RMB Exchange Rate, Overseas Education, and High-Quality Economic Growth

Sun Yuchen and Sun Xianchao*

Sichuan Normal University

Abstract: China is transitioning its industrial structure from labor-and resource-intensive industries that previously contributed significantly to the country’s GDP growth to technology-intensive industries emphasizing a highly-skilled workforce and sustainability to achieve high-quality economic growth.This paper examines the impact of the RMB exchange rate on high-quality economic growth through theoretical modeling and empirical analysis and discusses the variable of overseas education to explore the mechanism of how the RMB exchange rate and overseas education jointly impact high-quality economic growth.The research sample includes the National Bureau of Statistics data on education from 1995 to 2015, the Bank for International Settlements (BIS) data on the RMB exchange rate, and the added value of China’s high-quality economic growth estimated based on the national economy data.An empirical analysis of theoretical expectations was conducted, finding that RMB appreciation could make a positive contribution to China’s high-quality economic growth;RMB exchange rate fluctuations would impact the relative cost of overseas education and overseas returnees could have a positive impact on domestic resource utilization efficiency and domestic capacity to make sci-tech innovations, thereby injecting vitality to high-quality economic growth.This study focuses on both the RMB exchange rate and the population studying abroad, providing additional observation dimensions to existing research.

Keywords: RMB exchange rate, overseas education, high-quality economic growth

Xi Jinping, general secretary of the Communist Party of China (CPC) Central Committee, noted in the report to the 20th National Congress of the Communist Party of China, “To build a modern socialist country in all respects, we must, first and foremost, pursue high-quality development.” The CPC Central Committee stresses that the application of the new development philosophy to promote high-quality development is an integral part of China’s modernization drive.To achieve the goal of high-quality development,it is imperative to recognize innovation as the primary driver of growth, coordination as an inherent characteristic, the green economy as a universal framework, opening up as a steadfast pathway, and the pursuit of shared benefits as the ultimate aspiration.

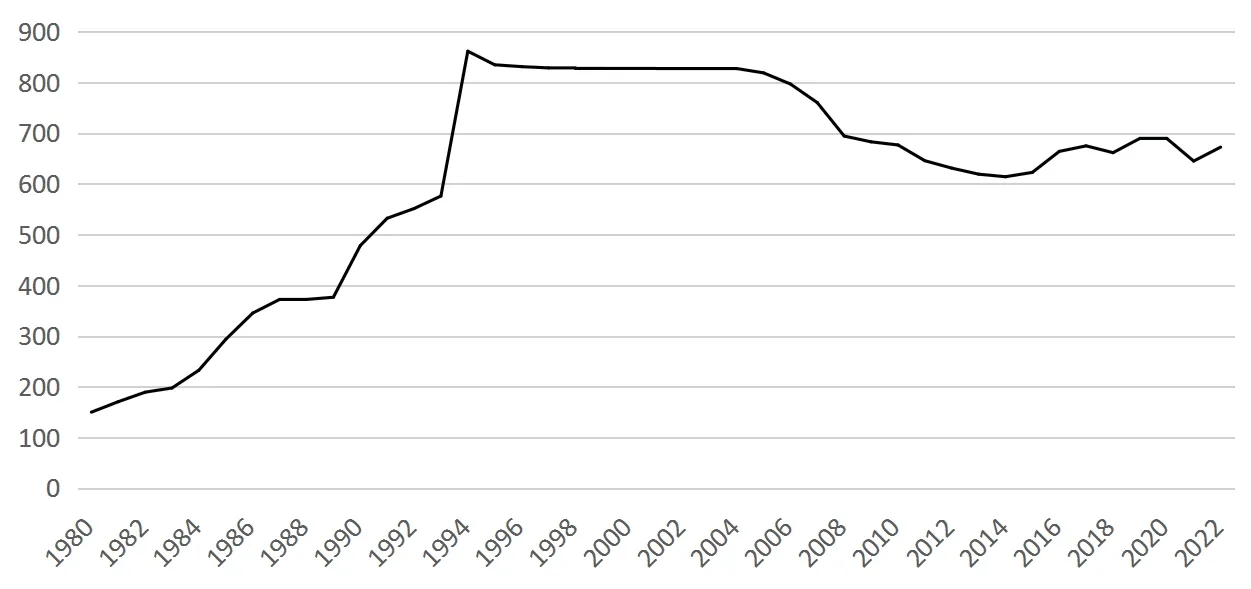

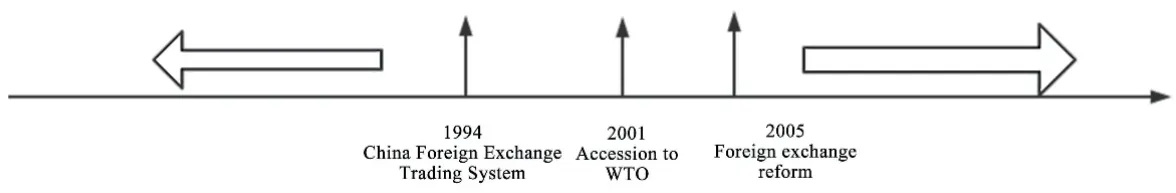

The RMB exchange rate is an important economic indicator to for China’s opening up.China implemented a fixed (or pegged) exchange rate regime and a dual exchange rate regime before the establishment of the China Foreign Exchange Trade System (CFETS) in 1994.CFETS’s establishment is an important milestone in China’s development towards a marketbased RMB exchange rate regime.In 2001, China acceded to the World Trade Organization(WTO), and the RMB gradually became freely convertible.In 2005, China reformed the RMB exchange rate regime and moved into a managed floating exchange rate regime based on market supply and demand with reference to a basket of currencies.

