Impact and Policy Implications of Swine Epidemic on Price Fluctuation of Livestock Products in China

Yan ZHAO, Hui LI, Xinyi ZHANG

College of Economics and Management, Henan Agricultural University, Zhengzhou 450000, China

Abstract The drastic price fluctuation of livestock products caused by frequent swine epidemics has seriously affected the stable and healthy development of the livestock product market. It is important to develop strategies for the stability and development of livestock product market by understanding the impact of swine epidemic on the price of livestock products. Therefore, we systematically analyzed the impact of the swine epidemic on the price of livestock products in China based on monthly data from February 2009 to July 2020 using the factor augmented vector autoregression (FAVAR) model. The results showed that: (i) During the swine epidemic, the price of pork first showed a negative response and then a positive response, while the price of other livestock products showed positive response overall. (ii) The price of pork was the most affected by the swine epidemic, followed by price of chicken. Price fluctuation of beef and mutton was similar, and the price response of eggs and fresh milk was relatively smaller. Based on these results, we put forward policy suggestions for stabilizing the price of livestock products in China during swine epidemic from the aspects of improving the defense system and guiding consumption scientifically.

Key words Swine epidemic, Price of livestock products, Price fluctuations, FAVAR model

1 Introduction

As an important part of agricultural products, livestock products occupy an important position in the nutritional diet structure of urban and rural residents. Its price changes not only directly affect the healthy operation of market economy, but also relate to the national economy and people’s livelihood. In recent years, Chinese animal husbandry industry develops rapidly and enters new stage step by step. At the same time, it has obtained the party and the government’s high attention. In September 2020, theOpinionsofTheGeneralOfficeoftheStateCouncilonPromotingHigh-qualityDevelopmentofAnimalHusbandrypointed out that the overall competitiveness of animal husbandry and the supply security of livestock and poultry products should be improved, so as to form a high-quality development pattern with product safety and regulation effectivity. However, there are still many problems in the development of Chinese animal husbandry industry. Factors such as rising breeding cost, shortage of agricultural resources, frequent occurrence of animal diseases, and change in trade terms continue to impact the market of livestock products, resulting in serious damage to the production of livestock and poultry, and drastic price fluctuations in the market of animal products.

China is the largest producer and consumer of pork in the world, and the total value of pig industry accounts for more than 65% of its total value of livestock husbandry[1-2]. As the main meat consumed by Chinese, changes in the balance between supply and demand of livestock products caused by pork price fluctuation will inevitably lead to the price fluctuation in other livestock and poultry products, and consequently can cause the CPI index to change[3-4]. However, swine epidemics occur frequently. The outbreak of swine pneumonia, swine erysipelas, porcine reproductive and respiratory syndrome in 2009, foot-and-mouth disease in 2011 and 2012, African swine fever in 2018, all disrupted supply and demand of pork market to varying degrees. At the same time, these events have caused a worldwide price fluctuation of pork and other livestock products, causing consumer to panic, and undermining the stable movement of animal product market[5]. Especially after the African swine fever spread to China, production of livestock products fell significantly. In 2009, China’s meat production fell 10.04% year over year, with pork production down 21.30%, which was the most pronounced decline in recent years. The decline of pork production changed the balance between market supply and demand, resulting in the price of pork rose to historically high 42.50% year-on-year in 2019. Meanwhile, the prices of other livestock products also showed an upward trend. The year-over-year price rising rates of beef, mutton, and chicken in 2019 separately reached 11.78%, 16.04% and 16.61%[6]. Therefore, the swine epidemic is an important contributing factor to the drastic fluctuation of the price of livestock products in China.

In this paper, factor augmented vector autoregression (FAVAR) model was used to analyze the impact of the swine epidemic as well as a large number of other factors on the price of livestock products. This study is helpful to accurately understand the impact of emergency event on the supply of animal products, to stabilize price of animal products, and to provide theoretical support and empirical basis for ensuring healthy and sustainable development of animal husbandry.

