Environmental and Economic Evaluation of Dual-Fuel Engine Investment of a Container Ship

Çağlar Karatuğ, Emir Ejder, Mina Tadros and Yasin Arslanoğlu

Abstract In this study, environmental and economic examinations of Liquefied Natural Gas (LNG) investments are conducted.A year-long noon report data is received from a container ship and LNG conversion is performed.Savings from both the fuel expenses and the amount of the emissions are calculated and presented.To eliminate the fuel consumption uncertainties in future operation periods of the stated ship, different scenarios that simulate various fuel consumption statuses are created and analyzed within the Monte Carlo Simulation method.Lastly, calculations are made with two different time prices, approx.one and half year apart.As a result of the analyses, LNG can provide high environmental benefits since it reduces 99% for SOx, 95% for PM10, 95% for PM2.5, 41% for CO2, and 82% for NOx, respectively.It is also determined that LNG investment is highly sensitive to fuel prices.In addition, the LNG usage can be beneficial for maritime companies in terms of marine policies such as paying carbon tax based on the expanding European Union Emission Trade System to maritime business.Still, it needs supportive carbon reduction method to comply with the maritime decarbonization strategy.This study has great importance in that the economic analysis way presented is able to adapt any alternative fuel system conversion for the maritime industry.

Keywords Dual-fuel engine; Monte Carlo simulation; Emission reduction; Maritime transportation; Economic analysis; Environmental analysis

1 Introduction

Maritime transportation is the backbone of international trade as it ensures the carriage of the vast majority of cargo around the world.The annual average growth of the world merchant fleet is 4.6% from 2008 to 2018 and includes around 117,000 ships (EMSA, 2019).On the other hand, it causes a considerable amount of air pollution and climate change due to the huge transportation volume (Ceylan et al., 2023).According to the last greenhouse gas (GHG)study conducted by International Maritime Organization(IMO), GHG emissions emitted into the atmosphere by ships increased by 9.6% from 2012 to 2018.In global anthropogenic emissions, maritime transportation shared with 2.89% in 2018 (IMO, 2020).

Accordingly, IMO gets enforced the International Con‐vention for the Prevention of Pollution from Ships (MAR‐POL) Annex-VI to decrease the released amount of GHG and, thus, increase the energy efficiency level of marine vessels.Besides, IMO released the Initial IMO Strategy that aims to reduce carbon intensity by 70% and total an‐nual GHG emission by 50% by 2050, compared to 2008,towards the decarbonization pathway of shipping, in 2018(IMO, 2018).To reduce the level of emissions from the fleet, maritime companies are forced to use low-sulphured fuels such as marine diesel oil (MDO), marine gas oil(MGO), low sulphur heavy fuel oil (LSHFO), or adaptation of exhaust gas after-treatment systems onboard such as exhaust gas cleaning system (EGCS) and selective catalytic reduction (SCR) (Fan et al., 2021).In addition, some energy efficiency-enhancing technical and operational methods such as power limitation (Kanberoğlu et al., 2023), engine performance optimization (Tadros et al., 2020), waste heat recovery (Campora et al., 2023), and alternative energy sources (Karatuğ and Durmuşoğlu, 2020) are investigated by researchers to meet the required level of Energy Effi‐ciency Design Index (EEDI), based on the Ship Energy Ef‐ficiency Management Plan (SEEMP) to reduce the fuel con‐sumption and control CO2emissions (Karatug et al., 2022;Sherbaz and Duan, 2012; Tadros et al., 2023).However,although current technical and operational approaches are insufficient to realize the Initial IMO Strategy (Ce Delft and UMAS, 2019), alternative marine fuels are the most promising solutions in this respect, especially in the short and mid-term decarbonization pathway (Brynolf et al.,2014; Karatuğ et al., 2023).

Among the alternative fuel types, Liquefied Natural Gas (LNG) recently has intense attention (Bruzzone and Sciomachen, 2023; Pagonis et al., 2016) since it has the advantages such as reducing sudden failures and mainte‐nance costs due to the high purity of the fuel (Jafarzadeh et al., 2017) and causing less fuel consumption due to its higher calorific value (Kim and Seo, 2019).In addition to its environmental and economic benefits, it is considered the most promising fuel that could meet the Tier-III regula‐tion for the maritime industry via its production and sup‐ply being made easier with advanced technology (Jeong et al., 2019).It is examined for different types of marine ves‐sels such as Very Large Crude Carrier (VLCC) (Huang et al., 2022), tugboats (Lebedevas et al., 2021), and fishing trawlers (Koričan et al., 2022).Iannaccone et al.(2020)compared the usage of LNG and diesel fuel on ships in terms of environmental, economic, and safety.With the use of the LNG system, 41% reduction in exhaust emissions and 31% savings in costs have been achieved through the 62% higher system safety index.