Figure 1 RMB to USD Exchange Rate (USD = 100) (Yuan)Source: National Bureau of Statistics—Annual Data

Figure 2 Timetable of China’s Foreign Exchange Rate Regime Reform

The process of the RMB exchange rate going market-based has an ongoing impact on the development and survival of market players.It reallocates resources through imports and exports.With the synergy of an open market environment and macroeconomic policies,China’s economic aggregate has continued to grow, and its model of growth has been evolving.In direct quotation, when the RMB exchange rate decreases, the value of the RMB goes up with stronger purchasing power.As a result, Chinese exporters see a fall in revenue when measured in domestic currency.Assuming that production costs remain the same and there are no imports of intermediate goods, this decrease in revenue leads to a fall in profit margins.Enterprises with low factor utilization efficiency often struggle to earn profits equal to or even lower than the industry average, making them more susceptible to excha nge rate r isk s.If t hese enterprises fail to improve their resource utilization efficiency within a brief period, they will face the risk of financial loss and find it challenging to maintain sustainable operations.Enterprises with high resource utilization efficiency have a competitive advantage in generating extra surplus value, leading to increased profit margins that enable them to manage exchange rate risks better.Moreover, they have more funds to invest in technical advancements and scientific innovations, providing favorable conditions for sustained business growth.In such a market selection mechanism, when the RMB exchange rate decreases, its purchasing power increases, forcing enterprises with low factor utilization efficiency to exit the market.In contrast, enterprises with high factor utilization efficiency are compelled to enhance their productivity further to attain sustained economic growth and maximize their profit margins.This is conducive to realizing high-quality economic growth.In addition, the decline in the RMB exchange rate has a “catfish effect,” driving small and medium-sized enterprises(SMEs) that rely on cheap labor, have low factor utilization efficiency, and lack independent development capabilities to better themselves.This sends a positive market signal, prompting the pursuit of high-quality economic growth.

In this open market, there is a special product in circulation, overseas education (or studying abroad).In this paper, overseas education is considered a consumer behavior of purchasing education as a product.As such, the cost of overseas education, measured in RMB, falls when the RMB exchange rate decreases.The reduced cost encourages more individuals to pursue overseas education.Most students who choose to study abroad seek to pursue a bachelor’s degree or above.This, coupled with the ranking of the universities they attend, as well as the comprehensiveness of the courses offered, contributes to the progressive development of these students and broadens their international perspective.When they return to China, they will play a positive role in enhancing China’s labor productivity.

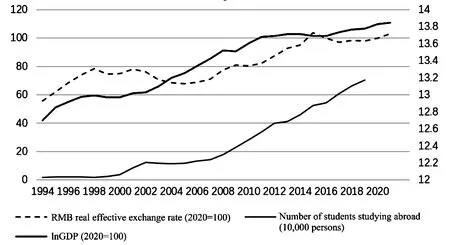

This paper explores issues associated with high-quality economic growth from the perspectives of the RMB exchange rate and human capital.Figure 3 presents a chart displaying the changes in the RMB exchange rate, the number of Chinese students studying abroad, and China’s GDP.The chart reveals a noticeable and strong correlation between the three factors.It can be concluded that this finding supports the arguments put forth in this paper.Building upon this initial finding, subsequent research endeavors unfold.

Figure 3 Trends of RMB Effective Exchange Rate, Number of Chinese Students Studying Abroad, and Log of China’s GDP From 1994 to 2021 Note: The National Bureau of Statistics has not included the data on the numbers of Chinese students studying abroad in 2020 and 2021, and this information is not available for display herein.Source: RMB real effective exchange rate (left axis) from BIS database, and number of Chinese students studying abroad (left axis) and log of China’s GDP(right axis) from annual statistical data of the National Bureau of Statistics.

Figure 4 Transmission Mechanism

Figure 5 Influence Mechanism

The primary objective of this paper is to investigate the influence of the RMB exchange rate on the number of Chinese students studying abroad and their effect on achieving high-quality economic growth.Specifically, it aims to explore how the RMB purchasing power varies with the RMB exchange rate fluctuations and how such changes transform China’s economic growth model through resource reallocation and improvements of factor productivity.This paper also discusses the behavior of studying abroad.Building on the above analysis, this paper provides a clearer explanation of the logical chain involved: RMB exchange rate fluctuations change resource flows and the resource utilization efficiency through imports and exports, which in turn, leads to high-quality economic growth.During this process of resource reallocations,the purchase of foreign educational resources is affected.Some individuals who make such purchases eventually enter China’s domestic labor market.With well-developed qualities and skills and a broader international perspective, these returnees are conducive to improving the efficiency of human capital in China, thus promoting high-quality economic growth.The above logical relationship can be simplified into the following transmission mechanism.

This paper builds theoretical models to examine the relationship between the RMB exchange rate and high-quality economic growth against the backdrop that the RMB exchange rate will become increasingly market-based and the RMB will appreciate in the long run, with consideration to the fact that the cost of studying abroad is subject to the RMB exchange rate.Furthermore, it explores how the RMB exchange rate and studying abroad jointly impact high-quality economic growth.Using theoretical models, this paper conducts an empirical analysis of the annual data from 1995 to 2015.It also discusses how the RMB exchange rate and the number of Chinese students studying abroad impact high-quality economic growth.

This paper examines how the RMB exchange rate and studying abroad impact China’s high-quality economic growth and the mechanism behind it from the perspectives of exchange rate and labor.This is an innovative practice because it not only explores the impact of the RMB exchange rate on China’s economic growth but also considers the potential driving role of studying abroad in enhancing the domestic labor market and the domestic factor utilization efficiency and the resulting impact on economic growth.This paper also conducts an empirical analysis.

Literature Review

Literature related to this paper falls into three main categories.The first category focuses on how RMB exchange rate fluctuations impact China’s economic growth.Liao & Zheng(2006, pp.4–5) performed a regression analysis of the data from 1983 to 1993, finding that there was a significant positive correlation between the RMB exchange rate and China’s exports in direct quotation and that RMB depreciation was conducive to introducing foreign investment and advanced technology.Lin et al.(2009, pp.28–31) analyzed the data from 1980 to 2006, concluding that when the RMB exchange rate rose, the RMB depreciated,lowering the relative cost for foreign capital to make investments in China and that there was a positive correlation between foreign investment and economic growth.Ba and Wang (2009,pp.50–56) analyzed the data from 1980 to 2006 using a Cointegration model, finding that the rise of the RMB real effective exchange rate (REER) increased the scale and number of employees in China’s tertiary industry, driving China’s economic growth.Yu and Lin (2013,pp.87–97) analyzed the data from 1994 to 2010 to check the transfer effect of RMB exchange rate fluctuations on China’s exports within ten industries that vary greatly regarding added values.They found that RMB appreciation had a greater impact on labor-and resourceintensive companies and a smaller impact on technology- and capital-intensive companies.In general, this was useful in driving the structural transformation of China’s exports.Frenkel(2004, pp.29–52) analyzed data from Argentina and Brazil and concluded that the real exchange rate had a significant and lagged effect on employment.In the long run, it affects the rate of new job creation and labor intensity.