2 Literature review

As an important consumer goods, animal products occupy an important position in everybody’s life. However, in recent years, frequent swine epidemics have caused drastic fluctuation of livestock products, which has seriously affected the normal consumption of livestock products (demand) and the operation of livestock product market (supply). The outbreak of swine epidemic is characterized by abruptness and extensiveness, which is an important uncertainty shock faced by animal husbandry[7]. Compared with breeding cost, consumer living standard and related product price changes, price of livestock products has been more significantly impacted by disease outbreak[8-9].

The essence of livestock product price fluctuation is the result of supply and demand acting together. On the supply side, the adoption of domestic or small-scale free-range farming in many areas of China, as well as the widespread practice of feeding untreated swill to pigs in China, has largely increased the risk of swine infection[10]. And there is no effective vaccine or treatment to the disease yet. Therefore, when the disease occurs, the pathogen spreads through animal feeding and product trade chain, causing high morbidity and mortality, affecting the production and price of animal products, and limiting the role of market mechanism[11].

With the rapid spread of the epidemic, factors like farmers’ lack of awareness of prevention and control, inadequate technical conditions for biosafetyetc.drastically reduce pork supply[12]. At the same time, farmers’ decreasing enthusiasm aggravates the reduction of pork supply and further widens the price fluctuation range. In summary, swine epidemic amplifies pork price fluctuation[13-14].

On the demand side, the outbreak of swine epidemic causes panic in the consumer market since swine epidemic has a big impact on consumers’ food demand and even consumers’ short-term consumption patterns, which brings huge losses to the pork industry[15]. Therefore, outbreak of swine epidemic can change both supply and demand of pork market, cause drastic price fluctuation and consumer panic, and can cause heavy blow to pork market[16].

In addition, livestock products can also interact with each other. Mason-D’Croz analyzed the impact of global pork production reduction due to pandemic of different impact size on other related industries. The results showed that a reduction in pork production can lead to an increase in global pork prices of 17%-85%, and the contribution rate of pork price fluctuation to beef price fluctuation was 4.15%. Changes in pork demand can directly or indirectly affect the feed market, as well as the demand and price of pork substitutes such as beef, mutton, and poultry[17-18]. Generally speaking, the prices of pork substitutes such as beef have the same fluctuation trend as pork prices[19].

To sum up, scholars have conducted in-depth discussions on the influencing factors of price fluctuations of livestock products from different perspectives. However, these studies mostly focused on the microeconomic factors that affect the price of livestock products, and few considered the impact of macroeconomic factors on the price of livestock products. We used FAVAR model for empirical test, which not only avoided the dimension limitation of VAR model, but also allowed for evaluation of multiple factors’ impact on price fluctuation of livestock. Therefore, we thoroughly analyzed the impact mechanism of swine epidemic on the price of livestock products in China, and empirically tested its effect degree with the help of FAVAR model. We put forward relevant suggestions based on this analysis to calm the price fluctuation of livestock products in China and to ensure sustainable and stable development of China’s livestock industry.

