely to be RMB 1.28 billion to RMB 1.34 billion,a YOY increase of 135.2%—147.3%.The Company’s customers are leading domestic power battery enterprises,such as CATL,Gotion High-tech,SVOLT,SUNWODA,Envision AESC and REPT.According to the data from a research institute,EV Tank,in 2022,shipment of anode materials of Shangtai Tech ranked the 6th place in 2022.

Shangtai Tech explained that,since the year of 2023,the growth in sales of NEV has been slowing down.Power battery market is impacted by destocking,and lithium battery customers are not proactive in production scheduling,which leads to a slowdown and even sluggishness of in the growth of anode material market demands;on the contrary,after years of production expansion of supply end,anode material manufacturers are entering the phase of capacity release.Effective capacity,with graphitization procedure as the core,has greatly been raised in the industry.Supply and demand of the whole anode material industry has been reversed,and the industry is facing the problem of overcapacity.Under the circumstance of unsatisfactory growth in demand and excess growth in supply,cost reducing and efficiency increasing is a key measure for the Company to respond to fierce market competition.According to Shangtai Tech,the aforesaid shutdown base accounted for 5.7% of total corporate capacity,rather a small proportion;under the circumstance of having not achieved full production and full sales,the cease of the base will help to mitigate inventory pressure for the Company,reduce expenditure and improve benefit.The capacity in production and current inventory of Shangtai Tech are able to meet the demands from customers,and the shutdown mentioned above will not impact normal sales and operation.

According to EV Tank,in 2022,a great deal of production capacity of graphitization and anode materials was constructed in Guizhou,Yunnan,Sichuan and Inner Mongolia.Gradual release of the under-construction capacity will help to shape the market pattern of the supply exceeding the demand.Some provinces and cities are using the measure of dual control of energy control to cease the examination and approval of graphitization and anode material projects,so as to contain fast unordered expansion of the industry.

As the growth in sales of NEV started to mitigate,the sequelae of excess production expansion in lithium battery industry started to manifest itself.Low utilization of capacity and high inventory in power battery companies in the middle stream of the industry chain have influenced raw material purchasing and processing of upstream of the industry.According to the data from China Automotive Power Battery Industry Innovation Alliance,in Q1 of 2022,current period inventory of the industry declined to less than 65%,and then soared to 132.7%,helping to shape a pattern of demand exceeding supply.In Q3,full production and full sales,but the rate declined to 56.4% in Q4.Specifically speaking,the production of batteries in Q4 presented a MOM slight increase of 4.8%while the sales presented a MOM decrease of 40%.According to the statistics from Rystad,a research institute,in the year when domestic power battery inventory was about 183GWh,current period inventory increased by nearly 200%,equivalent to 62% of 295GWh of annual battery loading capacity.

Apart from the big increase in inventory of power battery,crazy production expansion in all sectors of lithium battery industry chain and stocking up behavior (that leads to the big rise in raw material price) also resulted in the outcome that enterprises have to face the problem of overstock unconsumed raw materials.In addition,lithium price keeps falling.Enterprises have to slow down the pace of purchasing,and there are few purchasing orders in industry chain.The price of lithium carbonate,a key raw material in battery whose price had been soaring in the past two years,has been reducing by nearly 50% since 2023.Its quotation on March,28th was RMB 263000/ton,down by 47.7%,back to the level at the end of 2021.

Enterprises in the industry chain are taking various measures to reduce cost and improve efficiency.On March,16th,the 5th largest domestic power battery manufacturer,EVE,launched a scheme of “personnel efficiency improving”,which is to improve personnel efficiency by 32% based on the base number of 16000 employees.“The phenomenon of overcapacity is rather obvious this year.Lithium battery is the kind of overcapacity of customized production instead of homogenization.”According to an institutional shareholder from a second-tier lithium battery manufacturer,in 2023,the production situation of enterprises in lithium battery industry chain will depend on the binding downstream customers,and especially will be influenced by the sales of NEV.

Net Profit of Two Lithium Giants Soared in 2022 Will Extend to Downstream For New Business In The Future

In 2022,lithium industry achieved the highest level of prosperity,when the two domestic lithium giants,Tianqi Lithium and Ganfeng Lithium hit a new record in net profit making.With the fast decline in lithium price this year,the two companies are planning for downstream business and seeking new development potential.