The second category focuses on the impact of exchange rate fluctuations on total factor productivity.Xu (2013, pp.69–87) and Zhang et al.(2017, pp.86–99) focused on exploring the impact of exchange rate fluctuations on exports through the allocation and utilization efficiency of capital and resources.They held that RMB appreciation could enhance labor productivity and total factor productivity.Liu and Huang (2016, pp.27–37) studied data from Chinese enterprises using the difference-in-differences (DID) method.They held that RMB appreciation could reduce the market share of export-oriented Chinese companies and improve the efficiency of resource allocations.Ekholm et al.(2012, pp.101–117) argued that currency appreciation would result in reduced competitiveness of exported goods in the global market, eliminating entities with low efficiency.The surviving enterprises, on the other hand, would be compelled to prioritize innovation and development in order to effectively respond to the pressure arising from exchange rate fluctuations.Tang (2010) held that intensified competitive pressure would prompt entities to enhance their R&D efforts and integrate advanced technologies for higher productivity and that there was a positive correlation between the growth rate of the total factor productivity and entities’ dependence on foreign trade.Harris (2001, pp.277–314) believed that the depreciation of the domestic currency tended to foster a sense of complacency among businesses, impeding their ability to pursue innovation and technical progress.

The last category focuses on the impact of higher education on high-quality economic growth.Historical experience has proved that the sustainability and extensibility of human resources are of greater importance than physical capital.During the 1980s, prominent economists such as Paul Michael Romer and Robert Lucas Jr.proposed a new economic growth theory that underscored the pivotal role of sci-tech innovation in driving sustained economic development.Min (2017, pp.123–136, 190–191) proposed that labor could achieve production and accumulation through investment in education, which, in turn, could increase the total factor productivity, facilitate the upgrading of industrial structure, adjust income distribution, and ultimately promote consumption.Huang and Zhang (2021, pp.29–38, 49)argued that education would assume an increasingly vital role as a catalyst for economic growth and the optimization of economic structures in the era of the “education dividend.”With the growing societal emphasis on knowledge, higher education, serving as a vital channel for cultivating skilled labor forces and driving sci-tech progress, is playing an increasingly important role in social and economic development.According to Brambilla et al.(2012), exporting companies, particularly those targeting high-income countries, could significantly enhance their ability to create product differentiation and competitiveness by leveraging a well-educated workforce.Fang and Mao (2021, pp.1993–2016) analyzed the financial data of businesses from 2000 to 2007, finding that the expansion of human capital yielded positive effects on improving businesses’ export quality and resource allocation within their industries.

In summary, the current body of research on the influence of RMB exchange rate fluctuations on China’s economic growth predominantly concentrates on their effects on foreign direct investment (FDI), employment rates, industrial structures, and the overall volume of economic growth.There is a noticeable lack of discussion regarding their impact on the economic growth model.Existing research on the impact of RMB exchange rate fluctuations on the economic growth model mainly focuses on the enterprise level, with a special focus on the analysis of factors and mechanisms that affect the total productivity factors.Few researchers have investigated the impact of education on the economy through theoretical modeling and empirical analysis.This paper investigates the macro-level implications of the economic growth model by incorporating the number of Chinese students studying abroad into the empirical model.This research seeks to address how to achieve high-quality economic growth from the perspectives of exchange rates and human resources.

Theoretical Models

Economic Growth Model-Solow Growth Model

In his seminal work “Technical Change and the Aggregate Production Function,”published in 1957, Robert Solow decomposed the economic growth rate into two components:the rate of technical progress and the growth rate of factor inputs within the production function.In this paper, the relationship between economic growth and factor inputs, as well as technical progress, is represented by the Cobb-Douglas production function, which is expressed below:

A= technological knowledge, L= labor input, K= capital input, α and β are the output elasticities of capital and labor if the returns to scale are constant, α + β=1.

Take the logarithm of Formula (1), it becomes

Substitute N= lnLαKβinto Formula (2) and take differentiation, it becomes

Formula (4) reveals that economic growth can be divided into two parts: economic growth(ΔA) resulting from enhancements in total factor productivity.It is the result of the “highquality” economic growth model and economic growth resulting from increasing capital and labor inputs.In this paper, the economic growth achieved through increasing capital and labor inputs is defined as “factor-driven” economic growth.Both models play a significant role in contributing to overall economic growth.If “factor-driven” growth is considered as quantitative expansion and “high-quality” growth as qualitative improvements, it is important to recognize that real growth and economic strength of a country are determined by the appreciation of the country’s domestic currency and enhanced labor productivity.

Given that this paper wants to investigate factors that affect “high-quality” growth, a further transform was performed on Formula (2) to obtain the following formula:

lnA= lnY-αlnL-βlnK(5)

The Number of Chinese Students Studying Abroad as a Function of the RMB Exchange Rate

As previously discussed, RMB appreciation would boost the currency’s purchasing power and lower the cost of studying abroad.Within this logical chain, studying abroad is a consumer behavior of purchasing education as a product, and the price level influences its demand.Exchange rate fluctuations have an impact on the relative price of studying abroad.Considering the scarcity of educational resources in China, the demand for studying abroad exhibits a high degree of price elasticity.In other words, exchange rates affect the number of students studying abroad through the price mechanism.To make it simpler, this paper establishes an abstraction function between the RMB exchange rate and the number of Chinese students studying abroad as shown below, where Lout= the number of Chinese students studying abroad, e = RMB exchange rate in direct quotation, and ω= error term.

According to theoretical analysis, the economic relationship expressed by Formula (5)is that in direct quotation, when the RMB exchange rate decreases, the value of the RMB goes up, resulting in an increase in the number of Chinese students studying abroad.The fluctuation of the RMB exchange rate has a consequential impact on the relative cost of studying abroad, influencing the number of individuals pursuing studying abroad.When these individuals return to China to enter the domestic labor market, it changes the stock of domestic labor capital.In this paper, the impact of the number of students studying abroad on domestic human capital is reduced to the following model:

Combining Formulae (5) and (6), the following formula is obtained:

The correlation depicted in Formula (7) suggests that when the exchange rate of the RMB decreases, its value goes up, leading to an increase in the domestic labor stock.

Considering that these overseas returnees are technically progressive, they would inject more vitality into “high-quality” growth.To observe this correlation, this paper further explores the impact of RMB exchange rate fluctuations on “high-quality” growth when examining the model focusing on the driving role of exchange rates in promoting economic growth.

Model of Exchange Rates Promoting Economic Growth

Improved labor productivity results from higher resource utilization efficiency, and the economic growth resulting from improved labor productivity is known as high-quality growth.The mechanism of how a decreased exchange rate of a currency boosts local labor productivity is as follows.On the one hand, a decline in the exchange rate of a currency will boost its value.As a result, the equilibrium prices of goods and services exported,as determined by the international market, will decrease when measured by the domestic currency.This will in turn lead to a reduction in the total amount of savings and the inflow of foreign capital through the current and capital accounts.On the other hand, the domestic cost of producing goods and services remains the same, profit margins become smaller, and profit margins for exports fall.The two-way effect of exchange rate fluctuations on profits forces manufacturers to improve the efficiency of invested capital and labor, finally advancing highquality growth.

