Vietnam’s Robust Economic Recovery

Guo Xixian

Building on theeconomic recovery inthe fourth quarter of2021, Vietnam’s grossdomestic product (GDP) grew at a rate of morethan 5 percent again inthe first quarter of 2022, showing a good momentum of economicgrowth.

Statistics from the GeneralStatistics Office ofVietnam (GSO) showed that the country’s GDPin the first quarter of 2022 wasUS$92.17 billion, up 5.03 percentyear on year. Looking back at2021 statistics, Vietnam’s GDPgrew by 4.72 percent year on yearin the first quarter, 6.73 percentin the second quarter, and only6.17 percent in the third quarter.However, since the countryreopened in October, its economic activities have only resumedgradually. In the fourth quarter ofthe year, GDP grew by 5.22 percent year on year, which contributed to annual growth of 2.58 percent in2021.

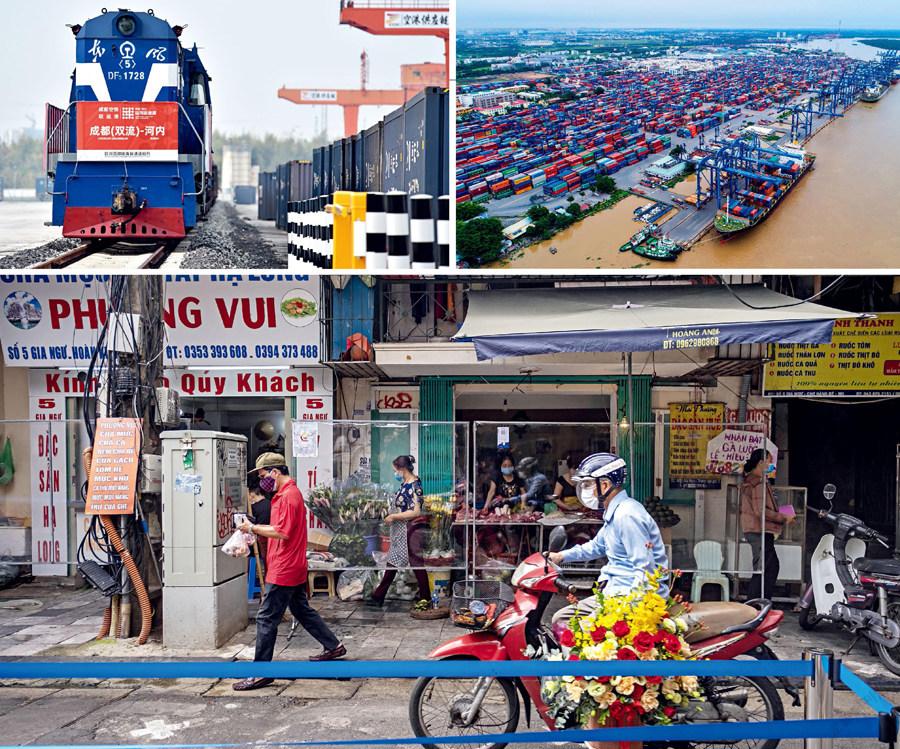

Vietnam’s economic growthin the first quarter of 2022 waslargely dependent on export trade. GSO statistics show that in thefirst quarter of 2022, Vietnam’stotal imports and exports ofgoods reached US$176.35 billion,up 14.4 percent year on year.Its exports reached US$88.58billion, up 12.9 percent, includingUS$65.31 billion of exports in thefield of foreign direct investment(FDI, including crude oil), up10 percent. Its imports reachedUS$87.77 billion, up 15.9 percentyear on year, including imports ofUS$58.34 billion through foreignenterprises, up 17.1 percent.

Alongside exports,consumption and investmentare also getting back on track.According to Vice Minister ofPlanning and Investment ofVietnam Tran Quoc Phuong, thecountry’s consumer price index(CPI) rose by 2.1 percent in thefirst four months of this year, thebalance between fiscal, money,and credit was guaranteed, andstate fiscal revenue was in surplus. Total retail sales of consumergoods and services in March 2022were estimated at 438 trillionVietnamese dong (VND), up 2.9percent month on month and 9.4percent year on year. In the firstquarter of 2022, Vietnam’s FDI wasestimated at US$4.42 billion, up 7.8 percent year on year to the highestlevel of FDI in the past five.

GSO Director General NguyenThi Huong identified severalareas that have been particularlyencouraging in the first quarter of 2022 compared to last year. Theservice sector has been recovering robustly, and manufacturing,especially processing, isembracing strong momentum.The Asian Development

Bank (ADB) released itsAsianDevelopment Outlook (ADO)2022 on April 6, which forecastVietnam’s GDP growth at 6.5percent and China’s at 5 percent for 2022. It also projected theVietnamese economy to further expand by 6.7 percent and 4.8percent for China in 2023.

