Softening the Landing Against a gloomy global outlook, China’s economy seeks a new transition

By Tao Zing

The debate regarding China’s economic outlook over the years to come is always relevant. It recently returned to the spotlight following broad stock market selloffs in October and the intensified fluctuation of the renminbi exchange rate over the past few months, with naysayers considering these the signal of a deep downturn.

Although to certain extent it reflects investor expectations, “whether it goes up or down, the stock market is not a good indicator of the economy,” David Blair, vice president and senior economist at the Center for China and Globalization (CCG), said.

Xu Hongcai, deputy director of the Economic Policy Commission at the China Association of Policy Science, echoed Blair and added that “the recovery trend of China’s economy is expected to consolidate in the near future.”

“I am optimistic about China’s longterm economic development,” he said.

The “China’s economic collapse” rhetoric has popped up more than once over the past decades—during the 1997 Asian financial crisis before China joined the World Trade Organization; in 2010, following the global financial crisis; and during the Chinese stock market crash of 2015. Yet the results speak for themselves—China countered all clichés.

“Recent times of economic slowdown require in-depth study and we should look at China’s economic development from the longer-term perspective and with a more positive attitude,” Xu Jin, a researcher with the Institute of World Economics and Politics under the China Academy of Social Sciences, said. “Bringing China’s economic outlook into disrepute might serve some political purpose, but the more important thing is we deal with the difficulties our economy faces right now.”

How to overcome COVID-19 disruptions is now a central feature on China’s economic development agenda.

Market Entities

Providing small businesses with abundant opportunities is important or else this kind of dynamic economy might be in trouble, according to Blair. “You need people who have the incentive to work hard to build a small business; they in turn also employ a lot of people. China needs to find a way to keep reassuring the small business,” he said, following his many conversations with Beijing-based entrepreneurs.

China’s registered market entities totaled 161 million by late June, up 4.4 percent from 2021, indicating sustained economic vitality. Among all, 50.39 million were businesses and 107.94 million were self-employed individuals, according to the State Administration for Market Regulation. Those businesses are mostly privately held small and medium-sized enterprises (SMEs).

Pu Chun, deputy head of the State Administration for Market Regulation, told a press conference on January 27 that market entities contribute 700 million jobs nationwide and have pushed China’s GDP to exceed 100 trillion yuan (US$15.76 trillion), therefore playing a critical role in economic development.

Last year, China unveiled a regulation to streamline market entity registration processes, lower institutional costs, and reduce their burden.

In November, a new regulation on advancing the development of selfemployed businesses took effect, with authorities pledging more support to those in difficulty. Efforts will be made to lower burdens on small firms and self-employed businesses, help them with financing and stimulate consumer demand, officials said.

In addition, many policies, including tax breaks and financial support, have been implemented to support SMEs in recent years in response to the impact of COVID-19.

Last year, China launched a series of anti-trust probes into some tech companies and stepped up regulation over their business operations, which was misinterpreted by some as a wide-ranging crackdown on private businesses or tech companies.

“These do not target the private sector or companies of any specific ownership types,” Xu Hongcai said, adding any monopoly could undermine fair competition, stifle market access and innovation, and ultimately harm consumer interests—and the entire economy.

“Allowing companies to establish monopolistic power is hurting small businesses and average people. I think what China is doing regarding the abuse of market dominance is necessary,” Blair said, stressing that the monopoly of big companies has led to declining U.S. entrepreneurship over the last 20 to 30 years.

Yadea electric scooters on the production line, September 22, 2022. (WANG QUANCHAO)

“These and other regulations not only apply to the private sector, but also to state-owned enterprises, and even to foreign capital; all need to be included given we always stress the promotion of fair competition and the efforts to create a high-standard market system and foster a world-class business environment,” Xu Hongcai added.

Multiple Measures

How to overcome COVID-19 disruptions is now a central feature on China’s economic development agenda. Nevertheless, some regional authorities have adopted simplistic measures to contain COVID-19 flare-ups, for example by implementing one-dimensional quarantine policies and expanding travel restrictions, according to media reports. These actions have led to widespread complaints of their impact on the country’s industrial and supply chains.