In terms of comparison of different emission reduction op‐tions, Ammar and Seddiek (2017) compared four emission reduction strategies on a Ro-Ro ship cruising in the Red Sea and stated that LNG conversion is the most suitable ap‐proach for environmental and economic reasons.Sharafian et al.(2019) compared the environmental effect of HFO and LNG using with life cycle assessment method.In the sense of compliance with the IMO Tier III regulation, it is pro‐posed that exhaust after-treatment strategies could be neces‐sary to consider medium or high-speed dual-fuel engines due to higher methane slip.Li et al.(2020) realized a study to specify the decision of shipping companies on compli‐ance with IMO 2020 regulations and found that both LNG implementation and scrubber installation are the most pre‐ferred options for the ships with a longer remaining life.

In sense of system implementation on board, Livanos et al.(2014) conducted a techno-economic analysis in 4 dif‐ferent scenarios for the propulsion system of a Ro-Ro ship.It is determined that the case that combine dual-fuel main engines, dual-fuel generators, and an installed waste heat recovery system, has higher energy efficiency, lower EEDI, and lower annual operating costs.Kana and Harri‐son (2017) analyzed the LNG conversion investment with uncertainties, such as economic parameters, regulatory sce‐narios, and supply chain risks, of a containership using the Monte Carlo simulation and revealed the impact of each uncertainty on the decision-makers.Eise Fokkema et al.(2017) proposed a novel LNG system investment evalua‐tion approach to marine vessels by simulating parameters such as stochastic fuel prices, Emission Control Areas(ECAs), and navigational routes.Xu and Yang (2020) ana‐lyzed the environmental impact of the LNG-fueled con‐tainer ships that navigated in the Arctic Sea and devel‐oped a model to determine economic benefits.Burel et al.(2013) examined the economic and environmental LNG usage on marine vessels by analysing the traffic data of the world fleet.They presented that 35% of OPEX and 25% of CO2emissions could be decreased through LNG utilization on a big-size tanker ship.Li et al.(2015) im‐proved a dual-fuel engine control system.They revealed its effect on some parameters such as braked-specific fuel consumption (BSFC), released emissions, and cost under various engine loads.

From the point of policy, Schinas and Butler (2016)discussed some issues, such as international regulatory structures, uncertainties of the LNG adaptation of a marine vessel, and the possible position of LNG-fueled ships between the existing world fleet, and recommended a methodology for the promotion of the adoption of LNG as an alternative marine fuel.Balcombe et al.(2021) evaluated the status of LNG-fueled vessels to meet the decarboniza‐tion target of the maritime industry.In addition to reducing different types of pollutants, they pay attention to possible methane emissions and state that the use of LNG should be supported with other efficiency-enhancing methods in line with the aim of decarbonization procedures.Sharma et al.(2020) revealed the possible benefits of the use of LNG as a marine fuel and examined some technical limita‐tions regarding the risk of the creation of sulphuric acid and corrosion for contribution to overall thermal efficiency.

In terms of simulation, Altosole et al.(2019) developed a model for increasing the energy efficiency of an LNG-fu‐eled marine vessel by gaining energy from the exhaust gas with a waste heat recovery system.Theotokatos et al.(2020)recommended some potential safety circumstances for the switching operations of the dual-fuel engine based on the analysis conducted on a simulation model.Wan et al.(2019)proposed a novel policy model that includes strategy, regula‐tion, economics, technology, and infrastructure for the devel‐opment of LNG-fueled ships in some regions of the world.

In the case of compliance with the emission regulations enforced by the IMO, investment costs, as well as the envi‐ronmental benefits of the LNG utilization on the ships,should be considered by the maritime companies.Even though environmental and operational cost impacts have been mostly evaluated, the LNG implementation requires a significant amount of installation costs.This study aimed to examine how sensible it is to install LNG on ships using Monte Carlo Simulation, an effective approach for evaluat‐ing an investment.To realize analysis, the fuel oil con‐sumption data have been obtained from a container ves‐sel’s noon reports among a year.Considering the change‐ability of the amount of fuel consumption, three scenarios are created for the future operation time of the vessel; 15%less fuel consumption, base condition, and 15% more fuel consumption.Simulations have been carried out in two sta‐tuses of the LNG installation: (i) considering just fuel cost saving of investment for economic benefit, (ii) considering both environmental financial and fuel cost savings for eco‐nomic benefit.The annual cash flow values are determined according to the stated case studies.The net present value(NPV) of each scenario has been calculated with various interest rates.The calculations are carried out with two dif‐ferent time prices, almost a year and a half year apart.As a result of the analyses, the significant indicators of the LNG conversion have been observed and presented.