Both paths finally lead to improved labor productivity.In other words, exchange rate fluctuations impact on high-quality economic growth.The following model is used to represent this correlation:

To sum up, economic growth is determined by the inputs of the factors of production and the efficiency of their use.The RMB exchange rate plays a crucial role in shaping factor utilization efficiency and also affects the number of Chinese students pursuing education abroad.The returnees, equipped with advanced technological knowledge and a global perspective, can significantly impact enterprises’ production activities and overall development as they enter the labor market.The ultimate consequence of these dynamics is the stimulation of high-quality economic growth.

Empirical Model, Variable Setting, and Data Description

Empirical Model

Check on the Impact of RMB Exchange Rate on High-Quality Economic Growth

This paper establishes a function to investigate high-quality economic growth by adding the RMB exchange rate, which serves as the core explanatory variable, and other control variables affecting high-quality economic growth into the Cobb-Douglas production function.Built on Formula (5) and Formula (9), the following baseline regression model is obtained:

where, t = year,At= added output resulting from high-quality economic growth within t year,Et= exchange rate within t year,Zt=control variables, εt= error term.

Check on the Influence Mechanism of RMB Exchange Rate on High-Quality Growth

The theoretical model shows that the relationship between the RMB exchange rate and high-quality economic growth may be affected by the number of Chinese students studying abroad.This paper builds a new model to explore the potential regulating mechanism of the number of students studying abroad.The model is expressed as follows:

where,Mt= mechanism variable.This paper mainly examines the mechanism variable of the number of students studying abroad and includes a discussion of the number of returnees,a variable associated with studying abroad.Other variables have the same definitions as in the baseline regression.

Variable Selection and Data Source

Explained Variable

In this paper, the added value of high-quality economic growth from 1995 to 2015 is the explained variable.With reference to the data on capital input, labor input, and total factor productivity as disclosed in the article “Can the productive service industry become new momentum for China’s economic growth” (Li, Fu, & Zhang, 2017, pp.5–21), published inChina Industrial Economics, this paper estimates the contribution rates of the three factors to China’s economic growth in order to measure the explained variable.The raw data comes from China Statistical Yearbooks, China Labor Statistical Yearbooks, Input-Output Tables,and CNKI statistical data on the Chinese economy and social development over this period.

Core Explanatory Variable

This paper aims to investigate the impact of the RMB exchange rate on high-quality economic growth.Therefore, it is particularly important to select an appropriate exchange rate as the core explanatory variable.Cheng (2019.pp.23–37, 108) calculated the real exchange rate by dividing the nominal exchange rate by the GDP deflator.Cao (2022, pp.65–82) estimated the real effective exchange rate at the enterprise level using the relevant data from the China Customs Database, China Industrial Enterprise Database, and China Patent Database.Yu (2018, pp.1207–1234) obtained the nominal effective exchange rate at the enterprise level by weighting the trade share in the initial year.This paper adopts the weighted average exchange rate of RMB against a basket of currencies to measure the real exchange rate and marks it as an effective exchange rate (EER).The EER is taken from the BIS database and adjusted to the constant price in 2012 (2012 = 100).

Mechanism Variable

The analysis of the exchange rate transmission mechanism shows that the exchange rate changes the number of overseas students by affecting the relative cost of studying abroad, which in turn affects the efficiency of human capital and contributes to high-quality economic growth.This paper designs an empirical model to check this mechanism variable, with the addition of the number of returnees, which also serves as a mechanism variable to supplement the logical chain of how returnees impact domestic resource utilization efficiency.Given that studying abroad is a consumer behavior,this educational investment is influenced not only by the relative cost associated with the RMB exchange rate but also linked with consumers’ willingness to pay.Thus, the metric of educational funding is introduced as a gauge to assess the societal emphasis on and inclination to invest in education as a whole.Educational funding includes various components, such as the government’s financial allocation towards education, funding raised by social organizations and individual citizens for school operations, philanthropic contributions, tuition fees, miscellaneous charges, and other related funds.The data on the number of Chinese students studying abroad, the number of returnees, and educational funding comes from the annual data of the State Bureau of Statistics.This paper holds that there is some substitutability among the three indicators.

Control Variables

While investigating the impact of the core explanatory variable on high-quality economic growth, this paper also includes nine control variables that may impact high-quality economic growth.They are the labor hours, total productive capital, gross national product(GNP), added value of secondary and tertiary industries, fertilizer consumption, forest coverage, technical cooperation grants, nuclear power generation, and air transport.Labor hours and total productive capital represent the factor inputs.Labor input is quantified by the number of working hours, commonly referred to as labor hours.This metric incorporates various factors, including overtime work and the distinction between full-time and parttime employees.Moreover, labor hours can also reflect the quality of labor input and the contributions made by highly educated professionals (Yue & Ren.2008, pp.16–28).It is a more reasonable indicator than the number of employees.The total productive capital is selected to quantify capital input.It is an indicator measured by using the perpetual inventory method in combination with various capital prices.Both are from the public data published in “Can the productive service industry become new momentum for China’s economic growth” (Li, Fu, & Zhang, 2017, pp.5–21).The data in this article are all from China Statistical Yearbooks, China Labor Statistical Yearbooks, Input-Output Tables, and CNKI statistical data on the Chinese economy and social development over this period.Data from projects such as the Chinese General Social Survey and the Chinese Household Income Project are also used to estimate labor hours.The GNP and the added value of secondary and tertiary industries are variables to reflect the total amount and model of economic growth,respectively.The data comes from the State Bureau of Statistics.Fertilizer consumption reflects agricultural productivity, and forest coverage represents the environment.Their data comes from the Food and Agriculture Organization of the United Nations (FAO).Technical cooperation grants reflect R&D inputs, with data from the World Bank and the Organization for Economic Co-operation and Development (OECD).Nuclear power generation reflects the energy structure, and the data is from the International Energy Agency (IEA) database.Air transport reflects the dynamism of imports and exports, and its estimation is based on the International Civil Aviation Organization (ICAO)’s civil aviation statistics of the world and the employees that ICAO has.