3 Analysis of transmission mechanism

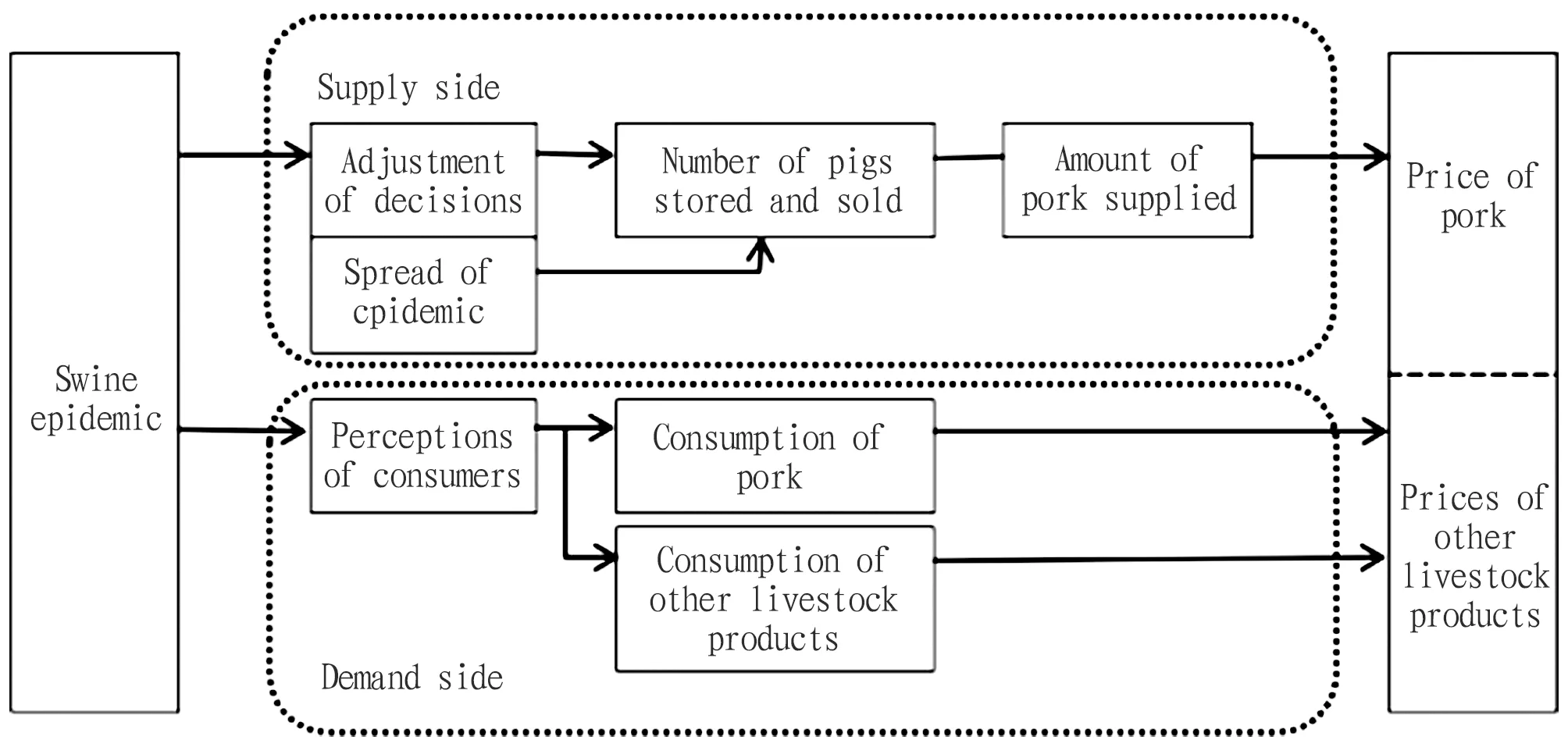

Swine epidemic affects the price of livestock products mainly through impacting market supply and demand. The price of pork and other livestock products have different reactions to this impact. The extent and direction of price fluctuation depends on the strength of the mechanism of supply and demand. The specific conduction roadmap is shown in Fig.1.

Fig.1 Roadmap for transmission of price fluctuation of livestock products affected by swine epidemic

3.1 Supply sideSwine epidemic impact the supply of livestock products in China mainly through two channels: production strategy adjustment and epidemic spread.

First, from the perspective of production strategy adjustment, after the outbreak of the epidemic, producers obtain relevant epidemic information through various channels. At the same time, producers make the decision and adjust production strategy according to their own experience, understanding of the epidemic, degree of risk preference and potential risk bearing capacity and other information. In response to epidemic, farmers will control the breeding scale to reduce losses in order to avoid risks[20]. In addition, majority of pig farmers in China are small scale farmers. Due to inadequate epidemic prevention awareness, small-scale farmers are prone to withdraw from the market during an epidemic, which greatly reduces the quantity of pig stock and sold and exacerbates the price fluctuation of pork[21]. Due to the spillover effect of the swine epidemic, decrease in pork consumption caused by the swine epidemic will lead to the increase in demand and consequent price of other animal products. Second, from the perspective of the spread channel of the epidemic, spreading of the pathogen of pig disease to the surrounding breeding areas through transportation vehicles or airborne powder and floating materials with the help of wind, will result in the expansion of the affected area and increase in the pig mortality rate and the number of sick pigs culled. Consequently, it will decrease the number of pigs stored and sold, and ultimately leads to the decrease of pork supply. Meanwhile, the epidemic rapidly spreads around the world resulting in global shortage of pig supply. Therefore, it is impossible for China to make up for the domestic consumption gap through expanding imports, which further exacerbates the rise in pork prices[22]. Due to the substitution effect among livestock products, the consumption demand for chicken, beef and other livestock products increases, and consequently their price rise.