In the paper, a case study for just LNG systems is car‐ried out, and the main contribution of the analysis is pro‐viding an influential economic evaluation method that could be used for each kind of alternative fuel option con‐sidered for onboard application.Compared to strategies proposed in the relevant literature, the economic approach demonstrated regarding alternative fuel utilization onboard provides performing feasibility analysis in a more realistic way considering a diverse range of fuel consumption based on past operation data.Hence, it is a highly effec‐tive, practical, and replicable strategy for maritime compa‐nies.The study’s novelty is to carry out economic analyses within various fuel consumption scenarios by effectively handling the uncertainties throughout the Monte Carlo Simulation approach.The methodology may also enable future forecasts by managing uncertainties within a large range of fuel consumption scenarios, effectively.Thus, it enables to improve the effectiveness of companies’ deci‐sions related to system installation.

The rest of the paper is organized as follows: LNG sys‐tems for marine vessels are introduced in Section 2.The materials and methodology of the paper are presented in Section 3.The various scenarios under two different case studies are conducted in Section 4.The results of the anal‐yses are presented and discussed in Section 5.A sensitivity analysis to reveal the impact of fuel price on LNG system application is performed in Section 6.In Section 7, the findings as a result of case study and sensitivity analysis are discussed.Finally, conclusions are given in Section 8.

2 Liquefied natural gas systems for ships

It is a reasonable solution to consider LNG as an alterna‐tive marine fuel in ships due to its global abundance, its ability to provide NOXTier III limitation without the need for exhaust gas after-treatment, to reduce CO2emissions and to be relatively cheaper than ultra-low sulphured fuel(Lin et al., 2014; Sharafian et al., 2019).It requires insulat‐ed vacuumed tanks for storage that ensures −163 ℃ and 1.7 bars, and the liquefaction process for the storage of LNG provides an advantage for the small-sized ship(Brynolf et al., 2014).

There are four types of LNG-fueled engines: mediumspeed 4-stroke lean burn spark ignition (LBSI), medium speed 4-stroke low-pressure dual-fuel (MS-LPDF), lowspeed 2-stroke low-pressure dual-fuel (LS-LPDF), and lowspeed 2-stroke high-pressure dual-fuel (LS-HPDF).LBSI engines operate between 316 kW and 9 700 kW through an efficiency level of 42% according to the Otto Cycle with only natural gas.Likewise, LBSI, MS-LPDF engine operates based on the Otto Cycle, and its efficiency can reach 44%.Compared to same-sized diesel engines, the compression ratio requirement of MS-LPDF engines is smaller (Stenersen and Thonstad, 2017).The efficiency of the LS-LPDF engines is approximately 51%, and they oper‐ate between 4.5 MW and 65 MW.In the case of the in-gas mode, gas injection is realized before the engine’s compres‐sion stroke (Sharafian et al., 2019).LS-HPDF engines are manufactured by the MAN, and their power production capacity can reach 42.7 MW (Milner, 2014).

Unlike the other types of engines, LS-HPDF engines work according to Diesel Cycle.In addition, compared to LS-HPDF engines, LS-LPDF has a simpler design, enables lowering PM emissions and requiring lower investment and maintenance costs.Nevertheless, lower fuel con‐sumption and methane emission are obtained via the use of LS-HPDF engines, while exhaust gas treatment for NOx is required to comply with IMO Tier III (Giernalc‐zyk, 2019).While the utilization of these types of engines on marine vessels gradually becomes widespread in the process of compliance with emission regulations, it is among the issues that need to be dealt with intensively by the engine manufacturers in studies on improving the qual‐ity of the combustion and preventing the release of unde‐sired emissions.General specifications of the LNG fuel are presented in Table 1.

3 Materials and methodology

3.1 Monte Carlo simulation

Monte Carlo Simulation is a model that estimates possi‐ble results of decisions with random numbers and allows realizing better solutions by evaluating the impact of risk factors.Monte Carlo Simulation is a statistical method where the statistical distribution of each decision by aprobabilistic approach is realized.It is the most sufficient,reliable, and widely used method for addressing uncertain‐ty (Ejder and Arslanoğlu, 2022; Salem, 2016).The simula‐tion is used in various fields, such as submarines (Kakaie et al., 2023), uncertainty estimation (Bhardwaj et al.,2023), and fire risk assessment (Zhang et al., 2022).In this study, the uncertainties of the LNG system investment in marine vessels such as discount rate, and fuel oil consump‐tion have been addressed during environmental and eco‐nomic evaluation using the Monte Carlo Simulation.Thus,the effectiveness of the possible investment has been pre‐sented in a probabilistic way.