Tianqi Lithium released its financial report on March,30th,which demonstrates that the Company realized operating income of RMB 40.45 billion in 2022,a YOY increase of 427.8%;net profit attributable to the parent company was RMB 24.12 billion,a YOY increase of over 10 times,a new record.

Ganfeng Lithium released its financial report on March,29th,which demonstrates that the Company realized operating income of RMB 41.82 billion in 2022,a YOY increase of 274.7%;net profit attributable to the parent company was RMB 20.5 billion,a YOY increase of 292.2%,also a new record.

For the easy multiplied growth,the two companies explained that the big increase in both sales and price are the driving force for the astonishing progress.In 2022,lithium ore smelting products sold by Tianqi Lithium was 768000 tons,a YOY increase of 40%;the sold lithium salt 58000 tons,a YOY increase of 20%.In the same period,the lithium salt sold by Ganfeng Lithium was 97400 tons,a YOY increase of 7.3%;186 million lithium batteries were sold,a YOY increase of 50%.Additionally,Tianqi Lithium acquired RMB 5.64 billion as the income on the investment as the Company holds 22.16% equity of SQM,a Chili lithium giant.

2022 is the year when lithium price reached the highest in history.Based on the data from ICCSINO,domestic price of lithium carbonate rose from RMB 270000-280000/ton at the end of 2021 to the highest RMB 600000-620000/ton in 2022.Although the price fell a bit in mid-November,the average price the whole year was still RMB 490000/ton,a YOY increase of 400%.Relying on the prosperity of the market,Tianqi Lithium entered Hongkong Stock Market in July,2022,and realized financing of HKD 13.055 billion,becoming the IPO with the second biggest financing amount in HK Stock Exchange.Tianqi also succeeded in paying off the loan that was borrowed in 2018 to acquire SQM.The Company’s asset liability ratio at the end of 2022 decreased by 34 percent points to 25.1%,back to the average level in the industry.

Currently,Tianqi Lithium has customers like CALB,Dynanonic,Korea SK Innovation,LG Chem,and Northvolt,a local European battery company.Ganfeng Lithium also entered into longterm supply contract or agreement with LG Chem,Tesla,BMW and other core customers.Tianqi Lithium managed to achieve higher gross profit margin relying on high-proportion self-owned ore.Gross profit margin of lithium chemical products that year reached 85.85%,a YOY increase of over 20 percent points.According to the explanation of Tianqi Lithium,its subsidiary,Australia Tailison Lithium,is the biggest lithium ore producer in the world.Its lithium concentrate production in 2022 accounted for 35% of total yield globally;the Company adopts vertical integrated business model,i.e.applying the raw material it produces to its mid-stream chemical product processing,which realizes 100% self-sufficiency.“Cost advantages are getting more prominent in today’s market environment.”

Ganfeng Lithium gets part of its supply of lithium concentrate from the underwriting agreement signed between the Company and overseas mining projects.In 2022,underwriting transaction volume accounted for 60% of total purchasing amount,and the average purchasing cost in the first half of year was RMB 352000/ton,and that in the second half of year was RMB 587000/ton.This kind of model compresses the growth in gross profit of Ganfeng Lithium.Gross profit rate of lithium products that year was 56.1%,a YOY increase of 8 percent points.

The demands for downstream NEV market slows down and supply and demand relationship varies swiftly.Lithium price has been decreasing since the end of 2022.As of March,31st,domestic lithium carbonate price was RMB 238000/ton,down by 53% since the beginning of the year,and back to the level at the end of 2021.The slowdown of growth in NEV penetration rate will lead to a slowdown of growth in demands for downstream lithium.It is estimated that in 2023,2024 and 2025,lithium demand and supply will present a lithium oversupply of 18000 tons,185300 tons and 179500 tons.

How to face new industry situation? The two companies expressed that firstly,they will continue to make further deployments in lithium resource to ensure stable resource self-sufficiency ability;secondly,they will develop downstream battery technologies,battery recycling and energy storage to explore new achievements.

Tianqi Lithium owns lithium salt annual capacity of 68800 tons currently;its planned annual capacity exceeds 110000 tons,and strategic planned annual capacity by 2027 is 300000 tons,4 times more than current capacity.Ganfeng Lithium owns domestic lithium salt capacity of about 120000-ton LCE(lithium carbonate equivalent),and it plans to reach annual capacity of no less than 600000-ton LCE by or before 2030,5 times more than current capacity.In the meantime,in the Five-Year plan released the same day by Tianqi Lithium,the Company will make further strategic deployments in new energy material in new energy value chain and next generation battery technology manufacturers including solid-state battery.The Company will also carry out more consolidated cooperation with them in the fields of precursor production and battery recycling and so on.Tianqi Lithium will continue to focus on investment opportunities in electric vehicle and energy storage field,and actively make deployments in downstream market.