3.2 Demand sideThe impact of swine epidemic on the demand side of the price of livestock products in China is mainly through the consumer’s cognitive channel. In the early days of swine epidemic, consumers obtain relevant information through news outlets, food safety education and other channels to improve their awareness of food safety risks. However, due to limited knowledge of the epidemic, consumers’ negative emotions towards pork purchase skyrockets and confidence in consumption declines, leading to consumer panic about food safety consumption[23-24]. Studies have found that losses caused by consumer panic were usually greater than the losses caused by food safety problems themselves[25]. In the early days of the swine epidemic outbreak, consumers overreacted to perceived risks, leading to a slump in pork consumption[26-27]. However, as the market supply of livestock products is basically unchanged in the short term, pork price consumption is reduced, resulting in a decrease in pork price. Meanwhile, consumption of pork substitutes increases and prices of other livestock products, such as chicken and beef rise. At the middle and late stages of the epidemic, with the effective control of epidemic by Chinese government and recovery of consumer confidence, the demand for pork recovers. At the same time, with continuing spread of the epidemic, market supply of pig further decreases. Increases in pork demand and decreases in pork supply lead to rise in pork price. On the other hand, the price of other livestock products increases due to the substitution effect[28].

In conclusion, swine epidemic affects both the supply and the demand of the livestock product market, and the joint action of supply and demand causes the price fluctuation of livestock products. That is, the swine epidemic directly affects the pork price through the production strategy adjustment and the spread of the epidemic. The consumer cognition on the demand side influences the product consumption in the livestock product market and then affects the price of pork and other livestock products.

4 Models and methods

4.1 Model settingThe price change of livestock products involves a variety of factors, but the VAR model can only contain a small number of variables, which is not enough to comprehensively measure the price change of livestock products. Therefore, we adopted the FAVAR estimation model proposed by Bernankeetal.[29]which effectively avoided the problem that the VAR model could not accommodate more variables and easy to omit important information. In addition, FAVAR model also improves the comprehensiveness of the model and the robustness of the final result. The model is set as follows:

Ct=Φ(L)Ct-1+Vt

(1)

Xt=ACt+et

(2)

In the traditional VAR model,Ctcontains only a small number of variables. In order to solve the problem of small scale and incomplete information in the traditional VAR model, this paper refers to the research method of Boivinetal.[30]to setCtconsists of observable factorF1and unobservable other influences cofactorF2, that is,Ct=[F1,F2].Φ(L) is the p-order lag operator polynomial,Vt-N(0,δ2) is the random disturbance term. Thus, model (1) becomes a VAR model consistingffactorF1andF2. IfF2is estimated, model (1) is transformed into a common VAR model, and then the impulse response function can be applied to reflect the dynamic effects contained in the model.Xtis the set of factors affecting the prices of major livestock products in China, which is a high-dimensional information set the few common factors inCtcan reflect the large amount of information inXt.Ais theN×K, the factor loading matrix, andetis theN×1 dimensional idiosyncratic shock.

4.2 Variable selectionIn order to more accurately measure the impact of the swine epidemic on the price changes of livestock products in China, we combined supply and demand theory investment and consumption theory, and selected livestock product price, swine epidemic breadth index, supply and demand variables, domestic market variables, and international factor variables to construct an 88-dimensional macroeconomic information set. All these variables were monthly data. Since swine diseases such as swine pulmonary disease, blue ear disease and swine erysipelas occurred frequently in 2009, and the breadth index of swine epidemic was published since February 2009. The time series data from February 2009 to July 2020 were selected as the data sample interval, and the actual sample period was 138.These data were obtained from Brick Agricultural Database, National Bureau of Statistics website, Foresight Database, People’s Bank of China website and International Monetary Fund (IMF) database.