Lifting Restrictions onReopening

An important factor drivingVietnam’s rapid economicrecovery in the past two quartershas been its active promotion ofvaccination and gradual relaxation of strict pandemic preventionand control restrictions. As ofMarch 2022, nearly 79 percentof the Vietnamese populationhad been vaccinated. In October2021, Ho Chi Minh City beganto lift restrictions. On October11, the Vietnamese governmentpromulgated Resolution No.128/NQ-CP, which classified thepandemic risk into four levelsand prescribed implementationmeasures to control local eventsand bolster socio-economicdevelopment while adaptingto the new status quo by theend of 2021. Professor Mi Liang,doctoral supervisor at BeijingForeign Studies University andexecutive director of the ChineseAssociation for Southeast AsianStudies, opined in an interviewthat COVID-19 has been the onlyreason for Vietnam’s decline ineconomic growth in the pasttwo years. If it can overcomethe problem, he expects itseconomy to resume rapid growth momentum.

On March 15, 2022, Vietnamannounced full reopeningof tourism, resuming its visaexemption policy for citizensfrom some countries andsimplifying the testing processfor inbound passengers. DinhViet Thang, director general ofthe Civil Aviation Administration of Vietnam (CAAV), disclosedthat the number of passengerstravelling by plane during the long weekend holidays will be 25 to 30 percent more than usual, up 90to 95 percent year on year. ZhouShixin, associate researcher atthe Asia-Pacific Research Centerof the Shanghai Institute forInternational Studies (SIIS), thinks that reopening internationaltravel will help get internationaltechnical managers to return,which will benefit Vietnam’smanufacturing industry. TimLeelahaphan, economist forVietnam and Thailand at Standard Chartered Bank, predictedthe reopening of tourism tocontribute about 10 percent toGDP growth.

With the COVID-19 pandemic surging around the world, many countries are facing a state ofstagnant economic activitiesand severely insufficientmarket supply. Vietnam hasseized the opportunity to leadthe resumption of work andproduction with an eye ongaining an even bigger share ofthe international market. Nguyen Teng Hsien, head of New LightTrading Company, said thatimproved market conditions have enabled his company to regain itsmarket share, export more goods,and even pay workers more. Heexpects the business performance of his company to continue toimprove. Chen Yueying, chairman of the business association ofThu Duc, a municipal city (sub-city) under the administration ofHo Chi Minh City, has identifiedplenty of business opportunitieswith bright prospects in 2022.Orders from producers andexporters have been filling upfast, with booming demand inthe international and domesticmarkets. The area has providedpositive stimulus for Vietnam’scontinued economic recovery.

Improving the BusinessEnvironment

In addition to full reopening,the Vietnamese governmenthas also introduced severalmeasures to improve the business environment and promoteeconomic recovery. First, thefirst extraordinary session ofthe 15th National Assemblyopened in Hanoi on January 4,2022. The session deliberatedand adopted a package of 350trillion VND (US$15.21 billion)to promote economic recovery.The package included 103.16trillion VND on investment intransportation infrastructure, 64trillion VND for tax reduction,and expenditures on pandemicresponse, the people’s wellbeing,recovery of tourism, and digitaltransformation. Second, theVietnamese governmentpromulgated its No. 2 Resolutionon continued improvement ofbusiness environment on January10, 2022, aiming to eliminate obstaclesto investment and business activitiescaused by laws and regulations, provideguidance for the reform of the digitaltransformation, support the peoplein resuming production and businessoperations, and promote internationalcooperation combined with the reform of the domestic business environment. In addition, Vietnam has repeatedlyrevised the Investment Law to attractforeign investment, with the mostrecent revision coming into effect onJanuary 1, 2021. Vietnam implementsnational treatment for foreign investors, offering enterprises in industrial parkstax exemption in the first two years, and tax cut by 50 percent in the ensuing fouryears. High-tech industries enjoy more preferential policies for tax exemption in the first four years and tax cuts by 50 percent in the ensuing nine years.

Nguyen Mai, chairman of theVietnam Association of Foreign-Invested Enterprises, pointed out thatalthough the global economy sufferedfrom the negative impact of COVID-19in 2021, encouraging achievementshad been made in attracting foreigninvestment, which is a bright spot inVietnam’s overall economic situation.Tran Quoc Phuong, Vice Minister forPlanning and Investment ofVietnam, is also optimistic about the future of theVietnamese economy, saying that theVietnamese government’s policies ofrelaxing pandemic response restrictions and promoting economic recovery willhelp companies expand investment.