Ganfeng Lithium has already been developing lithium battery business.Its subsidiary,Ganfeng Lithium Battery is making intensified efforts in solid-state battery,and shipment of its power and energy storage battery was 6 GWh in 2022.The Company is expanding its capacity.Chongqing Ganfeng has kicked off the 20GWh late-model lithium battery technology industry park,and the Company is making efforts to build it into the biggest solid-state battery production base in China.Phase two of the late-model lithium battery project in Xinyu of Jiangxi,with the annual capacity of 10GWh,is planned to be expanded.It is estimated that the highest capacity this year will reach 12GWh.Ganfeng Lithium Battery is planning for spin-off and listing.

Refined Copper Production by Province or City in 2023 Unit: metric ton

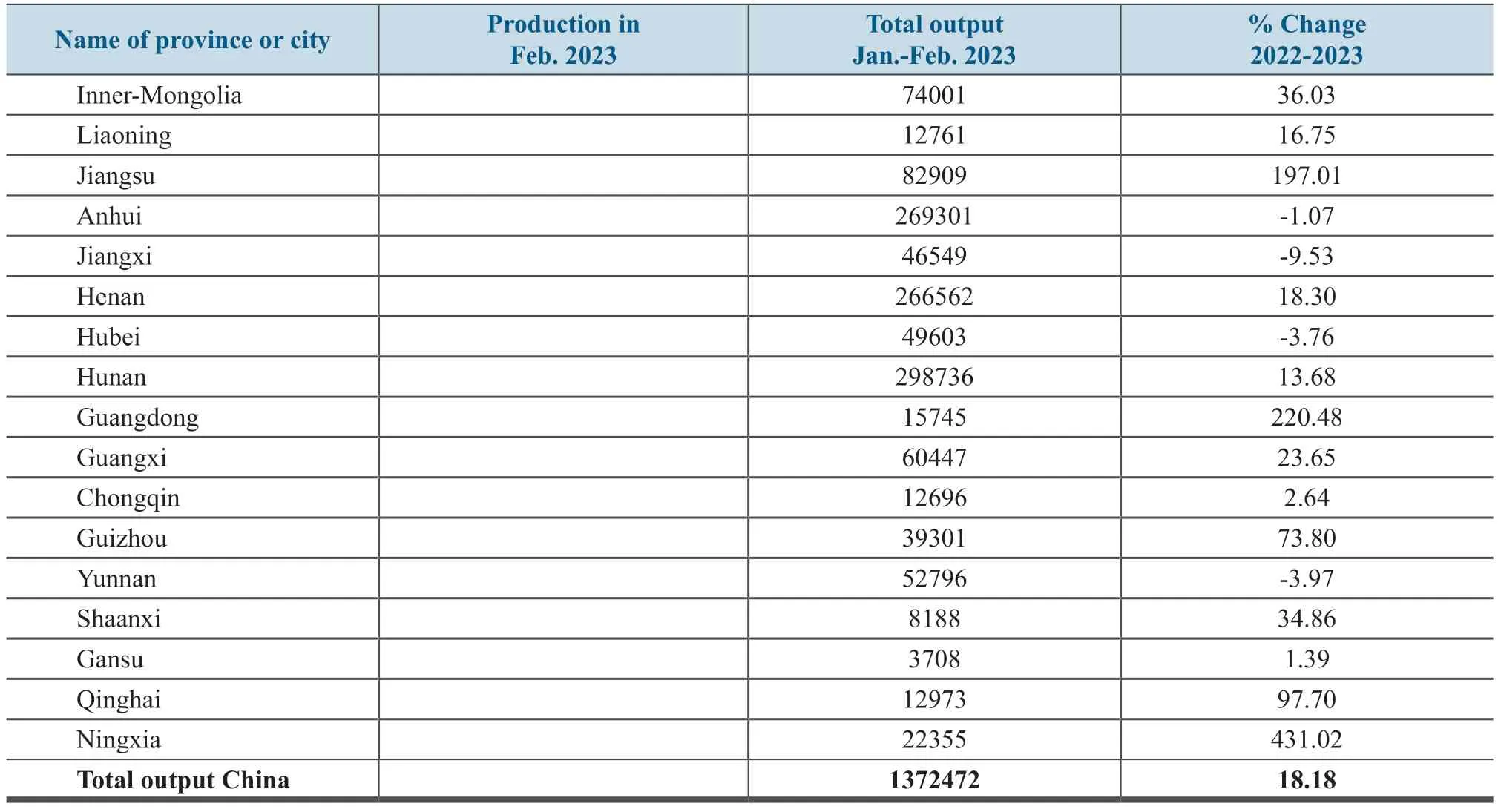

Aluminium Production by Province or City in 2023 Unit: metric ton

Production of the Ten Major Nonferrous Metals in 2023Unit: metric ton

Fabricated Copper Production by Province or City in 2023 Unit: metric ton

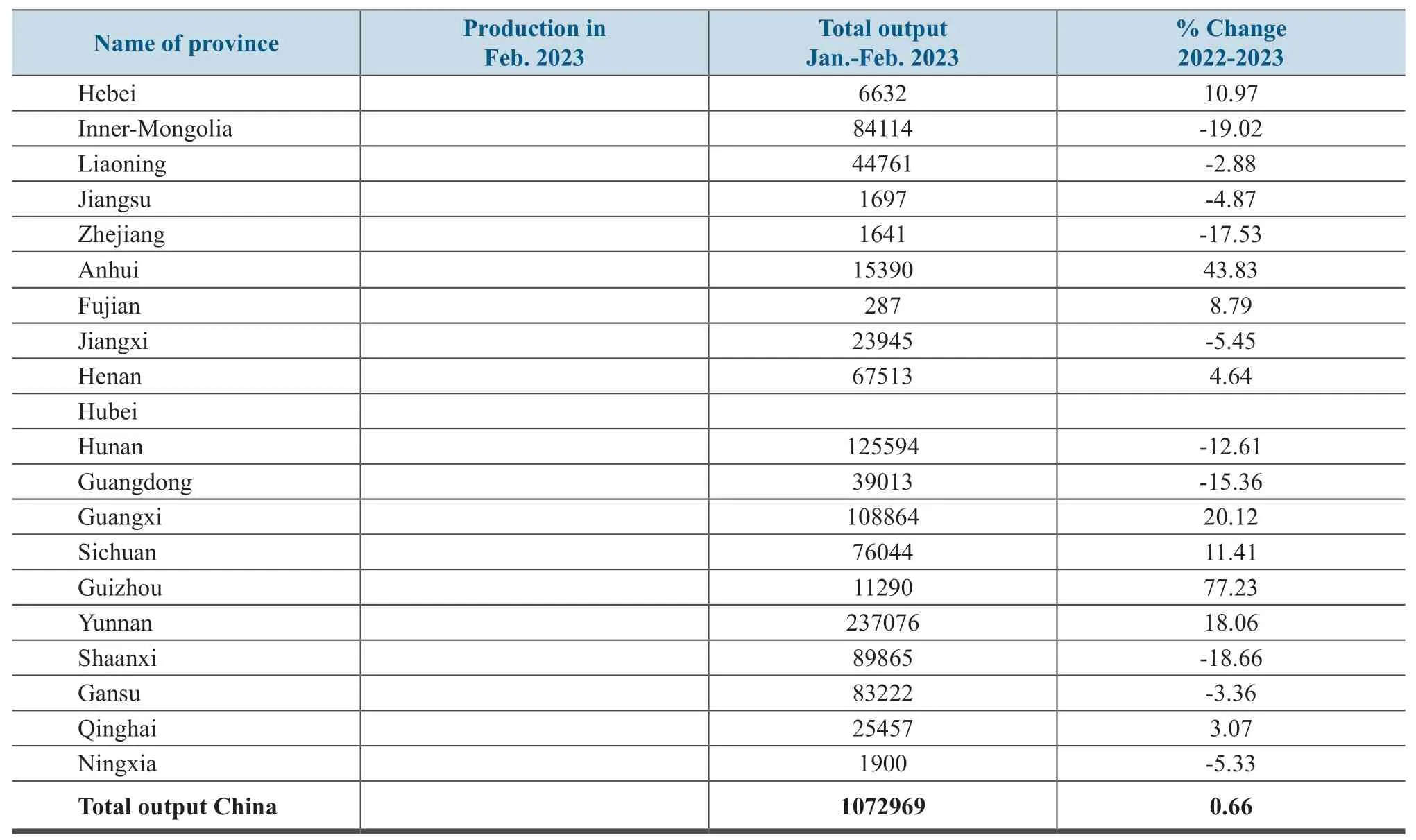

Lead Production by Province or City in 2023Unit:metricton

Key Financial Indicators of Non-ferrous Companies Above Designated Size January– November 2022