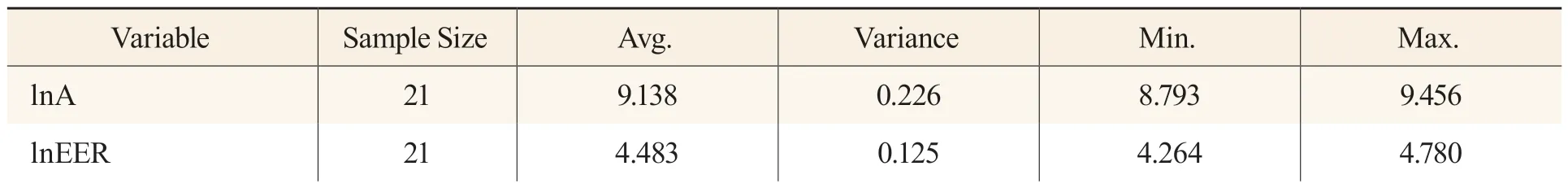

Descriptive Statistics of Variables

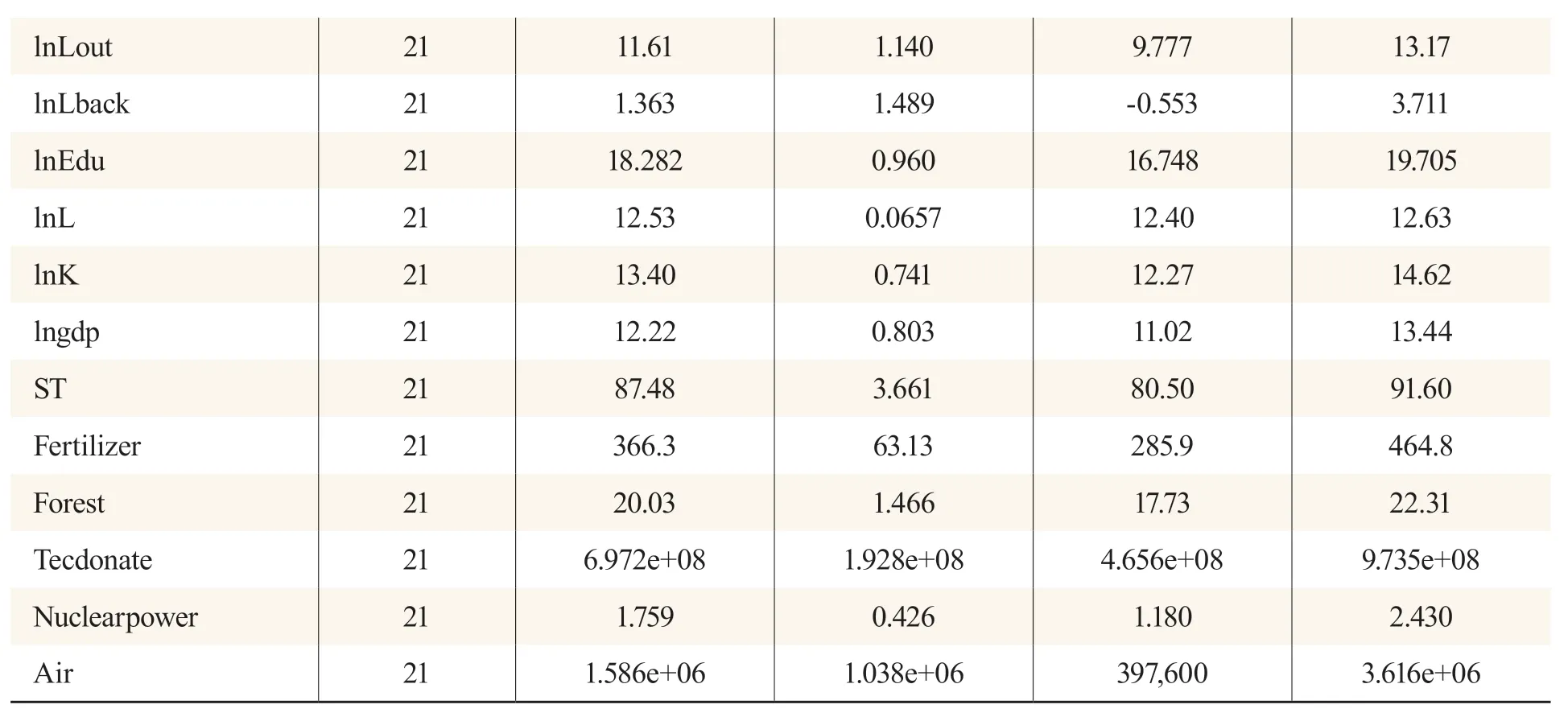

Table 2 Descriptive Statistics of Major Variables

lnLout 21 11.61 1.140 9.777 13.17 lnLback lnEdu 21 1.363 1.489 -0.553 3.711 21 18.282 0.960 16.748 19.705 lnL 21 12.53 0.0657 12.40 12.63 lnK 21 13.40 0.741 12.27 14.62 lngdp 21 12.22 0.803 11.02 13.44 ST 21 87.48 3.661 80.50 91.60 Fertilizer 21 366.3 63.13 285.9 464.8 Forest 21 20.03 1.466 17.73 22.31 Tecdonate 21 6.972e+08 1.928e+08 4.656e+08 9.735e+08 Nuclearpower 21 1.759 0.426 1.180 2.430 Air 21 1.586e+06 1.038e+06 397,600 3.616e+06

Empirical Results

Check on the Impact of the RMB Exchange Rate on High-Quality Economic Growth

Table 3 shows the impact of RMB exchange rate fluctuations on high-quality economic growth.In both models, the RMB effective exchange rates are positive,in line with the expectations of the theoretical models.Model (1) investigates the explanatory power of the RMB real effective exchange rate on high-quality economic growth and their correlation.The regression results show that high-quality economic growth and the RMB exchange rate are statistically significant at 1 percent and exhibit a strong positive correlation.These findings align with the expectations of the theoretical model depicted in Formula (9).It is important to note that the RMB effective exchange rate selected for the empirical analysis displays a positive correlation with the RMB purchasing power, while the theoretical model is based on direct quotation, where the RMB exchange rate exhibits a negative correlation with the RMB purchasing power.Therefore, Formula (9) necessitates a sign change,implying that an increase in the RMB effective exchange rate leads to an increase in the RMB purchasing power and, subsequently, a rise in the added value of high-quality economic growth.The overall goodness-of-fit of Regression (1) is 0.458, indicating a relatively moderate fit.However, when the control variables are introduced in Model(2), the overall goodness-of-fit reaches 1, suggesting proper inclusion of all relevant influencing factors and a strong model fit.Additionally, the core explanatory variable is statistically significant at the 5 percent level.The economic implication derived from these results indicates that a 1 percent increase in the RMB effective exchange rate leads to a 0.08 percent increase in high-quality economic growth.