The specific data are described as follows:

(i) Livestock product price variables. In this paper, six livestock products were selected for this study, and the selection was based mainly on the economic share in the market. The four categories of pork, chicken, beef and mutton account for more than 80% of the total meat production[31]. Pork, chicken, beef and mutton are produced, consumed, traded and transported in large quantities and are closely linked to the daily life of the population. Taking into account of the consumption needs of vegetarians and people in a few regions, two other livestock products with high annual production value, namely raw milk and eggs, were included to provide a more comprehensive overview of price changes in China’s livestock products market.

(ii) Swine Epidemic Index variable (EPI for short). Due to consumption preferences, pork consumption in China accounts for more than 60% of total meat consumption, and changes in pork prices are related to the daily social life of residents. The frequent outbreaks of major swine epidemic in recent years have led to persistently high pork prices, causing a huge impact on the livestock product market. In this paper, the width of the swine epidemic index was selected to measure the spread of the swine epidemic. The swine epidemic breadth index is a series of indices derived by monitoring the situation of swine epidemics in different places and quantifying the scores in terms of outbreak scale, severity and spread speed. The index is between 0 and 1. The smaller the index value is, the lighter the epidemic situation is. The normal epidemic level is between 0 and 0.2, and greater than 0.25 indicates a serious swine epidemic situation. The specific situation is shown in Fig.2.

Fig.2 Changes in the swine epidemic width index (Retrieved from Brick Agricultural Database)

(iii) Supply and demand variables. Supply variables including cost index, profit index, production price index and others were used to measure changes in production cost of livestock and poultry products. The demand variable included consumer price index (CPI), real gross domestic product (GDP), total retail sales of consumer goods and others to describe the economic situation of consumers. Among them, GDP is usually regarded as an important indicator to measure the economic development of a country or region, while CPI is a macroeconomic indicator reflecting the changes in the price level of consumer goods and services generally purchased by households, as well as an important indicator to measure inflation. The total retail sales of consumer goods and other variables were used to measure the living standard of residents, prices and purchasing power of society.

(iv) Variables of domestic market and international factors. Domestic market variables included gross domestic product, money supply, gross output value of agriculture, forestry, animal husbandry and fishery to measure the changes and market size of China’s money market. The international factor variables included the import and export value of animal products and the total value of import and export, to indicate the international situation and the state of trade. In addition, in the era of rapid economic and information development, energy and transportation have become indispensable development factors in China’s production and life. In this paper, crude oil output, electricity generation and other variables were selected to measure China’s energy transportation. At the same time, due to the unilateralism and trade protection policies of the United States, which have caused huge negative impact on international free trade, and the constant trade frictions between China and the United States, this paper introduced the uncertainty index of the trade policy of the United States to measure the changes of the political economy of the United States.

In this paper, the original data were processed as follows: (i) x-13 method was used to eliminate influence of seasonal factors for the series requiring seasonal adjustment, and HP filtering was used to extract the business cycle. (ii) In order to eliminate the influence of price factors, actual price data were converted using the consumer price index based on the January 2009 period. (iii) ADF method was used to test the stationarity of time series data. For non-stationary time series data, logarithmic or differential processing was adopted, and the same processing method was adopted for similar data. No manipulation was made to stable data. After testing, all variables in this paper were stationary data. (iv) In order to eliminate the influence of dimension, all data were standardized and processed into standard series with mean of 0 and standard deviation of 1.

4.3 Determination of the number of factorsIn order to estimate the results of the FAVAR model, the number of common factors must first be determined. In this paper, we referred to Jackson’s method[32]and used Eviews 9 to conduct factor analysis on the macroeconomic information set, and finally determined five common factors. The number of unobservable co-factors was determined to be 4, excluding the observable co-factor "swine epidemic". Then, Boivin’s principal component iterative method was used to eliminate the parts of the common factors that could be explained by the swine epidemic, so as to obtain F2. This method effectively overcomes the subjectivity of the method proposed by Bernankeetal.[29].