“We should not apply a one-size-fitsall approach and must do away with excessive prevention and control. This is a consensus,” Xu Hongcai said. “It is difficult to explore ways to balance virus containment with economic development. But we have to keep exploring.”

The relocation of some manufacturing and labor-intensive projects to countries with lower labor costs like India and Vietnam, too, has sparked concern and pushed China to seek new growth poles.

The digital economy, agriculture and senior healthcare industries all have huge potential with trillion-yuan markets, and they will eventually help to promote the development of technology and industrial upgrading, according to Xu Hongcai.

On the other hand, “the relocation also reflects that wages have gone up a lot in China, which is a good thing,” Blair said. “Real wages did not see this [type of evolution] in any other place. That means people in China are a lot better off. You want your wages to be high enough that the low value-added stuff relocates.”

Both of them agree the country should focus on innovation, which would act as a strong economic booster. “In fact, with the U.S. technology blockades [like the latest measure to exclude China from using semiconductor chips made anywhere in world with U.S. tools], we need to enhance our ability to innovate independently, especially in terms of training high-caliber professionals,” Xu Hongcai said.

Hard but High

“No economy is doing very well at this moment. Essentially, the whole world is coming to the end of a long boom,” Blair said.

China has created more real wealth and has been in a better situation than many other countries that rely entirely on monetary stimulus and debt to create nominal wealth, according to Blair. “Purely nominal wealth does not reflect improved living standards for ordinary people or increased productive capability.”

The Chinese economy grew by 3.9 percent year on year to 30.76 trillion yuan (US$4.32 trillion) in the third quarter of this year, 3.5 percentage points higher than that in the second quarter, data from the National Bureau of Statistics (NBS) showed.

In the first three quarters, the country’s GDP increased by 3 percent year on year, half a percentage point faster than that in the first half of 2022, according to the NBS data.

“China’s economy is on more solid ground in the third quarter of this year, with major indicators showing positive signs of stabilization,” Xu Hongcai explained, adding the recovery trend will continue.

But China is going to face challenges, partly because of a waning property market and shrinking external demand, according to Blair.

Regarding these problems, China has promoted a new pattern of development that is focused on the domestic economy and features positive interplay between domestic and international economic flows.

“China has entered a time of transition,” Blair said, “That’s going to require a lot of reforms, all sorts of investment, and lots of searching for opportunities to make life better,” Blair said.

- China Report Asean的其它文章

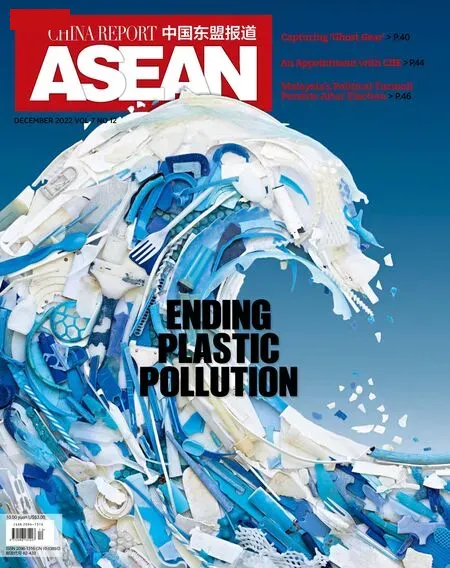

- Capturing ‘Ghost Gear’Discarded fishing gear continues to “fish” as the ocean’s silent killer

- Saving The Ocean From Plastic Humans are grappling with the growing plastic mess in the oceans

- NEWS in Brief

- Picturing the Times

- CHINA AND INDONESIA JOIN HANDS TO BOOST DEVELOPMENT Solidarity is key to tackling global challenges

- SOFT POWER, SOLID FOUNDATION Cultural exchanges take China-Thailand relations to new heights