Table 1 Specifications of LNG Fuel (Deniz and Zincir, 2016)

3.2 Emission factors

There are two common methods in the maritime sector to develop ship emission inventory: bottom-up and top-down.The bottom-up approach calculates ship-based released emissions based on the ship’s dynamic and static activity data.STEEM model had been proposed to determine emis‐sion inventory using this method (Wang et al., 2007), and Automatic Identification System (AIS) data is generally used to obtain ship's activity information (Huang et al.,2018; Jalkanen et al., 2009).On the other hand, the topdown approach could be based on both fuel and trade load.While total emission inventory is determined according to total consumed fuel and emission factors in fuel-based, it is calculated via the type and capacity of the cargo in tradebased.The fuel-based calculation provides more accurate emission inventory results from a global perspective,while the trade-based approach is more effective in region‐al emission estimation (Wang et al., 2007).

The fuel-based top-down approach is used to determine the emission inventory of the ship.During the emission es‐timation, data from ship noon reports, such as fuel type,time travelled during a manoeuvre, anchorage, and port time, have been considered.The amount of the ship-based emission is estimated according to Eq.1 (Trozzi, 2010).

whereEtripis the amount of emission over a complete trip(tonnes), FC is the fuel consumption (tonnes), EF is the emission factors (kg/t),iis a type of emission (NOx,SOx, CO2, PM),jis the engine type (slow speed, medium speed, high speed),mis the fuel type (VLSFO, HFO,MGO/MDO) andpis the different situation of the trip(cruise, berth, manoeuvring).

Emission factors according to the engine and pollutant type are presented in Table 2.

Table 2 The emission factors (IMO, 2020)

Different from the other pollutants, methane emission is calculated from the g/kWh approach based on average kW values.In the case of the determination of the emission inventory based on the very low sulphur fuel oil (VLSFO)usage, the contents of MGO and HFO have been consid‐ered 80% and 20%, respectively (Pavlenko et al., 2020).

3.3 Environmental benefits of different types of fuels

Welfare loss occurs for maritime companies since some emission gases are emitted into the atmosphere as a result of the shipping made.It is possible to minimize this loss by installing emission abatement methods on ships.The loss of welfare as currency per kilogram of the pollutant could be calculated by the marginal environmental exter‐nal costs.In the case of the comparison of the emission re‐duction of various approaches, the environmental benefits of each strategy could be revealed.The annual environ‐mental benefits of the use of VLSFO and LNG are calcu‐lated with Eq.2 (Jiang et al., 2014).

The marginal environmental costs of each type of pollut‐ant per kilogram are presented in Table 3.

3.4 Methodology

This study aimed to demonstrate the reasonability of analternative fuel system investment to be made on ships by approaching it from an environmental and economic per‐spective.To conduct the analysis, the LNG conversion of a container vessel has been realized as a case study.In this sense, during the determination of the CAPEX of the con‐version procedure, a four-stroke dual-fuel engine and a twostroke engine are considered as 740 $/kW and 700 $/kW,respectively.In addition, the maintenance costs are con‐sidered 0.003 $/kWh for dual fuel main engine and 0.012$/kWh for dual-fuel diesel generators (Trivyza et al., 2018).The fuel consumption value that is determined according to Eq.3 and 4 (MAN Energy Solutions, 2018) and the amount of emissions emitted into the atmosphere as a result of oper‐ating with the LNG system are calculated based on the noon reports obtained by the specified container vessel.

Table 3 The marginal external costs of the environment (De Bruyn et al., 2018)

where SGC and SPOC are specific gas consumption and specific pilot oil consumption, respectively.

To examine the installation of the LNG system more clearly, two different analyses are conducted in the case study (i) considering just fuel cost saving of investment for economic benefit and (ii) considering both environmen‐tal financial and fuel cost savings for economic benefit.The environmental financial benefits of the LNG adapta‐tion are determined based on the reduced amount of emis‐sions compared to VLSFO usage.

Ships’ fuel consumption value varies according to some uncertainties, such as weather conditions of ship’s route,hull contamination of the vessel, and conducted faulty operations on the ship.To eliminate the impact of these types of uncertainties on the stated ship’s future operation times, each case study is realized based on three scenarios.The first one is 15% less fuel consumption, the second one is the obtained fuel consumption (base case), and the last case is 15% more fuel consumption.Thus, the annual cash flow (CF) of each scenario has been revealed differently.Monte Carlo Simulation is used to handle uncertainties that have been used during the calculation of the invest‐ment’s Net Present Value (NPV) since the CF value could vary in every future operational year of the vessel.To determine the effect of the interest rate on the LNG investment, NPV calculations have been made with 5%and 8% interest rate values that are generally used in the literature (Jafarzadeh et al., 2017; Jeong et al., 2019;Karatuğ and Durmuşoğlu, 2020).NPV of the investment is calculated with Eq.5.

where CAPEX is the capital expenditure of the invest‐ment,nis the remaining operational time of the ship, CFiis cash flow in the year ofi, and r is the interest rate.

