Argentina’s new target: regional supply hub in Latin America

By Zhao Xinhua

Argentina, which has been hit by the COVID—19 crisis, is showing signs of optimism after huge efforts by the whole society, with a surprisingly fast industrial recovery in 2021, only lagging behind China. Investment and em—ployment have risen, and Argentina’s surge is a recovery from a low base. At the same time, Argentina’s weak production and supply capacity and strong dependence and vulnerability in its trade structure lead to its domestic economy being extremely sensitive to international market fluctuations and easily falling into the trouble of inflation. The development of companies in the textile and clothing value chain follows this trajectory, according to a survey by Fundacion Pro Tejer. The survey covers a representative sample of more than 80 companies of various sizes and regions in the value chain.

Clothing production needs technical support

According to the survey, four out of five companies improved their performance and sales in 2021 compared to 2019, with one of the most prominent areas of performance being investments, which exceeded USD 200 million. These investments include not only traditional invest—ments but also the development of cutting—edge products such as tech—nological textiles (flame retardants) and circular economy areas (pro—tecting the environment through waste recycling). It also covers smart textiles with technological content. Virtually all companies in the sector invested in new technologies related to Industry 4.0 and three out of five made traditional investments, such as installing new machinery and im—proving production facilities.

In terms of employment, more than half of companies created more jobs in 2021 than in 2019. Maintaining this trend is crucial to support the country’s economic recovery. Among them, the textile and clothing sector plays a major role, creating more than half a million jobs and with the po—tential to double that number in five years.

Argentina's textile and clothing industry chain covers a wide range. Whether it is raw materials such as cotton, wool and camel skin, synthetic fibers from petroleum, or clothing and end products made by spinning and weaving, Argentina has the potential and ability to continuously improve the value—added of the industrial chain. Among them, spinning and weaving show the greatest vitality, while garment production, as the weakest link in the value chain, still lags behind. This reveals the structural problems that have always existed in Argentina's garment production: the lack of workshops, the lack of formalization of operation pro—cesses, the shortage of skilled workers and low produc—tivity are becoming the huge bottlenecks of increasing production in Argentina's garment production.

Nevertheless, the textile industry has made great contributions to Argentina's foreign exchange Argen—tina has made remarkable achievements in the import and export of textiles. In 2021, 27% of the surveyed companies had export business, and it is expected that this proportion will further increase in 2022.

China is Argentina's largest textile importer

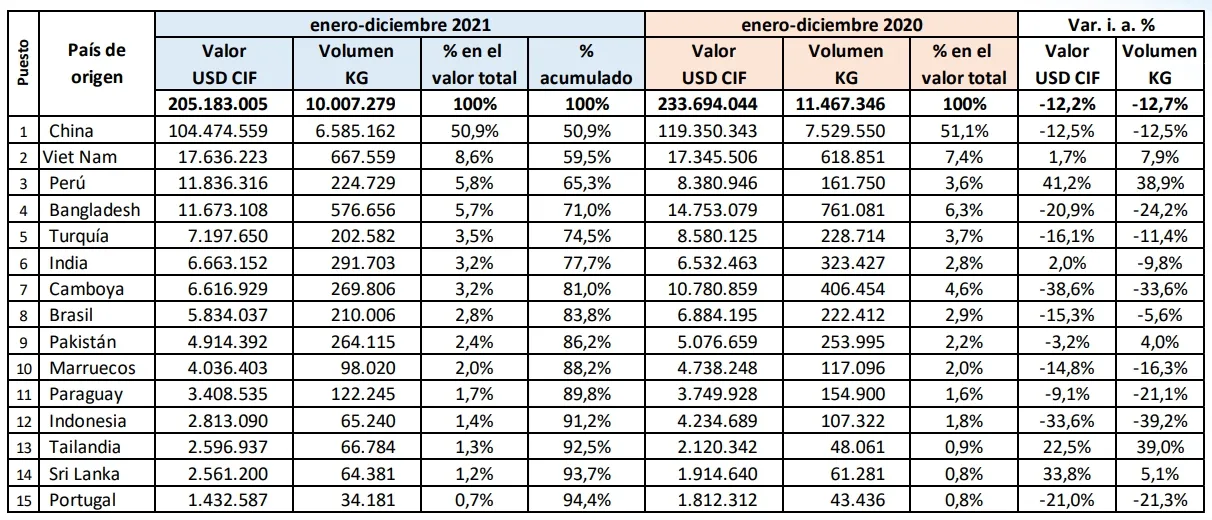

In January—December 2021, Argentina’s apparel imports in dollar terms fell by 12.2 percent year—on—year. Due to the low base of import values in 2020 and 2021 and the shortage of foreign exchange faced by the Argentine economy, the imports in 2022 is expected to be similar to the past two years, and possibly lower.