5 Results and analysis

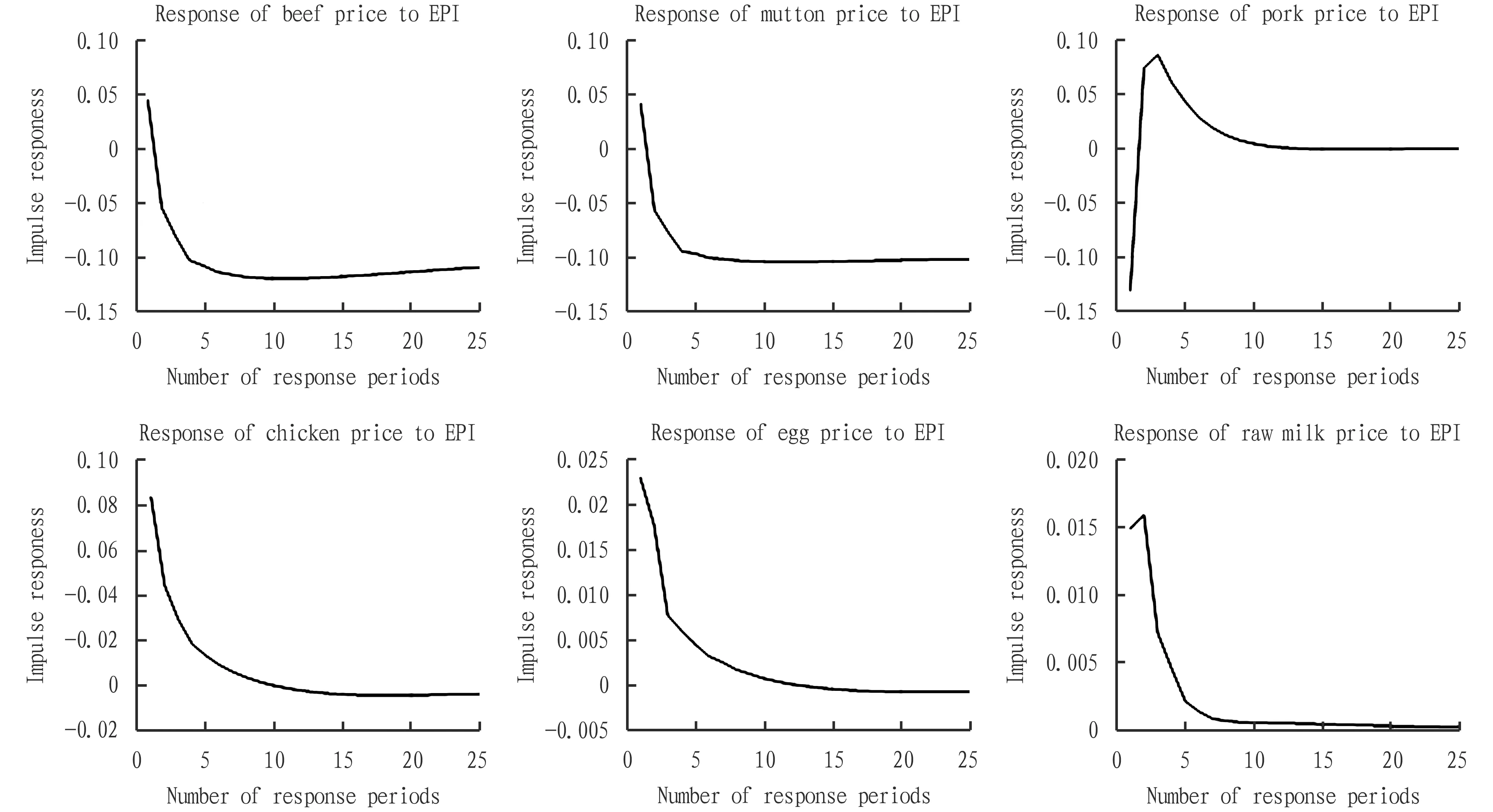

The impulse response function shows the impact of a variable shock on the current and future values of other variables and the time-delay relationship between variables. Impulse response plots were used to quantify and evaluate the impact of price changes on livestock products. The swine epidemic affects the price fluctuation of livestock products mainly through supply side and demand side. The impact mechanism and intensity of swine epidemic on pork price and other animal products were different. Specific results are shown in Fig.3.