Table 3 Baseline Regression

Model (2) also shows the impact of various control variables on high-quality economic growth.According to Table 3, the coefficients of labor hours and total productive capital are significantly negative, suggesting that excessive reliance on factor inputs hinders the attainment of high-quality economic growth.The coefficients of GNP, the added value of secondary and tertiary industries, and fertilizer consumption are significantly positive,indicating that an increase in economic aggregate, optimization of industrial structure, and enhancement of internal industry efficiency contribute positively to high-quality economic growth.The coefficient of forest coverage is significantly positive, signifying that environmental improvements promote high-quality economic growth.This underscores the importance of more efficient resource utilization and the adoption of sustainable development models to foster a favorable environment.The coefficient of technical cooperation grants is also significantly positive, indicating that increased investment in technical R&D supports high-quality economic growth.Higher R&D investment facilitates the integration of advanced technologies, injecting vitality into the pursuit of high-quality economic growth.Furthermore, the coefficient of air transport is significantly positive,indicating that increased import and export dynamism creates favorable conditions for high-quality economic growth.Although the coefficient of nuclear power generation is insignificantly positive, the regression results provide some evidence that changes in the energy mix can play a positive role in promoting high-quality economic growth.In general,an increase in the RMB real effective exchange rate has a significantly positive effect on high-quality economic growth.

Check on the Influence Mechanism of the RMB Exchange Rate and the Number of Chinese Students Studying Abroad on High-Quality Economic Growth

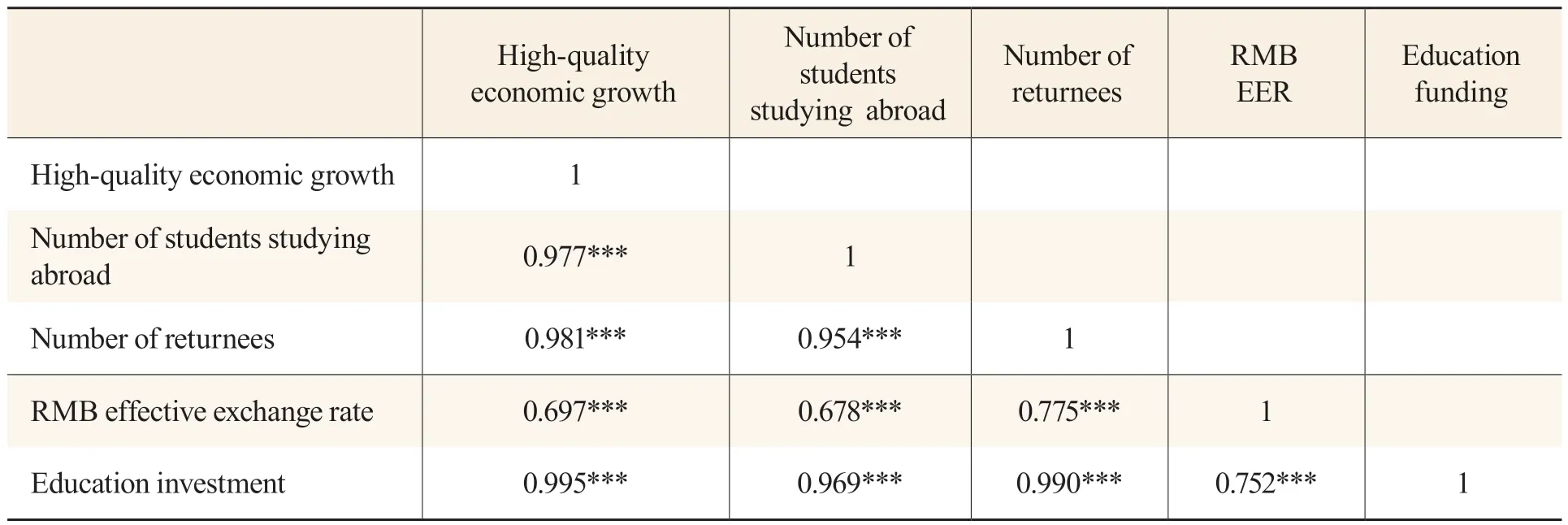

To observe the impact of the number of students studying abroad on high-quality economic growth, this study employs a mechanism check model represented by Formula(11).The examination focuses on assessing the combined influence of the RMB exchange rate and studying abroad on high-quality economic growth based on the coefficient value and significance of the interaction term.Since overseas graduates must undergo a learning period before entering the domestic labor market, this study includes the exchange rate(one-to-three-month lag) and the number of students studying abroad for analysis purposes.Before performing a regression analysis on the mechanism, this paper first performs tests to examine the correlation between variables.The results are shown in Table 4.It reveals a highly positive correlation between the variables in Table 4, which satisfies the hypothesis conditions for the mechanism test and aligns with the theoretical hypothesis presented in Formula (6) that RMB appreciation increases the number of students studying abroad.