The methodology of the paper is shown in the schematic diagram presented in Figure 1.

4 Case study

In this study, LNG utilization of a container vessel that navigates in the open seas is investigated both environmental and economic ways.The specifications of the container vessel whose data are used in the analysis are given in Table 4.

Table 4 Specifications of the specified container ship

Firstly, the LNG conversion of the stated ship has been realized for analysis.For this purpose, the operational status of the ship has been constituted via the received noon report.The operational chart of the specified ship is shown in Figure 2.

Figure 2 Operational chart of the container ship

Fuel consumption scenarios are created, and operational fuel costs according to the amount of fuel consumption are presented in Table 5.On the calculation, the price of the MGO and VLSFO is considered as 997 $/t and 672.5 $/t,respectively.For gas prices, the average between March 2021 and September 2023 is 1 339 $/t, and average fuel costs can be calculated with this pricing policy (Avarage Bunker prices, 2023).

As a result of the consumed fuels and their type, emis‐sions emitted into the atmosphere have been calculated in Table 6.

4.1 Considering just fuel cost savings of ınvestment for economic benefit

In this sub-heading, an economic evaluation of LNG application on the specified ship has been realized, consid‐ering operational fuel cost savings.Thus, the CF in Eq.5 is determined as in Eq.6.

whereCFuel,VLSFO,CFuel,LNG,CO&M,VLSFO, andCO&M,LNGare the annual operational fuel cost of VLSFO and LNG and the maintenance cost of VLSFO and LNG systems, respec‐tively.Monte Carlo Simulation is also applied to annual CF values for more realistic calculations.

4.2 Considering both environmental financial and fuel cost savings for economic benefit

To evaluate the LNG investment of the stated ship both environmentally and economically, the environmental financial benefits of the LNG utilization are calculated.The determined environmental external costs are given in Figure 3.

Table 5 Annual amount of fuel consumption and their operational costs

Table 6 Amount of annual emission (t/year)

Figure 3 Environmental benefits of the systems

The NPV and CF of the system are varied based on the environmental financial benefits.In this part of the analy‐sis, CF is calculated as in Eq.7.

whereBLNGis the annual environmental financial benefits of the LNG application.As a result of the Monte Carlo Simulation application, annual CF values are changed and the distribution of the income of each case is presented under Section 5.

5 Results

In this study, an economic and environmental assess‐ment of LNG application on a container ship, which could be adopted in line with IMO’s decarbonization target, has been conducted.In this sense, it has been aimed to present the economic effects of the investment for maritime com‐panies both in terms of the environmental external costs and considering economic savings by only fuel operating costs.

Due to sulphur limitations, VLSFO and MGO are con‐sumed by the specified marine vessels.To determine the amount of the ship’s fuel consumption, noon reports of the ship that covers a year are analyzed and it is determined that the ship consumed 7 280.4 t of VLSFO and 404.9 t of MGO annually.In this condition, the operational fuel cost is $5 299 740 over a year.To accomplish the LNG conversion, the values in the noon reports obtained from the ship are re-evaluated considering the operational status of the ship shown in Figure 2, and the annual LNG and MGO consumption are calculated as 4 946.13 t and 236.6 t,respectively.The LNG system’s operational fuel cost is$6 858 770 for a year.From these values, it is understood that the amount of fuel consumption and the operational fuel cost decrease as a result of LNG utilization.

With the reduction that could be achieved in the value of fuel consumption, the amounts of LNG-based emissions released from the ship are decreased.The comparison of the annual emission values emitted to the atmosphere has been presented in Table 6.As shown in Table 6, the ratio of the emission decreasing is calculated at approx.99% for SOx, 95% for PM10, 95% for PM2.5, 41% for CO2, and 82%for NOx, respectively.On the other hand, increasing CH4emission is observed related to LNG usage onboard.Ac‐cordingly, the ship’s LNG conversion provides significant advantages by decreasing ship-sourced air pollutants to comply with IMO’s emission regulations.

Figure 3 shows the economic and environmental bene‐fits of using LNG onboard.The advantages of the LNG system are estimated to be $24 799 246, while the costs are $4 840 200.

The amount of fuel consumption of a marine vessel changes based on the sea’s and ship’s conditions.To elim‐inate the uncertainties of fuel consumption value during the future operation period of the ship, case studies have been evaluated under three fuel consumption scenarios:15% less fuel consumption, base condition, and 15%more fuel consumption.The annual amount of consumed fuel and its operational fuel costs, emitted emissions and environmental benefits on the scenarios are presented in Tables 5, 6, and Figure 3, respectively.At this point, it is observed that as the consumption of fuels increases, the environmental financial benefits of the LNG system in‐crease as the emission release is lower than the conven‐tional system.