As shown in Fig.3, when the positive impact of one unit standard deviation was given to the swine epidemic in the current period, the price of pork showed first negative and then positive response, while the prices of other livestock products showed roughly positive response, and the response intensity gradually weakened over time. Among them, pork price had the largest response intensity, followed by chicken price. Beef and mutton prices had similar fluctuations, while eggs and fresh milk prices had relatively little response. Specifically, due to the impact of the live pig epidemic, pork price showed a negative response of 0.126 3 in the 1stperiod, then quickly turned to a positive response, and the positive response reached a peak of 0.085 9 at the 3rdperiod, and then the response gradually weakened and converged to 0 at about the 12thperiod. The chicken and egg prices reached the maximum positive response of 0.083 7 and 0.022 6 respectively in the first period after the impact of the swine epidemic, and then the response subsided and became stable in the 12thperiod. The price of beef and mutton showed a positive impact of 0.058 3 and 0.057 6 in the 1stperiod, and then the response decreased and became stable around the 8thperiod. After the fresh milk price was impacted, it showed a positive response of 0.014 9 in the 1stperiod, then rose to a peak of 0.015 6 in the 2ndperiod, and then the response weakened until the 8thperiod. This indicates that the swine epidemic has a large impact on the price of livestock products in China, and the impact on the price of pork is the biggest. In addition, the response degree of different animal product prices to the impact of swine epidemic factors was different, and the differences were shown in the following aspects.

Fig.3 Impulse response of swine epidemic on price fluctuations of livestock products

First, after the impact of swine epidemic factors, pork price initially showed a negative response, then quickly turned to a strong positive response, and the response intensity gradually weakened with time. The impact of the swine epidemic on pork prices is mainly transmitted through supply and demand side. At the beginning of the outbreak, from the point of the supply side, the pathogen of swine disease spread from endemic areas to non-endemic areas through various channels, and the number of dead pigs increased. In order to cut off the spread of the disease, some farmers even culled all pigs that might be affected, leading to a significant increase in the number of pigs culled and a sharp decline in the supply of pigs on the market[33]. From the point of the demand side, when consumers first obtained epidemic information through various channels, they usually showed excessive panic and held negative attitudes towards both epidemic and non-epidemic areas, which is called "Tacitus effect", resulting in a significant decline in pork purchase intention. Comparing the strength of supply and demand, at the beginning of the outbreak, the market supply of pork exceeded the demand, and the price of pork fell. At the middle and late stage of the epidemic, farmers had to invest a large amount for epidemic prevention procedures after the outbreak of the epidemic, which led to the increase of breeding costs. Large-scale pig farmers controlled the scale of breeding, and small-scale farmers were prone to exit the market, further aggravating the decline of pig stock and leading to a long-term supply shortage. From the perspective of the demand side, with the increase of the government’s control of the disease and the correct guidance of the media, consumer’s confidence picked up, the "Tacitus effect" gradually disappeared, and the consumption intention increased. In addition, consumers expected that the epidemic would be difficult to completely control in a short period of time, and the pork market would be in short supply for a long time. So, there was a large number of "meat hoarding" phenomenon, which further promoted the increase in demand for livestock products. During the middle and late period of the epidemic, the livestock product market showed an increase in demand and a decrease in supply, therefore pork prices rose rapidly, surpassing even pre-pandemic pork prices and increasing further. Therefore, during swine epidemic, the pork price showed first a negative and then a positive response.

Second, the response of pork price to swine epidemic was the strongest and lasted for a long time. The main reason is that the pathogen infects pigs and directly affects the culling quantity and mortality of pigs. Moreover, the transmission speed of large-scale pig disease is extremely fast, and the pathogen spreads around the world through air, excreta, transport vehicles and other media, which can quickly lead to the decline of the global pig market supply[34]. Therefore, it is impossible for China to fill the domestic supply and demand gap through the import of foreign pork. Besides, according to people’s consumption habits, pork is the main meat consumer product in China, and the market share of pork is extremely high. In addition, the growth cycle of pigs is usually 3-4 years, so it is difficult for pork production to increase quickly in the short term to fill the consumption gap. Therefore, when hit by swine epidemic, pork price changes most drastically compared to other livestock products and lasts longer.