Outerwear was the most imported item in 2021, accounting for 18.5 percent (USD 39.9 million) of the total value, followed by trousers at 17.6 percent and knitwear at 12.9 percent. While imports in almost all categories declined from the same period last year, imports of men’s swimsuits increased from USD 3.2 million in 2020 to USD 5.2 million in 2021. The main source of imports in 2021 was China, which accounted for 50.9 percent of imports in dollar terms (similar to 2020), followed by Vietnam with 8.7 percent and Peru with 5.8 percent. Mercosur accounted for 4.8 percent oftotal imports in 2021, while South America accounted for 11.8 per—cent. Asia accounts for more than 80 percent.

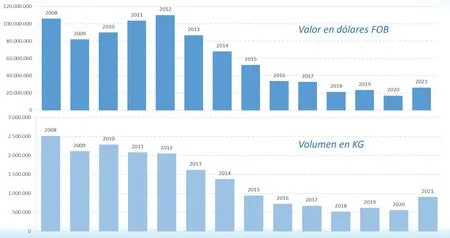

Figure 1 Accumulative import value and amount of clothing in Argentina in different years (Units: US dollars, kilos)

Figure 2 Top 15 countries in terms of apparel imports to Argentina in 2020 and 2021 (Units: US dollars, kilos)

Figure 3 Accumulative export value and amount of clothing in Argentina in different years (Units: US dollars, kilos)

In terms of exports, Argentina’s apparel exports in dollar terms increased by 54.5 percent to USD 26.3 million in January—December 2021 compared to the same period in 2020. While a number of fac—tors add to the uncertainty, such as the increase in global freight costs and the stability of real exchange rates, and the exports in 2022 is expected to be similar to that in 2021, Mercosur member states and Chile remain the main des—tinations for apparel exports. Footwear and stockings were exported the most in 2021, accounting for 25.9 percent of the total value, followed by trousers at 17.5 percent and T—shirts at 12.2 percent.

In early February this year, China and Argentina signed the MOU on Belt and Road Cooperation, creating new op—portunities for deepening bilateral cooperation. Through Belt and Road Cooperation, China and Argentina will give full play to their complementary strengths and deepen cooperation in infrastructure, energy and mining, manufacturing, agriculture and high technology to help Argentina achieve high—quality development.

Promising future of Argentine textile industry

Affected by the spillover effect of the Russia—Ukraine conflict and the COVID—19 pandemic, nearly 80 percent of Ar—gentina’s foreign trade enterprises have fallen into difficulties due to increased costs. The main problems they face are the sharp increase in freight costs and the shortage of contain—ers caused by the global logistics difficulties. In addition, due to the impact of the pandemic, customs clearance of cross—border land routes in Argentina, Chile and other countries has been slow, as well as the low water level of the waterway due to the continuous dry weather in South America, which has severely restricted water freight.

Even so, four out of five companies predicting business prospects for Argentina in 2022 think they will increase sales and overall performance, and more than half plan to hire new employees. And seven in ten plan to make new investments to boost production.

According to a survey by McKinsey and Company, 71 percent of apparel brands in the United States and Europe plan to increase the sources of supply in nearby countries by 2025. Argentina may become a regional supply hub for Latin America by expanding its businesses and building new facto—ries and creating international brands. Argentina will improve the predictability and enabling environment for the creation of industrial value—added.

- China Textile的其它文章

- Dear readers:

- 13th ITMF Corona Survey Business situation and expectations positive but visibly weaker

- CNTAC is strongly opposed to “Uyghur Forced Labor Prevention Act”

- European and American brands withdrawn from Russia

- France cooperates with EU institutions to try to get out of trouble

- Cross-industry innovations solve the new problems of German textile industry