Table 4 Correlation Analysis of Mechanism Variables

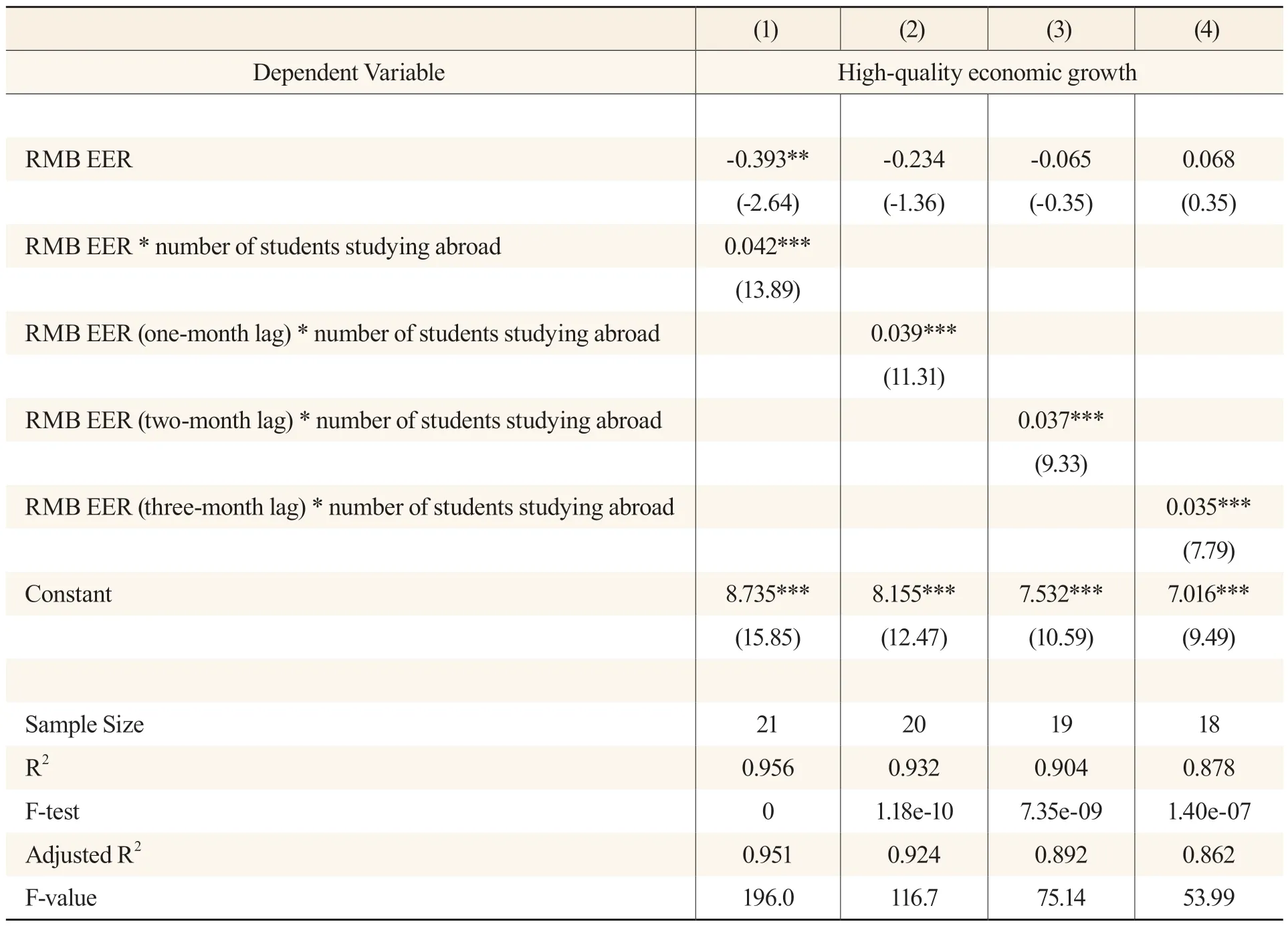

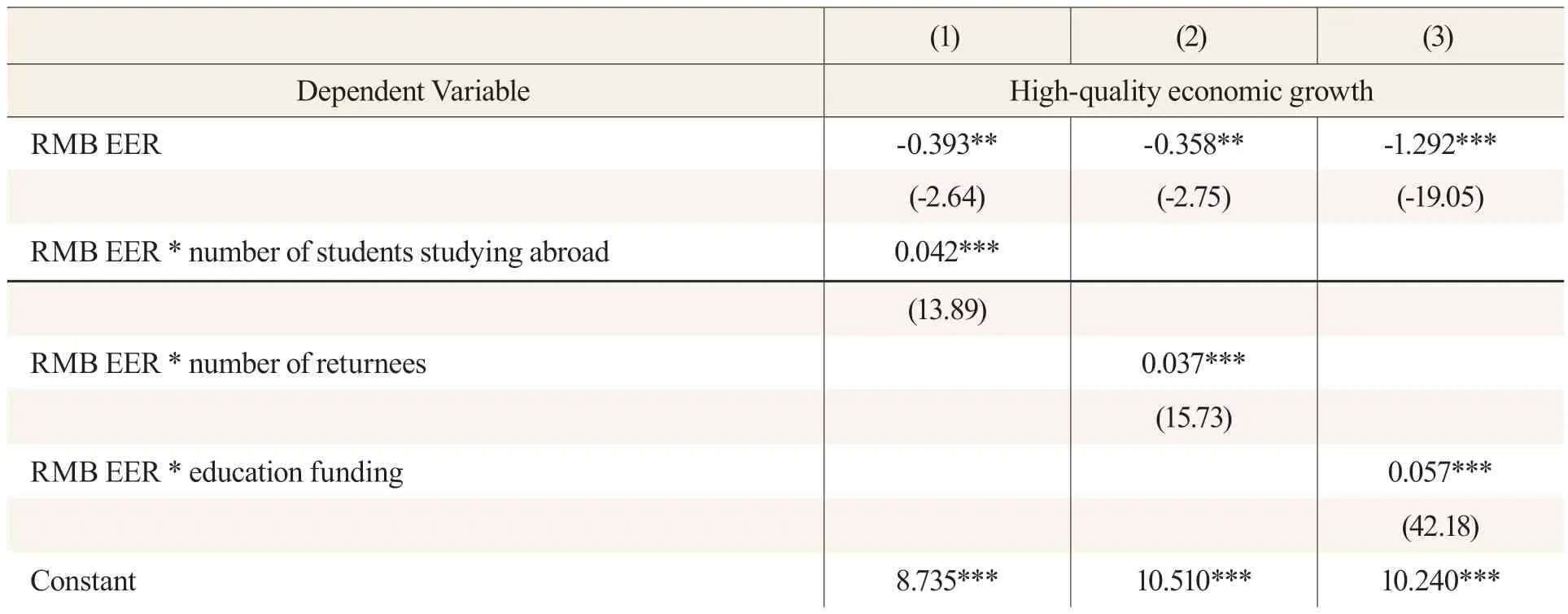

Table 5 presents the impact of the RMB exchange rate and the number of students studying abroad on high-quality economic growth.In Model (1), the coefficient of the interaction term obtained by multiplying the number of students studying abroad and the RMB real effective exchange rate is found to be significantly positive at the 1 percent level.This suggests that, under the combined influence of the two factors, high-quality economic growth can be achieved.This finding aligns with the underlying theory that the exchange rate affects high-quality economic growth by influencing the number of students studying abroad, as depicted by the logistic transmission mechanism proposed in this study.Models (2),(3), and (4) present the number of students studying abroad with an exchange rate (one-tothree-month lag) and the combined effect of the number of students studying abroad and the RMB exchange rate on high-quality economic growth.In all three models, the coefficients of the interaction terms are significantly positive.Notably, the RMB exchange rate (one-month lag), together with the resulting number of students studying abroad, exerts the largest impact on high-quality economic growth.This indicates a time lag in the logical chain where the exchange rate influences high-quality economic growth through changes in studying abroad resource purchases and domestic labor productivity.Table 6 introduces the effects of the RMB exchange rate in conjunction with the number of returnees and education investment on high-quality economic growth, respectively.Replacing the number of students studying abroad with the number of returnees and education investment, Models (1), (2), and (3) still exhibit significantly positive coefficients for the interaction terms, with a goodness of fit greater than 0.95.This reaffirms the conclusions drawn in Table 5, even when substituting the independent variables.Taken together, the results from Table 5 and Table 6 suggest that changes in the number of students studying abroad due to fluctuations in the RMB exchange rate contribute to high-quality economic growth.Furthermore, this conducive effect is more pronounced when overseas graduates return to participate in domestic production.The pursuit of studying abroad, which can be seen as a form of purchasing educational resources, is influenced not only by fluctuations in the RMB exchange rate but also by the societal emphasis on and investments in education.This purchasing behavior holds a positive influence on enhancing the quality of the domestic labor force, thereby improving resource utilization efficiency as well as fostering innovation capabilities.