Third, the prices of beef, mutton, chicken, eggs, and fresh milk showed positive response after being impacted by one unit of swine epidemic factor. The main reason is that after the outbreak of the swine epidemic, pork consumption confidence of both urban and rural residents had been negatively affected by the access to epidemic-related information, and a large number of buyers flowed into the substitute market, resulting in demand for chicken and other livestock products that exceeded supply and the price rose. Later, with recovery of consumer confidence, consumption of pork gradually picked up, and the number of consumers in the market of other animal products returned to a normal level, and the price gradually fell.

Fourth, the response intensity of price of chicken, beef and other livestock products to the swine epidemic was less than that of pork, with chicken price responded to swine epidemic more drastically than price of beef and other livestock. The main reason is that when the swine epidemic broke out, pork was directly affected, and other livestock products were indirectly impacted and their prices fluctuated due to spillover effect. Therefore, the response degree of chicken, beef and other livestock was smaller than that of pork price. Chicken is the second most consumed meat, and is a "perfect" substitute for pork. Chicken is an excellent source of proteins and is a popular choice for healthy diet. Chicken breast is especially popular for higher protein content and lower fat and fewer calories compared to other meats. More importantly, chicken is much cheaper than beef and mutton and has much shorter breeding cycle. When swine disease broke out, pork consumption fell, and the spillover effect led to an influx of buyers to the chicken market, which was in short supply and prices rose sharply.

6 Conclusions and policy implications

6.1 ConclusionsIn this paper, multidimensional monthly data from February 2009 to July 2020 were used to systematically analyze the impact of the swine epidemic on the price of livestock products in China using FAVAR model. The results showed that, under the impact of the swine epidemic, pork price was greatly affected by the changes in consumption demand at the initial stage, showing a negative response, and then quickly turned to a positive response because of sharp decrease of supply, and the response degree gradually weakened over time, and returned to 0 at about the 20thstage. Under the impact of the swine epidemic, the prices of chicken, beef and other livestock products showed a positive response due to the spillover effect of pork price changes; when one unit of pig epidemic factor was given to the price of livestock products, the price of pork was directly affected and fluctuated the most. As a "perfect" substitute for pork, the price of chicken fluctuated relatively more compared to price of other livestock such as beef and mouton.

6.2 Policy suggestionsFirst, we should strengthen epidemic prevention and control and improve the defense system. We should improve epidemic surveillance and early warning system to enable early epidemic detection. Outbreak and spread of the epidemic should be shared timely and transparently to carry out targeted intervention measures to avoid the price amplification effect caused by market information asymmetry.

Second, it is recommended to professional skills through continue education to enhance scientific decision-making. Strengthening knowledge training on epidemic prevention and control will enhance the differential diagnosis capability of animal epidemic prevention personnel and animal farms at the community level. This will also ensure that when uncertain factors occur, animal farmers can make decisions based on their scientific knowledge and experience, and avoid decisions driven by panic. This will also improve the level of biological safety.

Third, it is recommended to improve information management and strengthen consumer guidance. We should accelerate the construction of an information management system that effectively connects animal production, breeding and slaughtering. This will enable consumers to trace product information and will enhance consumer’s confidence in product quality. Government should also strengthen scientific education on transmission routes and methods of epidemic diseases so and guide consumer spending, so that residents are able to correctly understand the epidemic and do not believe rumors. This will also ensure rational consumption and avoid the outbreak of consumption panic.

Asian Agricultural Research2022年11期

Asian Agricultural Research2022年11期

- Asian Agricultural Research的其它文章

- Monitoring and Evaluation of Benefits of Project of Returning Farmland to Forests in Henan Province

- Present Situation of Dictyophora Industry in China and Cultivation Technique of Dictyophora rubrovolvata

- Relationship Between Micromorphological Structure of Leaf Epidermis and Drought Resistance in Callisia repens

- Impacts of ENSO on the Welfare of Rural Residents in China: A Stochastic CGE Model Assessment

- Impacts of Sand and Dust Storms on Regional Economy Based on Stochastic CGE Model: A Case Study in Inner Mongolia, China

- Current Situation, Problems and Countermeasures of Marine Ranching Development in Guangdong Province, China