Different fuel consumption scenarios were created with two different case studies.Annual cash flows (CFs) are determined and evaluated to obtain the net present value(NPV) of an investment.In this sense, 1 000 simulations are performed during the 10-year period, the remaining operating time on the ship, and the annual CF value dif‐fered every year.The annual maintenance costs of the conventional and LNG systems are $88 171 and $108 827,respectively.

Annual cash flows (CFs) were calculated using the mathematical models summarized in Equations 6 and 7.In the first scenario, referred to as case (i), the CFs were assessed considering only the fuel cost savings of the in‐vestment, which constitutes the economic benefit.In the case (ii), CFs were determined by considering environmen‐tal-economic, and fuel cost savings, thus providing a more comprehensive understanding of the financial benefits.

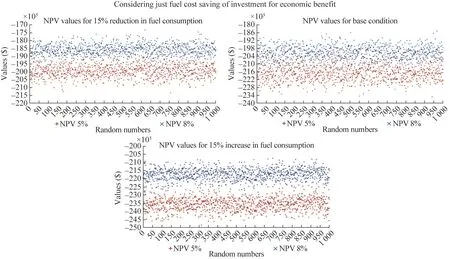

The NPV of the LNG conversion has been determined after the determination of the CFs.To observe the effect of the interest rate, the NPV of each scenario has also been calculated with an interest rate of 5% and 8%.The results of the NPV calculations are presented in Figures 4 and 5.

Figure 4 Net present values of case (i) scenarios

Figure 5 Net present values of case (ii) scenarios

For each scenario, it is observed that the NPV value is lower at the lower interest rate.The NPV values are also worse with the higher fuel consumption in case (i) which is seen in Figure 4.Because the price difference between VLSFO and LNG fuel increases as fuel consumption increases, the operational expenses for fuel consumption also rise.In this regard, the CF and corresponding NPV values have been getting lower since the price of LNG is extremely higher than the cost of VLSFO.Therefore, in case (i), the investment appears to be mostly negative since fuel prices are too high.

From the environmental financial perspective that is shown in Figure 5, more optimistic NPV results have been obtained compared to case (i).Nevertheless, it is observed that the NPV values are getting worse with the increasing amount of fuel consumption.The reduction in the amount of emissions presented in Table 6 and the better NPV val‐ues comparing the results of case (i) shown in Figure 5 shows that the use of LNG systems offers an effective solution for reducing environmental damage caused by merchant ships.These values also ensure important indica‐tors about the gains of maritime companies as a result of the LNG usage on their ships in cases such as emission taxes and environmental restrictions in ports that could be‐come fore in the future in the maritime industry.

According to Figures 4 and 5, it could be supposed that utilising the LNG systems on marine vessels is more rea‐sonable on newly built ships rather than on modifying the aged ships.However, the fuel prices, fuel running costs for the maritime companies, and external marginal costs of the emissions should be balanced to ensure the applicability of the investment.

6 Sensitivity analysis

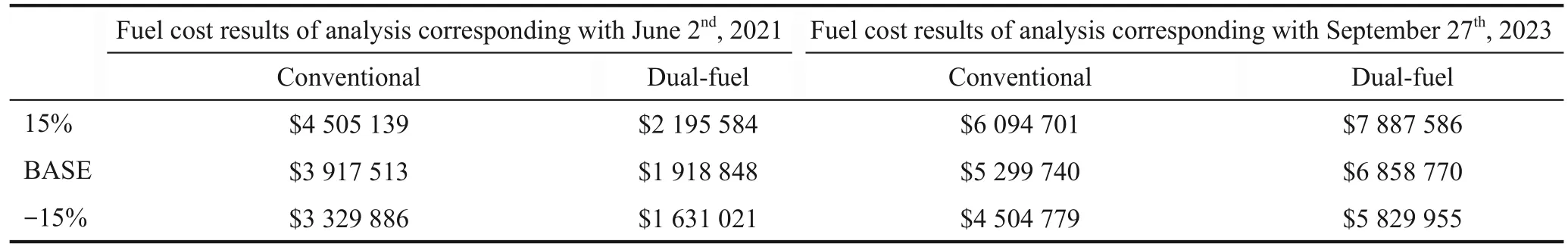

The similar analyses are conducted within the fuel prices obtained on June 2nd, 2021, to indicate the impact of the variability of global fuel prices on the LNG investment.Significant comparative findings regarding LNG applica‐tion to ships have been found since the price of each fuel is changed till September 27th, 2023.