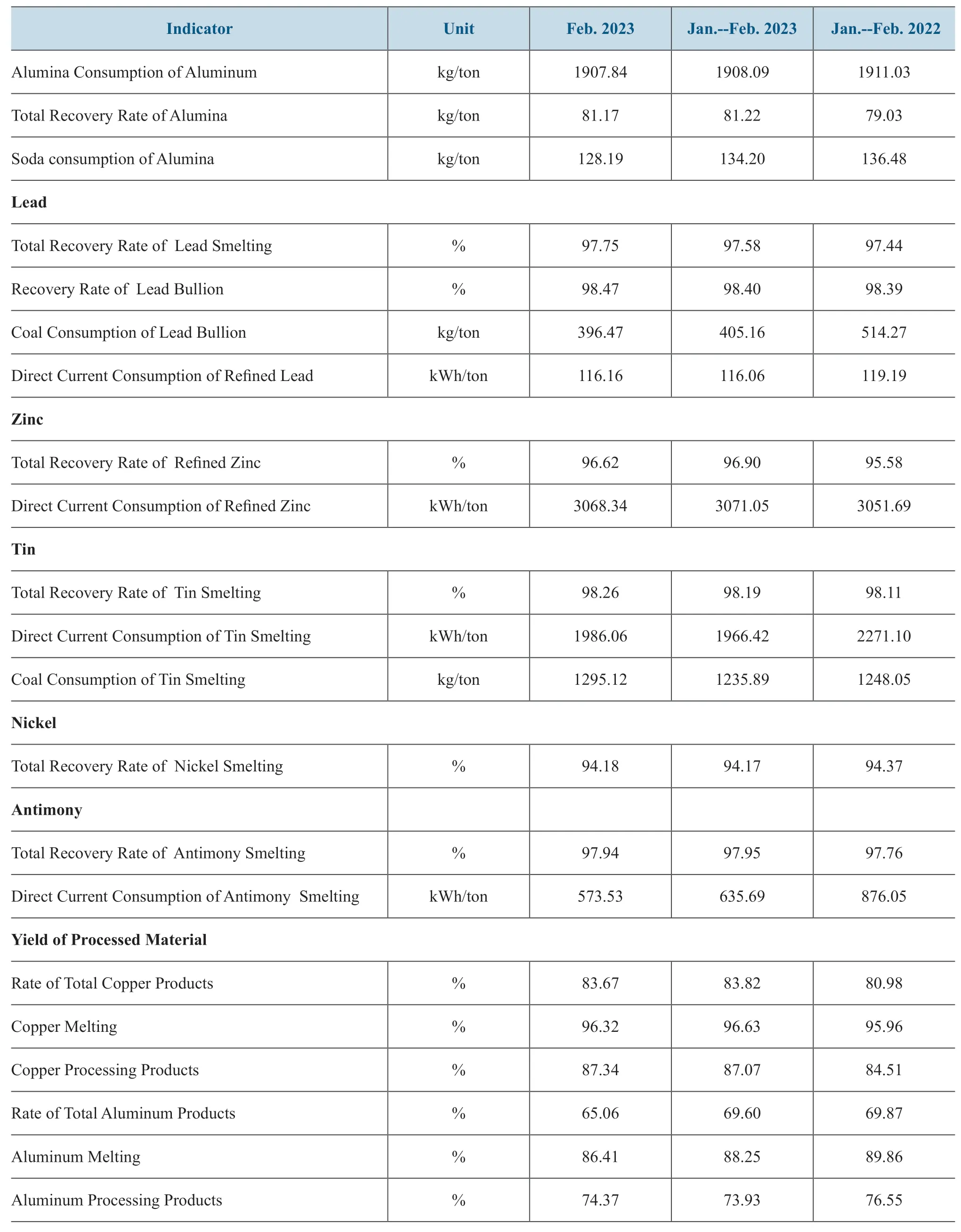

Technical and Economic Indicators of Major Enterprise

Continued from the previous page

Alumina Production by Province in 2023Unit: metric ton

Yield of Ten Major Types of Nonferrous Metals By Region

Zinc Production by Province in 2023