Table 5 Check on the Influence Mechanism of the RMB Exchange Rate and the Number of Students Studying Abroad on High-Quality Economic Growth

Table 6 Robustness Check of the Influence Mechanism of the RMB Exchange Rate on High-quality Economic Growth

Conclusion and Suggestions

Conclusion

The real purchasing power of the RMB varies with its exchange rate, leading to resource reallocation.When the currency is overvalued, its real purchasing power rises, and resources are more optimally allocated.Resource reallocation comes from improved factor utilization efficiency and technical progress.This in turn leads to high-quality growth.The most direct manifestation of this mechanism lies in imports and exports.Alterations in relative purchasing power, as a result of exchange rate fluctuations, impact the decision-making of various entities.Individually, studying abroad, as consumer behavior, not only grants them advantages in the job market but also catalyzes enhancing the quality of China’s domestic workforce, providing impetus for high-quality economic growth.

Suggestions

The China Banking and Insurance Regulatory Commission (CBIRC) emphasized that the long-term strengthening trend of the RMB will not change.This assertion is supported by China’s long-term balance of payments surplus and substantial net foreign investment, which act as reliable safeguards for maintaining the stability of the RMB exchange rate.The China Securities Regulatory Commission (CSRC) said it would expand high-level institutional opening-up, and moderately diversify financial channels for overseas listings.The People’s Bank of China (PBC) and the State Administration of Foreign Exchange (SAFE) stressed that efforts must be made to deepen the reform of the market-based exchange rate regime,further enhance the resilience of the RMB exchange rate, keep the RMB exchange rate at a reasonable equilibrium level, and maintain the healthy development of stock, bond, and real estate markets through concerted cross-department efforts.These public statements highlight that the RMB’s downward fluctuation is temporary, and its long-term strengthening trend will not change.On October 25, 2022, the PBC and the SAFE jointly announced to revise the macro-prudential adjustment parameter to 1.25 to expand companies’ and financial institutions’ cross-border funding sources and conduct a total of 230 billion yuan of reverse repos through bidding to maintain liquidity in the banking system.The above decisions show China’s determination and ability to stabilize the RMB exchange rate while maintaining the healthy development of stock, debt, foreign exchange, and real estate markets.The long-term strengthening of the RMB has created favorable conditions that facilitate highquality economic growth and ensure high-quality development.The long-term upward trajectory of the RMB exchange rate is expected to have a positive impact on fostering high-quality growth in China.This is further augmented by the policy of “supporting study abroad, encouraging return after graduation, and students and graduates making their due contributions whether staying abroad or returning home,” as well as the various talent introduction programs launched by different cities.Consequently, the entry of overseas returnees into the domestic labor market is anticipated to contribute to China’s economic development.

For individuals, the availability of a wider range of educational resources enables individuals to consider the possibility of studying abroad within their financial means.Currently, China faces a scarcity of educational resources, with a graduate student acceptance rate of only approximately 30 percent.The strategic utilization of foreign educational resources not only enhances the overall pool of educational opportunities but also provides individuals with academic advantages and a broader international perspective.In the postpandemic era, there has been a notable increase in the number of individuals participating in postgraduate entrance exams and civil service examinations, as well as a surge in the demand for studying abroad.Studying abroad presents an alternate avenue of competition that is comparably less intense than the competition in postgraduate entrance exams.It offers a cost-effective option when considering factors such as time cost, financial cost, personal development, and safety.From China’s perspective, studying abroad injects fresh vitality into its economy and expands the reservoir of well-educated and innovative talent.

For enterprises, it is necessary to be mindful of the potential risks associated with RMB exchange rate fluctuations and prioritize the application of innovation as a catalyst for growth.Traditional enterprises should direct their efforts towards transformation, with a particular emphasis on the utilization of technical professionals and innovative talent.Effective economic growth is impossible without the robust development and healthy competition of individual entities at the micro-level.Under the pressure of rising RMB exchange rates, enterprises are compelled to increase investments in R&D, introducing new equipment, upgrading operating systems, optimizing management systems, and adjusting organizational structures to enhance factor utilization efficiency.Such endeavors inevitably drive up the demand for technical and innovative talent, sending a signal to the labor market.Responding to these signals, individual participants in the labor market strive to enhance their skills and qualifications, ultimately bolstering labor productivity.At the same time, the increase in purchasing power also confers a competitive advantage to enterprises, allowing them to import more advanced production equipment, procure higher-quality imported intermediate goods, acquire knowledge of cutting-edge production technologies, hire employees with a more international perspective, and elevate labor productivity.

For the government, caution should be exercised to avoid excessive protectionism for enterprises, as it may potentially undermine the instrumental role played by RMB appreciation in driving enterprise transformation and investments in innovative R&D.It is also crucial to mitigate the survival and employment risks faced by businesses caused by the abrupt and significant changes in the exchange rate that allow limited time for enterprises to make necessary adjustments.Simultaneously, the government ought to enhance the talent introduction program to attract overseas graduates to return home and contribute to the realization of China’s great rejuvenation and minimize the brain drain.The entrance of overseas returnees into China’s domestic labor market will enhance domestic labor productivity and optimize domestic resources to some extent.This will pave the way for high-quality economic growth with greater synergy.

Contemporary Social Sciences2023年6期

Contemporary Social Sciences2023年6期

- Contemporary Social Sciences的其它文章

- The Modernization of Traditional Chinese Opera and a Local Perspective of Local Operas: A Case Study of the Research on the Yisu Art Troupe by Li Youjun and Guo Hongjun

- Reflections on, and Improvements of,the Mediation Functions of People’s Assessors

- Impact of Mandatory Provisions on the Validity of Juristic Acts: A Path for Legal Policy Analysis

- Promoting the International Dissemination of Chinese Culture Through International Chinese Language Education: A Case Study of Chinese-English Idiomatic Equivalence

- Research on the Chinese Path to Modernization in History, Key Topics,and Outlook: A CiteSpace-based Bibliometric Analysis

- An Empirical Assessment and Analysis of the United Nations Convention on Contracts Judicial Applicability in China