According to the obtained fuel prices from (Avarage Bunker prices, 2021) and (Avarage Bunker prices, 2023),the increase rates are determined as 1.7 times for MGO(from $575 to $997), 1.3 times for VLSFO (from $514 to$672.5), and 3.6 times for LNG (from $373 to $1 339),respectively.Also, the parity between EURO and USD reduced from 1.2 to 1.00.Therefore, many differences,especially in economic results, have occurred in the find‐ings between the analysis conducted for 2021 and 2023.The changings in the operational costs in the analysis corresponding with both 2021 and 2023 are presented in Appendix A comparatively.In addition, the found results of the analysis related to June 2nd, 2021, are presented in Appendix B-D.

As shown in Appendix A, the fuel cost of the ship in‐creases by 3.57 times in the base scenario for a dual-fuel engine.In addition, the environmental financial benefits of the LNG implementation in the base scenario, which are$12 408 608 in analysis related to June 2nd, 2021, increases to $19 959 046 as illustrated in Appendix B.Therefore,positive cash flow and NPV values were calculated in the analysis corresponding with 2021.On the other hand, dif‐ferences regarding economic findings were observed in the analysis corresponding with 2023.

Accordingly, a sensitivity analysis of the LNG invest‐ment has been successfully achieved.The impact of the fuel price on the proposed methodology has been clearly revealed through the difference between the findings cal‐culated in the analysis conducted for 2021 and 2023.To comfortably invest in LNG by maritime companies and to maintain emission reduction strategies of the maritime sector effectively, fuel prices should reduce, the environ‐mental financial costs of emissions should be regulated,and the sector should be encouraged in this issue by poli‐cymakers and stakeholders.

7 Discussion of the results

7.1 A comparison with previous studies

In this study, a different techno-economic examination related to the LNG conversion over a marine vessel has been performed.Within the scope of the analysis, both en‐vironmental impacts and economic results were presented.Reduction rates in the pollutants due to LNG use as an al‐ternative marine fuel onboard indicate similar values with the studies in the relevant literature.Differing from them,methane emission caused by LNG usage has been consid‐ered, which is one of the important GHG emissions given that it should be carefully managed.

In addition, an innovative economic evaluation has been carried out.During the analysis, different scenarios under two main cases have been created to measure financial sit‐uations corresponding to various fuel consumption condi‐tions.The Monte Carlo simulation method has been used for the diminishing impact of uncertainties in scenarios.Also, an efficient sensitivity analysis was realized where economic results were calculated with different real-time fuel prices belonging to different periods.According to the best knowledge of the authors, this kind of economic anal‐ysis is implemented to the relevant subject for the first time in the maritime literature.

7.2 Theoretical implications

From the perspective of theoretical, the LNG conver‐sion provides such crucial benefits to the maritime compa‐ny regarding emissions that reduction among pollutants are 99% for SOx, 95% for PM10, 95% for PM2.5, 41% for CO2, and 82% for NOx, respectively.On the other hand, it causes a remarkable amount of CH4emission as known in the literature.

The amount of the fuel consumption is also reduced by the LNG use.However, it is observed that although total fuel consumed decreased, fuel cost for the company in‐creased.That’s why, the NPV findings for case(i) seem dis‐advantageous.On the contrary, when the fee equivalences of environmental benefits of conversion are considered for financial evaluation, it is understood that the LNG use in some ship machinery is highly beneficial.

7.3 Management implications

Using LNG as an alternative marine fuel onboard may be examined from different parameters means of manage‐ment perspective, which are mainly environmental and financial.One of the main motivations for alternative fuels is the reduction of emissions collaborating with increasing the energy efficiency level of the ship.During the transi‐tion process, economic factors are also highly important for maritime companies.In this sense, the proposed meth‐odology covers the stated management factors for compa‐nies during the LNG investment by both revealing the pos‐sible environmental savings and comprehensive economic evaluation.

Despite CH4 emission, LNG use in ships is beneficial for emission decrease in general.It ensures notable solu‐tions for the decrease of SOx, PM, and NOx.Neverthe‐less, although about 41% CO2reduction was calculated,using just LNG as a marine fuel is not suitable for IMO’s decarbonization strategy.To overcome this issue, the com‐panies should consider additional emission-related meth‐ods such as CO2capture systems.Also, the methane slip problem for LNG usage should be carefully handled.

Economically, the findings indicate that just considering the fuel cost saving is not enough to make an investment in an LNG system onboard.On the other hand, when the cost equivalence of pollutants is added to the financial evaluation, it can be stated that the LNG transition is defi‐nitely advantageous for maritime companies.

7.4 Policy recommendation

The LNG was highly analyzed during the phase when maritime companies should obey sulfur restrictions intro‐duced by IMO in 2020 and it is still being evaluated in current days.From the policy perspective, it totally com‐plies with sulfur limits.Although it has various benefits for maritime companies in management, using LNG alone is not a complete solution for complying with IMO’s de‐carbonization strategy.To meet CO2reduction limits, it should be supported by different strategies such as CO2capture, speed optimization, or any energy efficiency-in‐creasing way.