Free Trade Agreements

In the long run, Vietnam’soutstanding economic performancehas been inseparable from its open-door economic policy. Chen Ching

Hai, deputy director general ofthe Department of Import-ExportAdministration of the Ministry ofIndustry and Trade of Vietnam, said that the biggest opportunity for Vietnam’sexports lies in various free tradeagreements (FTAs). Vietnam’s exportgrowth target for this year is 6-8 percent, and it is the strongest driving force forachieving this goal to give full play to the role of the FTAs.

Since the beginning of reform andopen-door policy in 1986, Vietnam hasbeen exploring the market economyroad, pursuing an export-orienteddevelopment policy. In 2006, Vietnamacceded to the WTO. In recent years, ithas successively signed FTAs includingthe Comprehensive and ProgressiveAgreement for Trans-Pacific Partnership (CPTPP), which officially took effecton January 14, 2019; the EU-VietnamFree Trade Agreement (EVFTA), whichofficially took effect on August 1, 2020;the UK-Vietnam Free Trade Agreement(UKFTA), which officially took effecton May 1, 2021; and the RegionalComprehensive Economic Partnership(RCEP), which officially took effect onJanuary 1, 2022. All of these agreementshave laid the foundation for reducingtrade barriers, enhancing tradefacilitation, and promoting economicdevelopment. For example, accordingto the EVFTA, Vietnam and the 28 EUeconomies enjoy preferential tariffs, and the two sides will remove 99 percentof tariffs within 10 years. The RCEP’sentry into force will eventually reducetariffs on more than 90 percent of tradein goods to zero.“The signing and entryinto force of the RCEP will open the door of opportunity for Vietnam to expand its market, increase its exports, participatein new value chains in the region, andattract more investment,”commentedNguyen Hong Dien, Minister of Industry and Trade ofVietnam.

Zhao Qian, head of the China Business Association Ho Chi Minh City Branch,identified two advantages Vietnamwields in manufacturing at this stage:Its land price and labor costs are low,and market access facilitation and tariffreductions brought about by the FTAs between Vietnam and other majoreconomies have helped. Xu Ningning,executive president of the China-ASEAN Business Council and chairman of theRCEP Industry Cooperation Committee, said that Vietnam’s participation invarious multilateral trade agreementsis helping Vietnam’s economy to attractmore investment, boost economicrecovery, and consolidate and developregional supply chains.

Geographic and DemographicAdvantages

In recent years, Southeast Asiancountries represented by Vietnamhave been favorites of European andAmerican countries as indispensablelinks on the global manufacturingsupply chain. One important reasonis the region’s geographic anddemographic advantages. Vietnamfaces the sea on three sides, with along coastline and numerous ports,providing ideal conditions for theimport and export of goods and tourism development. By the end of 2020,Vietnam had a population of 97.34million with rich human resources ofyoung people at low cost, which hasattracted many enterprises to invest and build factories there.

For example, Samsung, Sony,Qualcomm, Adidas, and Nike have all built factories in Vietnam. Vietnamis now Samsung’s largest productionbase in the world. In 2021, SamsungVietnam’s exports exceeded US$65.5billion, up 16 percent year on year. Bythe end of 2021, Samsung Electronicsinvested US$18 billion in Vietnam, up 102 percent year on year.

Risks and Challenges

Vietnam’s robust economic recovery has been accompanied by risks andchallenges. For example, the ongoingRussia-Ukraine conflict has exerted alot of pressure on Vietnam’s economy,including the rising price of rawmaterials, inflation, and the disruptionof global supply chains. Both Russiaand Ukraine are important tradingpartners ofVietnam. Russia has manyFDI projects in Vietnam, mainly in oil,gas, and electricity, all of which will have to be put on hold. According to an HSBCBank report on March 31, Vietnam’scrude oil imports doubled in Marchalone, and its gasoline imports were four times more than the same period lastyear. Rising international oil prices have directly affected the country’s importsof raw materials. Manuela Ferro, theWorld Bank’s Regional Vice Presidentfor East Asia and Pacific Affairs, saidthat although East Asian and Pacificeconomies are recovering from theimpact of the pandemic, tensions inUkraine have added to the challenges for economic growth.

Although the Vietnamese economyis growing rapidly, many problems arepersisting for the long run. For example,problems of excessive dependenceon foreign capital, unitary industrialstructure too reliant on processing, weak basic industries, and limited technicalcapacity are all bottlenecking Vietnam’seconomic development. ProfessorMi Liang remarked that despite itscomparative advantage of cheap labor,Vietnam’s disadvantages of low laborskills, incomplete industrial systems,and limited economic size prevent itfrom replacing China completely as amanufacturing power. Xu Ningningidentified Vietnam’s advantages ascheap young labor, low productioncost, improved infrastructure, andpreferential policies for attractingforeign capital. However, Vietnamnow imports many raw materials andspare parts from China. The countryneeds more technical managementpersonnel, core technologies, and amore systematic industrial chain. Many challenges remain for the country tomaintain long-term, sustained, andstable economic growth.