On the other hand, a new policy will be enforced in January 2024 in which the European Union Emissions Trading System (EU ETS) expands to the maritime indus‐try.Accordingly, the maritime companies will face finan‐cial consequences due to ship-sourced CO2emissions re‐leased into the atmosphere by their ships.In this sense,since LNG use reduces CO2emissions at a notable level, it will be getting more contributary to stakeholders by means of environmental cost saving.

7.5 Limitations of the study

The study is limited to conducting analysis on only a specific container ship.However, this methodology can be expanded for the whole fleet.For this analysis, sizing should be performed for each ship in the fleet.accordingly,although changes may possibly be observed in findings,the proposed methodology can still be a basis for this kind of analysis.

In the literature, various alternative marine fuels are in‐vestigated by companies and researchers.They were mostly evaluated in an analysis, comparatively.Therefore, consider‐ing only LNG is another limitation of the paper.However,the presented method may be easily replicated for the different fuel options.

8 Conclusions

This paper mainly aims to propose a novel framework for evaluating an alternative fuel system installation on‐board such as the LNG from perspectives of both environ‐mental and economic.

As a result of the analysis, environmental gains of LNG usage in ships are obviously an effective solution.This could be understood from the presented emission values in Table 6 and Figure 3.It is determined that the final eco‐nomic results of the analysis extremely differ from the analysis corresponding with 2021 conducted due to oc‐curred extreme changes in fuel prices.With the high fuel expenses, the LNG investment seems to be disadvanta‐geous for the maritime company due to negative CF and NPV values.When the economic results of the analysis for June 2nd, 2021, are evaluated, it could be stated that LNG installation is more effective for newly built or young-age marine vessels.Nevertheless, the fuel prices,fuel running costs for the maritime companies, and exter‐nal marginal costs of the emissions should be balanced to ensure the applicability of the LNG investment for the current times.

In future works, it is planning to develop a more com‐prehensive and detailed methodology that covers other types of alternative fuels considering the implementation of the other types of marine vessels.

Appendix A

Table 1 The changings in the operational costs analyses corresponding with different times

Appendix B

Figure 1 Environmental benefits calculated in analysis corresponding with June 2nd, 2021

Appendix C

Figure 2 Net present values of case (i) scenarios in analysis corresponding with June 2nd, 2021

Appendix D

Figure 3 Net present values of case (ii) scenarios in analysis corresponding with June 2nd, 2021

Nomenclature

AISAutomatic Identification System

BSFCBraked-Specific Fuel Consumption

CAPEXCapital Expenditures

CFCash Flow

CO2Carbon Dioxide

DWTDeadweight

ECAEmission Control Area

EEDIEnergy Efficiency Design Index

EGCSExhaust Gas Cleaning System

FMECAF

S

ahiilpusr

e Modes, Effects, and Criticality Analysis from

FTAFault Tree Analysis

GHGGreenhouse Gas

HFOHeavy Fuel Oil

IMOInternational Maritime Organization

LBSILean Burn Spark Ignition

LNGLiquefied Natural Gas

LSHFOLow Sulphur Heavy Fuel Oil

LS-HPDFLow-Speed 2-Stroke High-Pressure Dual-Fuel

LS-LPDFLow-Speed 2-Stroke Low-Pressure Dual-Fuel

MARPOLInternational Convention for the Prevention of Pollution

MDOMarine Diesel Oil

MGOMarine Gas Oil

MS-LPDFMedium Speed 4-Stroke Low-Pressure Dual-Fuel

NOxNitrogen Oxides

NPVNet Present Value

OPEXOperational Expenditures

PMParticulate Matter

SCRSelective Catalytic Reduction

SEEMPShip Energy Efficiency Management Plan

SGCSpecific Gas Consumption

SPOCSpecific Pilot Oil Consumption

SOxSulphur Oxides

VLCCVery Large Crude Carrier

VLSFOVery Low Sulphur Fuel Oil

EtripThe Amount of Emission Over A Complete Trip

FCFuel Consumption

EFEmission Factor

MECkMarginal External Costs

Competing interestThe authors have no competing interests to de‐clare that are relevant to the content of this article.

Journal of Marine Science and Application2023年4期

Journal of Marine Science and Application2023年4期

- Journal of Marine Science and Application的其它文章

- Decarbonization of Ship Operations

- The Potential of Inedible Biodiesel as an Eco-Friendly and Sustainable Alternative Fuel for Marine Diesel Engines in India

- Combustion Analysis of Low-Speed Marine Engine Fueled with Biofuel

- Combustion Characteristics of Diesel/Butanol Blends Within a Constant Volume Combustion Chamber

- Review of Risk Analysis Studies in the Maritime LNG Sector

- Maritime Energy Transition: Future Fuels and Future Emissions